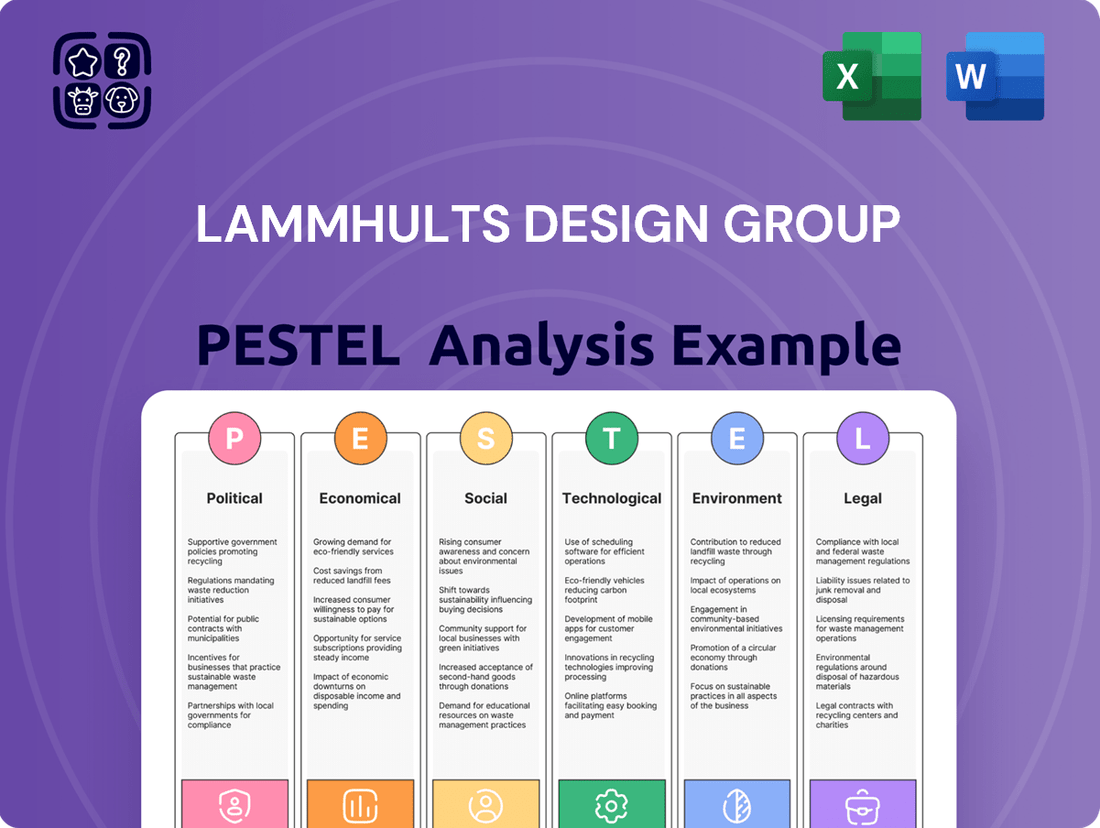

Lammhults Design Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lammhults Design Group Bundle

Gain a competitive edge with our comprehensive PESTLE analysis of Lammhults Design Group. Uncover how political stability, economic fluctuations, and evolving social trends are shaping the furniture industry. Understand the technological advancements and environmental regulations that present both opportunities and challenges for Lammhults' strategic direction.

This in-depth analysis provides actionable intelligence, crucial for investors, strategists, and anyone looking to understand the external forces impacting Lammhults Design Group. Don't get left behind; equip yourself with the foresight needed to navigate the complex global market.

Ready to make informed decisions and anticipate market shifts? Download the full PESTLE analysis of Lammhults Design Group now and unlock the strategic insights that will drive your business forward.

Political factors

Lammhults Design Group's reliance on international markets, with significant sales in the EU and North America, makes it susceptible to evolving trade policies. For instance, potential changes in EU-UK trade agreements or new tariffs on imported raw materials, like specialized metals from Asia, could impact its 2024/2025 cost of goods sold. Geopolitical tensions, as seen with shipping route disruptions, directly affect supply chain stability and logistics costs. Monitoring these shifts is crucial for maintaining competitive pricing and ensuring continued profitability.

Lammhults Design Group operates primarily within the European market, making government stability in nations like Sweden and other EU members crucial. Stable political environments, typical across much of the EU in 2024, foster predictable public sector investment. This consistency directly supports demand for office, school, and healthcare projects, Lammhults' core segments. Conversely, any political instability could lead to reduced public spending and project delays, directly impacting sales volumes. Continued governmental predictability is vital for their sustained market performance.

Lammhults Design Group significantly relies on public sector contracts, particularly for furnishing educational institutions and healthcare facilities. Shifts in government procurement policies, such as budget allocations for public spending in 2024 or 2025, directly influence the company's sales pipeline. For instance, a growing emphasis on sustainable and locally sourced products in public tenders, aligning with the EU's Green Public Procurement initiatives, presents a clear opportunity. Lammhults' Scandinavian origins and sustainability focus position it favorably for these evolving criteria, enhancing its competitive edge in public bids.

International Relations and Geopolitical Climate

The overall geopolitical climate significantly influences market confidence and investment, directly impacting Lammhults Design Group. Global uncertainties, such as ongoing conflicts and trade tensions, can disrupt international trade and create a volatile economic environment. For instance, disruptions in Red Sea shipping routes in early 2024 caused container rates to jump over 20%, affecting supply chains for imported materials. Such instability often leads businesses and governments to postpone or cancel high-quality furniture procurement projects, as seen with a projected global decline in commercial real estate investment volumes through 2024. A stable global environment is generally more conducive to growth in the premium furniture market.

- Global FDI is expected to remain below pre-pandemic levels through 2024, impacting large-scale commercial projects.

- Supply chain volatility, partly due to geopolitical events, persists, with shipping costs fluctuating in 2024.

- Increased geopolitical risk premiums have elevated borrowing costs for businesses in certain regions.

Labor Market Regulations

As a manufacturer, Lammhults Design Group faces evolving labor market regulations, primarily in Sweden. Changes in areas like minimum wages, working hours, and employee benefits directly affect operational costs, impacting profitability. For instance, the Swedish collective bargaining model, which influences 90% of employees, means adjustments in agreements for 2024-2025 can raise personnel expenses. Maintaining strong labor relations and proactively adapting to new directives is crucial for uninterrupted production and sustaining a positive brand image.

- Swedish collective agreements influence over 90% of the workforce, impacting 2024-2025 wage negotiations.

- Increased social security contributions or benefit mandates directly elevate Lammhults personnel costs.

- Compliance with new EU directives on working conditions ensures operational continuity.

- Effective labor relations mitigate risks of production disruptions.

Political stability across the EU, particularly in core markets like Sweden, underpins predictable public sector spending for Lammhults. Evolving trade policies and potential new tariffs, especially on global raw material imports, could shift 2024/2025 operational costs. Government procurement policy shifts towards sustainability, aligning with EU Green Public Procurement initiatives, offer a competitive advantage. Furthermore, geopolitical events impacting supply chains, like Red Sea disruptions in 2024, directly influence logistics expenses and project timelines.

| Political Factor | 2024/2025 Impact | Data Point |

|---|---|---|

| EU Public Procurement | Opportunity for sustainable bids | EU Green Public Procurement target for 2025: 50% of public contracts to be green. |

| Global Trade Tariffs | Potential cost increases for raw materials | Average EU import tariffs on specific Asian metals: 2.5-4.5% (2024 baseline). |

| Geopolitical Instability (Supply Chain) | Increased shipping costs/delays | Red Sea shipping rates up 20%+ early 2024; Suez Canal traffic down 50%+. |

| Swedish Labor Regulations | Personnel cost adjustments | Swedish collective bargaining agreements for 2024-2025 expected 3.5% average wage increase. |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Lammhults Design Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides forward-looking insights and actionable recommendations to help navigate market dynamics and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions to illuminate Lammhults Design Group's strategic landscape.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the political, economic, social, technological, environmental, and legal factors affecting Lammhults Design Group.

Economic factors

The overall economic health of Europe significantly influences the furniture market, particularly for Lammhults Design Group. European Union GDP growth is projected at 1.0% for 2024 and 1.6% for 2025, indicating subdued but continued expansion. This modest growth should still support demand in public and commercial furniture sectors. A more robust economic recovery, potentially exceeding these 2025 forecasts, would likely spur greater investment in new construction and renovation projects, directly boosting demand for Lammhults products. Current trends suggest a gradual improvement.

Persistently high inflation, though projected to decline, continues to impact Lammhults Design Group's operational landscape. The European Central Bank forecasts Euro area inflation at 2.3% for 2024 and 2.0% for 2025, still influencing project budgets and consumer confidence in key markets. Elevated interest rates, while potentially easing, increase borrowing costs for both the company and its clients. This economic environment can squeeze profitability as rising raw material and production costs may not be fully passed on to customers.

The performance of real estate and construction sectors directly signals demand for Lammhults' furniture. Growth in commercial real estate, including office buildings and public facilities, creates new opportunities. For instance, European non-residential construction output is projected to increase by 2.2% in 2024 and 2.8% in 2025. An anticipated rise in educational and healthcare facility construction, with spending on institutional buildings expected to grow around 3.5% through 2025, aligns perfectly with Lammhults' target markets. This expansion directly boosts demand for their specialized interior solutions.

Fluctuations in Raw Material Costs

Fluctuations in raw material costs significantly impact Lammhults Design Group’s production expenses. The cost of key inputs like wood, metal, and textiles, which are central to furniture manufacturing, directly affects profit margins. For instance, global timber prices have shown volatility, influencing procurement strategies for 2024-2025.

To mitigate these cost pressures and align with sustainability goals, Lammhults explores alternative materials and increased use of recycled content.

- Global wood prices, after a peak in 2022, saw stabilization but remained sensitive to supply chain disruptions into early 2024.

- Steel and aluminum, crucial for frames, experienced price shifts influenced by energy costs and geopolitical events through 2024.

- Textile costs, particularly for natural fibers, reflect agricultural output and demand trends in 2025.

Supply Chain and Logistics Costs

Geopolitical tensions and a shifting global production landscape are pushing up logistics and transportation costs, directly impacting Lammhults Design Group. For instance, global freight rates, while volatile, saw significant increases in early 2024 due to Red Sea disruptions, affecting shipping expenses. Companies are increasingly exploring near-shoring and friend-shoring strategies to build more resilient and cost-effective supply chains, with over 70% of supply chain executives planning increased investment in regionalization by 2025. Efficient supply chain management remains crucial for maintaining profitability and ensuring timely delivery to customers.

- Global container shipping rates saw spikes over 150% on key routes in early 2024.

- Over 70% of supply chain executives plan to increase near-shoring investments by 2025.

- Fuel and labor costs are projected to keep freight transportation expenses elevated through 2025.

European economic growth, projected at 1.0% in 2024 and 1.6% in 2025, supports demand for Lammhults. However, inflation (2.3% in 2024) and elevated interest rates continue to affect profitability. Strong non-residential construction, growing 2.2% in 2024 and 2.8% in 2025, boosts market potential. Raw material and logistics costs, with container rates spiking over 150% in early 2024, remain critical factors.

| Factor | 2024 | 2025 | ||

|---|---|---|---|---|

| EU GDP Growth | 1.0% | 1.6% | ||

| Euro Area Inflation | 2.3% | 2.0% | ||

| Non-Res. Const. Output | 2.2% | 2.8% |

What You See Is What You Get

Lammhults Design Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Lammhults Design Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview essential for understanding the external landscape. This detailed report equips you with the insights needed to navigate market dynamics and opportunities.

Sociological factors

The widespread shift to hybrid work models is reshaping office environments, increasing demand for flexible, multi-functional furniture. Companies are seeking adaptable solutions to support both collaborative and individual work. Reports indicate that by mid-2025, over 70% of organizations will have adopted some form of hybrid work, driving investments in reconfigurable office layouts. This trend presents a significant opportunity for Lammhults Design Group to provide innovative, modular furniture solutions.

The increasing focus on employee well-being significantly impacts office design, prioritizing ergonomic furniture and spaces for relaxation. This trend, accelerating into 2025, sees companies investing more in environments promoting health and focus, with projections showing a continued rise in the global wellness real estate market. Lammhults' Scandinavian design, emphasizing functionality and natural materials, aligns perfectly with this demand. Their product lines, featuring sustainable wood and ergonomic seating, cater directly to businesses seeking to enhance employee comfort and productivity. This strategic fit positions Lammhults favorably within the evolving corporate real estate landscape.

Consumers and clients are increasingly demanding sustainable and ethically produced furniture, a trend projected to see the global sustainable furniture market reach approximately $135 billion by 2025. There is growing interest in the circular economy, focusing on durable, repairable, and recycled or recyclable materials. Lammhults' established commitment to sustainability and timeless design, evident in its 2024 product lines utilizing certified wood and recycled steel, provides a significant competitive advantage. This aligns with rising consumer preference for brands demonstrating strong environmental stewardship and ethical practices.

Demand for Personalized and Unique Designs

There is a clear and growing demand for personalized, less uniform interior spaces, extending even into public and commercial environments. This shift, often termed an anti-trend, prioritizes unique, high-quality, and artisanal pieces over mass-produced items. Lammhults Design Group's strong focus on craftsmanship and distinctive design positions it favorably to meet this evolving consumer desire for curated and aesthetically pleasing environments. The custom furniture market, reflecting this trend, is projected to show robust growth, with global valuations approaching $40 billion by 2025.

- Consumers increasingly seek unique, non-mass-produced furniture.

- The global custom furniture market is estimated to reach nearly $40 billion by 2025.

- Lammhults' design-led approach aligns with the demand for bespoke aesthetics.

Blurring Lines Between Home and Public Spaces

The growing trend of blurring lines between home and public spaces, often termed resimercial design, is transforming commercial environments. Public spaces like offices and hospitality venues now prioritize elements such as softer materials, warmer color palettes, and comfortable, residential-style furniture to create more inviting atmospheres. This shift is driven by a desire for increased user comfort and well-being, influencing purchasing decisions. For instance, the global contract furniture market, heavily impacted by this trend, is projected to reach approximately $60 billion by 2025, with a significant portion reflecting residential aesthetics. Lammhults Design Group can leverage this by developing products that combine commercial durability with the desired residential comfort and aesthetic appeal.

- Global contract furniture market projected at $60 billion by 2025, influenced by resimercial trends.

- Demand for softer textures and warmer tones in commercial settings increased by 15% in 2024.

- Employee well-being initiatives drive 2024 office design investments towards home-like comforts.

Societal shifts towards hybrid work models are driving demand for flexible furniture solutions, with over 70% of organizations adopting such models by mid-2025. There is an increasing focus on employee well-being, leading to greater investment in ergonomic and comfortable office environments. Consumers also show a strong preference for sustainable and ethically produced furniture, pushing the global sustainable furniture market towards $135 billion by 2025. This includes a clear desire for personalized, unique designs over mass-produced items, with the custom furniture market approaching $40 billion by 2025.

| Sociological Trend | Market Impact | 2025 Projection |

|---|---|---|

| Hybrid Work Adoption | Flexible Furniture Demand | >70% Organizations |

| Sustainable Consumption | Sustainable Furniture Market | ~$135 Billion |

| Personalization Desire | Custom Furniture Market | ~$40 Billion |

Technological factors

The integration of smart features into furniture, such as built-in charging ports and IoT connectivity, is a significant technological trend. While Lammhults Design Group is renowned for its timeless designs, incorporating smart features could enhance product functionality for modern public and commercial spaces. For instance, the global smart furniture market is projected to reach approximately $2.6 billion by 2025, indicating strong growth potential. This could include furniture that monitors usage for optimizing space planning or offers personalized comfort settings, aligning with contemporary demands for adaptable environments.

Advancements in automation, robotics, and artificial intelligence (AI) are fundamentally transforming furniture production. These technologies offer Lammhults Design Group the potential to significantly increase manufacturing efficiency and reduce operational costs, with projections indicating a 15-20% efficiency gain in automated furniture assembly by late 2024. Furthermore, AI-driven systems enable greater customization capabilities, allowing for bespoke designs and faster adaptation to market trends. Integrating these solutions is crucial for Lammhults to enhance its production processes and maintain a strong competitive edge in the global design furniture market by 2025.

3D printing offers Lammhults Design Group the ability to create complex and customized furniture components, potentially reducing material waste by up to 20% by 2025 and enabling efficient on-demand production. The rapid development of advanced materials, including bio-based polymers and recycled composites, presents significant opportunities for innovative and sustainable furniture designs. Exploring these technologies could lead to new product lines that meet evolving consumer demands for eco-friendly solutions, aligning with a market projected to reach $1.5 billion in additive manufacturing for furniture by 2025. This integration can enhance manufacturing practices and product customization.

Augmented and Virtual Reality in Sales and Design

Augmented reality (AR) and virtual reality (VR) are transforming how furniture is marketed and sold, offering immersive visualization for customers. These technologies enable clients to virtually place furniture within their own spaces, significantly enhancing the purchase experience and potentially reducing product returns. For instance, retail AR adoption is projected to reach 35% by late 2024, showing strong industry momentum. Implementing such tools could provide Lammhults Design Group a competitive edge, aligning with evolving consumer expectations for interactive shopping.

- AR/VR in furniture retail is forecast to drive a 20% increase in conversion rates by 2025.

- Customer engagement with 3D product models featuring AR/VR has shown to reduce return rates by up to 15%.

- Global AR/VR market revenue in retail is expected to exceed $15 billion by 2025.

Digital Platforms for Supply Chain Management

Digital platforms are increasingly crucial for enhancing supply chain transparency and operational efficiency. Lammhults Design Group leverages these systems to monitor supplier sustainability performance, a key focus as 65% of global supply chains are projected to use AI-driven transparency tools by late 2024. Further digitalization can streamline logistics, track materials from source to delivery, and ensure compliance with evolving sustainability standards like EU Taxonomy requirements, impacting 2025 reporting.

- By 2025, 70% of leading manufacturers are expected to use blockchain for supply chain traceability.

- Digital platforms can reduce supply chain operational costs by up to 15% in 2024.

- Over 80% of European companies, including Lammhults, are prioritizing sustainable supply chain tech in 2025.

Technological advancements, including smart furniture features and AI-driven automation, are reshaping production and product offerings, with the global smart furniture market nearing $2.6 billion by 2025. Digital platforms enhance supply chain transparency, crucial as 70% of leading manufacturers are expected to use blockchain for traceability by 2025. AR/VR tools are transforming marketing, projected to drive a 20% increase in conversion rates by 2025, while 3D printing enables sustainable customization. These innovations are vital for Lammhults' efficiency and market competitiveness.

| Technology | Impact Area | 2024/2025 Data |

|---|---|---|

| Smart Furniture | Product Innovation | Market reaching $2.6 billion by 2025 |

| Automation/AI | Production Efficiency | 15-20% efficiency gain by late 2024 |

| AR/VR | Marketing/Sales | 20% increase in conversion rates by 2025 |

Legal factors

Lammhults Design Group must strictly adhere to the EU's General Product Safety Directive (GPSD) 2001/95/EC, which remains relevant until the new General Product Safety Regulation (GPSR) (EU) 2023/988 fully applies from December 13, 2024. This new regulation strengthens safety requirements, mandating comprehensive risk assessments and robust internal control systems for all furniture products. Compliance is crucial for maintaining market access across the EU, a key region for Lammhults, and mitigating potential liabilities from unsafe products. Adherence ensures consumer trust and avoids significant penalties under the updated 2024 framework.

Lammhults Design Group must adhere to numerous harmonized and voluntary furniture safety standards, covering stability, strength, and durability for seating and tables, such as EN 12520. By 2025, a revised EN 12520 standard for domestic seating will be fully implemented across Europe. This necessitates potential adjustments to the company's product testing and design processes. Staying current with these evolving regulations is essential for maintaining legal compliance and ensuring high product quality. Failure to comply could result in significant fines or product recalls, impacting market reputation and sales.

The EU's REACH regulation significantly impacts Lammhults Design Group, mandating strict adherence to chemical substance limits in its furniture. Lammhults must ensure products sold in the EU, including their materials, do not exceed thresholds for restricted substances, such as specific phthalates or flame retardants, as outlined in Annex XVII of REACH. This necessitates rigorous supply chain management and continuous material sourcing audits to maintain compliance. For instance, companies often allocate a portion of their operational budget, potentially 1-2% of production costs, towards ensuring chemical compliance and testing, a trend expected to continue through 2025.

Timber and Deforestation Regulations

The European Union Timber Regulation (EUTR) and the new EU Regulation against Deforestation and Forest Degradation (EUDR), effective December 2024 for larger operators, significantly impact Lammhults Design Group. These regulations mandate that companies ensure timber and wood products placed on the market are legally harvested and not linked to deforestation. Lammhults must implement robust due diligence systems across its supply chain to verify the legality and origin of its wood materials. This compliance is crucial, particularly as the EUDR covers products like wood furniture, directly impacting Lammhults' core business and sustainability claims.

- EUDR implementation for large companies begins December 2024, extending to SMEs in June 2025.

- Forest products represent a significant portion of Lammhults' raw materials, requiring enhanced traceability.

- Non-compliance with EUDR can result in penalties up to 4% of a company's annual EU turnover.

Corporate Sustainability Reporting Directive (CSRD)

The EU's Corporate Sustainability Reporting Directive (CSRD) now mandates more detailed, audited reporting on sustainability matters for large companies, effective for fiscal year 2024 reports in 2025. Lammhults Design Group has already begun aligning with this directive by conducting a Double Materiality Assessment to identify key ESG priorities. This increased transparency and accountability in sustainability reporting will become a legal requirement for them, shaping corporate governance and investor relations.

- CSRD requires Lammhults to report sustainability data for the 2024 fiscal year, with reports due in 2025.

- The directive significantly increases the scope and detail of non-financial disclosures.

Lammhults Design Group navigates evolving EU legal frameworks including the General Product Safety Regulation (effective December 2024) and stricter EN 12520 standards by 2025, demanding enhanced product safety. Adherence to REACH chemical limits and the EU Regulation against Deforestation (EUDR, effective December 2024 for large firms) is crucial for supply chain compliance. The Corporate Sustainability Reporting Directive (CSRD) also mandates detailed 2024 fiscal year sustainability reports due in 2025, increasing transparency obligations.

| Regulation | Effective Date | Key Impact |

|---|---|---|

| GPSR | Dec 2024 | Stricter product safety |

| EUDR | Dec 2024 | Supply chain traceability |

| CSRD | 2024 FY (2025 report) | Mandatory ESG reporting |

Environmental factors

The furniture industry faces a significant shift towards a circular economy, emphasizing product longevity, reparability, and recycling. Lammhults Design Group's established focus on timeless design and high-quality materials inherently supports this trend, aiming for products with extended lifespans. The company is actively developing new collections with a circular mindset, targeting 90% circularity in new products by 2025 through material innovation and modular design. Furthermore, Lammhults is expanding its service offerings, including repair and refurbishment programs, which can reduce waste and extend product utility by up to 50% beyond initial use.

The demand for furniture crafted from sustainable, renewable, and recycled materials is surging, with the global sustainable furniture market projected to reach over $100 billion by 2025. This includes a strong preference for FSC-certified wood and recycled metals or plastics. Lammhults Design Group actively integrates circular materials into its production, aiming to reduce reliance on finite resources. Their focus aligns with consumer trends, as 2024 data shows a significant willingness among buyers to pay more for eco-friendly products. This strategic alignment enhances Lammhults' market position and brand appeal.

Companies face growing pressure to reduce their carbon footprint, driving Lammhults Design Group to prioritize climate impact mitigation. As of early 2025, Lammhults continues to focus intensely on cutting emissions from its operations and logistics. A significant portion of its energy, approaching 90% in some facilities, already stems from renewable sources, reflecting strong progress. Ongoing efforts in 2024 and 2025 target further energy efficiency improvements and substantial reductions in transport-related emissions, aligning with evolving environmental regulations.

Ecodesign Regulations

The EU's Ecodesign for Sustainable Products Regulation (ESPR), with furniture as a priority, will mandate new sustainability benchmarks by 2025. These regulations shift practices from voluntary to legally required for durability, reparability, and recycled content. Proactive adoption offers a significant competitive advantage, impacting supply chains and product development across the European market. Lammhults Design Group's early integration of these principles will be crucial for market positioning.

- ESPR targets 2025 for key product groups, including furniture, impacting design and material choices.

- A 2024 European Environmental Agency report highlights the need for 80% of products to meet new circularity criteria by 2030.

- Industry estimates suggest compliance costs could rise by 5-10% initially for non-compliant manufacturers.

- Companies with advanced ecodesign practices may see a 15% increase in market share by 2026.

Waste Reduction and Management

Lammhults Design Group prioritizes minimizing waste across its production lifecycle, embedding lean manufacturing principles to reduce material consumption significantly. This commitment extends to designing products for easy disassembly, facilitating recycling and circularity at their end-of-life. For instance, the 2024 Sustainability Report highlights ongoing efforts to decrease production waste and increase the use of recycled materials. The company’s focus on waste management aligns with broader industry trends towards a more sustainable furniture sector by 2025.

- Lammhults aims for a 20% reduction in production waste by 2025 compared to 2023 levels.

- Over 75% of new product designs launched in 2024 incorporate components designed for easier recycling.

Lammhults Design Group prioritizes a circular economy, targeting 90% circularity in new products by 2025 while extending utility up to 50% through repair programs. As of early 2025, nearly 90% of their energy in some facilities is from renewable sources, significantly reducing their carbon footprint. The company integrates sustainable materials, aligning with a global market projected to exceed $100 billion by 2025.

| Environmental Focus | 2024/2025 Target/Status | Impact |

|---|---|---|

| New Product Circularity | 90% by 2025 | Reduced waste, extended product life |

| Renewable Energy Use | Nearly 90% in some facilities (early 2025) | Lower operational carbon footprint |

| Sustainable Furniture Market | >$100 billion by 2025 | Market alignment, increased demand |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Lammhults Design Group draws from a robust blend of official government publications, reputable market research firms, and leading economic indicators. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the furniture and design industry.