Nexi S.p.A. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nexi S.p.A. Bundle

The digital payment landscape is constantly shifting, and Nexi S.p.A. is at the heart of these changes. Understanding the political, economic, social, technological, legal, and environmental factors impacting this dynamic sector is crucial for any forward-thinking investor or strategist. Our comprehensive PESTLE analysis dives deep into these forces, revealing how they shape Nexi's opportunities and challenges. Don't get left behind; gain the critical insights you need to navigate this evolving market. Download the full PESTLE analysis now and equip yourself with actionable intelligence.

Political factors

European governments and the EU are making a concerted effort to shift away from cash, aiming to curb the shadow economy and boost financial transparency. This political will directly supports the digital payments sector.

Key legislation like the Instant Payments Regulation, set to be fully implemented by January 2025, will mandate that instant payment services are readily available and affordably priced for consumers and businesses. This regulation is a significant tailwind for companies like Nexi, which are at the forefront of facilitating these transactions.

The ongoing regulatory push across Europe to standardize and encourage digital transactions creates a more fertile ground for companies like Nexi to expand their services. This environment is expected to drive increased adoption of electronic payments throughout the region.

Geopolitical stability across Europe is a cornerstone for Nexi's extensive operations, given its position as a premier European PayTech provider. Significant disruptions, such as ongoing conflicts or heightened political tensions, could directly impede the seamless flow of cross-border transactions, a vital component of Nexi's business model. This instability also erodes consumer and business confidence, potentially triggering economic slowdowns in critical European markets where Nexi is active.

A calm and predictable political environment is essential for Nexi to maintain uninterrupted business activities and pursue its strategic growth initiatives throughout the continent. For instance, the ongoing geopolitical landscape in Eastern Europe, while presenting challenges, also highlights opportunities for payment modernization in regions seeking greater economic integration.

The drive for a unified European payments landscape, notably through initiatives like the European Payments Initiative (EPI) and its Wero payment solution, signifies a significant political push towards harmonized standards. This trend, gaining momentum throughout 2024 and expected to continue into 2025, aims to streamline cross-border transactions, potentially reducing operational friction for companies like Nexi.

Such inter-country cooperation directly benefits Nexi by simplifying its complex operating environment, potentially lowering compliance costs and fostering greater interoperability across the continent. As of late 2024, the European Central Bank has been actively supporting the development of these pan-European payment schemes, aiming to create a more competitive and efficient market for consumers and businesses alike.

Political pressure on interchange fees

Political discussions around capping interchange fees across Europe present a significant challenge for Nexi's merchant acquiring operations. For instance, the European Commission has been actively reviewing these fees, with potential regulatory caps being a recurring theme in recent years, aiming to reduce costs for merchants and encourage digital payments.

While lower interchange fees could boost the adoption of digital transactions by making them more attractive to businesses, this regulatory shift would likely squeeze the profit margins for payment service providers like Nexi. This pressure necessitates a strategic adaptation of Nexi's business model to ensure continued profitability in a changing regulatory landscape.

Nexi must proactively develop strategies to offset potential revenue reductions. This could involve diversifying revenue streams beyond traditional transaction fees, focusing on value-added services for merchants, or optimizing operational efficiencies. The company's ability to navigate these political and regulatory pressures will be crucial for its sustained success in the European payments market.

- Regulatory Scrutiny: Ongoing European Union discussions on interchange fee caps are a key political factor impacting Nexi.

- Margin Compression: Potential fee reductions could decrease profitability for Nexi's merchant acquiring services.

- Digital Payment Growth: Lower fees might stimulate broader digital payment adoption, creating new opportunities.

- Business Model Adaptation: Nexi needs to evolve its strategy to maintain financial health amidst these regulatory shifts.

Data sovereignty and cross-border data flow regulations

The intensifying global focus on data sovereignty and robust data protection mandates, exemplified by regulations like the EU's General Data Protection Regulation (GDPR), significantly shape Nexi's approach to managing sensitive payment information across its European operations. Compliance with these dynamic legal landscapes is paramount, directly affecting Nexi's technology investments and operational strategies to prevent substantial fines and uphold customer confidence.

Nexi must navigate a complex web of cross-border data flow rules, which can affect the efficiency and cost of processing transactions and storing data. For instance, while specific Nexi internal data on cross-border data flow costs isn't publicly detailed, the broader fintech sector anticipates increased compliance burdens. By mid-2024, European regulators continued to scrutinize data handling practices, particularly for cross-border transactions, underscoring the need for Nexi to maintain adaptable data governance frameworks.

- Data Localization Requirements: Certain countries may mandate that payment data generated within their borders must be stored and processed locally, potentially fragmenting Nexi's data infrastructure.

- Cross-Border Transfer Mechanisms: Nexi needs to ensure its data transfer mechanisms between countries comply with approved frameworks, such as Standard Contractual Clauses, to maintain legal data flow.

- Regulatory Scrutiny: Increased enforcement actions by data protection authorities across Europe in 2024 highlighted the critical need for Nexi to demonstrate rigorous compliance with GDPR and similar mandates.

- Impact on Innovation: Strict data regulations can influence the development and deployment of new payment technologies, requiring Nexi to balance innovation with privacy compliance.

Government initiatives across Europe, like the push for instant payments mandated by the Instant Payments Regulation effective January 2025, create a favorable political climate for Nexi. This regulatory drive aims to increase financial transparency and reduce the shadow economy, directly benefiting digital payment providers. Geopolitical stability is also crucial, as tensions can disrupt cross-border transactions, a core part of Nexi's business.

The ongoing development of pan-European payment solutions, such as the European Payments Initiative (EPI) and its Wero solution, signals political support for harmonized payment systems. This trend, gaining traction in 2024-2025, simplifies operations and potentially lowers compliance costs for Nexi by fostering interoperability across the continent. As of late 2024, the European Central Bank actively backs these schemes to promote a more competitive market.

Political discussions around capping interchange fees present a notable challenge. While the European Commission's review of these fees, a recurring theme in recent years, could spur digital payment adoption by lowering costs for merchants, it also poses a risk of margin compression for Nexi's acquiring services. This necessitates strategic adaptation to maintain profitability.

Global and EU data sovereignty regulations, such as GDPR, necessitate significant investments in technology and operational strategies for Nexi to ensure compliance and maintain customer trust. Navigating cross-border data flow rules remains complex, with regulators in mid-2024 continuing to scrutinize data handling practices, particularly for international transactions.

What is included in the product

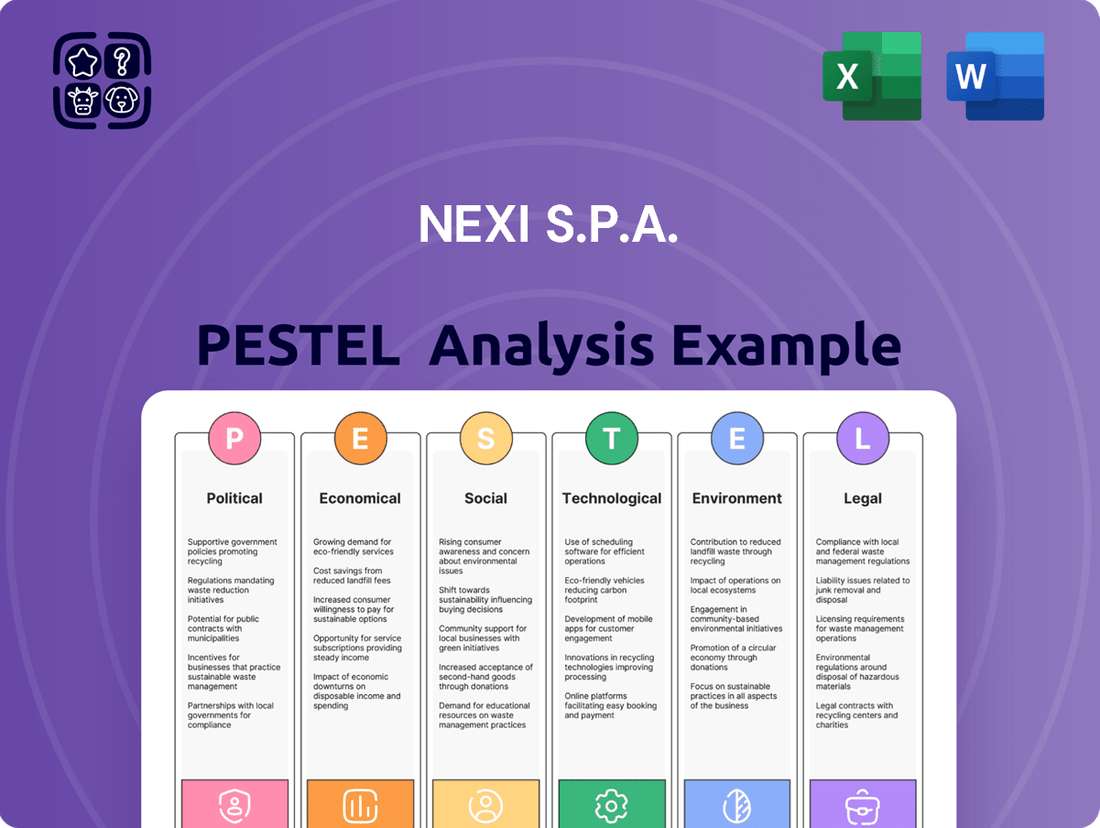

This Nexi S.p.A. PESTLE analysis offers a comprehensive examination of how political, economic, social, technological, environmental, and legal forces shape the company's operating landscape.

It provides actionable insights for strategic decision-making by highlighting key external factors and their potential impact on Nexi S.p.A.'s growth and market position.

This Nexi S.p.A. PESTLE Analysis provides a concise overview of external factors, serving as a pain point reliever by streamlining complex market dynamics for strategic decision-making.

Economic factors

Inflationary pressures across Europe are a significant factor affecting consumer spending power and, by extension, the volume and value of digital transactions. For Nexi, a leading European payments group, this means that as prices rise, consumers may have less discretionary income, potentially leading to a slowdown in the growth of transaction volumes. For instance, if inflation in the Eurozone averaged 3.5% in 2024, as some forecasts suggest, this could directly impact the frequency and size of purchases made using digital payment methods. This dynamic directly influences Nexi's revenue streams, which are largely dependent on transaction throughput.

While digital payments offer undeniable convenience, their growth is intrinsically linked to the health of consumer wallets. A sustained period of high inflation, such as the 5.5% average seen across the Eurozone in 2023, can erode purchasing power, forcing consumers to cut back on non-essential spending. This reduction in overall economic activity translates to fewer transactions processed by companies like Nexi. Therefore, it's crucial for Nexi to closely monitor economic indicators, including inflation rates and consumer confidence surveys, to accurately forecast demand for its payment services.

Interest rate fluctuations significantly influence Nexi's financial health and strategic planning. Higher interest rates can elevate the cost of borrowing for Nexi, impacting its ability to finance operations and pursue growth opportunities like acquisitions. Conversely, a low interest rate environment can make it more attractive for Nexi to invest in technological advancements and expand its market reach.

In March 2025, Nexi demonstrated its commitment to financial flexibility by completing a substantial refinancing of its debt. This initiative successfully extended the maturity profile of its borrowings and aimed to optimize overall financing costs, a crucial step in navigating potential interest rate volatility.

The ongoing expansion of e-commerce and the increasing adoption of digital payments are powerful economic drivers for Nexi. This shift away from cash is a fundamental economic change that directly benefits companies like Nexi, which facilitate these digital transactions.

Projections show a significant increase in digital commerce; by 2028, Western European retail e-commerce is expected to surpass USD 800 billion. Simultaneously, non-cash transactions across Europe are anticipated to exceed 600 billion, highlighting a major move towards cashless economies.

This strong market trend directly translates into a higher demand for Nexi's diverse range of digital payment processing services. As more consumers and businesses embrace online shopping and digital payment methods, Nexi is well-positioned to capitalize on this growth.

Competition from fintech startups

The European payments landscape is buzzing with activity, marked by a significant rise in fintech mergers and acquisitions throughout 2024 and into early 2025. This trend signals a period of intense competition and market consolidation. Nexi, as a major player, finds itself navigating this dynamic environment, facing challenges from both legacy institutions and agile fintech startups.

To stay ahead, Nexi must prioritize ongoing investment in cutting-edge product development and forge strategic alliances. This proactive approach is crucial for Nexi to not only preserve its market-leading position but also to capitalize on emerging growth avenues within the evolving payments sector. The ability to innovate rapidly and adapt to new technologies will be key differentiators.

- Fintech M&A Surge: European fintech M&A deals reached a notable volume in late 2024, with projections indicating continued activity in 2025.

- Competitive Pressures: Nexi contends with a growing number of fintech startups offering specialized, often digital-first payment solutions.

- Innovation Imperative: Maintaining market share requires substantial and continuous investment in research and development for new payment technologies.

- Partnership Opportunities: Strategic collaborations with fintechs can provide Nexi with access to new markets, technologies, and customer segments.

Economic stability of key European markets

Nexi's revenue stability is strongly tied to the economic health of its primary European markets, particularly Italy and the Nordic region. These areas represented a significant 76% of Nexi's revenue in 2024, underscoring the impact of local economic conditions on the company's financial performance. A stable economic environment in these regions directly fuels the growth of digital payments and increases transaction volumes, which are crucial for Nexi's business model.

The economic stability of these key European markets is a critical factor for Nexi. For instance, Italy, a core market, has shown signs of resilience. In 2024, Italy's GDP growth was projected to be around 1.1%, providing a supportive backdrop for consumer spending and digital transaction activity. Similarly, the Nordic countries, known for their advanced digital economies, continue to exhibit robust growth in e-commerce and digital payment adoption, further solidifying Nexi's revenue streams.

- Italy's economic stability: Supported by consistent GDP growth, fostering increased digital payment adoption.

- Nordic market strength: Advanced digital economies drive high transaction volumes and recurring revenue for Nexi.

- Revenue concentration: 76% of Nexi's 2024 revenue derived from Italy and the Nordics highlights the importance of these economies.

- Recurring revenue model: A substantial portion of Nexi's revenue is recurring, offering a degree of insulation from short-term economic fluctuations in these core markets.

Economic growth directly fuels the adoption of digital payments, benefiting Nexi's transaction-based revenue model. For example, projections indicated that Western European e-commerce would exceed USD 800 billion by 2028, with non-cash transactions surpassing 600 billion, underscoring a significant shift towards cashless societies. This trend directly translates to increased demand for Nexi's payment processing services.

Inflationary pressures, however, can temper consumer spending power, potentially slowing transaction volume growth for Nexi. While the Eurozone saw inflation average 5.5% in 2023, forecasts for 2024 suggested a moderation, which would be a positive development for transaction volumes. Nexi's ability to navigate these economic shifts is crucial for its sustained growth.

Interest rate changes impact Nexi’s financing costs and investment capacity. The company's March 2025 debt refinancing, which extended maturities and aimed to optimize costs, demonstrates a strategic approach to managing interest rate volatility and maintaining financial flexibility for future growth initiatives.

| Economic Factor | Impact on Nexi | Key Data/Trend |

|---|---|---|

| Economic Growth | Drives digital payment adoption and transaction volumes. | Western European e-commerce projected to exceed USD 800 billion by 2028. |

| Inflation | Can reduce consumer spending power, potentially slowing transaction growth. | Eurozone inflation averaged 5.5% in 2023; 2024 forecasts indicated moderation. |

| Interest Rates | Affects borrowing costs and investment capacity. | Nexi refinanced debt in March 2025 to optimize financing costs and extend maturities. |

| E-commerce Expansion | Directly increases demand for digital payment processing. | Non-cash transactions across Europe expected to exceed 600 billion. |

Preview Before You Purchase

Nexi S.p.A. PESTLE Analysis

The preview you see here is the exact Nexi S.p.A. PESTLE Analysis document you will receive after purchase. It is fully formatted and ready to be used for your strategic planning. You will gain immediate access to this comprehensive report, providing valuable insights into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing Nexi. This ensures you get the complete, professional analysis without any surprises.

Sociological factors

Consumer preferences are rapidly shifting towards digital and mobile payment solutions. By 2025, digital wallets and real-time bank transfers are expected to dominate the European payment ecosystem. This trend is driven by a growing demand for convenience and speed in transactions.

Over 72% of Europeans actively use a digital wallet, highlighting the widespread adoption of these technologies. Platforms such as Apple Pay and Google Pay have become essential for businesses to meet consumer expectations for fast and secure payment experiences.

Nexi S.p.A. is well-positioned to capitalize on this shift. Its SoftPOS solutions, which enable smartphones to function as payment terminals, directly address the increasing consumer demand for contactless and mobile payment options, making transactions more accessible for merchants of all sizes.

Societal trends are strongly favoring digital transactions, which directly benefits Nexi. Across Europe, people are increasingly leaving cash behind for more convenient digital payment methods. This shift is a major tailwind for Nexi's core business of facilitating electronic payments.

The European Central Bank noted that in 2024, cash was used for only 52% of transactions at the point of sale, a notable drop from 59% just two years earlier. This demonstrates a clear societal preference moving towards digital alternatives. Such a trend presents a substantial opportunity for Nexi to grow its digital payment infrastructure and broaden its service offerings throughout the region.

Demographic shifts are significantly altering how people pay for things. Younger generations, specifically those between 18 and 35 years old, are leading this change by embracing mobile wallets and digital payment methods. In fact, data from 2024 indicates that over 60% of this age group now uses these digital tools for their everyday purchases.

As these younger demographics accumulate more wealth and spending influence, their ingrained preference for quick and easy digital transactions will increasingly dictate market trends. This means companies like Nexi must consistently adapt their offerings to align with these evolving consumer behaviors, ensuring their services remain relevant and competitive in the digital payment landscape.

Financial inclusion initiatives

Financial inclusion initiatives are crucial, and digital payment solutions are at the forefront. Nexi's commitment to making electronic transactions accessible to everyone, especially those with less purchasing power, directly contributes to empowering underserved populations. This focus aligns with global efforts to bridge the financial access gap. For instance, the World Bank reported in 2023 that 76% of adults worldwide now have a financial institution or mobile money account, an increase from 51% in 2011, highlighting the impact of such initiatives.

Nexi's role in facilitating these digital transactions supports broader societal goals of financial empowerment. By ensuring equal access to financial products, Nexi helps integrate more individuals into the formal economy. This is vital as digital payments offer a gateway to other financial services like credit and savings. In Europe, for example, the adoption of instant payments, a key area for Nexi, saw a significant surge, with the European Payments Council reporting over 13 billion instant SEPA Credit Transfers processed in 2023, up 56% from the previous year.

- Digital Payments as an Enabler: Nexi's platforms provide essential infrastructure for individuals and small businesses to participate in the digital economy, fostering greater financial inclusion.

- Bridging the Gap: The company's efforts focus on reaching segments of the population that have traditionally been excluded from formal financial services.

- Societal Impact: By enabling easier and more secure transactions, Nexi contributes to economic growth and reduces financial vulnerability for a wider population.

- Growth in Digital Transactions: The increasing reliance on digital payment methods across Europe, with significant year-on-year growth, underscores the relevance and impact of Nexi's strategic direction.

Public trust in digital payment security

Public trust is a cornerstone for the widespread adoption of digital payments, a trend that continues to accelerate. Consumers need to feel confident that their financial information is protected when making transactions online or through mobile devices. Nexi's focus on robust security measures for its digital payment infrastructure is therefore critical for maintaining and growing this trust.

Nexi's 2024 Sustainability Report underscores its dedication to safeguarding end-users and bolstering digital payment security. This commitment is directly responsive to societal concerns about data breaches and fraud in the digital realm. As of early 2025, reports indicate a growing consumer demand for transparency and strong security protocols from payment providers.

The continued expansion of digital payments hinges on addressing public apprehension regarding security. Nexi's proactive approach, emphasizing enhanced digital payment security, is designed to build confidence among users. This societal expectation is reflected in market research, which shows that security features are a primary consideration for consumers choosing payment solutions.

- Growing reliance on digital transactions: By 2025, estimates suggest over 80% of consumer transactions in many developed economies will be digital.

- Consumer demand for security: Surveys in early 2025 revealed that over 70% of consumers prioritize data security when selecting digital payment platforms.

- Nexi's security investment: Nexi has consistently allocated significant resources to cybersecurity, aiming to mitigate risks associated with digital payment processing.

- Impact on adoption rates: Public trust directly correlates with the rate at which new digital payment methods are adopted, making security a key driver of market growth.

Societal shifts are fundamentally reshaping payment behaviors, with a pronounced move away from cash towards digital and mobile solutions across Europe. This trend is accelerated by younger demographics, who are increasingly adopting digital wallets and instant payment systems for their daily transactions, demonstrating a clear preference for convenience and speed.

Nexi's strategic focus on digital payment infrastructure, including solutions like SoftPOS, directly aligns with these evolving consumer preferences and societal expectations. The company's efforts in financial inclusion also resonate with broader societal goals, aiming to bring more individuals into the formal economy through accessible digital payment channels.

Public trust remains paramount, and Nexi's commitment to robust cybersecurity measures is crucial for fostering confidence in digital transactions. As consumers become more aware of data privacy, prioritizing security features will be a key differentiator for payment providers, directly impacting adoption rates for new digital payment methods.

| Societal Factor | Trend Description | Implication for Nexi | Supporting Data (2024/2025) |

|---|---|---|---|

| Shift to Digital Payments | Declining cash usage, rising digital wallet adoption. | Increased demand for Nexi's payment processing services. | Cash used for 52% of POS transactions in Europe (ECB, 2024); >72% European digital wallet usage. |

| Demographic Influence | Younger generations prefer digital/mobile payments. | Need to cater to evolving preferences of future high-spending consumers. | >60% of 18-35 year olds use digital payments for daily purchases (2024 data). |

| Financial Inclusion | Digital payments enabling access for underserved populations. | Opportunity to expand services and impact through accessible financial tools. | 76% global adult population with financial/mobile money account (World Bank, 2023); 13B+ instant SEPA transfers processed (2023, +56% YoY). |

| Public Trust & Security | Consumer demand for secure digital transactions. | Importance of strong cybersecurity to maintain and grow user confidence. | >70% consumers prioritize security in payment platforms (Early 2025 surveys). |

Technological factors

Technological advancements are reshaping the payments landscape, with a strong emphasis on cybersecurity. Nexi is committed to robust infrastructure resilience and effective fraud prevention, demonstrated by its 99.99% service continuity in its digital payment infrastructure during 2024.

The adoption of sophisticated security technologies such as tokenization and biometrics is paramount, particularly as mobile payments gain traction. These innovations are crucial for safeguarding transactions and fostering essential user confidence in digital payment systems.

Open banking, significantly driven by regulations like PSD2, is revolutionizing the financial sector by promoting seamless data exchange and interoperability. This trend allows companies like Nexi to build innovative services by connecting with other financial institutions and third-party providers.

Nexi's strategic adoption of a cloud-native architecture, underpinned by robust APIs, is central to its ability to integrate rapidly with diverse internal and external applications. This technological foundation enhances operational efficiency and provides the agility needed to respond to evolving market needs.

The company’s API-first approach empowers it to offer advanced payment solutions, such as Pay by Bank, which directly benefit from the open banking ecosystem. This allows Nexi to streamline payment processes for both merchants and consumers, fostering greater convenience and security.

By embracing open banking and API integrations, Nexi is well-positioned to capitalize on the growing demand for integrated financial services. For instance, the European open banking market is projected to grow substantially, with transaction volumes expected to surge, indicating a significant opportunity for Nexi to expand its market share.

The payments industry is being reshaped by new technologies, with Central Bank Digital Currencies (CBDCs) and instant payments rapidly becoming standard, particularly in Europe. This shift is underscored by the Instant Payments Regulation, set to take effect in January 2025, which will require all payment service providers to offer real-time payment availability. Nexi's proactive approach to investing in innovative products and up-to-date technology platforms is crucial for them to effectively leverage these emerging trends.

Data analytics and AI for fraud detection and personalization

Nexi is significantly leveraging data analytics and artificial intelligence (AI) to bolster its fraud detection capabilities and personalize customer experiences. In 2024, the company continued to invest in these technologies, recognizing their crucial role in the evolving payments landscape. For instance, AI algorithms are instrumental in identifying anomalous transaction patterns, thereby minimizing financial losses due to fraud. This focus on data-driven innovation is central to Nexi's strategy for enhancing security and delivering tailored services to its diverse clientele.

The increasing sophistication of AI in payments is a key technological driver for Nexi. By analyzing vast datasets, AI can predict and prevent fraudulent activities with greater accuracy than traditional methods. This not only protects Nexi and its customers but also builds trust, a critical element in the financial sector. Nexi's commitment to leveraging these advanced tools positions it at the forefront of secure and customer-centric payment solutions.

Looking ahead, emerging regulations such as the EU AI Act, expected to be fully implemented in phases through 2024 and 2025, will shape how Nexi deploys AI. This legislation will mandate greater transparency, fairness, and accountability in AI systems used within the payments industry. Nexi must ensure its AI models are robust, explainable, and compliant with these new standards to maintain its operational integrity and market position.

The strategic importance of AI for Nexi can be highlighted by industry trends. For example, a Juniper Research report in late 2023 projected that AI-powered fraud detection and prevention solutions would save businesses globally over $40 billion by 2027, with a significant portion of this attributable to the financial services sector. Nexi's proactive adoption of these technologies aligns with this growth trajectory.

- AI-Driven Fraud Prevention: Nexi employs advanced AI algorithms to analyze transaction data in real-time, identifying and mitigating fraudulent activities more effectively.

- Personalization Strategies: The company utilizes data analytics to understand customer behavior, enabling the delivery of tailored payment solutions and offers.

- Regulatory Compliance: Nexi is preparing for stricter regulations like the EU AI Act, which will require transparent and accountable AI applications in financial services, impacting its development and deployment strategies through 2024-2025.

- Investment in Innovation: Nexi's ongoing investment in data analytics and AI underscores its commitment to technological leadership and enhancing customer security and experience.

Cloud computing infrastructure for scalability

Nexi's strategic adoption of cloud computing infrastructure is a key technological enabler for its scalability, allowing it to efficiently handle vast volumes of payment transactions. This cloud-native architecture not only optimizes resource utilization but also unlocks significant economies of scale, crucial for a high-throughput payment processor. For instance, by migrating to more efficient cloud solutions, Nexi aimed to reduce its ICT operational costs by approximately 15-20% through data center rationalization by the end of 2024.

This technological foundation directly supports Nexi's agility in product innovation. Banks can rapidly integrate new payment features and services, which is vital in a fast-evolving financial landscape. Furthermore, the cloud infrastructure streamlines adherence to complex regulatory requirements and enhances overall operational flexibility, ensuring Nexi can adapt swiftly to market demands and compliance changes.

- Cloud-native architecture for enhanced scalability and resource optimization.

- Facilitates rapid product innovation and quicker integration for banking partners.

- Aims to achieve ICT cost efficiencies through data center rationalization.

- Supports streamlined regulatory compliance and increased operational flexibility.

The rise of instant payment systems, like those mandated by the January 2025 Instant Payments Regulation in Europe, is a significant technological shift. Nexi's investment in up-to-date technology platforms is critical to capitalizing on this trend, which requires real-time payment availability from all providers.

AI and data analytics are increasingly vital for Nexi, enhancing fraud detection and personalizing customer experiences. In 2024, the company continued to invest in these areas, recognizing their role in minimizing losses from fraud through advanced pattern recognition.

Emerging regulations such as the EU AI Act, with phased implementation through 2024-2025, will necessitate transparent and accountable AI use in financial services, influencing Nexi's deployment strategies.

Nexi’s cloud-native architecture, supported by robust APIs, enables rapid integration and innovation, such as its Pay by Bank service, leveraging the open banking ecosystem. This infrastructure is designed for scalability, aiming for significant ICT cost efficiencies by the end of 2024.

| Technology Trend | Impact on Nexi | Key Data/Fact (2024/2025 Focus) |

|---|---|---|

| Instant Payments | Requirement for real-time transaction processing | Instant Payments Regulation effective January 2025 |

| AI & Data Analytics | Enhanced fraud detection, customer personalization | Continued investment in 2024; AI algorithms identify anomalous patterns |

| Open Banking & APIs | Facilitates new service integration (e.g., Pay by Bank) | European open banking market projected for substantial growth |

| Cloud-Native Architecture | Scalability, cost efficiency, agility in innovation | Targeting 15-20% ICT operational cost reduction via data center rationalization by end of 2024 |

| Cybersecurity | Infrastructure resilience, fraud prevention | 99.99% service continuity in digital payment infrastructure achieved in 2024 |

Legal factors

The Payment Services Directive 2 (PSD2) has already reshaped European payments by mandating open banking, allowing third-party providers access to customer data with consent. This has spurred innovation and competition, directly influencing how companies like Nexi operate and develop their services. For instance, PSD2's Strong Customer Authentication (SCA) requirements, implemented across the EU, have increased security but also created compliance overhead.

Looking ahead, the anticipated Payment Services Directive 3 (PSD3) is poised to build upon PSD2’s foundations, further standardizing and enhancing the payment ecosystem. While details of PSD3 are still being finalized, the focus is expected to be on improving consumer protection, combating fraud, and ensuring a level playing field for all payment service providers. Nexi will need to remain agile, investing in technology and compliance to meet these evolving regulatory demands and capitalize on new opportunities.

Nexi, as a major player in the European payments sector, faces significant legal hurdles related to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are designed to combat financial crime and are becoming increasingly complex across various jurisdictions. Adhering to these mandates is not optional; it's a fundamental requirement for operating within the financial ecosystem. For instance, the European Union's 6th Anti-Money Laundering Directive (AMLD6), which came into effect in December 2020, further harmonized AML rules, impacting companies like Nexi.

To navigate this intricate legal landscape, Nexi must continuously invest in sophisticated compliance technologies and robust internal frameworks. This includes implementing advanced transaction monitoring systems and rigorous customer due diligence processes to identify and report suspicious activities. Failure to comply can result in substantial fines and reputational damage, as seen with other financial institutions facing penalties for AML breaches. Nexi's commitment to these evolving legal standards is crucial for maintaining trust and ensuring the security of its payment services across its European operations.

The General Data Protection Regulation (GDPR) significantly impacts Nexi S.p.A. by mandating stringent protocols for personal data handling. For Nexi, a company processing extensive sensitive payment information, adherence to GDPR is crucial to avert substantial financial penalties, with fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is greater. This regulatory framework directly shapes Nexi's data management strategies and reinforces the necessity of robust security measures to safeguard customer information and maintain operational integrity.

Competition law and anti-trust scrutiny

As a major player in Europe's digital payments sector, Nexi faces significant scrutiny under competition law. The market's ongoing consolidation, driven by numerous mergers and acquisitions, heightens the risk of anti-trust investigations. Nexi's aggressive acquisition history, while fueling growth, has also placed it under the watchful eye of regulatory bodies concerned with market dominance.

The European Commission, in particular, actively monitors mergers and acquisitions within the financial technology space to prevent undue concentration. For instance, the ongoing integration of Nets, acquired by Nexi in 2022, underwent extensive review. This regulatory landscape necessitates that Nexi carefully navigates its expansion strategies, often adopting a more conservative approach to acquisitions to mitigate anti-trust concerns.

- Regulatory Oversight: Nexi operates under the watchful eye of European competition authorities, who scrutinize its market practices and M&A activities to ensure fair competition.

- Market Consolidation Impact: The ongoing consolidation within the European PayTech market increases the likelihood of anti-trust reviews for large players like Nexi.

- Acquisition Strategy Adjustments: Nexi's approach to mergers and acquisitions has become more cautious to proactively address and manage potential competition law challenges.

Consumer protection laws related to payments

Consumer protection laws are a critical legal factor influencing payment service providers like Nexi. These regulations aim to guarantee that consumers are treated fairly and that payment processes are transparent. For example, upcoming mandates for instant payments will require providers to offer these services at the same cost as traditional bank transfers, a change set to take effect by January 2025.

Nexi must meticulously align its service offerings and pricing strategies with these evolving consumer protection standards. Failure to comply not only risks penalties but also jeopardizes consumer trust and brand reputation. Adherence ensures Nexi operates within legal boundaries while safeguarding its customer base.

- Mandated Instant Payment Pricing: By January 2025, payment service providers must offer instant payment services at the same cost as standard transfers.

- Transparency Requirements: Laws often mandate clear disclosure of fees, processing times, and dispute resolution procedures for payment services.

- Data Privacy and Security: Regulations like GDPR and similar frameworks globally impose strict rules on how consumer payment data is collected, stored, and processed.

- Consumer Recourse Mechanisms: Legal frameworks typically establish channels for consumers to dispute unauthorized transactions or seek redress for faulty payment services.

Nexi must navigate a complex web of regulations, including the upcoming Payment Services Directive 3 (PSD3), which aims to enhance consumer protection and combat fraud, potentially impacting operational costs and service offerings. Furthermore, stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, such as AMLD6, necessitate continuous investment in compliance technology and robust internal processes. The company also faces scrutiny under competition law due to market consolidation, requiring careful consideration of its M&A strategies to avoid anti-trust challenges.

Environmental factors

Stakeholders, including customers and investors, are increasingly pushing companies to embrace sustainable operations and disclose their environmental, social, and governance (ESG) efforts. This trend directly impacts businesses like Nexi.

Nexi has proactively addressed this by implementing a three-year ESG Strategy spanning 2023 to 2025. This strategy centers on key pillars: ensuring secure resilience, empowering both businesses and society, and actively contributing to climate action and circular economy principles.

This commitment is not just aspirational; it's embedded in how Nexi operates and the services it provides. For example, in 2023, Nexi reported that 97.5% of its energy consumption was sourced from renewable electricity, showcasing tangible progress towards its climate goals.

Nexi is proactively addressing the carbon footprint of its data centers and operations. The company achieved a significant 23% reduction in CO2 emissions by 2024 when compared to 2021 levels, demonstrating a strong commitment to environmental sustainability.

Further enhancing its green initiatives, Nexi reported an impressive 86.1% renewable energy usage in its operations. This figure underscores their dedication to transitioning towards cleaner energy sources, with a clear target of reaching 100% renewable energy by 2030.

A key strategic move involves the rationalization of its data centers. This initiative is designed not only to boost ICT cost efficiency but also to directly contribute to reducing the overall environmental impact associated with their IT infrastructure.

Nexi is actively embracing green finance, aligning its operations with the EU Corporate Sustainability Reporting Directive (CSRD). This directive mandates comprehensive reporting on environmental, social, and governance (ESG) factors, ensuring greater transparency and accountability for companies operating within the European Union. Nexi's commitment to integrating ESG risks into its core risk management frameworks demonstrates a proactive approach to sustainability.

The company has publicly committed to a carbon transition plan with the ambitious goal of achieving net-zero emissions by 2040. This forward-looking strategy underscores Nexi's dedication to mitigating its environmental impact and contributing to a low-carbon economy. Such a commitment is crucial in an era where climate change is a significant global concern and regulatory pressures are increasing.

Nexi's strong ESG performance has been consistently recognized, including its inclusion in the S&P Sustainability Yearbook for the fifth consecutive year. This sustained recognition is a testament to the company's robust sustainability practices and its ability to deliver on its environmental and social commitments.

Waste reduction from physical cards

Even though Nexi is largely digital, its operations still require physical components, such as point-of-sale (POS) terminals. The company has shown a strong commitment to environmental responsibility by focusing on reducing waste associated with these physical elements.

Nexi has proactively addressed the issue of waste from physical cards and POS devices. The company's efforts have led to significant achievements in promoting a circular economy within the payments industry.

- POS Device Refurbishment: Nexi has exceeded its 2025 target for POS device refurbishment, reaching an impressive 87% refurbishment rate. This demonstrates a substantial commitment to extending the lifespan of hardware.

- Circular Economy Contribution: By refurbishing POS devices, Nexi actively contributes to waste reduction and champions circular economy principles, lessening the environmental impact of its physical infrastructure.

Regulatory pressure for environmental disclosures

Regulatory pressure for environmental disclosures is increasing, particularly within the European Union. The EU Corporate Sustainability Reporting Directive (CSRD), which came into effect in early 2024 for many companies, mandates more standardized and comprehensive Environmental, Social, and Governance (ESG) reporting. This directive aims to enhance transparency and comparability of sustainability information for investors and stakeholders.

Nexi S.p.A. is actively responding to these evolving environmental disclosure requirements. The company has demonstrated its commitment to transparency by integrating ESG risks into its overall risk management framework. Furthermore, Nexi has adopted standardized ESG reporting practices, aligning with the growing demand for consistent and reliable environmental data. This proactive approach ensures compliance and positions Nexi favorably in a landscape where environmental accountability is paramount.

Nexi's efforts in adopting standardized ESG reporting are crucial for several reasons:

- Compliance with CSRD: Nexi's adoption of standardized reporting directly addresses the stringent requirements of the CSRD, ensuring adherence to EU regulations.

- Enhanced Investor Confidence: Clear and standardized ESG disclosures build trust with investors who increasingly prioritize sustainability in their investment decisions.

- Risk Mitigation: Integrating ESG risks into management processes helps Nexi identify and mitigate potential environmental liabilities and operational disruptions.

- Market Positioning: By embracing transparency and robust environmental reporting, Nexi strengthens its reputation as a responsible corporate citizen.

Nexi is committed to environmental sustainability, evidenced by its 2023-2025 ESG Strategy focused on climate action and circular economy principles. The company achieved 97.5% renewable electricity sourcing in 2023 and reduced CO2 emissions by 23% by 2024 compared to 2021 levels. Nexi aims for 100% renewable energy by 2030 and has a net-zero emission target by 2040.

| Metric | 2023/2024 Data | Target |

| Renewable Electricity Usage | 97.5% (2023) | 100% by 2030 |

| CO2 Emission Reduction | 23% by 2024 (vs 2021) | Net-zero by 2040 |

| POS Device Refurbishment Rate | 87% | Exceeded 2025 target |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Nexi S.p.A. is built on a robust foundation of data from official regulatory bodies, European Union economic reports, and leading financial news outlets. This ensures comprehensive coverage of political, economic, and legal factors impacting the payments industry.