McMillan Shakespeare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

McMillan Shakespeare Bundle

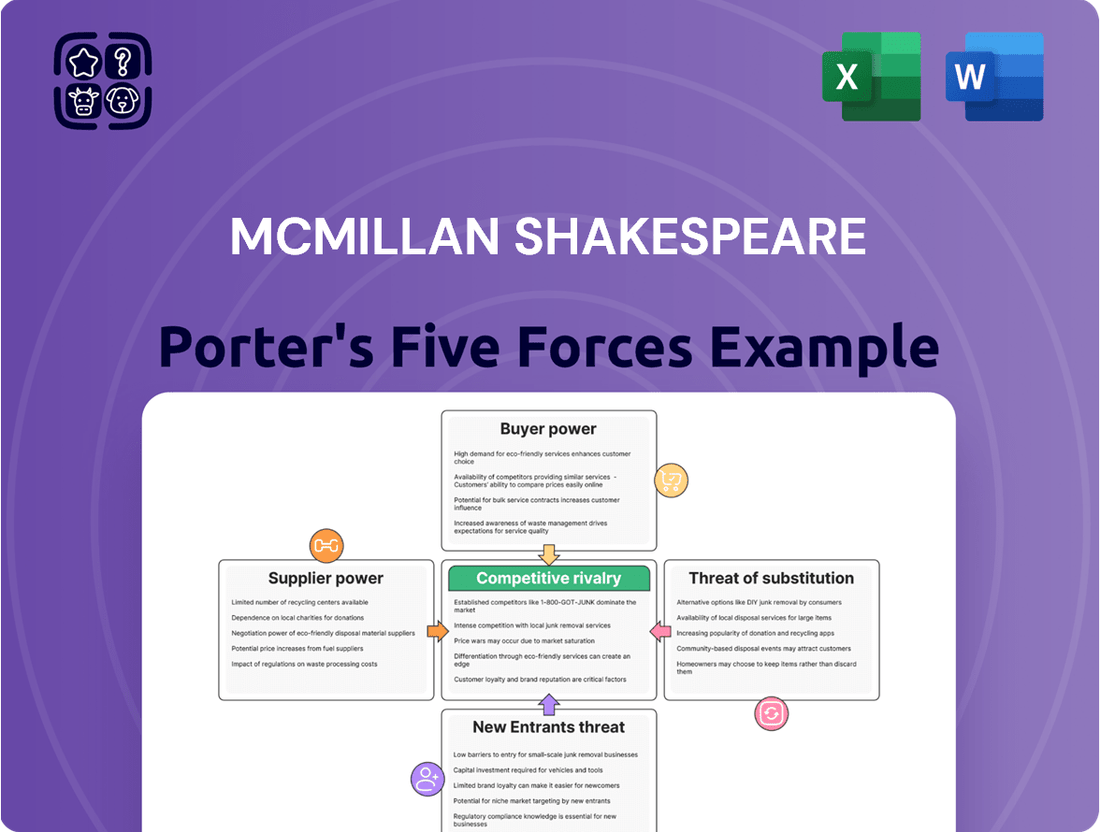

McMillan Shakespeare's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the intensity of rivalry. Understanding these dynamics is crucial for any stakeholder looking to grasp the company's market position.

The threat of new entrants and the availability of substitute products also play significant roles in defining McMillan Shakespeare's operational environment. These external pressures can impact pricing power and market share.

Suppliers can exert influence, potentially affecting the cost of goods and services that McMillan Shakespeare relies upon. This supplier power is a critical factor in profitability.

The full Porter's Five Forces Analysis reveals the real forces shaping McMillan Shakespeare’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

McMillan Shakespeare (MMS) sources vehicles from a broad range of manufacturers and dealers, but the concentration of power varies. While individual dealerships might not hold significant sway, major vehicle manufacturers can exert considerable influence due to their production volumes and brand loyalty.

Financial institutions providing funding for novated leases represent another critical supplier group. The availability and cost of capital from these institutions directly impact MMS's operations and profitability. In 2023, interest rate hikes by central banks globally put pressure on funding costs for many financial services firms, a trend that would have continued to be a factor for MMS.

Technology providers for MMS's leasing and salary packaging platforms are also important suppliers. While there are many such providers, specialized or proprietary software solutions can concentrate power in the hands of a few key players, requiring MMS to maintain strong relationships and potentially negotiate favourable terms.

Switching suppliers for McMillan Shakespeare's (MMS) core services, such as vehicle procurement and financing, presents substantial costs. These expenses can include the considerable investment in new IT systems, the time and effort required to renegotiate contracts with a fresh network of dealerships, and establishing new funding arrangements.

For instance, the integration of a new fleet management software alone could cost hundreds of thousands of dollars, alongside the potential for operational disruptions during the transition period. This complexity and financial outlay significantly bolster the bargaining power of MMS's current suppliers, as the cost of switching is a major deterrent.

McMillan Shakespeare (MMS) holds a considerable sway in the Australian market, particularly within the novated leasing sector. This substantial presence translates into a significant volume of business for its suppliers, including vehicle dealerships and finance providers. For instance, in the fiscal year 2023, MMS facilitated the leasing of thousands of vehicles, representing a consistent revenue stream for many automotive partners.

This consistent demand makes MMS a crucial client for many of these suppliers. A partnership with MMS can represent a notable portion of a dealership's annual sales or a finance company's loan portfolio. Consequently, suppliers may be less inclined to exert significant price increases or impose unfavorable terms due to the potential loss of such a substantial customer.

The mutual dependency between MMS and its suppliers can therefore foster more balanced negotiations. While suppliers provide essential vehicles and financing, MMS's consistent order volume provides them with predictable revenue and market access. This dynamic can temper the suppliers' individual bargaining power, as they rely on maintaining a strong relationship with MMS.

Availability of Substitute Inputs

The bargaining power of suppliers for McMillan Shakespeare (MMS) is influenced by the availability of substitute inputs, particularly concerning vehicles, financing, and technology. While a wide array of vehicle models, including an increasing number of electric vehicles (EVs), offer some choice, the specialized nature of novated leasing and fleet management solutions means that direct substitutes for these core financial services are less common. This creates a degree of dependence on existing supplier relationships.

Here’s a breakdown of substitute input availability impacting MMS:

- Vehicle Sourcing: The automotive market offers diverse vehicle options, with new models and EV advancements providing buyers with more choices. However, for fleet management and novated leasing, the integration with specific financing and maintenance platforms can limit the practical substitutability of certain vehicle suppliers.

- Financing Alternatives: While various financial products exist, the specialized nature of novated leasing and salary packaging arrangements means that the pool of direct substitute financiers or leasing providers with comparable integrated offerings might be smaller than in broader consumer finance markets.

- Technological Integrations: The technology platforms that underpin fleet management and novated leasing often require specific integrations with vehicle systems, maintenance providers, and regulatory compliance. This can reduce the ease with which MMS can switch technology suppliers without significant disruption or investment.

Threat of Forward Integration by Suppliers

The threat of forward integration by McMillan Shakespeare's (MMS) suppliers, such as automotive finance companies or banks, is generally low. These entities possess the capital and customer bases to potentially offer salary packaging or novated leasing directly. However, the specialized administrative, regulatory, and tax-compliance expertise required for these services represents a significant barrier to entry for them. MMS has built its business on navigating this complexity, a niche that financial institutions may find challenging to replicate efficiently.

While large automotive finance arms and major banks could theoretically move into offering salary packaging or novated leasing, the day-to-day operational demands are substantial. Managing the intricate tax laws, payroll integrations, and ongoing customer service for a diverse range of corporate clients is a core competency for MMS. For instance, in 2024, the Australian salary packaging market is valued in the billions, with complex regulatory frameworks governing fringe benefits tax and employee entitlements. This complexity discourages many potential entrants who lack MMS's established infrastructure and specialized knowledge.

- Low Threat of Forward Integration: Key suppliers like auto finance firms or banks could offer similar services, but the specialized administrative and tax expertise needed for salary packaging is a significant hurdle.

- MMS's Niche Expertise: McMillan Shakespeare's strength lies in its deep understanding of complex regulatory environments and tax compliance, which is difficult for financial institutions to replicate.

- Operational Complexity: Managing the intricacies of salary packaging, including fringe benefits tax and payroll, requires dedicated systems and knowledge that are not standard offerings for most financial service providers.

- Market Value and Regulation: The multi-billion dollar Australian salary packaging market is subject to stringent regulations, making it a challenging sector for new entrants without established compliance frameworks.

The bargaining power of suppliers for McMillan Shakespeare (MMS) is moderately high due to the specialized nature of its operations. While many vehicle manufacturers exist, the integration required for novated leasing and fleet management can limit choice. Financial institutions providing capital are also key, and their pricing power is influenced by interest rate environments, as seen with global rate hikes in 2023.

Technology providers for MMS’s platforms can also wield significant influence if their solutions are specialized or proprietary. The substantial costs and operational disruptions associated with switching these critical suppliers, estimated to be hundreds of thousands of dollars for a single software integration, create a strong deterrent for MMS, thereby enhancing supplier leverage.

However, MMS's considerable market share, particularly in Australian novated leasing, where it facilitated thousands of vehicle leases in FY23, provides some counter-leverage. This volume makes MMS a crucial client for many suppliers, potentially tempering their ability to dictate terms due to the risk of losing this significant business.

The bargaining power of suppliers for McMillan Shakespeare (MMS) is influenced by the availability of substitute inputs, particularly concerning vehicles, financing, and technology. While a wide array of vehicle models, including an increasing number of electric vehicles (EVs), offer some choice, the specialized nature of novated leasing and fleet management solutions means that direct substitutes for these core financial services are less common. This creates a degree of dependence on existing supplier relationships.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored specifically to McMillan Shakespeare's unique business model and operating environment.

Easily visualize competitive pressures with a dynamic, interactive dashboard that highlights key threats and opportunities.

Customers Bargaining Power

McMillan Shakespeare's (MMS) customer base is largely concentrated among large employers, with 97% of its salary packaging clients coming from sectors like government, healthcare, and not-for-profit organizations. While individual employees have minimal sway, these major corporate and government entities can exert considerable bargaining power due to the substantial volume of business they contribute to MMS.

Customer switching costs for McMillan Shakespeare (MMS) can influence their bargaining power. While changing providers for services like salary packaging or fleet management might appear simple, it often entails administrative work, employee communication, and potential adjustments to benefit programs for corporate clients. This complexity can deter some employers from switching.

For individual employees, the effort involved in moving to a new provider might also act as a barrier, even if better options exist. MMS aims to mitigate this by enhancing its digital platforms, making account management and potential transitions smoother. For instance, in 2024, companies are increasingly looking for integrated digital solutions, which can increase the perceived cost of switching away from a provider that offers such features.

Customer price sensitivity remains a significant factor for McMillan Shakespeare (MMS). Both employers and employees are acutely aware of costs, particularly with persistent cost-of-living pressures evident throughout 2024. Employees are actively looking for ways to increase their take-home pay, making tax-effective remuneration a key incentive for engaging with salary packaging and novated leasing services.

This focus on maximizing disposable income means that the perceived value and cost savings offered by MMS are paramount. For instance, in 2023, the average Australian household experienced a 3.5% increase in the cost of essential goods, further highlighting the need for individuals to manage their budgets tightly. This environment directly benefits providers who can demonstrably reduce out-of-pocket expenses for their clients.

Employers, too, are driven by efficiency and cost-effectiveness when selecting benefits providers. Offering attractive packages without incurring excessive administrative burdens or costs is a priority for businesses aiming to retain talent and manage their operational expenses. As such, MMS’s ability to deliver competitive and cost-efficient solutions directly influences their attractiveness to the corporate market.

Availability of Substitute Services

Customers considering novated leasing or salary packaging services have several substitute options. These include traditional employer-provided benefits, securing personal loans from banks for vehicle purchases, or managing their vehicle acquisition and running costs independently. The appeal of these substitutes is heavily influenced by factors like current tax regulations, individual financial situations, and the overall convenience and integration offered by McMillan Shakespeare's (MMS) services.

For instance, the Australian government's Fringe Benefits Tax (FBT) exemption for electric vehicles (EVs) significantly enhances the attractiveness of novated leasing for these vehicles. This exemption can lead to substantial savings for employees compared to outright purchasing an EV or using a traditional loan. In 2024, the ongoing push towards EV adoption, coupled with these tax incentives, directly strengthens the bargaining power of customers who can leverage these alternatives.

- Substitute Options: Direct employer benefits, personal loans, independent financial management.

- Factors Influencing Substitutes: Tax regulations, personal finances, convenience of integrated services.

- EV Impact: FBT exemption for EVs makes novated leasing a highly competitive option.

- Market Trend: Increasing EV adoption in 2024 further empowers customer choice towards EV novated leases.

Threat of Backward Integration by Customers

The threat of customers backward integrating into salary packaging or fleet management is a significant consideration for McMillan Shakespeare (MMS). Large clients, such as corporate or government bodies, possess the financial clout to develop these services internally.

However, the inherent administrative complexity and the need for specialized expertise, particularly in navigating intricate tax-effective arrangements, present substantial barriers to entry. For instance, maintaining compliance with constantly evolving tax legislation requires dedicated resources that many organizations may find prohibitive to replicate.

MMS's value proposition lies in its ability to simplify these complexities, offering a more efficient and cost-effective solution than a self-managed approach for most clients. This specialization is a key deterrent to backward integration.

Consider the ongoing regulatory landscape; for example, changes in fringe benefits tax (FBT) rules necessitate continuous adaptation of packaging solutions, a task that requires significant ongoing investment in expertise for a client managing this internally.

McMillan Shakespeare's (MMS) customers, primarily large employers, hold significant bargaining power due to the volume of business they represent. While individual employees have little leverage, these major clients can influence terms. Switching costs, though present due to administrative complexities, can be mitigated by MMS's integrated digital solutions, which are increasingly sought after by employers in 2024. This makes a seamless digital experience a key factor in customer retention.

Customer price sensitivity is high, with individuals actively seeking to maximize disposable income, especially given the 3.5% rise in essential goods costs in Australia in 2023. Employers also prioritize cost-effectiveness and efficiency in benefits provision to attract and retain talent. The attractiveness of MMS's services, such as novated leasing, is amplified by tax incentives, like the FBT exemption for electric vehicles, a trend gaining momentum in 2024.

The threat of backward integration by large clients is present but limited by the administrative complexity and specialized expertise required for tax-effective arrangements. MMS simplifies these complexities, offering a more efficient and cost-effective solution than internal management, particularly given the need to adapt to evolving tax legislation.

Full Version Awaits

McMillan Shakespeare Porter's Five Forces Analysis

This preview showcases the complete McMillan Shakespeare Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape. The document you see here is precisely the same professionally written and formatted analysis you will receive instantly upon purchase. You can be assured that there are no placeholders or missing sections; what you preview is your exact deliverable, ready for immediate application. This comprehensive breakdown will equip you with a thorough understanding of the industry's dynamics, enabling informed strategic decisions.

Rivalry Among Competitors

McMillan Shakespeare (MMS) navigates a competitive landscape characterized by a few major players and a broader array of smaller, specialized firms. In Australia's outsourced salary packaging sector, MMS and Smartgroup are the dominant forces, collectively holding approximately 80% of the market share. This concentration suggests a significant degree of market power held by these two entities.

Beyond salary packaging, the novated leasing and fleet management segments present further competitive pressures. Key rivals in these areas include SG Fleet, Smartgroup, and FleetPartners, alongside a multitude of other firms of comparable size and smaller, niche providers. This diverse competitive set, from large, established companies to specialized operators, underscores the intensity of rivalry across MMS's operational domains.

The Australian salary packaging and novated leasing sectors are seeing robust growth, fueled by a desire for tax-efficient employee benefits and the accelerating adoption of electric vehicles, bolstered by government incentives. This upward trajectory in demand for these services is a positive indicator for the industry.

Specifically, the fleet management services market is anticipated to expand significantly, a trend that directly benefits companies operating within the novated leasing space. Industry reports from 2024 suggest this market could see a compound annual growth rate of over 7% in the coming years. This expansion offers ample room for all participants.

While this overall industry expansion provides opportunities and can temper intense rivalry by increasing the total addressable market, it does not eliminate the competitive landscape. Companies are still actively vying for market share and customer acquisition within this growing environment.

McMillan Shakespeare (MMS) strives to stand out through exceptional customer service and advanced digital platforms, including its 'Simply Stronger' initiative and the 'Oly' tool for small to medium enterprises. However, the fundamental nature of salary packaging and novated leasing can often be seen as interchangeable offerings, leading to intense competition focused on pricing and operational efficiency.

This commoditization means that providers often compete on who can offer the most attractive fee structures or deliver services most smoothly. For instance, in 2024, the Australian salary packaging market continues to see intense competition among established players and new entrants, with providers frequently adjusting their pricing strategies to attract and retain clients.

MMS's strategic expansion into areas such as disability plan management offers a degree of differentiation. By bundling these diverse services with its core offerings, MMS can create a more comprehensive value proposition that is less susceptible to direct price-based competition.

Exit Barriers

Exit barriers in the salary packaging and fleet management sectors are generally moderate, influenced by several key factors. These include the significant investment required for specialized technology infrastructure, such as sophisticated IT systems for payroll processing and fleet tracking. Furthermore, long-term contracts with employer clients create a sticky customer base, making it difficult and costly for companies to disengage without penalty.

Maintaining stringent regulatory compliance is another critical component that elevates exit barriers. Companies must adhere to various financial regulations and data privacy laws, necessitating ongoing investment in compliance systems and personnel. For instance, McMillan Shakespeare, a prominent player in this market, reported that its IT and systems depreciation was a significant operational cost, highlighting the substantial capital tied up in its technological backbone. This commitment to technology and compliance makes a swift exit challenging.

- Specialized Technology: High upfront investment in IT systems for payroll, fleet management, and compliance.

- Long-Term Contracts: Agreements with employers often span multiple years, creating customer lock-in.

- Regulatory Compliance: Ongoing costs and complexity associated with adhering to financial and data protection laws.

- Brand Reputation and Client Relationships: Established trust and relationships with a large client base are difficult to replicate or divest.

Fixed Costs and Capacity Utilization

The competitive rivalry within the employee benefits and salary packaging sector, where McMillan Shakespeare (MMS) operates, is intensified by substantial fixed costs. These costs are tied to developing and maintaining sophisticated technology platforms, robust administrative infrastructure, and essential compliance teams. For instance, significant ongoing investment is required to ensure adherence to evolving regulatory frameworks and to support complex payroll integrations.

Profitability in this industry is heavily reliant on achieving high capacity utilization across these fixed assets. Firms that can effectively leverage their technology and administrative systems to service a larger volume of clients and transactions will naturally spread their fixed costs over a broader revenue base, leading to improved margins. This drive for utilization often fuels aggressive pricing strategies as companies vie for market share and predictable revenue streams.

MMS, with its stated focus on operational efficiencies and technological advancement, is well-positioned to benefit from this dynamic. By investing in technology to streamline processes and reduce the per-transaction cost, the company can more effectively compete on price while still achieving healthy profitability through higher volumes. This strategy is crucial in a market where securing significant client bases is paramount to offsetting the industry's inherent fixed cost burdens.

- High Fixed Costs: Investment in technology platforms, administration, and compliance are significant barriers to entry and operational necessities.

- Capacity Utilization is Key: Profitability hinges on maximizing the use of these fixed assets to spread costs and gain economies of scale.

- Competitive Pricing: The need for high utilization encourages competitive pricing to attract and retain volume clients.

- MMS Strategy: McMillan Shakespeare leverages operational efficiencies and technology to reduce costs and drive competitive pricing.

The competitive rivalry within McMillan Shakespeare's (MMS) operating sectors is intense, primarily driven by the dominance of a few large players and a fragmented base of smaller competitors. In Australia's salary packaging market, MMS and Smartgroup together command approximately 80% of the market share, indicating a concentrated industry structure where these two entities wield significant influence. This concentration means that competition often revolves around strategic maneuvers between these major players, alongside efforts to capture market share from smaller, more specialized firms in segments like novated leasing and fleet management.

Companies like SG Fleet, Smartgroup, and FleetPartners are key rivals in the novated leasing and fleet management spaces, competing against MMS and a multitude of other firms. The industry's growth, fueled by demand for tax-efficient benefits and EV adoption, is expected to continue, with the fleet management market alone projected for a compound annual growth rate exceeding 7% as of 2024. Despite this growth, the fundamental nature of salary packaging services often leads to commoditization, forcing providers to compete aggressively on pricing and operational efficiency. MMS counters this by emphasizing customer service, digital platforms, and expanding into adjacent services like disability plan management to create a more differentiated offering.

| Competitor/Segment | Market Share (Approx.) | Key Services | Competitive Strategy Example |

| McMillan Shakespeare (MMS) | ~40% (Salary Packaging) | Salary Packaging, Novated Leasing, Fleet Management, Disability Plan Management | 'Simply Stronger' initiative, 'Oly' tool for SMEs, Service Differentiation |

| Smartgroup | ~40% (Salary Packaging) | Salary Packaging, Novated Leasing, Fleet Management | Focus on large corporate clients |

| SG Fleet | N/A (Significant in Fleet) | Fleet Management, Novated Leasing | Technology-driven fleet solutions |

| FleetPartners | N/A (Significant in Fleet) | Fleet Management, Novated Leasing | Integrated fleet and leasing services |

SSubstitutes Threaten

Alternative financial arrangements or transportation solutions present a spectrum of price-performance trade-offs against McMillan Shakespeare's (MMS) offerings. For instance, a direct vehicle purchase or a personal loan might seem more cost-effective initially. However, these options often miss the significant tax advantages and consolidated cost management inherent in a novated lease.

The Fringe Benefits Tax (FBT) exemption for Electric Vehicles (EVs) is a critical factor, demonstrably improving the price-performance ratio of novated leases specifically for qualifying vehicles. This governmental incentive directly lowers the overall cost of EV ownership when structured through a novated lease, making it a compelling alternative for environmentally conscious consumers.

Customer propensity to substitute for McMillan Shakespeare's services hinges on several factors. Awareness of the tax benefits associated with salary packaging, particularly for employee benefits and electric vehicle leases, plays a crucial role. For instance, in 2024, the Australian government continued to offer significant Fringe Benefits Tax (FBT) concessions for EVs, making salary packaging a highly attractive option for those employees.

However, some individuals or employers may choose simpler alternatives, even if less tax-efficient, to sidestep the perceived complexity and administrative burden. This reluctance can increase the threat of substitutes if user-friendly, low-overhead options become more prevalent.

The perceived value of McMillan Shakespeare's offerings versus the effort required is also a key consideration. If the administrative effort is seen as too high relative to the tax savings or other benefits, customers might explore easier-to-manage solutions.

Employees have access to a range of direct financial alternatives that can substitute for novated leasing. For instance, individuals might opt for personal car loans from banks or credit unions, or utilize public transportation and ride-sharing services like Uber or DiDi, especially in urban areas. In 2024, the average interest rate for a personal car loan in Australia hovered around 8-12%, a factor employees weigh against the potential tax savings of novated leasing.

Beyond vehicle-related benefits, other salary packaging options also face direct competition. Employees can elect to receive a higher direct salary, which they can then invest in personal wealth creation vehicles such as managed funds, superannuation accounts, or direct shareholdings. The perceived complexity and administrative effort associated with salary packaging versus managing personal finances directly often influence this choice.

Emergence of New Technologies or Business Models

Technological advancements are a significant threat of substitutes for McMillan Shakespeare (MMS). For instance, sophisticated financial planning apps are emerging that allow individuals to manage their finances more directly, potentially reducing the perceived need for comprehensive salary packaging services. Similarly, the rise of peer-to-peer car sharing platforms offers an alternative to traditional fleet management solutions, catering to specific mobility needs without requiring a full-service package.

New digital payment platforms also represent a threat by simplifying transactions and potentially fragmenting the market for integrated financial solutions. While these innovations may not directly replicate MMS's core offerings, they can erode the demand by providing more accessible, albeit specialized, alternatives. For example, by 2024, the global fintech market was projected to reach significant valuations, indicating a strong trend towards digital solutions that could bypass traditional service providers.

- Financial Planning Apps: Offer direct budget management and investment tools, potentially reducing reliance on salary packaging for financial optimization.

- Peer-to-Peer Car Sharing: Provides flexible and often cost-effective mobility solutions, lessening the demand for managed fleet services for occasional use.

- Digital Payment Platforms: Streamline transactions and payments, potentially fragmenting the need for integrated financial management offered by salary packaging providers.

Regulatory or Policy Changes

Regulatory and policy changes present a significant threat of substitutes for McMillan Shakespeare, particularly concerning salary packaging and novated leasing. Alterations in tax laws, such as personal income tax rates or Fringe Benefits Tax (FBT) exemptions, directly influence the cost-effectiveness and appeal of these services. For example, the Australian government's decision to extend FBT exemptions for electric vehicles (EVs) through to March 31, 2027, has demonstrably boosted the uptake of novated leases for EVs, making them a more attractive substitute for traditional car ownership. Conversely, potential changes to FBT exemptions for plug-in hybrid vehicles, as indicated from April 1, 2025, could reshape leasing preferences and create new substitute options.

The evolving regulatory landscape can rapidly shift the competitive dynamics. For instance, if governments were to reduce or eliminate FBT concessions on novated leases, the cost savings for employees would diminish, making outright purchase or other financing methods more competitive substitutes. The Australian Taxation Office's (ATO) ongoing focus on compliance within the salary packaging sector also means that any tightening of rules or increased scrutiny could indirectly encourage alternative employment benefit structures or compensation methods. This regulatory uncertainty necessitates a proactive approach to understanding and adapting to policy shifts to mitigate the threat of substitutes.

- Impact of FBT Exemptions: The extension of FBT exemptions for EVs until March 31, 2027, directly supports novated leasing as a preferred option for acquiring electric vehicles.

- Potential for Hybrid Vehicle Changes: Anticipated changes to FBT exemptions for plug-in hybrids from April 1, 2025, could influence future leasing trends and the attractiveness of these vehicles as substitutes.

- Tax Law Sensitivity: The core business model relies heavily on favorable tax treatment; therefore, any adverse changes to personal income tax rates or FBT legislation pose a significant threat.

- Regulatory Scrutiny: Increased compliance focus by regulatory bodies like the ATO could lead to stricter interpretations of existing rules, potentially impacting the perceived benefits of salary packaging.

The threat of substitutes for McMillan Shakespeare's services is moderate. Direct vehicle purchase, personal loans, and public transport represent alternatives, but often lack the tax efficiencies of novated leases. The perceived complexity of salary packaging can drive some customers to simpler, albeit less beneficial, options.

The evolving landscape of financial technology and mobility solutions presents growing substitute threats. Sophisticated financial apps and peer-to-peer car sharing platforms offer alternative ways for individuals to manage their finances and transportation needs, potentially bypassing traditional salary packaging providers.

Government incentives, particularly Fringe Benefits Tax (FBT) exemptions for Electric Vehicles (EVs), significantly influence the substitute threat. The extension of these exemptions for EVs until March 31, 2027, bolsters novated leasing's appeal, while potential changes for plug-in hybrids from April 1, 2025, could alter the competitive dynamic.

Customers weigh the administrative effort against the tax savings. For instance, in 2024, Australian personal car loan interest rates averaged 8-12%, a direct comparison point for novated lease benefits.

| Substitute Type | Key Features | Impact on MMS | 2024 Data Point |

|---|---|---|---|

| Personal Loans/Direct Purchase | Simpler administration, no FBT implications | Lower tax benefit appeal | Avg. personal car loan rate: 8-12% |

| Public Transport/Ride-Sharing | Convenience, lower upfront cost for occasional use | Reduces need for owned vehicles | Growth in ride-sharing usage |

| Financial Apps | Direct financial management, investment tools | Potential bypass of salary packaging | Significant growth in fintech adoption |

| EV FBT Exemptions | Reduced cost of EV ownership via novated lease | Strengthens MMS EV offering | Extended EV FBT exemption to March 2027 |

Entrants Threaten

The salary packaging, novated leasing, and fleet management sectors demand considerable upfront capital. Companies need to invest heavily in sophisticated technology platforms, which are crucial for managing complex transactions and customer data. For instance, establishing and maintaining the necessary IT infrastructure and compliance systems can easily run into millions of dollars.

Furthermore, securing funding for leasing portfolios, often referred to as funding warehouses, represents another significant capital hurdle. McMillan Shakespeare, for example, operates its own funding warehouse, Onboard Finance, highlighting the scale of capital needed to support its leasing operations. This requirement means new players must either have substantial backing or secure significant debt financing from the outset.

Building out the extensive operational infrastructure to support nationwide service delivery, including sales, administration, and customer support, also adds to the initial capital outlay. This comprehensive setup is essential for competing effectively and providing the level of service customers expect. Consequently, the high capital requirements act as a formidable barrier to entry for many aspiring competitors.

The automotive leasing and salary packaging industry faces significant threat from new entrants due to stringent regulatory requirements in its key operating markets, Australia and the UK. Navigating the Australian Financial Services Licence (AFSL) regime, for instance, demands substantial investment in compliance infrastructure and expertise. Similarly, understanding and adhering to Fringe Benefits Tax (FBT) legislation adds another layer of complexity and cost for potential new players.

These regulatory hurdles, coupled with data privacy regulations such as the UK's GDPR, create a considerable barrier. Obtaining the necessary licenses and establishing robust compliance processes can be both time-consuming and expensive, deterring many aspiring competitors. For example, the process to obtain an AFSL can take many months and involve significant legal and consulting fees, often running into tens of thousands of dollars.

Established players like McMillan Shakespeare leverage substantial economies of scale, a critical barrier for new entrants. Their high operational volumes translate into more efficient processing and stronger bargaining power with suppliers, such as car dealerships. This allows them to secure more favorable pricing and pass those savings onto customers, creating a cost advantage that is difficult for newcomers to replicate quickly. For instance, McMillan Shakespeare's extensive fleet management operations in 2024 likely enable them to negotiate bulk discounts on vehicle purchases, a significant cost saving.

Brand Loyalty and Customer Relationships

McMillan Shakespeare's deep-seated brand loyalty, cultivated over years of serving major health, not-for-profit, government, and private sector organizations, presents a significant barrier to new entrants. These established, trusted relationships mean that new competitors struggle to gain a foothold, as corporate clients prioritize the security and proven track record of McMillan Shakespeare for their critical financial services.

The difficulty in replicating these extensive and loyal customer bases is a key deterrent for potential new entrants. For instance, in 2024, companies that successfully entered similar service sectors often did so by targeting niche markets or offering disruptive pricing, rather than attempting to immediately displace established players with strong client relationships.

This loyalty is reinforced by the sensitive nature of the financial services McMillan Shakespeare provides. Businesses are hesitant to switch providers for services like salary packaging and novated leasing, where reliability and trust are paramount. McMillan Shakespeare's consistent performance and established reputation in these areas solidify its market position.

New entrants face the considerable challenge of building comparable trust and demonstrating equivalent reliability to attract large, established clients. This often requires substantial investment in marketing, compliance, and service infrastructure, making the threat of new entrants, at least concerning large corporate accounts, relatively low in 2024 and likely into 2025.

- Established Client Base: McMillan Shakespeare serves a diverse range of large organizations, fostering deep loyalty.

- Trust and Reliability: Clients value McMillan Shakespeare's proven track record in sensitive financial services.

- Barriers to Entry: Replicating long-standing relationships and trust is a significant hurdle for newcomers.

- Niche Targeting: New entrants in 2024 often focused on specific market segments to circumvent established loyalty.

Access to Distribution Channels and Technology

New competitors often struggle to secure access to vital distribution channels, particularly established employer networks. Building these relationships requires time and significant effort, a hurdle that existing players like McMillan Shakespeare have already overcome. For instance, gaining traction with large corporate clients, a key revenue stream, is a substantial barrier.

Furthermore, the development and maintenance of sophisticated, user-friendly digital platforms are essential for customer engagement and operational efficiency. McMillan Shakespeare’s Oly platform for SMEs, for example, represents a significant technological investment. New entrants must replicate this level of technological advancement and user experience, which demands considerable capital outlay and expertise, thereby protecting incumbent market share.

- Distribution Channel Barriers: New entrants face difficulties accessing established employer networks, a crucial distribution channel for salary packaging and related services.

- Technological Investment: Developing and maintaining advanced, user-friendly digital platforms, like McMillan Shakespeare's Oly, requires substantial capital and expertise, deterring new market participants.

- Replication Costs: Replicating the technological infrastructure and service delivery models of incumbents necessitates significant upfront investment, creating a high barrier to entry.

The threat of new entrants in the salary packaging and novated leasing sector is mitigated by significant capital requirements. Building the necessary technology platforms and securing funding for leasing portfolios demands millions of dollars, acting as a substantial initial hurdle. For example, McMillan Shakespeare's investment in its funding warehouse, Onboard Finance, underscores the capital intensity involved.

Stringent regulatory environments in Australia and the UK, including AFSL and FBT compliance, add further complexity and cost. Obtaining licenses and establishing robust compliance processes, which can take months and tens of thousands of dollars, deter many potential competitors. Additionally, established players like McMillan Shakespeare benefit from economies of scale, allowing them to negotiate better terms with suppliers and offer more competitive pricing, a cost advantage difficult for newcomers to match.

Deep-seated brand loyalty and established customer relationships with large organizations are also formidable barriers. Clients prioritize McMillan Shakespeare's proven track record and reliability in sensitive financial services, making it challenging for new entrants to gain trust and secure significant corporate accounts. In 2024, new market entrants often found success by targeting niche segments rather than directly challenging established players with strong, long-standing client bases.

Accessing vital distribution channels, such as employer networks, and replicating sophisticated digital platforms like McMillan Shakespeare's Oly also present significant challenges. These require substantial time, effort, and capital investment, effectively limiting the threat of new entrants for established market leaders.

Porter's Five Forces Analysis Data Sources

Our McMillan Shakespeare Porter's Five Forces analysis is built upon a foundation of comprehensive data, including McMillan Shakespeare's annual reports and investor presentations, along with industry-specific reports from reputable market research firms and government statistics.