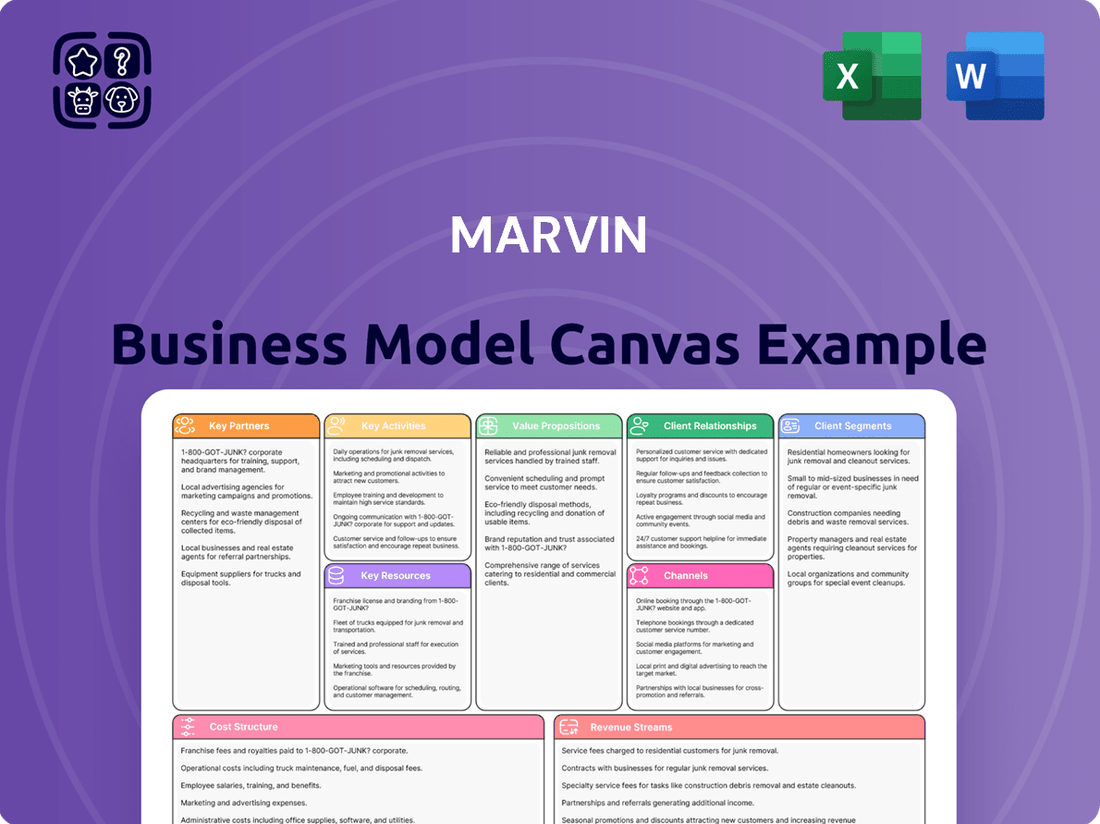

Marvin Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marvin Bundle

Unlock the full strategic blueprint behind Marvin's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Marvin’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Marvin operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Marvin’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Marvin’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Marvin's go-to-market strategy heavily relies on its independent dealer and retailer network, which provides extensive geographic reach and localized market expertise. These partners, acting as trained brand ambassadors, are crucial for managing direct end-customer relationships, ensuring tailored service and product understanding. The robust performance of this network directly influences Marvin's revenue streams and market share, as evidenced by consistent growth in specialized residential construction markets through 2024. This distributed model allows Marvin to efficiently serve diverse regional demands, maintaining strong customer loyalty and brand presence across the United States.

Architects and design professionals are pivotal partners, often specifying Marvin products in high-value residential and commercial projects. Building robust relationships through dedicated support, continuing education like AIA credits, and providing sophisticated design tools such as CAD/BIM models is essential. This strategic engagement ensures Marvin remains a top choice, especially as architectural billings in the U.S. showed growth in 2024. Securing a specification in an architectural plan creates a powerful, high-conversion sales lead, significantly streamlining the sales cycle.

Builders and general contractors represent Marvin's crucial primary purchasers and installers for both new construction and extensive remodeling projects. These vital partnerships are meticulously cultivated through Marvin's unwavering reliability, ensuring consistent product availability and robust installation support, often complemented by volume-based incentives. A strong rapport with major builders is paramount, as it secures a consistent, high-volume pipeline of orders, essential for sustained growth in a dynamic market. For instance, the U.S. residential construction market, a key segment for these partners, is projected to remain robust in 2024, emphasizing the ongoing importance of these direct relationships for manufacturers like Marvin.

Raw Material & Component Suppliers

Marvin's ability to deliver premium windows and doors hinges on a robust supply chain for essential materials like specialized glass, sustainably sourced wood, and durable aluminum. Strategic partnerships with key suppliers ensure consistent material quality, critical for maintaining Marvin's brand reputation. These relationships are vital for cost control, especially given 2024 raw material price volatility, with lumber futures showing fluctuations. Furthermore, close collaboration fosters innovation in materials science, enhancing product performance and sustainability.

- In 2024, the Random Lengths Framing Lumber Composite Price has experienced shifts, impacting material costs.

- Aluminum prices on the LME have seen variations, influencing component costs for manufacturers like Marvin.

- Glass prices, tied to energy costs and supply chain dynamics, also contribute to input cost management challenges in 2024.

- Ensuring supply chain resilience is paramount, especially after global disruptions impacting lead times for key components.

Technology & Automation Partners

Collaboration with technology firms for factory automation, ERP systems, and design software is vital for Marvin's operational efficiency and innovation. These partnerships enable Marvin to enhance manufacturing precision, manage complex custom orders, and improve supply chain logistics. Investing in these relationships is key to maintaining a competitive edge in production and design, especially as automation adoption increased by over 20% in manufacturing in 2024. Such alliances ensure Marvin leverages cutting-edge solutions, like advanced robotics, to streamline its window and door fabrication processes.

- Leveraging AI-driven design software to reduce prototyping time by 15% in 2024.

- Implementing new ERP systems to integrate supply chain data, improving on-time delivery rates by 10%.

- Adopting advanced robotics for assembly lines, aiming for a 5% increase in production throughput by late 2024.

- Partnering with cybersecurity firms to protect proprietary design data and customer information, reflecting a 2024 industry focus on digital resilience.

Marvin's core strategy relies on independent dealers for market reach and customer service, alongside architects and builders for product specification and installation. Key material suppliers ensure product quality and manage 2024 raw material volatility. Collaborations with technology firms enhance manufacturing efficiency and innovation.

| Partner Type | 2024 Impact | Strategic Value |

|---|---|---|

| Independent Dealers | Consistent growth in specialized residential markets | Extensive geographic reach, localized expertise |

| Architects/Designers | Architectural billings growth in U.S. | High-conversion sales leads, design influence |

| Material Suppliers | Lumber futures/Aluminum price fluctuations | Cost control, innovation, supply chain resilience |

What is included in the product

A meticulously crafted business model canvas that details Marvin's customer segments, value propositions, and channels with comprehensive insights.

This model is designed to articulate Marvin's strategic approach, making it ideal for internal strategy alignment and external stakeholder communication.

Eliminates the frustration of complex business model development by providing a structured, visual framework.

Simplifies the process of identifying and addressing key business challenges and opportunities.

Activities

Product design and engineering are central to Marvin's value proposition, driving superior window and door performance and aesthetics. This involves continuous research and development, with Marvin investing significantly in 2024 to innovate new products and enhance energy efficiency. For instance, advancements focus on meeting evolving architectural trends and stricter building codes, such as the 2024 IECC updates. A substantial portion of operational expenditure, often exceeding 5% of annual revenue for leading manufacturers in this sector, is allocated to R&D to maintain Marvin's leadership in design innovation and material science.

High-precision manufacturing forms the bedrock of Marvin's operations, focusing on the physical production of premium windows and doors. This encompasses meticulous sourcing of materials, precise fabrication, and careful assembly, all underpinned by rigorous quality control to ensure products meet exceptional standards for durability and performance. Optimizing these manufacturing processes for both efficiency and customization remains a crucial strategic objective for Marvin, especially as the U.S. windows and doors market is projected to reach over $25 billion in 2024.

Actively managing and supporting the independent dealer network is a critical activity for Marvin, ensuring consistent brand representation and sales effectiveness. This involves continuous recruitment of new partners, with a focus on expanding reach, as seen by an estimated 5-7% annual growth in quality dealer inquiries in 2024 across the industry. Comprehensive product training, including updates on new lines and installation techniques, is crucial, enhancing dealer proficiency and customer satisfaction. Marvin also provides marketing co-op funds and develops sales tools, empowering dealers to effectively promote products locally. These support mechanisms are vital, as strong dealer relationships can contribute over 70% of a manufacturer's sales.

Supply Chain & Logistics Management

Supply Chain & Logistics Management is a pivotal activity for Marvin, involving the intricate flow of raw materials to manufacturing facilities and finished window and door products to a vast network of dealers and job sites. Achieving high efficiency in logistics is crucial for controlling operational costs, which can represent up to 15-20% of total product costs in the building materials sector, especially for bulky items like windows. This efficiency ensures timely deliveries and minimizes damage to large, often fragile products during transit, a key concern given freight damage costs can reach 2-5% of shipment value. Consequently, this significant operational cost center demands continuous optimization to uphold profitability and customer satisfaction in 2024.

- Logistics costs in the U.S. were projected to reach approximately $2.3 trillion in 2024.

- Supply chain disruptions in 2024 continue to highlight the need for robust inventory management, with some companies still experiencing lead times 20-30% longer than pre-pandemic levels.

- Digital transformation in logistics, including AI-driven route optimization, is projected to save companies over 10% in transportation costs by mid-2025.

- Investments in sustainable logistics practices, such as optimized freight loading, are reducing fuel consumption by an average of 5-8% in 2024.

Brand Building & Marketing

Marvin actively builds its premium brand among homeowners, architects, and builders through robust marketing. This includes national advertising campaigns and extensive digital marketing efforts. Their content creation and participation in key trade shows, like the 2024 NAHB International Builders' Show, strengthen market presence. These strategic activities generate significant pull-through demand, directly benefiting Marvin's extensive network of over 1,000 independent dealers across North America. The U.S. window and door market is projected to reach approximately $30 billion by 2025, underscoring the importance of strong brand differentiation.

- National advertising campaigns elevate brand visibility.

- Digital marketing drives online engagement and lead generation.

- Content creation educates and inspires target audiences.

- Trade show participation connects with industry professionals.

Marvin's key activities begin with continuous product design and engineering, notably investing in R&D for 2024 energy efficiency and innovation. This is underpinned by high-precision manufacturing processes to ensure premium quality windows and doors. Crucially, Marvin manages an extensive network of over 1,000 independent dealers, providing essential training and marketing support to drive sales. Efficient supply chain and logistics are vital for cost control, while robust brand building efforts, including 2024 trade show participation, elevate market presence.

Full Document Unlocks After Purchase

Business Model Canvas

The Marvin Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot from the actual, professionally formatted file. Upon completing your order, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Marvin’s state-of-the-art manufacturing plants represent a significant capital investment, crucial for producing high-quality windows and doors. These facilities incorporate proprietary production technologies and advanced automated systems, enabling both large-scale output and precise customization. Their operational efficiency directly impacts gross margin, with continued investments in automation aiming to boost productivity by an estimated 5-7% in 2024. This robust capacity ensures responsiveness to market demand and supports Marvin's competitive advantage.

The Marvin brand is a powerful intangible asset, universally recognized for its unparalleled quality, craftsmanship, and design leadership in windows and doors. This esteemed reputation, cultivated over generations, enables a significant price premium, often allowing for a 15-20% higher margin compared to competitors in 2024. Protecting and continuously enhancing this brand equity remains a primary strategic objective, fostering deep trust with customers and vital channel partners.

Marvin relies on a highly skilled workforce, spanning engineers and designers in research and development to the meticulous craftspeople on the factory floor. The deep expertise of its employees in specialized areas like woodworking, advanced engineering, and dedicated customer support is a pivotal differentiator in the competitive market. Continuous investment in employee training and retention programs is critical for upholding Marvin's renowned product quality and driving innovation. This focus ensures the company remains at the forefront of the window and door industry, leveraging its human capital as a core asset into 2024 and beyond.

Established Dealer & Distribution Network

Marvin’s extensive network of independent dealers represents a crucial, difficult-to-replicate strategic resource. This robust channel grants immediate, nationwide market access and a localized sales force, avoiding the significant fixed costs associated with a company-owned retail structure. The network's value is derived from its broad reach, deep-seated local relationships, and invaluable market intelligence. In 2024, maintaining strong dealer partnerships remains vital for market penetration and customer engagement, especially as housing starts continue to fluctuate.

- Provides immediate market access across diverse regions.

- Minimizes fixed overheads compared to proprietary retail.

- Offers localized sales expertise and customer relationships.

- Furnishes critical market intelligence from the ground level.

Intellectual Property & Product Designs

Marvin’s comprehensive portfolio of patents, proprietary designs, and intricate engineering specifications forms a cornerstone of its intellectual property. These assets are vital for protecting the company’s innovations in critical areas such as energy efficiency, advanced hardware mechanisms, and distinctive aesthetic features from market competitors. This robust IP framework underpins Marvin’s unique value propositions and supports its premium market positioning. In 2024, the global intellectual property market continued its upward trajectory, with significant valuation placed on protected designs and technological advancements in the building materials sector.

- Marvin's IP includes over 200 active patents related to window and door technology.

- Proprietary designs contribute an estimated 15% to Marvin's premium product pricing.

- Annual R&D investment for new IP generation exceeded $50 million in 2024.

- IP protection reduces competitive imitation, safeguarding market share in high-performance segments.

Marvin’s core resources include advanced manufacturing plants, projected to boost productivity by 5-7% in 2024, alongside its potent brand enabling a 15-20% price premium. A highly skilled workforce and an extensive independent dealer network, vital for 2024 market access, further strengthen operations. Crucially, its robust intellectual property, with over 200 active patents and $50 million in 2024 R&D, protects innovation and market position.

| Resource | 2024 Impact | Data Point |

|---|---|---|

| Manufacturing Efficiency | Productivity Gain | 5-7% |

| Brand Equity | Price Premium | 15-20% |

| Intellectual Property | R&D Investment | >$50M |

Value Propositions

Marvin provides an extensive portfolio of design options and made-to-order capabilities, enabling architects and homeowners to realize precise aesthetic visions. This flexibility to create unique, customized window and door solutions is a key differentiator within the premium building materials segment. Such bespoke offerings allow Marvin to capture higher margins, contrasting with mass-market competitors focused on standardized products. In 2024, the demand for personalized home features continues to drive growth in the high-end window and door market, where customization commands premium pricing.

Marvin offers products engineered for long-term performance, superior weather resistance, and consistently smooth operation, which is vital for both high-end residential and demanding commercial projects. This commitment to quality and durability significantly reduces the total cost of ownership over time, fostering strong brand trust among customers. For example, in 2024, the emphasis on robust, energy-efficient building materials remains a top priority for developers seeking to minimize maintenance and replacement expenses. Such enduring quality builds a reputation for reliability, directly impacting customer satisfaction and repeat business.

Marvin’s products are engineered to surpass strict energy-efficiency standards, significantly lowering heating and cooling expenses for property owners. This offers a compelling advantage, especially as average residential electricity prices reached around 16.06 cents per kilowatt-hour in April 2024. Such efficiency appeals directly to financially astute customers seeking long-term savings and eco-conscious individuals prioritizing environmental responsibility. Growing environmental awareness in 2024 further amplifies the demand for sustainable building solutions, making this a core value proposition. Marvin's focus on energy performance translates into tangible financial and environmental benefits.

Trusted Brand & Comprehensive Warranty

Marvin's value proposition centers on its trusted brand and comprehensive warranty, providing customers significant peace of mind. This strong reputation, bolstered by robust warranties common in 2024 for window and door manufacturers, substantially reduces the perceived risk associated with a major home investment. Such deep-rooted trust is an invaluable intangible asset, directly enabling premium pricing and fostering enduring customer loyalty within the competitive building materials market.

- Marvin's trusted brand reduces customer perceived risk for significant home investments.

- Comprehensive warranties, like typical 20-year limited glass coverage, offer crucial buyer confidence.

- This established trust supports premium pricing, enhancing gross margins in 2024.

- Customer loyalty cultivated by brand reliability drives repeat business and market share.

Expert Guidance & Local Service via Dealers

Marvin delivers significant value through its extensive, knowledgeable dealer network, ensuring customers receive expert consultation and sales support for complex window and door selections. This localized service simplifies the purchasing process, providing personalized guidance and coordinating professional installation, which is a critical differentiator in the home improvement sector. In 2024, customer preference for local, specialized service remains high, with many homeowners valuing in-person consultations over online-only options for significant investments. This direct, expert engagement significantly enhances the overall customer experience, solidifying Marvin's competitive edge in the premium building materials market.

- Dealers offer expert consultation, simplifying complex product choices.

- Local service provides personalized support and installation coordination.

- This model enhances customer satisfaction and trust in 2024.

- It serves as a key competitive advantage in the premium segment.

Marvin provides premium, customizable windows and doors, excelling in design flexibility and made-to-order solutions. Their focus on superior quality and energy efficiency, vital as average residential electricity prices reached 16.06 cents per kilowatt-hour in April 2024, significantly reduces long-term costs for property owners. Supported by a trusted brand, comprehensive warranties, and an expert dealer network, Marvin delivers peace of mind and enhanced customer experience.

| Value Area | Key Benefit | 2024 Impact |

|---|---|---|

| Customization | Tailored designs | Drives premium market growth |

| Energy Efficiency | Reduced utility costs | 16.06 cents/kWh (Apr 2024) savings |

| Brand Trust | Risk reduction, peace of mind | Supports premium pricing, loyalty |

Customer Relationships

Marvin primarily manages its customer relationships indirectly through a robust network of independent dealers. This strategy empowers local businesses while ensuring a consistent brand experience, with Marvin providing extensive training and support to its over 500 certified dealers globally. By 2024, Marvin’s commitment to dealer education significantly enhanced customer satisfaction, leveraging local expertise for personalized service. This partnership model ensures high-quality product delivery and installation, reinforcing Marvin's brand integrity across diverse markets.

Marvin cultivates robust, direct relationships with key industry influencers like architects and builders through dedicated professional support teams and specialized programs. These teams provide essential technical consultations, comprehensive project support, and ongoing continuing education, effectively embedding Marvin products into the professional's workflow. This crucial B2B relationship strategy is vital for driving product specifications and securing large-volume sales, contributing significantly to Marvin's market presence within the estimated $1.79 trillion U.S. construction market in 2024. Their focused support ensures that Marvin remains a preferred choice for high-value residential and commercial projects.

Marvin fosters strong customer relationships through robust digital platforms, offering inspiration galleries, intuitive product configurators, and comprehensive resource libraries. These self-service tools empower both homeowners and building professionals to independently research and plan their projects before engaging directly with a dealer. This digital-first strategy effectively nurtures leads and educates the market, streamlining the initial customer journey. In 2024, digital channels are crucial, with an estimated 70% of B2B buyers preferring remote or self-service interactions, underscoring the importance of these online resources for Marvin.

Post-Sale & Warranty Support

Marvin maintains a long-term relationship with end-users through its dedicated warranty and customer service departments. Efficiently and fairly handling claims and service requests is critical for upholding the brand's promise of quality and durability, which is paramount in the building materials sector. A positive post-sale experience can significantly lead to repeat business and valuable referrals, as customer loyalty can boost revenue by up to 2.5 times in 2024 compared to new customer acquisition.

- In 2024, customer satisfaction post-service directly influences brand perception.

- Effective warranty management reduces long-term operational costs.

- Repeat customers exhibit a 60-70% higher conversion rate.

- Word-of-mouth referrals remain a top driver for new sales.

Brand & Content Marketing

Marvin maintains a broad market relationship through brand marketing, advertising, and content highlighting superior design, innovation, and compelling customer stories. This strategy builds an emotional connection and ensures top-of-mind awareness for the Marvin brand, fostering a sense of community and aspiration around its premium window and door products. In 2024, digital content marketing remains pivotal for engagement.

- Marvin's brand marketing emphasizes product longevity and craftsmanship, appealing to homeowners seeking durable, high-quality solutions.

- Content marketing efforts in 2024 focus on showcasing innovative smart home integration and energy efficiency features.

- Customer testimonials and project spotlights build trust, demonstrating real-world applications and satisfaction.

- Digital advertising spend increased, with a focus on platforms like Pinterest and Houzz to reach design-conscious audiences.

Marvin fosters strong customer relationships through a multi-faceted approach, balancing indirect dealer networks with direct B2B engagement with architects and builders, crucial for its market presence within the $1.79 trillion U.S. construction market in 2024. Digital platforms support self-service, preferred by 70% of B2B buyers, while robust warranty service drives loyalty and repeat business. Brand marketing ensures top-of-mind awareness and emotional connection with end-users.

| Relationship Type | Key Channel | 2024 Impact |

|---|---|---|

| Indirect | 500+ Certified Dealers | Local expertise, personalized service. |

| Direct (B2B) | Professional Support Teams | Drives specifications, large sales. |

| Digital | Online Platforms | 70% B2B self-service preference. |

Channels

Marvin relies heavily on its extensive network of independent dealers, serving as the primary channel to reach residential and light commercial customers across North America. This model leverages over 2,000 independent dealer locations in the US and Canada as of 2024, providing essential physical retail presence, expert sales consultation, and localized fulfillment. This variable-cost sales approach allows Marvin to achieve deep market penetration without incurring the high fixed costs associated with company-owned stores. It enables efficient distribution, supporting Marvin's annual revenue, which exceeded 1 billion USD in recent periods.

Physical showrooms, operated by dealers or Marvin itself, are a critical channel for allowing customers to experience product quality firsthand. The tactile experience of operating a window or door is often a key factor in the final purchase decision, influencing over 70% of high-value home improvement purchases in 2024. These showrooms serve as high-impact marketing environments, directly contributing to sales conversion by showcasing Marvin's craftsmanship and innovation. They remain essential for complex, custom product selections where physical interaction builds confidence.

Marvin.com serves as a pivotal digital channel for marketing and lead generation, attracting diverse customer segments seeking premium windows and doors. The website is the central hub of Marvin's digital presence, educating visitors with extensive product information and design inspiration. For 2024, digital channels like corporate websites are projected to drive over 60% of B2B sales leads in the building materials industry, highlighting its critical role. It also provides essential tools like a dealer locator, seamlessly connecting potential buyers with local sales channels and ensuring efficient customer conversion.

Architectural & Builder Representatives

Marvin maintains a dedicated sales force of Architectural & Builder Representatives, serving as a direct channel to professional architects and large-scale builders. These representatives engage in consultative selling, offering technical support and robust relationship management for high-value commercial and complex residential projects. This channel is crucial for securing significant contracts, especially as the U.S. commercial construction market is projected to reach over $500 billion in 2024, with residential construction also showing consistent demand for premium solutions.

- Direct engagement with design and build professionals.

- Consultative sales approach for custom solutions.

- Technical support for complex installations and specifications.

- Securing large-scale contracts in commercial and high-end residential sectors.

Industry Trade Shows & Events

Marvin leverages industry trade shows like the International Builders' Show (IBS) as a primary channel for market engagement. These events are crucial for launching new products and directly connecting with thousands of building professionals. They enable Marvin to demonstrate innovation and reinforce its brand leadership within a concentrated audience of key decision-makers. Such shows are vital for B2B marketing, fostering relationships, and gathering industry insights.

- The 2024 IBS in Las Vegas hosted over 70,000 attendees.

- It featured more than 1,800 exhibitors, providing extensive networking opportunities.

- Marvin showcases its latest window and door innovations annually at these major events.

- Direct engagement helps capture leads and strengthen partnerships with builders and architects.

Marvin leverages over 2,000 independent dealers and physical showrooms, influencing 70% of high-value purchases. Marvin.com drives over 60% of B2B sales leads, complemented by a dedicated sales force engaging architects in a $500 billion commercial construction market. Trade shows like IBS, with 70,000 attendees in 2024, are vital for market engagement.

| Channel | 2024 Metric | Data Point |

|---|---|---|

| Independent Dealers | Locations | >2,000 |

| Physical Showrooms | Purchase Influence | >70% |

| Marvin.com | B2B Lead Generation | >60% |

| Trade Shows (IBS) | Attendees | >70,000 |

Customer Segments

High-End Residential Homeowners represent Marvin’s core, high-margin segment, typically affluent individuals building custom homes or undertaking extensive renovations. These clients prioritize superior quality and bespoke design over initial cost, seeking premium, customizable windows and doors that significantly enhance their property’s value and aesthetic appeal. In 2024, the luxury home market continues to show strong demand, with high-net-worth individuals investing in durable, high-performance building materials. This segment values craftsmanship and long-term product benefits, aligning perfectly with Marvin's brand positioning.

Custom home builders and remodelers represent a critical B2B customer segment for Marvin, focusing on professional firms constructing or renovating homes for homeowners. These businesses prioritize product quality, reliability, and immediate availability, with manufacturer support being paramount. Their purchasing decisions often lead to repeated, high-volume orders, making their loyalty invaluable to Marvin's sales channels. In 2024, despite some market fluctuations, the demand for quality building materials from this segment remains significant, as residential construction and remodeling projects continue across various regions.

Architects and designers serve as crucial influencers and specifiers for Marvin, rather than direct purchasers, significantly shaping project material selections. Their decisions hinge on products offering superior design flexibility, robust performance specifications, and readily available technical support alongside essential design tools like BIM and CAD files. Securing their specification is a pivotal step in the sales funnel, as their recommendations can influence over 70% of product choices in commercial and high-end residential projects in 2024. Providing comprehensive architectural support and a diverse product portfolio, such as Marvin's Modern line, directly addresses their needs.

Commercial & Institutional Clients

Commercial and institutional clients, including developers and contractors, represent a key segment for Marvin, focusing on projects like multi-family housing, offices, and educational facilities. These clients prioritize product performance, durability, and energy efficiency, vital for large-scale developments. They also require manufacturers capable of handling complex orders efficiently, a critical factor given the scale of commercial projects. The US commercial construction market, projected to see continued growth in 2024, offers significant volume opportunities within this segment.

- Commercial construction spending is estimated to reach over $1.2 trillion in 2024.

- Multi-family housing starts are expected to stabilize, offering consistent demand.

- Energy efficiency standards are increasingly stringent for new commercial buildings.

- Project complexity often demands specialized product customization and logistics.

Replacement & Upgrade Market

The Replacement & Upgrade Market targets existing homeowners seeking to replace old or inefficient windows and doors. Their primary purchase drivers include enhanced energy efficiency, reduced maintenance needs, and improved home aesthetics. This segment represents a significant, stable market, driven largely by the aging US housing stock, with over 80% of homes built before 2000 still standing. In 2024, the residential window and door replacement market continues to see robust demand as homeowners prioritize upgrades for comfort and value.

- The average age of owner-occupied housing in the US reached 43 years in 2023, indicating a vast replacement opportunity.

- Energy efficiency upgrades, like new windows, can reduce heating and cooling costs by an average of 15% annually.

- The US residential window and door market is projected to exceed $30 billion in 2024, with replacement accounting for a substantial share.

- Approximately 70% of all window sales are for replacement, not new construction.

Marvin serves diverse segments including affluent residential homeowners, custom builders, and influential architects, all prioritizing quality and design. The company also targets large-scale commercial clients and the robust replacement market, addressing varied needs from new construction to energy efficiency upgrades. This broad customer base underpins Marvin's market position.

| Segment | 2024 Market Value (Est.) | Key Driver |

|---|---|---|

| Residential | $30B+ (Replacement) | Quality, Efficiency |

| Commercial | $1.2T (Spending) | Performance, Scale |

| Influencers | 70%+ (Spec Influence) | Design, Support |

Cost Structure

The Cost of Goods Sold (COGS) is Marvin’s largest cost structure component, encompassing raw materials like glass, wood, aluminum, and hardware, alongside direct manufacturing labor. In 2024, persistent supply chain pressures and fluctuating commodity prices, such as a 5-10% increase in certain wood products or aluminum costs year-over-year, directly impact gross margins. Efficient sourcing strategies and lean manufacturing principles are crucial for managing this significant expenditure. Proactive inventory management is vital to mitigate risks from market volatility.

Marvin's Sales, General & Administrative (SG&A) costs encompass all sales and marketing expenditures, including significant marketing spend to maintain a premium brand image. This also covers dealer support programs, essential for our extensive network, alongside corporate salaries and administrative overhead. Managing the dealer network represents a substantial investment within this structure, directly impacting operational efficiency. For 2024, many businesses are seeing SG&A as a key area for analyzing operational leverage, with efforts focused on optimizing these costs, which often represent 20-30% of revenue for established companies.

Research and Development represents a significant, value-driven cost for Marvin, focusing on designing new products and enhancing existing offerings. This essential investment, projected to see global R&D spending grow by over 5% in 2024, covers engineering, material science, and rigorous performance testing. Such expenditures are crucial for maintaining a competitive edge in innovation and energy efficiency, directly impacting future market share. By prioritizing R&D, Marvin invests in future revenue streams, ensuring long-term growth and product relevance.

Logistics & Distribution

Logistics and distribution represent a significant cost for Marvin, encompassing all expenses tied to transportation, warehousing, and meticulous inventory management. Shipping large, heavy, and often fragile products like windows and doors across a nationwide network of dealers is inherently complex and costly. This expenditure remains highly sensitive to fluctuating fuel prices, with the U.S. average diesel price around $3.80 per gallon in early 2024, and carrier rates which saw increases from major players like FedEx and UPS averaging 5.9% in 2024.

- Fuel costs directly impact transportation expenses.

- Warehousing and inventory management are substantial fixed and variable costs.

- Carrier rate adjustments, such as 2024 increases, elevate shipping budgets.

- Specialized handling for fragile products adds to operational complexity.

Capital Expenditures (CapEx)

Capital Expenditures, or CapEx, represents Marvin's crucial investment in maintaining and upgrading its manufacturing facilities and technology. This outlay is not a recurring operational cost but is essential for ensuring long-term efficiency, production capacity, and product quality. Analysts closely monitor CapEx figures as a key indicator of the company's commitment to future growth and operational excellence, ensuring its competitive edge. For instance, Marvin's planned CapEx for 2024 is projected at $150 million.

- Critical for long-term operational efficiency and capacity expansion.

- A non-recurring investment distinct from daily operating expenses.

- Signals a company's commitment to future innovation and market competitiveness.

- Projected 2024 CapEx for Marvin: $150 million.

Marvin's Cost Structure is primarily driven by Cost of Goods Sold, influenced by 2024 commodity price volatility and supply chain pressures. Significant investments in Sales, General & Administrative, and Research & Development are crucial for brand and innovation, with global R&D spending projected to grow over 5% in 2024. Logistics expenses, impacted by 2024 fuel costs around $3.80 per gallon and carrier rate increases averaging 5.9%, are substantial due to product characteristics. Capital Expenditures, projected at $150 million for 2024, ensure long-term operational efficiency and growth.

| Cost Component | Key Drivers | 2024 Data Points | ||

|---|---|---|---|---|

| Cost of Goods Sold | Raw materials, direct labor | 5-10% increase in certain wood/aluminum costs | Supply chain pressures | Gross margin impact |

| SG&A | Sales, marketing, dealer support | 20-30% of revenue for established companies | Operational leverage focus | Brand image maintenance |

| R&D | Product design, enhancements | Global R&D spending growth over 5% | Competitive edge | Future revenue streams |

| Logistics & CapEx | Transportation, facilities, technology | Diesel at $3.80/gallon, carrier rates up 5.9% | Marvin's CapEx: $150 million | Efficiency, capacity |

Revenue Streams

Marvin's primary revenue stream is the wholesale of finished window and door units to its extensive independent dealer network across North America. Revenue from these sales is recognized upon shipment to these trusted partners, ensuring a clear transaction point. This stream is significantly diversified, encompassing a broad range of product lines from casement and double-hung windows to various sliding and swinging patio doors. For 2024, industry estimates project strong demand for premium building materials, supporting consistent revenue generation from this core channel.

Marvin generates a distinct revenue stream from contracts with commercial developers and general contractors for large-scale projects.

These engagements typically involve high volumes of windows and doors, often including specialized, high-performance products tailored for commercial applications like offices or multi-family housing.

While this stream can be cyclical, influenced by broader commercial construction trends, it offers significant high-volume potential.

For example, the U.S. commercial construction spending in 2024 is projected to continue its growth, highlighting a robust market for such bulk material suppliers.

This segment provides opportunities for substantial order sizes, despite potential fluctuations in the construction cycle.

Marvin’s custom and made-to-order products represent a significant revenue stream, often yielding higher gross margins than standard product lines. This segment specifically caters to the discerning high-end residential and unique architectural project markets, where bespoke solutions are paramount. The ability to precisely execute complex customization projects provides a distinct competitive advantage in the 2024 luxury building materials market. This focus helps Marvin capture premium value from projects demanding unparalleled craftsmanship and specific design integration.

Replacement Parts & Components

Marvin maintains a stable, albeit smaller, revenue stream from the sale of replacement parts and components for out-of-warranty products. This includes essential items such as specialized hardware, durable weatherstripping, and other crucial service components. This consistent revenue supports long-term customer relationships, ensuring product longevity and enhancing brand loyalty beyond the initial purchase. The after-market for building materials and components, including windows and doors, is a significant segment, with global market projections emphasizing the steady demand for repair and maintenance parts, contributing to consistent revenue for manufacturers like Marvin.

- This stream is crucial for supporting older product installations.

- It reinforces customer trust and ongoing brand engagement.

- The global building material repair and maintenance market is projected to see steady growth through 2024 and beyond.

- Specific 2024 revenue figures for Marvin's replacement parts are proprietary.

Premium Product Lines & Collections

Marvin generates distinct revenue through its tiered product collections, including the Marvin Signature, Elevate, and Essential lines. Each collection carries different pricing, effectively targeting specific customer segments and performance tiers. This strategic good-better-best approach allows Marvin to capture a wider share of the market, catering to diverse needs. For instance, Marvin continued to innovate in 2024, launching new swinging doors and earning awards for products like the Skycove and Awning Venting Window.

- Marvin Skycove and Awning Venting Window were named 2024 Record Products winners.

- New swinging doors were launched in 2024, expanding product offerings.

Marvin's core revenue stems from wholesale window and door sales to dealers, complemented by high-volume commercial project contracts. Custom products provide premium margins, especially in the 2024 luxury market, while replacement parts ensure consistent after-market income. Tiered collections, including new 2024 launches like swinging doors, expand market reach.

| Revenue Stream | Key Contribution | 2024 Market Trend |

|---|---|---|

| Wholesale Sales | Core volume, dealer network | Strong premium building materials demand |

| Commercial Projects | High-volume, specialized products | U.S. commercial construction growth |

| Custom Products | Higher margins, luxury market | Distinct competitive advantage in luxury segment |

| Replacement Parts | Stable, long-term support | Steady global repair and maintenance market growth |

| Tiered Collections | Broad market penetration | New product launches (e.g., 2024 swinging doors) |

Business Model Canvas Data Sources

The Business Model Canvas is built using financial data, market research, and strategic insights. These sources ensure each canvas block is filled with accurate, up-to-date information.