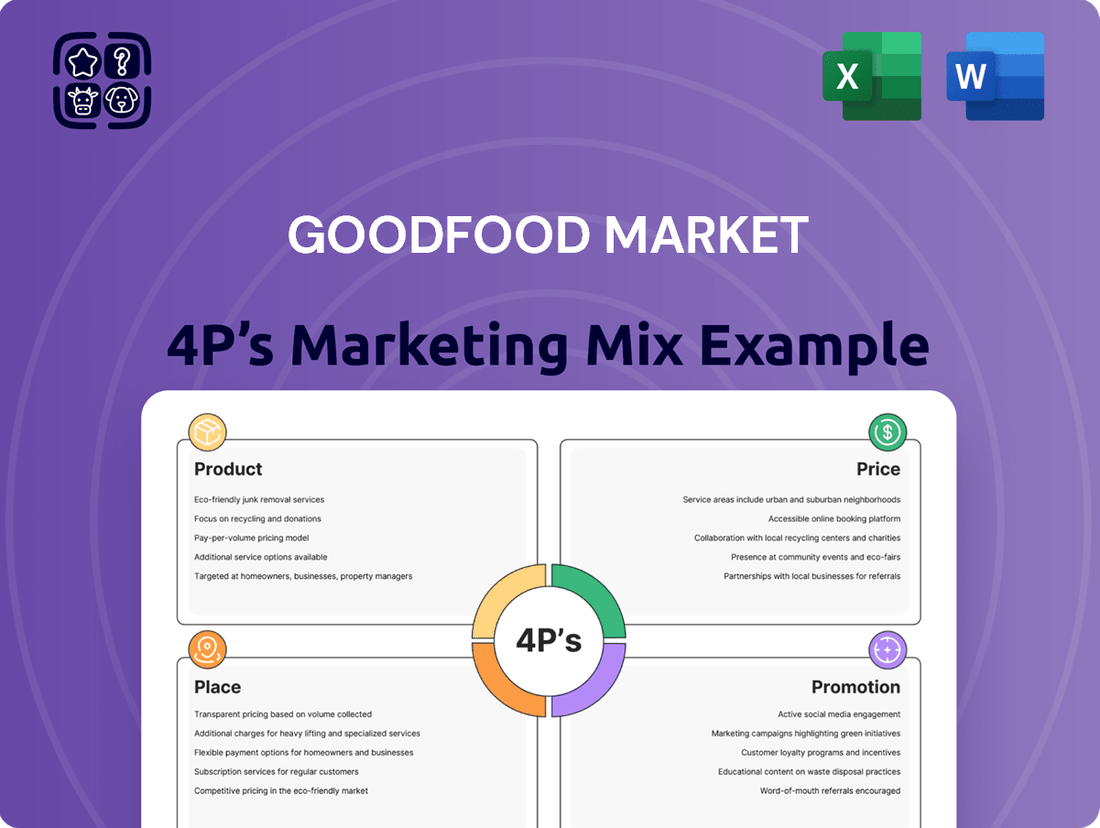

Goodfood Market Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodfood Market Bundle

Goodfood Market excels by offering convenient, pre-portioned meal kits that cater to busy lifestyles. Their product strategy focuses on quality ingredients and diverse culinary options, ensuring customer satisfaction and repeat business.

Their pricing is competitive, reflecting the value of convenience and premium ingredients, with subscription models offering further savings. This thoughtful pricing structure attracts a broad customer base while maintaining profitability.

Goodfood's distribution strategy leverages a direct-to-consumer online model, ensuring fresh products reach customers efficiently across various regions. This direct approach minimizes intermediaries and enhances control over the customer experience.

Promotional efforts include targeted digital advertising, social media engagement, and referral programs, effectively building brand awareness and customer loyalty. These tactics highlight the ease and enjoyment of their meal kit service.

Want to understand how Goodfood Market masterfully orchestrates its Product, Price, Place, and Promotion strategies?

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

Goodfood's central product is its subscription-based meal kit service, providing pre-portioned ingredients for chef-designed recipes. This offering targets convenience, reducing food waste by up to 25% for subscribers, and delivering a superior home-cooking experience. The product strategy emphasizes variety, with new recipes offered weekly to maintain customer engagement and cater to diverse culinary tastes. Goodfood continues to innovate, aiming to expand its meal kit offerings in 2024-2025 to capture a larger share of the evolving Canadian food market.

Goodfood has significantly expanded its product offering beyond traditional meal kits, evolving into a more comprehensive online grocery provider. This strategic shift includes a wider range of add-on products such as breakfast items, snacks, and essential grocery staples available for delivery. The diversification aims to increase the average order value, with Goodfood reporting a focus on expanding its grocery selection to capture a larger share of the customer's total food budget, targeting enhanced customer lifetime value by late 2024.

Recognizing the evolving demand for even faster meal solutions, Goodfood has strategically introduced ready-to-eat offerings, notably their Heat & Eat line. These pre-cooked meals require minimal preparation, directly addressing consumers seeking maximum convenience. This expansion broadens Goodfood's market reach beyond traditional meal kits, tapping into a segment valued at an estimated CAD 1.5 billion in Canada for prepared meals by 2025. The Heat & Eat products aim to capture a significant share of this growth by catering to time-pressed individuals and households. Goodfood's focus on this category aligns with broader industry trends towards convenience and ease of consumption.

Line Acquisitions

Goodfood's product strategy actively incorporates strategic line acquisitions to quickly expand into new market segments. The recent acquisition of Genuine Tea, completed in late 2023, marks a pivotal move to build a portfolio of high-growth, next-generation food and beverage brands, adding an estimated 500+ SKUs. This approach allows Goodfood to integrate established, high-margin products, like specialty teas with a 65% gross margin, directly onto its platform, leveraging cross-promotional opportunities across its existing 150,000+ active subscribers as of Q1 2024, enhancing overall product appeal and revenue streams.

- Genuine Tea acquisition completed in late 2023.

- Added over 500 SKUs to Goodfood's product catalog.

- Genuine Tea boasts an approximate 65% gross margin.

- Leverages Goodfood's 150,000+ active subscribers for cross-promotion as of Q1 2024.

Focus on Quality and Sustainability

Goodfood Market significantly emphasizes ingredient quality and sustainable practices, which are central to its brand identity. The company achieved B Corp certification in late 2023, underscoring its commitment to high social and environmental standards for its meal kits and grocery items. This focus on ethical sourcing and sustainability serves as a key differentiator, appealing to a growing segment of conscious consumers whose purchasing decisions are increasingly influenced by environmental impact. Goodfood aims to divert 75% of its packaging waste from landfills by 2025, a goal that resonates with its customer base.

- Goodfood’s B Corp certification in Q4 2023 reinforces its sustainable sourcing.

- The company targets 75% packaging waste diversion by 2025.

- Sustainable practices attract environmentally conscious consumers.

- Quality ingredients remain a core competitive advantage.

Goodfood Market's product strategy is centered on its evolving meal kit service, significantly expanded by late 2024 to include comprehensive online grocery and ready-to-eat solutions like Heat & Eat, targeting Canada's CAD 1.5 billion prepared meal segment by 2025. Strategic acquisitions, such as Genuine Tea in late 2023, have added over 500 SKUs, boasting a 65% gross margin. The company also emphasizes quality and sustainability, evidenced by its B Corp certification in late 2023 and a 2025 goal to divert 75% of packaging waste. This diversification leverages 150,000+ active subscribers (Q1 2024) to enhance customer lifetime value.

| Product Category | Key Offering | 2024-2025 Focus |

|---|---|---|

| Core Meal Kits | Subscription-based, pre-portioned ingredients | Continued variety, market share growth |

| Grocery Expansion | Breakfast, snacks, staples, add-ons | Increased average order value by late 2024 |

| Ready-to-Eat | Heat & Eat line (pre-cooked meals) | Capture CAD 1.5B market by 2025 |

| Strategic Acquisitions | Genuine Tea (500+ SKUs, 65% gross margin) | Leverage 150,000+ subscribers (Q1 2024) |

| Sustainability | B Corp certified (late 2023), ethical sourcing | 75% packaging waste diversion by 2025 |

What is included in the product

This analysis provides a comprehensive deep dive into Goodfood Market's Product, Price, Place, and Promotion strategies, offering actionable insights for marketers and managers.

It uses actual brand practices and competitive context to ground the analysis in reality, making it ideal for benchmarking or strategy development.

Simplifies Goodfood's marketing strategy, highlighting how each P addresses customer pain points like time constraints and meal planning stress.

Offers a clear, actionable overview of Goodfood's 4Ps, demonstrating how they collectively solve customer frustrations in the meal kit market.

Place

Goodfood Market primarily distributes its meal kits and groceries through its direct-to-consumer digital platform, accessible via its website and mobile application. This e-commerce model removes the need for traditional retail overhead, fostering a direct relationship with its substantial customer base. The digital platform serves as the central hub for customers to place orders, manage their subscriptions, and interact directly with Goodfood. As of early 2024, this efficient digital channel continues to be critical for Goodfood, which reported a shift in focus to profitability and customer retention within this streamlined distribution framework.

Goodfood Market operates a robust national distribution network, leveraging multiple production and fulfillment centers strategically located across Canada. These key facilities, including sites in Quebec, Ontario, and Alberta, are essential for efficient operations. This decentralized infrastructure is critical for ensuring the timely delivery of fresh meal kits and grocery items to customers nationwide. It enables Goodfood to effectively reach approximately 95% of the Canadian population, maintaining a broad market presence as of early 2025.

Goodfood Market's core place strategy centers on its direct-to-consumer home delivery service, bringing meal kits and groceries directly to customers' doorsteps. This model provides ultimate convenience, a key component of its value proposition in the competitive e-commerce grocery space. The company continuously optimizes its logistics network to enhance delivery speed and reliability across Canada, aiming for efficient last-mile operations. Goodfood has reported maintaining high on-time delivery rates, often exceeding 98% in fiscal Q2 2024, ensuring customer satisfaction and operational efficiency. This robust delivery infrastructure is critical for Goodfood's market penetration and customer retention.

On-Demand Delivery in Urban Centers

Goodfood has explored on-demand, 30-minute delivery in urban centers like Montreal and Toronto, leveraging micro-fulfillment centers. This strategy, aiming for immediate consumption needs, directly competes with established food delivery apps and convenience stores. It broadens Goodfood's reach beyond its core weekly meal kit deliveries, targeting impulse purchases and diverse usage occasions.

- Goodfood's Q3 2024 results indicated a focus on efficiency, crucial for expanding such rapid delivery models.

- The on-demand service addresses a distinct consumer need, separate from planned grocery trips.

- This initiative diversifies revenue streams beyond the declining meal kit subscription segment.

- Goodfood faces intense competition from larger players like Uber Eats and SkipTheDishes in urban rapid delivery.

Digital User Experience Enhancements

Goodfood Market's digital platform is a crucial aspect of its Place strategy, focusing on enhancing the customer journey. The company invests in user experience to reduce friction and improve ease-of-use, aiming to boost customer retention and average order values. Features like protein customization and a streamlined ordering process are key. For instance, Goodfood reported a 7.4% sequential increase in active customers in Q1 2024, partly attributed to improved digital engagement.

- Digital platform improvements target reduced churn rates.

- Seamless ordering aims to increase average order value per customer.

- Customization features enhance user satisfaction and loyalty.

- Q1 2024 saw a sequential active customer increase to 116,000.

Goodfood Market primarily utilizes a direct-to-consumer digital platform for distribution, supported by a robust national network of fulfillment centers across Canada. This infrastructure enables efficient home delivery to approximately 95% of the Canadian population by early 2025, ensuring convenience. The company also explores rapid 30-minute urban delivery from micro-fulfillment centers, diversifying its service beyond weekly kits. Digital platform enhancements, like those contributing to a 7.4% active customer increase in Q1 2024, are crucial for retention and order value.

| Aspect | Key Metric | Data Point |

|---|---|---|

| Market Reach | Canadian Population Coverage | ~95% (early 2025) |

| Delivery Efficiency | On-time Delivery Rate | >98% (Fiscal Q2 2024) |

| Digital Engagement | Active Customer Growth | +7.4% Seq. (Q1 2024) |

Full Version Awaits

Goodfood Market 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence. This comprehensive Goodfood Market 4P's Marketing Mix Analysis delves into Product, Price, Place, and Promotion strategies. Understand how Goodfood positions its meal kit offerings, competitive pricing structures, efficient distribution channels, and targeted marketing campaigns. This document equips you with a clear understanding of their market approach.

Promotion

Goodfood employs a robust digital marketing strategy for customer acquisition, leveraging social media advertising, search engine marketing, and targeted email campaigns. The company strategically used incentives and promotions to attract initial users, contributing to its growth in previous years. However, reflecting a shift in strategy towards profitability, Goodfood has significantly reduced promotional spend, with marketing and selling expenses dropping to $11.6 million in Q3 2024 from $15.5 million in Q3 2023. This pivot aims to focus on acquiring and retaining more profitable customers, optimizing long-term value over sheer volume.

Goodfood Market leverages robust referral and loyalty programs as a cornerstone of its promotional strategy, recognizing that word-of-mouth and customer retention are vital for subscription models. These initiatives encourage existing members to refer new customers, often through credit-based incentives, effectively reducing customer acquisition costs. By focusing on engaging their most loyal subscribers, Goodfood aims to drive sustainable growth and enhance the lifetime value of each customer. This strategy is critical as Goodfood reported a significant reduction in marketing spend in Q1 2024, emphasizing efficient, retention-focused growth.

Goodfood Market actively invests in content marketing, providing diverse recipes and culinary inspiration to position itself as a trusted food brand. Recent campaigns, such as their 2024 push emphasizing convenience, aimed to forge an emotional connection, highlighting joy and stress relief from meal preparation. This strategy builds brand equity beyond just functional benefits, contributing to increased customer engagement and a loyal subscriber base, which Goodfood reported at approximately 120,000 active subscribers as of early 2025.

Strategic Partnerships and Public Relations

Goodfood actively uses strategic partnerships to broaden its market reach and product offerings, notably through its collaboration with gourmet grocer Pusateri's, which enhances its premium segment appeal. Public relations efforts are key for announcing significant corporate milestones, such as its B Corp certification in late 2023, and communicating financial results to maintain investor confidence. This consistent communication strategy, alongside partnerships, is vital for building brand credibility and visibility in the competitive meal kit and grocery delivery market as Goodfood aims for sustainable profitability into fiscal year 2025.

- Goodfood's partnership with Pusateri's expands its premium grocery offerings.

- Public relations highlights milestones like its late 2023 B Corp certification.

- Financial results communications maintain transparency with stakeholders.

- These strategies boost brand visibility and market credibility for Goodfood.

Seasonal Campaigns and s

Goodfood Market strategically aligns its promotional activities with seasonal consumer behaviors. Marketing efforts typically intensify during key periods like the back-to-school season, observed in Q1 2025, to attract families seeking convenient meal solutions. However, the company faces reduced demand during winter holidays and summer months, which historically impact Q3 and Q4 2024 sales by up to 15% compared to peak periods. To counteract these seasonal dips, Goodfood implements targeted promotions, such as exclusive summer bundles or holiday discounts, aiming to sustain customer engagement and revenue streams.

- Q1 2025 saw increased marketing for back-to-school meal kits.

- Sales in Q3 2024 and Q4 2024 experienced seasonal declines.

- Goodfood offered targeted summer 2024 promotions to mitigate dips.

- Strategic discounts are crucial for maintaining engagement during off-peak times.

Goodfood Market's promotion strategy in 2024-2025 prioritizes profitable growth, significantly reducing marketing spend to $11.6 million in Q3 2024 from $15.5 million in Q3 2023. The company leverages digital marketing, robust referral programs, and content focused on convenience, engaging approximately 120,000 active subscribers by early 2025. Strategic partnerships, like the one with Pusateri's, and public relations efforts for milestones such as its late 2023 B Corp certification, enhance brand visibility. Seasonal promotions, especially during Q1 2025 for back-to-school, mitigate demand fluctuations observed in Q3 and Q4 2024.

| Metric | Q3 2023 | Q3 2024 | Early 2025 |

|---|---|---|---|

| Marketing & Selling Expenses | $15.5M | $11.6M | N/A |

| Active Subscribers | N/A | N/A | 120,000 |

| B Corp Certification | N/A | Late 2023 | N/A |

Price

Goodfood's core pricing model is subscription-based, with costs varying significantly based on the number of meals and servings selected weekly, ranging from approximately C$8.99 to C$11.99 per serving in early 2025, depending on the plan size. This tiered approach is crucial for generating consistent recurring revenue streams, essential for their financial stability. To address market price sensitivity and attract new customers, Goodfood introduced a 'Value Plan' offering lower-cost entry points, which helped broaden its customer base amid competitive pressures in 2024.

Goodfood Market employs a competitive pricing strategy, aligning its meal-kit costs with rivals like HelloFresh and the average grocery spend, which was approximately C$215 per Canadian household in early 2025. The company emphasizes its value proposition through convenience, reduced food waste, and high-quality ingredients. Strategic pricing optimization has significantly contributed to improving Goodfood's gross margin, reaching 23.4% in its Q1 2025 results, reflecting efficient cost management and consumer value. This approach aims to attract and retain customers by balancing affordability with premium service.

Goodfood has strategically pivoted towards profitability and enhanced unit economics, shifting focus from rapid growth. This involves refined pricing strategies and reduced promotional spending, aiming to attract and retain higher-value customers. For Q2 fiscal 2024, net sales per active customer climbed to $427, up from $419 in Q2 fiscal 2023, despite active customers decreasing to approximately 86,000. This deliberate approach prioritizes sustainable financial health over sheer customer volume.

Dynamic Pricing and Add-Ons

Goodfood's pricing strategy effectively leverages dynamic pricing to increase basket size by offering add-on grocery items and premium recipe options. Customers frequently upgrade their weekly meal kits or include additional products, a key driver for enhanced revenue per customer. This approach successfully boosted average order value to approximately $68 CAD in Q1 2025, reflecting strong customer uptake of these flexible offerings.

- Average order value reached $68 CAD in Q1 2025.

- Add-on sales significantly contribute to revenue growth.

- Premium recipe options drive higher basket sizes.

Flexible, No-Commitment Model

Goodfood Market employs a flexible, no-commitment model, which is a core part of its pricing strategy and value proposition. While operating as a subscription service, customers can easily skip weekly deliveries or cancel their subscription without incurring any penalties. This low-commitment approach significantly reduces the barrier to entry, attracting new customers who might otherwise hesitate to commit to long-term plans.

This flexibility has been crucial for Goodfood, especially as the meal kit market sees fluctuating demand, with customer retention rates often a key metric. The ability to pause or cancel without friction supports customer acquisition by alleviating initial apprehension.

- Goodfood's Q3 2024 results indicate a strategic focus on customer retention through service adaptability.

- The low-commitment model is a direct response to consumer demand for convenience and control over recurring services.

- Flexible options contribute to a lower customer acquisition cost by converting hesitant prospects more readily.

Goodfood's pricing strategy employs a tiered, subscription model, with costs from C$8.99 to C$11.99 per serving in early 2025, alongside a 'Value Plan' for broader appeal. This competitive approach, combined with dynamic pricing for add-ons, increased average order value to C$68 in Q1 2025 and improved gross margin to 23.4%. The flexible, no-commitment model significantly reduces customer acquisition barriers, prioritizing sustainable profitability and retention.

| Metric | 2024/2025 Data | Description |

|---|---|---|

| Per Serving Cost | C$8.99 - C$11.99 | Early 2025, based on plan size |

| Gross Margin | 23.4% | Q1 2025 result, reflecting efficiency |

| Average Order Value | C$68 | Q1 2025, driven by add-ons |

| Net Sales Per Active Customer | C$427 | Q2 fiscal 2024, up from C$419 |

4P's Marketing Mix Analysis Data Sources

Our Goodfood Market 4P's analysis is grounded in a comprehensive review of their corporate website, investor relations materials, and publicly available financial reports. We also incorporate insights from industry publications and competitive landscape analyses to ensure accuracy and relevance.