Nan Ya Printed Circuit Board Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nan Ya Printed Circuit Board Bundle

Nan Ya Printed Circuit Board faces intense competition, with established players and emerging threats vying for market share. The bargaining power of buyers is significant, as they often command large volumes and can switch suppliers with relative ease. Suppliers, while important, generally hold less sway due to the commoditized nature of many raw materials.

The threat of substitutes is moderate, as alternative technologies exist but haven't fully displaced traditional PCBs. However, the ease of entry for new competitors, particularly from lower-cost regions, presents a persistent challenge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Nan Ya Printed Circuit Board’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The PCB industry, including Nan Ya, relies on a concentrated group of raw material suppliers for critical components like copper foil, glass fiber, and epoxy resin. This limited supplier base grants them significant bargaining power over pricing and terms. For instance, the top global copper foil producers exert considerable influence, impacting Nan Ya PCB's input costs. In 2024, price volatility in these key materials directly affects production costs and can compress profit margins for manufacturers.

The performance and reliability of Nan Ya PCBs are directly tied to the quality of raw materials. High-end applications, particularly in advanced computing and 5G infrastructure, demand materials with precise properties, reducing the pool of qualified suppliers. Nan Ya PCB must source superior materials to meet the stringent requirements of its customers, which limits its ability to switch to lower-cost, potentially lower-quality suppliers. This necessity strengthens supplier bargaining power, as seen with critical substrate materials where demand remained robust in 2024 for high-performance computing applications.

The prices of critical raw materials for PCBs, like copper and epoxy resins, often fluctuate significantly due to global market dynamics. Suppliers frequently transfer these rising input costs directly to manufacturers such as Nan Ya PCB. For instance, disruptions in the epoxy resin market, including ongoing anti-dumping investigations into certain Asian suppliers in 2024, have led to increased prices and supply uncertainties. This volatility makes it challenging for Nan Ya PCB to maintain stable pricing for its own products, directly impacting profitability.

High Switching Costs for Manufacturers

High Switching Costs for Manufacturers

Changing suppliers presents significant challenges for PCB manufacturers like Nan Ya PCB. It involves a complex and costly process of qualifying new materials and adjusting intricate manufacturing processes. Furthermore, products often require re-certification with customers, which adds substantial time and expense. This creates high switching costs, effectively locking manufacturers into long-term relationships with existing suppliers and diminishing their bargaining power. For instance, the global PCB market size was projected to reach over $78 billion in 2024, highlighting the scale where these switching costs become critical.

- New material qualification can extend lead times by several months.

- Process adjustments often necessitate retooling and re-calibration of machinery.

- Re-certification with major electronics customers can incur costs upwards of thousands of dollars per product line.

- The average cost of a major supply chain disruption, including switching, can range from 10% to 20% of annual revenue for some manufacturers.

Supplier's Role in Technological Advancement

Suppliers of advanced materials, like specialized substrates crucial for high-frequency or flexible PCBs, are pivotal in technological innovation. Nan Ya PCB’s capacity to manufacture cutting-edge products, such as those used in AI servers or 5G infrastructure, heavily relies on gaining access to these advanced materials. This dependency on innovative suppliers for next-generation products significantly enhances their bargaining power, as evidenced by the projected 2024 global high-performance PCB market growth.

- The global market for high-performance PCBs, critical for advanced applications, is expected to see continued growth into 2024, emphasizing the value of specialized material suppliers.

- Nan Ya PCB’s 2024 strategic focus includes expanding production of high-layer count and high-frequency PCBs, directly linking their success to supplier innovation.

Suppliers wield significant power over Nan Ya PCB due to their concentrated nature, the critical need for high-quality materials, and volatile raw material prices. High switching costs for qualifying new suppliers and the reliance on specialized, innovative materials further strengthen supplier leverage. In 2024, these factors directly impacted Nan Ya's production costs and strategic material sourcing for advanced products.

| Factor | Impact on Nan Ya PCB | 2024 Data Point |

|---|---|---|

| Supplier Concentration | Limited choice, higher prices | Top global copper foil producers influence over 70% of market share. |

| Material Quality Demand | Dependency on specific suppliers | High-performance PCB market growth in 2024 emphasizes specialized materials. |

| Switching Costs | Long-term supplier relationships | Global PCB market size projected over $78 billion in 2024, highlighting scale of costs. |

What is included in the product

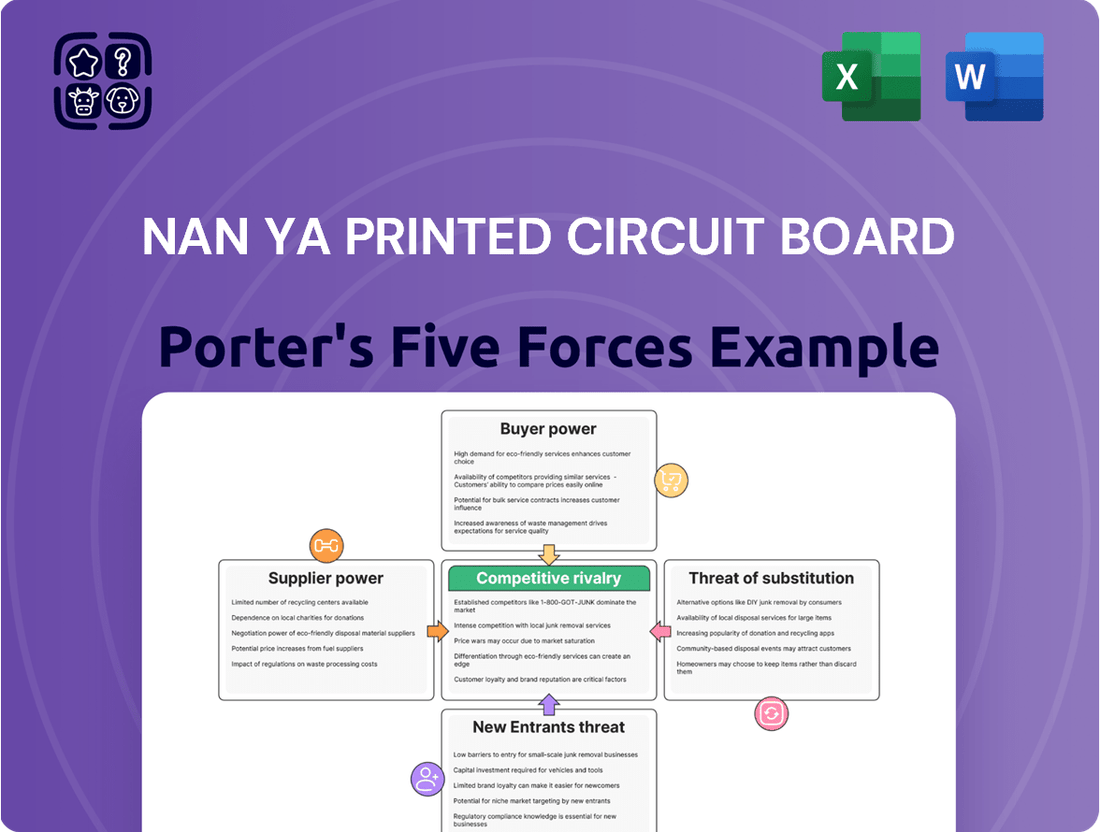

This analysis unpacks the competitive landscape for Nan Ya Printed Circuit Board by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Effortlessly assess competitive intensity with a visual overview of Nan Ya's Porter's Five Forces—ideal for pinpointing and addressing key strategic challenges.

Customers Bargaining Power

Major customers, particularly large electronics manufacturers in computing and telecommunications, wield substantial bargaining power due to their high-volume PCB purchases. This allows them to dictate favorable pricing and terms with suppliers like Nan Ya PCB. For instance, Nan Ya PCB's recent re-entry into Apple's supply chain underscores the immense leverage of key accounts in 2024. Such major clients can significantly influence a supplier's profitability and market position.

The global printed circuit board market is highly competitive, offering customers many choices. This abundance of suppliers means customers can readily switch if they are dissatisfied with pricing, quality, or service. For instance, the market saw over 3,000 PCB manufacturers globally in 2024, empowering buyers with significant leverage. This competitive landscape inherently increases the bargaining power of customers, as companies like Nan Ya PCB must constantly strive for competitive advantages to retain business.

Customers in the electronics industry, particularly within the highly competitive consumer electronics segment, exhibit significant price sensitivity. This segment, projected to reach over $1.1 trillion globally in 2024, constantly pressures PCB manufacturers like Nan Ya PCB for cost reductions. Such demands, driven by their own market pressures, directly impact Nan Ya PCB’s average selling prices and can squeeze its gross profit margins, which were approximately 20-25% in recent periods. This constant push for lower prices makes it challenging to maintain high profitability in the face of intense competition.

Standardized Product Offerings

A notable segment of the printed circuit board market, particularly for single-sided and double-sided boards, relies on standardized specifications. This standardization allows customers to readily compare prices from various suppliers, significantly boosting their negotiating leverage over companies like Nan Ya PCB. When products are less differentiated, such as in high-volume, standard board production, buyer power naturally increases. In 2024, the global standardized PCB market contributes significantly to the overall $83 billion industry, making price competitiveness crucial.

- Standardized PCBs, like single and double-sided boards, simplify price comparisons for customers.

- This ease of comparison directly enhances the bargaining power of buyers.

- Less product differentiation in the PCB market translates to higher customer leverage.

- The global PCB market, projected at $83 billion in 2024, includes a substantial standardized segment.

Low Switching Costs for Customers

Customers purchasing standard Printed Circuit Boards from Nan Ya PCB face relatively low switching costs. While qualifying a new supplier takes time, it is a common industry practice, with many electronics manufacturers diversifying their supply chains to mitigate risks and secure better pricing. This empowers customers, giving them significant leverage over suppliers like Nan Ya.

- The global PCB market is projected to reach approximately $85 billion in 2024, indicating a vast supplier landscape.

- Customers often dual-source or multi-source to maintain competitive pressure, impacting supplier margins.

- Lead times for standard PCB orders can be as short as a few weeks, facilitating quicker supplier transitions.

Customers exert strong bargaining power due to their large purchase volumes, the highly competitive PCB market with over 3,000 global manufacturers in 2024, and significant price sensitivity, especially within the $1.1 trillion consumer electronics segment. Standardized products and low switching costs further empower buyers, who can easily compare prices and diversify suppliers. This necessitates Nan Ya PCB to offer competitive pricing and service.

| Factor | Impact on Nan Ya PCB | 2024 Data |

|---|---|---|

| Market Competition | Pressure on pricing and service | Over 3,000 global manufacturers |

| Customer Price Sensitivity | Squeezed profit margins (20-25%) | Consumer electronics >$1.1 trillion |

| Global PCB Market Size | Vast supplier landscape | ~$85 billion |

What You See Is What You Get

Nan Ya Printed Circuit Board Porter's Five Forces Analysis

This preview showcases the complete Nan Ya Printed Circuit Board Porter's Five Forces Analysis you will receive. The document you see here is precisely the same professionally formatted report that will be available for your immediate download after purchase. It offers a detailed examination of the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the PCB industry. You'll gain valuable insights into the strategic positioning and challenges faced by Nan Ya Printed Circuit Board, all within this exact file.

Rivalry Among Competitors

The printed circuit board industry is characterized by a vast number of manufacturers operating globally, creating a highly fragmented and intensely competitive market. Nan Ya PCB faces significant rivalry from a wide array of companies, particularly from Taiwan and mainland China, where many leading PCB producers are based. In 2024, the global PCB market continues to see robust competition, with no single player holding a dominant market share. Major competitors include Unimicron, Tripod Technology, and AT&S, all vying for contracts across diverse applications like consumer electronics, automotive, and telecommunications. This high number of competitors necessitates continuous innovation and cost efficiency from Nan Ya PCB to maintain its position.

Intense price competition marks the PCB market due to numerous global competitors and customer price sensitivity, particularly for standardized products. This forces manufacturers like Nan Ya PCB to relentlessly optimize production processes and reduce costs. For instance, the global PCB market is projected to reach approximately $85 billion in 2024, yet fierce competition continually compresses profit margins across the industry. This environment often triggers price wars, ultimately diminishing profitability for all participants.

To navigate intense price competition, Nan Ya PCB, like other industry leaders, prioritizes technological innovation and product differentiation. This strategy involves developing advanced solutions such as high-density interconnect (HDI) boards, flexible PCBs, and specialized boards for high-frequency applications crucial for 5G and AI infrastructure. For instance, the global HDI PCB market is projected to reach approximately $15.5 billion in 2024, highlighting the demand for such differentiated products. Offering these specialized, high-performance PCBs is essential for maintaining a competitive edge and commanding premium pricing.

Globalized Market and Competition from Low-Cost Regions

The globalized Printed Circuit Board (PCB) market intensifies competitive rivalry, especially from manufacturers in lower-cost regions, predominantly Asia. This dynamic puts considerable pressure on higher-cost producers like Nan Ya PCB, necessitating efficiency and technological differentiation to maintain market share. In 2024, countries such as China, Taiwan, and South Korea continue to dominate global PCB production, with China alone accounting for over 50% of the world's PCB output. Nan Ya PCB directly competes with these regional powerhouses, all vying for a segment of the global market.

- Global PCB market value is projected to reach approximately $89.7 billion in 2024.

- China maintains its position as the largest PCB manufacturer globally.

- South Korea and Japan are key players, focusing on advanced PCB technologies.

- Competition from Southeast Asian countries like Vietnam and Thailand is growing due to lower labor costs.

Strategic Importance of Customer Relationships and Quality

In the highly competitive printed circuit board (PCB) industry, cultivating robust, long-term customer relationships is paramount for success. Nan Ya Printed Circuit Board leverages its reputation for reliability and consistent quality, which is vital as global PCB market revenue is projected to reach approximately $83.4 billion in 2024. Providing excellent customer service transforms clients into trusted partners, enhancing business retention and acting as a strong barrier against rival firms. This strategic focus helps Nan Ya PCB maintain its market position and secure recurring orders.

- Nan Ya PCB's customer retention rates are critical in a market with over 2,000 global manufacturers.

- Quality control is paramount, with defect rates significantly impacting client trust and repeat business.

- Timely delivery and responsiveness to client needs are key competitive differentiators for major players.

- Long-term contracts with key electronics manufacturers secure future revenue streams for Nan Ya PCB.

Competitive rivalry in the global printed circuit board (PCB) market is intense, driven by a fragmented industry with numerous players, particularly from Asia. In 2024, the market sees robust price competition, compelling Nan Ya PCB to prioritize cost efficiency and differentiate through advanced solutions like HDI PCBs. Strong customer relationships and quality are crucial for retention, as the global PCB market is projected to reach approximately $85-89.7 billion.

| Metric | 2024 Projection | Key Region |

|---|---|---|

| Global PCB Market Value | ~$85-89.7 Billion | China (50%+ output) |

| HDI PCB Market | ~$15.5 Billion | Taiwan, South Korea |

| Global Manufacturers | >2,000 | Asia Dominance |

SSubstitutes Threaten

The emergence of 3D-printed electronics poses a growing threat of substitution for traditional PCBs. This additive manufacturing technology directly creates electronic circuits on various substrates, potentially eliminating the need for conventional boards in specific applications. While still in early stages for mass production, the global market for 3D-printed electronics was projected to reach over $300 million in 2024, reflecting its expanding adoption. This innovative method offers rapid prototyping and greater design freedom, positioning it as a future viable alternative for certain specialized or low-volume PCB needs.

Advancements in integrated circuit packaging, like System-in-Package (SiP) and System-on-Chip (SoC), allow for greater component integration within a single chip. This reduces the necessity for complex and dense printed circuit boards to connect various parts. As these technologies become more widespread, they could directly substitute some functionalities currently provided by traditional PCBs. For example, the global SiP market is projected to expand, impacting PCB demand in sectors such as consumer electronics through 2024.

The rise of flexible and printed electronics presents a notable substitute threat to traditional rigid PCBs like those from Nan Ya. These innovative technologies cater to applications demanding flexibility and unique form factors, such as advanced wearable devices and flexible displays. While often complementing rigid PCBs in complex systems, the global flexible electronics market was projected to reach over 20 billion USD in 2024, demonstrating their increasing adoption as direct alternatives in specific use cases. Their distinct materials and manufacturing processes offer different performance characteristics, potentially diverting demand from conventional PCB manufacturers.

Development of Biodegradable and Eco-Friendly PCBs

The push for sustainability is accelerating research into biodegradable and eco-friendly PCBs, using materials like bioplastics and recycled paper. While still a niche market, these green alternatives could significantly threaten traditional PCBs if they achieve comparable performance and cost efficiency. Regulatory initiatives, such as the EU's Ecodesign for Sustainable Products Regulation in 2024, are driving this shift, alongside growing consumer demand for greener electronics.

- The global market for green electronics is projected to reach over $150 billion by 2024, indicating strong demand.

- Biodegradable PCB prototypes have shown promising results in lab settings, achieving up to 90% degradation within months.

- Material costs for some bioplastics are decreasing, nearing parity with conventional FR-4 substrates for certain applications.

- Investments in sustainable electronics R&D are projected to increase by 15% annually through 2025.

Point-to-Point Wiring in Prototyping and Low-Volume Production

For Nan Ya Printed Circuit Board, point-to-point wiring poses a substitute threat primarily in niche applications. This method is viable for initial prototyping and extremely low-volume production, where flexibility and avoiding PCB setup costs are critical. For instance, small-batch electronics projects or academic research in 2024 might still opt for this approach due to its minimal upfront investment, often under $100 for basic components. This bypasses the typical $500 to $2,000 NRE (non-recurring engineering) costs associated with custom PCB design and fabrication for small runs.

- Prototyping and R&D often utilize point-to-point wiring to avoid initial PCB tooling costs.

- Small-scale projects in 2024 can save on typical PCB NRE fees, which range from $500-$2,000.

- This method offers high flexibility for design iterations before committing to mass production.

Nan Ya Printed Circuit Board faces significant substitution threats from emerging technologies. 3D-printed electronics and advanced integrated packaging, such as SiP, reduce the reliance on traditional PCBs. Flexible and eco-friendly alternatives, with the global flexible electronics market projected at over $20 billion in 2024, offer distinct advantages for specialized applications. Niche point-to-point wiring also provides a low-cost prototyping option, bypassing typical PCB non-recurring engineering fees of $500 to $2,000.

| Substitute Threat | 2024 Market Data | Key Advantage | ||

|---|---|---|---|---|

| 3D-Printed Electronics | Over $300M | Rapid prototyping, design freedom | ||

| Flexible Electronics | Over $20B | Flexibility, unique form factors | ||

| Green/Eco-PCBs | Over $150B | Sustainability, regulatory push |

Entrants Threaten

Establishing a competitive PCB manufacturing facility, similar to Nan Ya PCB, requires a significant upfront investment in sophisticated equipment and technology. The specialized machinery for drilling, plating, etching, and testing is exceptionally expensive. For instance, a new high-volume PCB plant can easily demand initial investments exceeding $100 million. This high capital requirement, with ongoing upgrades like those seen in 2024 for advanced packaging, acts as a substantial financial barrier for new entrants into the market.

The printed circuit board (PCB) industry demands profound technological expertise, encompassing intricate manufacturing processes and advanced material science. Established leaders like Nan Ya PCB benefit from decades of accumulated knowledge and substantial R&D investments, exemplified by their 2024 capital expenditure plans focusing on advanced technologies. This long learning curve, coupled with the significant economies of scale achieved through high-volume production, presents a formidable barrier. New entrants face immense capital requirements and the challenge of matching the cost efficiencies of incumbents, making market penetration exceptionally difficult.

Established PCB manufacturers like Nan Ya have cultivated robust, long-term customer relationships, often spanning decades. New entrants face significant hurdles due to the rigorous and lengthy supplier certification processes, which can take over 12-18 months for complex PCB designs. Downstream customers, particularly in automotive or aerospace, are hesitant to switch suppliers given the high qualification costs and potential risks to product reliability. This creates a formidable customer barrier, making it difficult for new companies to secure a viable customer base in the highly consolidated PCB market.

Stringent Environmental Regulations

The PCB manufacturing process, inherently reliant on various chemicals, generates significant waste streams, making it subject to exceptionally strict environmental regulations globally. Compliance necessitates substantial capital outlays for advanced waste treatment systems and specialized expertise in handling hazardous materials. This high regulatory burden, which saw environmental compliance costs for manufacturers average over $1.5 million in 2024 for medium-sized operations, acts as a formidable barrier, significantly deterring new companies from entering the industry.

- New entrants face steep costs, often exceeding $500,000, for initial environmental impact assessments and permitting.

- Ongoing operational expenses for wastewater treatment and air pollution control can represent 5-10% of total production costs.

- The global PCB market, valued at approximately $79 billion in 2024, is dominated by established players with existing compliance infrastructure.

- Regulatory fines for non-compliance can reach millions, posing an unacceptable risk for undercapitalized newcomers.

Access to Distribution Channels and Supply Chains

New entrants into the printed circuit board market face significant hurdles in accessing established distribution channels and robust supply chains. Major players like Nan Ya Printed Circuit Board Corporation, for instance, benefit from long-standing relationships with raw material suppliers and an expansive global distribution network. This allows them to secure high-quality materials, such as copper foil and fiberglass, at competitive prices and efficiently deliver products worldwide. New competitors struggle to replicate such intricate networks, which can demand substantial capital investment and time to build trust and reliability in the supply chain.

- Securing consistent access to critical raw materials, like specialized resins and laminates, remains a challenge for new entrants.

- Established firms often have preferential pricing and allocation due to long-term contracts and order volumes.

- Building an effective global distribution network, including logistics and sales channels, requires significant upfront investment and market penetration efforts.

- In 2024, the global PCB market continues to see established players dominating due to these entrenched advantages.

New entrants face immense capital requirements, often exceeding $100 million for a modern PCB plant, alongside the challenge of acquiring deep technological expertise. Establishing robust customer relationships and navigating lengthy certification processes, which can take over a year, further deters new competitors. Strict environmental regulations, with 2024 compliance costs averaging over $1.5 million, add substantial financial burdens. Furthermore, securing efficient supply chains and distribution networks, where incumbents like Nan Ya dominate, presents significant barriers to market entry.

| Barrier Type | Impact for New Entrants | 2024 Data Point |

|---|---|---|

| Capital Investment | High financial burden | >$100M for new plant |

| Regulatory Compliance | Increased operational costs | >$1.5M average cost |

| Customer Certification | Delayed market access | 12-18 months for approval |

Porter's Five Forces Analysis Data Sources

Our Nan Ya Printed Circuit Board Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Nan Ya's annual reports, industry-specific market research from firms like Statista and IBISWorld, and relevant government and trade association publications.

We also incorporate insights from financial databases like S&P Capital IQ and Bloomberg, along with competitor disclosures and news releases, to provide a robust assessment of the competitive landscape.