Lee Enterprises SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lee Enterprises Bundle

Lee Enterprises, a prominent player in the media industry, faces a dynamic landscape shaped by both internal capabilities and external forces. Understanding their strengths in local journalism and their opportunities in digital transformation is crucial for navigating the evolving media consumption habits of consumers.

However, their weaknesses, such as reliance on traditional advertising models, and threats, like intense competition and changing reader preferences, demand strategic attention. This initial overview only scratches the surface of what's truly driving Lee Enterprises' market position.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Lee Enterprises boasts a significant local market presence, operating in 72 markets across 25 states. This extensive network includes daily newspapers, alongside numerous weekly and specialty publications, reaching a broad audience within these communities.

This deep local penetration enables Lee Enterprises to provide highly tailored content and advertising opportunities, fostering strong connections and trust within the communities they serve. Their strategic focus on midsize markets allows them to excel in delivering vital local journalism where national competitors often have a lesser impact.

As of September 2023, Lee Enterprises reached approximately 32 million unique monthly digital visitors, underscoring the breadth of their local digital footprint.

Lee Enterprises has reached a significant milestone, with digital revenue now accounting for more than half of its total operating revenue. In the first quarter of fiscal year 2025, digital revenue hit 51%, climbing to 53% in the second quarter. This achievement underscores the company's effective digital-first strategy, demonstrating a clear pivot towards a more sustainable revenue model.

Lee Enterprises is seeing substantial gains in its digital subscription numbers. In the first quarter of fiscal year 2025, digital-only subscriptions grew by 14%, and this momentum continued into the second quarter with a 20% increase on a same-store basis. This builds on an already strong performance, with a 41% surge in fiscal year 2024.

The company's Amplified Digital Agency is also a key driver of this digital success. This agency offers marketing services tailored for local businesses, and its growth is directly contributing to Lee Enterprises' overall digital revenue. This expansion into digital services provides a more robust and diversified revenue stream for the company.

Strategic Partnerships and AI Investment

Lee Enterprises is actively forging strategic alliances to enhance its technological capabilities. A key partnership with Amazon Web Services (AWS) is focused on leveraging cloud computing and generative AI. This collaboration is designed to streamline content delivery and elevate customer interaction.

Further strengthening its AI focus, Lee has also partnered with advanced AI search engines such as Perplexity and ProRata.ai. These alliances are instrumental in Lee's strategy to innovate digital products and deliver hyper-personalized local content. The company aims to utilize AI for more effective, real-time advertising solutions.

These strategic investments in AI and partnerships are positioning Lee Enterprises at the forefront of digital transformation within the media industry. For instance, in the first quarter of fiscal year 2024, Lee reported digital revenue growth of 5.9%, a testament to these initiatives.

Key strengths derived from these partnerships include:

- Enhanced AI Capabilities: Access to advanced AI platforms from AWS and specialized AI search engines.

- Optimized Operations: Improvements in content delivery and customer engagement through cloud solutions.

- Innovative Product Development: Driving new digital products and personalized content experiences.

- Competitive Advantage: Positioning Lee as an early adopter and leader in AI-driven media solutions.

Robust Cost Management Initiatives

Lee Enterprises demonstrates a strong focus on cost management, with plans to implement approximately $40 million in annualized cost reductions by the second quarter of fiscal year 2025. This initiative builds upon a history of successfully reducing total cash costs in recent years.

This aggressive approach to controlling expenses is a key strength, especially when coupled with their digital revenue growth. Such financial discipline is vital for boosting adjusted EBITDA and fostering long-term financial stability and sustainability for the company.

- Commitment to Cost Reduction: Targeting $40 million in annualized savings by Q2 FY25.

- Proven Track Record: Demonstrated success in reducing total cash costs over past years.

- Financial Health Driver: Cost management is essential for improving adjusted EBITDA.

- Long-Term Sustainability: Crucial for achieving and maintaining financial health.

Lee Enterprises has successfully transitioned to a digital-first revenue model, with digital revenue comprising 53% of total operating revenue in Q2 FY2025. This shift is further bolstered by a 20% increase in digital-only subscriptions in the same quarter, building on a 41% surge in FY2024.

The company's Amplified Digital Agency is a significant contributor, offering local businesses tailored marketing services and diversifying revenue streams. Strategic partnerships with AWS, Perplexity, and ProRata.ai are enhancing AI capabilities for content delivery and personalized customer experiences.

Lee Enterprises is also demonstrating strong financial discipline, targeting $40 million in annualized cost reductions by Q2 FY2025. This focus on cost management is crucial for improving adjusted EBITDA and ensuring long-term financial sustainability.

| Metric | Q2 FY2025 | FY2024 |

|---|---|---|

| Digital Revenue % of Total | 53% | >50% |

| Digital-Only Subscriptions Growth | 20% | 41% |

| Targeted Cost Reductions (Annualized) | $40 million (by Q2 FY25) | N/A |

What is included in the product

Offers a full breakdown of Lee Enterprises’s strategic business environment, detailing its internal capabilities and external market challenges.

Helps identify and address Lee Enterprises' weaknesses by providing a clear framework for strategic improvement.

Weaknesses

Despite efforts to boost digital presence, Lee Enterprises continues to grapple with a substantial downturn in its traditional print revenue. This persistent decline is evident across both print advertising and subscription sales, directly impacting the company's overall financial performance.

In the first quarter of fiscal year 2025, Lee Enterprises reported a 16% year-over-year decrease in total print revenues. More specifically, print advertising revenue saw an even sharper drop of 19% during the same period.

These figures highlight the ongoing challenge of offsetting the shrinking print segment's contribution to operating revenue and overall profitability. The company's ability to navigate this trend is heavily reliant on the pace and success of its digital transformation initiatives.

While Lee Enterprises is seeing growth in its digital revenue streams, this hasn't been enough to offset the broader decline in total operating revenue. For example, in the first quarter of fiscal year 2025, the company reported $145 million in revenue, a drop from prior periods. This persistent revenue shortfall is a significant weakness.

Further underscoring these financial challenges, Lee Enterprises posted a net loss of $16 million in Q1 FY25 and followed that with another $12 million net loss in Q2 FY25. These figures also fell short of what financial analysts had anticipated, highlighting concerns about the company's profitability.

The core issue is that the gains from digital expansion and ongoing cost-saving measures haven't yet fully balanced out the shrinking revenue from traditional sources like print advertising. This gap directly impacts the company's overall financial health and its ability to invest in future growth initiatives.

Lee Enterprises carries a significant debt load, amounting to approximately $446 million as of the first quarter of fiscal year 2025. This debt comes with a fixed annual interest rate of 9.0%, which, while having long-term maturity, still represents a considerable financial obligation.

The company's liquidity position is a key concern, with only $6 million in cash on hand during Q1 FY25. This limited cash reserve could hinder Lee Enterprises' ability to invest in new growth opportunities or pursue strategic acquisitions, impacting its long-term expansion potential.

Slowdown in Digital Subscriber Growth Rate

While Lee Enterprises is seeing an increase in digital-only subscription revenue, the pace at which they are acquiring new digital subscribers has noticeably slowed. For instance, the growth rates observed in the first three quarters of 2024 indicate a deceleration, which could put pressure on achieving their ambitious long-term subscriber goals. This slowdown raises concerns about meeting projected digital revenue targets for fiscal year 2028.

- Slowing Digital Subscriber Acquisition: Growth rates for digital subscribers declined in Q1-Q3 2024.

- Impact on Long-Term Targets: This trend questions Lee Enterprises' ability to reach its subscriber projections.

- Revenue Projection Risk: The deceleration may hinder the achievement of fiscal year 2028 digital revenue goals.

Vulnerability to Cybersecurity Incidents

Lee Enterprises faces significant challenges due to its vulnerability to cybersecurity incidents. A notable event occurred in February 2025, which directly impacted its second quarter of fiscal year 2025 operating results. This incident necessitated substantial restoration costs and temporarily restricted the company's product offerings, demonstrating the tangible financial and operational consequences of such breaches.

The cybersecurity incident underscores a critical weakness: the susceptibility of Lee Enterprises' systems to cyber threats. Such vulnerabilities can create a ripple effect, disrupting core business operations, negatively affecting advertising revenue streams, and hindering the company's ability to acquire and retain customers. The financial repercussions, including restoration expenses and lost revenue, can be substantial.

- Cybersecurity Incident Impact: A February 2025 incident led to significant Q2 FY25 operating result impacts.

- Financial Repercussions: The company incurred restoration costs and experienced a temporary limitation of its product portfolio.

- Operational Disruption: The breach highlighted the risk of cyber threats disrupting normal business activities.

- Revenue and Customer Acquisition: Vulnerabilities can negatively affect advertising revenue and customer acquisition efforts.

The company's reliance on print revenue remains a significant vulnerability, with print advertising revenue declining 19% in Q1 FY25, contributing to an overall 16% drop in print revenues. This persistent revenue erosion, despite digital growth, led to a $12 million net loss in Q2 FY25, missing analyst expectations and highlighting profitability challenges.

Lee Enterprises faces a considerable debt burden of approximately $446 million as of Q1 FY25, with a 9.0% fixed annual interest rate. Coupled with a low cash reserve of only $6 million in Q1 FY25, this financial structure limits the company's capacity for strategic investments and growth initiatives.

A slowdown in digital subscriber acquisition, with decelerating growth rates observed in the first three quarters of 2024, poses a risk to achieving long-term subscriber goals and projected digital revenue targets for fiscal year 2028.

A cybersecurity incident in February 2025 significantly impacted Q2 FY25 operations, incurring restoration costs and temporarily limiting product offerings, underscoring the financial and operational risks associated with system vulnerabilities.

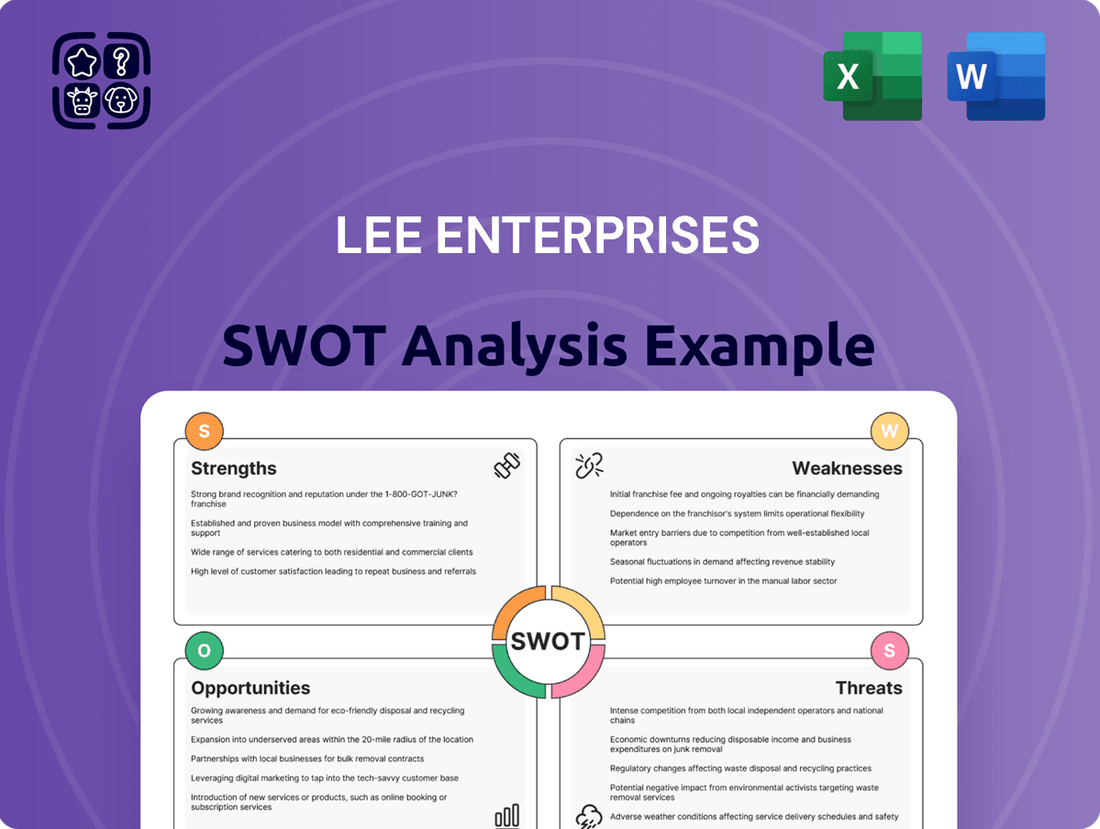

Preview the Actual Deliverable

Lee Enterprises SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Lee Enterprises SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. Upon purchase, you unlock the complete, in-depth report, providing a comprehensive understanding of the company's strategic position. This ensures you get exactly what you need for informed decision-making.

Opportunities

Lee Enterprises has a clear path to boost its digital business, with digital revenue already making up more than half of its total income. This presents a prime chance to expand its digital-only subscriptions and its Amplified Digital Agency offerings even further.

By continuing to invest in high-quality local news and improving its digital marketing, Lee can attract more subscribers and encourage local businesses to spend more on advertising. This focus on content and marketing is key to driving user acquisition and ad revenue.

The company itself anticipates that its digital revenue growth will pick up speed, projecting a range of 7% to 10% for the entire fiscal year of 2024. This forecast highlights the significant potential for digital channels to become even more dominant revenue drivers.

Lee Enterprises' strategic alliances with industry leaders like AWS, Perplexity, and ProRata.ai present a significant opportunity to harness the power of artificial intelligence. This integration can facilitate hyper-personalized content delivery, enabling the company to tailor news and advertising to individual reader preferences, thereby boosting engagement.

The ability to leverage AI for real-time advertising is another key advantage. This allows for dynamic ad placement and optimization, potentially increasing advertising revenue and offering more value to advertisers. For instance, in 2024, the digital advertising market is projected to reach over $600 billion globally, highlighting the immense potential for companies adept at leveraging AI.

Further investment in AI-driven solutions can unlock new revenue streams beyond traditional advertising models. This could include premium personalized content subscriptions or data analytics services for local businesses. By embracing these technological advancements, Lee Enterprises can enhance operational efficiencies and reinforce its standing as an innovator in the local media landscape.

The substantial revenue growth experienced by Lee Enterprises' Amplified Digital Agency, reaching an impressive 25% year-over-year increase in Q1 2024, highlights a prime opportunity. This success demonstrates a clear market demand for digital marketing solutions.

Capitalizing on this momentum, Lee Enterprises can expand its marketing services to local businesses, leveraging its existing strong local relationships. The increasing reliance of small and medium-sized businesses on digital channels presents a significant untapped market share.

By offering a broader suite of digital marketing services, potentially including SEO optimization, social media management, and targeted advertising campaigns, Lee Enterprises can further solidify its position. This expansion could capture a larger portion of the local advertising spend, which is projected to grow by 10% in 2024.

Capitalize on Local News Trust and Demand

Local newspapers consistently hold a high level of trust among Americans, with a significant majority deeming local news essential. This inherent trust is a powerful asset for Lee Enterprises. By emphasizing their commitment to local journalism, Lee can solidify its position as a go-to source for community-specific information, a crucial differentiator in today's media landscape.

Lee Enterprises can harness this trust to bolster its digital presence and attract more paying subscribers. Focusing on high-quality, localized content that resonates with community needs will drive engagement and conversion. This strategy directly addresses the strong demand for reliable local news, allowing Lee to convert readers into loyal digital subscribers.

- High Trust in Local News: A 2024 Pew Research Center study indicated that 67% of Americans believe it is important to have a local newspaper.

- Digital Subscription Growth: Lee Enterprises reported a year-over-year increase in digital-only subscriptions in its Q1 2025 earnings call, reflecting growing demand for online local content.

- Community Engagement Focus: Successful local news outlets often see higher engagement rates on digital platforms when they prioritize hyper-local stories and community events.

Strategic Acquisitions in Underserved Local Markets

The consolidation trend among smaller and mid-sized newspaper groups, alongside the growing number of communities identified as news deserts, creates a significant acquisition opportunity for Lee Enterprises. These underserved local markets often feature struggling media assets that could be acquired at favorable valuations, allowing Lee to expand its geographic reach.

By strategically acquiring these local news outlets, Lee can achieve operational efficiencies through consolidation and integrate them into its established digital-first strategy. This approach can revitalize local journalism and bolster Lee's market presence. For instance, the ongoing challenges faced by local newspapers mean many are available for purchase, with reports indicating a substantial number of independent papers have been shuttered in recent years, leaving voids in local reporting.

- Expansion: Acquire local media assets in midsize markets to broaden Lee's operational footprint.

- Consolidation: Achieve cost synergies by integrating acquired operations into Lee's existing infrastructure.

- Digital Integration: Leverage Lee's digital-first model to modernize and monetize newly acquired local news services.

- Attractive Valuations: Capitalize on the current market conditions where distressed local media properties may be available at lower price points.

Lee Enterprises' strategic alliances with industry leaders like AWS, Perplexity, and ProRata.ai present a significant opportunity to harness the power of artificial intelligence for hyper-personalized content delivery. This integration can tailor news and advertising to individual reader preferences, boosting engagement and allowing for real-time advertising optimization, a crucial advantage in the over $600 billion global digital advertising market projected for 2024.

Threats

The persistent and rapid decrease in print readership and advertising income presents a substantial challenge for Lee Enterprises. This trend, evident across the industry, has led to a significant number of newspaper closures and a continued erosion of print-based revenue streams.

For instance, by the end of fiscal year 2023, Lee Enterprises reported a notable decrease in advertising revenue, with print advertising experiencing a sharper decline compared to digital. If the company's digital initiatives do not accelerate their growth trajectory quickly enough to compensate for these print losses, it will inevitably strain overall profitability and cash flow generation.

Lee Enterprises contends with formidable rivals in the digital advertising arena, notably giants like Google and Meta (Facebook), which collectively capture a substantial portion of the online ad spend. For instance, in 2023, Meta's advertising revenue alone was approximately $134.9 billion, highlighting the immense scale of these platforms.

The proliferation of digital-native news outlets and the shift in how younger audiences consume information, increasingly through social media channels like TikTok, directly challenge Lee's established reach and its capacity to monetize digital content effectively. This evolving media landscape means Lee must innovate to capture attention and advertising dollars in a highly fragmented market.

Economic instability, particularly a potential recession in late 2024 or early 2025, poses a significant threat to Lee Enterprises. Local businesses, a core customer base for Lee, often reduce advertising budgets during economic downturns. This directly impacts Lee's advertising revenue streams, which are highly susceptible to cyclical spending patterns.

While Lee Enterprises is diversifying into digital agency services, its traditional advertising segments remain vulnerable. For instance, during the COVID-19 pandemic in 2020, many businesses slashed advertising budgets, and a similar contraction could occur if economic conditions worsen. This sensitivity to economic cycles can create volatility in financial projections and revenue growth.

High Debt Servicing Costs

Lee Enterprises faces a significant challenge with its substantial debt burden. As of the most recent reports, the company carries approximately $446 million in debt, serviced at a fixed interest rate of 9.0%. This means a considerable portion of its operating cash flow is allocated solely to interest payments, significantly impacting its financial flexibility.

This high debt servicing cost directly curtails the capital available for crucial investments. Funds that could otherwise fuel digital innovation, attract top talent, or support other strategic growth initiatives are instead committed to debt obligations. This constraint can hinder Lee Enterprises' ability to adapt and compete effectively in the evolving media landscape.

- Debt Principal: Approximately $446 million.

- Interest Rate: Fixed at 9.0%.

- Impact: Diverts operating cash flow from strategic reinvestment.

- Consequence: Limits capacity for digital innovation and talent acquisition.

Shareholder Activism and Potential Acquisition Attempts

Lee Enterprises faces a significant threat from shareholder activism and potential acquisition attempts, particularly highlighted by unsolicited interest from The Hoffmann Family of Companies. This entity has been steadily increasing its stake in Lee, signaling a clear intention to pursue an acquisition, which could manifest as disruptive shareholder activism or a hostile takeover bid. For instance, by early 2024, The Hoffmann Family of Companies had amassed a substantial ownership percentage, making their influence a tangible concern for Lee's current management and board.

Such persistent interest creates considerable uncertainty regarding the company's future strategic direction and leadership stability. While a successful takeover could potentially offer a premium for existing shareholders, the process itself often involves intense scrutiny and can divert management's focus away from crucial long-term objectives, such as executing its digital transformation strategy. This ongoing pressure can hinder operational execution and strategic planning, impacting the company's ability to innovate and grow organically.

The active pursuit by Hoffmann, and the potential for other interested parties to emerge, places Lee under a spotlight that can lead to:

- Increased pressure on management to deliver short-term results.

- Potential proxy battles or board seat challenges.

- Uncertainty in strategic decision-making due to takeover speculation.

- A distraction from executing the company's core digital strategy.

The intense competition from digital-native news outlets and evolving consumer habits, especially among younger demographics who favor social media platforms like TikTok for news consumption, pose a significant threat. This fragmentation of audience attention challenges Lee's ability to capture and monetize digital content effectively, demanding constant innovation to stay relevant and competitive in a crowded media landscape.

Economic downturns, such as a potential recession anticipated for late 2024 or early 2025, directly impact Lee Enterprises. Local businesses, a key advertising client base, tend to reduce their ad spending during economic contractions, leading to a predictable decline in Lee's advertising revenues. This sensitivity to economic cycles creates revenue volatility, as demonstrated by budget cuts during the 2020 pandemic.

Lee Enterprises is burdened by a substantial debt of approximately $446 million, carrying a fixed interest rate of 9.0%. This high debt servicing cost consumes a significant portion of operating cash flow, directly limiting the capital available for essential investments in digital transformation, talent acquisition, and other strategic growth initiatives, thereby hindering its competitive adaptability.

The ongoing shareholder activism and acquisition interest from entities like The Hoffmann Family of Companies create considerable uncertainty regarding Lee's strategic direction and leadership stability. This persistent pressure can divert management's focus from long-term objectives, potentially impacting the execution of its digital transformation strategy and overall operational performance.

| Threat Category | Specific Challenge | Impact on Lee Enterprises | Illustrative Data/Context |

| Digital Competition | Dominance of Google and Meta in digital advertising | Difficulty in capturing a significant share of online ad spend | Meta's 2023 ad revenue: ~$134.9 billion |

| Changing Media Consumption | Shift to social media (e.g., TikTok) for news | Erosion of traditional reach; challenges in monetizing digital content | Younger audiences increasingly relying on social platforms |

| Economic Sensitivity | Recession risk (late 2024/early 2025) | Reduced advertising budgets from local businesses; revenue volatility | Similar impact observed during the COVID-19 pandemic in 2020 |

| Debt Burden | High debt principal and interest rate | Limited capital for reinvestment and innovation; reduced financial flexibility | Debt: ~$446 million; Interest Rate: 9.0% |

| Shareholder Activism/Acquisition Interest | Unsolicited interest from The Hoffmann Family of Companies | Strategic uncertainty; management distraction; potential proxy battles | Hoffmann Family steadily increasing stake by early 2024 |

SWOT Analysis Data Sources

This Lee Enterprises SWOT analysis is built on a foundation of robust data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.