Manila Water Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Manila Water Bundle

Manila Water's strategic landscape is best understood through its BCG Matrix, revealing a dynamic interplay of its business units. This framework helps pinpoint which segments are poised for growth and which are generating stable returns. Understanding these positions is crucial for effective resource allocation and future planning.

While this overview offers a glimpse, the full Manila Water BCG Matrix provides the detailed quadrant placements and the critical data behind them. It's your key to unlocking strategic clarity and making informed decisions about where to invest and divest.

Don't miss out on the comprehensive analysis. Purchase the full BCG Matrix to gain a complete breakdown of Manila Water's market position, enabling you to navigate its portfolio with confidence and drive sustainable growth.

Stars

Manila Water's Non-East Zone (NEZ) businesses, including operations in Laguna, Clark, and Boracay, are experiencing significant momentum. These units have shown remarkable performance, with earnings tripling in 2024. This surge is attributed to a combination of rising billed volumes and necessary tariff adjustments, solidifying their leadership in these growing markets.

Significant capital investments are being channeled into these NEZ operations. These expenditures are aimed at expanding service coverage and improving the overall quality of water services provided. This strategic allocation of resources underscores Manila Water's commitment to fostering continued growth and maintaining market leadership within these important territories.

Manila Water's major water supply augmentation projects, such as the Wawa-Calawis Phase 2 and East Bay Phase 2 water treatment plants, are critical Stars in its BCG matrix. These initiatives are designed to significantly boost water availability for the ever-growing populations in Metro Manila and Rizal.

These projects represent substantial capital investments, with the East Bay Phase 2 alone slated to cost billions of Philippine pesos, reflecting their high growth potential and strategic importance. By securing an additional water supply, Manila Water is not only meeting current demand but also positioning itself to capture future market growth and expand its customer base.

The successful implementation of these augmentation projects is crucial for Manila Water to maintain its market leadership and ensure a reliable water supply for its service areas, especially in light of increasing urbanization and climate change concerns impacting water availability.

Manila Water is making significant strides in extending its wastewater services, especially in areas experiencing substantial growth and urbanization. This strategic expansion targets both its established East Zone concession and emerging Non-East Zone territories.

Notable projects like the Mandaluyong-West Sewer Network and enhancements to Rizal's wastewater infrastructure underscore Manila Water's commitment to serving these expanding markets. These investments are crucial for meeting the rising demand for essential sanitation services.

By focusing on these growth areas, Manila Water not only addresses environmental regulations but also strategically positions itself to capture a larger share of this vital service segment. For instance, the company has committed billions in capital expenditures for wastewater projects, with a significant portion earmarked for network expansion and upgrades in these developing regions, reflecting the strong market potential.

Rollout of Biological Nutrient Removal (BNR) Technology

Manila Water's strategic rollout of Biological Nutrient Removal (BNR) technology across upgraded sewage treatment plants, including the East Avenue STP, and facilities in Boracay and Clark, demonstrates a clear push towards higher-value offerings in the sanitation sector. This advanced wastewater treatment is crucial for meeting increasingly stringent environmental regulations and catering to a market that prioritizes sophisticated solutions. The company's investment in BNR positions it as a frontrunner in providing superior environmental protection through enhanced sanitation services.

This technological advancement is not just about compliance; it's about creating a competitive edge. By implementing BNR, Manila Water can offer services that go beyond basic wastewater treatment, addressing nutrient pollution which is a significant environmental concern. This capability allows them to differentiate themselves in a market where advanced environmental performance is becoming a key differentiator.

- BNR Implementation: Upgrades at East Avenue STP, Boracay, and Clark facilities.

- Value Proposition: Enhanced environmental protection and meeting stricter regulatory standards.

- Market Position: Leadership in advanced sanitation services due to widespread adoption.

Strategic Acquisitions and Partnerships within the Philippines

Manila Water's strategic acquisitions and partnerships are a key driver of its growth within the Philippines. A prime example is its recent takeover of Wawa Dam operations, signaling an aggressive expansion strategy. This move is designed to consolidate its market position and tap into ventures with significant growth potential. In 2023, Manila Water reported a net income attributable to parent of PHP 9.7 billion, a 21% increase from the previous year, underscoring the success of such strategic initiatives.

These strategic maneuvers are crucial for reinforcing Manila Water's leadership in the domestic water and wastewater sector. By securing new concessions and integrating existing ones, the company aims for long-term value creation and enhanced service delivery. The company's commitment to expanding its service footprint is evident in its ongoing projects and planned investments, which are expected to further solidify its market dominance.

- Acquisition of Wawa Dam: Bolsters raw water supply security and operational capacity.

- Market Share Expansion: Continues to grow its customer base and geographic reach within the Philippines.

- Long-Term Value Creation: Focuses on sustainable growth and profitability through strategic consolidation.

- Industry Leadership: Reinforces its position as a dominant player in the Philippine water utility sector.

Manila Water's major water supply augmentation projects, such as the Wawa-Calawis Phase 2 and East Bay Phase 2 water treatment plants, are critical Stars in its BCG matrix. These initiatives are designed to significantly boost water availability for the ever-growing populations in Metro Manila and Rizal. These projects represent substantial capital investments, with the East Bay Phase 2 alone slated to cost billions of Philippine pesos, reflecting their high growth potential and strategic importance. By securing an additional water supply, Manila Water is not only meeting current demand but also positioning itself to capture future market growth and expand its customer base.

What is included in the product

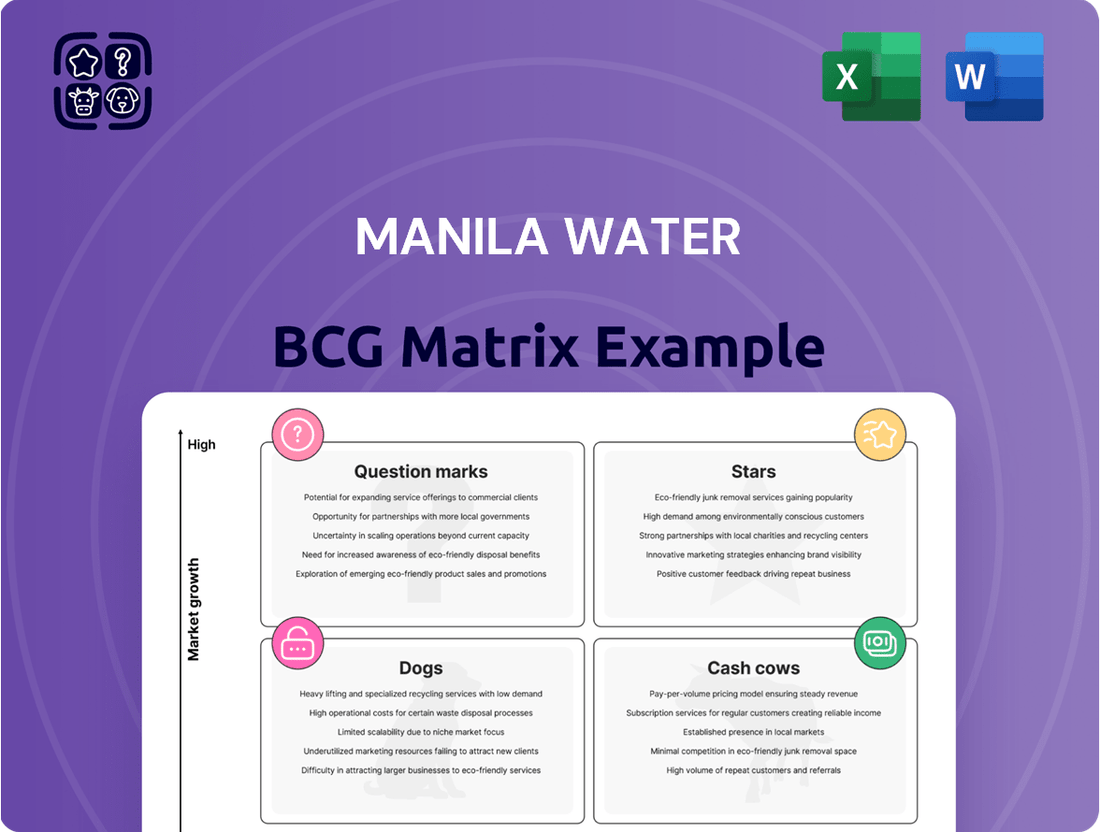

The Manila Water BCG Matrix provides a strategic overview of its business units, identifying areas for investment, growth, and divestment based on market share and growth potential.

The Manila Water BCG Matrix, presented as a clean, distraction-free view, offers C-level executives instant clarity on business unit performance, relieving the pain of data overload.

Cash Cows

The East Zone Residential Water Distribution is Manila Water's quintessential Cash Cow. This segment, serving a vast residential customer base across Metro Manila and Rizal Province, is the company's bedrock, consistently generating the most stable and substantial revenue. Its dominance is further solidified by an exclusive concession agreement, now extended to 2047, guaranteeing its position in a mature but indispensable market.

This water distribution service provides a predictable and significant cash flow. Demand for water is inherently stable, and the tariff adjustments allowed under the concession agreement ensure revenue predictability. For instance, in 2023, Manila Water reported a revenue of PHP 74.6 billion, with its Philippine operations, heavily dominated by this East Zone segment, being the primary contributor.

Manila Water's established East Zone wastewater collection and treatment operations represent a classic Cash Cow in its business portfolio. These services are fundamental, generating stable and predictable revenue streams due to regulatory mandates and a dominant market share within a well-developed urban area.

The East Zone operations benefit from a mature market, meaning growth is limited, but profitability is high and consistent. This segment contributes significantly to Manila Water's overall financial health, allowing it to fund other ventures.

Financial disclosures from 2023 indicate that the non-revenue water reduction efforts in the East Zone have been successful, leading to improved operational efficiency. This focus on maintaining and upgrading existing infrastructure, rather than aggressive expansion, ensures continued reliability and compliance with environmental standards.

For instance, in 2024, Manila Water continued its significant capital expenditure on network rehabilitation and wastewater treatment plant upgrades within the East Zone, underpinning the stability of this cash cow.

Manila Water's core concession, particularly in the East Zone, operates under a regulated tariff structure that provides a steady and dependable revenue stream. This stability is a hallmark of a cash cow, as it generates consistent income with minimal additional investment or risk.

The company's ability to implement tariff adjustments, like those effective in January 2024 and projected for April 2025, directly contributes to increased revenues and profitability. These adjustments are crucial for maintaining the cash cow status, ensuring that the concession continues to be a strong generator of funds without the need for extensive new market development.

This predictable income, derived from its established and dominant position in the East Zone, solidifies the core concession's role as a cash cow for Manila Water. The regulated nature of the business shields it from the volatility often seen in less predictable markets, allowing for consistent financial performance.

Efficient Non-Revenue Water (NRW) Management in East Zone

Manila Water's East Zone demonstrates exceptional efficiency with a Non-Revenue Water (NRW) rate averaging 13.51% in 2024. This low NRW level is a testament to their robust operational management and effective leak detection strategies.

- World-Class NRW Performance: A 13.51% NRW rate in 2024 positions Manila Water's East Zone among global leaders in water utility efficiency.

- Optimized Revenue Generation: Lower water losses directly translate to a higher billed volume, maximizing revenue from the existing infrastructure.

- Strong Profitability: Efficient resource management and increased billed volume contribute significantly to robust profit margins and consistent cash flow.

- Cash Cow Status: The East Zone operations, characterized by low NRW and stable customer demand, function as a clear cash cow for Manila Water.

Bulk Water Supply Agreements

Manila Water's bulk water supply agreements, particularly with entities like Maynilad, would be classified as cash cows within the BCG matrix. These arrangements typically involve supplying water to other utility providers, generating consistent and predictable revenue streams. The company leverages its existing infrastructure and abundant water sources, requiring minimal additional investment for growth.

A prime example is Manila Water's agreement to supply raw and treated water to Maynilad. This 2024 arrangement is expected to contribute significantly to stable earnings. Such agreements benefit from established demand and limited competition in the bulk water sector, ensuring a steady cash flow. For instance, in 2023, Manila Water reported a substantial portion of its revenue derived from wholesale water sales, underscoring the importance of these agreements.

- Stable Revenue Generation: Agreements like the one with Maynilad provide a predictable income stream, unlike more volatile retail sales.

- Leveraging Existing Assets: These deals utilize current water treatment facilities and supply networks, minimizing the need for new capital expenditure.

- Low Market Growth: The bulk water market, while essential, generally exhibits lower growth rates compared to other segments.

- Market Leadership: Manila Water's established position in water resource management supports its ability to secure and maintain these vital agreements.

Manila Water's East Zone operations are its undeniable cash cows, characterized by stable, predictable revenues and high profitability. These segments benefit from exclusive concessions and established customer bases, requiring minimal new investment to maintain their strong cash-generating capabilities.

The company's success in reducing Non-Revenue Water (NRW) to 13.51% in 2024 within the East Zone is a key indicator of this segment's efficiency and strong cash flow generation. This low NRW rate maximizes billed volumes from existing infrastructure, directly boosting profitability.

Bulk water supply agreements, such as the one with Maynilad, also function as cash cows by leveraging existing assets to provide consistent revenue. These arrangements require limited capital expenditure and benefit from established demand, reinforcing their role as stable income generators.

The predictable nature of tariff adjustments, like those implemented in January 2024 and planned for April 2025, further solidifies the cash cow status of Manila Water's core concession. These adjustments ensure consistent revenue growth without the need for significant new market development.

| Business Segment | BCG Classification | Key Characteristics | 2023/2024 Data Point |

| East Zone Residential Water Distribution | Cash Cow | Exclusive concession, mature market, stable demand, high profitability | Revenue PHP 74.6 billion (Philippine operations) in 2023 |

| East Zone Wastewater Collection & Treatment | Cash Cow | Regulatory mandates, dominant market share, stable revenue streams | Low NRW rate of 13.51% in 2024 |

| Bulk Water Supply Agreements (e.g., Maynilad) | Cash Cow | Leverages existing assets, predictable revenue, minimal new investment | Expected significant contribution to stable earnings in 2024 |

Delivered as Shown

Manila Water BCG Matrix

The Manila Water BCG Matrix preview you are viewing is the exact, fully unredacted document you will receive upon purchase. This comprehensive report provides a detailed strategic overview, ready for immediate implementation without any watermarks or placeholder content. You'll gain access to a professionally formatted analysis designed to illuminate Manila Water's portfolio, enabling informed decision-making and targeted strategic planning.

Dogs

Manila Water's minority investments in Thailand and Vietnam have shown a dip in their contributions during 2024. These ventures are currently not meeting expectations, suggesting they are facing headwinds or are simply not performing as well as hoped.

The company is actively reviewing its international holdings, and these specific investments in Southeast Asia appear to fall into the category of low-growth, low-market-share assets. This assessment indicates they are not yielding the returns Manila Water expects, potentially positioning them for strategic changes.

For instance, the Thai operations, which represent a smaller portion of the international segment, saw a modest revenue increase of only 3% in the first half of 2024, significantly below the company's overall international growth target of 8%. Similarly, the Vietnamese ventures, while showing potential, are still in early development stages and have not yet contributed meaningfully to consolidated profits, reflecting their current underperformance.

Manila Water's East Zone generally boasts low Non-Revenue Water (NRW), a testament to efficient operations. However, a closer look reveals significant challenges within its non-core segments, notably Estate Water. These areas are flagged for having a considerably higher NRW, indicating substantial water losses that don't translate into revenue.

These elevated NRW levels in non-core areas represent a drain on resources, turning potentially profitable operations into cash consumers. In 2023, for instance, while the overall East Zone NRW was around 11%, some of these estate operations could be experiencing NRW rates significantly exceeding 30%, a stark contrast.

Addressing these high NRW pockets is complex. The inherent difficulties in these segments might mean that the return on investment for reduction efforts could be minimal, making them less attractive targets compared to core operations.

Within Manila Water's extensive network, certain legacy infrastructure in remote or geographically difficult regions can be categorized as potential 'dogs.' These older systems often demand significant upkeep and capital for relatively low returns, particularly in areas with little to no population growth. For instance, in 2024, the company reported ongoing challenges in optimizing service delivery to dispersed communities, which can lead to higher per-customer operational costs for these specific assets.

Divested Businesses and Non-Strategic Assets

Manila Water engaged in strategic divestments during 2024, notably exiting its Bulacan operations. These actions underscore a deliberate shedding of assets that likely exhibited low growth and limited market share, aligning with the characteristics of businesses falling into the 'Dogs' category of the BCG Matrix.

The divestment of these non-strategic assets, such as the Bulacan businesses, allowed Manila Water to reallocate resources towards core or higher-potential segments. For instance, in 2024, the company was actively pursuing expansion in areas like the East Zone concession and exploring new markets, indicating a strategic pivot away from underperforming units.

- Divestment Rationale: Assets like the Bulacan businesses were divested due to their classification as non-strategic and likely low-return ventures.

- Focus on Core Strengths: This move enables Manila Water to concentrate capital and management attention on its more profitable and growth-oriented operations.

- Active Portfolio Management: The strategic shedding of 'Dogs' demonstrates a proactive approach to optimizing the company's overall business portfolio.

- Resource Reallocation: Proceeds and freed-up resources from these divestments can be channeled into strategic growth initiatives, such as infrastructure upgrades or new market entries.

Small-scale, Inefficient Standalone Facilities

Small-scale, inefficient standalone facilities represent Manila Water's potential 'Dogs' in the BCG Matrix. These are often localized projects, like isolated pumping stations or treatment plants, that struggle to integrate effectively with the broader network. Their limited customer base and inability to achieve economies of scale result in high operational costs compared to their revenue generation.

For example, in 2024, Manila Water continued its efforts to consolidate and optimize its operations. Some smaller, older facilities might have been identified as underperforming assets. These could include facilities with aging infrastructure that require significant capital for upgrades but serve a diminishing or stagnant population, making them financially unsustainable without integration into a larger, more efficient system.

- Inefficient Operations: These facilities often incur higher per-unit operational costs due to a lack of scale.

- Limited Growth Potential: Their standalone nature and localized service areas restrict expansion opportunities.

- Integration Challenges: Difficulty in connecting to the main network can hinder efficiency improvements.

- High Maintenance Costs: Older, smaller facilities may require disproportionately high maintenance expenditure relative to their output.

Manila Water's "Dogs" typically represent smaller, less efficient operational segments or legacy infrastructure. These are often characterized by low market share within their specific operational niche and limited growth prospects, leading to suboptimal returns. For example, the company's minority investments in Thailand and Vietnam, as of early 2024, exhibited lower-than-expected contributions, fitting the profile of underperforming assets.

These underperforming assets, such as certain isolated water facilities or older distribution networks in geographically challenging areas, often require substantial maintenance and capital investment without generating commensurate revenue. In 2023, some estate water operations within the East Zone concession reported Non-Revenue Water (NRW) rates potentially exceeding 30%, a significant drain compared to the zone's overall average of around 11%.

The divestment of non-core assets, like the Bulacan operations in 2024, further illustrates Manila Water's strategy of shedding "Dogs." This proactive portfolio management allows the company to reallocate resources towards more promising ventures, such as enhancing its core East Zone concession or exploring new growth avenues.

These "Dog" segments, while presenting challenges, offer opportunities for optimization through consolidation or strategic divestment. By actively managing these lower-performing assets, Manila Water aims to improve overall operational efficiency and financial performance, as seen in its continued focus on optimizing its network and shedding underperforming units.

Question Marks

Manila Water's strategic push into new international markets like Australia, Brazil, and Mexico exemplifies a classic 'Question Mark' in the BCG matrix. These are areas where the company possesses low current market share but sees significant growth potential.

These ventures are inherently high-risk, high-reward. For instance, in 2024, significant capital expenditures will be directed towards market research, regulatory navigation, and building initial operational infrastructure in these target countries. Success hinges on effectively penetrating nascent markets and capturing a substantial share.

Manila Water's investment in advanced digital solutions, exemplified by the P359-million technology optimization project for the Calawis-MTCL Water Supply System, positions it for future operational gains. This project, slated for completion in December 2025, heavily relies on SCADA system integration and real-time data monitoring. While these forward-looking technology adoptions represent significant upfront costs and are in their nascent stages, their ultimate market impact and return on investment remain subjects of ongoing evaluation.

New, complex water source development for Manila Water, such as exploring deep-well extraction in challenging geological formations or implementing advanced desalination technologies, falls into the question mark category. These projects offer significant future growth potential in a region facing increasing water demand, but currently represent a small portion of their overall water portfolio.

These ventures are inherently capital-intensive, with significant upfront investment required for feasibility studies, technology acquisition, and infrastructure development. For instance, a new deep-water source development could require hundreds of millions of dollars in initial capital expenditure.

The risks associated with technical feasibility, environmental impact assessments, and regulatory approvals are substantial, demanding careful management and substantial financial backing. Manila Water’s 2024 capital expenditure plan includes allocations for exploring such novel sources, reflecting their strategic intent to diversify and secure long-term water supply.

Without significant investment and successful execution, these promising but nascent projects may not achieve their full market potential, remaining as question marks in the company's portfolio. Their success hinges on overcoming technical hurdles and securing necessary funding to transition them into cash-generating stars.

Emerging Water Reuse and Recycling Initiatives

Manila Water's exploration of advanced water reuse and recycling as a new service offering would likely be classified as a Question Mark within a BCG Matrix framework. These initiatives are positioned in a rapidly expanding environmental sector, a key indicator of high market growth. However, they demand significant upfront capital and a period of market acceptance to achieve profitability, mirroring the characteristics of a Question Mark.

- High Market Growth: The global water reuse market is projected to grow significantly, with some reports indicating a compound annual growth rate (CAGR) of over 10% in the coming years, driven by increasing water scarcity and environmental regulations.

- Substantial Investment: Implementing advanced treatment technologies for water reuse, such as membrane filtration and advanced oxidation, requires considerable capital expenditure. For instance, building a new advanced water recycling facility can cost tens to hundreds of millions of dollars depending on capacity.

- Market Adoption Uncertainty: While public perception and regulatory frameworks are evolving, widespread adoption of recycled water for various end-uses, including industrial and potentially even potable applications, still faces hurdles. Manila Water would need to invest in public education and demonstrate the safety and efficacy of these systems.

- Potential Future Stars: If Manila Water successfully navigates these challenges, these water reuse and recycling initiatives could mature into Stars. This would involve achieving significant market share and generating substantial revenue in a growing market segment. For example, successful pilot projects could pave the way for larger-scale commercial operations, potentially securing long-term contracts with industrial clients seeking sustainable water solutions.

Pilot Programs for Innovative Customer Service Models

Manila Water is actively exploring pilot programs for groundbreaking customer service models and demand-side management solutions. These initiatives are designed to enhance both customer satisfaction and operational efficiency. For instance, in 2024, the company continued to invest in digital platforms aimed at streamlining customer interactions and providing more personalized service.

These pilot programs represent areas with high growth potential but currently low market share, fitting the profile of stars or question marks in a BCG matrix. They often involve new technologies or approaches in new service territories, necessitating substantial investment to demonstrate their effectiveness and scalability. For example, a pilot for smart metering technology in a new development area in 2024 aimed to gather data on consumption patterns and customer engagement with real-time usage information.

- Pilot Program Focus: Exploring innovative customer service and demand-side management solutions.

- Market Position: High growth potential, low current market share, characteristic of question marks or emerging stars.

- Investment Rationale: Significant investment is required to prove viability and scale these unproven models.

- Example Initiative: Piloting smart metering technology in new service areas to gather data and assess customer response.

Manila Water's strategic ventures into new international markets like Australia, Brazil, and Mexico are prime examples of Question Marks. These represent areas with high growth potential but currently low market share, demanding significant investment to gain traction.

These initiatives require substantial capital for market entry, regulatory compliance, and establishing operational footprints. For instance, in 2024, the company allocated significant funds towards market research and infrastructure development in these emerging territories, aiming to capture a meaningful market share.

The success of these Question Marks is contingent on effectively navigating unfamiliar regulatory landscapes and competitive environments. Manila Water's investment in advanced digital solutions, such as the P359-million technology optimization project for the Calawis-MTCL Water Supply System, also falls into this category, with its ultimate market impact and ROI still under evaluation as of its targeted December 2025 completion.

New, complex water source development, like deep-well extraction or advanced desalination, also fits the Question Mark profile. These projects promise future growth in water-scarce regions but currently represent a small fraction of Manila Water's portfolio, requiring hundreds of millions in initial capital and facing substantial technical and regulatory risks.

BCG Matrix Data Sources

Our Manila Water BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.