Nan Ya Printed Circuit Board PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nan Ya Printed Circuit Board Bundle

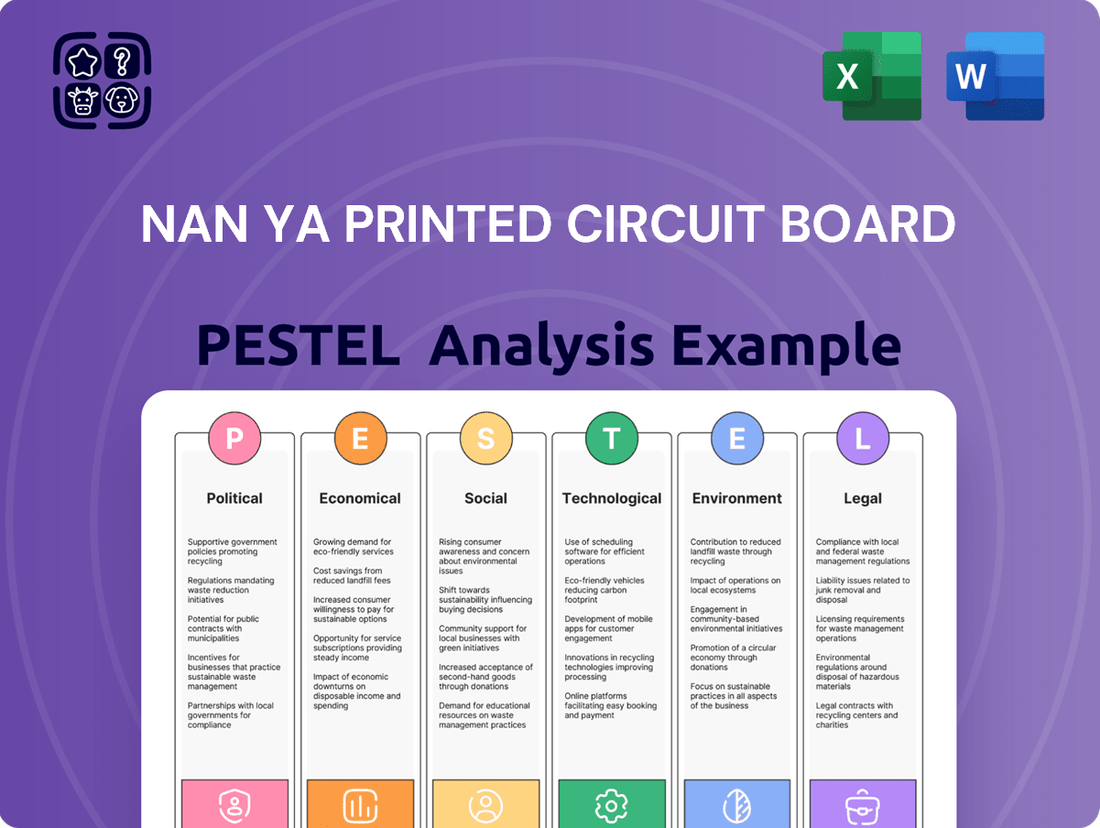

Unlock the strategic landscape of Nan Ya Printed Circuit Board with our comprehensive PESTLE analysis. Understand how evolving political stability, economic fluctuations, and technological advancements are directly impacting their operations and future growth. This analysis delves into the social shifts and environmental regulations that are crucial for navigating the competitive PCB market. Gain the foresight needed to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now for actionable intelligence to refine your own market strategy.

Political factors

The ongoing trade friction between the US and China creates significant uncertainty for Taiwan-based manufacturers like Nan Ya PCB. Potential tariffs and export controls, such as those seen impacting semiconductor supply chains into 2024, pose major concerns for their costs and market access. The company must navigate these complex geopolitical dynamics, which includes diversifying its production footprint. For instance, companies are increasingly exploring Southeast Asian facilities to mitigate risks associated with over-reliance on a single region, a trend accelerating through 2025.

Major clients, especially in the US, increasingly mandate that suppliers like Nan Ya PCB establish manufacturing outside China and Taiwan to bolster supply chain resilience. This political and commercial pressure is driving substantial investment in new facilities across Southeast Asia, particularly in Thailand and Vietnam. Nan Ya PCB is actively expanding into these regions, with planned investments exceeding $500 million in Vietnam by 2025, to meet customer demands and mitigate escalating geopolitical risks. This strategic pivot ensures continued market access and strengthens long-term operational stability.

Taiwan's 'Silicon Shield' strategy hinges on its global leadership in advanced semiconductors and high-end PCBs, a sector estimated to contribute significantly to the island's 2024 GDP. The government actively supports this industry, providing incentives and R&D funding to maintain its technological edge and geopolitical influence. For instance, Taiwan holds an estimated 30% share in the global high-end PCB market in 2024. However, as companies like Nan Ya PCB diversify production globally, including expansions in North America and Southeast Asia by 2025, this strategic dispersal could subtly alter the concentrated leverage the traditional 'silicon shield' provides.

Local Government Regulations in Expansion Regions

As Nan Ya PCB expands into new countries like Thailand, it must navigate complex local labor and investment regulations. For instance, Thailand's updated Labor Protection Act for 2025 mandates that foreign companies aim for at least 70% local employee hiring. This presents a significant challenge for Nan Ya PCB in securing skilled mid and senior-level staff for new manufacturing facilities, such as the planned plant in Thailand's Eastern Economic Corridor. Successfully complying with these local directives is crucial for the operational efficiency and long-term viability of these new sites.

- Thailand's 2025 labor regulations target 70% local workforce.

- Securing specialized talent for new PCB manufacturing sites remains a key hurdle.

- Compliance impacts operational costs and recruitment strategies.

Global Cybersecurity and Data Regulations

Increasingly stringent international regulations, such as the EU's Cyber Resilience Act effective in late 2024, impose new cybersecurity requirements on electronic component manufacturers. Nan Ya PCB must ensure its products and manufacturing processes fully comply with these evolving standards to maintain access to crucial markets like Europe, which represented approximately 15% of its 2023 revenue. The company recently obtained ISO/IEC 27001:2022 certification in Q1 2024, demonstrating its proactive commitment to robust information security and data protection. This compliance is vital for securing new contracts and mitigating regulatory risks.

- EU Cyber Resilience Act: Effective late 2024, mandates enhanced cybersecurity for digital products.

- ISO/IEC 27001:2022: Nan Ya PCB achieved certification in Q1 2024, affirming data security.

- Market Access: Compliance crucial for European market, accounting for 15% of 2023 revenue.

Geopolitical tensions, particularly US-China trade friction, compel Nan Ya PCB to diversify production, with over $500 million planned for Vietnam by 2025 to meet client demands. Taiwan's government supports its 30% global high-end PCB market share, but global dispersal may alter this leverage. New regulations, like Thailand's 2025 70% local hiring mandate and the EU's late 2024 Cyber Resilience Act, also shape operational strategy.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Trade Friction | Production diversification | >$500M Vietnam investment by 2025 |

| Taiwan Policy | Industry support | 30% global high-end PCB market share 2024 |

| Labor Laws | Hiring challenges | Thailand 70% local hiring target 2025 |

| EU Regulations | Compliance costs | Cyber Resilience Act effective late 2024 |

What is included in the product

This Nan Ya Printed Circuit Board PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company.

It provides actionable insights for strategic decision-making by highlighting market trends and potential challenges.

A concise Nan Ya Printed Circuit Board PESTLE Analysis that highlights key external factors, offering clarity and reducing complexity for strategic decision-making.

This Nan Ya Printed Circuit Board PESTLE Analysis provides a clear, actionable overview of external influences, helping teams quickly identify and address potential challenges and opportunities.

Economic factors

The market for printed circuit boards is directly tied to the health of the global electronics industry. Projections for 2025 indicate a steady recovery and growth in demand, with global smartphone shipments forecast to exceed 1.3 billion units and PC shipments seeing a rebound. This growth is driven by new replacement cycles and significant technological upgrades, especially in AI-related applications. For instance, AI PC shipments are expected to reach nearly 50 million units in 2025. This recovering demand, particularly for high-performance computing and AI infrastructure, presents a strong positive for Nan Ya PCB's revenue streams.

As a global exporter with extensive operations across multiple countries, Nan Ya PCB's financial performance is notably sensitive to currency fluctuations. For instance, a sharp appreciation of the New Taiwan dollar (NTD), which saw the NTD strengthen against the USD in early 2024, can negatively impact earnings when foreign currency revenues are converted back. The company must employ robust hedging strategies, such as forward contracts or options, to mitigate the risks associated with volatile exchange rates and protect its profitability.

Global macroeconomic conditions, specifically persistent inflation and elevated interest rates, are significantly impacting consumer spending on electronics and raising the cost of capital for Nan Ya Printed Circuit Board's expansion initiatives. Although projections for late 2024 and 2025 suggest some easing of these pressures, they continue to suppress overall market demand and affect the company's profitability. Nan Ya's net profit margin in Q1 2024, for instance, reflected these challenging economic headwinds. The current environment necessitates careful capital expenditure planning, with global interest rates still influencing borrowing costs for new projects.

Intense Industry Competition and Pricing Pressure

The global PCB market faces intense competition, leading to significant pricing pressure and impacting profit margins for manufacturers like Nan Ya Printed Circuit Board. This competitive landscape, particularly evident in 2024, has seen companies vying aggressively for orders, often resulting in reduced average selling prices. Nan Ya's net profit margin, for instance, reflected these pressures, with reports indicating a contraction in early 2024 compared to previous periods. To counteract this, Nan Ya is strategically shifting focus towards high-value products, such as advanced substrates for AI and high-performance computing applications, aiming for stronger margins in these niche segments.

- Global PCB market projected to reach approximately 80 billion USD in 2024, with intense competition.

- Nan Ya's Q1 2024 revenue for PCB and substrates showed a decline, reflecting market pressures.

- Focus on AI and HPC substrates aims to capture premium market share, with demand growing over 20% annually through 2025.

- Strategic shift to high-end products is crucial for maintaining profitability amidst fierce competition.

Growth in AI and High-Performance Computing (HPC)

The explosive growth of Artificial Intelligence (AI) serves as a significant economic driver for the high-end PCB market, especially for advanced IC substrates. Demand for these specialized substrates, crucial for AI servers, GPUs, and cloud computing infrastructure, is surging with the AI market projected to exceed $300 billion by 2025. Nan Ya PCB is strategically positioning itself to capitalize on this by investing substantially in R&D and expanding production capacity for these high-value segments, aiming to capture a larger share of the advanced packaging market.

- Global AI market value expected to surpass $300 billion in 2025.

- Demand for AI server PCBs and IC substrates grew over 20% in 2024.

- Nan Ya PCB allocated significant capital expenditure for advanced substrate expansion in 2024-2025.

- High-performance computing (HPC) and AI segments are driving over 50% of new IC substrate demand.

Global electronics demand, driven by 1.3 billion smartphone and 50 million AI PC shipments in 2025, fuels PCB market recovery. However, intense competition in the $80 billion global PCB market (2024) creates pricing pressure, reflected in Nan Ya's Q1 2024 profit margins. Currency volatility and elevated interest rates also impact profitability and expansion costs. Nan Ya mitigates this by focusing on high-margin AI/HPC substrates, with demand growing over 20% annually through 2025, strategically capturing premium market share.

| Factor | 2024 Impact | 2025 Outlook |

|---|---|---|

| Global PCB Market Value | ~$80 Billion | Growth expected |

| AI PC Shipments | Growing | ~50 Million Units |

| AI Market Value | Rapid Growth | >$300 Billion |

What You See Is What You Get

Nan Ya Printed Circuit Board PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Nan Ya Printed Circuit Board PESTLE Analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the market dynamics and strategic considerations for Nan Ya. The content and structure shown in the preview is the same document you’ll download after payment, offering valuable insights.

Sociological factors

Consumers consistently demand smaller, lighter, and more powerful electronic devices, from smartphones to wearables. This societal trend fuels the need for High-Density Interconnect HDI and flexible PCBs, essential for compact designs. The global flexible PCB market, valued at USD 17.1 billion in 2023, is projected to reach USD 30.5 billion by 2032, underscoring this demand. Nan Ya must continually innovate in HDI and flexible PCB technologies to meet the evolving design requirements of modern consumer electronics, especially as the overall PCB market approaches USD 95.8 billion by 2025.

Growing global eco-consciousness is significantly impacting the PCB industry, with consumers and regulators increasingly demanding environmentally friendly products and sustainable manufacturing. This societal shift compels manufacturers like Nan Ya PCB to adopt greener practices, such as using biodegradable materials and optimizing resource consumption. Nan Ya PCB is actively responding, demonstrating commitment through its 2023 ESG report, which highlights a 5% reduction in electricity consumption and a 7% decrease in water usage compared to 2022. This proactive approach helps meet market expectations for sustainable production by 2025.

The increasing integration of the Internet of Things (IoT) into daily life, encompassing smart homes, wearables, and connected vehicles, profoundly shapes consumer behavior and market demand. This societal shift drives a massive need for specialized PCBs featuring integrated sensors, ultra-low power consumption, and robust wireless connectivity. The global IoT market is projected to reach approximately $1.8 trillion by 2025, highlighting a significant growth trajectory for related components. Nan Ya's product portfolio must critically adapt to cater to the diverse and expanding applications within this dynamic IoT ecosystem, ensuring compatibility with emerging standards like Wi-Fi 7 and 5G RedCap.

Health and Wellness Technology Boom

The increasing global focus on personal health and wellness is driving a boom in medical wearables and consumer health devices. This market, projected to reach over $200 billion by 2025, often requires highly reliable, flexible, and miniaturized PCBs. Nan Ya PCB can capitalize on this demand by supplying specialized components for this expanding sector.

- Global digital health market is projected to exceed $660 billion by 2025.

- Wearable medical device market is expected to grow at a CAGR of 25% through 2025.

- Miniaturized PCBs are crucial for devices like smartwatches and continuous glucose monitors.

Talent Shortage in the Semiconductor Industry

Taiwan's semiconductor and electronics industry, despite its global prominence, grapples with a persistent shortage of skilled engineers and technical talent. This societal challenge poses a significant risk to the long-term growth and innovation capabilities of companies like Nan Ya PCB.

Recent reports from 2024 indicate a projected annual demand for over 20,000 new semiconductor professionals in Taiwan, far exceeding the current supply of graduates. Addressing this critical gap requires strategic investment in advanced training programs, aggressive recruitment initiatives, and fostering an attractive work environment to secure the necessary human capital for sustained competitiveness.

- Taiwan's Ministry of Education aims to increase STEM graduates by 25% by 2026 to mitigate the talent deficit.

- The semiconductor industry's average vacancy rate for engineers in 2024 reached approximately 15-20% in key roles.

- Companies are boosting starting salaries for new engineering graduates by 10-15% in 2025 to attract talent.

- Government-industry partnerships are investing over NT$10 billion in 2024-2025 for specialized semiconductor training academies.

Societal shifts towards eco-conscious consumption and the pervasive integration of IoT are reshaping demand for sustainable, specialized PCBs by 2025. The burgeoning health and wellness market, projected at over $200 billion by 2025 for wearables, further necessitates miniaturized, flexible components. However, Taiwan's critical shortage of skilled engineers, with a 15-20% vacancy rate in 2024, poses a significant risk to Nan Ya's innovation capacity. Addressing these requires strategic talent investment and product adaptation.

| Societal Factor | Market Impact (2024/2025) | PCB Implication |

|---|---|---|

| Eco-Consciousness | Global flexible PCB market: $30.5B by 2032 | Demand for sustainable materials, green practices |

| IoT Integration | Global IoT market: ~$1.8T by 2025 | Need for specialized, low-power, connected PCBs |

| Health & Wellness | Medical wearables: >$200B by 2025 | Crucial for miniaturized, flexible, reliable PCBs |

| Talent Shortage | Taiwan engineer vacancy: 15-20% in 2024 | Risk to innovation, R&D capacity |

Technological factors

Advancements in AI and automation are transforming PCB manufacturing, boosting precision and efficiency. AI-driven design optimization and automated optical inspection (AOI) are now standard, with the global industrial robotics market in electronics manufacturing projected to reach over $7 billion by 2025. Nan Ya integrates AI and big data into its production management, enhancing operational performance and quality control. This strategic embrace of smart manufacturing technologies, including predictive maintenance, is crucial for maintaining a competitive edge in the evolving market.

The relentless drive for smaller electronics fuels the demand for High-Density Interconnect (HDI) technology, allowing more connections in a compact area. This crucial capability, utilizing advanced microvias and multi-layer designs, significantly enhances signal integrity and performance in cutting-edge devices. For Nan Ya PCB, mastering HDI is essential to serve the booming consumer electronics, mobile, and wearable markets, which are projected to see continued growth into 2025 with increased integration of complex functionalities.

Innovation in substrate materials is crucial for next-generation electronics, driving demand for advanced PCB solutions. This includes developing materials with superior thermal properties and ultra-low-loss characteristics essential for high-frequency applications like 5G and emerging 6G infrastructure. Nan Ya's R&D efforts are intensely focused on high-frequency, high-speed, and eco-friendly substrates, aligning with the surging demands from AI servers and sophisticated automotive electronics. For instance, the global high-frequency laminate market, a key segment for Nan Ya, is projected to reach approximately $1.5 billion by 2025, underscoring the importance of these material advancements.

Rise of 3D-Printed PCBs

The rise of 3D-printed PCBs, utilizing additive manufacturing, is transforming production by enabling rapid prototyping and intricate multi-layer designs. This evolving technology offers potential for on-demand, customized circuit board manufacturing, significantly reducing lead times. Staying abreast of these developments is crucial for Nan Ya PCB's long-term competitiveness, as the global 3D printing electronics market is projected to reach over $500 million by 2025.

- The global 3D printing electronics market is expected to grow at a Compound Annual Growth Rate (CAGR) exceeding 25% through 2025.

- 3D printing can reduce PCB prototyping cycles from weeks to days, enhancing market responsiveness.

- Specialized conductive inks are advancing, supporting higher performance and reliability in 3D-printed circuits.

- By 2024, an estimated 5-7% of all PCB prototypes could incorporate some form of additive manufacturing.

Demand for High-Frequency PCBs for 5G/6G

The rapid global rollout of 5G and the ongoing development of 6G networks are creating a significant demand for advanced high-frequency PCBs. These specialized boards must manage high-frequency signals with minimal loss, necessitating the use of low-loss dielectric materials and sophisticated thermal management solutions. Nan Ya Printed Circuit Board is a key supplier, actively developing and manufacturing PCBs designed for high-frequency and high-speed applications, directly supporting the expanding telecommunications infrastructure market. This strategic focus aligns with projections for the 5G PCB market reaching approximately $20.5 billion by 2025.

- Global 5G PCB market projected to reach $20.5 billion by 2025.

- Growth driven by demand for high-frequency, low-loss materials.

- 6G research emphasizes even higher frequency capabilities.

- Nan Ya’s specialized materials like Ajinomoto Build-up Film (ABF) substrates are crucial.

Technological advancements are rapidly reshaping PCB manufacturing, with AI and automation boosting efficiency and precision. The global industrial robotics market in electronics manufacturing is set to exceed $7 billion by 2025. Nan Ya PCB’s focus on HDI, advanced substrates for 5G/6G, and exploring 3D printing, with the 3D printing electronics market projected over $500 million by 2025, is crucial for competitiveness.

| Technology Area | 2025 Market Projection | Impact on Nan Ya PCB | ||

|---|---|---|---|---|

| Industrial Robotics (Electronics) | >$7 Billion | Enhanced automation and quality control | ||

| High-Frequency Laminates | ~$1.5 Billion | Supports 5G/6G and AI server demand | ||

| 5G PCB Market | ~$20.5 Billion | Drives demand for specialized high-speed boards |

Legal factors

The PCB industry faces stringent environmental regulations regarding waste disposal, water usage, and chemical handling, often labeled as high-pollution. Compliance with directives such as RoHS and REACH is crucial for Nan Ya PCB to maintain market access, particularly in European markets. By 2025, stricter global standards are expected to push for even lower hazardous substance limits, requiring continuous investment in green manufacturing processes. Nan Ya must allocate significant capital, projected at a 5-7% increase in compliance costs for 2024-2025, to meet these evolving legal standards and client demands for sustainability.

In the high-tech electronics sector, safeguarding intellectual property is paramount for Nan Ya Printed Circuit Board. This involves securing patents for advanced PCB manufacturing processes and material innovations, crucial for maintaining a competitive edge in 2024. Robust legal frameworks are essential to prevent IP theft, a threat costing the global economy an estimated $300 billion annually in counterfeit goods and pirated software. Enforcing these patents across diverse international jurisdictions, especially given global supply chains, presents significant legal complexities. Effective IP protection directly impacts market valuation and investor confidence, crucial for sustained growth.

Nan Ya PCB must navigate diverse labor laws when expanding operations, encompassing regulations on wages, working hours, and workplace safety in each country. For instance, in 2024, Thailand reinforced its Alien Employment Act, tightening the local-to-foreign employee ratio requirements for certain industries, directly influencing Nan Ya's hiring and talent acquisition strategies. Adhering to these evolving standards is crucial to avoid substantial legal penalties, which can exceed 300,000 Thai Baht per non-compliant instance, and to uphold a positive corporate reputation among stakeholders.

Trade Compliance and Tariffs

Nan Ya Printed Circuit Board's extensive global operations mean it navigates a complex web of international trade laws, tariffs, and customs regulations. For instance, the ongoing US-China trade dynamics, including potential tariff adjustments in 2024-2025, directly influence the cost of raw materials and finished goods, necessitating agile supply chain reconfigurations. The company must continuously monitor these legal and political shifts to avoid disruptions and maintain competitive pricing, especially as global trade policies remain fluid.

- Trade policy shifts, such as potential adjustments to Section 301 tariffs on Chinese goods by the US in 2024, directly impact Nan Ya's import costs.

- Compliance with regional trade agreements and customs declarations is crucial for efficient cross-border movement of components and products.

- Increased scrutiny on supply chain origins, driven by new regulations on forced labor or environmental standards, adds layers of compliance complexity.

- Strategic adjustments to sourcing and manufacturing locations are often a direct response to evolving tariff structures and trade barriers.

Corporate Governance and Financial Reporting Standards

As a prominent company on the Taiwan Stock Exchange, Nan Ya PCB operates under stringent corporate governance and financial reporting standards. This includes a commitment to transparent financial disclosures, ethical management practices, and robust protection of shareholder rights. Adherence to these legal requirements is essential for maintaining strong investor confidence and the overall integrity of the capital market. For instance, companies like Nan Ya PCB must comply with the Securities and Exchange Act of Taiwan, ensuring timely and accurate reporting of their 2024 and 2025 financial performance.

- Taiwan Stock Exchange (TWSE) mandates adherence to IFRS for financial reporting.

- Regular audits are conducted by independent firms to ensure compliance with reporting standards.

- Shareholder meetings and voting rights are protected under Taiwanese corporate law.

- The company's 2024 annual report emphasizes governance structures for transparency.

Nan Ya PCB faces evolving legal landscapes, from stringent environmental compliance like RoHS and REACH, with projected 5-7% higher costs for 2024-2025, to critical intellectual property protection against theft. Global operations demand adherence to diverse labor laws, such as Thailand's reinforced Alien Employment Act, and navigating complex international trade tariffs, including potential US-China adjustments impacting 2024-2025 supply chains. Strict corporate governance under Taiwan Stock Exchange mandates, including IFRS reporting, ensures transparency and investor confidence.

| Legal Area | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Environmental | Compliance Cost Increase | 5-7% higher for 2024-2025 |

| Intellectual Property | Global IP Theft Cost | Estimated $300 billion annually |

| Labor Laws | Thai Alien Employment Act Penalty | Over 300,000 THB per non-compliance |

Environmental factors

Nan Ya Printed Circuit Board faces significant pressure from global clients and governments to drastically reduce its carbon footprint and align with net-zero emissions goals by 2050. This necessitates substantial investment, with companies like Nan Ya allocating capital towards energy-efficient manufacturing processes and increasing renewable energy adoption, potentially aiming for 50% renewable energy use by 2030. Failure to meet these escalating environmental standards, such as achieving Scope 1 and 2 emission reductions, could lead to losing major orders from eco-conscious clients who prioritize sustainable supply chains, directly impacting revenue streams.

PCB manufacturing, including Nan Ya's operations, is highly water-intensive, making water conservation paramount, especially given Taiwan's vulnerability to droughts, like the significant challenges seen in early 2024. Companies are increasingly mandated to implement advanced water recycling technologies, with some facilities aiming for over 90% water reuse rates to minimize freshwater intake. This commitment to efficient water and resource management is crucial for operational continuity and aligns with the industry's sustainability goals, impacting both regulatory compliance and public perception in 2025.

The electronics industry is rapidly moving towards sustainable practices, with a significant shift to eco-friendly and biodegradable materials for PCB substrates to reduce electronic waste. This includes innovations like bio-based resins and halogen-free laminates, critical for 2024-2025 compliance. There is also an increased emphasis on designing PCBs for easier disassembly and recyclability, aiming for higher material recovery rates, projected to exceed 60% for some components by 2025. Nan Ya Printed Circuit Board is actively developing and integrating greener materials into its products, aligning with global sustainability targets and consumer demand for environmentally responsible electronics.

Waste Management and Pollution Control

The manufacturing of printed circuit boards, like those by Nan Ya PCB, inherently involves chemicals, leading to significant concerns regarding hazardous waste and pollution. Stringent environmental regulations, particularly in regions like Taiwan and China where Nan Ya operates, mandate advanced waste treatment and disposal protocols. For instance, Taiwan's Environmental Protection Administration (EPA) continues to tighten industrial waste discharge standards, impacting operational costs for 2024-2025. Effective waste management systems are not just a legal necessity but critically underpin a company's environmental stewardship and its social license to operate, influencing investor ESG ratings.

- Global e-waste generation is projected to reach 74.7 million metric tons by 2030, highlighting the industry's extended responsibility.

- Compliance costs for hazardous waste treatment for large manufacturers can exceed 5% of their operational expenses.

- Taiwan's EPA reported over NT$100 million in environmental fines for industrial non-compliance in 2023, emphasizing regulatory strictness.

Climate Change Risks to Operations

Physical climate risks, such as increasing water shortages and extreme weather events, directly threaten Nan Ya PCB's manufacturing operations and supply chain stability, especially given Taiwan's vulnerability to droughts, like the 2021 event that impacted the electronics sector. Companies in the electronics industry must develop robust resilience strategies to mitigate these growing threats to production and logistics. Nan Ya PCB actively assesses and manages its exposure to climate-related risks through participation in initiatives like the CDP (Carbon Disclosure Project), aiming to enhance transparency and risk preparedness. This proactive approach is crucial as global climate patterns intensify, affecting resource availability and operational continuity.

- Taiwan faces increasing drought risks, directly impacting water-intensive electronics manufacturing.

- Global supply chains remain vulnerable to extreme weather, necessitating diversified sourcing.

- CDP scores reflect a company's climate risk management, influencing investor confidence.

Nan Ya Printed Circuit Board faces significant environmental pressures, including client demands for net-zero emissions by 2050 and strict water conservation due to Taiwan's drought risks in 2024. The company is actively integrating eco-friendly materials and advanced waste treatment, with compliance costs potentially exceeding 5% of operational expenses for hazardous waste. Stringent regulations from Taiwan's EPA, with fines over NT$100 million in 2023, underscore the necessity for robust environmental stewardship. This also supports the industry's shift towards higher recyclability, targeting over 60% material recovery by 2025, and addressing the projected 74.7 million metric tons of global e-waste by 2030.

| Environmental Factor | Key Metric/Target | Impact for 2024/2025 |

|---|---|---|

| Carbon Emissions | 50% Renewable Energy by 2030 | Investment in energy-efficient processes; Net-zero by 2050 goal. |

| Water Usage | Over 90% Water Reuse Rate | Critical for operational continuity; Taiwan drought vulnerability in 2024. |

| Material Sustainability | Over 60% Material Recovery by 2025 | Shift to bio-based, halogen-free materials; Addresses 74.7M tons global e-waste by 2030. |

| Waste Management | Compliance Costs >5% Operational Expenses | Taiwan EPA tightening standards; NT$100M+ environmental fines in 2023. |

PESTLE Analysis Data Sources

Our Nan Ya Printed Circuit Board PESTLE Analysis is built on comprehensive data from leading market research firms, official government publications regarding technological advancements and trade policies, and reports on global economic trends. We ensure each factor is informed by reliable, up-to-date information.