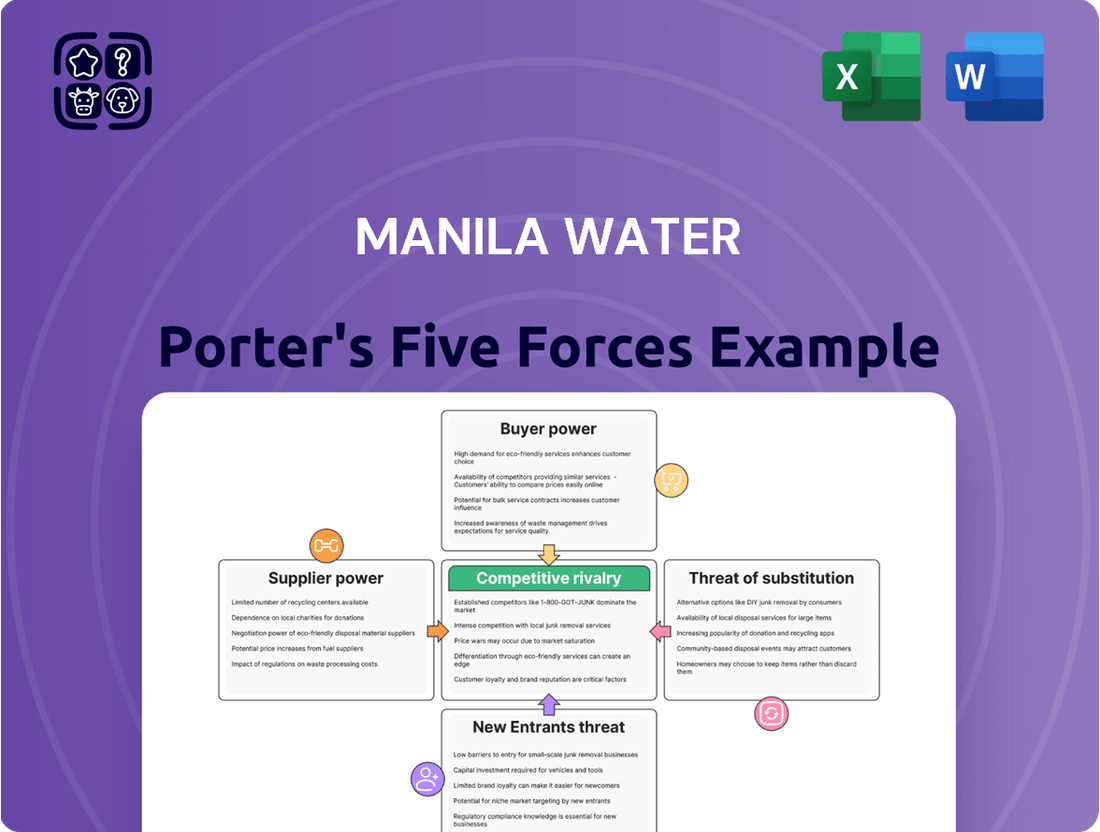

Manila Water Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manila Water Bundle

Manila Water navigates a landscape shaped by significant buyer power from its large customer base and moderate bargaining power from its suppliers. The threat of new entrants, while present, is somewhat mitigated by high capital requirements and regulatory hurdles. Substitutes for water services are limited, offering Manila Water a degree of market insulation.

However, the intensity of rivalry among existing players demands constant strategic adaptation and operational efficiency. Understanding these dynamics is crucial for anyone looking to grasp Manila Water's competitive positioning and future outlook.

The complete report reveals the real forces shaping Manila Water’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Manila Water's significant reliance on Angat Dam, which supplies about 96% of Metro Manila's water, grants considerable power to the National Water Resources Board (NWRB) and owners of alternative raw water sources. This dependency limits Manila Water's ability to negotiate favorable terms for its essential raw water supply.

The scarcity of viable, large-scale alternative raw water sources in the region further consolidates the bargaining power of existing suppliers. Manila Water has fewer options to turn to, increasing the leverage of those who control the necessary water resources.

While projects like the Cardona Water Treatment Plant and East Bay are underway to diversify supply, these are long-term solutions requiring substantial investment. Until these projects are fully operational and significantly reduce dependency on Angat Dam, the suppliers of raw water will retain substantial bargaining power.

Manila Water's reliance on specialized equipment for its operations, such as advanced water treatment systems and sophisticated pipeline infrastructure, can significantly influence supplier bargaining power. The need for highly specific technologies in water purification and efficient distribution means that a limited number of manufacturers may possess the necessary expertise and patents.

For instance, the development and maintenance of advanced membrane filtration or desalination technologies often involve proprietary processes. If Manila Water is dependent on a few key suppliers for these critical components, those suppliers can command higher prices or more favorable terms, particularly if switching costs are substantial.

In 2023, capital expenditures for infrastructure upgrades and maintenance were a significant portion of Manila Water's operational costs. The procurement of specialized pumps and treatment chemicals, for example, can represent substantial investments where supplier leverage is evident if alternative sources are scarce or require extensive re-qualification.

Manila Water's reliance on energy, especially electricity for water pumping and treatment, makes it vulnerable to the bargaining power of utility providers. In 2024, electricity prices in the Philippines have seen fluctuations, impacting operational costs significantly. For instance, the Wholesale Electricity Spot Market (WESP) prices can directly influence Manila Water's energy expenditure, as it's a key component of their operating expenses.

Furthermore, the company sources essential chemicals for water purification from a select group of specialized suppliers. The critical nature of these chemicals, coupled with a potentially limited supplier base, grants these suppliers considerable leverage. The cost of these chemicals, often denominated in foreign currencies, can also be affected by exchange rate volatility, adding another layer to supplier bargaining power.

Labor and Expertise

The bargaining power of suppliers in Manila Water's context is significantly influenced by the availability of specialized labor and expertise. Maintaining and expanding complex water infrastructure requires a deep well of engineering, technical, and operational know-how.

The scarcity of highly skilled professionals and niche consulting firms in this sector can give these human resource suppliers considerable leverage. This is particularly true when it comes to intricate projects demanding unique skill sets, allowing them to negotiate higher wages and fees.

- Specialized Skills Demand: The water utility sector requires specific engineering disciplines and operational expertise not readily found in the general labor market.

- Niche Consulting Services: Firms offering specialized services like advanced water treatment technology or complex network management can command premium pricing.

- Project Complexity: The more technically demanding a project, the greater the bargaining power of the skilled labor and consultants needed to execute it.

- Limited Supply of Expertise: A smaller pool of qualified individuals and specialized firms means they can dictate terms more effectively.

Infrastructure and Construction Contractors

The bargaining power of infrastructure and construction contractors significantly impacts Manila Water. Large-scale projects, like building new water treatment facilities or expanding sewer networks, necessitate specialized engineering and construction firms. The limited pool of contractors with proven expertise in water utility infrastructure can tilt the scales in their favor.

For instance, in 2024, major infrastructure development in the Philippines saw intense competition for skilled construction firms. Manila Water's capital expenditure plans, often running into billions of pesos annually for network upgrades and new facilities, mean they rely heavily on these specialized contractors. The scarcity of companies capable of handling such complex, capital-intensive projects, especially those with a strong track record in water infrastructure, grants these contractors substantial leverage in negotiating terms and pricing.

- Limited Qualified Contractors: The specialized nature of water infrastructure projects restricts the number of viable construction and engineering partners.

- Project Scale and Complexity: Manila Water's need for large-scale, intricate projects amplifies the bargaining power of experienced contractors.

- Contractor Expertise: Firms with a demonstrated history in water utilities and a robust project pipeline can command better terms.

- Negotiating Leverage: The critical need for these specialized services allows contractors to negotiate higher prices and more favorable contract conditions.

Manila Water's bargaining power with suppliers is influenced by its reliance on a few key raw water sources, primarily Angat Dam, which supplies approximately 96% of Metro Manila's water. This dependency grants significant leverage to the National Water Resources Board (NWRB) and owners of alternative water sources, limiting Manila Water's ability to negotiate favorable terms.

The scarcity of large-scale alternative raw water sources further consolidates the power of existing suppliers. While Manila Water is investing in projects like the Cardona Water Treatment Plant, these are long-term solutions that do not immediately reduce its dependence on current primary suppliers.

The company's need for specialized equipment for water treatment and infrastructure also empowers suppliers. Manufacturers of advanced filtration systems or proprietary treatment chemicals, often with limited competition, can dictate higher prices, especially given the substantial switching costs involved.

Furthermore, Manila Water's operational costs are significantly impacted by energy prices. Fluctuations in electricity costs, influenced by factors like Wholesale Electricity Spot Market (WESP) prices in 2024, directly affect its expenses and the bargaining power of utility providers.

The availability of specialized labor and niche consulting services is another critical factor. The scarcity of highly skilled engineers and firms with expertise in water utility infrastructure allows these suppliers to command premium wages and fees, especially for complex projects.

Infrastructure and construction contractors with proven experience in water utility projects also hold considerable bargaining power. Manila Water's substantial capital expenditure for infrastructure development in 2024 means it relies on a limited pool of qualified firms, enabling them to negotiate more favorable contract terms and pricing.

| Supplier Type | Key Dependency | Impact on Bargaining Power | 2024 Relevance/Data Point |

|---|---|---|---|

| Raw Water Sources | Angat Dam (96% of supply) | High | Continued reliance on Angat Dam for bulk supply. |

| Specialized Equipment Manufacturers | Proprietary treatment technologies, advanced filtration | Moderate to High | Capital expenditures on infrastructure upgrades in 2023/2024 highlight ongoing need for specialized tech. |

| Energy Providers | Electricity for pumping and treatment | Moderate | Electricity prices in the Philippines experienced fluctuations in 2024, impacting operational costs. |

| Chemical Suppliers | Water purification chemicals | Moderate | Critical nature of chemicals and potential for limited supplier base. |

| Skilled Labor/Consultants | Engineering, technical expertise for infrastructure | Moderate to High | Demand for specialized skills in water utility sector remains high. |

| Construction Contractors | Large-scale infrastructure projects | High | Intense competition for skilled firms in infrastructure development in 2024. |

What is included in the product

This analysis of Manila Water's competitive environment examines the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the impact of substitute products.

Instantly identify and mitigate competitive threats and opportunities with a comprehensive overview of Manila Water's Porter's Five Forces.

Gain actionable insights into the bargaining power of suppliers and buyers, allowing for more strategic contract negotiations.

Customers Bargaining Power

Water and wastewater services are fundamental necessities for urban populations, and critically, there are no direct substitutes for these services. This inherent lack of alternatives significantly diminishes the bargaining power of individual residential and commercial customers in a major metropolitan area like Manila.

For Manila Water, this translates to a lower threat from customers demanding lower prices or better terms, as the essential nature of the service means customers must procure it. In 2023, Manila Water served approximately 7.7 million people in its concession area, highlighting the vast customer base reliant on its services.

Manila Water's bargaining power of customers is significantly tempered by regulated tariff adjustments. The Metropolitan Waterworks and Sewerage System Regulatory Office (MWSS RO) is the ultimate authority on setting water tariffs. This means customers, while consulted, do not directly negotiate pricing with Manila Water.

Public consultations are a mandatory part of the tariff-setting process, allowing customer feedback to be heard. However, the MWSS RO makes the final determination, balancing customer affordability with Manila Water's need to cover operational expenses and fund necessary infrastructure investments. For instance, in 2023, Manila Water sought a tariff adjustment to fund a P18.7 billion service improvement program, highlighting the regulatory process rather than direct customer negotiation.

Customers within Manila Water's exclusive concession area, covering the East Zone of Metro Manila and Rizal Province, face an insurmountable barrier to switching providers. This lack of alternative options effectively eliminates any bargaining power customers might otherwise exert.

The extensive and integrated infrastructure required for water supply makes it practically impossible for consumers to switch to another water utility. This inherent characteristic of the essential service removes competitive pressure that would typically arise from customer choice.

For context, Manila Water serves approximately 7.7 million people across its concession. The sheer scale of this infrastructure, including pipelines and treatment facilities, locks customers into their current provider, significantly diminishing their bargaining power.

Fragmented Customer Base

Manila Water's customer base is incredibly diverse, serving over 7.3 million accounts. This vast network includes residential households, numerous commercial establishments, and various industrial clients. This sheer volume and wide range of customer types inherently limit their ability to coalesce and present a united front to negotiate terms.

The fragmented nature of Manila Water's customer base significantly weakens their collective bargaining power. It's challenging for such a large and varied group to organize effectively, making it difficult to exert substantial pressure on pricing or service conditions. This diffusion of demand is a key factor in maintaining the company's pricing leverage.

- Customer Volume: Over 7.3 million served.

- Customer Segments: Residential, commercial, and industrial.

- Organizational Difficulty: High fragmentation hinders collective action.

- Negotiating Impact: Limited ability to influence pricing or terms.

Limited Customer Choice and Monopoly Status

Manila Water's exclusive concession in its service areas significantly limits customer choice, essentially establishing it as a natural monopoly. This lack of alternatives concentrates considerable power with the company regarding service delivery and pricing, albeit within the framework of regulatory oversight.

For instance, in 2024, the Metropolitan Waterworks and Sewerage System Regulatory Office (MWSS-RO) continued to oversee Manila Water's operations, including tariff adjustments. While customers cannot switch providers, the MWSS-RO's role is crucial in mitigating the monopolistic power by ensuring fair pricing and service standards.

- Exclusive Concession: Manila Water holds a sole concession agreement for water supply in its East Zone service area.

- Natural Monopoly: The infrastructure required for water distribution makes it impractical for multiple companies to operate, creating a natural monopoly.

- Limited Consumer Choice: Customers within the East Zone have no alternative water providers.

- Regulatory Oversight: The MWSS-RO acts as a check on Manila Water's pricing and service quality, mitigating unchecked monopolistic power.

The bargaining power of customers for Manila Water is notably low due to the essential nature of water and the absence of direct substitutes, coupled with its exclusive concession. This means customers have no alternative water providers and cannot easily switch, significantly limiting their ability to negotiate prices or terms. For example, in 2023, Manila Water served approximately 7.7 million people, all reliant on its singular service provision.

While customers can provide feedback through public consultations, the ultimate decision on tariff adjustments rests with the Metropolitan Waterworks and Sewerage System Regulatory Office (MWSS RO). This regulatory body balances customer affordability with the company's operational needs, as demonstrated when Manila Water sought a P18.7 billion program in 2023. The vast and diverse customer base, exceeding 7.3 million accounts across residential, commercial, and industrial sectors, also presents challenges for collective action, further diminishing their leverage.

| Factor | Description | Impact on Manila Water |

| Essential Service & No Substitutes | Water is a fundamental necessity with no direct alternatives available. | Significantly reduces customer ability to switch or demand lower prices. |

| Exclusive Concession | Manila Water operates as a natural monopoly in its East Zone concession area. | Eliminates customer choice and creates a captive customer base. |

| Regulatory Oversight (MWSS RO) | Tariff adjustments and service standards are regulated by the MWSS RO. | Mitigates unchecked customer power by setting pricing, but customers do not directly negotiate. |

| Customer Fragmentation | A large, diverse customer base (over 7.3 million accounts) makes collective bargaining difficult. | Weakens the ability of customers to organize and exert unified pressure. |

Preview Before You Purchase

Manila Water Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Manila Water's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, providing a comprehensive strategic overview.

Rivalry Among Competitors

Manila Water benefits from an exclusive concession for the East Zone of Metro Manila and Rizal Province. This regulatory structure effectively creates a near-monopoly, meaning direct competition within its core operational area is virtually non-existent. This significantly dampens competitive rivalry, as no other water utility can legally operate and offer services within this specific territory.

The Philippine water sector's concessionaire model creates a unique competitive landscape. Manila Water and Maynilad Water Services, Inc. are assigned exclusive service areas in Metro Manila, meaning they don't directly vie for the same customer base. This geographical segmentation significantly limits head-to-head competition between these two dominant players.

This lack of direct overlap means that rivalry is less about price wars or aggressive marketing campaigns to steal customers. Instead, the competition often manifests in performance metrics and adherence to service level agreements stipulated in their respective concessions. For instance, Manila Water's reported non-revenue water rate, a key efficiency indicator, stood at 12.65% as of the first quarter of 2024, showcasing a focus on operational improvement rather than direct market share battles.

While Manila Water's core East Zone concession is relatively stable with limited direct rivals, the real battleground for future growth lies in securing new concession areas and expansion opportunities. This is particularly true in emerging markets and other regions within the Philippines where new water infrastructure is needed.

Manila Water is actively seeking to diversify and grow its business beyond its traditional East Zone. The company has been strategically pursuing opportunities in non-East Zone areas within the Philippines and has also made significant inroads into international markets. For instance, by the end of 2023, Manila Water had secured new concession agreements in Vietnam and Indonesia, signaling its commitment to global expansion.

The competitive intensity for these future concessions is expected to increase as more players recognize the potential in the water utility sector. Companies with strong financial backing, proven operational expertise, and a commitment to sustainable practices will be best positioned to win these bids. Manila Water's past performance and ongoing investments in innovation are key strengths in this regard.

Regulatory Oversight and Performance Benchmarking

The MWSS Regulatory Office plays a significant role in shaping competitive dynamics within the water sector by benchmarking the performance of concessionaires like Manila Water. This oversight, while not direct market competition, fosters a rivalry centered on operational efficiency, service delivery standards, and the crucial metric of non-revenue water (NRW) reduction.

This regulatory pressure acts as a catalyst for continuous improvement. For instance, in 2023, Manila Water reported a Non-Revenue Water (NRW) rate of 12.55%, a testament to their efforts in infrastructure management and leak detection, a figure that other concessionaires would likely strive to match or surpass.

- Benchmarking Drives Efficiency: The MWSS Regulatory Office sets performance standards, compelling concessionaires to improve operational efficiency and service quality to meet or exceed these benchmarks.

- Focus on NRW Reduction: A key performance indicator is the reduction of Non-Revenue Water (NRW), encouraging investment in leak detection and water loss management. Manila Water's 2023 NRW rate stood at 12.55%.

- Indirect Rivalry: While not engaging in direct price wars, concessionaires compete indirectly through their ability to meet regulatory targets and deliver superior service, influencing public perception and regulatory favor.

- Incentivizing Continuous Improvement: Regulatory oversight encourages ongoing investment in infrastructure upgrades and technological advancements to maintain and enhance performance levels.

Potential for Policy Shifts

Discussions about restructuring the Philippine water sector, including proposals for a dedicated Department of Water Resources and a Water Regulatory Commission, signal a potential for significant policy shifts. These reforms, if enacted, could introduce new regulatory frameworks that reshape the competitive dynamics for companies like Manila Water in the long term. However, the immediate operational reality continues to be dominated by the existing concession model.

For instance, in 2024, discussions around these potential reforms were ongoing within the Philippine Congress, aiming to address fragmentation and improve service delivery across the archipelago. While the concession agreements, like those held by Manila Water, are designed for long-term operation, any new legislation could introduce altered oversight, pricing mechanisms, or even operational mandates. The current concession model, however, provides a degree of stability in the near term, with Manila Water continuing to operate under its established agreement for its East Zone concession in Metro Manila.

Competitive rivalry for Manila Water is notably subdued within its East Zone concession due to its exclusive operating rights, effectively creating a near-monopoly in that area. The primary competition arises not from direct market share battles but from meeting stringent regulatory performance benchmarks set by the MWSS Regulatory Office. This indirect rivalry incentivizes continuous improvement in operational efficiency and service delivery, with a key focus on reducing non-revenue water (NRW).

Manila Water's focus on operational excellence is demonstrated by its reported NRW rates, such as 12.55% in 2023 and 12.65% in Q1 2024. These figures are critical for comparison against industry standards and regulatory expectations, fostering a competition based on efficiency rather than customer acquisition through aggressive tactics.

| Metric | 2023 | Q1 2024 |

|---|---|---|

| Non-Revenue Water (NRW) Rate | 12.55% | 12.65% |

SSubstitutes Threaten

For Manila Water, the threat of substitutes is significantly low, primarily due to the lack of economically viable and scalable alternatives for its core services. An urban population of millions relies on a centralized, piped water supply and comprehensive wastewater management, for which there are no practical direct replacements at scale.

While individual deep wells or rainwater harvesting might serve niche purposes, they are entirely insufficient to meet the massive daily demand of a metropolis like Metro Manila. These localized solutions cannot provide the consistent volume, quality, and reliability that a large-scale utility offers, making them non-competitive substitutes.

Developing private alternative water sources, such as deep wells or rainwater harvesting systems, presents substantial initial investment hurdles. These costs include drilling, sophisticated pumping mechanisms, and essential water treatment facilities to meet safety standards. For instance, setting up a commercial-grade water treatment plant can easily run into millions of dollars.

Ensuring the consistent quality and safety of water from these private sources is another significant challenge. Unlike regulated public utilities, private systems may lack the rigorous testing and oversight required, potentially exposing users to contaminants. This unreliability can lead to increased health risks and further costs associated with water purification.

Manila Water's regulated pricing structure generally positions its services as more economically viable and dependable than individual self-supply efforts. In 2024, the average monthly water bill for residential customers in Manila Water's concession area remained relatively stable, offering a predictable cost compared to the variable and often escalating expenses of maintaining private water infrastructure.

The threat of substitutes for Manila Water's core service is heightened by health and sanitation risks associated with alternative water sources. Consumers may turn to unregulated or untreated water supplies if Manila Water's pricing or service quality is perceived as inadequate. This reliance on alternatives, however, exposes the public to significant health dangers, such as outbreaks of waterborne diseases like cholera and typhoid, which can have severe public health and economic consequences.

Manila Water's essential role lies in its provision of treated and quality-monitored water, a critical public health function. In 2023, the company reported investing significantly in its water treatment facilities and ongoing quality assurance programs to ensure safe and reliable water delivery across its concession area. This commitment to public health mitigates the appeal of less safe substitutes.

Wastewater Management Complexity

The threat of substitutes for Manila Water's core business, particularly wastewater management, is relatively low. Beyond just supplying clean water, the collection and treatment of wastewater are intricate processes requiring significant infrastructure and expertise, making it difficult for individual households or businesses to replicate these services effectively. Manila Water's substantial investments in sophisticated sewage treatment plants underscore the critical environmental and public health functions these services fulfill, functions that are not easily replaced by alternative solutions.

The complexity of wastewater management means that readily available substitutes are scarce. For instance, while some properties might utilize septic tanks, these are often insufficient for larger populations and require their own maintenance, and they do not address the broader environmental pollution concerns that centralized treatment facilities mitigate. The capital expenditure and operational know-how needed for effective wastewater treatment create a high barrier for potential substitutes.

Manila Water's commitment to wastewater infrastructure is a key differentiator. In 2023, the company continued its significant capital expenditure program, with a substantial portion allocated to wastewater projects to improve water quality in waterways. This ongoing investment solidifies their position by addressing a fundamental need that cannot be easily substituted.

- Wastewater Treatment Complexity: The technical requirements for collecting and treating sewage are substantial, involving specialized infrastructure and expertise that most end-users cannot replicate.

- Environmental and Public Health Imperative: Effective wastewater management is crucial for preventing pollution and safeguarding public health, needs that alternative, localized solutions often fail to meet comprehensively.

- Infrastructure Investment: Manila Water's ongoing capital expenditure, including significant outlays for sewage treatment plants, reinforces the difficulty for substitutes to emerge due to the high barrier to entry.

- Regulatory Compliance: Stringent environmental regulations necessitate advanced wastewater treatment capabilities, further limiting the viability of simpler, substitutable methods.

Regulatory Disincentives for Substitutes

Government and regulatory bodies often favor centralized water and wastewater systems. This preference stems from a desire for greater efficiency, ensuring public health standards, and achieving robust environmental protection. For instance, in 2024, the Philippine government continued to emphasize the development of large-scale water infrastructure projects, allocating significant budgets to these initiatives.

Policies enacted by these authorities can actively discourage the widespread adoption of individual or alternative water solutions. Concerns about potential resource depletion from numerous decentralized sources and the fragmented environmental impact of such systems often drive these regulatory disincentives. This regulatory landscape creates a significant barrier for potential substitutes looking to gain traction against established centralized providers like Manila Water.

- Regulatory Favoritism: Government policies in the Philippines, as of 2024, largely support and fund large-scale, centralized water and wastewater infrastructure.

- Public Health & Environmental Standards: Centralized systems are often seen as more effective in meeting stringent public health and environmental regulations.

- Resource Management Concerns: Regulators express concerns about the potential for uncontrolled resource depletion and environmental degradation from a proliferation of individual water solutions.

- Discouragement of Alternatives: These concerns translate into policies that may limit or disincentivize the widespread use of alternative water sources or treatment methods.

The threat of substitutes for Manila Water is minimal because there are no readily available or economically feasible alternatives for large-scale water supply and wastewater management in urban areas. The sheer volume and reliability required by millions of people in Metro Manila cannot be met by individual solutions like deep wells or rainwater harvesting, which are impractical and costly at scale.

For example, the capital investment for a commercial-grade water treatment plant can easily exceed millions of dollars, a prohibitive cost for most users compared to Manila Water's regulated tariffs. In 2024, Manila Water's stable residential billing offers a predictable expense, starkly contrasting with the unpredictable and often escalating costs of maintaining private water infrastructure.

Furthermore, the health and sanitation risks associated with unregulated private water sources are substantial, making Manila Water's role in providing safe, quality-monitored water critical for public health. The company's continued investment in treatment facilities, as seen in its 2023 capital expenditures, reinforces the difficulty for less safe substitutes to gain traction.

Entrants Threaten

The water utility sector, particularly in a major metropolitan area like Manila, presents a formidable barrier to entry due to substantial capital investment requirements. Developing the necessary infrastructure, from securing water sources and building treatment facilities to establishing vast distribution and sewerage networks, demands an enormous financial outlay. For instance, Manila Water's planned capital expenditure of P26.3 billion for 2024 underscores the significant financial commitment required to operate and expand within this industry, deterring potential new competitors.

The threat of new entrants in Manila Water's operating environment is significantly muted due to exclusive long-term concession agreements. These concessions, awarded by the Metropolitan Waterworks and Sewerage System (MWSS), effectively carve up service territories, preventing new companies from easily entering and competing within an already serviced area.

For instance, Manila Water's concession for the East Zone of Metro Manila, renewed until 2037, represents a substantial barrier. This exclusivity means that any potential new water utility would need to secure its own concession or acquire an existing one, a process that is both lengthy and complex, involving significant regulatory hurdles and capital investment.

Navigating Manila Water's complex regulatory environment presents a significant hurdle for new entrants. Obtaining the necessary permits, adhering to stringent water quality standards, and securing tariff approvals are time-consuming and resource-intensive processes. For instance, compliance with the Philippine Clean Water Act of 2004 and its subsequent amendments requires substantial investment in treatment technologies and monitoring systems.

The ongoing discussions and potential reforms within the water sector in the Philippines, as of recent years leading up to 2025, introduce further uncertainty. These reforms could alter the existing framework for concession agreements, pricing, and operational requirements, making it difficult for potential new players to accurately forecast costs and profitability. This regulatory ambiguity discourages new companies from entering the market.

Established Infrastructure and Network Effects

Manila Water's established infrastructure presents a formidable barrier to new entrants. The sheer scale and complexity of its water distribution and treatment facilities, developed over decades, represent a massive capital investment. Replicating this extensive network, including pipelines, treatment plants, and pumping stations across its service areas, would require billions of dollars and years of construction, making it economically unfeasible for most potential competitors.

Furthermore, network effects significantly strengthen Manila Water's competitive position. As more customers connect to its network, the value of that network increases for all users, facilitating efficient service delivery and economies of scale. This creates a powerful moat, as new entrants would struggle to achieve the same level of coverage and operational efficiency, even with substantial investment.

For context, as of its 2024 financial reporting, Manila Water operates a vast network of over 7,000 kilometers of water mains and serves millions of customers. The capital expenditure required to build such a system from scratch is a critical deterrent.

- Prohibitive Capital Investment: Replicating Manila Water's extensive water infrastructure, including pipes, treatment plants, and pumping stations, necessitates billions in upfront capital, a significant hurdle for newcomers.

- Economies of Scale: The existing large customer base allows Manila Water to achieve lower per-unit operating costs, a competitive advantage that new entrants would find difficult to match initially.

- Network Effects: A larger customer base enhances the efficiency and reliability of the water network, making it more attractive than smaller, nascent networks.

- Regulatory and Permitting Challenges: Establishing new water infrastructure involves navigating complex regulatory approvals and permits, which can be time-consuming and costly, favoring incumbents with established relationships.

Access to Water Sources and Land

Securing access to reliable raw water sources and the land needed for infrastructure presents a significant barrier for potential new entrants in the water utility sector. Manila Water, as an established concessionaire, has already made substantial investments and secured long-term rights to these vital resources. For instance, by 2023, Manila Water's service area relied on key water sources like the Angat Dam, Ipo Dam, and La Mesa Dam, with extensive pipeline networks already in place. This pre-existing infrastructure and resource control makes it exceptionally difficult for newcomers to replicate the operational capacity and scale required to compete effectively.

The capital expenditure required to acquire or develop comparable water sources and rights-of-way is immense. New players would face lengthy permitting processes, environmental impact assessments, and significant land acquisition costs, all of which add substantial time and financial risk. This creates a natural moat for incumbent utilities like Manila Water, effectively deterring new entrants from challenging their market position.

- Significant upfront investment in water source acquisition and land rights.

- Lengthy regulatory and environmental approval processes for new infrastructure.

- Existing concessionaires like Manila Water possess established rights to critical water sources.

- High costs associated with securing rights-of-way for extensive pipeline networks.

The threat of new entrants for Manila Water is substantially low, primarily due to the immense capital required to establish a competing water utility. Developing the necessary infrastructure, from securing water sources to building extensive distribution networks, demands billions of dollars. For instance, Manila Water's 2024 capital expenditure plan of P26.3 billion highlights the ongoing significant financial commitments in this sector, acting as a strong deterrent.

Exclusive concession agreements with the MWSS are another major barrier, effectively segmenting the market and preventing new companies from entering serviced territories. Manila Water's concession for the East Zone, renewed until 2037, grants it a protected market share, making it incredibly difficult for any new player to gain a foothold without acquiring an existing concession or navigating a complex regulatory overhaul.

Furthermore, the intricate regulatory landscape, encompassing permits, water quality standards, and tariff approvals, poses a significant challenge. Compliance with regulations like the Philippine Clean Water Act necessitates substantial investment in technology and monitoring, favoring established operators with existing systems and expertise.

Manila Water's vast, established infrastructure, including over 7,000 kilometers of water mains, represents a decades-long investment that is prohibitively expensive to replicate. This, combined with network effects where a larger customer base leads to greater efficiency and reliability, creates a robust competitive moat that discourages new entrants.

| Barrier Type | Description | Implication for New Entrants |

| Capital Investment | Building water infrastructure requires billions. Manila Water's 2024 capex of P26.3 billion shows the scale. | Extremely high cost to match existing infrastructure. |

| Concession Agreements | Exclusive rights to serve specific territories granted by MWSS. Manila Water's East Zone concession is until 2037. | Limited market access; new entrants need to secure their own concessions. |

| Regulatory Hurdles | Complex permits, quality standards, and tariff approvals. Compliance with the Clean Water Act is resource-intensive. | Time-consuming and costly to navigate, favoring incumbents. |

| Established Infrastructure | Extensive network of pipes and treatment plants. Over 7,000 km of water mains for Manila Water. | Replication is economically unfeasible for most potential competitors. |

| Resource Access | Secured rights to critical water sources like Angat, Ipo, and La Mesa dams. | New entrants face difficulties acquiring comparable resources and land. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Manila Water is built upon a robust foundation of data from annual reports, industry-specific publications, and regulatory filings. We also incorporate insights from market research firms and macroeconomic databases to ensure a comprehensive understanding of the competitive landscape.