Lutz Fleischwaren GmbH PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lutz Fleischwaren GmbH Bundle

Navigate the complex external environment shaping Lutz Fleischwaren GmbH with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends present both challenges and opportunities for this prominent meat producer. Our expert-crafted report offers actionable intelligence to inform your strategic decisions and gain a competitive edge.

The technological landscape is rapidly changing, impacting everything from production efficiency to consumer engagement for Lutz Fleischwaren GmbH. Our PESTLE analysis delves into these critical technological advancements, alongside environmental regulations and legal frameworks that directly influence the company's operations and future growth. Don't be left behind; secure your complete understanding.

Gain a profound understanding of the external forces at play for Lutz Fleischwaren GmbH, from shifting consumer preferences to the latest environmental legislation. Our detailed PESTLE analysis provides the critical insights you need to anticipate market changes and identify strategic advantages. Download the full version now and empower your business strategy with unparalleled market intelligence.

Political factors

Lutz Fleischwaren GmbH navigates a complex landscape of evolving German and EU food safety regulations, a critical political factor influencing its operations. Recent updates, such as Regulation (EU) 2024/1141, impose stricter hygiene standards for foods derived from animals and introduce specific guidelines for aged meat products.

Adherence to these directives is non-negotiable for market participation and maintaining consumer confidence. These regulations, covering everything from manufacturing processes to detailed product labeling, directly shape Lutz Fleischwaren's production strategies and associated expenses.

Government policies and subsidies in Germany's agricultural sector significantly shape the operational landscape for meat processors like Lutz Fleischwaren GmbH. These policies directly impact the cost and availability of essential raw materials, such as livestock and feed. For instance, the German government's commitment to the Common Agricultural Policy (CAP) continues to influence farming practices and the economic viability of livestock producers.

Changes in these agricultural policies, including shifts towards supporting more sustainable farming methods or adjustments to animal welfare regulations and associated levies, can ripple through the supply chain. These adjustments can necessitate changes in Lutz's sourcing strategies and pricing models to accommodate potentially higher input costs or altered supply volumes. For example, increased environmental standards might lead to higher production costs for farmers, which could be passed on to processors.

Furthermore, ongoing discussions and potential future policy developments, such as the introduction of higher taxes on meat products to fund sustainable agricultural initiatives, present a significant variable for companies like Lutz. Such measures could directly influence consumer demand and the competitive pricing of meat products, requiring strategic adaptation in product development and marketing efforts. In 2023, debates intensified around the environmental impact of meat consumption, signaling a potential policy direction that could affect the entire industry.

As a German company, Lutz Fleischwaren GmbH operates within the framework of European Union trade policies, significantly influencing its import and export activities for meat products. These EU-wide regulations dictate terms for engaging with both member states and international partners.

Changes in international trade agreements, the imposition of tariffs, or the introduction of non-tariff barriers directly affect how competitive German meat products remain across Europe and globally. Such shifts can alter cost structures and market access.

Data from 2024 indicates a noticeable downturn in Germany's foreign trade concerning meat and meat products. Both the volume of imports and exports experienced a decline during this period, underscoring the sensitivity of the sector to global trade dynamics.

Labor Laws and Employment Policies

Germany's stringent labor laws, particularly those affecting the food processing industry, significantly impact Lutz Fleischwaren GmbH. These regulations cover minimum wage, maximum working hours, and employee working conditions. For instance, the German minimum wage saw an increase to €12.41 per hour as of January 1, 2024, directly affecting labor costs for all businesses, including Lutz Fleischwaren.

Any shifts in these labor policies, such as further increases to the minimum wage or stricter enforcement of working hour limits, could necessitate adjustments in Lutz Fleischwaren's operational expenses and workforce planning. The company may need to explore further investments in automation to mitigate potential rises in labor expenditures, especially as the food processing sector grapples with escalating production costs.

The rising cost of production in the food processing sector is a persistent challenge. In 2023, the German food industry reported significant cost increases, with energy prices and raw material expenses being major contributors. This economic climate makes managing labor costs even more critical for companies like Lutz Fleischwaren.

- Minimum Wage Impact: The €12.41 per hour minimum wage in Germany (effective Jan 2024) directly increases Lutz Fleischwaren's payroll expenses.

- Regulatory Adaptations: Potential future changes to labor laws require proactive HR strategy reviews and possible automation investments.

- Industry Cost Pressures: Rising overall production costs in the German food sector exacerbate the impact of labor law compliance.

- Workforce Management: Strict regulations on working hours and conditions necessitate careful scheduling and adherence to labor standards.

Political Stability and Industry Support

Germany and the broader European Union generally offer a politically stable environment, which is beneficial for businesses like Lutz Fleischwaren GmbH. Government support for domestic food industries further solidifies this stable operating landscape.

However, the political climate is also shaped by ongoing debates and potential legislative changes concerning agricultural practices. For instance, Germany's proposed amendments to its Animal Welfare Act in 2024 signal a political inclination towards elevated welfare standards for farm animals.

These potential shifts in legislation could require substantial operational modifications for meat producers. Industry stakeholders are closely monitoring developments, as stricter regulations might impact production costs and processes.

- Political Stability: Germany and the EU provide a generally stable political framework.

- Government Support: Continued government backing for the domestic food sector offers a supportive operational backdrop.

- Regulatory Evolution: Discussions around agricultural transformation and animal welfare, such as the 2024 German Animal Welfare Act amendments, indicate a trend toward stricter standards.

- Industry Impact: These evolving regulations may necessitate significant operational adjustments for meat processing companies like Lutz Fleischwaren GmbH.

Political stability in Germany and the EU provides a generally secure operating environment for Lutz Fleischwaren GmbH, further bolstered by government support for the domestic food industry.

However, evolving agricultural policies, such as Germany's proposed 2024 amendments to its Animal Welfare Act, indicate a trend towards stricter standards that could necessitate significant operational adjustments and potentially increase production costs.

The company must remain agile to adapt to these legislative shifts, which may impact sourcing, processing, and overall competitiveness.

| Factor | Description | Impact on Lutz Fleischwaren GmbH | Data Point |

| Political Stability | Stable governance in Germany and EU | Provides a predictable business environment | Germany is consistently ranked high for political stability in global indices. |

| Agricultural Policy | Government support and evolving regulations | Influences raw material costs and availability, potential for increased compliance costs | Proposed 2024 amendments to German Animal Welfare Act signal trend towards higher standards. |

| Trade Policy | EU trade agreements and tariffs | Affects import/export competitiveness and market access | Germany’s meat product trade saw a decline in both imports and exports in 2024. |

| Labor Law | Minimum wage and working condition regulations | Directly impacts labor costs and requires careful workforce management | German minimum wage increased to €12.41 per hour as of January 1, 2024. |

What is included in the product

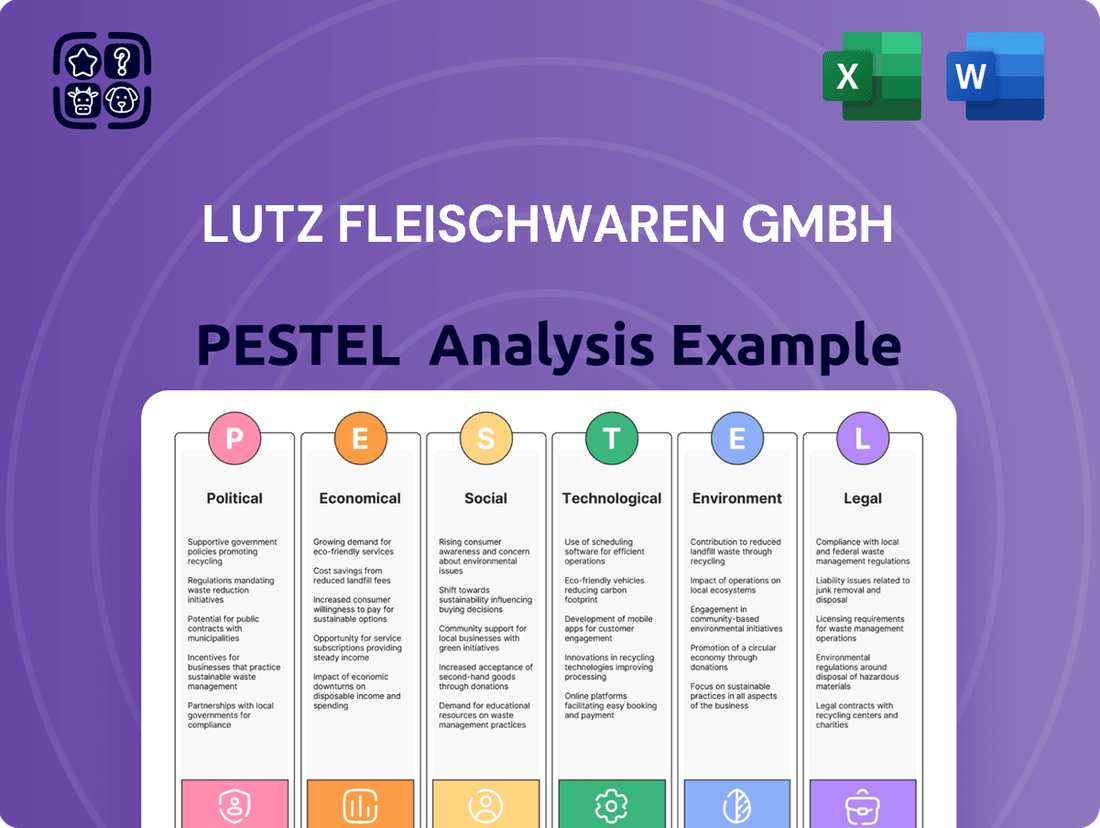

This PESTLE analysis of Lutz Fleischwaren GmbH examines how political shifts, economic conditions, social trends, technological advancements, environmental regulations, and legal frameworks impact the company's operations and strategic planning.

It provides actionable insights for identifying emerging opportunities and potential risks within the broader market landscape.

The Lutz Fleischwaren GmbH PESTLE Analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing in meetings and planning sessions.

Economic factors

Inflation in Germany has been a significant concern, impacting how much consumers can buy. Even for everyday items like food, people are becoming more careful with their spending. This means companies selling these products need to be extra mindful of their pricing.

Despite a small rise in German meat production in 2024, the prices consumers paid for meat didn't jump up much. This suggests that customers are quite sensitive to price changes. For businesses like Lutz Fleischwaren GmbH, this situation demands a sharp focus on controlling expenses and perhaps rethinking how they set prices to stay competitive in the market.

The fluctuating prices of key inputs like meat, spices, and packaging directly impact Lutz Fleischwaren GmbH's manufacturing expenditures. Similarly, the cost of electricity and natural gas, essential for their operations, significantly influences their bottom line.

Across the German food sector in 2024, companies are grappling with escalating production costs, particularly from energy and raw material price hikes. This environment presents a considerable hurdle for businesses like Lutz Fleischwaren GmbH in their efforts to sustain profitability and achieve sales growth.

Consumer spending on food products is a critical economic driver for Lutz Fleischwaren GmbH. Despite a projected recovery in German private consumption for 2025, the food sector faces headwinds. While domestic meat consumption experienced a modest uptick in 2024, the broader German food market in 2025 is anticipated to remain subdued.

This subdued outlook is largely attributed to ongoing price sensitivity among consumers and persistent inflation. For instance, the German consumer price index for food products remained elevated throughout 2024, impacting purchasing power. Consequently, Lutz Fleischwaren GmbH must remain agile, continuously monitoring market demand and strategically adjusting its product portfolio to align with evolving consumer preferences and affordability concerns.

Competition and Market Saturation

The German meat market is highly competitive and nearing saturation, driving down prices for consumers. Lutz Fleischwaren GmbH operates within this dynamic environment, facing intense rivalry from both large established players and smaller specialized producers. This necessitates a strategic approach to stand out amidst the crowded marketplace.

With the German meat market valued at approximately €44.9 billion in 2024, the sheer size of the industry underscores the formidable competitive pressures. Companies like Lutz Fleischwaren GmbH must actively seek ways to differentiate their offerings to capture and retain market share in this price-sensitive sector. Focusing on unique selling propositions is therefore crucial for sustained success.

- Market Value: The German meat market was estimated at €44.9 billion in 2024.

- Key Challenge: High competition and market saturation lead to downward pressure on prices.

- Strategic Imperative: Differentiation through traditional methods and product quality is vital for Lutz Fleischwaren GmbH.

- Industry Trend: Consolidation within the German retail food sector further intensifies competition.

Economic Growth Outlook

Germany's economic growth is projected to be modest in 2024, with forecasts suggesting a period of broad stagnation for 2025. This outlook indicates that the German economy might lag behind the average growth rate anticipated for the wider Euro area. Such a subdued economic climate, partly stemming from a dependence on international markets and demographic shifts like an aging population, could constrain the overall expansion opportunities for food processing companies like Lutz Fleischwaren GmbH.

This situation necessitates that Lutz Fleischwaren GmbH be strategically positioned to navigate a landscape of limited domestic market growth. Furthermore, an increase in household savings rates could also impact consumer spending patterns within the food sector.

- Economic Growth Forecast: Germany's GDP growth is expected to be around 0.2% for 2024, with a similar flat outlook for 2025, potentially trailing Eurozone growth.

- Key Influences: Reliance on exports and an aging demographic are significant factors contributing to this subdued growth forecast.

- Market Implications: Limited economic expansion may translate to slower demand growth for processed food products.

- Consumer Behavior: A potential rise in household savings rates could lead to more cautious consumer spending on non-essential or premium food items.

Germany's economic trajectory in 2024 and 2025 indicates a period of subdued growth, with forecasts suggesting stagnation. This cautious economic climate, influenced by factors such as a reliance on global markets and demographic shifts, could limit expansion opportunities for food processing firms like Lutz Fleischwaren GmbH. Consequently, companies must focus on efficiency and strategic market positioning to thrive amidst slower domestic demand.

The German meat market, valued at approximately €44.9 billion in 2024, is characterized by intense competition and saturation, leading to downward price pressures. Lutz Fleischwaren GmbH operates within this challenging environment, requiring a strong emphasis on differentiation through product quality and unique selling propositions to maintain market share. Consolidation within the broader German retail food sector further exacerbates these competitive pressures.

| Economic Indicator | 2024 Forecast | 2025 Outlook | Impact on Food Sector |

|---|---|---|---|

| German GDP Growth | ~0.2% | Flat/Stagnant | Constrained market growth, potential for slower demand. |

| German Meat Market Value | €44.9 billion | N/A | High competition, price sensitivity, need for differentiation. |

| Inflation (Food Products) | Elevated | Persistent concern | Impacts consumer purchasing power, necessitates cost control. |

Preview Before You Purchase

Lutz Fleischwaren GmbH PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Lutz Fleischwaren GmbH details Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external landscape shaping Lutz Fleischwaren GmbH's operations and strategic decisions.

Sociological factors

German consumers are increasingly opting for plant-based diets and reducing their meat intake, driven by concerns for both personal health and environmental sustainability. This trend directly impacts the demand for traditional meat products offered by companies like Lutz Fleischwaren GmbH.

Despite a slight uptick in overall meat consumption in 2024, particularly for poultry, the overarching trajectory points towards a long-term decrease in per capita meat consumption. For instance, while Germans consumed an estimated 59.2 kg of meat per capita in 2023, projections indicate a continued, albeit gradual, decline in the coming years, challenging the market for conventional meat offerings.

German consumers are increasingly prioritizing health, leading to a higher demand for products perceived as healthier, including those in the meat sector. This growing health consciousness means Lutz Fleischwaren GmbH must acknowledge that a notable segment of the population is actively reducing their meat consumption for well-being. For instance, a 2023 study indicated that around 10% of Germans follow a vegetarian or vegan diet, a figure expected to climb further.

This societal shift directly impacts consumer purchasing decisions, pushing companies like Lutz Fleischwaren GmbH to innovate. Offering a broader range of products that align with health-conscious preferences, such as leaner cuts, organic options, or even plant-based alternatives, becomes crucial for market relevance. Adapting to these evolving tastes is not just about meeting current demand but also about future-proofing the business in a dynamic marketplace.

Consumer demand for ethically sourced meat products is on the rise in Germany, directly impacting companies like Lutz Fleischwaren GmbH. Surveys in early 2024 indicated that over 70% of German consumers consider animal welfare when purchasing meat, a significant increase from previous years.

The German government and industry bodies are actively discussing enhancements to animal welfare labeling, such as the 'Haltungsform' system, to provide consumers with clearer information. This societal push towards greater transparency and improved standards necessitates that Lutz Fleischwaren GmbH actively showcases its dedication to humane farming and responsible sourcing practices to maintain consumer trust and market share.

Demand for Regionality and Transparency

German consumers are increasingly prioritizing regional products and supply chain transparency when buying meat. Studies in 2024 indicate that approximately 38% of German consumers actively look for meat with a 'Made in Germany' label, showing a clear preference for locally sourced options and a desire to avoid imported goods. This trend underscores a growing demand for traceability and guarantees about the origin and production methods of food.

Lutz Fleischwaren GmbH is well-positioned to capitalize on this societal shift. The company's commitment to traditional production methods and its emphasis on quality align perfectly with consumer desires for authenticity and verifiable sourcing. By highlighting its regional roots and transparent processes, Lutz Fleischwaren can build stronger connections with a significant segment of the German market.

- Regional Preference: Nearly 40% of German consumers seek 'Made in Germany' meat.

- Transparency Demand: Consumers value knowing the origin and production methods of their food.

- Opportunity for Lutz: The company's traditional methods resonate with this consumer preference.

- Brand Connection: Emphasizing origin and quality fosters trust and loyalty.

Perception of Processed Meats

Consumer perception of processed meats significantly influences demand, with growing concerns about transparency and quality standards in large-scale production facilities. While Lutz Fleischwaren GmbH highlights its commitment to traditional methods and premium product quality, it faces the challenge of overcoming consumer skepticism regarding processed food manufacturing. For instance, a 2023 survey indicated that 45% of German consumers are more concerned about the ingredients and production processes of processed meats than they were five years ago.

To maintain and build trust, Lutz Fleischwaren GmbH must proactively address these anxieties. Demonstrating adherence to rigorous quality control and offering clear information about sourcing and production can mitigate negative perceptions. The company's emphasis on "Metzgertradition" (butcher tradition) aims to resonate with consumers seeking authenticity and reliability in their food choices, a trend supported by a 2024 market analysis showing a 10% year-over-year increase in demand for products marketed with traditional craftsmanship.

- Growing Consumer Skepticism: Approximately 45% of German consumers expressed increased concern about processed meat production in 2023.

- Demand for Transparency: Consumers are increasingly seeking clear information on ingredients and manufacturing processes.

- Lutz's Brand Appeal: The company's focus on traditional methods and quality aims to counter negative perceptions.

- Market Trend: Products emphasizing traditional craftsmanship saw a 10% rise in demand in 2024.

German societal values increasingly emphasize health and sustainability, driving a shift away from traditional meat consumption towards plant-based diets. This trend, evident in the growing number of vegetarians and vegans, now estimated at 10% of the population as of 2023, directly challenges the market for conventional meat products.

Consumer demand for ethically produced food is also on the rise, with over 70% of Germans considering animal welfare in 2024 purchasing decisions. This focus on transparency and responsible sourcing, coupled with a strong preference for regional products (nearly 40% seek 'Made in Germany' labels), presents both challenges and opportunities for Lutz Fleischwaren GmbH to align its practices with evolving consumer expectations.

| Sociological Factor | 2023/2024 Data Point | Implication for Lutz Fleischwaren GmbH |

|---|---|---|

| Dietary Shifts | 10% of Germans are vegetarian/vegan (2023). | Need to diversify product offerings, potentially into plant-based alternatives. |

| Health Consciousness | Growing demand for perceived healthier options. | Opportunity to promote leaner cuts, organic, or lower-fat meat products. |

| Ethical Consumption | Over 70% consider animal welfare (2024). | Must highlight ethical sourcing and animal welfare standards in marketing. |

| Regional Preference | ~40% prefer 'Made in Germany' labels (2024). | Leverage strong regional ties and local sourcing for brand appeal. |

Technological factors

Automation and robotics are transforming the meat processing sector, offering substantial gains in efficiency and cost reduction. In 2024, the German food industry, a significant market for Lutz Fleischwaren GmbH, continued to grapple with rising production expenses, making advanced food and packaging machinery a crucial investment. These technologies not only streamline operations but also bolster food safety and hygiene standards, critical in this industry.

For Lutz Fleischwaren GmbH, embracing automation can lead to optimized production workflows, potentially lowering labor costs per unit and improving throughput. According to industry reports from early 2025, German food manufacturers are increasingly investing in smart factory solutions, with automation adoption rates climbing, signaling a competitive imperative to integrate these advancements to maintain market share and profitability.

Technological advancements in cold chain logistics are fundamental for Lutz Fleischwaren GmbH, ensuring the quality and safety of their meat products throughout the supply chain. Innovations in refrigeration, temperature monitoring, and packaging are crucial for preserving freshness and preventing spoilage. For instance, real-time temperature tracking systems can alert stakeholders to deviations, minimizing risks and product loss.

New European Union regulations, like Regulation (EU) 2024/1141 effective from mid-2024, are setting more stringent standards for carcass transportation and refrigeration. This legislation mandates improved hygiene and temperature control, pushing companies like Lutz Fleischwaren to invest in upgraded fleets and storage facilities. Compliance requires adherence to precise temperature ranges, typically between 0°C and 4°C for chilled meat, impacting operational costs and efficiency.

Technological advancements like blockchain and RFID are revolutionizing food supply chain transparency, offering unprecedented traceability. These systems allow for real-time tracking of products from origin to consumer.

Germany is a significant player in adopting food traceability technology, with its market projected for substantial growth. This expansion is fueled by increasingly stringent sustainability regulations and a strong consumer demand for transparency in food sourcing.

Lutz Fleischwaren GmbH can significantly benefit by integrating these technologies. Enhancing product information, enabling rapid identification of issues in the supply chain, and meeting consumer expectations for clear sourcing are key advantages.

For instance, the German market for food traceability solutions was estimated to be around €350 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12% through 2028, according to market research.

Packaging Innovations

Packaging innovations, particularly in sustainable materials and methods, are increasingly important in Germany. This trend is fueled by stringent environmental laws and a growing consumer desire for greener products. The German market for sustainable packaging is steadily expanding, with the food and beverage sector being a significant user. For Lutz Fleischwaren GmbH, adopting eco-friendly packaging options is a strategic move to meet both consumer expectations and regulatory mandates.

Considerations for Lutz Fleischwaren GmbH regarding packaging innovations include:

- Material Sourcing: Investigating biodegradable or compostable plastics, recycled content, and paper-based alternatives.

- Design Efficiency: Optimizing packaging to reduce material usage and transportation emissions.

- Consumer Engagement: Communicating sustainability efforts clearly on packaging to resonate with environmentally conscious buyers.

- Regulatory Compliance: Staying ahead of evolving German and EU regulations on packaging waste and recyclability, such as the Packaging Act (VerpackG).

Data Analytics and AI for Optimization

The integration of data analytics and artificial intelligence (AI) is fundamentally reshaping how companies in the food sector, including Lutz Fleischwaren GmbH, manage their operations. These technologies offer powerful tools for fine-tuning everything from manufacturing efficiency to understanding what consumers will want next.

AI-powered analytics can provide unprecedented visibility into complex supply chains. This enhanced transparency allows businesses to anticipate issues, manage inventory more effectively, and respond swiftly to market shifts. For Lutz Fleischwaren GmbH, this means better control over raw material sourcing, production scheduling, and distribution, ultimately leading to reduced waste and improved profitability.

The predictive capabilities of AI are particularly valuable for demand forecasting in the dynamic food market. By analyzing vast datasets, including sales history, seasonal trends, and even social media sentiment, AI can generate more accurate predictions. This supports optimized production runs, minimizing the risk of overstocking or stockouts. For instance, a report from Statista in early 2024 indicated that the global AI in food and beverage market was projected to reach approximately USD 4.5 billion by 2027, highlighting the significant investment and adoption of these technologies.

- Enhanced Production Optimization: AI algorithms can identify bottlenecks and inefficiencies in manufacturing processes, suggesting improvements to increase output and reduce energy consumption.

- Accurate Demand Forecasting: Predictive analytics, powered by AI, can forecast consumer demand with greater precision, enabling better inventory management and reduced food spoilage.

- Supply Chain Transparency: Real-time data analysis across the supply chain improves traceability and allows for quicker, more informed decision-making regarding logistics and sourcing.

- New Product Development: AI can analyze market trends and consumer preferences to assist in the development of innovative new food products, potentially leading to new revenue streams.

Advancements in automation and AI are driving efficiency in the meat processing sector, a critical factor for Lutz Fleischwaren GmbH given rising production costs in Germany. By early 2025, smart factory solutions were seeing increased adoption among German food manufacturers, underscoring a competitive need for these technologies to maintain profitability.

The integration of blockchain and RFID enhances supply chain transparency, with Germany's traceability market projected to grow significantly, fueled by sustainability regulations and consumer demand for clear sourcing. For Lutz Fleischwaren GmbH, adopting these technologies means improved product information and rapid issue identification.

Innovations in sustainable packaging are also paramount, driven by German environmental laws and consumer preferences for eco-friendly products. Lutz Fleischwaren GmbH must navigate material sourcing, design efficiency, and regulatory compliance, such as the Packaging Act (VerpackG), to meet these evolving demands.

Legal factors

Lutz Fleischwaren GmbH navigates a complex web of food labeling regulations, crucial for consumer trust and market access in Germany and the broader European Union. These rules mandate detailed information on everything from potential allergens and product origin to comprehensive nutritional data and essential identification markings.

A significant recent development is the introduction of a new EU marking system under Regulation (EU) 2024/1141, which will supersede the current CE marking specifically for animal products. This regulatory shift, effective from 2024, requires all food business operators, including Lutz Fleischwaren GmbH, to adapt their labeling processes to ensure ongoing compliance and avoid penalties.

Environmental protection laws, especially those governing waste management, emissions, and water consumption in industrial settings, significantly influence meat processing companies like Lutz Fleischwaren GmbH. These regulations are becoming more stringent, requiring substantial investments in compliance and potentially altering operational procedures.

Germany's push for improved recycling infrastructure and circular economy models, as highlighted by recent government initiatives, translates to increased legal obligations for Lutz Fleischwaren GmbH to embrace sustainable practices. Failure to adapt could lead to penalties and reputational damage.

For instance, the German Packaging Act (VerpackG) mandates specific recycling quotas and fees for packaging materials used by food producers, impacting the cost of goods and supply chain management for Lutz Fleischwaren GmbH.

Furthermore, stricter water usage regulations, driven by concerns over scarcity and quality, may necessitate upgrades to water treatment and recycling systems within the company's facilities, representing a considerable capital expenditure.

Consumer protection laws, such as those concerning product liability and advertising standards, are fundamental to Lutz Fleischwaren GmbH's operations. These regulations mandate that the company prioritize product safety and refrain from making deceptive marketing claims, necessitating stringent quality control and clear consumer communication.

Germany's ongoing commitment to safeguarding consumers is evident in initiatives like the Food Safety Authority's continued provision of training programs focused on enhancing food safety practices. This reflects a consistent emphasis on protecting public health and ensuring fair market practices within the food industry, directly impacting Lutz Fleischwaren GmbH.

Competition Law and Anti-Trust Regulations

Lutz Fleischwaren GmbH operates within a robust legal framework governing fair competition in Germany and across the European Union. These regulations are designed to prevent market monopolization and ensure a level playing field for all businesses. For instance, the German Federal Cartel Office (Bundeskartellamt) actively monitors mergers and acquisitions, as well as cartel agreements, to maintain competitive market dynamics. In 2023, the office investigated numerous cases across various sectors, demonstrating its commitment to enforcing competition law.

These anti-trust provisions directly influence Lutz Fleischwaren's strategic decisions, particularly concerning market expansion, potential partnerships, or acquisitions within the meat processing industry. Compliance with these laws is crucial to avoid significant fines and operational disruptions. The EU's Directorate-General for Competition also plays a vital role, ensuring that national enforcement aligns with overarching European Union competition policy.

Key aspects of competition law impacting Lutz Fleischwaren include:

- Prohibition of Cartels: Agreements between competitors that restrict competition, such as price-fixing or market sharing, are illegal.

- Abuse of Dominant Position: Companies holding a dominant market share cannot exploit their position to the detriment of consumers or competitors.

- Merger Control: Significant mergers or acquisitions require pre-notification and approval from competition authorities to prevent the creation of dominant market players.

- State Aid Rules: Regulations govern how governments can provide financial support to businesses, ensuring it does not distort competition.

Animal Welfare Legislation

Animal welfare legislation in Germany, particularly recent amendments to the Tierschutzgesetz (Animal Welfare Act), presents significant operational considerations for Lutz Fleischwaren GmbH. For instance, the ban on chick culling, which took full effect in 2022, requires the industry to adopt alternative methods like in-ovo sex determination, impacting supply chains and potentially increasing costs. Ongoing discussions and potential future regulations, such as mandatory video surveillance in slaughterhouses, signal a trend towards greater transparency and stricter oversight, necessitating investment in new technologies and potentially altering processing workflows.

The evolving legal landscape reflects a growing societal demand for improved animal welfare. While certain 2024 amendments may have been viewed as incremental by some advocacy groups, the direction is clear: stricter standards are likely to continue. Companies like Lutz Fleischwaren must proactively adapt to these changes to maintain compliance and consumer trust. For example, the German government has been exploring measures to improve animal transport conditions, which could influence logistics and handling procedures.

- Chick Culling Ban: Germany fully implemented the ban on chick culling in 2022, pushing for in-ovo sex determination technologies.

- Slaughterhouse Surveillance: Discussions are ongoing regarding mandatory video surveillance in slaughterhouses to enhance animal welfare monitoring.

- Transport Regulations: The government continues to review and potentially update regulations concerning the welfare of animals during transport.

- Industry Adaptation: Continuous legislative pressure requires meat processors to invest in new technologies and adapt operational practices to meet higher welfare standards.

Lutz Fleischwaren GmbH must adhere to stringent food safety and labeling laws, including upcoming EU regulations like Regulation (EU) 2024/1141 affecting animal product markings from 2024. Environmental legislation, such as the German Packaging Act (VerpackG), mandates recycling quotas and fees, impacting packaging costs and waste management. Consumer protection laws require product safety and truthful advertising, with authorities like the Food Safety Authority offering training to enhance compliance.

Environmental factors

The meat industry, including companies like Lutz Fleischwaren GmbH, faces growing pressure regarding its substantial carbon footprint. This impact spans the entire value chain, from the methane emissions of livestock to the energy-intensive processing and transportation. In 2024, global greenhouse gas emissions from agriculture, a significant portion of which is livestock, are estimated to be around 10-12% of total anthropogenic emissions.

Consumer demand for sustainable and environmentally friendly products is on the rise. Surveys in 2024 indicate that a majority of consumers are willing to pay more for products with a lower environmental impact. This shift necessitates that Lutz Fleischwaren GmbH actively seeks ways to reduce its ecological footprint.

To address this, Lutz Fleischwaren GmbH should consider implementing strategies such as improving energy efficiency in its production plants, which could lead to a reduction in Scope 1 and 2 emissions. For instance, investing in renewable energy sources for its facilities could be a key step. Furthermore, exploring more sustainable sourcing of raw materials, potentially through partnerships with farms employing reduced-emission practices, is crucial.

Effective waste management and reduction, especially for food and packaging, are paramount environmental concerns for Lutz Fleischwaren GmbH. German consumers increasingly favor sustainable food and beverage packaging, with a notable preference for reusable options. This trend is driven by both consumer awareness and stringent environmental regulations.

In 2023, the German Packaging Act (VerpackG) continued to shape the industry, requiring companies to register their packaging and meet recycling quotas. Consumer surveys from 2024 indicate that over 70% of German shoppers consider packaging sustainability a key factor in their purchasing decisions, pushing businesses like Lutz Fleischwaren towards more eco-friendly solutions to minimize waste and meet market expectations.

Meat processing is inherently water-intensive, and managing water usage alongside effective wastewater treatment presents a significant environmental challenge for Lutz Fleischwaren GmbH. In 2024, the European Union continued to strengthen its water directives, with member states like Germany seeing increased scrutiny on industrial water consumption and discharge quality. For Lutz Fleischwaren, this means adhering to strict permits that limit pollutant levels in wastewater.

Implementing water-saving technologies is not just about environmental responsibility but also financial prudence. For instance, investing in closed-loop water systems or advanced filtration can reduce both water purchase costs and wastewater treatment expenses. Reports from 2024 indicated that companies proactively adopting such measures in the food processing sector saw operational cost reductions of up to 10% on water-related expenditures.

Sustainability of Raw Material Sourcing

The sustainability of sourcing raw materials, especially for feed production and land use in livestock farming, is a significant and growing concern for both consumers and regulatory bodies. This trend directly impacts the meat industry, including companies like Lutz Fleischwaren GmbH.

Consumers are increasingly making purchasing decisions based on environmental factors, with a noticeable trend towards reducing meat consumption. In 2024, surveys indicated that over 50% of European consumers consider sustainability when buying food products, a figure expected to rise. This shift puts pressure on food manufacturers to demonstrate responsible sourcing.

Lutz Fleischwaren GmbH's commitment to traditional farming methods can be a powerful asset in addressing these concerns. By highlighting these practices, the company can showcase its dedication to responsible sourcing and transparency, directly appealing to the growing consumer demand for ethically produced food. For instance, in 2024, companies with clear sustainability reports saw a 15% higher consumer trust rating.

- Growing Consumer Awareness: Over half of European consumers factored sustainability into their food choices in 2024, a number projected to climb.

- Regulatory Scrutiny: Environmental regulations concerning feed sourcing and land use are tightening across the EU.

- Brand Differentiation: Emphasizing traditional, responsible sourcing can create a competitive advantage for Lutz Fleischwaren GmbH.

- Market Trends: The reduction in meat consumption by a segment of the population necessitates a focus on the quality and ethical production of the meat that is consumed.

Climate Change Impact on Supply Chains

Climate change presents significant environmental hurdles for Lutz Fleischwaren GmbH's supply chain, particularly impacting the agricultural sector. Extreme weather events, such as prolonged droughts or severe floods, directly affect feed availability for livestock and can compromise animal health, leading to increased raw material costs and reduced supply stability for meat processors. For instance, the European Union experienced significant agricultural losses in 2023 due to extreme weather, with some regions reporting a 30% decrease in crop yields.

To mitigate these risks, Lutz Fleischwaren GmbH must proactively build resilience within its supply chains. This involves diversifying sourcing regions, investing in climate-resilient farming practices with suppliers, and potentially exploring alternative protein sources. Companies that fail to adapt may face production disruptions and higher operational expenses as they navigate the increasing volatility of environmental conditions. The global food supply chain is projected to see an increase in price volatility by 10-20% by 2030 due to climate change impacts.

- Extreme weather events: Droughts and floods reduce feed quality and quantity, impacting livestock health and increasing costs for meat processors like Lutz Fleischwaren GmbH.

- Supply chain volatility: Agricultural output fluctuations directly affect the availability and price of key raw materials, demanding robust risk management strategies.

- Adaptation and resilience: Investing in climate-smart agriculture and diversifying sourcing are crucial for ensuring consistent production and managing environmental risks.

- Increased operational costs: Failure to adapt can lead to higher expenses related to raw material procurement and potential production downtime.

The meat industry, including companies like Lutz Fleischwaren GmbH, faces growing pressure regarding its substantial carbon footprint. In 2024, global greenhouse gas emissions from agriculture, a significant portion of which is livestock, are estimated to be around 10-12% of total anthropogenic emissions. Consumer demand for sustainable products is rising, with surveys in 2024 indicating a majority of consumers willing to pay more for eco-friendly options, pushing Lutz Fleischwaren to reduce its ecological impact.

Effective waste management and reduction are paramount, especially for packaging. The German Packaging Act (VerpackG) requires companies to meet recycling quotas, and in 2024, over 70% of German shoppers considered packaging sustainability when buying food. This necessitates Lutz Fleischwaren embracing more eco-friendly packaging solutions.

Water usage and wastewater treatment are significant environmental challenges. European Union water directives are strengthening, with increased scrutiny on industrial water consumption and discharge quality in 2024. Companies like Lutz Fleischwaren must adhere to strict permits, making water-saving technologies crucial for both environmental responsibility and cost reduction, potentially lowering water-related expenditures by up to 10%.

Climate change also presents hurdles, with extreme weather events impacting feed availability and livestock health, leading to increased raw material costs. For example, some regions in the EU saw a 30% decrease in crop yields in 2023 due to extreme weather. Building supply chain resilience through diversification and climate-resilient farming practices is vital for Lutz Fleischwaren to ensure consistent production and manage these environmental risks.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Lutz Fleischwaren GmbH is informed by a comprehensive review of official German government publications, European Union policy directives, and leading industry association reports. We also incorporate data from reputable market research firms and economic forecasting agencies to ensure a robust understanding of the macro-environmental landscape.