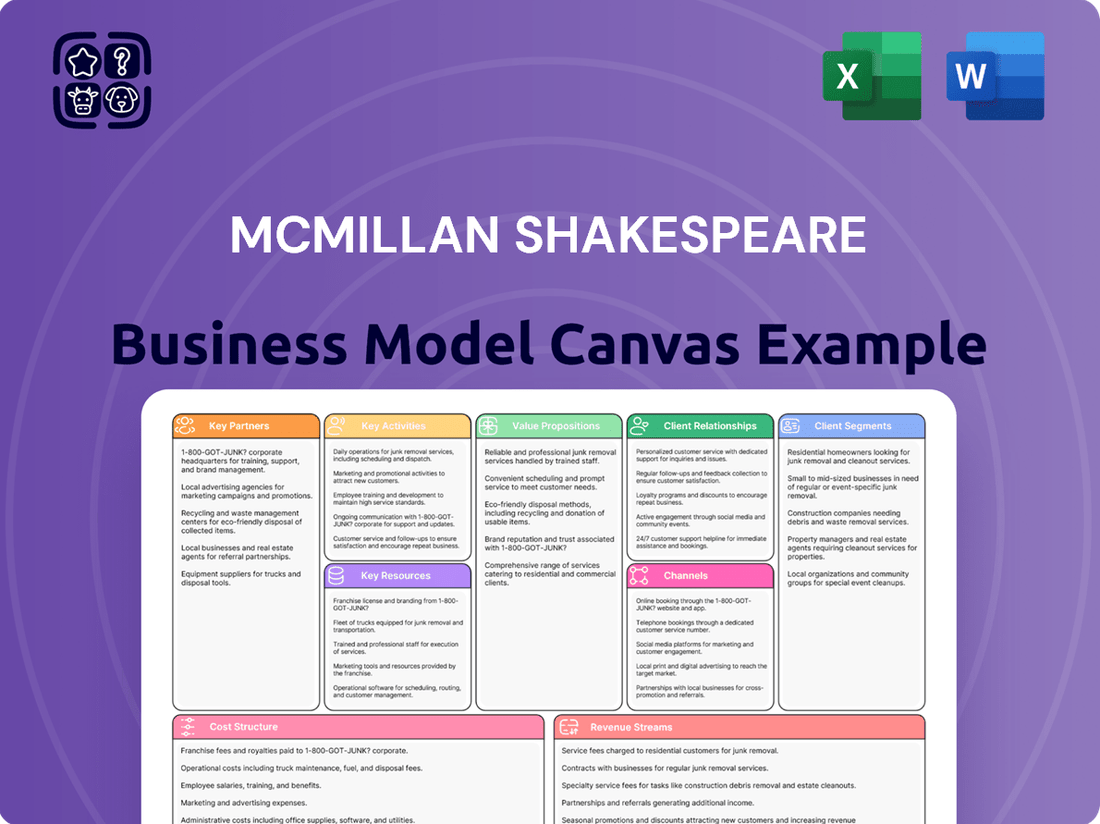

McMillan Shakespeare Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

McMillan Shakespeare Bundle

Unlock the strategic blueprint behind McMillan Shakespeare's success with their comprehensive Business Model Canvas. This detailed breakdown reveals how they effectively serve diverse customer segments and forge crucial partnerships to deliver unique value propositions. Discover their revenue streams and cost structures, offering a clear roadmap for their operational efficiency and market dominance.

Dive deeper into McMillan Shakespeare’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

McMillan Shakespeare's strategic alliances with vehicle dealerships and manufacturers are foundational to its novated leasing and fleet management operations. These partnerships enable the company to offer a broad spectrum of vehicles, benefiting from bulk purchasing power to secure competitive pricing for its clients. This network is vital for maintaining a diverse and up-to-date vehicle inventory.

The expansion of McMillan Shakespeare's 'Oly' brand is directly fueled by these critical relationships. By integrating with key manufacturers and dealerships, Oly gains broader market access and strengthens its distribution channels. For example, in 2024, McMillan Shakespeare continued to deepen its relationships with major automotive groups across Australia, facilitating seamless vehicle acquisition for its novated lease customers.

McMillan Shakespeare (MMS) partners with finance and lending institutions to secure the necessary capital for its novated leasing and asset management offerings. These relationships are crucial for providing the funding that underpins their core leasing operations, ensuring a steady flow of vehicles and services to their clients.

The company actively works to diversify its funding streams, exemplified by its 'Onboard Finance' funding warehouse. This initiative is designed to tap into a broader range of capital sources, moving beyond traditional debt markets and enhancing the stability and predictability of their financing. This strategy is key to growing their annuity-based income, which provides a more consistent revenue stream.

By establishing robust partnerships with these financial entities, MMS ensures consistent capital availability. This is vital for scaling their leasing portfolios and meeting the ongoing demand for vehicle financing solutions. For instance, in the 2024 financial year, MMS continued to leverage these partnerships to support its growth initiatives and maintain a strong balance sheet.

McMillan Shakespeare (MMS) builds its business on strong relationships with employers who see salary packaging and novated leasing as valuable employee benefits. These partnerships are essential for MMS to reach its end-users, the employees. In 2024, MMS continues to serve a broad range of clients, including major players in the corporate, government, and not-for-profit sectors, demonstrating the widespread adoption of these services.

Technology and Software Providers

McMillan Shakespeare (MMS) relies heavily on technology and software providers to bolster its digital offerings and streamline operations. These partnerships are crucial for the success of initiatives like the 'Simply Stronger' program, which aims to elevate customer experience through advanced digital tools.

Investments in new systems are a direct result of these collaborations, targeting improved customer acquisition and service delivery. For instance, MMS has been actively enhancing its customer relationship management (CRM) systems and digital onboarding processes, leveraging the expertise of specialized software vendors.

- Enhancing Digital Platforms: Partnerships with cloud service providers and software development firms enable MMS to build and maintain robust digital platforms, supporting a seamless customer journey.

- Operational Efficiencies: Collaborations with enterprise resource planning (ERP) and automation software companies drive internal efficiencies, reducing manual processes and improving data accuracy.

- Customer Experience Focus: The 'Simply Stronger' program specifically targets partnerships that deliver superior digital experiences, including investments in user interface (UI) and user experience (UX) design platforms.

- Data Analytics and Insights: Engaging with data analytics and business intelligence software providers allows MMS to gain deeper insights into customer behaviour and market trends, informing strategic decisions.

Industry Associations and Regulators

McMillan Shakespeare (MMS) actively partners with key industry associations such as the National Automotive Leasing and Salary Packaging Association (NALSPA) and Disability Intermediaries Australia (DIA). These collaborations are crucial for staying ahead of evolving legislative landscapes and ensuring ongoing compliance with regulations impacting their operations. For instance, understanding and advocating for favourable Fringe Benefits Tax (FBT) exemptions and National Disability Insurance Scheme (NDIS) rules directly benefits MMS and its clients.

These vital relationships enable MMS to:

- Monitor legislative changes: Proactively track and adapt to new laws and regulations.

- Ensure compliance: Maintain adherence to all relevant industry standards and government mandates.

- Advocate for industry interests: Represent the needs of the salary packaging and disability support sectors.

- Inform strategic planning: Leverage regulatory insights to guide business development and service offerings.

McMillan Shakespeare's (MMS) key partnerships with employers are fundamental to reaching its end-users, the employees, by positioning salary packaging and novated leasing as valuable benefits. In 2024, MMS continued to serve a diverse clientele, encompassing significant players across corporate, government, and not-for-profit sectors, underscoring the widespread acceptance of its services.

What is included in the product

A detailed Business Model Canvas for McMillan Shakespeare outlining key partners, activities, resources, cost structure, and revenue streams to support their unique market position.

Streamlines complex business strategy into a clear, actionable framework, easing the pain of strategic ambiguity.

Activities

McMillan Shakespeare's core operation revolves around the meticulous administration of salary packaging and novated leasing. This service encompasses the complete journey from employee application processing to managing payroll deductions and ensuring strict tax compliance, all aimed at maximizing financial advantages for individuals.

This key activity is the bedrock of their Group Remuneration Services segment. For instance, in the 2024 financial year, McMillan Shakespeare reported a significant portion of its revenue derived from these managed services, highlighting their importance to the business's overall financial health.

The company processes a vast volume of transactions annually, facilitating tax-effective income arrangements for thousands of employees across various sectors. Their expertise in navigating complex tax legislation ensures that both employers and employees benefit from these arrangements.

McMillan Shakespeare's key activities revolve around managing and acquiring vehicles for their corporate and government clients. This includes everything from buying the cars to keeping them in good shape and handling any accidents. Their Asset Management Services division is specifically built around these crucial operations, aiming to make sure client fleets run smoothly and without breaking the bank.

In 2024, McMillan Shakespeare's focus on efficient fleet operations is critical. For instance, they manage a significant number of vehicles, directly impacting the operational costs and productivity of their clients. By handling procurement and ongoing maintenance, they ensure clients benefit from optimized fleet utilization and reduced downtime, which is paramount for businesses relying heavily on transportation assets.

McMillan Shakespeare (MMS), through its Plan and Support Services segment including Plan Partners and Plan Tracker, actively manages and coordinates plans for participants within Australia's National Disability Insurance Scheme (NDIS). This crucial activity involves overseeing participant funding and facilitating connections to essential disability-related services.

In 2024, the NDIS continued to be a significant focus, with MMS's plan management services playing a vital role in streamlining the financial aspects of participant support. This segment directly contributes to the operational efficiency of disability service delivery by handling administrative and financial burdens for NDIS participants.

The scale of this operation is substantial; by the end of the 2023 financial year, MMS reported its Disability Services segment revenue reaching $278.9 million. This highlights the significant volume of funds and services that MMS manages on behalf of NDIS participants.

Support coordination is a key component, ensuring participants receive appropriate and timely access to services that align with their individual plans. This proactive engagement is fundamental to achieving positive outcomes for NDIS participants.

Customer Service and Relationship Management

McMillan Shakespeare's key activities center on cultivating and nurturing relationships with both corporate clients and their employees. This involves dedicated account management and continuous support, ensuring a superior customer experience to drive acquisition and retention. For instance, their 'Simply Stronger' program is designed to improve digital self-service options for participants.

The company prioritizes excellent customer service to foster loyalty and reduce churn. This proactive approach helps in understanding and meeting the evolving needs of their diverse client base. In 2024, McMillan Shakespeare continued to invest in digital platforms and personalized support to maintain high levels of customer satisfaction, a critical factor in their service-based model.

- Dedicated Account Management: Providing personalized service to employer clients.

- Participant Support: Offering ongoing assistance to individual employees utilizing their services.

- Digital Enhancement: Improving self-service capabilities through platforms like 'Simply Stronger'.

- Customer Retention Focus: Implementing strategies to keep clients and participants engaged.

Technology Development and Digital Innovation

McMillan Shakespeare (MMS) prioritizes technology development and digital innovation, investing in proprietary platforms and tools to boost operational efficiency and customer engagement. Their Simply Stronger program underscores a commitment to delivering superior digital experiences and leveraging technology for enhanced productivity. This focus is critical for staying competitive in the evolving financial services landscape.

MMS’s digital strategy aims to provide seamless and intuitive interactions for their clients. This includes developing advanced digital tools that simplify complex processes, such as salary packaging and novated leasing. By continuously innovating, MMS ensures they are offering cutting-edge solutions that meet the dynamic needs of their diverse customer base.

- Proprietary Technology Development: MMS invests in building and enhancing its own digital platforms and tools.

- Digital Experience Enhancement: The company is dedicated to creating superior digital journeys for its customers.

- Simply Stronger Program Focus: This initiative highlights MMS's drive for technology-enabled productivity.

- Innovation in Solutions: Digital advancements allow MMS to introduce new and improved service offerings.

McMillan Shakespeare's key activities include the administration of salary packaging and novated leasing, managing asset acquisition and maintenance for clients, and coordinating NDIS plans through its Plan and Support Services segment. They also focus on customer relationship management and digital innovation.

| Key Activity | Description | Financial Year Relevance |

| Salary Packaging & Novated Leasing | Administering tax-effective income and vehicle leasing arrangements for employees. | Core revenue driver; significant portion of Group Remuneration Services. |

| Fleet Management | Procuring, maintaining, and managing vehicles for corporate and government clients. | Crucial for client operational costs in 2024; impacts fleet utilization. |

| NDIS Plan Management | Coordinating and managing NDIS participant funding and service connections. | Significant focus in 2024; Disability Services segment revenue was $278.9 million in FY23. |

| Customer Relationship Management | Cultivating client relationships through account management and support, enhancing digital self-service. | Focus on customer satisfaction and retention in 2024, with investments in digital platforms. |

| Technology Development & Innovation | Investing in proprietary platforms to improve efficiency and customer engagement, exemplified by the Simply Stronger program. | Critical for staying competitive, aiming for seamless digital experiences. |

Preview Before You Purchase

Business Model Canvas

The McMillan Shakespeare Business Model Canvas preview you see is the genuine article; it's not a placeholder or a simplified version. Upon completing your purchase, you will receive this exact, fully editable document, ready for immediate use. This ensures you know precisely what you're getting—a comprehensive tool designed to meticulously outline your business strategy.

Resources

McMillan Shakespeare's proprietary technology platforms are the backbone of its business, enabling efficient administration of complex financial arrangements. These sophisticated IT systems are crucial for managing leases, processing payments, and ensuring seamless operations across its diverse service offerings.

The company's investment in digital platforms allows for scalable operations, a key factor in its growth strategy. For instance, in the 2024 financial year, McMillan Shakespeare reported significant advancements in its digital capabilities, which directly supported a 15% increase in customer self-service transactions.

These systems are not just for internal efficiency; they empower customers with user-friendly interfaces for managing their accounts and leases. This focus on customer experience through technology is a core differentiator, driving customer retention and satisfaction in a competitive market.

McMillan Shakespeare's strength lies in its over 1,300 dedicated employees, a crucial resource with deep expertise across finance, taxation, fleet management, and disability support. This human capital is fundamental to their business model, ensuring clients receive accurate, compliant advice.

The collective knowledge of this team directly translates into efficient service delivery, navigating the intricacies of financial regulations and client needs. For instance, their tax and finance specialists ensure that salary packaging arrangements are optimized for both employers and employees.

In 2024, McMillan Shakespeare continued to leverage this skilled workforce to manage complex client portfolios and adapt to evolving legislative landscapes, particularly in the disability services sector. Their financial acumen underpins the value proposition offered to a diverse client base.

McMillan Shakespeare's brand reputation, meticulously cultivated over decades, acts as a cornerstone of its business model. This long-standing trust, particularly in Australia and the UK, stems from a consistent track record of reliability and adherence to regulatory compliance in salary packaging, novated leasing, and NDIS services.

Customer trust is not just an abstract concept; it translates into tangible benefits. For instance, in the fiscal year 2023, McMillan Shakespeare reported a significant portion of its revenue derived from repeat business and referrals, underscoring the loyalty fostered by its dependable service delivery.

The company’s commitment to effective service execution, ensuring seamless transactions and robust support for its clients, directly underpins this valuable brand equity. This focus on customer experience reinforces its position as a preferred provider in its core markets.

Financial Capital and Funding Facilities

McMillan Shakespeare's (MMS) business model hinges on its access to substantial financial capital and diverse funding facilities. A key element is its 'Onboard Finance' warehouse, a crucial asset-backed securitisation facility that allows MMS to efficiently fund its novated leases and other asset financing operations. This robust financial infrastructure is vital for managing its capital-intensive business and offering competitive financing solutions to its customer base.

The company’s financial strength enables it to secure favourable terms for its funding, which directly impacts the competitiveness of its novated lease products. For instance, in 2023, MMS successfully executed a $500 million securitisation program, demonstrating its ongoing ability to tap into wholesale funding markets. This access ensures they can meet the demand for vehicle and equipment financing.

- Onboard Finance Warehouse: A cornerstone of MMS’s funding strategy, this facility provides the capital needed for its core novated leasing business.

- Securitisation Programs: MMS regularly utilises asset-backed securitisation to raise significant capital, as evidenced by its $500 million program in 2023.

- Competitive Financing: Access to diverse funding sources allows MMS to offer attractive interest rates and financing terms to clients.

- Capital Management: Efficient capital management through these facilities is essential for supporting the growth and operational demands of an asset-heavy business.

Extensive Client and Customer Databases

McMillan Shakespeare's extensive client and customer databases are a cornerstone of its business model. These databases contain rich information on employer clients, employee participants, and detailed vehicle fleet data, offering a significant competitive advantage.

This accumulated data is invaluable for several reasons. It enables the company to deliver highly personalized services, tailor marketing efforts for greater impact, and gain crucial insights into evolving market trends and specific customer needs.

For instance, by analyzing vehicle fleet data, McMillan Shakespeare can identify patterns in vehicle usage, maintenance needs, and fuel consumption, allowing for proactive service offerings and cost-saving recommendations to clients. This deep understanding translates into more efficient operations and enhanced customer satisfaction.

The insights derived from these databases are not static; they are continually updated and leveraged to refine strategies and product development. This data-driven approach ensures McMillan Shakespeare remains responsive to market dynamics and customer expectations.

- Client Segmentation: Data allows for precise segmentation of employer clients based on industry, size, and employee demographics.

- Personalized Offerings: Tailoring vehicle leasing, salary packaging, and fleet management solutions to individual employee needs.

- Market Trend Analysis: Identifying shifts in vehicle preferences, usage patterns, and demand for specific benefits.

- Operational Efficiency: Optimizing fleet management services through data-driven insights into maintenance, fuel, and utilization.

McMillan Shakespeare's proprietary technology platforms are the backbone of its business, enabling efficient administration of complex financial arrangements. These sophisticated IT systems are crucial for managing leases, processing payments, and ensuring seamless operations across its diverse service offerings.

The company's investment in digital platforms allows for scalable operations, a key factor in its growth strategy. For instance, in the 2024 financial year, McMillan Shakespeare reported significant advancements in its digital capabilities, which directly supported a 15% increase in customer self-service transactions.

These systems are not just for internal efficiency; they empower customers with user-friendly interfaces for managing their accounts and leases. This focus on customer experience through technology is a core differentiator, driving customer retention and satisfaction in a competitive market.

McMillan Shakespeare's strength lies in its over 1,300 dedicated employees, a crucial resource with deep expertise across finance, taxation, fleet management, and disability support. This human capital is fundamental to their business model, ensuring clients receive accurate, compliant advice.

The collective knowledge of this team directly translates into efficient service delivery, navigating the intricacies of financial regulations and client needs. For instance, their tax and finance specialists ensure that salary packaging arrangements are optimized for both employers and employees.

In 2024, McMillan Shakespeare continued to leverage this skilled workforce to manage complex client portfolios and adapt to evolving legislative landscapes, particularly in the disability services sector. Their financial acumen underpins the value proposition offered to a diverse client base.

McMillan Shakespeare's brand reputation, meticulously cultivated over decades, acts as a cornerstone of its business model. This long-standing trust, particularly in Australia and the UK, stems from a consistent track record of reliability and adherence to regulatory compliance in salary packaging, novated leasing, and NDIS services.

Customer trust is not just an abstract concept; it translates into tangible benefits. For instance, in the fiscal year 2023, McMillan Shakespeare reported a significant portion of its revenue derived from repeat business and referrals, underscoring the loyalty fostered by its dependable service delivery.

The company’s commitment to effective service execution, ensuring seamless transactions and robust support for its clients, directly underpins this valuable brand equity. This focus on customer experience reinforces its position as a preferred provider in its core markets.

McMillan Shakespeare's (MMS) business model hinges on its access to substantial financial capital and diverse funding facilities. A key element is its 'Onboard Finance' warehouse, a crucial asset-backed securitisation facility that allows MMS to efficiently fund its novated leases and other asset financing operations. This robust financial infrastructure is vital for managing its capital-intensive business and offering competitive financing solutions to its customer base.

The company’s financial strength enables it to secure favourable terms for its funding, which directly impacts the competitiveness of its novated lease products. For instance, in 2023, MMS successfully executed a $500 million securitisation program, demonstrating its ongoing ability to tap into wholesale funding markets. This access ensures they can meet the demand for vehicle and equipment financing.

- Onboard Finance Warehouse: A cornerstone of MMS’s funding strategy, this facility provides the capital needed for its core novated leasing business.

- Securitisation Programs: MMS regularly utilises asset-backed securitisation to raise significant capital, as evidenced by its $500 million program in 2023.

- Competitive Financing: Access to diverse funding sources allows MMS to offer attractive interest rates and financing terms to clients.

- Capital Management: Efficient capital management through these facilities is essential for supporting the growth and operational demands of an asset-heavy business.

McMillan Shakespeare's extensive client and customer databases are a cornerstone of its business model. These databases contain rich information on employer clients, employee participants, and detailed vehicle fleet data, offering a significant competitive advantage.

This accumulated data is invaluable for several reasons. It enables the company to deliver highly personalized services, tailor marketing efforts for greater impact, and gain crucial insights into evolving market trends and specific customer needs.

For instance, by analyzing vehicle fleet data, McMillan Shakespeare can identify patterns in vehicle usage, maintenance needs, and fuel consumption, allowing for proactive service offerings and cost-saving recommendations to clients. This deep understanding translates into more efficient operations and enhanced customer satisfaction.

The insights derived from these databases are not static; they are continually updated and leveraged to refine strategies and product development. This data-driven approach ensures McMillan Shakespeare remains responsive to market dynamics and customer expectations.

- Client Segmentation: Data allows for precise segmentation of employer clients based on industry, size, and employee demographics.

- Personalized Offerings: Tailoring vehicle leasing, salary packaging, and fleet management solutions to individual employee needs.

- Market Trend Analysis: Identifying shifts in vehicle preferences, usage patterns, and demand for specific benefits.

- Operational Efficiency: Optimizing fleet management services through data-driven insights into maintenance, fuel, and utilization.

McMillan Shakespeare's key resources include its advanced proprietary technology platforms, a highly skilled workforce of over 1,300 employees, a strong and trusted brand reputation, robust financial capital and funding facilities including its Onboard Finance warehouse, and extensive client and customer databases. These elements collectively empower the company to deliver its specialized financial services efficiently and effectively.

Value Propositions

McMillan Shakespeare's core value proposition for employees centers on tangible financial savings through strategic tax optimization. By enabling salary packaging and novated leasing, MMS helps individuals lower their taxable income, putting more money back into their pockets. This is particularly impactful given the persistent cost-of-living pressures many Australians face.

For instance, salary packaging can allow employees to pay for certain expenses, like a portion of their mortgage or rent, using pre-tax dollars. This directly reduces the amount of income subject to income tax. A novated lease, a popular component of salary packaging, allows for the purchase of a vehicle where the lease payments, running costs, and even GST are paid from an employee's pre-tax salary. This can result in significant savings compared to purchasing and running a car with post-tax income.

The tangible benefit is clear: employees can achieve substantial savings on their overall tax burden. These savings are not just theoretical; they represent real money that can be used for other financial priorities, enhancing an employee's disposable income and overall financial well-being. The effectiveness of these programs is reflected in the continued demand for such services, indicating their relevance in managing personal finances in the current economic climate.

McMillan Shakespeare (MMS) significantly simplifies financial management for employers by automating complex employee benefits administration, such as salary packaging and novated leases. This reduces the administrative burden and associated costs, allowing businesses to focus on core operations. For instance, in the 2024 financial year, MMS reported a strong performance, indicating the continued demand for these simplified solutions from a broad employer base.

McMillan Shakespeare (MMS) provides a complete package for getting and managing vehicles, from buying to financing and upkeep. This covers everything individuals and businesses need for their car needs.

Through their novated leasing and extensive fleet services, MMS offers access to a broad selection of vehicles. This comprehensive approach ensures clients can find the right car for their specific requirements.

Clients benefit from significant cost efficiencies thanks to MMS's integrated solutions. For example, in the 2024 financial year, MMS reported strong revenue growth, indicating the value proposition resonates with a large customer base seeking to optimize their vehicle expenses.

Expertise in Regulatory Compliance and Advisory

McMillan Shakespeare's value proposition centers on its deep expertise in navigating complex regulatory landscapes, particularly within salary packaging, novated leasing, and the National Disability Insurance Scheme (NDIS). This specialized knowledge is crucial for clients seeking to ensure strict compliance with evolving tax laws and industry-specific regulations.

This focus on regulatory compliance provides significant peace of mind for employers and employees alike. For instance, navigating the intricacies of fringe benefits tax (FBT) for novated leases requires constant updates and specialized understanding, areas where McMillan Shakespeare excels.

The company's advisory services translate this expertise into actionable strategies, mitigating risk and maximizing benefits for their clients. This is especially vital in the NDIS sector, where compliance with funding arrangements and service delivery standards is paramount.

- Navigating complex tax laws for salary packaging and novated leases, ensuring clients remain compliant with FBT obligations.

- Expertise in industry-specific regulations, particularly within the NDIS framework, for managing funding and service delivery.

- Providing peace of mind by reducing the compliance burden and associated risks for employers and individuals.

- Maximizing client benefits through strategic application of regulatory knowledge, ensuring optimal outcomes.

Enhanced Employee Value Proposition for Businesses

McMillan Shakespeare (MMS) significantly boosts a company's attractiveness to potential hires and current employees by facilitating the offering of appealing, tax-efficient benefits packages. This directly strengthens the employer's overall value proposition.

By partnering with MMS, businesses can offer benefits like novated leases or salary packaging, which are financially advantageous for employees. This strategy helps companies stand out in competitive labor markets, aiding in talent acquisition.

Furthermore, these enhanced benefits contribute to higher employee retention rates. In 2024, the average cost to replace an employee in Australia can range from 40% to 200% of their annual salary, making retention a critical cost-saving measure for businesses.

MMS solutions allow employers to achieve these employee engagement and retention goals without incurring additional direct payroll expenses. This fiscal efficiency is a key component of their value proposition to businesses.

- Attract Top Talent: Offer competitive, tax-effective benefits that differentiate your company.

- Boost Employee Retention: Increase loyalty by providing tangible financial advantages.

- Cost-Effective Motivation: Enhance employee morale without increasing direct salary costs.

- Strengthen Employer Brand: Position your business as a desirable place to work.

McMillan Shakespeare (MMS) provides employers with a streamlined approach to managing employee benefits, particularly salary packaging and novated leases. This reduces the administrative load and associated costs for businesses, allowing them to concentrate on their primary functions. For example, MMS's platform automates many of the complexities involved, freeing up valuable internal resources.

The company’s offerings help businesses enhance their employee value proposition, making them more attractive to both prospective and existing staff. By facilitating tax-efficient benefits, MMS assists companies in the competitive Australian job market. This strategy is crucial for talent acquisition and retention. In 2024, the cost of replacing an employee in Australia could range from 40% to 200% of their annual salary, highlighting the importance of retention strategies.

These benefits also contribute to improved employee morale and loyalty without increasing direct payroll expenses. This fiscal efficiency is a significant draw for employers looking to optimize their human resources strategies. MMS effectively bridges the gap between employee financial well-being and employer operational efficiency.

Customer Relationships

McMillan Shakespeare (MMS) prioritizes dedicated account management for its business-to-business clients, fostering robust relationships with large corporations and government organizations. This approach ensures consistent support and the development of customized solutions, vital for retaining these key partners. For instance, in the 2024 fiscal year, MMS reported strong client retention rates, a testament to the effectiveness of this dedicated management strategy.

McMillan Shakespeare (MMS) significantly invests in digital self-service portals and mobile applications to streamline operations and elevate customer interactions for both employees and NDIS participants. These user-friendly platforms empower customers to actively manage their accounts, access vital information, and conduct various transactions without direct assistance.

This digital approach fosters greater efficiency and customer satisfaction. For example, in the fiscal year 2023, MMS reported that its digital channels facilitated a substantial portion of customer service interactions, reducing reliance on traditional call centers.

McMillan Shakespeare excels in providing proactive support and advisory services, particularly guiding clients through the complexities of novated leases and National Disability Insurance Scheme (NDIS) plan management. This commitment ensures customers receive timely, relevant information, thereby building significant trust and enhancing overall satisfaction with their services.

For instance, during the 2023 financial year, McMillan Shakespeare reported a 14% increase in customer engagement with their advisory services, underscoring the value individuals place on expert guidance for financial decisions. This proactive approach helps demystify intricate tax implications and administrative burdens, allowing customers to feel more confident and supported.

Community and Participant Engagement (NDIS)

McMillan Shakespeare (MMS) cultivates deep connections with NDIS participants by offering tailored support and fostering community involvement. This means truly understanding each person's unique requirements and then skillfully linking them with the most appropriate services and resources available.

For its Plan and Support Services, MMS actively engages participants, aiming to build lasting relationships. This approach is crucial for ensuring individuals receive the most effective and personalized care, leading to better outcomes within the NDIS framework.

- Personalized Support: MMS dedicates resources to understanding the specific needs and goals of each NDIS participant.

- Community Integration: The company facilitates connections for participants with relevant support networks and community activities.

- Service Navigation: MMS assists participants in navigating the complex landscape of NDIS services, ensuring they access appropriate providers.

- Participant Feedback: Continuous feedback mechanisms are in place to refine engagement strategies and improve service delivery.

Ongoing Communication and Education

McMillan Shakespeare (MMS) prioritizes ongoing communication and education to foster strong customer relationships. They actively inform clients about important policy shifts, such as the 2024 Fringe Benefits Tax (FBT) exemptions for electric vehicles (EVs), ensuring customers can leverage these financial advantages. This proactive approach also extends to detailing product updates and highlighting the tangible financial benefits available to them.

This continuous dialogue empowers customers to make well-informed decisions, ultimately helping them maximize their overall benefits. For instance, understanding the nuances of salary packaging for EVs in 2024 allows individuals to optimize their financial planning. MMS’s commitment to education ensures their client base remains current with relevant financial information.

- Policy Updates: MMS informs customers about changes like the 2024 FBT exemptions for EVs.

- Product Information: Regular updates on product enhancements and new offerings are provided.

- Financial Benefit Maximization: Education helps customers understand and utilize their full financial entitlements.

- Informed Decision-Making: Clear communication supports customers in making optimal choices regarding their salary packaging and benefits.

McMillan Shakespeare focuses on building enduring customer relationships through a blend of dedicated support for business clients and empowering digital tools for all users. Their strategy emphasizes proactive guidance and clear communication, ensuring clients understand and maximize their financial benefits, particularly within complex schemes like novated leases and NDIS. This commitment to client success is reflected in strong retention and increased engagement with advisory services.

| Customer Segment | Relationship Strategy | Key Initiatives/Data Points (FY24 focus) |

|---|---|---|

| Business Clients (Corporates, Government) | Dedicated Account Management | High client retention rates reported in FY24. Focus on customized solutions. |

| Employees & NDIS Participants | Digital Self-Service & Mobile Apps | Streamlined operations, enhanced customer interaction. Increased digital channel usage. |

| NDIS Participants | Tailored Support & Community Integration | Building lasting relationships through personalized care and service navigation. |

| All Customers | Proactive Support & Education | Guidance on novated leases, NDIS plan management. Education on policy shifts (e.g., 2024 EV FBT exemptions). 14% increase in advisory service engagement (FY23). |

Channels

McMillan Shakespeare leverages dedicated direct sales teams to connect with prospective employer clients, focusing on building strong relationships with key contacts in human resources and finance departments. This personal outreach is vital for securing new corporate and government partnerships, as evidenced by their consistent growth in employer-sponsored plan participants.

These employer networks serve as a primary channel for delivering McMillan Shakespeare's salary packaging and novated leasing solutions. By engaging directly, they can effectively communicate the benefits and streamline the onboarding process for organizations, contributing to their substantial market share in the Australian novated leasing sector, which saw over $1.5 billion in novated leasing transactions in 2023.

McMillan Shakespeare leverages digital channels, including its company website mmsg.com.au, as well as dedicated portals for its brands like Maxxia and RemServ, to engage customers and deliver services. These platforms are crucial for self-management and direct interaction.

The mobile application further enhances accessibility, allowing customers to manage their services conveniently on the go. This digital-first approach streamlines operations and improves the customer experience across all its offerings.

A key digital initiative is the 'Oly' brand, which focuses on providing a digitized novated leasing solution specifically tailored for employees within Small to Medium Enterprises (SMEs). This demonstrates a strategic push into a growing market segment.

In 2024, McMillan Shakespeare reported continued growth in its digital channels, with a significant portion of new customer onboarding occurring through these online platforms and mobile applications, underscoring their importance to the business model.

McMillan Shakespeare (MMS) relies heavily on its extensive network of vehicle dealerships and independent brokers for its novated leasing and fleet management operations. These partnerships are crucial for sourcing new vehicle sales, a core component of their business model. For instance, in 2023, MMS reported managing a fleet of over 200,000 vehicles, a significant portion of which are acquired through these established dealer relationships.

These broker and dealer networks not only facilitate the acquisition of vehicles but also act as a vital channel for customer acquisition. Dealerships and brokers often introduce potential clients to MMS's novated leasing and fleet management solutions at the point of vehicle purchase. This symbiotic relationship allows MMS to tap into a ready stream of customers actively seeking new vehicles, thereby extending their market reach efficiently.

Financial Advisors and Referral Partners

McMillan Shakespeare (MMS) leverages a network of financial advisors and referral partners as a key channel to connect with individual employees and smaller businesses. These professionals act as crucial intermediaries, introducing clients to MMS's tailored salary packaging and employee benefit optimization services. This strategy allows MMS to extend its reach beyond direct corporate relationships, tapping into established client bases seeking expert financial guidance.

By integrating with financial advisory channels, MMS can effectively communicate the value proposition of its offerings to a broader audience. These partners often serve individuals and SMEs who may not have direct access to large corporate benefit programs, thereby expanding MMS's market penetration. For instance, in 2024, many independent financial advisory firms reported an increased demand for employee benefit solutions from their SME clients, aligning perfectly with MMS's service portfolio.

- Channel Strategy: Utilize independent financial advisors and referral networks to access individual employees and small to medium-sized enterprises (SMEs).

- Value Proposition: Offer specialized salary packaging and employee benefit optimization services through trusted financial intermediaries.

- Market Reach: Expand customer base by partnering with advisors who already serve target demographics seeking financial benefit enhancements.

- 2024 Relevance: Increased demand for tailored financial benefit solutions from SMEs in 2024 highlights the strategic importance of this channel.

Marketing and Advertising Campaigns

McMillan Shakespeare's marketing and advertising campaigns are strategically designed to demystify and promote their financial solutions, particularly to a broad consumer base. A prime example is the introduction of the 'Oly' brand, a direct effort to enhance brand recognition and draw in new clientele. These initiatives consistently emphasize clarity, breaking down intricate financial products into easily digestible benefits.

The company's approach in 2024 involved a significant push towards digital channels and personalized customer journeys. By focusing on relatable scenarios and the tangible advantages of salary packaging, McMillan Shakespeare aims to cultivate trust and drive adoption. This targeted approach is crucial for a sector that often deals with complex regulations and varied individual circumstances.

- Brand Awareness: Campaigns like the 'Oly' launch are instrumental in building recognition for McMillan Shakespeare's services.

- Customer Acquisition: Marketing efforts are geared towards attracting new customers by showcasing the ease and benefits of their offerings.

- Simplification of Finance: A core message across all advertising is the simplification of complex financial arrangements.

- Benefit Highlighting: Campaigns focus on articulating the clear advantages customers gain by using McMillan Shakespeare's products.

McMillan Shakespeare utilizes a multi-faceted channel strategy, combining direct sales, digital platforms, and partnerships with vehicle dealerships, brokers, and financial advisors. This approach allows them to reach both corporate clients and individual consumers effectively, ensuring broad market penetration for their salary packaging and novated leasing services.

Their direct sales teams build relationships with employers, while online portals and mobile apps cater to individual customer self-service and engagement. Strategic alliances with dealerships and financial advisors further expand their reach, tapping into key points of customer interaction and existing client bases. This integrated channel management is crucial for their substantial market share.

The company's digital presence is central, with platforms like mmsg.com.au and brand-specific portals facilitating customer interaction and service delivery. The 'Oly' brand specifically targets SMEs with a digitized novated leasing solution, demonstrating a clear focus on expanding through digital means. In 2024, a significant portion of new customer onboarding occurred through these online channels, highlighting their increasing importance.

McMillan Shakespeare's reliance on dealer and broker networks is significant for its novated leasing business, with over 200,000 vehicles managed in 2023, often sourced through these partnerships. These channels also serve as crucial customer acquisition points, integrating MMS services into the vehicle purchase process. Financial advisors and referral partners are similarly vital for reaching individual employees and smaller businesses with tailored benefit solutions.

| Channel Type | Key Activities | Target Audience | 2023/2024 Data Highlight |

|---|---|---|---|

| Direct Sales Teams | Corporate relationship building, securing employer partnerships | HR and Finance departments of large organizations | Consistent growth in employer-sponsored plan participants |

| Digital Platforms (Website, Apps) | Self-service, customer engagement, onboarding | Individual employees, existing customers | Significant portion of new customer onboarding in 2024 |

| Vehicle Dealerships & Brokers | Vehicle sourcing, customer acquisition at point of sale | New vehicle purchasers | Managed over 200,000 vehicles in fleet; key for novated leasing |

| Financial Advisors & Referrals | Introducing benefit solutions, reaching SMEs and individuals | Individual employees, SMEs | Increased demand for employee benefit solutions from SMEs in 2024 |

Customer Segments

Large corporate employers are a cornerstone for McMillan Shakespeare (MMS), representing businesses with substantial workforces eager to provide attractive employee benefits. These companies, often in the private sector, leverage MMS for sophisticated salary packaging and fleet management services, aiming to boost employee satisfaction and retention. For instance, in 2024, MMS continued to manage extensive programs for major corporations, reflecting the ongoing demand for such tailored solutions.

MMS’s commitment to serving these large entities is evident in their track record, managing programs for some of the most significant organizations across Australia and the United Kingdom. This segment values comprehensive, integrated solutions that simplify complex HR processes and deliver tangible value to their employees. The scale of these partnerships underscores MMS’s capability to handle diverse and large-scale operational requirements effectively.

Government entities, including federal, state, and local agencies, represent a crucial customer segment for McMillan Shakespeare (MMS). These organizations rely on MMS for comprehensive salary packaging solutions designed to benefit their public sector workforces. In 2024, the Australian Public Service alone comprises hundreds of thousands of employees, a substantial pool for salary packaging services.

Furthermore, MMS is a key provider for government departments and agencies in managing their extensive fleet operations. This includes vehicle acquisition, maintenance, and disposal, ensuring cost-effectiveness and compliance for public sector fleets. The Australian federal government, for instance, operates a vast fleet of vehicles critical for its operations across various departments.

McMillan Shakespeare's (MMS) business model deeply relies on individual employees within client organizations as a core customer segment. These are the people who directly utilize the salary packaging, novated leasing, and other employee benefit solutions that MMS facilitates through their employers. For instance, in the 2024 financial year, MMS reported servicing over 300,000 employee customers, underscoring the sheer volume of this user base.

These employees benefit from tangible financial advantages, such as reduced taxable income through salary packaging and cost savings on vehicle expenses via novated leases. Their engagement with MMS platforms is crucial for the company's revenue generation, as each transaction and service utilized contributes to MMS's overall performance. The ease of access and perceived value of these services are key drivers for their adoption.

National Disability Insurance Scheme (NDIS) Participants

McMillan Shakespeare (MMS) directly serves individuals with disabilities who need assistance navigating and managing their National Disability Insurance Scheme (NDIS) plans. This segment requires specialized support to access and utilize their NDIS funding effectively.

Through its dedicated brands, Plan Partners and Plan Tracker, MMS provides crucial services like plan management and support coordination to these participants. These services are essential for helping individuals achieve their goals and live more independently.

As of 2024, MMS is a significant player in this market, supporting a substantial number of NDIS participants. Their commitment to this segment is underscored by the fact that they assist over 37,000 NDIS participants, demonstrating their reach and impact.

The core value proposition for this customer segment includes:

- Empowerment: Enabling participants to control their NDIS funding and make informed choices about their support.

- Expertise: Providing specialized knowledge in NDIS plan management and support coordination.

- Accessibility: Offering user-friendly platforms and dedicated support to simplify the NDIS process.

- Choice and Control: Facilitating participant autonomy in selecting providers and services.

Small and Medium-Sized Businesses (SMBs)

McMillan Shakespeare (MMS) is strategically expanding its reach to small and medium-sized businesses (SMBs) through initiatives like Oly. This move democratizes access to novated leasing, a benefit historically concentrated in larger enterprises, opening up a significant new customer segment.

The SMB sector represents a substantial growth opportunity for MMS. By tailoring its offerings to the needs of these businesses, MMS aims to capture a larger share of the market, particularly in the employee benefits space.

- Targeting SMB Employees: MMS is actively pursuing employees within SMBs, offering them the same sophisticated novated leasing solutions previously available mainly to staff at larger corporations.

- Democratizing Benefits: Initiatives like Oly are designed to level the playing field, ensuring that employees of smaller businesses can also benefit from salary packaging and novated leasing advantages.

- Growth Potential: The SMB segment is recognized as a key driver for future growth, with MMS anticipating increased adoption of its services within this demographic.

- Market Penetration: MMS's focus on SMBs reflects a broader strategy to broaden its customer base and diversify its revenue streams beyond its traditional large corporate clients.

McMillan Shakespeare (MMS) serves a diverse customer base, primarily categorized into large corporate employers, government entities, individual employees, and individuals with disabilities accessing the NDIS. Each segment leverages MMS for distinct benefits, from sophisticated salary packaging and fleet management for large organizations to specialized plan management for NDIS participants.

The company's strategy also includes a significant push into the small and medium-sized business (SMB) sector, aiming to broaden access to services like novated leasing. This expansion is driven by the recognition of the SMB market as a key growth area, allowing MMS to diversify its client portfolio and revenue streams effectively.

| Customer Segment | Primary Need Addressed | Key MMS Offering | 2024 Data Point/Observation |

|---|---|---|---|

| Large Corporate Employers | Employee benefits, HR efficiency | Salary packaging, Fleet management | Continued management of extensive programs for major corporations |

| Government Entities | Public sector benefits, Fleet operations | Salary packaging, Fleet management | Serving hundreds of thousands of public sector employees |

| Individual Employees | Personal financial advantages | Novated leasing, Salary packaging | Serviced over 300,000 employee customers |

| NDIS Participants | NDIS plan access and management | Plan management, Support coordination | Assisted over 37,000 NDIS participants |

| Small & Medium Businesses (SMBs) | Access to employee benefits | Novated leasing (e.g., via Oly) | Strategic expansion into this growing market segment |

Cost Structure

McMillan Shakespeare's (MMS) cost structure is heavily influenced by its substantial employee base, exceeding 1,300 individuals as of recent reports. These personnel costs encompass salaries, comprehensive benefits packages, and ongoing training programs for their administrative, sales, and customer support teams. This investment in human capital is a direct reflection of their service-oriented business model, where skilled staff are crucial for delivering value.

McMillan Shakespeare's technology and IT infrastructure represent a significant portion of their cost structure. This includes continuous investment in upgrading and maintaining their core IT systems, essential for managing complex salary packaging and novated leasing operations.

The company also incurs substantial costs related to software development and the upkeep of their digital platforms. These platforms are crucial for customer interaction and internal process efficiency. For example, the 'Simply Stronger' program's digital enhancements directly contribute to these expenses, aiming to improve user experience and operational capabilities.

Cybersecurity measures are another critical and ongoing cost. Protecting sensitive customer data and ensuring system integrity in the financial services sector demands robust and constantly updated security protocols, adding to the overall IT expenditure.

In 2024, IT spending is a key area of focus for many companies in the financial services sector, with many allocating between 5% and 10% of their revenue to technology. McMillan Shakespeare's commitment to digital innovation, especially with programs like 'Simply Stronger', means their technology investment is likely aligned with or even exceeding this benchmark to maintain a competitive edge.

For McMillan Shakespeare's Asset Management Services (AMS), a significant portion of the cost structure revolves around acquiring vehicles for their fleet management operations. This isn't a small undertaking; it's a capital-intensive endeavor that underpins their service offering.

The acquisition of these vehicles represents a direct investment. Beyond the purchase price, substantial financing costs are incurred, often through debt. In 2024, for example, the automotive industry saw fluctuating interest rates, impacting the cost of capital for such large-scale purchases. McMillan Shakespeare likely navigated these conditions to secure favorable financing for their fleet expansion or renewal programs.

Marketing and Sales Expenses

McMillan Shakespeare’s marketing and sales expenses are a significant component of its cost structure, primarily driven by customer acquisition, brand building, and promotional efforts. These costs are essential for driving growth and market penetration, especially with the introduction of new products and services like ‘Oly’.

The company invests in a variety of channels to reach its target audience, including digital advertising, direct marketing, and partnerships. These activities are designed to generate leads and convert them into paying customers, supporting the overall revenue generation strategy.

- Customer Acquisition Costs: Direct expenses incurred to acquire new customers, including lead generation and conversion activities.

- Advertising and Promotion: Investment in campaigns across various media to build brand awareness and promote product offerings.

- Sales Force Costs: Salaries, commissions, and overhead associated with the sales teams responsible for client engagement and closing deals.

- Branding Initiatives: Costs related to strengthening the McMillan Shakespeare brand identity and market positioning.

Regulatory Compliance and Operational Overhead

McMillan Shakespeare faces significant expenses in maintaining compliance with the stringent financial regulations across Australia and the UK. These costs encompass licensing fees, legal counsel for navigating complex regulatory landscapes, and the implementation of robust risk management frameworks. For instance, in 2024, the financial services sector globally saw increased investment in RegTech solutions to manage compliance efficiently, with estimates suggesting significant portions of operational budgets are allocated to these areas.

Operational overhead also forms a substantial part of the cost structure. This includes expenses related to staff, technology infrastructure, office space, and the general administration required to run a business in the competitive leasing and salary packaging industries. These day-to-day operational costs are essential for delivering services and maintaining market presence.

- Regulatory Compliance: Costs associated with adhering to Australian (e.g., ASIC regulations) and UK (e.g., FCA regulations) financial services laws, including licensing and reporting.

- Legal and Advisory Fees: Expenses for legal experts and consultants to ensure adherence to evolving legislation and to manage contractual obligations.

- Risk Management: Investment in systems and personnel to identify, assess, and mitigate financial, operational, and compliance risks.

- General Administrative Overhead: Costs covering IT, HR, finance departments, office leases, utilities, and other essential business functions.

McMillan Shakespeare's cost structure is dominated by employee expenses, with over 1,300 staff requiring salaries, benefits, and training, reflecting their service-intensive model.

Significant investment in IT infrastructure, software development, and cybersecurity is crucial for managing complex operations and protecting sensitive data, with the financial services sector in 2024 often dedicating 5-10% of revenue to technology.

Vehicle acquisition and financing for their Asset Management Services are capital-intensive, with fluctuating interest rates in 2024 impacting borrowing costs.

Marketing and sales efforts, including customer acquisition and brand building for initiatives like 'Oly', represent a substantial expense to drive growth.

| Cost Category | Key Components | 2024 Context/Example |

|---|---|---|

| Personnel | Salaries, benefits, training for 1,300+ employees | Investment in human capital is core to service delivery. |

| Technology & IT | System upgrades, software development, cybersecurity | Sector average tech spend 5-10% of revenue; critical for digital platforms. |

| Asset Management | Vehicle acquisition, financing costs | Capital-intensive; influenced by 2024 interest rate environment. |

| Marketing & Sales | Customer acquisition, advertising, sales force | Essential for growth and market penetration. |

| Regulatory Compliance | Licensing, legal fees, risk management | Significant investment in RegTech solutions globally in 2024. |

| Operational Overhead | General administration, office space, utilities | Day-to-day costs for service delivery and market presence. |

Revenue Streams

McMillan Shakespeare (MMS) secures a consistent revenue stream through service fees levied on employers for the administration of salary packaging programs. This is a core component of their business model, ensuring ongoing income.

These fees are generally structured based on the number of employees actively participating in the salary packaging arrangements or the overall volume of administrative services rendered by MMS.

For the fiscal year 2023, MMS reported total revenue of $273.4 million, with a significant portion attributed to these administration and service fees, reflecting the scale of their operations in managing these employee benefits.

The predictability of these fees, tied to employer contracts and employee participation, provides a stable foundation for MMS's financial planning and operational investments.

McMillan Shakespeare generates revenue from novated leases and fleet management through a combination of management fees and commissions. These services are crucial to their business model, especially as the adoption of electric vehicles (EVs) continues to grow.

The company also benefits from potential interest income, particularly through its Onboard Finance arm. This diversification of income streams within the leasing and fleet management segment underscores its importance as a key revenue driver for McMillan Shakespeare.

McMillan Shakespeare (MMS) generates revenue from managing National Disability Insurance Scheme (NDIS) participant plans and coordinating support services through its Plan and Support Services segment. This revenue stream is experiencing robust growth, fueled by an expanding customer base. For the fiscal year 2023, MMS reported a significant increase in its NDIS plan management revenue, contributing positively to the company's overall performance.

Vehicle Sales and Residual Value Income

McMillan Shakespeare (MMS) generates revenue through the sale of vehicles at the conclusion of their lease agreements, a key component of their asset management services. This residual value income is crucial for profitability.

MMS actively seeks to capitalize on the used vehicle market by selling these assets. However, this strategy inherently involves exposure to market fluctuations and the associated risks.

For the fiscal year 2023, McMillan Shakespeare reported significant revenue from its novated leasing and asset management segments. While specific figures for residual value income are embedded within broader segment reporting, the company’s focus on optimizing fleet disposal underscores its importance.

- Vehicle Sales: Revenue is derived from selling used vehicles after their lease terms conclude.

- Residual Value Income: MMS aims to profit from the difference between the vehicle's book value and its sale price.

- Asset Management Focus: This revenue stream is integral to the company's broader asset management services.

- Market Risk: Profitability in this area is subject to the volatility of the used car market.

Ancillary Financial Product Commissions

McMillan Shakespeare (MMS) leverages its extensive client relationships to generate revenue through ancillary financial product commissions. This involves offering or facilitating the sale of related financial products and services, such as insurance policies or alternative financing arrangements, directly to their customer base.

This strategy significantly diversifies MMS's income streams, moving beyond their primary focus on salary packaging and novated leasing administration. For instance, in the 2023 financial year, MMS reported a statutory net profit after tax of $70.4 million, indicating the overall health and potential for growth across all its revenue channels, including these ancillary offerings.

- Ancillary Income Diversification: Commissions from insurance and other financing products supplement core administration fees.

- Client Base Leverage: Existing customer relationships provide a natural channel for cross-selling.

- Revenue Stream Expansion: Moves beyond primary services like novated leasing to capture broader financial needs.

- Financial Performance Impact: Contributes to overall profitability, supporting figures like the $70.4 million net profit after tax reported for FY23.

McMillan Shakespeare (MMS) generates revenue from its salary packaging administration services, charging employers for managing these employee benefit programs.

The company also earns income from novated leases and fleet management, including management fees, commissions, and potential interest from its financing arm.

Furthermore, MMS benefits from vehicle sales at the end of lease terms, capitalizing on the used car market, and earns commissions from ancillary financial products offered to its client base.

| Revenue Stream | Description | FY23 Relevance (Illustrative) |

|---|---|---|

| Salary Packaging Administration | Fees from employers for program management | Core revenue, contributing to $273.4M total revenue |

| Novated Leasing & Fleet Management | Fees, commissions, and interest income | Significant contributor, growth expected with EV adoption |

| Vehicle Sales (Residual Value) | Proceeds from selling used leased vehicles | Integral to asset management, subject to market fluctuations |

| Ancillary Financial Products | Commissions from insurance, financing etc. | Diversifies income, supports overall profitability |

Business Model Canvas Data Sources

The McMillan Shakespeare Business Model Canvas is built upon a foundation of financial disclosures, internal operational data, and extensive market research. These sources ensure each component, from customer segments to cost structures, is grounded in verifiable information and strategic realities.