Marathon Petroleum Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Petroleum Bundle

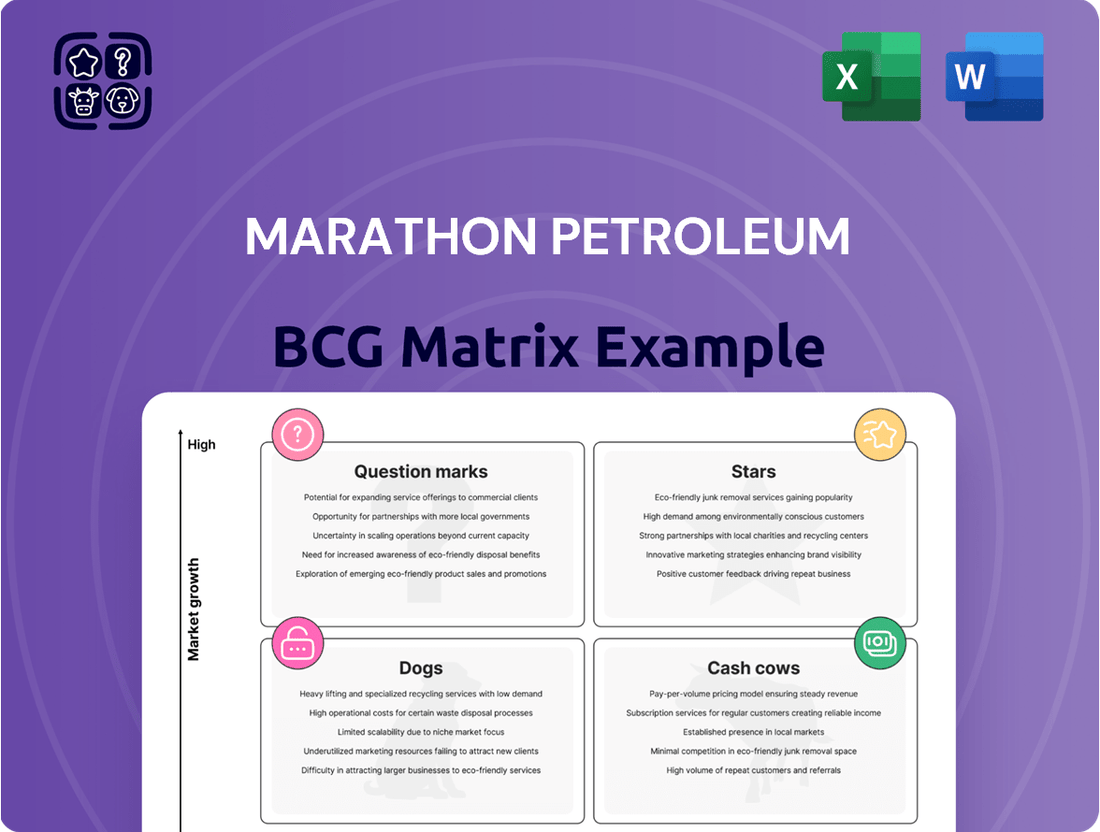

Marathon Petroleum's strategic positioning in the energy sector is illuminated by its BCG Matrix. This powerful tool categorizes its diverse portfolio, offering a clear visual of which ventures are market leaders and which require closer examination. Understanding these placements is crucial for optimizing resource allocation and driving future growth.

This preview offers a glimpse into Marathon Petroleum's product landscape. To truly grasp the company's competitive edge and identify untapped potential, dive deeper into the full BCG Matrix. It's your essential guide to navigating the complexities of the energy market and making informed strategic decisions.

Unlock the complete picture of Marathon Petroleum's market performance and future prospects. Purchase the full BCG Matrix to gain detailed quadrant analysis, actionable insights, and a roadmap for strategic investment that will propel your business forward.

Stars

Marathon Petroleum's renewable diesel segment, driven by its Martinez Renewables joint venture with Neste, is a significant growth area. This venture is slated to become one of the largest renewable diesel producers globally by early 2024, with a capacity of 914 million gallons annually. The company continues to prioritize capital allocation towards this segment, with substantial investments planned through 2025. This focus underscores Marathon Petroleum's commitment to expanding its footprint in the burgeoning renewable fuels market.

Marathon Petroleum’s midstream arm, MPLX, is heavily investing in expanding its Permian to Gulf Coast infrastructure. This includes significant projects like the BANGL pipeline expansion and the development of new fractionation complexes.

These strategic expansions are designed to handle the rising volumes of natural gas liquids and crude oil. In 2023, MPLX reported strong performance, with its midstream segment adjusted EBITDA showing robust growth, reflecting the demand for its services in key production areas.

The BANGL pipeline expansion, for instance, is a key component in this growth strategy, enhancing MPLX's ability to move hydrocarbons efficiently. The company’s focus on integrated value chains positions it well to capitalize on the continued energy production increases in the Permian Basin.

Marathon Petroleum's Stars category includes high-return refinery optimization projects. For instance, the distillate hydrotreater at the Galveston Bay refinery and energy efficiency upgrades at the Los Angeles refinery are anticipated to deliver returns between 20-25%.

These initiatives are crucial for boosting the competitiveness and profitability of Marathon's core refining operations. By focusing on improved reliability and reduced operating costs, these projects directly address market needs for premium products.

Jet Fuel Production Optimization

Marathon Petroleum's investment in its Robinson, Illinois refinery is a strategic move to enhance jet fuel production capabilities. This upgrade, expected to be operational by 2026, focuses on increasing the refinery's flexibility to optimize output. The project anticipates a return on investment of around 25%.

This initiative directly addresses the ongoing recovery and expansion of global air travel. By boosting its capacity and flexibility for jet fuel, Marathon Petroleum is positioning itself to capitalize on the increasing demand within this vital transportation fuel sector. The company aims to secure a more substantial market share as air travel continues its upward trajectory.

- Refinery Investment: Robinson, Illinois refinery upgrade focused on jet fuel production.

- Projected ROI: Approximately 25% once operational in 2026.

- Market Opportunity: Capturing share in a high-growth transportation fuel market driven by recovering air travel.

- Strategic Goal: Enhance flexibility to optimize jet fuel output in response to growing global demand.

Renewable Natural Gas (RNG) Ventures

Marathon Petroleum's investment in Renewable Natural Gas (RNG) through its 49.9% stake in LF Bioenergy positions it in a promising, albeit nascent, sector. This venture targets RNG production from dairy farms, a market with substantial growth potential in the low-carbon fuel space. By 2026, Marathon aims to significantly increase its renewable energy production capacity, leveraging this strategic entry to diversify its energy portfolio.

The LF Bioenergy partnership is a key component of Marathon's broader strategy to expand its renewable fuels business. This initiative is expected to contribute to the company's overall carbon reduction goals while tapping into a rapidly expanding market. By 2024, the demand for RNG is projected to continue its upward trajectory, driven by policy support and corporate sustainability targets.

- Market Entry: Marathon's 49.9% equity interest in LF Bioenergy signifies a strategic move into the high-growth RNG market, focusing on dairy farm waste.

- Growth Potential: This venture is poised to expand RNG production capacity and diversify Marathon's renewable energy offerings, with significant potential by 2026.

- Strategic Diversification: The RNG initiative aligns with Marathon's strategy to reduce its carbon footprint and broaden its participation in low-carbon fuel markets.

- Market Outlook: The RNG sector is experiencing robust growth, supported by environmental regulations and increasing corporate demand for sustainable fuels, with projections indicating continued expansion through 2024 and beyond.

Marathon Petroleum's Stars represent high-return refinery optimization projects. These initiatives, such as the Galveston Bay refinery's distillate hydrotreater and energy efficiency upgrades at the Los Angeles refinery, are projected to yield returns between 20-25%. The Robinson, Illinois refinery upgrade, focused on jet fuel and expected to be operational by 2026, anticipates a similar 25% return on investment.

These projects are key to enhancing Marathon's refining operations' profitability and competitiveness. They directly target market demands for premium products by improving reliability and lowering operating expenses.

The strategic investments in refinery upgrades are designed to capture growing market demand for refined products. By focusing on efficiency and specialized fuel production, Marathon Petroleum aims to bolster its market position and financial performance.

The company's commitment to these high-return projects underscores its strategy to maximize value from its existing refining assets.

| Project | Location | Focus | Projected ROI | Operational |

|---|---|---|---|---|

| Distillate Hydrotreater | Galveston Bay Refinery | Refinery Optimization | 20-25% | Ongoing |

| Energy Efficiency Upgrades | Los Angeles Refinery | Refinery Optimization | 20-25% | Ongoing |

| Jet Fuel Production Enhancement | Robinson, Illinois Refinery | Jet Fuel Production & Flexibility | ~25% | 2026 |

What is included in the product

The Marathon Petroleum BCG Matrix analyzes its business units, identifying which to invest in, hold, or divest based on market share and growth.

Clear visualization of Marathon Petroleum's business units, identifying Stars, Cash Cows, Question Marks, and Dogs.

Simplifies strategic decision-making by highlighting areas needing investment or divestment.

Cash Cows

Marathon Petroleum's conventional refining and marketing operations function as a classic Cash Cow within the BCG framework. These operations benefit from a vast refining capacity, around 2.9 million barrels per day, which reliably produces significant cash through the sale of gasoline and diesel. Even with market volatility, their established market share in a vital sector provides a steady income stream.

MPLX's established crude oil and product pipelines are indeed classic cash cows within Marathon Petroleum's portfolio. These extensive networks, vital for transporting energy resources, hold a dominant market share in the midstream sector. Their maturity translates into consistent, fee-based revenue streams, acting as a reliable engine for the company's cash generation.

These mature assets require minimal growth capital, primarily focusing on maintenance to ensure operational integrity. This allows MPLX to generate substantial free cash flow that can be allocated to other strategic initiatives or returned to shareholders. For instance, in 2023, MPLX reported significant distributable cash flow, underscoring the strength of its pipeline operations.

Marathon Petroleum's refined product export sales have become a significant contributor, with volumes reaching 370 thousand barrels per day in 2024. This surge highlights robust international demand for the company's refined products.

These export sales effectively utilize Marathon Petroleum's established refining capacity and well-developed market infrastructure. By capitalizing on these assets, the company generates incremental revenue from mature product lines in the global marketplace.

Integrated Retail and Wholesale Distribution

Marathon Petroleum's integrated retail and wholesale distribution, notably through its Speedway brand, is a classic Cash Cow. This segment leverages a massive customer base, ensuring steady, reliable cash flow. The market for essential fuel products, while mature with low growth, benefits from Marathon's high market share.

In 2024, Marathon Petroleum continued to benefit from this robust segment. The company's extensive network of Speedway stores and wholesale operations provides a stable revenue stream, even in a low-growth environment. This stability is crucial for funding other ventures within the company's broader portfolio.

- Market Dominance: Speedway holds a significant share in the retail fuel market, providing consistent sales volumes.

- Predictable Cash Flow: The essential nature of fuel ensures a reliable, ongoing revenue stream from a broad customer base.

- Low Market Growth: While not a growth engine, the mature market allows for efficient operations and cash generation.

- Strategic Importance: This segment's cash generation supports investments in higher-growth areas of Marathon Petroleum's business.

Existing Natural Gas Processing and Fractionation Assets (MPLX)

MPLX's existing natural gas processing and fractionation assets are clear cash cows within Marathon Petroleum's portfolio. These operations, especially in well-established basins with dependable production, consistently generate robust adjusted EBITDA. For instance, in the first quarter of 2024, MPLX reported adjusted EBITDA of $1.44 billion, a testament to the stable cash-generating capabilities of its midstream infrastructure.

These assets, while not experiencing rapid expansion, play a vital role in the energy sector. They are indispensable for the efficient movement and separation of natural gas liquids, ensuring a steady supply for various industrial uses. This reliability translates into significant and predictable cash flows for Marathon Petroleum, underpinning the company's financial stability.

- Stable Cash Generation: MPLX’s processing and fractionation assets are designed for consistent, long-term cash flow generation.

- Mature Basin Focus: Operations are concentrated in mature basins, ensuring reliable feedstock and stable production volumes.

- Significant EBITDA Contribution: These assets are key contributors to Marathon Petroleum's overall adjusted EBITDA, demonstrating their financial importance.

- Energy Value Chain Criticality: MPLX’s infrastructure is essential for the processing and distribution of natural gas and natural gas liquids.

Marathon Petroleum's traditional refining and marketing segment stands as a prime example of a cash cow. With a substantial refining capacity of approximately 2.9 million barrels per day, it consistently generates significant cash from fuel sales, providing a stable income stream despite market fluctuations.

MPLX's extensive pipeline network, a cornerstone of Marathon Petroleum's midstream operations, functions as a reliable cash cow. These mature, fee-based revenue streams, supported by a dominant market share in essential energy transportation, act as a consistent cash-generating engine for the company.

The integrated retail and wholesale distribution, particularly the Speedway brand, represents another key cash cow. Its vast customer base and the essential nature of fuel sales ensure predictable, ongoing revenue, even in a low-growth market, which is crucial for funding other business areas.

| Segment | BCG Category | Key Characteristics | 2024 Data/Context |

|---|---|---|---|

| Refining & Marketing | Cash Cow | High capacity, steady fuel sales, established market share | ~2.9 million bpd refining capacity |

| MPLX Pipelines | Cash Cow | Dominant market share, fee-based revenue, essential transportation | Consistent fee-based revenue |

| Speedway Retail & Wholesale | Cash Cow | Large customer base, essential product, stable revenue | Significant market share in retail fuel |

What You’re Viewing Is Included

Marathon Petroleum BCG Matrix

The Marathon Petroleum BCG Matrix you are currently previewing is the exact, fully formatted document you will receive upon purchase, offering a comprehensive strategic analysis without any watermarks or demo content.

This preview accurately represents the final BCG Matrix report for Marathon Petroleum, providing you with a market-backed, professionally crafted tool ready for immediate strategic application and business planning.

What you see here is the actual Marathon Petroleum BCG Matrix file you’ll get upon purchase, unlocking the complete version immediately available for editing, printing, or presenting to stakeholders.

You're previewing the real BCG Matrix document for Marathon Petroleum that becomes yours after a one-time purchase, providing an analysis-ready file instantly downloadable for your strategic needs.

Dogs

Marathon Petroleum's older, less efficient refining units could be considered as having a low market share and low growth potential within the BCG framework. These units, while still operational, may struggle to compete with newer, more advanced facilities in terms of profitability per barrel. For example, if these units are less adaptable to processing heavier, cheaper crude oils, their margins could be squeezed.

In 2024, the refining industry faced continued pressure from fluctuating crude oil prices and evolving environmental regulations. Older units, often requiring more intensive maintenance and consuming more energy, would likely see their operating costs rise disproportionately. This could lead to a negative cash flow contribution, or at best, a break-even scenario, further solidifying their position as potential question marks or even dogs if they consistently underperform.

These less efficient assets might represent a drag on overall capital efficiency for Marathon Petroleum. While they might still contribute to overall production volume, their lower profitability per barrel means they tie up capital without generating significant returns. Analyzing their contribution in 2024, it's crucial to assess if the capital invested in maintaining these older units could be better deployed in modernizing existing facilities or investing in higher-growth areas.

Marathon Petroleum's portfolio might include niche heavy oil products that are experiencing a downturn in demand. These could be specific types of fuel oil or petrochemical feedstocks whose traditional markets are shrinking due to technological shifts or stricter environmental regulations.

For instance, certain industrial fuels derived from heavy oil may see reduced consumption as industries transition to cleaner energy sources. In 2024, global demand for residual fuel oil, often derived from heavy crude, continued its downward trend, with projections indicating a further decline as shipping and industrial sectors increasingly adopt lower-sulfur alternatives and natural gas.

These segments represent low-growth, low-market-share areas within Marathon's broader operations. The challenge lies in the fact that maintaining or revitalizing these niche product lines might demand significant capital investment and operational focus for relatively modest returns, especially when compared to their higher-growth segments.

Consequently, these "dogs" in the BCG matrix could be prime candidates for divestiture. Alternatively, Marathon might explore repurposing the assets involved in producing these declining products for more profitable ventures, such as specialized lubricants or chemical intermediates, if feasible.

Underperforming localized marketing assets, particularly individual retail or wholesale outlets in saturated or economically declining local markets, can be categorized as Dogs within Marathon Petroleum's BCG Matrix. These struggling locations often fail to capture substantial market share, leading to minimal profit generation. For instance, if a specific Marathon gas station in a town experiencing population decline and facing intense competition from numerous other fuel providers consistently reports lower-than-average sales volumes, it would likely fit this classification.

These assets might also drain valuable resources due to ongoing maintenance requirements or operational inefficiencies that outweigh their meager financial contributions. Consider a scenario where a wholesale distribution terminal in a region with shrinking industrial activity requires significant capital investment for upgrades to remain compliant with environmental regulations, yet its throughput volumes have steadily decreased year-over-year. In 2024, such an asset might represent a significant cash drain without a clear path to substantial improvement.

Non-Core, Legacy Assets from Acquisitions

Non-core, legacy assets from acquisitions at Marathon Petroleum might include divested refining or marketing segments that no longer fit the company's strategic direction. These could be older facilities with limited modernization potential, operating in regions with declining demand. For instance, if Marathon acquired a smaller, regional chain of gas stations as part of a larger deal, and these stations don't leverage Marathon's integrated supply chain or brand strength, they'd be candidates for this category.

These assets typically exhibit low market growth rates and a relatively small contribution to Marathon Petroleum's overall revenue or profit. Their operational costs might also be higher due to their legacy nature, making them less competitive. The company would likely seek to divest these holdings to free up capital for more promising ventures. In 2023, Marathon Petroleum continued its portfolio optimization efforts, which often involves assessing and potentially divesting such non-core assets.

- Low Growth Prospects: Assets that are geographically isolated or operate in mature, non-expanding markets.

- Non-Strategic Alignment: Businesses or facilities that do not complement Marathon Petroleum's core refining, marketing, and midstream operations.

- Divestment Potential: These assets are prime candidates for sale to unlock value and redeploy capital into strategic growth areas.

Certain Conventional Lubricant Product Lines

Certain conventional lubricant product lines within Marathon Petroleum's portfolio likely represent their Dogs. These segments operate in mature markets characterized by high competition and slow growth potential. Consequently, they typically hold a low market share and generate minimal profits, often struggling to cover their investment costs.

Marathon Petroleum's strategic approach to these Dog products would likely involve careful evaluation for potential divestment or significant reduction in operational focus. The rationale is to reallocate capital and resources towards higher-growth, more profitable business areas. For instance, while specific 2024 figures for individual lubricant lines are not publicly detailed, the broader industrial lubricants market, where many conventional products reside, has seen growth rates in the low single digits, highlighting the maturity of these segments.

- Low Market Share: These conventional lubricants often compete against numerous established and emerging players, making it difficult to capture significant market share.

- Slow Market Growth: The demand for basic, conventional lubricants is often tied to industries experiencing modest expansion, limiting revenue growth opportunities.

- Limited Profitability: Intense price competition in mature markets squeezes profit margins, making these product lines less attractive financially.

- Rationalization Potential: Marathon may consider phasing out or selling off these underperforming conventional lubricant lines to streamline operations and improve overall portfolio efficiency.

Marathon Petroleum's "Dogs" likely encompass older, less efficient refining units and niche product lines with declining demand. These segments, characterized by low market share and minimal growth, may struggle to generate significant profits, potentially draining resources. In 2024, these underperformers might face increased operating costs due to fluctuating oil prices and stricter environmental rules, further solidifying their position as candidates for divestment or repurposing.

| BCG Category | Marathon Petroleum Example | Market Characteristics | Strategic Implications |

|---|---|---|---|

| Dogs | Older, less efficient refining units | Low growth, low market share, high operating costs | Divestment, modernization, or repurposing |

| Dogs | Niche heavy oil product lines | Shrinking demand due to technological shifts and environmental regulations | Divestment or focus reduction |

| Dogs | Underperforming localized retail outlets | Saturated or declining local markets, intense competition | Divestment or operational review |

| Dogs | Non-core, legacy assets from acquisitions | Low modernization potential, declining regional demand | Divestment to free up capital |

| Dogs | Conventional lubricant product lines | Mature markets, high competition, slow growth | Divestment or phasing out |

Question Marks

Marathon Petroleum's involvement in Carbon Capture, Utilization, and Storage (CCUS) projects positions these initiatives as potential 'Question Marks' within its business portfolio. This sector is characterized by substantial growth potential but remains in its early stages, with rapidly developing technologies and an evolving regulatory landscape.

Marathon Petroleum currently holds a minor market share in this nascent CCUS market. These investments demand considerable initial capital outlay, and while immediate returns are uncertain, the long-term growth prospects are significant, reflecting the typical profile of a Question Mark business.

Marathon Petroleum is likely exploring early-stage hydrogen production as a component of its long-term strategy, aligning with the global shift towards cleaner energy. These ventures represent high-growth potential markets where Marathon's current market share is minimal, necessitating significant capital infusion to establish a strong foothold.

In 2024, the global hydrogen market is projected to reach over $200 billion, signaling substantial growth opportunities. Marathon's investments in this nascent sector would place it in a position to capture a slice of this expanding market, even with initial low penetration.

Marathon Petroleum's investment in advanced biofuels through its subsidiary Virent positions it within the "Question Marks" of the BCG matrix. This signifies a high-growth potential market that Marathon is exploring beyond its established renewable diesel operations, aiming for future market leadership.

Virent's research into advanced biofuels, such as those derived from plant-based sugars and waste feedstocks, represents a significant R&D undertaking. While these technologies are still in early commercialization phases, they hold the promise of a substantial future market if successful breakthroughs are achieved, justifying ongoing capital allocation despite low current market share.

In 2024, the advanced biofuels sector is experiencing considerable investment and policy support, with projections indicating significant growth. For instance, the U.S. Department of Energy has continued to fund various advanced biofuel projects, recognizing their potential to reduce greenhouse gas emissions and enhance energy security.

Marathon's strategic commitment to Virent's development is crucial. Continued investment is essential to navigate the technical and economic challenges inherent in scaling up novel biofuel production methods. Success here could transform Virent into a future "Star" for Marathon Petroleum.

New Specialty Chemicals or Derivatives

Exploring new specialty chemicals or derivatives from Marathon Petroleum's refining processes, aimed at high-growth industrial applications, would likely position them as a Question Mark in the BCG Matrix. These ventures start with low market share but possess significant growth potential, provided they align with emerging industry demands.

Such initiatives demand substantial investment in research, development, and marketing to achieve penetration. For instance, a new high-performance lubricant additive derived from petroleum could target the rapidly expanding electric vehicle (EV) battery cooling market, a sector projected to grow substantially in the coming years.

- Market Opportunity: Specialty chemicals for advanced manufacturing, such as those used in semiconductors or renewable energy components, represent a segment with strong projected growth.

- Investment Needs: Significant capital expenditure would be required for process innovation, product testing, and building market awareness. For example, developing a new line of specialty solvents might necessitate millions in R&D and pilot plant construction.

- Risk Factor: High uncertainty exists regarding market acceptance and competitive response. In 2024, companies venturing into novel chemical derivatives face volatile raw material costs and evolving regulatory landscapes.

- Potential Returns: Successful entry into niche, high-margin markets can yield substantial profitability, especially if the derivative offers a unique performance advantage or addresses an unmet need.

International Market Entry for Renewable Fuels

Marathon Petroleum's aggressive expansion of its renewable fuels marketing into new international markets, where it currently has a limited presence, would be classified as a Question Mark in the BCG matrix. The global demand for sustainable fuels is robust, with the International Energy Agency reporting that renewable fuel production is expected to reach 34 billion liters by 2028, a significant increase from 2022. However, entering these new regions necessitates substantial strategic investment and navigating intense competition from established players and evolving regulatory landscapes.

Establishing market share in foreign territories presents considerable challenges. For instance, the European Union's Renewable Energy Directive (RED III) sets ambitious targets, but compliance requires tailored supply chains and localized distribution networks. Marathon's existing U.S. infrastructure and market knowledge may not directly translate, demanding significant adaptation and potentially higher initial operating costs.

- High Global Demand: The renewable fuels market is experiencing substantial growth, driven by environmental regulations and corporate sustainability goals.

- Market Entry Costs: Significant capital investment is required for new infrastructure, regulatory compliance, and building brand presence in unfamiliar international markets.

- Competitive Landscape: Established international refiners and emerging renewable fuel producers create a highly competitive environment, making market penetration difficult.

- Regulatory Hurdles: Navigating diverse international regulations, certifications, and tax incentives for renewable fuels adds complexity and potential delays to market entry.

Marathon Petroleum's initiatives in CCUS, hydrogen production, advanced biofuels via Virent, and new specialty chemicals all represent businesses with significant growth potential but currently low market share. These ventures require substantial capital investment and face technological and market uncertainties, aligning them with the 'Question Mark' category in the BCG matrix.

The strategic importance of these Question Marks lies in their potential to diversify Marathon Petroleum's revenue streams and position the company for future energy transitions. Success in these areas could transform them into future 'Stars' or 'Cash Cows'.

In 2024, the global hydrogen market is projected to exceed $200 billion, while advanced biofuels are seeing increased investment and policy support. These figures underscore the significant growth opportunities Marathon Petroleum is targeting with these Question Mark businesses.

| Marathon Petroleum Question Marks | Market Growth Potential | Current Market Share | Investment Needs | Risk Level |

|---|---|---|---|---|

| CCUS Projects | High | Low | High | High |

| Hydrogen Production | Very High (>$200B market in 2024) | Minimal | Substantial | High |

| Advanced Biofuels (Virent) | High (Significant investment & policy support in 2024) | Low | Significant R&D and scaling | High |

| Specialty Chemicals | High (e.g., EV battery cooling market) | Low | High (R&D, testing, marketing) | High |

| International Renewable Fuels Marketing | High (Global demand robust) | Low | High (Infrastructure, compliance) | High |

BCG Matrix Data Sources

Our Marathon Petroleum BCG Matrix is constructed using comprehensive data from SEC filings, industry growth forecasts, and proprietary market share analyses to provide strategic clarity.