Marathon Petroleum Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Petroleum Bundle

Marathon Petroleum operates within a dynamic energy sector, facing significant competitive pressures. Understanding the intensity of rivalry among existing players, the bargaining power of their suppliers, and the influence of buyers are crucial for strategic planning.

The threat of new entrants, while potentially moderate due to high capital requirements, and the ever-present danger of substitute products or technologies can reshape market landscapes. These forces collectively dictate profitability and influence Marathon Petroleum's long-term viability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Marathon Petroleum’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Marathon Petroleum's reliance on crude oil as its main input means the bargaining power of oil suppliers is a critical factor. The global oil market, dominated by a few major producing countries and blocs like OPEC+, wields considerable influence over both supply volumes and price levels. This concentration allows these suppliers to exert significant leverage, particularly for specialized or high-demand crude grades.

In 2024, the dynamics of crude oil supply continued to be shaped by geopolitical events and production decisions. For instance, OPEC+ maintained its influence through managed production quotas, impacting global availability. This strategic management of supply directly translates into enhanced bargaining power for these suppliers when negotiating with refiners like Marathon Petroleum.

The bargaining power of suppliers in Marathon Petroleum's (MPC) analysis is significantly influenced by specialized transportation and logistics. The sheer scale of moving crude oil and refined products necessitates unique assets like pipelines, tankers, and specialized railcars. This infrastructure represents a substantial capital outlay and is often subject to stringent regulatory approvals, making it difficult for new entrants to compete.

Companies like MPLX, which Marathon Petroleum has a significant stake in, wield considerable power. MPLX operates a vast network of midstream infrastructure, including pipelines and terminals, vital for transporting MPC's products. As of late 2023, MPLX's operations spanned over 100,000 miles of pipeline and 7,000 miles of gathering systems, highlighting the critical role and supplier leverage held by such integrated logistics providers in the energy sector.

Refining operations are heavily dependent on sophisticated, frequently proprietary, technologies and specialized catalysts. Suppliers of these essential components can wield considerable leverage due to high switching costs and the direct impact of their technologies on refinery efficiency and product output. For instance, the global catalyst market, crucial for refining processes, was valued at approximately $2.7 billion in 2023 and is projected to see steady growth, underscoring the critical nature of these inputs.

Labor Market Dynamics

The bargaining power of suppliers in the labor market is a significant consideration for Marathon Petroleum. A highly skilled workforce is crucial for the safe and efficient operation of its complex refining and midstream assets. When there are shortages of specialized talent, such as experienced process engineers or certified welders, or when unions have a strong presence, these workers gain leverage. This can lead to increased wage demands and benefits, directly impacting Marathon Petroleum's operational expenses and its ability to maintain competitive costs.

For instance, in 2024, the U.S. experienced ongoing tightness in certain skilled trades, a trend that has persisted from previous years. This scarcity can translate into higher compensation expectations for Marathon Petroleum's specialized employees. The company's ability to attract and retain this talent is vital for operational continuity and cost management.

- Skilled Workforce Dependency: Marathon Petroleum relies on specialized labor for its refining and midstream operations.

- Labor Shortages Impact: Scarcity of skilled workers, like process engineers, can drive up labor costs.

- Unionization Influence: Strong union presence in certain regions amplifies workers' bargaining power.

- Cost Competitiveness: Increased labor costs can challenge Marathon Petroleum's ability to maintain competitive operating expenses.

Geopolitical and Regulatory Influence

Geopolitical events and regulatory shifts in oil-producing nations directly affect crude oil availability and pricing, thereby influencing supplier bargaining power. For instance, in 2024, ongoing geopolitical tensions in Eastern Europe continued to create supply chain uncertainties for many refiners, including Marathon Petroleum.

Suppliers situated in regions with stable production and favorable political climates, such as parts of the Middle East or North America, are often in a stronger position to negotiate better terms. Conversely, suppliers operating in politically volatile areas introduce significant supply risks, potentially weakening their leverage. The Organization of the Petroleum Exporting Countries (OPEC+) decisions in 2024, for example, demonstrated how coordinated supply management by a bloc of nations can exert considerable influence on global prices and availability.

Government policies, including export restrictions or mandates on environmental standards, also play a crucial role in shaping supplier power. Changes in these regulations can either enhance or diminish a supplier's ability to dictate terms. For example, discussions around increased environmental compliance costs for oil extraction in 2024 could lead to higher production costs for some suppliers, indirectly affecting their pricing power.

- Geopolitical Stability: Suppliers in stable regions like the Permian Basin in the US, a key supply area for Marathon Petroleum, generally hold stronger bargaining power due to consistent output.

- Regulatory Environment: Shifting environmental regulations globally in 2024 could increase operating costs for some suppliers, potentially increasing their leverage if these costs are passed on.

- Export Policies: Decisions by major oil-exporting countries to voluntarily cut production in 2024, as seen with Saudi Arabia, directly impacts global supply and strengthens the bargaining power of those participating suppliers.

- Supply Chain Risks: Disruptions in key oil-producing regions due to conflict or natural disasters in 2024 can lead to price spikes and give remaining suppliers greater pricing power.

The bargaining power of Marathon Petroleum's suppliers is substantial, particularly given the company's heavy reliance on crude oil. The concentration of oil production among a few key global players, and the specialized nature of transportation infrastructure, means suppliers can significantly influence pricing and terms.

In 2024, geopolitical factors and coordinated production cuts by blocs like OPEC+ continued to bolster supplier leverage. Furthermore, the critical need for specialized refining catalysts and skilled labor adds to this power, as switching suppliers or finding alternatives can be costly and complex.

A table illustrating key supplier categories and their influence highlights this:

| Supplier Category | Key Factors Influencing Bargaining Power (2024) | Impact on Marathon Petroleum |

|---|---|---|

| Crude Oil Producers | OPEC+ production quotas, geopolitical stability in supply regions, global demand. | Direct impact on input costs and availability. |

| Midstream Logistics (e.g., MPLX) | Infrastructure ownership (pipelines, terminals), regulatory hurdles for new entrants. | Control over transportation costs and efficiency. |

| Refining Technology/Catalysts | Proprietary technology, high switching costs, impact on refinery output. | Influence on operational efficiency and product quality. |

| Skilled Labor | Shortages of specialized talent (engineers, technicians), unionization rates. | Affects labor costs and operational continuity. |

What is included in the product

This analysis details Marathon Petroleum's competitive environment by examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the refining and marketing industry.

Instantly assess competitive intensity across the refining industry, helping Marathon Petroleum navigate threats from rivals and potential new entrants.

Customers Bargaining Power

The commodity nature of refined products like gasoline and diesel significantly amplifies the bargaining power of customers. Because these products are largely undifferentiated, buyers face minimal switching costs and can easily compare prices across numerous suppliers.

This lack of product differentiation means that price becomes the primary competitive factor, driving intense price sensitivity among customers. For Marathon Petroleum, this translates to a constant pressure to keep prices competitive, as customers readily switch to cheaper alternatives.

In 2024, the average retail gasoline price in the U.S. fluctuated, but the underlying commodity nature remained constant, allowing consumers to shop around. For instance, differences of even a few cents per gallon could drive significant customer traffic between stations.

Wholesale distributors also benefit from this commodity status, as they can leverage multiple refining sources to secure the best pricing. This further empowers them in negotiations with refiners like Marathon Petroleum, limiting the refiner's ability to dictate terms.

Marathon Petroleum's customers are often large-scale entities like wholesalers, distributors, and major commercial operators such as airlines and trucking firms. These significant buyers possess considerable bargaining clout due to the sheer volume of their purchases.

This ability to buy in bulk directly translates into leverage for negotiating better prices and more favorable contract terms. For instance, a large airline could represent a substantial portion of Marathon Petroleum's jet fuel sales, empowering it to demand competitive pricing.

In 2024, the energy market saw fluctuating prices, making these bulk purchasers even more sensitive to cost. Any ability to secure fuel at a lower rate directly impacts their operational expenses and profitability, intensifying their negotiation efforts.

The sheer scale of these wholesale transactions means that even small concessions on price per gallon can significantly impact Marathon Petroleum's overall revenue and profit margins. This customer concentration creates a potent force that Marathon must actively manage.

The accelerating adoption of electric vehicles (EVs) significantly impacts Marathon Petroleum by directly reducing demand for its primary products, gasoline and diesel. As EV sales surged, with the global EV market expected to reach over 30 million units sold in 2024 according to various industry projections, this trend inherently shifts bargaining power towards consumers.

This long-term shift means refiners like Marathon Petroleum face a shrinking market for traditional fuels. Consequently, customers gain leverage as the competition intensifies among fewer suppliers vying for a declining customer base, potentially leading to downward pressure on prices.

Sensitivity to Fuel Prices

Consumers and businesses alike are keenly aware of fuel price shifts, as these directly influence their spending habits and operational expenses. This heightened sensitivity means Marathon Petroleum faces a challenge in fully transferring increased costs, particularly when crude oil prices are unpredictable or the economy slows.

For instance, in 2024, average gasoline prices in the United States experienced volatility, with fluctuations impacting consumer demand. When prices climb significantly, consumers may reduce discretionary travel or seek more fuel-efficient transportation, directly affecting the volume of fuel sold by Marathon.

- Consumer Sensitivity: High sensitivity to gasoline and diesel prices limits Marathon's pricing power.

- Business Costs: Businesses, especially transportation and logistics sectors, are directly impacted by fuel costs, influencing their demand for Marathon's products.

- Economic Impact: Economic downturns amplify price sensitivity, forcing consumers and businesses to cut back on fuel consumption.

- Pass-Through Limitations: Marathon struggles to pass on the full extent of rising crude oil costs to end-users due to this price sensitivity.

Regulatory and Environmental Pressures on Demand

Increasingly stringent government regulations and growing societal pressure for reduced carbon emissions are significantly shifting consumer demand. This trend directly impacts industries like Marathon Petroleum by steering customers toward cleaner fuels and alternative energy sources. For instance, by the end of 2024, a significant portion of new vehicle sales in many developed nations are projected to be electric, illustrating this shift.

This evolving consumer preference grants greater bargaining power to customers who actively seek to minimize their environmental footprint. They are more inclined to choose products and services that align with sustainability goals, potentially leading to a decreased demand for traditional refined products. This dynamic forces companies to adapt, often by investing in or offering more eco-friendly options to retain market share.

- Regulatory Shifts: Governments worldwide are implementing stricter emissions standards and carbon pricing mechanisms, directly influencing fuel choices.

- Consumer Awareness: Public awareness campaigns and growing environmental consciousness are making consumers more discerning about the sustainability of their energy consumption.

- Demand Diversification: The rise of electric vehicles and renewable energy sources presents viable alternatives, fragmenting the market for conventional fuels.

- Customer Leverage: As demand for cleaner alternatives grows, customers gain leverage to negotiate better terms or switch to providers offering more sustainable solutions.

The bargaining power of Marathon Petroleum's customers is substantial, driven by the commodity nature of refined products and the significant volume purchased by key clients. This means customers can easily switch suppliers based on price, and large buyers wield considerable influence in negotiations.

In 2024, the energy market's volatility intensified customer sensitivity to price. For instance, fluctuations in U.S. retail gasoline prices meant consumers actively shopped for the best deals, impacting sales volumes. Similarly, major commercial operators like trucking firms, representing significant purchase volumes, leveraged their scale to negotiate favorable terms, directly affecting Marathon's revenue.

The growing adoption of electric vehicles further empowers customers by signaling a long-term shift away from traditional fuels, reducing the overall market size for products like gasoline and diesel. This trend forces refiners to compete for a shrinking customer base, increasing customer leverage.

| Factor | Impact on Marathon Petroleum | 2024 Relevance |

| Product Homogeneity | High customer switching | Gasoline and diesel are essentially identical across suppliers. |

| Customer Volume | Leverage for bulk buyers | Large distributors and commercial fleets can negotiate significant discounts. |

| Price Sensitivity | Limits pricing power | Consumers and businesses are highly attuned to price changes. |

| EV Adoption | Shrinking market for core products | Projected over 30 million EVs sold globally in 2024, reducing demand for gasoline. |

Preview the Actual Deliverable

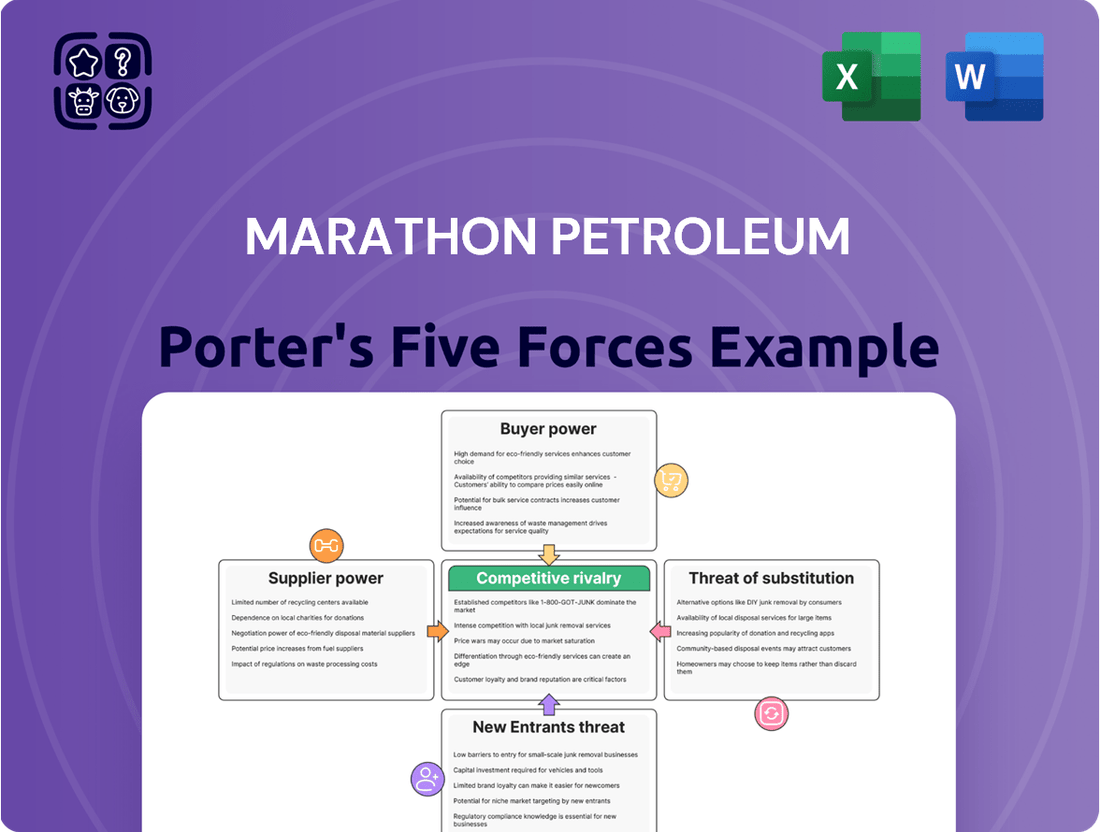

Marathon Petroleum Porter's Five Forces Analysis

This preview showcases the complete Marathon Petroleum Porter's Five Forces Analysis, offering a detailed examination of industry competition, buyer power, supplier leverage, threat of new entrants, and the potential for substitute products. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your immediate use. This comprehensive analysis provides valuable insights into the strategic landscape of Marathon Petroleum, enabling informed decision-making for stakeholders. No mockups, no samples – the document you see here is precisely what you’ll be able to download after payment.

Rivalry Among Competitors

The U.S. refining sector is quite consolidated, with giants like Marathon Petroleum, Valero, and Phillips 66 dominating the landscape. This means there aren't many companies vying for business, but the ones that are have a lot of influence. For instance, in 2023, Marathon Petroleum operated 13 refineries with a combined capacity of 2.9 million barrels per day, underscoring this concentration.

Despite the limited number of players, the competition remains fierce. Refiners face substantial fixed costs associated with their facilities. This economic reality pushes them to run their plants at high utilization rates to spread those costs and maximize profitability. In 2024, U.S. refinery utilization rates have consistently hovered around 90%, a testament to this drive for efficiency, even when it means intense price competition.

This pursuit of high operating levels naturally leads to aggressive competition for market share and thinner profit margins. When demand fluctuates or when new capacity comes online, these large, concentrated players can significantly impact pricing. The drive to keep those expensive assets running at peak capacity means they’ll often compete on price to secure every available barrel.

The market for traditional refined petroleum products in developed countries, like those Marathon Petroleum operates in, is quite mature. This means growth is slow, and in some areas, demand is actually decreasing as the world shifts towards cleaner energy sources. For example, projections for gasoline demand in North America show a gradual decline over the coming years.

This low growth environment naturally fuels intense competition. Refiners are all trying to capture market share from a pie that isn't getting any bigger, and sometimes it's even shrinking. This struggle for customers puts significant pressure on profit margins for companies like Marathon.

In 2023, Marathon Petroleum reported refinery utilization rates averaging around 88%, a testament to the need to keep facilities running efficiently to manage costs in a competitive landscape. Despite this, the underlying market dynamics mean that each percentage point of market share becomes even more valuable.

Marathon Petroleum faces significant competitive rivalry due to high exit barriers in the refining sector. The immense capital investment required for refinery construction and specialized equipment makes it exceptionally difficult and costly for companies to leave the market. This situation often results in underperforming businesses remaining operational, contributing to persistent overcapacity.

These high exit barriers can intensify competitive pressure, particularly impacting refining margins. For instance, in 2023, the U.S. refining industry operated with an average utilization rate of around 89%, indicating that while demand was strong, there was still capacity that kept margins competitive.

Price Volatility and Margin Pressure

Competitive rivalry in the refining industry, exemplified by Marathon Petroleum, is fierce, largely driven by price volatility and the resulting margin pressure. Refining margins, the difference between the cost of crude oil and the selling price of refined products like gasoline and diesel, are notoriously unstable. These margins are susceptible to fluctuations based on crude oil prices, the ebb and flow of product demand, and the overall global refining capacity.

In 2024, the refining sector faced a particularly challenging environment. Margins experienced a noticeable decline, a direct consequence of increased product supply coupled with weaker-than-anticipated demand. This scenario creates an intensely competitive landscape where companies must constantly strive for operational efficiency to remain profitable.

This inherent volatility compels refiners to place a significant emphasis on cost efficiency and operational excellence. To navigate these choppy waters and maintain profitability, companies like Marathon Petroleum must meticulously manage their expenses and optimize every aspect of their operations.

- Refining margins are highly volatile, influenced by crude oil prices, product demand, and global refining capacity.

- In 2024, margins declined due to increased supply and weak demand, creating a challenging environment for refiners.

- This volatility forces companies to focus intensely on cost efficiency and operational excellence to maintain profitability.

- For instance, the average refining margin for West Texas Intermediate (WTI) crude in the US Gulf Coast region experienced fluctuations throughout 2024, impacting profitability.

Geographical Market Dynamics

Competitive rivalry in the refining sector is significantly shaped by geographical market dynamics. U.S. refiners, including Marathon Petroleum, contend with varying levels of competition depending on the region. For instance, new refining capacity coming online in areas like the Middle East and Africa can introduce global supply pressures that impact domestic markets.

While U.S. refiners might benefit from certain structural advantages, such as access to cost-advantaged feedstock, a global oversupply scenario can still exert downward pressure on refining margins. This intensified rivalry forces companies to focus on operational efficiency and cost management to maintain profitability.

- Global Refining Capacity Growth: Projections for 2024 indicate continued, albeit moderating, growth in global refining capacity, with significant additions expected in Asia and the Middle East.

- Regional Feedstock Advantages: Countries with access to lower-cost crude oil, such as those in the Middle East, often possess a competitive edge in refining economics.

- U.S. Export Markets: U.S. refiners often serve export markets, meaning global supply-demand balances and competitor actions in regions like Europe and Latin America directly influence domestic competitive intensity.

The competitive rivalry within the U.S. refining sector, where Marathon Petroleum operates, is intense due to the industry's consolidated nature and high fixed costs. This forces companies to maintain high utilization rates, leading to aggressive competition on price.

In 2024, the sector experienced margin compression, driven by increased product supply and softening demand, making operational efficiency paramount. Furthermore, high exit barriers deter companies from leaving the market, perpetuating competitive pressure and potentially leading to overcapacity.

The mature market for traditional refined products in developed economies, coupled with the slow growth and potential decline in demand, intensifies the struggle for market share, further pressuring profit margins for major players like Marathon.

| Metric | 2023 Data | 2024 Outlook/Data |

|---|---|---|

| Marathon Petroleum Refinery Utilization | ~88% | Expected to remain high, driven by cost pressures |

| U.S. Refinery Utilization (Industry Average) | ~89% | Hovering around 90% |

| Refining Margins | Experienced fluctuations | Declined due to increased supply and weaker demand |

SSubstitutes Threaten

The most significant threat of substitutes for Marathon Petroleum comes from the accelerating adoption of Electric Vehicles (EVs). These vehicles directly compete by reducing the demand for gasoline and diesel fuel, which are Marathon's primary products.

The global EV market is experiencing robust expansion. For instance, by the end of 2023, cumulative EV sales worldwide surpassed 40 million units, a substantial increase from previous years. This trend is particularly pronounced in regions like China and Europe, where government incentives and consumer preference are driving rapid uptake.

Projections indicate that this shift could significantly impact oil demand. Analysts anticipate that the widespread adoption of EVs could displace several million barrels of oil demand daily by 2030. This presents a considerable long-term structural challenge for Marathon Petroleum, as it directly erodes the market for its core offerings.

The increasing viability of biofuels, such as ethanol and renewable diesel, presents a significant threat of substitution for Marathon Petroleum's traditional fuel products. Government mandates and incentives in 2024 continue to drive the adoption of these alternatives, making them more competitive. For instance, the Renewable Fuel Standard (RFS) in the United States mandates the blending of renewable fuels into the nation's transportation fuel supply, creating a consistent demand for biofuels.

Marathon Petroleum's own investments in renewable diesel production, like its Dickinson, North Dakota facility which processes soybean oil, demonstrate an acknowledgment of this market shift. However, the broader expansion of the biofuels sector, supported by technological advancements and growing consumer preference for greener options, directly challenges the market share of conventional gasoline and diesel. This trend is expected to intensify as more companies enter the renewable fuels space.

Trends towards increased public transportation and ride-sharing services are gaining momentum, directly impacting individual vehicle usage. For instance, in 2024, many major cities are seeing continued growth in their transit ridership numbers, with some reporting a notable uptick compared to pre-pandemic levels. This shift means fewer personal cars on the road, which in turn reduces the overall demand for transportation fuels like gasoline and diesel, a core product for Marathon Petroleum.

Urbanization also plays a significant role, concentrating populations in areas where public transit is more viable and often preferred. As more people choose to live in densely populated urban centers, the necessity and convenience of owning and operating a personal vehicle diminish. This can lead to a substantial decrease in vehicle miles traveled per capita, presenting a clear substitute for the traditional reliance on refined petroleum products.

Hydrogen and Alternative Energy Sources

The long-term threat from hydrogen fuel cells and other alternative energy sources for transportation and industry is a developing concern for Marathon Petroleum. While currently not at a mass-market scale, ongoing technological improvements and supportive government policies could hasten their integration. For instance, by mid-2024, several nations are aggressively pursuing hydrogen infrastructure development, with countries like Germany aiming for significant increases in green hydrogen production capacity. This diversification of the energy sector presents potential substitutes for traditional petroleum products.

The increasing viability of these alternatives could impact demand for gasoline and diesel fuel.

- Hydrogen Fuel Cell Adoption: Projections suggest a notable increase in hydrogen fuel cell electric vehicles (FCEVs) in commercial fleets and heavy-duty transport by 2030, driven by efficiency gains and declining costs.

- Renewable Energy Integration: Advancements in battery technology and electric vehicle (EV) charging infrastructure continue to expand the practical range and convenience of EVs, posing a direct substitute for internal combustion engine vehicles.

- Policy and Investment Trends: Global investment in clean energy technologies, including hydrogen and advanced battery storage, reached record highs in 2023 and is expected to continue its upward trajectory through 2025, signaling a commitment to energy transition.

- Industrial Decarbonization Efforts: Industries are exploring hydrogen as a cleaner fuel for high-heat processes, potentially reducing reliance on natural gas and, by extension, the broader fossil fuel ecosystem.

Energy Efficiency Improvements

Energy efficiency improvements present a significant threat to companies like Marathon Petroleum. As vehicles become more fuel-efficient and industrial processes are optimized, the demand for refined petroleum products naturally decreases. For instance, the average fuel economy for new passenger vehicles sold in the US reached an estimated 26.1 miles per gallon (MPG) in 2023, an increase from previous years, directly impacting gasoline consumption. This shift means that less fuel is needed to cover the same distance or power the same operation, effectively substituting technological advancement for the volume of Marathon's core products.

This trend is further amplified by increasing environmental awareness and regulatory pressures. Consumers and businesses are actively seeking ways to reduce their carbon footprint and operating costs, making energy-efficient alternatives more attractive. The rise of electric vehicles (EVs) is a prime example; by 2024, EV sales are projected to continue their upward trajectory, offering a direct substitute for gasoline-powered vehicles. This continuous innovation in efficiency and alternative energy sources directly curtails the market size for traditional refined fuels.

- Growing Fuel Efficiency Standards: Government mandates continue to push for higher MPG ratings in new vehicles, directly reducing the amount of gasoline and diesel required per mile traveled.

- Advancements in Industrial Processes: Industries are investing in more efficient machinery and technologies, leading to lower energy consumption per unit of output, thereby decreasing the demand for industrial fuels.

- Consumer Behavior Shifts: Increased adoption of ride-sharing, public transportation, and remote work arrangements contribute to a reduction in overall vehicle miles traveled, impacting fuel demand.

- Rise of Alternative Energy: The increasing viability and adoption of renewable energy sources in transportation and industry offer direct substitutes for petroleum-based products.

The threat of substitutes for Marathon Petroleum is significant, primarily driven by the accelerating adoption of electric vehicles (EVs) and the growing viability of biofuels. These alternatives directly challenge the demand for gasoline and diesel, Marathon's core products.

EVs are rapidly gaining market share, with global cumulative sales surpassing 40 million by the end of 2023. Projections indicate that by 2030, EVs could displace millions of barrels of oil demand daily. Simultaneously, government mandates in 2024, like the US Renewable Fuel Standard, bolster the market for biofuels such as ethanol and renewable diesel. Marathon itself is investing in renewable diesel, acknowledging this shift.

| Substitute Category | Key Trend | Impact on Marathon Petroleum | Relevant 2023-2024 Data/Projections |

|---|---|---|---|

| Electric Vehicles (EVs) | Rapid adoption, increasing market share | Directly reduces demand for gasoline and diesel | Global cumulative EV sales > 40 million by end of 2023; Projected displacement of millions of bbls/day oil demand by 2030 |

| Biofuels | Government mandates and incentives, growing production | Competes with traditional diesel and gasoline | US Renewable Fuel Standard mandates blending; Marathon investing in renewable diesel production |

| Public Transportation & Ride-Sharing | Increasing usage in urban areas | Reduces personal vehicle miles traveled, lowering fuel demand | Notable uptick in transit ridership in major cities in 2024 compared to pre-pandemic levels |

| Energy Efficiency | Improved vehicle MPG, optimized industrial processes | Decreases overall fuel consumption per unit | Estimated US new passenger vehicle fuel economy reached 26.1 MPG in 2023 |

Entrants Threaten

The petroleum refining industry presents a formidable barrier to entry due to exceptionally high capital costs. Constructing a new, modern refinery can easily run into the tens of billions of dollars, with some projects exceeding $20 billion as of 2024. This massive financial commitment, coupled with the long lead times for construction and regulatory approvals, deters all but the most well-capitalized and risk-tolerant organizations.

The refining industry, including companies like Marathon Petroleum, faces significant threats from new entrants due to complex regulatory and environmental hurdles. Obtaining the necessary permits for operation, ensuring strict safety compliance, and adhering to evolving environmental standards demand substantial upfront investment and expertise. For instance, the U.S. Environmental Protection Agency (EPA) continuously updates regulations like the Renewable Fuel Standard (RFS) and National Ambient Air Quality Standards (NAAQS), requiring ongoing capital expenditures for compliance.

New players entering the refining and marketing sector would struggle significantly to gain access to consistent, long-term crude oil supplies. The established relationships and contracts that companies like Marathon Petroleum possess are a substantial barrier, often requiring deep market penetration and a proven track record.

Building out the necessary infrastructure for crude oil acquisition and product distribution, including pipelines, storage terminals, and retail gasoline stations, represents a monumental capital investment. For instance, the cost to construct even a moderate-sized pipeline can run into hundreds of millions of dollars, a cost that new entrants would need to bear without the benefit of existing operational scale.

Marathon Petroleum's extensive network of over 3,000 branded retail outlets across the United States provides a significant competitive advantage. Replicating this reach and brand recognition would be an arduous and costly undertaking for any new entrant.

In 2024, the capital expenditures for major refining projects often exceed billions of dollars, underscoring the immense financial hurdle for new competitors aiming to establish a foothold in this capital-intensive industry.

Economies of Scale and Operational Expertise

Incumbent refiners, like Marathon Petroleum, possess a significant advantage due to substantial economies of scale. This allows them to spread fixed costs over a larger volume of production, resulting in lower per-barrel operating costs. For instance, Marathon's refining capacity, among the largest in the U.S., enables cost efficiencies that are difficult for newcomers to replicate.

New entrants face a daunting challenge in achieving comparable cost efficiencies. They would require immense initial capital investment to build refineries with a throughput large enough to compete on cost. Furthermore, the decades of accumulated operational expertise that established players like Marathon have developed are crucial for optimizing complex refining processes and maintaining profitability, a learning curve new entrants cannot easily surmount.

- Economies of Scale: Large-scale operations lead to lower per-unit costs for established refiners.

- Operational Expertise: Decades of experience in managing complex refinery operations are a significant barrier.

- Capital Intensity: Building new, competitive refineries requires massive upfront investment.

- Cost Disadvantage: New entrants would likely operate at a higher cost base initially compared to incumbents.

Mature Market and Demand Uncertainty

The threat of new entrants is significantly mitigated by the mature nature of the refining market and the inherent demand uncertainty. Building new refineries is a capital-intensive endeavor, and the prospect of entering a market with slowing or even declining demand for traditional refined products, such as gasoline, presents a substantial financial risk. This is compounded by the ongoing energy transition, which casts a long shadow of doubt over the long-term viability of such large-scale investments.

The outlook for refined product demand further discourages new players. Projections suggest that the demand for many refined products may peak in the near future, making new, large-scale refinery investments less attractive. For instance, the U.S. Energy Information Administration (EIA) has highlighted the potential for peak gasoline demand in the coming years, a key driver for refinery operations.

- Mature Market Dynamics: The refining industry is characterized by high capital costs, established players, and significant regulatory hurdles, making it difficult for new entrants to gain a foothold.

- Demand Uncertainty: The shift towards electric vehicles and renewable energy sources creates uncertainty regarding the long-term demand for refined petroleum products.

- Economic Viability: The high cost of building new refineries, coupled with fluctuating crude oil prices and refining margins, makes new investments economically challenging.

- Capacity Utilization: Existing refineries often operate below full capacity, indicating that the market may already be adequately supplied, further deterring new entrants.

The threat of new entrants for Marathon Petroleum is considerably low due to the immense capital requirements, with new refinery construction often exceeding $20 billion in 2024. Regulatory complexities, including EPA standards, demand significant upfront investment and ongoing compliance. Furthermore, securing stable crude oil supplies and establishing extensive distribution networks, like Marathon's 3,000+ retail outlets, present formidable barriers for any newcomer.

| Factor | Description | Impact on New Entrants |

|---|---|---|

| Capital Costs | Building a new refinery can cost over $20 billion (2024). | Extremely High Barrier |

| Regulatory Hurdles | Complex environmental and safety compliance (e.g., EPA standards). | High Barrier |

| Supply Chain Access | Securing long-term crude oil supply agreements. | High Barrier |

| Distribution Network | Replicating existing infrastructure (pipelines, retail). | Very High Barrier |

| Economies of Scale | Established players have lower per-unit costs. | High Barrier |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Marathon Petroleum is built upon a foundation of financial statements, investor relations disclosures, and industry-specific market research reports. This blend of internal company data and external market intelligence allows for a comprehensive understanding of the competitive landscape.