Goodfood Market Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goodfood Market Bundle

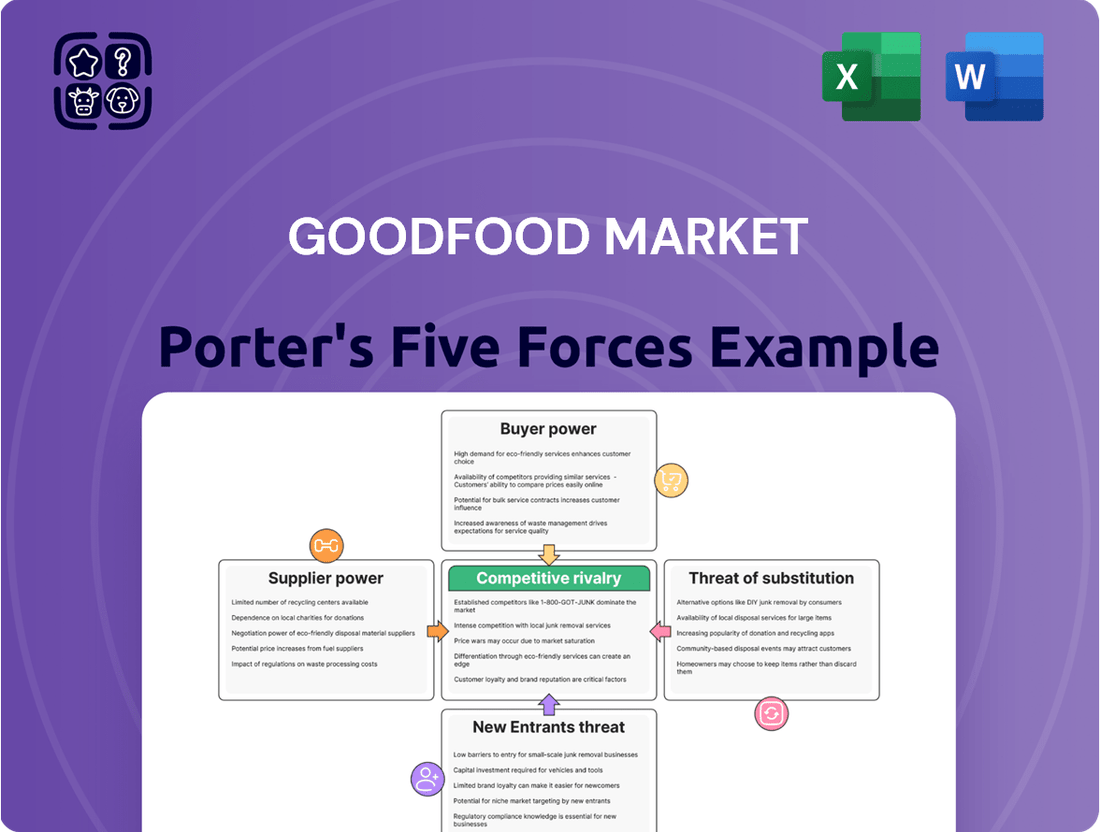

Goodfood Market navigates a dynamic landscape shaped by several key competitive forces. Understanding the intensity of rivalry among meal kit providers and the bargaining power of both suppliers and customers is crucial for their success. The threat of new entrants and the availability of substitutes also present significant challenges.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Goodfood Market’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Goodfood Market sources its diverse ingredients from a highly fragmented agricultural supply base, involving numerous farmers and food producers. This widespread network typically minimizes the bargaining power of any single supplier, as Goodfood maintains flexibility to switch providers. Despite this, the company's strong emphasis on fresh, local, and organic produce can create specific dependencies on a limited number of suppliers who consistently meet these stringent quality and sustainability requirements, impacting procurement dynamics in 2024.

Goodfood Market relies significantly on suppliers for specialized inputs beyond raw food, including temperature-controlled packaging and third-party logistics for delivery. These niche suppliers, especially in 3PL and advanced packaging solutions, often hold concentrated power due to their specialized services. For instance, in fiscal year 2024, rising logistics costs across the industry could directly impact Goodfood's gross margins. Disruptions or price escalations from these key partners can substantially increase Goodfood’s operational expenses and affect its ability to maintain competitive pricing.

The prices of essential raw food ingredients are highly susceptible to market fluctuations, driven by factors like adverse weather, varying crop yields, and broader economic shifts. This inherent volatility directly impacts Goodfood Market’s cost of goods sold, posing a significant challenge to profitability. For instance, global food commodity prices, while easing from 2022 peaks, remained elevated through early 2024, influencing Canadian grocery costs. Although Goodfood can absorb minor fluctuations, substantial and sustained price increases from suppliers, such as those seen with dairy or fresh produce, will inevitably compress operating margins or necessitate price adjustments for customers to maintain financial viability.

Supplier Relationships for Quality

Goodfood Market cultivates strong relationships with its partner farms and suppliers to ensure a consistent supply of high-quality, fresh ingredients. This collaborative approach, while vital for quality control and marketing, can sometimes empower suppliers who consistently meet Goodfood's stringent standards. However, Goodfood's substantial purchasing volume, which saw its active subscriber count reach 142,000 as of early 2024, provides significant counter-leverage, balancing the supplier's power.

- Goodfood prioritizes long-term supplier partnerships for consistent quality.

- Reliable suppliers gain some leverage due to their consistent performance.

- Goodfood's large procurement volume mitigates supplier bargaining power.

- Active subscriber base of 142,000 in early 2024 underscores purchasing scale.

Consolidation and Strategic Sourcing

While agricultural production at the farm level remains fragmented, certain segments of food processing and distribution are significantly more consolidated, giving those suppliers substantial leverage. Goodfood Market mitigates this by diversifying its menu and ingredient sourcing, allowing flexibility to shift away from powerful intermediaries. The company's strategy, particularly in 2024, focuses on direct relationships with partner farms, reducing reliance on consolidated distribution channels. This direct-to-consumer model enhances their bargaining position.

- Goodfood's direct sourcing from over 200 partner farms as of late 2023 reduces intermediary power.

- The Canadian food processing sector, with key players, can exert pressure on smaller buyers.

- Goodfood's diversified ingredient list, including over 1,000 unique SKUs, provides sourcing flexibility.

- The company's focus on local and seasonal ingredients further supports supplier diversification.

Goodfood Market navigates moderate supplier power; while its fragmented raw material base generally limits individual supplier leverage, specialized logistics and packaging providers hold more concentrated influence. Rising logistics costs in 2024 and volatile food commodity prices directly pressured Goodfood's margins. However, Goodfood's significant purchasing volume, supported by 142,000 active subscribers in early 2024, and its strategy of direct farm relationships, help mitigate overall supplier bargaining power.

| Supplier Type | Power Dynamic | 2024 Context/Data |

|---|---|---|

| Raw Material Suppliers | Fragmented, generally low power | Global food commodity prices elevated early 2024 |

| Specialized Suppliers (3PL, Packaging) | Concentrated, higher power | Rising logistics costs directly impact margins |

| Goodfood's Counter-Leverage | High purchasing volume | 142,000 active subscribers (early 2024) |

| Direct Sourcing | Reduces intermediary power | Over 200 partner farms (late 2023) |

What is included in the product

This analysis dissects Goodfood Market's competitive environment, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the meal kit industry.

Instantly visualize the competitive landscape and identify key threats to Goodfood Market's strategy with a powerful, easy-to-understand Porter's Five Forces analysis.

Customers Bargaining Power

Customers face very low switching costs when considering Goodfood Market, as they can easily pivot to competitors like HelloFresh, Chefs Plate, or even various grocery delivery services. Their flexible subscription models, which allow users to pause or cancel with minimal friction, contribute to this ease of transition. For instance, many meal kit services offer weekly plans that can be modified or skipped without long-term commitments. This forces Goodfood to intensely compete on factors like price, ingredient quality, and overall customer experience to retain its user base in a highly competitive market, especially as consumers seek value in 2024.

Consumers, facing persistent food price inflation and economic uncertainty, are increasingly scrutinizing their spending, leading to high price sensitivity. Meal kits like Goodfood are often perceived as a premium service, making customers particularly responsive to price changes. With the Canadian food inflation rate at 1.5% as of May 2024, customers are acutely aware of value. Goodfood must constantly justify its pricing against cheaper alternatives, such as cooking from scratch or purchasing from discount grocers.

The abundance of online information significantly empowers Goodfood Market customers. The internet allows easy comparison of prices, menus, and promotions across a wide array of meal kit providers and other food delivery services, such as HelloFresh or even local grocery delivery. This transparency increases buyer power, as consumers can quickly identify if a competitor is offering a better deal or more appealing options, potentially leading to churn rates that impact revenue. Brand loyalty is often weaker when tangible benefits, like the potential 2024 cost savings from switching providers, are readily accessible elsewhere through quick searches.

Importance of Service and Convenience

The entire value proposition of a meal kit service, like Goodfood Market, hinges on delivering convenience, significant time savings, and a consistently positive user experience. Customers hold high expectations for critical elements such as on-time delivery, the freshness of ingredients, and the clarity of recipes. Any failure in these core service areas can rapidly lead to customer dissatisfaction and churn, empowering customers with significant bargaining power to demand superior service levels. For instance, in 2024, customer retention remains a top challenge in the meal kit sector, with high switching costs for providers.

- Customer expectations for delivery punctuality are paramount, directly impacting satisfaction.

- Ingredient freshness is a non-negotiable factor, influencing repeat purchases.

- Clear, easy-to-follow recipes are crucial for a positive cooking experience.

- High churn rates, reportedly up to 50% within the first year for some meal kit services, underscore customer power.

Discretionary Nature of the Product

For many households, a meal kit subscription, like those offered by Goodfood Market, remains a discretionary purchase rather than an essential service. During periods of economic strain, such as the persistent inflationary pressures observed through 2024, these services are often among the first expenses consumers reduce or eliminate. This inherent flexibility in customer spending grants buyers significant collective power, as their purchasing decisions are heavily influenced by their disposable income levels and perceived value. The Canadian consumer price index for food purchased from stores continued to rise in 2024, indirectly making meal kits a less attractive option for budget-conscious consumers.

- Canadian consumer spending on discretionary goods showed caution in early 2024 amidst economic uncertainties.

- Goodfood Market reported a net loss in Q2 2024, reflecting challenges in customer acquisition and retention.

- Roughly 30% of Canadian households adjusted their spending habits on non-essentials in 2024 due to inflation.

- The meal kit market faces intense competition, further empowering customers with numerous alternative options.

Customers wield strong bargaining power over Goodfood Market due to minimal switching costs and high price sensitivity, amplified by May 2024's 1.5% Canadian food inflation. Online transparency allows easy comparison of alternatives, while meal kits remain a discretionary expense, impacting companies like Goodfood, which reported a net loss in Q2 2024. High expectations for ingredient freshness and delivery punctuality further empower customers.

| Factor | Impact on Goodfood | 2024 Data |

|---|---|---|

| Switching Costs | Very Low | Easy pivot to competitors (e.g., HelloFresh) |

| Price Sensitivity | High | Canadian food inflation at 1.5% (May 2024) |

| Discretionary Status | High Risk | Goodfood Market Net Loss Q2 2024 |

Preview Before You Purchase

Goodfood Market Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Goodfood Market delves into the competitive landscape, supplier power, buyer bargaining, threat of substitutes, and the intensity of rivalry within the meal kit delivery industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The Canadian meal kit market sees intense rivalry, primarily between Goodfood and HelloFresh, which also operates Chefs Plate. This fierce competition drives aggressive customer acquisition tactics, including deep introductory discounts and diverse menu offerings. HelloFresh, benefiting from its global scale, leverages significant marketing budgets and superior operational efficiencies, allowing it to maintain a dominant market share. For example, HelloFresh reported 2024 global revenue projections showing continued investment in market penetration, intensifying pressure on Goodfood's profitability and growth.

Major Canadian supermarket chains are increasingly encroaching on the meal kit market, directly competing with companies like Goodfood Market by launching their own branded meal solutions and significantly expanding online grocery delivery. These grocers, including Loblaw Companies Limited and Empire Company Limited, possess immense brand recognition and established supply chains, often leveraging their physical store networks for click-and-collect options. By early 2024, their expanded digital platforms allow them to bundle meal kits with broader grocery orders, offering a seamless and convenient experience. This integration provides a formidable competitive threat, leveraging their vast customer bases and operational efficiencies.

The intense fight for market share in the meal kit industry results in very high selling, general, and administrative (SG&A) expenses, particularly for marketing and customer acquisition. Companies like Goodfood Market must continuously invest in advertising to attract new subscribers, many of whom are trying meal kit services for the first time. For instance, Goodfood's SG&A expenses were reported at $22.6 million for the second quarter of fiscal 2024, highlighting the ongoing need to spend on growth. This constant need for significant marketing outlays puts considerable pressure on profitability and cash flow.

Low Product Differentiation

Goodfood Market faces significant competitive rivalry due to low product differentiation. While companies aim to stand out with unique recipes or ingredient sourcing, the fundamental offering—a box of pre-portioned ingredients for home cooking—is largely similar across competitors. This inherent likeness makes it challenging for Goodfood to establish a strong, defensible competitive advantage based solely on its product. Consequently, competition often intensifies around price and promotional activities, rather than distinct product features, driving down margins and increasing customer acquisition costs.

- The Canadian meal kit market saw continued growth into 2024, yet customer churn remains a persistent challenge due to readily available alternatives.

- Goodfood Market reported a net loss of $20.9 million in Q1 2024, partly reflecting the intense promotional environment.

- Customer retention in the meal kit sector averaged around 30-40% after the first month in recent years, highlighting the ease of switching between providers.

- Ingredient sourcing and recipe innovation are key differentiators, but the core convenience factor is easily replicated by new entrants.

Market Saturation and Slowing Growth

The meal kit market is showing signs of maturity, with industry analysis suggesting a slowdown from its previous explosive growth phase. As this market becomes more saturated, competition for new customers transforms into a zero-sum game, intensifying rivalry among existing players like Goodfood Market. Companies are now compelled to focus on capturing market share from competitors rather than expanding into a rapidly growing customer base, which impacts profitability and marketing strategies.

- Global meal kit market growth is projected to decelerate, with an estimated compound annual growth rate (CAGR) of around 15% from 2024 to 2030, down from higher rates observed during the pandemic.

- Goodfood Market reported active subscribers at 104,000 as of February 2024, reflecting the challenge of customer acquisition in a competitive landscape.

- The Canadian meal kit market, where Goodfood operates, reached an estimated value of over CAD 500 million in 2024.

- Intense competition from HelloFresh, Chef's Plate, and local players forces aggressive pricing and promotional activities.

Goodfood Market navigates intense rivalry in the Canadian meal kit sector, primarily against HelloFresh and expanding supermarket chains. This competition drives high SG&A expenses, with Goodfood reporting $22.6 million in Q2 2024, and limits product differentiation. Customer churn remains high, with retention around 30-40% after the first month, intensifying the fight for market share in a maturing industry.

| Metric | Goodfood Market (2024) | Canadian Market (2024) |

|---|---|---|

| Q1 Net Loss | $20.9 million | N/A |

| Active Subscribers (Feb) | 104,000 | N/A |

| Market Value Estimate | N/A | Over CAD 500 million |

SSubstitutes Threaten

Traditional grocery stores, whether in-store or online, pose the most significant substitute threat as consumers can cook from scratch. This option provides maximum control over ingredients, portion sizes, and cost, appealing especially to budget-conscious households. Major grocers like Loblaw and Sobeys are actively enhancing their own ready-made meal and in-store meal kit selections, directly competing on convenience. For instance, the Canadian grocery market, valued at over $100 billion, continues to see strong consumer preference for flexibility and value.

For consumers prioritizing convenience, restaurants, take-out, and third-party delivery apps like Uber Eats and SkipTheDishes are powerful substitutes for Goodfood Market. These services eliminate the need for any food preparation, directly catering to immediate cravings. The Canadian online food delivery market is projected to reach approximately CAD 5.9 billion in revenue in 2024, highlighting the significant market share held by these alternatives. The decision to order a meal kit directly competes with the ease of ordering a fully prepared meal from a local restaurant or via a delivery platform.

The market for prepared and frozen meals, readily available at grocery stores, poses a significant threat to meal kit services like Goodfood. These substitutes, such as pre-made salads or frozen dinners, satisfy the consumer need for quick and effortless meal solutions, often requiring minimal to no cooking. They are typically priced lower than meal kits, which still demand 15-30 minutes of preparation time. Goodfood has directly responded to this competitive pressure by launching its own Heat and Eat line, aiming to capture a share of the convenience-focused market. In 2024, the global ready meals market continues its growth trajectory, with projections indicating sustained demand for ultra-convenient options.

Online Recipe Platforms and Food Blogs

The threat from online recipe platforms and food blogs is significant for meal kit services like Goodfood Market. A vast number of free, high-quality recipes are readily available online through popular blogs, YouTube channels, and dedicated recipe websites. For consumers who enjoy cooking but seek inspiration, these platforms directly substitute the recipe-curation aspect of meal kits. Users can leverage these free resources and then purchase ingredients from any grocer, often leading to a lower total cost compared to a meal kit subscription. This flexibility and cost-effectiveness present a continuous challenge.

- In 2024, online recipe searches continued to surge, with millions accessing free culinary content.

- Consumers often find grocery shopping for individual ingredients more cost-effective than meal kits, saving an estimated 15-30%.

- The convenience of choosing ingredients from diverse retailers also appeals to cost-conscious shoppers.

- Goodfood must innovate beyond just recipes to retain customers against this free alternative.

Local and Niche Food Providers

Local farm-to-table delivery services, independent butchers, and specialty food shops pose a significant substitute threat to Goodfood Market. These providers appeal strongly to consumers prioritizing high-quality, unique ingredients and supporting local economies, a trend that continues to grow in 2024. While requiring more planning, these options cater to a similar demographic interested in food provenance and culinary exploration. The Canadian local food market saw continued consumer interest, with many seeking direct-from-producer options.

- Local food sales in Canada reached approximately $1.5 billion in 2023, indicating a robust market for niche providers.

- A 2024 consumer survey indicated over 60% of Canadians prioritize buying local food when available.

- Specialty food retailers experienced a 3% growth in revenue in early 2024, reflecting sustained demand.

- Farm-to-table delivery services expanded their reach by 15% across major Canadian cities in the last year.

The threat of substitutes for Goodfood Market is significant, primarily from traditional grocery stores where consumers can cook from scratch, offering cost control and ingredient flexibility. Additionally, the ease of ordering from restaurants and third-party delivery apps, a market projected at CAD 5.9 billion in Canada for 2024, directly competes on convenience. Free online recipe platforms and readily available prepared meals also present strong alternatives, challenging Goodfood's value proposition and convenience offerings.

| Substitute Category | 2024 Market Data (Canada) | Competitive Advantage |

|---|---|---|

| Traditional Grocers/DIY | Grocery market over $100 billion | Cost control, ingredient choice |

| Online Food Delivery | CAD 5.9 billion projected revenue | Ultimate convenience, no prep |

| Free Online Recipes | Millions of daily searches | Zero cost for recipes, flexibility |

Entrants Threaten

Entering the meal kit market at scale demands significant capital investment, especially for sophisticated production and a robust logistics network. A new entrant must fund fulfillment centers and temperature-controlled delivery, which are major operational hurdles. For instance, Goodfood Market reported over $17 million in property and equipment as of February 2024, highlighting the substantial asset base required. Solving the last-mile delivery challenge efficiently further deters potential competitors, making market entry incredibly costly and complex.

Goodfood Market, much like industry leader HelloFresh, benefits significantly from economies of scale. These established players can negotiate superior pricing from suppliers and spread their substantial fixed costs, such as marketing and logistics, across a vast customer base. For instance, HelloFresh reported over 7 million active customers globally in Q1 2024, enabling massive purchasing power. A new entrant would face immense pressure to compete on price and operational efficiency without first achieving a comparable scale, making market entry challenging.

Leading meal kit and grocery delivery companies have significantly invested in their brands, achieving high name recognition. A new entrant, like a potential competitor to Goodfood Market, would face substantial customer acquisition costs (CAC) due to the need for a massive marketing budget. For instance, customer acquisition costs in the online grocery sector can range from $50 to over $100 per customer in 2024, making profitable entry challenging. Existing consumers are already saturated with offers from established services, further increasing the barrier for new players.

Established Supplier Relationships

Existing meal kit providers like Goodfood Market benefit from deeply entrenched relationships with their network of farmers, food producers, and logistics partners. Establishing a reliable and high-quality supply chain, particularly for fresh, perishable ingredients, is an incredibly time-consuming and capital-intensive undertaking for any new market entrant. For instance, Goodfood reported a gross merchandise volume of $187.3 million in fiscal year 2023, showcasing the scale of their established procurement. Building such a robust system from scratch presents a significant barrier.

- Goodfood Market's extensive supplier network reduces procurement costs.

- New entrants face significant capital expenditure to replicate supply chain infrastructure.

- Quality control for perishable goods is a complex, relationship-dependent process.

- Securing reliable logistics for nationwide distribution is a major hurdle for new companies.

Potential for Niche Entry

While a national-scale entry into the meal kit market remains challenging due to significant capital and logistical demands, Goodfood Market faces a higher threat from new niche players. These entrants can focus on specialized dietary needs, such as plant-based or allergy-specific options, or target specific local and regional markets. Smaller-scale entries typically encounter lower initial barriers to entry, often leveraging direct-to-consumer models.

- Niche players can target specific dietary needs, like gourmet or plant-based meals.

- New entrants might focus on local or regional markets, avoiding national competition.

- Lower initial barriers exist for these smaller-scale, specialized businesses.

- Goodfood Market reported net sales of $153 million in fiscal year 2024, highlighting the scale a large competitor would need to match.

The meal kit market presents high barriers to entry for large-scale players due to significant capital needs for logistics and production, like Goodfood Market's $17 million in property and equipment as of February 2024. Established brands benefit from economies of scale and high customer acquisition costs, potentially $50-$100 per customer in 2024, deterring new national competitors. However, the threat increases from niche entrants targeting specific dietary needs or local markets, which face lower initial barriers. Goodfood Market's fiscal year 2024 net sales of $153 million underscore the scale required for broad competition.

| Barrier Type | Impact on New Entrants | 2024 Data Point |

|---|---|---|

| Capital Requirements | High initial investment needed for infrastructure. | Goodfood Market property/equipment: $17M (Feb 2024) |

| Customer Acquisition | Significant marketing spend for brand awareness. | CAC for online grocery: $50-$100 per customer |

| Economies of Scale | Difficulty competing on price/efficiency without scale. | HelloFresh active customers: 7M+ (Q1 2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Goodfood Market is built upon comprehensive data from industry-specific market research reports, financial disclosures of publicly traded competitors, and proprietary consumer behavior surveys.