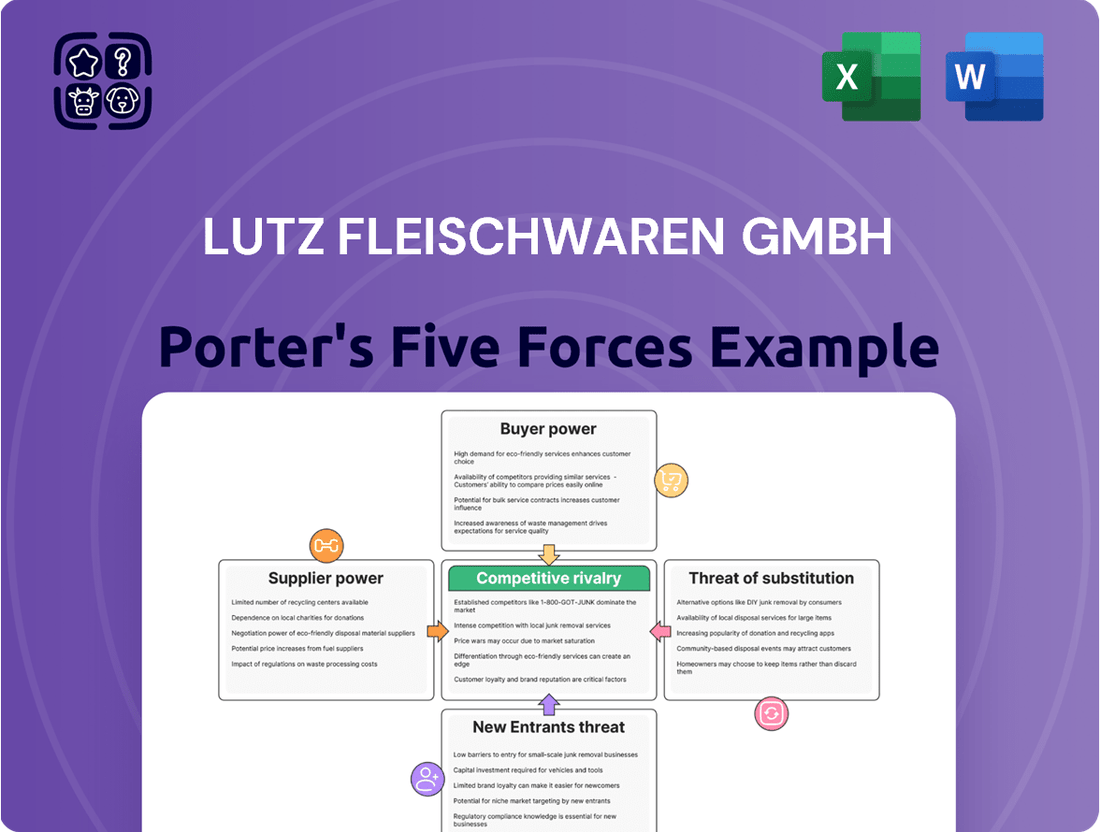

Lutz Fleischwaren GmbH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lutz Fleischwaren GmbH Bundle

Lutz Fleischwaren GmbH operates in a dynamic sector where buyer bargaining power is moderate, influenced by brand loyalty and product differentiation. The threat of substitute products, while present, is somewhat mitigated by the inherent nature of processed meat. However, intense rivalry among existing players significantly shapes the competitive landscape, driving innovation and price sensitivity.

The analysis reveals that supplier power, particularly from livestock producers, can exert considerable influence on Lutz Fleischwaren GmbH's costs and supply chain stability. Moreover, the threat of new entrants, though potentially high due to established distribution channels and capital requirements, is a critical factor to monitor for future market dynamics.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Lutz Fleischwaren GmbH’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The meat processing sector, including companies like Lutz Fleischwaren GmbH, faces significant challenges from raw material price swings. The cost of live animals—pigs, cattle, and poultry—along with essential feed components, can fluctuate dramatically. This instability is often driven by unpredictable elements such as adverse weather patterns affecting harvests, the impact of animal disease outbreaks, and the ever-shifting global balance between supply and demand for these agricultural commodities. In 2024, reports indicated that European pork prices, a key input for many processors, saw considerable year-on-year volatility, with some periods experiencing double-digit percentage changes due to supply disruptions and changing consumer preferences.

The bargaining power of suppliers is significantly influenced by market concentration. If a few large suppliers dominate the market for essential inputs, such as specialized animal breeds or ethically sourced feed, they gain leverage. For Lutz Fleischwaren GmbH, which prioritizes traditional farming and high-quality products, this means a smaller pool of potential suppliers for its raw materials.

In 2024, the European meat industry, including Germany, faced ongoing supply chain challenges. Reports indicated that for certain premium or organic livestock breeds, the number of qualified producers remained limited, potentially allowing these suppliers to command higher prices. This concentration directly impacts Lutz Fleischwaren's input costs and negotiation flexibility.

While basic raw meat might appear undifferentiated, Lutz Fleischwaren GmbH could face switching costs when sourcing specific cuts, quality grades, or meat from animals raised under particular welfare standards. These costs could involve establishing new quality assurance protocols and adjusting existing supply chain logistics. For example, a supplier guaranteeing specific traceability or organic certifications might command a premium, and changing such a supplier would require significant upfront investment in vetting and integration.

Supplier Integration Threat

Suppliers can threaten Lutz Fleischwaren GmbH by moving forward into the company's own business areas, like meat processing or even distribution, effectively becoming direct competitors. While this is less likely for suppliers of live animals, it's a possibility with large agricultural cooperatives or specialized, high-value breeders who might see an opportunity to capture more of the value chain themselves.

For instance, a significant agricultural cooperative in Germany, which supplies a substantial portion of the livestock to the meat processing industry, could decide to invest in its own processing facilities. This would directly pit them against established players like Lutz Fleischwaren. Data from 2024 indicates that the German agricultural sector is increasingly consolidating, with cooperatives playing a more prominent role in the supply chain, potentially increasing their leverage and capability for forward integration.

- Forward Integration Threat: Suppliers may integrate into meat processing or distribution.

- Competitor Emergence: This integration turns suppliers into direct rivals.

- Cooperative Power: Larger agricultural cooperatives are more likely candidates for this strategy.

- Market Trends: Consolidation in German agriculture (2024 data) could enable such moves.

Uniqueness of Supplier Inputs

For Lutz Fleischwaren GmbH, the uniqueness of its inputs is a significant factor in supplier bargaining power. The company's commitment to traditional manufacturing and high product quality often relies on specific breeds of animals or sourcing from particular regions. If these inputs are not readily available from multiple sources, or if they possess unique characteristics essential to Lutz Fleischwaren's product differentiation, suppliers can exert considerable influence.

This reliance on specialized inputs can translate into higher costs or less favorable terms for Lutz Fleischwaren. For instance, if a particular regional farm consistently supplies the premium quality pork required for a signature product, and there are few alternatives, that farm's supplier power increases. This is particularly relevant in 2024, where supply chain resilience and sourcing transparency are paramount.

- Specialized Breeds: Sourcing specific, high-quality livestock breeds that are integral to Lutz Fleischwaren's product identity can create supplier dependence.

- Regional Sourcing: Exclusive access to meat from specific, reputable regions known for quality standards enhances supplier leverage.

- Unique Rearing Conditions: If suppliers provide animals raised under unique, verifiable conditions (e.g., specific feed, ethical treatment) that Lutz Fleischwaren markets, these suppliers gain power.

- Scarcity of Inputs: Limited availability of these specialized inputs in the market amplifies the bargaining power of the few suppliers who can provide them.

The bargaining power of suppliers for Lutz Fleischwaren GmbH is notably high due to the specialized nature of their inputs and the increasing concentration within the agricultural sector. Suppliers of specific, high-quality livestock breeds or those adhering to unique rearing conditions, essential for Lutz Fleischwaren's premium product lines, possess considerable leverage. This is exacerbated when such specialized inputs are scarce, limiting the company's alternatives and increasing its dependence on a few key providers.

In 2024, volatility in European pork prices, driven by supply chain disruptions and animal disease concerns, underscored this supplier power. Reports indicated significant year-on-year price swings, impacting input costs for processors like Lutz Fleischwaren. Furthermore, consolidation within the German agricultural sector, with cooperatives gaining prominence, suggests a growing capacity for these suppliers to integrate forward into processing, posing a competitive threat and further strengthening their bargaining position.

| Factor | Impact on Lutz Fleischwaren | 2024 Relevance |

|---|---|---|

| Market Concentration | Limited choice of specialized suppliers increases leverage. | Organic/premium livestock producers remain concentrated. |

| Input Uniqueness | Reliance on specific breeds/regions for product differentiation. | Traceability and ethical sourcing demands are growing. |

| Switching Costs | Vetting and integration of new suppliers for specialized inputs. | Maintaining quality assurance protocols is critical. |

| Forward Integration Threat | Suppliers may enter meat processing or distribution. | German agricultural cooperatives are consolidating. |

What is included in the product

This analysis of Lutz Fleischwaren GmbH reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential for substitute products, providing a comprehensive view of its competitive environment.

Quickly identify and mitigate competitive threats by visualizing the intense rivalry among German meat processors.

Streamline supplier negotiations by understanding the bargaining power of key agricultural producers impacting Lutz Fleischwaren GmbH.

Customers Bargaining Power

The German retail food market's consolidation significantly amplifies customer bargaining power for Lutz Fleischwaren GmbH. The top four grocery chains in Germany, such as Edeka, Rewe, Schwarz Group (Lidl and Kaufland), and Aldi, collectively held over 85% of the grocery market share in 2023. This concentration means these large retailers wield considerable influence, allowing them to demand favorable pricing and stringent terms from suppliers like Lutz Fleischwaren.

While Lutz Fleischwaren GmbH focuses on its premium offerings, the wider German meat market, particularly during periods of economic strain, exhibits notable price sensitivity among end consumers. This sensitivity creates a ripple effect, intensifying pressure on retailers, who in turn often exert downward price pressure on their suppliers. For instance, German consumer spending on food, while generally resilient, saw shifts in purchasing habits in 2023, with a noticeable increase in demand for budget-friendly options. This dynamic directly impacts the bargaining power of customers by limiting the pricing flexibility of meat processors like Lutz Fleischwaren.

Lutz Fleischwaren GmbH faces significant customer bargaining power driven by the wide availability of substitutes. Consumers now have a vast array of meat products from various producers, and importantly, the market for plant-based alternatives is expanding rapidly. This increased choice means customers are less reliant on any single meat company, directly strengthening their negotiating position.

The burgeoning plant-based food sector is a prime example of this trend. In 2024, the global plant-based meat market was valued at an estimated $10.5 billion and is projected to grow substantially. This growth provides consumers with viable alternatives that directly compete with traditional meat products, forcing companies like Lutz Fleischwaren to consider pricing and product innovation more carefully to retain market share.

Low Switching Costs for Customers

For Lutz Fleischwaren GmbH, the bargaining power of customers is significantly influenced by low switching costs. Retailers and foodservice clients can relatively easily switch between processed meat suppliers, particularly for standardized products. This flexibility allows buyers to readily compare and select vendors based on competitive pricing, product quality, and reliable delivery schedules, thereby enhancing their leverage.

This ease of switching is a core factor in how customers exert their power. For example, in 2024, the German processed meat market saw numerous promotions and price adjustments from various suppliers vying for market share. Lutz Fleischwaren must remain competitive not just on product but also on cost to retain these customers who face minimal hurdles in exploring alternatives.

The implications for Lutz Fleischwaren are clear: maintaining strong customer relationships requires continuous focus on value.

- Price Competitiveness: Customers can easily compare prices across multiple suppliers.

- Quality Consistency: Any perceived dip in quality can prompt a swift switch.

- Delivery Reliability: Consistent and timely delivery is a key factor in customer retention.

- Product Standardization: For basic processed meats, differentiation is harder, increasing the ease of switching.

Customer Information and Transparency

Customers are becoming much more aware of where their food comes from, its quality, and how it's produced. This growing demand for transparency means companies like Lutz Fleischwaren GmbH need to clearly communicate their sourcing and production practices. For instance, a 2024 survey indicated that 70% of German consumers consider ethical sourcing a key factor in their purchasing decisions for meat products.

This heightened consumer knowledge directly impacts Lutz Fleischwaren GmbH by allowing customers to compare offerings and demand specific attributes, such as locally sourced ingredients or certified animal welfare standards. This increased power can influence pricing strategies and product development, pushing companies to align with consumer values.

- Informed Consumers: A significant portion of consumers actively researches product origins and ethical standards.

- Demand for Transparency: Customers increasingly expect clear information about sourcing, quality, and production methods.

- Influence on Pricing: Consumer awareness can lead to demands for premium pricing for ethically produced goods.

- Impact on Product Development: Companies must adapt product lines to meet evolving consumer expectations for transparency and ethical sourcing.

The significant consolidation within the German retail sector, where the top four chains controlled over 85% of the market in 2023, grants considerable bargaining power to customers, including large supermarket chains. This concentration allows them to dictate terms and pricing to suppliers like Lutz Fleischwaren. Furthermore, the readily available substitutes, especially the rapidly expanding plant-based meat market valued at $10.5 billion in 2024, empower consumers further by reducing their reliance on any single meat producer. Low switching costs for retailers and foodservice clients also mean they can easily opt for competitors offering better prices or quality, forcing Lutz Fleischwaren to maintain high standards and competitive pricing.

| Factor | Description | Impact on Lutz Fleischwaren |

| Retailer Consolidation | Top 4 German grocery chains held >85% market share in 2023. | Increased leverage for retailers to demand favorable pricing and terms. |

| Availability of Substitutes | Expanding plant-based meat market ($10.5B in 2024). | Reduced customer dependence on traditional meat products, strengthening negotiating position. |

| Low Switching Costs | Ease for clients to switch between meat suppliers. | Pressure on Lutz Fleischwaren to remain competitive on price, quality, and delivery. |

| Consumer Awareness | 70% of German consumers consider ethical sourcing in 2024. | Customers can demand specific attributes, influencing pricing and product development. |

Preview Before You Purchase

Lutz Fleischwaren GmbH Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Lutz Fleischwaren GmbH, detailing competitive rivalry, the threat of new entrants, buyer power, supplier power, and the threat of substitutes within the German meat processing industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It provides actionable insights into the market's competitive landscape and potential strategic advantages. By understanding these forces, businesses can better navigate industry dynamics and formulate effective strategies.

Rivalry Among Competitors

The German meat processing industry is a crowded marketplace, featuring a wide array of companies. This includes large-scale industrial processors that dominate mass production, as well as a significant number of smaller, regional butchers and specialized producers. Lutz Fleischwaren GmbH finds itself competing directly with both ends of this spectrum, needing to differentiate itself from high-volume, low-cost providers and other quality-oriented businesses.

The German meat market, while substantial, is experiencing sluggish growth, with volume expected to remain flat or even contract in certain areas like red meat. This limited market expansion forces companies like Lutz Fleischwaren GmbH to fiercely compete for existing market share, rather than benefiting from a growing overall demand. For instance, the German meat industry saw a slight decline in consumption of pork and beef in recent years, while the plant-based alternative market surged by over 30% in 2023 alone.

Lutz Fleischwaren GmbH leverages its commitment to traditional production methods and superior product quality as significant differentiators. This focus aims to elevate its offerings beyond mere commodities in a competitive marketplace.

By emphasizing quality, a strong brand reputation, and an appeal rooted in tradition, Lutz Fleischwaren GmbH seeks to lessen the intensity of direct price competition. This strategy is crucial in a sector where many products are easily substitutable.

For instance, in 2024, the German sausage market, a key segment for Lutz Fleischwaren, saw continued consumer interest in premium and traditionally produced items. Reports indicate that consumers are willing to pay a premium for products perceived as higher quality and more authentic.

This differentiation strategy directly addresses the threat of rivalry by creating a unique selling proposition that transcends simple price points, fostering customer loyalty and reducing the pressure to engage in price wars with competitors.

High Exit Barriers

The meat processing industry, including companies like Lutz Fleischwaren GmbH, often faces high exit barriers. This is largely due to substantial investments in specialized production facilities and machinery, which are difficult to repurpose or sell off. For instance, the capital expenditure for a modern meat processing plant can run into tens of millions of Euros, making it a significant commitment. This financial entanglement means that companies are often compelled to continue operations, even when market conditions are unfavorable, to avoid substantial losses on their fixed assets.

These high exit barriers directly contribute to intensified competitive rivalry. When firms cannot easily leave the market, they are more likely to compete aggressively on price or volume to maintain market share and cover their ongoing operational costs. This can lead to prolonged periods of low profitability for all players in the industry. In 2024, the German meat processing sector, a key market for Lutz Fleischwaren, continued to navigate these pressures, with many medium-sized businesses demonstrating a reluctance to divest due to these sunk costs.

- Significant Capital Investment: Meat processing plants require extensive and specialized machinery, representing a major fixed cost.

- Specialized Labor: The need for skilled workers in areas like butchery and food safety adds another layer of commitment.

- Asset Impairment: Attempting to exit can result in significant write-downs on specialized, hard-to-repurpose assets.

- Market Persistence: Companies may stay in operation during downturns to avoid capital losses, thereby sustaining industry competition.

Competitive Strategies and Innovation

Competitive rivalry within the meat processing industry, including for Lutz Fleischwaren GmbH, is intense, fueled by a range of strategies. Companies actively compete on price, leverage aggressive marketing campaigns, and prioritize product innovation, introducing convenient options and novel flavors to capture consumer interest. A significant battleground also lies in investments towards sustainable practices, responding to growing environmental consciousness among buyers.

To maintain a competitive edge, businesses must remain agile, continuously adapting to evolving consumer tastes and navigating a complex, often changing, regulatory landscape. For instance, in 2024, the German food industry, a key market for Lutz, saw continued emphasis on transparency and traceability, influencing product development and marketing efforts.

Key competitive strategies observed include:

- Price Competition: Direct price reductions and promotional offers are common tactics to attract volume sales.

- Product Innovation: Development of ready-to-eat meals, plant-based alternatives, and unique flavor profiles are crucial for differentiation.

- Marketing and Branding: Strong brand messaging focusing on quality, origin, and health benefits plays a vital role in consumer choice.

- Sustainability Investments: Initiatives in ethical sourcing, reduced packaging, and energy efficiency are increasingly important for brand reputation and market share.

Competitive rivalry in the German meat processing sector is fierce, with Lutz Fleischwaren GmbH facing numerous competitors ranging from large industrial players to specialized regional producers. This competition is intensified by sluggish market growth, forcing companies to fight for existing market share. For example, while the overall meat market saw limited volume growth in 2024, the plant-based alternative segment experienced significant expansion, drawing consumer attention and resources.

| Competitor Type | Key Strategy | 2024 Market Focus |

| Large Industrial Processors | Volume, Price Efficiency | Cost leadership, broad product range |

| Regional Butchers/Specialty Producers | Quality, Tradition, Local Sourcing | Premium products, niche markets |

| New Entrants (e.g., Plant-Based) | Innovation, Sustainability | Health-conscious consumers, environmental appeal |

SSubstitutes Threaten

The most significant threat of substitution for Lutz Fleischwaren GmbH stems from the burgeoning plant-based meat alternatives market in Germany. Sales of these products have seen substantial growth, indicating a clear shift in consumer preferences. For instance, the German plant-based food market was valued at approximately €1.1 billion in 2023, with meat alternatives representing a significant portion of this. This trend is fueled by increasing consumer awareness regarding health benefits, environmental sustainability, and ethical considerations surrounding traditional meat production.

The growing consumer focus on health and sustainability presents a significant threat of substitutes for Lutz Fleischwaren GmbH. As awareness of the environmental and health impacts of traditional meat consumption rises, consumers are increasingly opting for plant-based alternatives, which saw substantial growth in 2024. For instance, the global plant-based meat market was projected to reach over $20 billion by 2024, indicating a strong and expanding substitute category.

This shift isn't just about complete avoidance of meat; many consumers are also seeking leaner, organic, or sustainably sourced animal products, which can be considered substitutes for conventional offerings. This trend directly challenges Lutz Fleischwaren's core product portfolio by offering alternative protein sources that align better with evolving consumer values and dietary preferences.

The rise of hybrid meat products, blending conventional meat with plant-based proteins, represents a significant threat of substitution for traditional meat producers like Lutz Fleischwaren GmbH. These hybrids offer consumers an accessible way to decrease their meat consumption without fully committing to vegetarian or vegan lifestyles. For instance, in 2024, the global plant-based meat market, which includes many hybrid formulations, was valued at over $10 billion and is projected to grow substantially.

Convenience and Ready-to-Eat Alternatives

Consumers seeking quick meal solutions may opt for convenient protein sources beyond plant-based alternatives. Ready-to-eat meals, often featuring diverse protein options like chicken, fish, or legumes, present a direct challenge. In 2024, the global ready-to-eat meal market reached an estimated USD 198.5 billion, indicating strong consumer preference for convenience. This trend directly impacts Lutz Fleischwaren by offering readily available, time-saving protein choices that can replace processed meat products.

Seafood and dairy/egg products also act as significant substitutes, particularly for consumers prioritizing health or variety. For instance, the global seafood market is projected to grow, with consumption patterns showing increased interest in convenient fish preparations. Similarly, the demand for eggs as a versatile and quick protein source remains robust. These alternatives provide consumers with different nutritional profiles and preparation methods, thereby diverting demand from traditional processed meats.

- Convenience-driven demand for ready-to-eat meals poses a threat.

- Seafood and dairy/egg products offer alternative protein sources.

- Busy lifestyles encourage adoption of convenient meal solutions.

- Consumer preference for variety impacts processed meat consumption.

Price-Performance of Substitutes

The growing affordability and improving quality of plant-based alternatives are significantly impacting the meat industry. As private-label brands increasingly offer competitive pricing and enhanced taste and texture, they present a more attractive substitute for consumers. This trend directly pressures traditional meat producers like Lutz Fleischwaren GmbH to maintain competitive pricing and consistent quality to retain market share.

The price-performance ratio of these meat substitutes is a critical factor in their adoption. For instance, in early 2024, the average price per pound for plant-based ground meat was often comparable to or even slightly higher than conventional ground beef, but this gap is narrowing. Innovations in ingredients and production methods are driving down costs for plant-based options. This evolving landscape means consumers are increasingly finding substitutes that meet their taste expectations without a significant price penalty, amplifying the competitive threat.

- Price Convergence: Plant-based alternatives are becoming more cost-competitive, particularly private-label options, which are often priced closer to conventional meat products.

- Quality Improvement: Advances in food technology are leading to plant-based products that better mimic the taste, texture, and cooking experience of traditional meat.

- Consumer Perception: As substitutes become more accessible and appealing, consumer willingness to switch from meat-based products increases.

- Market Pressure: This shift necessitates that traditional meat producers focus on efficiency, innovation, and value to counter the rising attractiveness of alternatives.

The threat of substitutes for Lutz Fleischwaren GmbH is significant and multifaceted. Consumers are increasingly turning to plant-based alternatives, which saw global market value projections exceeding $20 billion by 2024. Furthermore, the demand for convenience fuels the ready-to-eat meal market, valued at approximately USD 198.5 billion in 2024, offering protein sources like legumes and fish that bypass traditional meat products. Even hybrid meat products, blending meat with plant-based ingredients, are gaining traction as consumers seek to reduce their meat intake gradually.

| Substitute Category | 2024 Market Relevance | Impact on Lutz Fleischwaren |

|---|---|---|

| Plant-Based Meat Alternatives | Global market projected over $20 billion | Direct competition, shifting consumer preferences |

| Ready-to-Eat Meals | Global market ~USD 198.5 billion | Offers convenient protein alternatives (e.g., legumes, fish) |

| Hybrid Meat Products | Growing segment within plant-based market | Appeals to consumers reducing meat consumption |

| Seafood & Dairy/Eggs | Robust and growing demand | Alternative protein sources with health and variety appeal |

Entrants Threaten

The meat processing industry, including companies like Lutz Fleischwaren GmbH, presents a formidable capital requirement for new players. Establishing a modern, compliant facility demands significant upfront investment in specialized machinery for cutting, processing, packaging, and refrigeration, alongside the construction or acquisition of suitable infrastructure.

These capital outlays are further amplified by the necessity to meet rigorous food safety standards, such as HACCP, and strict hygiene regulations, which often necessitate advanced filtration systems, sterile environments, and specialized waste management. For instance, the global meat processing equipment market was valued at approximately USD 15 billion in 2023 and is projected to grow, indicating the scale of investment needed.

New entrants must also account for substantial working capital to cover raw material procurement, labor, energy costs, and marketing. The sheer financial commitment involved acts as a strong deterrent, creating a substantial barrier to entry and protecting established firms like Lutz Fleischwaren GmbH from immediate competitive threats.

Economies of scale present a significant barrier for new entrants into the meat processing industry, directly impacting Lutz Fleischwaren GmbH. Established players, like the major German meat producers, leverage their substantial production volumes to secure raw materials at lower prices. For instance, in 2023, the average purchase price for live pigs in Germany remained a key cost driver, and large processors could negotiate better terms due to their consistent, high-volume demand.

This purchasing power translates into lower per-unit production costs. New companies entering the market would find it challenging to match these efficiencies immediately, as they would likely start with smaller production runs. This cost disadvantage means new entrants would struggle to compete on price with established firms, making it difficult to gain market share.

Furthermore, distribution networks are also optimized for scale. Large processors have efficient logistics in place, reducing transportation costs per unit. A new entrant would need to invest heavily to build a comparable distribution system, adding to their initial capital expenditure and ongoing operational costs, which would further hinder their ability to offer competitive pricing compared to a company like Lutz Fleischwaren GmbH.

Lutz Fleischwaren GmbH cultivates strong brand loyalty by consistently highlighting its commitment to traditional methods and high-quality products. This dedication resonates with consumers, making it harder for newcomers to lure away established customer bases. For instance, in 2023, the German processed meat market saw continued consumer preference for established brands known for quality and origin, a trend Lutz leverages.

Furthermore, Lutz Fleischwaren GmbH benefits from deeply entrenched relationships with a vast network of retailers and foodservice clients across Germany. These established distribution channels represent a significant barrier to entry, as new competitors would struggle to replicate the same reach and shelf space. In 2024, securing prime retail placement remains a critical challenge for emerging food brands, underscoring the advantage of Lutz's existing partnerships.

Regulatory Hurdles and Food Safety Standards

The meat processing sector in Germany, including companies like Lutz Fleischwaren GmbH, faces substantial regulatory burdens. These include stringent EU and German laws concerning food safety, hygiene, and animal welfare. For instance, the German Federal Ministry of Food and Agriculture (BMEL) enforces detailed regulations derived from EU directives like Regulation (EC) No 852/2004 on the hygiene of foodstuffs.

Meeting these comprehensive standards necessitates significant capital expenditure for facilities, equipment, and ongoing compliance monitoring. New entrants must also invest heavily in specialized personnel, such as quality control experts and veterinarians, to navigate the complex legal landscape. This financial and operational commitment creates a formidable barrier, effectively deterring many potential competitors from entering the market.

Compliance with these regulations can add a considerable percentage to a company's operating costs. In 2024, the estimated cost of compliance for food safety measures alone can range from 5% to 15% of annual revenue for smaller operations, making it a critical factor for market entry.

- Stringent Health and Safety Laws: German and EU regulations mandate rigorous hygiene and safety protocols throughout the meat processing chain.

- Animal Welfare Requirements: Compliance with evolving animal welfare standards, often exceeding basic legal minimums, adds further complexity and cost.

- Significant Capital Investment: New entrants need substantial funds for compliant infrastructure, advanced technology, and skilled labor.

- Expertise in Regulatory Affairs: Navigating and maintaining compliance requires dedicated internal expertise or costly external consultation.

Access to Raw Materials and Expertise

New entrants into the meat processing industry, like those looking to compete with Lutz Fleischwaren GmbH, can face significant hurdles in securing consistent access to high-quality raw meat. This is particularly true if established players have strong, long-term relationships with premium suppliers or if specific, traditional animal husbandry practices are a requirement. For instance, in 2024, the European Union's agricultural sector continued to emphasize sustainable farming, which can limit the readily available supply of conventionally raised meat for new, less established businesses.

Furthermore, the acquisition of specialized skills and expertise in traditional meat processing methods presents another barrier. This includes everything from butchery techniques to the nuanced understanding of curing and sausage making that contributes to product quality and brand reputation. The German meat industry, for example, boasts a rich heritage of craftsmanship, meaning that new companies might struggle to find and train staff with the necessary proficiency, impacting their ability to produce goods that meet consumer expectations and compete with established brands like Lutz Fleischwaren.

- Limited Raw Material Access: New entrants may struggle to secure consistent supply of high-quality raw meat, especially for niche or traditionally sourced products.

- Skilled Labor Shortage: Acquiring experienced butchers and traditional meat processing experts is a significant challenge, impacting production quality and efficiency.

- Supplier Relationships: Established companies like Lutz Fleischwaren likely have strong, preferential relationships with meat suppliers, making it harder for newcomers to negotiate favorable terms.

- Capital Investment: Setting up processing facilities that meet stringent hygiene and quality standards requires substantial initial investment, acting as a deterrent for potential new entrants.

The threat of new entrants for Lutz Fleischwaren GmbH is relatively low due to high capital requirements and established economies of scale. New companies need substantial investment for facilities and machinery, a barrier amplified by rigorous food safety regulations. For instance, the global meat processing equipment market was valued at approximately USD 15 billion in 2023, indicating the scale of investment.

Existing players like Lutz benefit from lower per-unit costs due to high-volume production, making it difficult for newcomers to compete on price. Furthermore, strong brand loyalty and established distribution networks, secured through long-term partnerships with retailers, create significant hurdles for new entrants attempting to gain market share and shelf space in 2024.

The complex regulatory environment, including stringent EU and German food safety laws, adds another layer of difficulty and cost for potential entrants. Compliance alone can add 5% to 15% of annual revenue in operational costs for smaller entities in 2024, necessitating significant upfront investment in compliant infrastructure and specialized personnel.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Lutz Fleischwaren GmbH leverages data from industry-specific market research reports, company financial statements, and German food industry trade publications to provide a comprehensive overview of the competitive landscape.