Lee Enterprises Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lee Enterprises Bundle

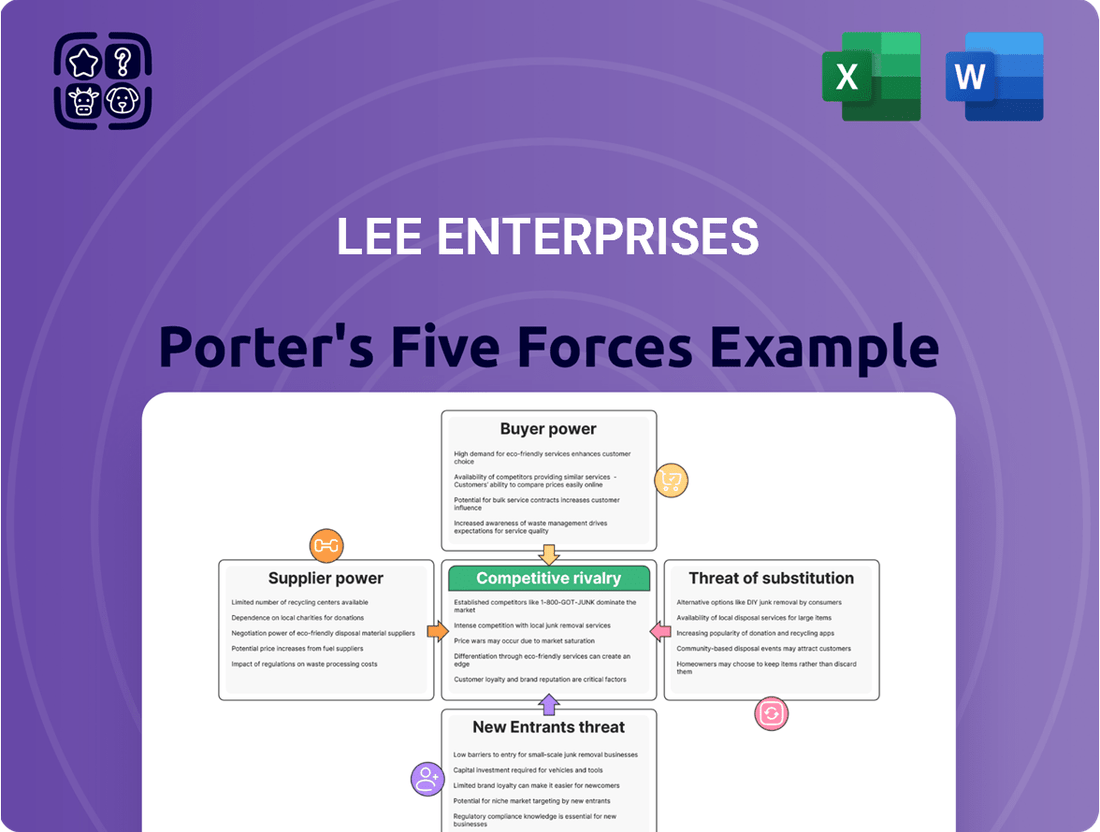

Lee Enterprises operates in a dynamic media landscape shaped by intense competition and evolving consumer habits. Our Porter's Five Forces analysis delves into the core pressures affecting this company, from the bargaining power of its buyers to the constant threat of new entrants disrupting its market share. Understanding these forces is crucial for navigating the complexities of the modern media industry.

Discover the intricate web of supplier relationships and the potency of substitute products that challenge Lee Enterprises's traditional business models. This brief overview only scratches the surface of the competitive forces at play.

Unlock the full Porter's Five Forces Analysis to explore Lee Enterprises’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Lee Enterprises faces supplier power due to the concentration of key providers for its operations. For instance, in the realm of newsprint, a relatively small number of large paper mills historically dictated terms. While digital media lessens this reliance, the specialized nature of large-scale printing machinery and specific software solutions for digital platforms means a limited number of vendors can exert significant influence.

The ongoing digital transformation further shifts dependence towards technology providers. Companies like Lee Enterprises now rely on major tech firms for content management systems, cloud infrastructure, and advertising technology platforms. These large technology companies often hold substantial market power, allowing them to dictate terms and pricing for essential digital services.

Switching costs for Lee Enterprises are notably high, especially concerning their physical infrastructure like printing presses and established distribution networks. These assets represent substantial, sunk capital, making it difficult and expensive to replace them with alternatives. This inherent inflexibility in physical assets directly impacts their ability to switch suppliers for these critical components.

Furthermore, transitioning Lee's digital platforms and core operational software systems involves significant investment. This includes not only the cost of new technology but also extensive employee training and the potential for operational disruptions during the migration process. These factors contribute to a dependence on existing technology suppliers, as changing vendors can be a complex and costly undertaking.

The considerable expenses and potential operational hurdles associated with changing suppliers for both physical and digital infrastructure create a degree of leverage for Lee's current vendors. This leverage limits Lee's flexibility, as the cost and complexity of switching can outweigh the benefits of seeking a new supplier, thereby strengthening the bargaining power of those suppliers.

The uniqueness of what suppliers offer significantly impacts their bargaining power. For Lee Enterprises, commodity items like paper or standard office supplies typically grant suppliers little leverage. However, when suppliers provide specialized goods or services that are hard to substitute, their power increases.

Consider specialized newsprint or proprietary printing inks; these can be critical inputs for Lee Enterprises' printing operations, giving those suppliers more sway. Similarly, the digital advertising technologies Lee relies on might be unique, concentrating power in the hands of a few providers.

Content syndication is another area where uniqueness matters. A few dominant providers supply wire content and national stories, making these offerings unique and strengthening the bargaining position of those syndicators. In 2024, the market for such content continues to be concentrated among a handful of major players.

Looking ahead, the growing demand for AI solutions for local businesses presents a new frontier. These specialized AI service providers could emerge as suppliers with considerable bargaining power, especially if their solutions offer distinct advantages that Lee Enterprises needs to adopt to remain competitive.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the local news publishing business for a company like Lee Enterprises is generally low in traditional media. Paper mills and printing press manufacturers typically lack the expertise and infrastructure to operate a newsroom and distribution network.

However, the digital landscape presents a nuanced threat. Major technology firms that provide advertising platforms or content delivery systems could theoretically move into creating their own local news content or advertising networks.

While these tech giants have the resources, their core business models are not centered on local journalism. For instance, in 2024, companies like Google and Meta continue to dominate digital advertising but have largely focused on aggregating existing news rather than producing original local content.

This means while the potential exists, a direct competitive threat from these tech suppliers venturing into local news production remains a less significant concern compared to other forces.

Impact of Digital Transformation on Supplier Power

Digital transformation is reshaping the bargaining power of suppliers for Lee Enterprises. As the media landscape shifts, traditional suppliers like newsprint providers are seeing their influence wane. This is directly tied to the declining reliance on print media, a trend observed across the industry.

Conversely, the power of technology suppliers is on the rise. Companies providing digital advertising platforms, cloud infrastructure, and artificial intelligence solutions are becoming increasingly vital. Lee's strategic pivot towards a digital-first model makes these new, specialized suppliers integral to its operational success and future revenue generation. For instance, by 2024, many media companies were investing heavily in AI for content personalization and ad targeting, demonstrating the growing importance of these tech vendors.

- Declining Power of Traditional Suppliers: The reduced demand for print media directly weakens the bargaining position of newsprint manufacturers.

- Increasing Power of Technology Providers: Lee's digital strategy elevates the importance of, and thus the power held by, suppliers of digital advertising, cloud services, and AI.

- Emergence of New Critical Suppliers: The shift necessitates partnerships with technology firms whose services are essential for digital operations and growth.

- Strategic Dependence on Tech Vendors: Lee's ability to compete and innovate in the digital space is increasingly dependent on the capabilities and pricing of these technology partners.

The bargaining power of suppliers for Lee Enterprises is a mixed bag, heavily influenced by the company's ongoing digital transformation. Traditional suppliers, like newsprint manufacturers, find their leverage diminishing as Lee reduces its reliance on print. However, this shift elevates the power of technology providers, whose specialized digital services are now critical for Lee's operations and future growth.

In 2024, Lee Enterprises, like many media companies, continued to invest in digital advertising technology and AI solutions. These specialized tech vendors possess significant bargaining power due to the unique nature of their offerings and the high switching costs associated with integrating new systems. For example, reliance on specific cloud infrastructure or advanced analytics platforms concentrates power in the hands of a few dominant tech firms.

The concentration of key providers in areas like digital advertising platforms and content management systems means Lee Enterprises faces limited alternatives. This scarcity allows these specialized suppliers to command higher prices and dictate terms, directly impacting Lee's operational costs and strategic flexibility. The dependency on these technologies is undeniable for competitive survival in the current media landscape.

| Supplier Category | Influence on Lee Enterprises | Key Factors | 2024 Trend Impact |

|---|---|---|---|

| Newsprint Manufacturers | Decreasing | Declining print demand, availability of alternatives | Reduced bargaining power for suppliers |

| Printing Machinery/Ink Suppliers | Moderate to Decreasing | High switching costs for existing infrastructure, but declining print volume | Leverage diminishes as print operations scale down |

| Digital Advertising Platforms | Increasing | Concentration of providers, high integration costs, essential for revenue | Suppliers exert significant pricing and term control |

| Cloud Infrastructure Providers | Increasing | Dependence on specialized services, high migration expenses | Vendor lock-in strengthens supplier position |

| AI & Content Technology Providers | Emerging and Increasing | Uniqueness of solutions, necessity for innovation and efficiency | Significant potential for supplier leverage in specialized tech |

What is included in the product

Examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes specifically for Lee Enterprises.

Lee Enterprises' Porter's Five Forces Analysis simplifies complex competitive landscapes, offering a clear visualization of market pressures to guide strategic adjustments and alleviate decision-making paralysis.

Customers Bargaining Power

The price sensitivity of Lee Enterprises' news subscribers is a significant factor influencing the bargaining power of customers. In today's media environment, where a vast amount of news is available for free online, consumers often view news subscriptions as discretionary. This abundance of free content directly challenges Lee's digital subscription model, forcing them to carefully consider their pricing strategies to remain competitive and retain subscribers.

Lee Enterprises faces the challenge of balancing subscription prices to attract and keep readers, particularly as print readership continues its downward trend. While the company is actively pursuing digital subscriptions, a substantial portion of potential subscribers remain price-sensitive. Research from organizations like the Pew Research Center consistently shows that while a segment of the population is willing to pay for quality online journalism, a larger group is hesitant to do so, especially if comparable information can be accessed without cost.

This high price sensitivity limits Lee's flexibility in raising subscription rates. For instance, a 2024 study on digital media consumption revealed that over 60% of surveyed individuals would reconsider or cancel a digital news subscription if prices increased by more than 10%. This means Lee must carefully calibrate its pricing to avoid alienating a significant portion of its subscriber base, thereby capping its ability to extract higher prices from its customers.

Customers today have an almost overwhelming number of choices when it comes to getting their news. Beyond traditional newspapers like those published by Lee Enterprises, there are countless national news websites, active social media feeds, niche blogs, informative podcasts, and local television and radio stations all vying for attention. This sheer volume of alternatives directly strengthens the bargaining power of the customer.

When a customer can easily switch to another provider or get the same information elsewhere for free or at a lower cost, their leverage increases significantly. For Lee Enterprises, this means they are not just competing with other newspaper companies. They are in a constant battle for eyeballs and loyalty against digital-native news organizations and the vast, often free, content found on social media platforms.

In 2024, the digital news landscape continues to be dominated by platforms that offer immediate and often personalized content. While specific market share data for Lee Enterprises' individual markets can vary, the broader trend shows a continued shift in advertising revenue from print to digital, with platforms like Google and Meta capturing a significant portion. This economic reality underscores the intense competition and the customer's ability to dictate terms by simply choosing where to spend their time and attention.

Lee Enterprises' advertising revenue heavily relies on local businesses in midsize markets. While individual clients may not hold significant sway, the collective bargaining power of numerous small and medium-sized advertisers, often operating with constrained marketing budgets, can indeed pressure advertising rates.

The competitive landscape for advertising is also a key factor. The pervasive shift of ad spending towards major digital platforms and large tech companies provides advertisers with a broader array of choices, thereby increasing their leverage and ability to negotiate favorable terms with publishers like Lee Enterprises.

Customer Switching Costs for Advertisers

For advertisers, the bargaining power of customers is amplified by relatively low switching costs. Businesses can readily shift their advertising budgets between Lee's print and digital offerings, other local media outlets, or even major global digital advertising platforms such as Google and Meta. This flexibility allows advertisers to chase the best return on investment.

The straightforward process of launching campaigns on diverse digital platforms significantly lowers the barrier for advertisers to reallocate their spending. As of late 2023, digital advertising spending continued its upward trajectory, with projections indicating further growth, underscoring the competitive landscape advertisers can easily access.

- Low Switching Costs: Advertisers face minimal hurdles when moving their ad spend between different media channels.

- Digital Platform Accessibility: Ease of campaign setup on platforms like Google Ads and Meta Ads empowers advertisers to compare and shift budgets efficiently.

- Performance-Based Allocation: Advertisers prioritize cost-effectiveness, readily moving funds to channels demonstrating superior results.

- Competitive Landscape: The broad availability of advertising options, from local to global digital giants, intensifies competitive pressure on publishers like Lee Enterprises.

Impact of Digital Platforms on Customer Power

Digital platforms have significantly amplified customer power, particularly for audiences and advertisers. Readers now have a vast array of news sources at their fingertips, often accessible without charge, diminishing the reliance on any single publisher. For advertisers, the digital landscape offers highly specific targeting capabilities and demonstrable return on investment, a stark contrast to traditional media's broader reach and less precise metrics.

This shift presents a considerable challenge to companies like Lee Enterprises. The ability for customers, both readers and advertisers, to easily switch to alternative digital channels or platforms that offer greater convenience, lower cost, or more perceived value directly impacts Lee's market position. In 2024, the continued growth of social media platforms and search engines as primary news consumption and advertising hubs underscores this trend, forcing traditional publishers to innovate rapidly to maintain engagement and revenue streams.

- Increased Reader Choice: Readers can access news from countless online publications, blogs, and aggregators, often for free, fragmenting audience attention.

- Advertiser Agility: Advertisers can leverage sophisticated digital tools from companies like Google and Meta for precise audience targeting and performance tracking, demanding greater accountability from publishers.

- Lee's Digital Response: Lee Enterprises' investment in its Amplified Digital® Agency reflects an effort to directly address this enhanced customer power by offering integrated digital marketing solutions to advertisers, aiming to capture a share of digital ad spend.

- Market Dynamics: The digital advertising market continues its robust growth, with global digital ad spending projected to exceed $900 billion in 2024, highlighting the competitive pressure on traditional media to adapt.

The bargaining power of customers for Lee Enterprises is substantial, driven by the abundance of readily available news and advertising alternatives. Readers have access to a vast digital ecosystem, often at no cost, making them less reliant on any single publisher. Similarly, advertisers can easily shift budgets to platforms offering precise targeting and demonstrable ROI, intensifying pressure on traditional media outlets.

This dynamic significantly limits Lee Enterprises' pricing flexibility for both subscriptions and advertising. Customers can readily switch to competitors or free alternatives, forcing Lee to remain competitive on price and value. The ease with which advertisers can reallocate spending, particularly towards digital giants, further erodes Lee's pricing leverage.

| Factor | Impact on Lee Enterprises | Supporting Data (2024 Projections/Trends) |

|---|---|---|

| Reader Choice | High | Digital ad spend projected to exceed $900 billion globally in 2024. |

| Advertiser Agility | High | Over 60% of consumers reconsider subscriptions if prices rise >10%. |

| Switching Costs | Low | Continued growth in digital advertising platforms accessibility. |

Same Document Delivered

Lee Enterprises Porter's Five Forces Analysis

This preview shows the exact, professionally crafted Porter's Five Forces Analysis for Lee Enterprises that you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape affecting Lee Enterprises, including the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. The document displayed here is the part of the full version you’ll get, ready for download and immediate use the moment you buy. This detailed analysis will equip you with the strategic insights needed to understand and navigate the market dynamics impacting Lee Enterprises' business.

Rivalry Among Competitors

Lee Enterprises contends with a crowded field of competitors in the local media arena. This includes a multitude of local newspapers, emerging digital-only news platforms, established local television and radio broadcasters, and even national news organizations that extend their reach into local markets.

While Lee holds a notable position in its mid-sized operational areas, the broader media environment is characterized by significant fragmentation. Many entities are actively competing for consumer engagement and essential advertising revenue.

For context, as of early 2024, the local news landscape continues to see new digital entrants. For example, the number of digital-native local news outlets has grown considerably over the past decade, adding to the competitive pressure on traditional print media like Lee Enterprises.

The traditional newspaper industry is experiencing a significant decline in print revenues and readership, signaling a negative growth rate for its core legacy business. This contraction is a major challenge for companies like Lee Enterprises.

Conversely, the digital media and local advertising sectors are showing robust growth. Specifically, digital advertising and subscription models are expanding, presenting new opportunities for revenue generation and market penetration.

Lee Enterprises is strategically navigating this landscape by prioritizing digital transformation. This focus is evident in their financial reporting, where digital revenue now accounts for more than half of their total revenue, demonstrating a successful pivot towards a growth-oriented segment of the market.

Competitive rivalry in the local news sector is intense, with many companies offering similar content. Lee Enterprises strives to stand out by focusing on in-depth local reporting and strong community ties. They also differentiate through integrated advertising services like their Amplified Digital Agency, aiming to provide unique value to both readers and advertisers.

Exit Barriers for Competitors

Exit barriers for competitors in the local media sector, including companies like Lee Enterprises, can be quite substantial. These high barriers often stem from significant investments in physical assets such as printing presses and real estate, which are costly to divest or repurpose. Furthermore, the perceived social obligation to maintain local news coverage can make a complete shutdown or sale a difficult decision for some operators.

These factors can trap less profitable firms in the market longer than might otherwise be expected. Even as print circulation declines, the expense of ceasing operations or selling off these legacy assets remains a deterrent. This situation can perpetuate competitive pressure, as struggling entities continue to operate rather than face the high costs of exiting.

- High Fixed Asset Costs: Printing presses and associated real estate represent significant sunk costs.

- Social Responsibility: A perceived duty to provide local news can discourage outright exits.

- Divestment Expenses: The financial and logistical challenges of selling off declining assets are considerable.

- Continued Competitive Pressure: Competitors may continue operating at a loss due to high exit barriers, impacting industry profitability.

Strategic Shifts Towards Digital and AI

Competitive rivalry within the media industry, including for Lee Enterprises, is intensifying as companies pivot to digital-first strategies and embrace artificial intelligence. This shift means competitors are pouring resources into online platforms, engaging video content, and AI tools for both creating news and selling ads. For instance, many media organizations are leveraging AI to automate routine tasks like summarizing articles or generating basic reports, freeing up journalists for more in-depth work.

Lee Enterprises is actively participating in this digital arms race. They are focused on growing their digital subscription numbers, a key metric for sustained revenue in the modern media landscape. Furthermore, Lee is expanding its Amplified Digital® Agency, which offers digital marketing services to local businesses, demonstrating a commitment to diversified digital revenue streams. The company is also developing and launching new AI solutions specifically designed to benefit local businesses, positioning itself to capitalize on the growing demand for data-driven marketing and operational efficiency.

- Digital Subscription Growth: Lee Enterprises reported a continued increase in digital-only subscribers, reflecting a broader industry trend of consumers migrating to online news consumption.

- AI in Content and Operations: Competitors are increasingly deploying AI for tasks such as audience segmentation, personalized content delivery, and programmatic advertising, aiming for greater efficiency and revenue.

- Amplified Digital® Agency Expansion: Lee's investment in its digital agency signifies a strategic push to capture a larger share of local advertising budgets shifting online.

- AI Solutions for Local Businesses: The introduction of AI tools for local businesses aims to provide competitive advantages in marketing, customer engagement, and data analytics.

Competitive rivalry for Lee Enterprises is fierce, driven by a fragmented media landscape and aggressive digital-first strategies. Companies are heavily investing in online platforms, video, and AI to capture audience attention and advertising dollars. For instance, many media organizations are leveraging AI to streamline content creation and personalize user experiences, directly impacting how Lee and its peers must innovate.

Lee Enterprises is actively responding by prioritizing digital subscriptions and expanding its Amplified Digital® Agency. This strategic pivot is crucial as digital revenue now represents a significant portion of their overall income, a trend mirrored across the industry as print revenues continue to decline. Their development of AI solutions for local businesses also reflects a commitment to staying competitive in a rapidly evolving market.

The intense competition is further fueled by the increasing adoption of AI across the media sector. Competitors are deploying AI for audience segmentation and programmatic advertising, aiming for greater efficiency and revenue generation. Lee's focus on growing digital subscribers, as evidenced by their increasing digital-only subscriber base, demonstrates a clear strategy to counter these pressures and capture market share in the burgeoning digital space.

| Metric | Lee Enterprises (Early 2024) | Industry Trend (2024) |

|---|---|---|

| Digital Revenue Share | Over 50% of total revenue | Increasing across most media companies |

| Digital-Only Subscribers | Growing | Upward trend as print readership declines |

| AI Adoption in Media | Developing AI solutions for local businesses | Widespread use for content automation and advertising |

| Advertising Revenue Shift | Focus on digital marketing services (Amplified Digital® Agency) | Significant migration of ad spend to digital platforms |

SSubstitutes Threaten

The ease with which consumers can access free news online is a major competitive threat for Lee Enterprises. Platforms like Google News, Apple News, and countless social media feeds offer a constant stream of information, often at no cost to the user. This accessibility means that many people may not see the value in paying for news content that they can find elsewhere, even if the quality or depth differs.

In 2024, the digital news landscape continues to be dominated by free aggregators and social media. For example, Statista reported that in early 2024, over 60% of global internet users accessed news through social media platforms. This widespread habit directly substitutes for traditional news subscriptions, including those offered by Lee Enterprises, forcing them to constantly innovate and highlight the unique aspects of their local reporting.

Lee Enterprises must therefore focus on differentiating its offerings. The value proposition needs to shift from simply providing news to delivering unique, investigative, and hyper-local content that cannot be easily replicated by free online sources. This includes leveraging their established local presence and journalistic expertise to provide context and analysis that free, aggregated news often lacks.

The persistent migration of audiences to social media and digital platforms presents a significant threat of substitutes for traditional news outlets like Lee Enterprises. Platforms such as TikTok, Instagram, and X (formerly Twitter) are increasingly becoming the primary news sources for many, especially younger demographics. This shift means consumers are bypassing print newspapers and even dedicated news websites, opting for readily accessible, often free, content delivered through their social feeds.

In 2024, the trend is undeniable, with a substantial portion of the population, particularly Gen Z and Millennials, relying on social media for their daily news intake. For instance, reports from early 2024 indicated that over 50% of Americans under 30 get their news primarily from social media. This directly erodes the customer base for print publications and even digital subscriptions to traditional news organizations, as users find aggregated, bite-sized news on these substitute platforms.

Advertisers have a vast array of alternative channels to reach their target audiences, significantly diminishing the unique value proposition of traditional newspaper advertising. Platforms like Google Ads, with its extensive reach and precise targeting capabilities, and social media advertising on giants such as Meta (Facebook and Instagram), which captured an estimated 25.1% of the global digital ad spending in 2024, offer compelling substitutes. These digital avenues, alongside direct mail and specialized digital marketing agencies, provide advertisers with more granular control and often more measurable results compared to print.

Emergence of Hyper-Local Blogs and Community Forums

Independent blogs and community forums are increasingly acting as substitutes for traditional local news outlets like Lee Enterprises. These platforms, often fueled by citizen journalism, can deliver hyper-local and niche content with a speed and specificity that larger organizations might struggle to match. For instance, a local online forum might offer immediate updates on a community event or a specific neighborhood issue, attracting an audience that values this grassroots information flow.

While these substitutes may not possess the extensive resources for investigative reporting, their ability to cater to highly localized interests poses a threat. Consider the growth in online community engagement; in 2023, the number of active online community members grew by 15%, indicating a strong preference for platforms offering tailored content. This trend suggests that a portion of Lee Enterprises' potential audience may be diverted to these more accessible, community-driven sources, particularly for information that is time-sensitive or highly specific to a particular locality.

The impact of these substitutes can be seen in audience fragmentation. As more individuals turn to these hyper-local sources for their news and information needs, the overall audience for traditional local media can diminish. This is especially true for younger demographics who are more accustomed to consuming information through digital, community-centric platforms.

- Audience Fragmentation: Hyper-local blogs and forums draw away segments of Lee Enterprises' potential readership.

- Niche Content Appeal: These substitutes excel at providing immediate, community-specific information that larger outlets may overlook.

- Resource Disparity: While lacking professional resources, their agility allows them to cover hyper-local events effectively.

- Digital Engagement Growth: The increasing participation in online communities highlights a preference for grassroots information sources.

Impact of AI-Generated Content and News Summaries

The increasing sophistication of AI-generated content and news summaries poses a significant threat of substitution for traditional news providers like Lee Enterprises. These AI tools can rapidly process vast amounts of information, delivering concise summaries that might satisfy readers who previously relied on in-depth articles or multiple news sources. For instance, by mid-2024, several platforms are offering AI-powered news aggregation that can provide daily briefings, potentially reducing the need for direct engagement with individual news websites.

This emerging technology could erode the value proposition of subscriptions and individual article purchases if readers find AI summaries to be a sufficient, low-cost alternative. While Lee Enterprises is investigating AI for internal efficiencies and new product development, the broader industry faces a challenge as AI-driven content offers a substitute for the core product: news consumption. By 2024, the market for AI-powered content creation tools has seen substantial growth, indicating a direct competitive pressure on traditional media business models.

- AI's ability to quickly synthesize information: This can lead to easily digestible news summaries that compete with full articles.

- Reduced perceived need for traditional subscriptions: Readers might opt for AI summaries over paying for in-depth reporting.

- Lee Enterprises' strategic exploration of AI: The company is looking into AI for operations and new products, acknowledging its potential impact.

- Broader industry challenge: AI-generated content represents a significant substitution threat across the entire news sector.

The ease with which consumers can access free news online, often aggregated through platforms like Google News or social media feeds, directly substitutes for paid content from entities like Lee Enterprises. In 2024, over 60% of global internet users accessed news via social media, as reported by Statista, highlighting a significant shift in consumption habits that bypasses traditional news subscriptions.

Independent blogs, community forums, and citizen journalism also act as potent substitutes, particularly for hyper-local news. These agile sources can offer immediate, niche content that resonates with specific community interests. In 2023, online community engagement grew by 15%, demonstrating a growing preference for these grassroots information channels over established media.

The increasing sophistication of AI-generated content and news summaries presents another formidable substitute threat. By mid-2024, AI-powered news aggregation tools offer concise daily briefings, potentially diminishing the perceived value of in-depth articles and subscriptions offered by companies like Lee Enterprises.

| Substitute Type | Key Characteristics | Impact on Lee Enterprises | 2024 Data Point |

| Free Online News Aggregators & Social Media | Accessibility, vast content, often no cost | Erodes paid subscription base, audience diversion | >60% global internet users access news via social media (Statista) |

| Hyper-local Blogs & Community Forums | Speed, specificity, citizen journalism | Captures niche local audiences, bypasses traditional outlets | 15% growth in online community engagement (2023) |

| AI-Generated Content & Summaries | Rapid information synthesis, conciseness | Reduces need for in-depth articles, challenges subscription models | Emergence of AI-powered daily news briefings (mid-2024) |

Entrants Threaten

The capital required to launch a traditional print media operation, complete with printing presses and extensive distribution infrastructure, presents a formidable barrier for potential newcomers. This high initial investment significantly dampens the threat of new entrants within the physical newspaper segment. For instance, establishing a new printing facility could easily run into tens of millions of dollars.

However, Lee Enterprises' strategic pivot towards digital platforms notably lowers these entry barriers. Setting up an online news outlet demands substantially less capital investment compared to its print counterpart. In 2023, Lee Enterprises reported its digital revenue accounted for approximately 32% of its total revenue, highlighting the growing importance and lower capital intensity of this segment.

Lee Enterprises benefits from strong brand loyalty and a long-standing reputation for delivering local news in its established markets. This deep connection with communities is a significant hurdle for any potential newcomer. Building that level of trust and credibility in journalism requires substantial time and considerable investment, making it challenging for new entrants to swiftly capture a dedicated readership.

The brand equity Lee Enterprises has cultivated serves as a formidable barrier to entry, particularly in the highly localized and personal sphere of community news. For instance, in 2024, many of Lee's flagship newspapers continue to be the primary source of local information for their respective cities, a position earned through decades of consistent reporting and community engagement.

New entrants to the news industry, like those looking to compete with Lee Enterprises, face significant hurdles in securing access to effective distribution channels. For print publications, this means establishing reliable delivery networks, a costly and complex undertaking. In the digital realm, reaching a broad audience and effectively delivering advertising requires substantial investment in marketing and platform development.

Lee Enterprises benefits from its existing, established distribution networks, honed over years of operation, and its pre-existing content acquisition agreements. This infrastructure provides a significant advantage, allowing for efficient reach and content sourcing that new players must replicate from scratch, which is a major barrier.

Emerging digital news outlets often struggle for visibility in a crowded online space. Without substantial marketing budgets or strategic partnerships, gaining traction and attracting a significant audience for advertising revenue proves exceptionally difficult, highlighting the challenge of overcoming established players' market presence.

Regulatory Hurdles and Legal Frameworks

New entrants to the media industry, like Lee Enterprises, face regulatory challenges. For instance, the Federal Communications Commission (FCC) in the United States has rules regarding media ownership concentration, which can limit how many outlets a single entity can control. While these rules may not be as stringent as in some other sectors, they still require careful navigation by potential new competitors.

The legal environment also presents significant barriers. Companies must contend with complex regulations concerning copyright, data privacy, and online advertising practices. Startups, often lacking substantial legal departments, find these requirements particularly daunting, especially when compared to established players like Lee Enterprises, which possess existing legal infrastructure and expertise.

- Media Ownership Rules: For example, FCC regulations may limit the number of broadcast stations a single entity can own in a given market, impacting potential new entrants aiming for broad reach.

- Content Rights and Licensing: Navigating the complexities of acquiring and protecting intellectual property for journalistic content requires significant legal and financial investment.

- Privacy Regulations: Compliance with laws like the California Consumer Privacy Act (CCPA) or GDPR impacts how user data can be collected and utilized, a key area for digital media.

- Online Advertising Standards: Adherence to evolving standards and regulations in digital advertising, including those from bodies like the Digital Advertising Alliance, adds another layer of complexity.

Lower Barriers for Digital-Only News Startups

The most significant threat of new entrants for companies like Lee Enterprises stems from digital-only news startups. These new players benefit from considerably lower overhead costs compared to traditional print media, enabling them to operate with leaner structures. Their ability to focus on specific, niche audiences allows for more targeted content and marketing efforts.

Leveraging social media platforms for distribution is another key advantage for these digital startups. This significantly reduces their reliance on established distribution networks and provides direct access to potential readers. While individually these startups may operate on a smaller scale, their collective presence can lead to increased fragmentation of the audience and the advertising market, impacting established players.

However, data indicates a potential cooling in this particular threat. A recent report highlighted a slowing trend in the number of new digital news startup launches across North America since 2022. This suggests that while the barriers to entry remain low, the rate of new competition may be moderating.

- Lower Overhead: Digital-only startups avoid the significant costs associated with printing presses, physical distribution, and large newsroom infrastructures.

- Niche Targeting: They can carve out specific audience segments, offering specialized content that may be overlooked by broader publications.

- Social Media Distribution: Direct access to readers via social platforms bypasses traditional, more costly distribution channels.

- Slowing Launch Rate: A reported slowdown in new digital news startup launches in North America since 2022 may indicate a maturing market or increased challenges for new entrants.

The threat of new entrants for Lee Enterprises is significantly moderated by the high capital requirements for traditional print operations, though digital entry barriers are lower. Established brand loyalty and community trust are substantial hurdles for newcomers, as is navigating complex regulatory and legal landscapes. While digital startups offer a more accessible entry point, a recent slowdown in their launch rates suggests a potential moderation of this threat.

| Barrier Type | Impact on New Entrants | Lee Enterprises' Advantage |

|---|---|---|

| Capital Requirements (Print) | Very High | Established infrastructure and economies of scale |

| Brand Loyalty & Reputation | High | Decades of community engagement and trusted reporting |

| Distribution Networks | High (Print), Moderate (Digital) | Existing print delivery and digital platform reach |

| Regulatory & Legal Compliance | Moderate to High | Existing legal infrastructure and expertise |

| Digital-Only Startups | Moderate | Lower overhead, niche focus, social media distribution |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Lee Enterprises leverages data from its annual reports, investor presentations, and SEC filings. We supplement this with industry-specific reports from organizations like Pew Research Center and analyses from financial news outlets to gain a comprehensive understanding of the competitive landscape.