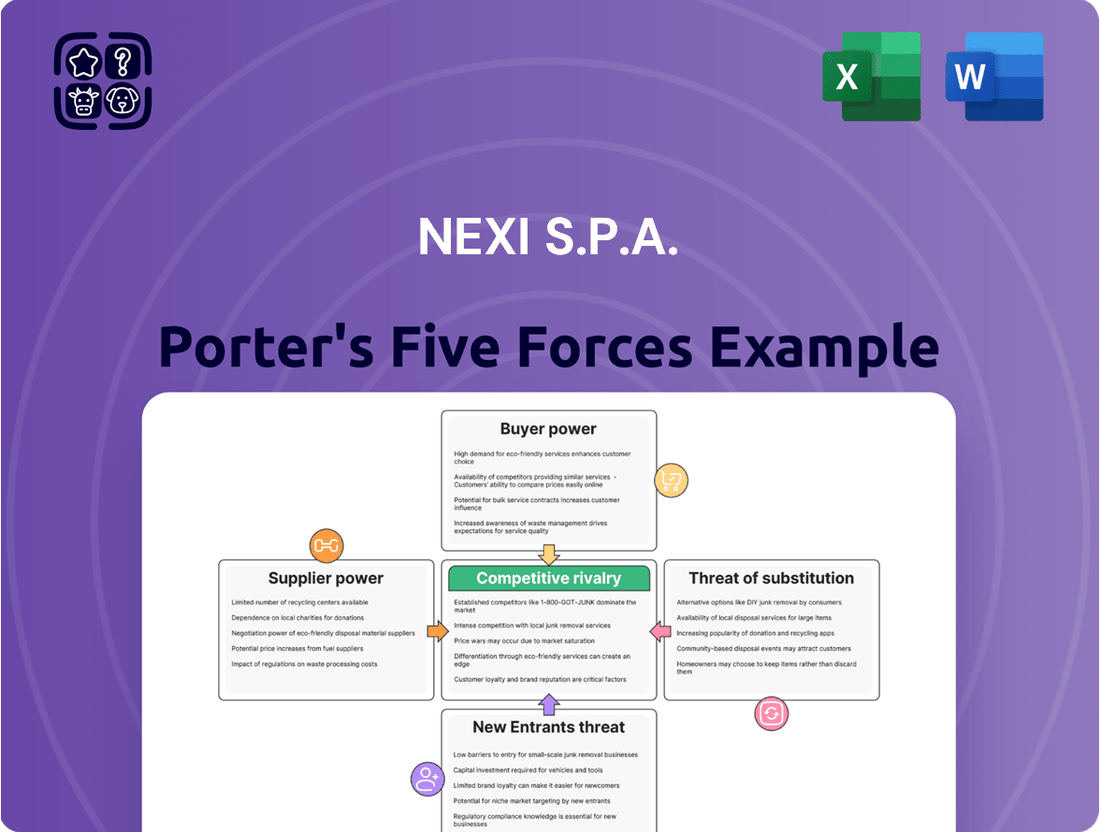

Nexi S.p.A. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nexi S.p.A. Bundle

Nexi S.p.A. operates within a dynamic payments landscape shaped by intense competition and evolving customer expectations. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this market. The bargaining power of buyers, particularly large merchants, can influence pricing and service demands, while the concentration of key technology providers can impact Nexi's operational costs. The threat of substitutes, though currently moderate, could grow as new payment methods emerge.

The complete report reveals the real forces shaping Nexi S.p.A.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of Nexi's suppliers is influenced by the concentration and uniqueness of its technology and infrastructure providers. If only a few companies offer critical payment processing software, hardware, or network services essential for Nexi's operations, these suppliers can exert significant leverage. For instance, reliance on specialized, proprietary systems for transaction routing or fraud detection, with limited alternative providers, would strengthen supplier power. In 2024, the digital payments infrastructure market continues to consolidate, meaning fewer, larger players often dominate specific technology niches, potentially increasing their ability to dictate terms.

The bargaining power of suppliers for Nexi S.p.A. is a critical factor in its operational costs and profitability. Considering Nexi's position in the payment processing industry, the switching costs associated with changing primary suppliers for essential technology or infrastructure can be substantial. These costs might include the expense and time required to integrate new software systems, reconfigure network infrastructure, or retrain technical personnel. For instance, if Nexi relies on a proprietary platform from a key supplier, the effort to transition to a new, potentially incompatible system could involve significant capital expenditure and operational disruption. High switching costs inherently strengthen the suppliers' leverage, making it more challenging for Nexi to negotiate favorable terms or explore alternative sourcing options.

The bargaining power of suppliers for Nexi S.p.A. is influenced by the availability of substitute inputs. If Nexi relies on highly specialized or proprietary technology from a limited number of providers, these suppliers hold significant power. Conversely, if Nexi can readily source components or services from multiple vendors, or if it possesses the in-house capability to develop certain inputs, supplier power is reduced.

In 2024, the payments processing industry continues to see consolidation, which can concentrate supplier power. For instance, major cloud infrastructure providers like Amazon Web Services (AWS) or Microsoft Azure are critical for Nexi's operations. Their pricing and service terms have a direct impact, and while alternatives exist, switching costs can be substantial, giving these large tech firms a degree of leverage.

Furthermore, the development of new payment technologies or standards could shift supplier dynamics. If Nexi adopts a widely available open-banking framework, for example, it might reduce reliance on specific proprietary software providers, thereby diluting their bargaining strength. The ability of Nexi to integrate various fintech solutions in-house also acts as a counter-balance to external supplier power.

Supplier Power 4

Nexi's bargaining power with its suppliers is influenced by its purchasing volume and the concentration of its supplier base. If Nexi accounts for a substantial portion of a supplier's sales, that supplier is likely more amenable to negotiating favorable terms, such as lower prices or extended payment periods. Conversely, if Nexi is a smaller client among many for its suppliers, the suppliers hold greater leverage.

For instance, in the competitive landscape of payment processing technology and services, Nexi relies on a diverse range of suppliers for hardware, software, and specialized IT infrastructure. The specific contractual agreements and the availability of alternative suppliers play a crucial role in determining the balance of power. As of its latest financial disclosures in 2024, Nexi's strategic sourcing initiatives aim to consolidate purchasing power, potentially increasing its influence over key suppliers.

- Supplier Dependence: The extent to which Nexi’s revenue constitutes a significant share of a supplier’s total business directly impacts the supplier's willingness to concede on pricing and terms.

- Alternative Suppliers: The availability and quality of alternative suppliers for critical components or services can significantly reduce the bargaining power of existing suppliers.

- Switching Costs: High costs for Nexi to switch to a new supplier for essential services or technology can inadvertently strengthen the position of current suppliers.

- Nexi's Purchasing Scale: Larger order volumes and long-term contracts generally grant Nexi greater leverage in negotiations.

Supplier Power 5

The bargaining power of suppliers for Nexi S.p.A. is generally moderate, but it can increase if suppliers possess unique or specialized technology that is critical to Nexi's payment processing operations. If a key technology provider were to develop a superior, proprietary solution for a core component of Nexi’s infrastructure, their ability to demand better terms would rise significantly. For instance, a supplier of advanced fraud detection algorithms or a unique tokenization service could hold substantial leverage.

A critical factor is the potential for forward integration by these suppliers. If a supplier, such as a major card network or a specialized fintech provider, were to realistically begin offering direct payment processing services to Nexi's existing merchant base or financial institution clients, this would represent a direct competitive threat. This scenario would dramatically enhance their bargaining power, potentially allowing them to capture market share previously held by Nexi.

Consider the scenario where a supplier of crucial data analytics software for transaction monitoring could leverage its position. If this supplier were to develop a more comprehensive, end-to-end solution that directly competes with Nexi’s core offerings, it would shift the power dynamic. As of late 2024, the payment processing landscape is marked by increasing specialization, meaning providers of niche, high-value components could indeed gain more leverage.

- Potential for Forward Integration: Suppliers in areas like secure payment gateway technology or advanced data analytics could potentially offer direct services to merchants or banks.

- Supplier Concentration: If Nexi relies on a limited number of specialized technology providers, these suppliers have increased leverage.

- Switching Costs: High costs associated with changing technology providers for critical payment infrastructure components empower existing suppliers.

- Uniqueness of Offering: Suppliers providing proprietary or highly differentiated technology essential for Nexi's operations hold greater bargaining power.

The bargaining power of Nexi's suppliers is influenced by the concentration and uniqueness of technology providers. In 2024, consolidation in the digital payments infrastructure market means fewer, larger players often dominate specific technology niches, increasing their ability to dictate terms.

High switching costs for Nexi to change essential technology or infrastructure providers, such as integrating new software or reconfiguring networks, significantly strengthen supplier leverage. For instance, reliance on proprietary platforms for transaction routing or fraud detection, with limited alternatives, empowers suppliers.

Nexi's purchasing scale and the proportion of a supplier's business it represents also impact supplier power. If Nexi is a major client, suppliers are more likely to negotiate favorable terms. Strategic sourcing initiatives in 2024 aim to consolidate purchasing power, potentially increasing Nexi's influence.

| Factor | Description | Impact on Nexi |

| Supplier Concentration | Few providers of critical tech (e.g., cloud services like AWS, Azure) | Moderate to High Leverage for Suppliers |

| Switching Costs | Integration of new payment processing software/hardware | High Costs = Increased Supplier Power |

| Uniqueness of Offering | Proprietary fraud detection or tokenization services | Stronger Negotiation Position for Suppliers |

| Nexi's Purchasing Scale | Nexi's share of a supplier's revenue | Larger Share = More Nexi Leverage |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Nexi S.p.A.'s position in the European payments sector.

Nexi S.p.A.'s Porter's Five Forces Analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick strategic decision-making and identifying key vulnerabilities.

Customers Bargaining Power

Nexi's customer base is diverse, encompassing merchants, financial institutions, corporations, and public administration bodies. While many merchants are small, large financial institutions and major corporate clients represent significant bargaining power. These larger clients can often demand more favorable pricing and customized service agreements, potentially impacting Nexi's margins.

The bargaining power of customers for Nexi, primarily merchants, is moderate. Switching costs for merchants can be relatively low if they are using common, off-the-shelf payment terminals and platforms. For instance, if a merchant can easily replace their existing POS system with one from a competitor without significant disruption or investment, their ability to negotiate better terms with Nexi increases.

However, Nexi's integrated digital payment solutions and value-added services can create higher switching costs. If a merchant relies on Nexi for a suite of services beyond basic transaction processing, such as fraud prevention, loyalty programs, or advanced analytics, the effort and potential loss of functionality involved in switching providers can be substantial. This integration makes the decision to switch more complex than simply changing a payment terminal.

By 2024, the competitive landscape in digital payments has intensified. While specific switching cost data for Nexi's merchant base isn't publicly detailed, the general trend in the fintech sector shows that providers offering seamless integration and comprehensive feature sets tend to retain customers more effectively, thereby moderating customer bargaining power.

Nexi's clients, primarily businesses, have a considerable degree of bargaining power due to the availability of numerous alternative payment processing solutions. The competitive landscape includes global players like Stripe and Adyen, as well as regional providers, offering Nexi's customers a wide array of choices. If these alternatives present comparable or more attractive pricing structures and feature sets, Nexi's clients can leverage this to negotiate better terms or switch providers. This readily available competition significantly limits Nexi's ability to dictate terms and pricing, as customers can easily seek more favorable arrangements elsewhere.

Customer Power 4

Nexi's customer power is influenced by varying price sensitivities across its diverse client base. Small and medium-sized businesses (SMBs) often exhibit higher price sensitivity, seeking cost-effective payment processing solutions. In contrast, larger enterprises and financial institutions tend to place greater emphasis on advanced functionalities, robust security, and reliable service, potentially overlooking minor price discrepancies for these benefits.

This dynamic is reflected in the payment processing industry. For instance, in 2024, the average transaction fee for SMBs can range from 1.5% to 3.5% plus a fixed fee, making them more likely to switch providers for better rates. Nexi's strategy likely involves tiered pricing and feature sets to cater to these different segments effectively.

- Price Sensitivity of SMBs: SMBs are more prone to switching providers based on pricing, impacting Nexi's ability to retain these customers without competitive offers.

- Value Proposition for Large Clients: Nexi can leverage its advanced technology and security features to command higher prices from larger clients less focused on marginal cost differences.

- Switching Costs: While not excessively high, the effort involved in changing payment processors can act as a minor deterrent for some customers, giving Nexi some leverage.

- Market Competition: The presence of numerous payment service providers intensifies competition, particularly for SMBs, thereby increasing their bargaining power.

Customer Power 5

The bargaining power of customers for Nexi S.p.A. is moderate, influenced by the potential for large clients to develop in-house payment solutions. Major financial institutions or significant retailers, with their substantial transaction volumes, could explore backward integration into payment processing. This capability would grant them leverage by providing an alternative to Nexi's services.

Nexi's customer base includes a mix of large enterprises and smaller businesses, each with varying degrees of bargaining power. For instance, large banking groups or major retail chains might possess the scale and technical expertise to consider developing their own payment infrastructure. This threat of disintermediation is a key factor influencing pricing and service negotiations.

- Potential for Backward Integration: Large clients like major banks or large retailers could develop their own payment processing capabilities, reducing reliance on Nexi.

- Customer Concentration: While Nexi serves many businesses, a few very large clients could represent a significant portion of revenue, giving them more leverage.

- Switching Costs: For smaller merchants, switching providers might be relatively easy. For larger, deeply integrated clients, switching could involve substantial costs and complexity.

- Availability of Alternatives: The payment processing market has other providers, which can limit Nexi's pricing power if customers have viable alternatives readily available.

Nexi's customer bargaining power is generally moderate, leaning higher for large clients due to their significant transaction volumes and potential to develop in-house payment solutions. Smaller businesses, while more price-sensitive, often face lower switching costs, contributing to a degree of leverage. The competitive landscape in 2024 offers numerous alternatives, amplifying customer ability to negotiate terms.

| Customer Segment | Bargaining Power Factors | Impact on Nexi |

|---|---|---|

| Large Enterprises/Financial Institutions | High transaction volume, potential for backward integration, demand for advanced features. | Can negotiate favorable pricing and customized service agreements, potentially impacting margins. |

| Small and Medium-sized Businesses (SMBs) | Price sensitivity, lower switching costs for basic services. | More likely to switch for better pricing, requiring Nexi to offer competitive rates and value. |

| Overall Market (2024) | Intense competition from global and regional players (e.g., Stripe, Adyen), availability of alternative solutions. | Limits Nexi's pricing power and necessitates a strong value proposition to retain customers. |

Preview Before You Purchase

Nexi S.p.A. Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis for Nexi S.p.A. meticulously details the competitive landscape, starting with the intense rivalry among existing players in the payments sector. The document thoroughly examines the bargaining power of buyers, considering the influence of merchants and consumers on pricing and service offerings. Furthermore, it assesses the threat of new entrants, evaluating the barriers to entry and the potential for disruptive technologies. You will also find a detailed breakdown of the bargaining power of suppliers, including card networks and technology providers, and an in-depth look at the threat of substitute products or services that could impact Nexi's market share.

Rivalry Among Competitors

Competitive rivalry within the European PayTech sector is intense. Nexi faces formidable competition from established players like Worldline, which reported revenues of €4.2 billion in 2023, and Adyen, a rapidly growing company that processed €600 billion in transactions in the first half of 2023. Stripe, though not solely European, is a significant contender with a valuation exceeding $65 billion as of its last funding round.

Furthermore, traditional banks are increasingly investing in and enhancing their digital payment services, attempting to retain market share. This includes major institutions across Europe actively developing their own payment solutions or partnering with fintechs.

The landscape is also populated by numerous smaller, agile fintech startups, constantly innovating and carving out niche markets. These disruptors often offer specialized services or leverage new technologies, adding further pressure on incumbent players like Nexi.

The European payment processing industry is characterized by a moderate growth rate, which inherently fuels intensified competitive rivalry. As the market matures, existing players are compelled to adopt more aggressive pricing and marketing tactics to capture or retain market share. This dynamic directly impacts companies like Nexi S.p.A. by increasing pressure on margins and demanding continuous innovation to differentiate services.

Competitive rivalry within the payment processing sector, particularly for Nexi S.p.A., is significant, with many players offering similar core functionalities. This often leads to a commoditized market where price becomes a key differentiator. However, Nexi differentiates itself through its integrated digital payment solutions and value-added services, aiming to reduce direct price-based competition.

In 2024, the landscape continues to be shaped by technological advancements and evolving customer expectations. Companies that invest in superior technology, such as advanced fraud detection and seamless integration capabilities, can command a premium and lessen the impact of pure price competition. Nexi's focus on innovation and expanding its service portfolio, including data analytics and loyalty programs, aims to build customer stickiness and move beyond basic transaction processing.

Competitive Rivalry 4

The digital payments industry, where Nexi operates, exhibits a significant cost structure influenced by substantial investments in technology infrastructure and regulatory compliance. These high fixed costs necessitate a focus on transaction volume to achieve economies of scale and profitability. In 2023, Nexi's operational expenses, heavily weighted towards technology and personnel, underscored the importance of maximizing its processing capacity. When market demand softens or new entrants disrupt pricing, companies with high fixed costs can be pressured into aggressive pricing strategies to maintain utilization rates, potentially leading to price wars.

The competitive landscape for Nexi is characterized by intense rivalry, with numerous players vying for market share. This includes established banks, other payment processors, and increasingly, fintech companies offering innovative solutions. The drive to acquire and retain merchants, coupled with the need to invest in cutting-edge technology, creates a dynamic environment. For instance, the ongoing consolidation within the European payments sector, highlighted by Nexi's own strategic acquisitions, demonstrates the pressure to scale and achieve cost efficiencies in a highly competitive arena.

- High fixed costs in technology and infrastructure drive the need for high transaction volumes.

- Companies may engage in price competition to ensure full capacity utilization during periods of excess supply.

- The digital payments sector faces rivalry from banks, other processors, and agile fintech firms.

- Strategic consolidation, like Nexi's acquisitions, reflects efforts to gain scale and competitive advantage.

Competitive Rivalry 5

The payment processing sector, including companies like Nexi S.p.A., faces significant competitive rivalry. High exit barriers, such as substantial investments in specialized technology, regulatory compliance, and entrenched customer relationships, can make it difficult for less successful firms to leave the market. This can lead to prolonged periods of intense competition, even for companies that are not performing optimally, as they are compelled to remain operational due to these sunk costs.

These high exit barriers mean that even struggling competitors might continue to operate, potentially at reduced margins, to recover some of their initial investments. This dynamic intensifies the pressure on profitable players like Nexi to maintain efficiency and innovation. For instance, the cost of migrating data and retraining staff for a new system can be prohibitive, locking companies into existing infrastructure and the competitive landscape it defines.

Consider these factors contributing to intense rivalry:

- Specialized Assets: Significant capital is invested in proprietary payment gateways, fraud detection systems, and data centers, creating high switching costs for customers and making asset divestment challenging for processors.

- Long-Term Contracts: Many payment processors operate under multi-year contracts with merchants, binding them to the service provider and increasing the difficulty of exiting the market without penalty.

- Regulatory Hurdles: Navigating complex financial regulations requires ongoing investment and expertise, making it a barrier for new entrants and a costly commitment for existing players looking to exit.

- Brand Loyalty and Network Effects: Established relationships and the perceived security of well-known payment processors can foster loyalty, making it harder for competitors to gain market share and for firms to exit without impacting their reputation.

Competitive rivalry is fierce in the European PayTech sector, with Nexi facing strong opposition from giants like Worldline, which posted €4.2 billion in revenue for 2023, and Adyen, which processed €600 billion in transactions in the first half of 2023. Stripe, a significant global player with a valuation over $65 billion in its last funding round, also adds to this competitive pressure. Traditional banks are also enhancing their digital payment offerings, aiming to retain their customer base.

The market is further crowded by numerous nimble fintech startups, consistently introducing innovative niche services. These disruptors often leverage new technologies, intensifying the challenge for established companies like Nexi. The moderate growth rate of the European payment processing industry fuels this competition, pushing players towards more aggressive pricing and marketing strategies to secure or maintain market share, impacting Nexi's margins and demanding continuous innovation.

High fixed costs, particularly in technology and regulatory compliance, necessitate high transaction volumes for profitability in the digital payments sector. This can lead to price competition, especially when market demand slackens or new entrants emerge. Nexi's strategy involves differentiating through integrated digital payment solutions and value-added services, aiming to move beyond simple price competition and build customer loyalty.

| Competitor | 2023 Revenue/Valuation | Key Differentiators |

| Worldline | €4.2 billion (Revenue) | Established presence, broad service portfolio |

| Adyen | €600 billion (H1 2023 Transactions) | Technology-driven platform, global reach |

| Stripe | >$65 billion (Valuation) | Developer-focused, online payment solutions |

SSubstitutes Threaten

The threat of substitutes for Nexi's electronic payment services remains a key consideration. While declining, traditional methods like cash and checks still represent a substitute, particularly in certain demographics or smaller transactions. However, the primary substitutes are evolving digital alternatives that bypass traditional card networks, such as peer-to-peer payment apps or emerging cryptocurrencies, though their widespread adoption for everyday retail transactions is still developing.

Direct bank-to-bank payment solutions, like instant payments and Account-to-Account (A2A) transfers, pose a significant threat to Nexi S.p.A. by potentially bypassing traditional card networks. These A2A methods can offer merchants substantially lower transaction fees compared to card processing, which directly impacts Nexi's revenue streams. For instance, in 2024, many European countries saw increased adoption of real-time payment systems, with some reporting that A2A transactions can be up to 70% cheaper than card payments for businesses. This cost advantage incentivizes merchants to explore and implement these alternative payment rails.

Emerging payment technologies, such as cryptocurrencies and blockchain-based systems, represent a growing, albeit currently niche, threat of substitutes for Nexi S.p.A. These technologies offer potential disintermediation, bypassing traditional financial intermediaries. For instance, by mid-2024, global cryptocurrency adoption continued to expand, with estimates suggesting over 420 million users worldwide, indicating increasing acceptance.

While consumer adoption of cryptocurrencies for everyday transactions remains limited, their underlying technology could be leveraged for more efficient and potentially lower-cost payment processing. Businesses are increasingly exploring stablecoins and blockchain for cross-border payments, a segment where Nexi operates. By the end of 2023, the total value of crypto transactions globally surpassed $10 trillion, demonstrating the scale of this emerging market.

Threat of Substitutes 4

The threat of substitutes for Nexi S.p.A. is moderate, driven by evolving payment technologies and strategic moves by large players. For instance, major retailers and financial institutions are increasingly exploring or implementing their own payment solutions, aiming to bypass third-party processors. This trend is amplified by the growing adoption of open banking frameworks, which facilitate the creation of in-house payment ecosystems.

This strategic shift by large merchants and banks can significantly reduce their dependence on PayTech providers like Nexi. Consider the potential for a large e-commerce platform to develop a seamless, integrated payment experience within its own app, thereby diminishing the need for external payment gateways. Such proprietary systems can offer greater control over customer data and transaction fees.

The increasing interoperability of payment systems, a byproduct of open banking, also lowers the switching costs for businesses. Instead of being locked into a single provider, they can more easily integrate alternative payment methods or build their own. This flexibility directly challenges the market position of established players like Nexi.

- Potential for proprietary payment ecosystems by large merchants and financial institutions.

- Leveraging open banking initiatives to create in-house payment solutions.

- Reduced reliance on third-party PayTech providers like Nexi.

- Lowered switching costs due to increased payment system interoperability.

Threat of Substitutes 5

The threat of substitutes for Nexi's payment processing services is moderate but growing. While established players like Visa and Mastercard have deep integrations, alternative payment methods are gaining ground, particularly in specific consumer segments. For instance, digital wallets and buy-now-pay-later (BNPL) services offer a different price-performance trade-off, often perceived as more convenient for smaller, impulse purchases. In 2024, the European BNPL market is projected to continue its robust expansion, with transaction volumes expected to surpass €100 billion, presenting a direct challenge to traditional card-based processing.

These substitutes can erode Nexi's market share if they offer significantly lower costs or greater convenience for certain use cases. For merchants, the integration costs and transaction fees associated with alternative payment gateways can be a key consideration.

- Digital Wallets: Services like Apple Pay and Google Pay offer streamlined checkouts, directly competing for consumer preference and potentially reducing reliance on traditional card networks for online and in-app purchases.

- Buy-Now-Pay-Later (BNPL): BNPL providers present an attractive financing option for consumers, especially for larger purchases, which could divert transaction volume from card processing.

- Peer-to-Peer (P2P) Payments: For person-to-person transactions, P2P apps can bypass traditional payment rails entirely.

- Cryptocurrency Payments: While still niche, the increasing acceptance and usability of cryptocurrencies for certain transactions represent a nascent but potential substitute.

The threat of substitutes for Nexi S.p.A. is characterized by the rise of direct bank-to-bank payments and evolving digital wallet solutions. Account-to-Account (A2A) transfers, often facilitated by instant payment systems, offer merchants a compelling alternative due to significantly lower transaction fees compared to card processing. For instance, in 2024, several European countries reported that A2A transactions could be up to 70% more cost-effective for businesses than traditional card payments, directly impacting Nexi's revenue potential.

Digital wallets and Buy-Now-Pay-Later (BNPL) services also represent growing substitutes, particularly for consumer-facing transactions. BNPL providers, in particular, are seeing substantial growth; the European BNPL market was projected to exceed €100 billion in transaction volumes in 2024, presenting a direct challenge to card-based processing models. These alternatives can erode Nexi's market share by offering either enhanced convenience or different pricing structures for specific transaction types.

Entrants Threaten

The threat of new entrants for Nexi S.p.A. is generally moderate due to significant regulatory and licensing requirements in the European payment services industry. Obtaining a Payment Institution (PI) or Electronic Money Institution (EMI) license, mandated by directives like PSD2, involves substantial capital, compliance, and operational readiness, creating high entry barriers.

These stringent regulations mean that new companies must invest heavily in legal, compliance, and technological infrastructure before they can even begin offering services, effectively deterring many potential competitors. For instance, the capital requirements for an EMI license can range from hundreds of thousands to over a million euros, depending on the scope of services.

While established players like Nexi benefit from existing licenses and customer trust, new fintech startups face a lengthy and costly authorization process. This complexity, coupled with the need for robust security and anti-money laundering (AML) protocols, ensures that only well-funded and serious contenders can navigate the initial hurdles.

Launching a payment processing business, like Nexi S.p.A. operates within, demands considerable financial muscle. The sheer capital required for robust technology infrastructure, including secure data centers and advanced fraud detection systems, acts as a significant barrier. For instance, building a compliant and reliable payment gateway often necessitates millions in upfront investment, a sum many aspiring competitors simply cannot muster.

Beyond initial setup, ongoing investments in cybersecurity and regulatory compliance are substantial. Companies must continuously update their systems to meet evolving data protection standards and combat sophisticated cyber threats. In 2024, the cost of maintaining PCI DSS compliance alone can be a considerable operational expense, further increasing the capital intensity and deterring less-resourced entrants.

The established network effects and brand recognition of incumbents like Nexi also pose a challenge. New entrants struggle to gain market share without a proven track record and a broad customer base, which takes time and significant marketing expenditure to build. This makes it difficult for newcomers to compete on price or service offerings against established players who benefit from economies of scale.

The threat of new entrants in the PayTech sector, particularly for a company like Nexi, is significantly mitigated by strong network effects and economies of scale. Nexi's extensive existing network of merchants and banking partners creates a formidable barrier, as new players struggle to reach the critical mass necessary for viable competition.

Achieving comparable scale and cost efficiencies is a major hurdle for newcomers. For instance, Nexi's processing volume allows for lower per-transaction costs, a competitive advantage that is difficult for smaller, emerging companies to replicate quickly. In 2023, Nexi processed a substantial volume of transactions, underscoring its scale advantage.

Threat of New Entrants 4

The threat of new entrants for Nexi S.p.A. is moderate, primarily due to the significant capital requirements and regulatory hurdles inherent in the payment processing industry. Establishing trust and brand loyalty with both merchants and consumers is a lengthy and costly endeavor for newcomers. Nexi's established reputation and extensive network are considerable barriers.

New entrants face challenges in replicating Nexi's scale and the deep integration it has with existing financial ecosystems. The trust required in financial services means that building a credible brand and a reliable track record takes years, if not decades. For instance, obtaining necessary licenses and complying with stringent data protection regulations like GDPR adds substantial upfront costs and time to market.

- High Capital Investment: New payment processors need substantial funds for technology development, regulatory compliance, and marketing.

- Regulatory Barriers: Obtaining licenses and adhering to financial regulations across various jurisdictions is complex and time-consuming.

- Brand Trust and Loyalty: Building a reputation for security and reliability in handling financial transactions is crucial and difficult for new players to achieve quickly.

- Network Effects: Nexi benefits from existing relationships with banks, merchants, and consumers, creating a powerful network effect that new entrants struggle to overcome.

Threat of New Entrants 5

The threat of new entrants for Nexi S.p.A. is moderated by the significant capital and specialized expertise required in the payment processing industry. Innovation in areas like cybersecurity, blockchain, and AI demands a deep pool of skilled professionals. A global shortage of talent in these fields, particularly in cybersecurity, can act as a substantial barrier for newcomers attempting to establish a competitive presence.

Furthermore, the established network effects and customer loyalty enjoyed by incumbents like Nexi are difficult to replicate. Building trust and a robust customer base in a sector heavily reliant on security and reliability takes considerable time and investment. The stringent regulatory landscape also presents a hurdle; new entrants must navigate complex compliance requirements across various jurisdictions, adding to the cost and complexity of market entry.

In 2024, the demand for cybersecurity professionals remained exceptionally high, with reports indicating a global shortfall of millions of such specialists. This talent scarcity directly impacts the ability of potential new payment processors to build secure and compliant operations, thereby reinforcing the barriers to entry for companies looking to challenge established players like Nexi.

- High Capital Requirements: Setting up payment processing infrastructure demands substantial upfront investment in technology, security, and regulatory compliance.

- Specialized Talent Scarcity: A shortage of experts in cybersecurity, AI, and blockchain impedes new entrants' ability to innovate and operate securely.

- Regulatory Hurdles: Navigating diverse and complex financial regulations globally is a significant barrier for new market participants.

- Established Network Effects: Incumbents benefit from existing customer bases and merchant relationships, creating loyalty that is hard for newcomers to overcome.

The threat of new entrants for Nexi S.p.A. is generally considered moderate. Significant capital investment is required for technology, regulatory compliance, and establishing brand trust. For instance, obtaining necessary payment licenses in Europe can involve substantial capital reserves, sometimes in the millions of euros, alongside extensive operational and security infrastructure.

Regulatory hurdles, such as compliance with PSD2 and GDPR, create high barriers. New entrants must invest heavily in legal, compliance, and robust security frameworks. In 2024, the ongoing costs of maintaining data protection standards and cybersecurity measures continue to be a significant deterrent.

Established network effects and brand loyalty also play a crucial role. Nexi benefits from its extensive existing relationships with banks and merchants, making it difficult for newcomers to achieve comparable scale and cost efficiencies. Building this level of trust and integration takes considerable time and resources.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment in technology, security, and licensing. | Significant deterrent for less-funded startups. |

| Regulatory Compliance | Navigating complex financial regulations (e.g., PSD2, GDPR). | Costly and time-consuming authorization process. |

| Brand Trust & Loyalty | Building reputation for security and reliability. | Difficult for new players to achieve quickly against established incumbents. |

| Network Effects | Existing relationships with banks and merchants. | Hard for newcomers to replicate Nexi's scale and integration. |

Porter's Five Forces Analysis Data Sources

Our Nexi S.p.A. Porter's Five Forces analysis is built upon a foundation of financial reports, industry-specific market research from firms like Statista and IBISWorld, and publicly available regulatory filings.

We leverage data from Nexi's annual reports, investor presentations, and analyses from financial data providers such as Bloomberg and S&P Capital IQ to assess competitive dynamics.