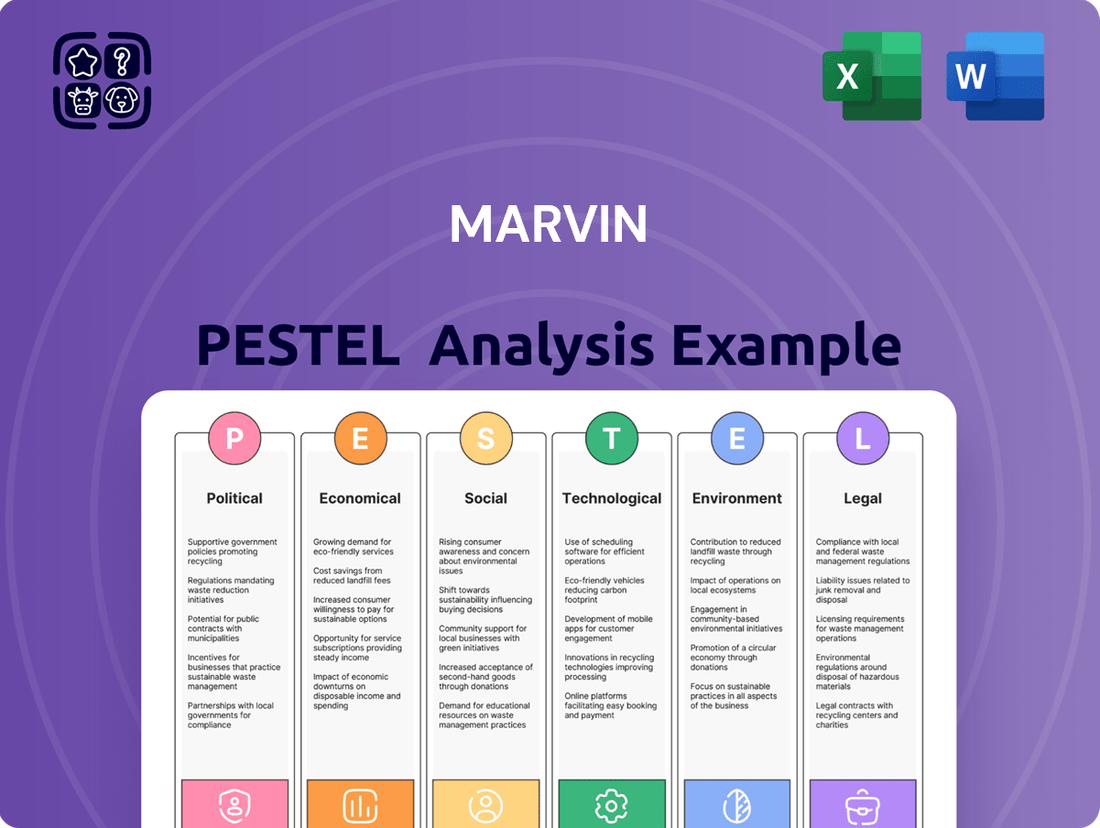

Marvin PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marvin Bundle

Curious about the forces shaping Marvin's future? Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting the company. Understand the landscape to anticipate challenges and seize opportunities.

Gain a competitive edge by grasping how external trends influence Marvin's strategy and operations. This comprehensive analysis provides the essential intelligence you need to make informed decisions and refine your own market approach.

Whether you're an investor, consultant, or strategic planner, this PESTLE analysis offers expert-level insights into Marvin's operating environment. Equip yourself with the knowledge to navigate complexities and identify growth avenues.

Don't get left behind. Download the full PESTLE analysis of Marvin now and unlock actionable intelligence. Make smarter, data-driven decisions and strengthen your position in the market.

Political factors

Trade agreements and tariffs on essential materials like aluminum, steel, and lumber significantly impact Marvin's manufacturing costs. For instance, US tariffs on imported steel and aluminum, largely maintained through 2024, can inflate raw material expenses by 10-25% depending on origin. Shifts in administration or global trade relations, such as potential adjustments to the US-Canada-Mexico Agreement (USMCA) or new trade discussions in 2025, could alter supply chain strategies and product pricing. Monitoring these international policy changes is crucial for effective cost management and maintaining competitive pricing in the window and door market.

Government initiatives, including projects under the Bipartisan Infrastructure Law, often include Buy American provisions that prioritize domestically manufactured goods. These clauses, effective through 2025, mandate that federal infrastructure spending favors U.S.-based products, creating a distinct competitive advantage for companies like Marvin. This policy can significantly increase demand for their window and door products in government-funded construction, potentially boosting sales in the billions of dollars allocated for infrastructure upgrades.

Government-backed tax credits and rebates significantly influence consumer purchasing for home improvements. The Energy Efficient Home Improvement Credit, extended through 2032 by the Inflation Reduction Act, offers homeowners a 30% credit up to $1,200 annually for efficient windows and doors, directly boosting demand for Marvin's products in 2024 and 2025. This incentive, alongside state-specific programs, drives market growth. However, potential modifications or the eventual sunsetting of federal programs like ENERGY STAR could shift consumer investment priorities, impacting future sales projections for high-performance building materials.

Housing and Infrastructure Spending

Government investment in housing and infrastructure significantly boosts demand for building materials like windows and doors. Federal budgets, such as those influenced by the Bipartisan Infrastructure Law, continue to allocate substantial funds. This leads to increased activity in both new residential and commercial construction projects.

For instance, the US Census Bureau projects continued growth in non-residential construction spending, impacting commercial window and door markets. These allocations directly translate into greater opportunities for manufacturers like Marvin.

- The Bipartisan Infrastructure Law (BIL) is set to invest over $1.2 trillion through 2026, with a significant portion directed towards infrastructure and public works.

- Residential construction spending, while sensitive to interest rates, saw federal support for affordable housing initiatives continue into 2025.

- Public non-residential construction spending is forecast to rise by approximately 7% in 2024, driven by federal infrastructure projects.

- This sustained governmental commitment ensures a robust pipeline of projects requiring high-quality building components.

Political Stability and Economic Outlook

The overall political climate directly influences consumer and business confidence, significantly impacting the housing and remodeling markets. Political stability often correlates with a more predictable economic environment, which encourages long-term investments like home construction and renovation. For example, the US political landscape leading into 2025, particularly regarding fiscal policy and regulatory consistency, will shape investor certainty. This stability supports consistent demand, as seen with projected steady growth in residential remodeling expenditures, estimated to increase by 2.5% in 2024 and stabilize into 2025, according to industry forecasts.

- Consumer confidence, crucial for big-ticket purchases, averaged 97.5 in Q1 2024, reflecting cautious optimism.

- Housing starts, influenced by policy, are projected to reach 1.4 million units in 2024.

- Government incentives for energy-efficient renovations could boost remodeling spending by 3-5% in specific segments.

- Interest rate stability, a key political influence, directly impacts mortgage rates and thus housing affordability.

Government policies, including the Bipartisan Infrastructure Law and Buy American provisions, significantly boost demand for Marvin's products by prioritizing domestic manufacturing through 2025. Tax credits, such as the Energy Efficient Home Improvement Credit extended to 2032, directly stimulate consumer purchases of energy-efficient windows and doors in 2024 and 2025. Trade tariffs on materials like steel continue to impact manufacturing costs, influencing pricing strategies. Overall political stability supports consistent market demand for construction and renovation.

| Policy Area | 2024 Impact | 2025 Outlook |

|---|---|---|

| Bipartisan Infrastructure Law (BIL) | $1.2T investment ongoing; Buy American provisions boost demand | Continued federal spending, sustained demand for US-made goods |

| Energy Tax Credits (IRA) | 30% credit up to $1,200 for efficient products | Ongoing consumer incentives through 2032 |

| Raw Material Tariffs | US tariffs on steel/aluminum remain, 10-25% cost inflation | Potential adjustments based on trade relations |

What is included in the product

The Marvin PESTLE Analysis systematically examines the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights by detailing specific sub-points with relevant examples and forward-looking perspectives to aid strategic decision-making.

The Marvin PESTLE Analysis provides a structured framework to identify and understand external factors, alleviating the pain of navigating an unpredictable business landscape.

By offering a clear, categorized overview of political, economic, social, technological, environmental, and legal influences, it simplifies complex market dynamics for strategic decision-making.

Economic factors

The health of the housing market directly drives demand for Marvin's windows and doors. Factors like new housing starts, which are projected to reach 1.04 million units in 2025, and existing home sales, forecast around 4.7 million in 2025, are crucial. While home prices are expected to stabilize, affordability challenges persist for many buyers. Overall, 2025 anticipates a generally stable but mixed market, impacting renovation and new construction projects.

Interest rates significantly influence the cost of financing for Marvin's clients, directly affecting both new construction and renovation projects. As of mid-2024, the Federal Funds Rate, impacting prime lending, hovered around 5.25%-5.50%, making borrowing more expensive for consumers and businesses. Higher rates, such as those seen in 2024, can slow project starts, as clients become more price-sensitive and hesitant to undertake large capital expenditures. Conversely, a potential rate decrease in late 2024 or 2025 could stimulate demand, making home improvement and new builds more affordable and spurring growth in the construction and remodeling sectors.

Inflationary pressures significantly impact Marvin's economic landscape, driving up the cost of raw materials, labor, and transportation. For instance, the Producer Price Index for construction materials saw an increase of approximately 2.5% year-over-year through early 2024, tightening profit margins for manufacturers. The rising costs of building materials, such as lumber and steel, directly translate to higher product prices for Marvin's offerings. This can potentially dampen consumer demand, as seen with a slight cooling in housing starts projected for late 2024, or shift preferences towards more budget-friendly alternatives in the competitive market.

Consumer Spending on Home Improvement

Consumer spending on home improvement significantly shapes the market for Marvin's products. Trends in disposable income and consumer confidence directly impact the home remodeling sector, with 2024 projections showing continued, albeit moderate, growth in spending. A willingness to invest in home upgrades, often driven by factors like stable home values, fuels demand for high-quality windows and doors. The home improvement market is expected to reach approximately 620 billion USD by 2025, reflecting ongoing homeowner investment.

- US disposable income growth projected at around 2.5% for 2024.

- Consumer confidence indices show cautious optimism for home spending in mid-2024.

- Home remodeling market expected to grow by 2.8% in 2024.

- Demand for premium building materials remains robust due to renovation trends.

Supply Chain Disruptions

Global and domestic supply chain issues continue to pose an economic challenge, potentially leading to material shortages and extended lead times for Marvin's manufacturing inputs. While the New York Fed Global Supply Chain Pressure Index (GSCPI) indicated a significant easing of pressures by early 2024, down from its 2021 peak, the stability for essential components remains crucial for maintaining production schedules and managing costs. Persistent geopolitical tensions in 2024/2025 could reintroduce volatility, impacting the availability and pricing of critical raw materials and finished goods. This necessitates robust inventory management and diversified sourcing strategies to mitigate risks.

- Global Supply Chain Pressure Index (GSCPI) eased significantly by early 2024, yet specific component risks persist.

- Lead times for some industrial components, though improved, can still fluctuate based on regional disruptions.

- Transportation costs, while down from 2022 highs, remain a factor in overall supply chain expenses for 2024.

- Strategic diversification of suppliers is a key focus for maintaining operational resilience through 2025.

Marvin's economic outlook for 2024/2025 is shaped by a stable yet mixed housing market, with 1.04 million new housing starts projected for 2025. Interest rates, around 5.25%-5.50% in mid-2024, influence project financing. Inflationary pressures, like a 2.5% PPI increase for construction materials through early 2024, impact costs. Consumer spending on home improvement, expected to reach 620 billion USD by 2025, remains a key driver, alongside easing but persistent supply chain considerations.

| Economic Factor | 2024 Data | 2025 Projection |

|---|---|---|

| New Housing Starts | 1.04 million units (2025 proj.) | 1.04 million units |

| Federal Funds Rate | 5.25%-5.50% (mid-2024) | Potential decrease |

| Construction Materials PPI | +2.5% YoY (early 2024) | Continued pressure |

| Home Improvement Market | Moderate growth | USD 620 billion |

Preview the Actual Deliverable

Marvin PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. Our Marvin PESTLE analysis provides a comprehensive look at the external factors influencing the brand. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental aspects. This detailed report is designed to equip you with strategic knowledge.

Sociological factors

The growing desire for indoor/outdoor living is a significant sociological trend impacting housing design, driving demand for products that seamlessly connect interior and exterior spaces. Consumers increasingly seek large sliding glass doors, floor-to-ceiling windows, and multi-panel door systems to maximize natural light and improve access to patios. This trend is robust, with the U.S. residential remodeling market projected to grow by 9.7% in 2024, emphasizing open-concept designs. Homeowners are investing more in features like expansive glass walls, which can increase property appeal and market value. Marvin benefits directly from this shift as a leading provider of premium, customizable window and door solutions.

Homeowners are increasingly prioritizing features that enhance well-being, driving demand for natural light in residential spaces. This societal shift supports Marvin's sales of larger windows and innovative designs that maximize interior brightness. Industry reports indicate that over 70% of new home buyers in 2024 consider natural light a top priority, influencing design choices. This preference for brighter living environments is believed to improve mood, productivity, and overall occupant health, aligning with wellness trends.

Homeowners are increasingly viewing windows and doors as crucial elements for personalizing their living spaces and enhancing curb appeal. The market reflects this shift, with a notable surge in demand for contemporary aesthetics like sleek, minimalist frame designs. Black window frames, for instance, have seen significant adoption, becoming a dominant trend in 2024, often preferred for their striking contrast and modern appeal. Additionally, natural wood-grain finishes continue to be highly sought after, aligning with preferences for authenticity and warmth in design. This personalization trend drives specific product innovations and market segment growth for companies like Marvin.

Demand for Sustainable and Eco-Friendly Homes

A significant sociological shift involves consumers increasingly prioritizing sustainable and eco-friendly homes. This growing environmental consciousness fuels demand for building materials with a smaller footprint and superior energy performance, directly benefiting manufacturers like Marvin. By 2024, approximately 77% of home buyers consider energy efficiency very important, aligning with Marvin's focus on products like ENERGY STAR certified windows. The global market for green building materials is projected to reach around $450 billion by 2025, underscoring this trend. Marvin’s commitment to energy-efficient solutions and durable products positions it favorably within this evolving consumer landscape.

- 77% of 2024 home buyers prioritize energy efficiency.

- Global green building materials market expected to reach $450 billion by 2025.

- Demand for ENERGY STAR certified windows, a Marvin specialty, continues to grow.

Aging-in-Place and Universal Design

The increasing aging population significantly boosts demand for homes supporting aging-in-place, influencing Marvin's product development. By 2025, over 58 million Americans will be aged 65 or older, driving a strong market for accessible design.

This demographic shift emphasizes features like automated windows and doors, along with low-threshold entryways, ensuring comfort and ease of use for all ages. The global smart home market, including these automated solutions, is projected to exceed $150 billion by 2025, with a growing segment focused on accessibility.

- By 2025, the US population aged 65 and over is projected to reach 58.3 million, increasing demand for accessible homes.

- The global market for smart home automation, including accessible features, is forecast to surpass $150 billion by 2025.

- Demand for low-threshold entryways and automated window systems continues to grow, aligning with universal design principles.

Sociological factors in 2024/2025 highlight a strong consumer shift towards indoor/outdoor living, with the U.S. residential remodeling market projected to grow 9.7% in 2024. Natural light is a top priority for over 70% of 2024 new home buyers, influencing design choices. Personalization, including dominant black window frames in 2024, and sustainability are key, with 77% of 2024 buyers prioritizing energy efficiency and the green building market reaching $450 billion by 2025. The aging population, exceeding 58 million by 2025, drives demand for accessible features within the smart home market, projected to surpass $150 billion by 2025.

| Sociological Factor | Trend Impact | Key Data (2024/2025) |

|---|---|---|

| Indoor/Outdoor Living | Increased demand for large doors/windows. | U.S. residential remodeling: 9.7% growth (2024). |

| Well-being & Natural Light | Prioritization of brighter living spaces. | 70%+ of 2024 buyers prioritize natural light. |

| Sustainability & Energy Efficiency | Demand for eco-friendly building materials. | 77% of 2024 buyers prioritize energy efficiency; global green building market: $450B (2025). |

| Aging-in-Place & Accessibility | Focus on accessible home features. | US 65+ population: 58M+ (2025); global smart home market: $150B+ (2025). |

Technological factors

The demand for smart home technology is significantly influencing the windows and doors market, with projections showing the global smart windows market reaching $1.5 billion by 2025. Consumers increasingly seek features like automated operation and integrated sensors for enhanced security, often controlled via smartphone apps or existing home automation systems. Furthermore, advancements in dynamic glass, allowing electronic tint adjustment, are becoming more prevalent, attracting tech-savvy homeowners. This integration of smart features expands Marvin's product innovation and market opportunities.

Automation is transforming the fenestration industry, enhancing precision, efficiency, and consistency in production. Technologies like robotic glazing and automated cutting systems are becoming standard, managing complex product lines. This shift addresses labor shortages, with a projected 15% increase in robotics adoption in manufacturing by mid-2025 across the sector. Material handling robots further streamline operations, ensuring Marvin maintains high product quality and throughput. These advancements are crucial for competitive advantage in 2024 and 2025.

Innovations in materials science are transforming Marvin's product offerings, leading to more durable and energy-efficient windows. Advanced low-emissivity (Low-E) coatings, like those achieving U-factors below 0.25, are now standard, significantly improving thermal performance. Triple- or quadruple-pane glass units are increasingly common, with some projected to capture over 15% of high-performance market share by 2025. Durable composite frame materials, mimicking wood aesthetics but requiring less maintenance, offer enhanced longevity. These advancements are crucial for meeting rising consumer demand for sustainability and energy cost savings in 2024-2025.

Artificial Intelligence in Design and Construction

Artificial Intelligence is transforming the building sector, optimizing designs for superior energy efficiency and structural integrity. AI-driven tools enable architects and builders to create more sustainable and cost-effective projects, influencing the selection of Marvin windows and doors. For instance, AI algorithms can predict optimal U-factors and Solar Heat Gain Coefficients, leading to specifications for high-performance products. This shift aligns with a projected 15% increase in AI adoption within construction by 2025, enhancing material usage and reducing waste.

- AI optimizes material usage, potentially cutting project waste by 10-15% by late 2024.

- Predictive AI models are improving energy performance by up to 20% in new builds.

- The global AI in construction market is expected to reach 2.3 billion USD by 2025.

- AI tools can significantly reduce design iteration time by over 30%.

Virtual and Augmented Reality in Sales

Virtual and augmented reality tools are reshaping how customers visualize Marvin products, like windows and doors, within their homes before purchase. These immersive technologies significantly enhance the sales process for Marvin's dealer network, offering an interactive customer experience. For instance, the global AR/VR market is projected to exceed $100 billion by 2025, indicating strong adoption potential in home improvement sectors.

- By 2024, AR applications in retail were already boosting conversion rates by up to 20% for some brands.

- Marvin could leverage VR showrooms to display custom configurations, reducing the need for physical samples.

- Customer engagement with AR tools for home visualization can increase purchase intent by over 30%.

Technological advancements are profoundly shaping Marvin's operations and offerings, from smart home integration in products to AI-driven design optimization. Automation in manufacturing, including robotics, boosts efficiency and consistency, while innovative materials like advanced Low-E coatings enhance product performance. Virtual and augmented reality tools are also revolutionizing sales and customer engagement for Marvin.

| Technology | Impact Area | 2025 Projection |

|---|---|---|

| Smart Home Integration | Product Innovation | $1.5B Global Smart Windows Market |

| Robotics & Automation | Manufacturing Efficiency | 15% Increase in Robotics Adoption |

| Artificial Intelligence | Design & Waste Reduction | $2.3B AI in Construction Market |

| AR/VR | Sales & Customer Engagement | >$100B Global AR/VR Market |

Legal factors

Local, state, and national building codes, such as the forthcoming 2024 International Building Code (IBC) amendments, dictate stringent minimum performance standards for Marvin's windows and doors. These mandates cover crucial aspects like structural integrity, safety, and emergency egress requirements. Manufacturers must consistently ensure their products meet or exceed these evolving codes. For instance, compliance with updated energy efficiency standards under the 2024 IECC is vital for market access.

Government programs like ENERGY STAR mandate specific energy performance criteria for windows and doors, including U-factor and Solar Heat Gain Coefficient (SHGC). Compliance is crucial for Marvin, as it allows customers to qualify for federal tax credits, such as the 2024 credit up to $600 for energy-efficient windows and skylights under the Inflation Reduction Act. These standards also serve as a significant selling point for energy-conscious consumers. However, shifts in regulatory focus or potential program adjustments could alter market demand and compliance requirements.

Marvin, as a manufacturer, must strictly adhere to product liability and warranty laws, which mandate clear terms for consumers and accountability for defects. Non-compliance with safety and performance claims, such as those under the Consumer Product Safety Act, can lead to significant legal actions and fines, potentially impacting profitability. For instance, a major product recall in the manufacturing sector can cost millions in 2024, alongside severe reputational damage. Therefore, robust quality control measures and transparency in warranty provisions are crucial for mitigating legal risks and maintaining customer trust, ensuring long-term operational stability.

Workplace Safety Regulations

Workplace Safety Regulations significantly impact Marvin's manufacturing and construction site operations, which are strictly governed by Occupational Safety and Health Administration (OSHA) standards. Compliance is crucial for Marvin to ensure a safe working environment, encompassing ongoing employee training and rigorous equipment maintenance. In 2024, OSHA continued its focus on reducing workplace hazards, with penalties for serious violations potentially reaching up to $16,131 per violation, reinforcing the need for proactive safety protocols. Marvin's commitment to these regulations helps mitigate risks, reduce potential fines, and enhance employee well-being.

- OSHA's 2024 penalty for serious violations is up to $16,131, emphasizing the cost of non-compliance.

- Regular safety audits and training programs are essential to meet evolving regulatory requirements.

- Investment in advanced safety equipment and maintenance reduces workplace incidents.

- Proactive compliance improves employee morale and operational efficiency, avoiding costly disruptions.

Environmental Regulations for Manufacturing

Marvin's manufacturing operations must strictly adhere to evolving environmental regulations, including the Clean Air Act and Clean Water Act. These laws rigorously govern industrial emissions, waste disposal protocols, and the handling of hazardous materials. Compliance demands significant investment in advanced pollution control technologies and sustainable practices, with U.S. manufacturers facing an estimated $30 billion annually in environmental compliance costs by 2025.

- New EPA standards for 2024-2025 aim to reduce industrial greenhouse gas emissions by up to 20%.

- Waste disposal regulations are becoming stricter, potentially increasing hazardous waste management costs by 10-15% for manufacturers.

- Investment in air filtration systems and wastewater treatment facilities is critical for maintaining operational permits.

- Failure to comply can result in substantial fines, potentially exceeding $50,000 per violation for serious breaches.

Marvin navigates a complex legal landscape, requiring strict adherence to evolving 2024 building codes like IBC and IECC, alongside ENERGY STAR mandates for customer tax credits up to $600. Compliance with product liability and warranty laws is crucial to avoid costly 2024 recalls. Additionally, robust OSHA adherence, with penalties up to $16,131 for violations, and environmental regulations like EPA standards for 2024-2025 emissions, are essential for operational stability and mitigating significant financial risks.

| Legal Factor | Key Requirement | 2024/2025 Data Point |

|---|---|---|

| Building Codes | Meet evolving standards | 2024 IBC/IECC amendments |

| Energy Efficiency | ENERGY STAR compliance | IRA tax credit up to $600 |

| Workplace Safety | OSHA adherence | 2024 penalty up to $16,131 |

| Environmental Regs | Pollution control | 2025 compliance costs $30B/yr |

Environmental factors

Increasingly severe weather events and changing climate patterns are profoundly influencing building design in 2024 and 2025. This drives a growing demand for windows and doors engineered to withstand higher wind loads, such as those exceeding 120 mph, and improve resistance to water intrusion. The market for impact-resistant windows alone is projected to grow by over 7% annually through 2028, reflecting this critical need for enhanced building resiliency. Manufacturers like Marvin must innovate to meet updated building codes and consumer expectations for climate-adaptive solutions, particularly as insured losses from natural catastrophes remain elevated, surpassing $100 billion globally in recent years.

The environmental focus for 2024-2025 intensely targets reducing building energy consumption to lower greenhouse gas emissions. High-performance, energy-efficient windows and doors are crucial for achieving these goals. They significantly cut heating and cooling costs, with windows often accounting for 25-30% of residential energy use. U.S. homeowners can claim 30% tax credits, up to $600, for qualifying energy-efficient window improvements through 2032 under the Inflation Reduction Act. This drives demand for Marvin's products, contributing to a smaller carbon footprint for end-users.

The construction industry is rapidly adopting circular economy principles, with a strong emphasis on reusing and recycling materials to drastically minimize waste. This shift involves designing products for easier disassembly and utilizing sustainable or recycled content, such as the 2024 projection of over 20% recycled content in new European building materials. This approach significantly reduces reliance on virgin resources, aligning with stricter environmental regulations anticipated by 2025.

Corporate Sustainability Reporting

Growing pressure and legal requirements compel companies like Marvin to enhance corporate sustainability reporting, particularly concerning environmental impacts. New directives, such as the EU's Corporate Sustainability Reporting Directive (CSRD) effective January 2025 for large companies, mandate detailed disclosure on climate-related risks and environmental performance. This includes reporting Scope 1, 2, and increasingly Scope 3 emissions, driving transparency across supply chains.

- By 2025, over 50,000 EU companies will be subject to CSRD reporting.

- Global corporate climate disclosures increased by 20% in 2024, reflecting investor demand.

- The SEC's climate disclosure rules, though facing legal challenges, signal US intent for increased reporting.

- Supply chain emissions (Scope 3) often constitute over 70% of a company's total carbon footprint.

Sustainable Sourcing of Raw Materials

Consumers and regulators are increasingly scrutinizing the environmental impact of raw materials like wood and aluminum, pressuring companies like Marvin to adopt sustainable practices. Sourcing materials from certified sustainable forests or utilizing recycled aluminum significantly bolsters environmental credentials, appealing to a growing segment of green-conscious buyers. This shift is crucial as the market for eco-friendly building materials is projected to expand, with sustainable construction practices gaining more traction in 2024 and 2025.

- By 2025, consumer demand for sustainable products is expected to further influence purchasing decisions in the building sector.

- Utilizing recycled content, such as recycled aluminum, can reduce energy consumption by up to 95% compared to primary production.

- Certifications like the Forest Stewardship Council (FSC) ensure wood products originate from responsibly managed forests.

Marvin faces increasing demand for climate-resilient products due to severe weather, with the impact-resistant window market growing over 7% annually through 2028. Energy efficiency is paramount, driven by policies like the IRA’s 30% tax credits for qualifying windows, reducing energy use where windows account for 25-30% of residential consumption. The shift towards circular economy principles and sustainable sourcing, including over 20% recycled content in new European building materials by 2024, is critical. Enhanced corporate sustainability reporting, notably under the EU’s CSRD by 2025 for over 50,000 companies, demands transparency on Scope 3 emissions.

| Environmental Factor | Key Data (2024/2025) | Implication for Marvin |

|---|---|---|

| Climate Resiliency Demand | Impact-resistant window market growth >7% annually through 2028. | Increased need for durable, high-performance products. |

| Energy Efficiency Incentives | US IRA offers 30% tax credits up to $600 for qualifying windows. | Drives consumer demand for energy-efficient products. |

| Corporate Reporting Mandates | Over 50,000 EU companies subject to CSRD by 2025; 20% increase in global climate disclosures in 2024. | Requires enhanced transparency and data on environmental performance. |

| Sustainable Sourcing | Recycled content in new EU building materials >20% by 2024; recycled aluminum reduces energy by up to 95%. | Pressure to utilize certified and recycled materials, reducing environmental footprint. |

PESTLE Analysis Data Sources

Our PESTLE Analysis synthesizes information from reputable sources including government publications, international financial institutions, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting your business.