Lammhults Design Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lammhults Design Group Bundle

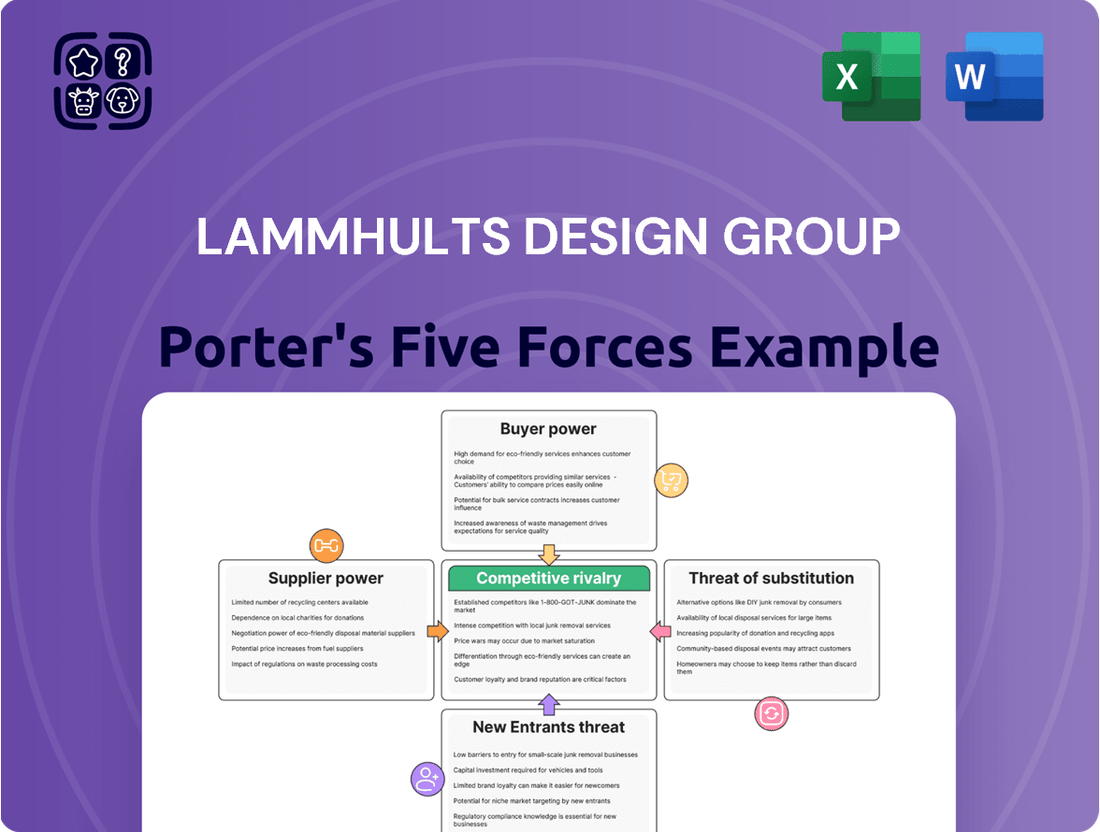

Lammhults Design Group navigates a competitive landscape shaped by several key forces, including the bargaining power of buyers and suppliers.

The threat of new entrants and the availability of substitute products also present significant challenges and opportunities.

Understanding the intensity of rivalry within the furniture design industry is crucial for Lammhults Design Group's strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Lammhults Design Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Lammhults Design Group relies on specialized suppliers for premium materials like FSC-certified wood, recycled metals, and high-quality textiles, essential for their Scandinavian design furniture. Their commitment to sustainability, highlighted in their 2023 Sustainability Report, means partnering with a select few who meet stringent environmental and quality standards. This specialization grants these suppliers significant leverage, particularly for unique or certified eco-friendly components. Given global supply chain pressures and increased demand for sustainable materials in 2024, these relationships are crucial.

The European furniture market generally presents a wide array of material suppliers, which typically dilutes the bargaining power of any single supplier. However, for Lammhults Design Group, sourcing specialized or certified sustainable materials, crucial for their brand ethos, often narrows the pool of qualified vendors. The company's centralized sourcing organization, as highlighted in their 2024 strategic initiatives, actively works to boost cost-efficiency and transparency. This approach strategically manages supplier relationships, aiming to reduce potential power imbalances and ensure a stable supply chain for high-quality components.

Switching suppliers for standard materials, such as basic wood or metal components, is relatively easy for Lammhults Design Group due to widespread availability of alternatives in the 2024 market. However, for specialized or custom-designed components, which are often integral to Lammhults' distinctive identity and quality promise, changing suppliers can involve significant costs in finding, vetting, and integrating new partners. Lammhults' emphasis on timeless design and extended product lifecycles, as highlighted in their 2024 business strategy, necessitates consistent material quality and reliable supply chains. This focus makes established supplier relationships crucial, as disruptions could impact production efficiency and brand reputation, potentially leading to increased costs and delays in new product development or existing order fulfillment.

Importance of Volume to Suppliers

As a key player in premium public and office furniture, Lammhults Design Group's substantial purchasing volume provides considerable leverage with its suppliers. This high volume allows for more favorable terms in negotiations, particularly with specialized component providers. While the overall European furniture market was valued at approximately €130 billion in 2024, many niche suppliers still rely heavily on contracts with established design houses like Lammhults.

- Lammhults' purchasing power is enhanced by its significant volume, impacting supplier negotiations.

- Specialized suppliers may have limited alternatives, increasing their dependence on major clients like Lammhults.

- The company's strong market presence in premium segments reinforces its importance to its supply chain.

- This dependence can lead to more competitive pricing and favorable delivery terms for Lammhults.

Forward Integration Threat

The threat of suppliers integrating forward to manufacture and sell their own furniture is generally low for Lammhults Design Group. The furniture industry demands substantial investment in design, branding, marketing, and distribution, which differs significantly from raw material supply. Lammhults' established market presence and strong brand identity, evidenced by its 2024 focus on premium segments, create a high barrier for any supplier attempting to become a direct competitor.

- Furniture production requires distinct capabilities beyond raw material supply.

- Brand building and distribution networks are significant barriers to entry.

- Lammhults' established market position deters supplier forward integration.

- The 2024 outlook reinforces the high capital and expertise required in finished goods.

Lammhults Design Group faces moderate supplier bargaining power, primarily from specialized vendors providing FSC-certified wood and recycled metals crucial for their premium sustainable products. While the 2024 European furniture market offers diverse suppliers, Lammhults' specific material needs narrow the pool, increasing leverage for niche providers. However, Lammhults' substantial purchasing volume within the €130 billion European furniture sector provides significant counter-leverage. The threat of suppliers integrating forward remains low due to the distinct capital and expertise required for furniture manufacturing.

| Factor | Lammhults' Impact | Supplier Power Level |

|---|---|---|

| Material Specialization | High demand for FSC-certified wood, recycled metals | Moderate to High |

| Switching Costs | Low for standard, High for custom components | Varies |

| Lammhults' Volume | Significant purchasing leverage in 2024 market | Low to Moderate |

| Forward Integration | Low due to high industry entry barriers | Low |

What is included in the product

This analysis details the competitive forces impacting Lammhults Design Group, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the furniture design industry.

A clear, one-sheet summary of all five forces—perfect for quick decision-making regarding Lammhults Design Group's competitive landscape.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Lammhults Design Group's Porter's Five Forces.

Customers Bargaining Power

Lammhults Design Group caters to a diverse customer base, spanning offices, educational institutions, libraries, and healthcare facilities within the contract furniture market. This broad and often fragmented customer base, which includes numerous smaller public institutions alongside corporate clients, generally dilutes their collective bargaining power. However, significant orders from major corporate or government clients, such as large 2024 public sector contracts, can provide these specific buyers with substantial leverage over pricing and terms for Lammhults.

Customers, particularly in public and corporate sectors, exhibit significant price sensitivity due to stringent budget constraints and procurement frameworks. For large-volume purchases, despite valuing Lammhults Design Group's durability and design, cost remains a primary consideration. The global office furniture market, estimated at over $73 billion in 2024, shows a substantial segment seeking a balance between quality and affordability, with many procurement processes heavily weighing price. This dynamic often leads to competitive bidding, where even a slight price difference can influence decisions.

The contract furniture market, where Lammhults Design Group operates, is highly competitive with numerous domestic and international players. Customers have access to a vast array of alternatives, ranging from other high-end Scandinavian design brands to more budget-friendly options. This broad availability of substitutes significantly increases buyer power, as clients can easily compare various manufacturers' prices and product features. The global contract furniture market continues to see robust competition in 2024, driven by diverse offerings and evolving design trends.

Brand Loyalty and Differentiation

Lammhults Design Group effectively mitigates customer bargaining power through its established brand reputation, emphasizing timeless Scandinavian design and a strong commitment to quality and sustainability. Customers, particularly those procuring furniture for public spaces, often prioritize durability and aesthetics, fostering significant brand loyalty. This differentiation means buyers are less likely to switch based solely on price, recognizing the long-term value and design integrity Lammhults provides. For example, Lammhults reported a net sales increase in Q1 2024, reflecting continued demand for its premium offerings.

- Lammhults Design Group's net sales reached SEK 211.3 million in Q1 2024.

- Their strong brand loyalty reduces price sensitivity among B2B customers.

- The focus on Scandinavian design principles differentiates them from competitors.

- Commitment to quality and sustainability reinforces customer retention.

Switching Costs for Customers

Customers of Lammhults Design Group face significant switching costs, particularly for large-scale furniture installations. This extends beyond the direct financial outlay for new pieces to include operational disruptions and the challenge of maintaining aesthetic consistency with existing collections. Given the long lifecycle of Lammhults products, replacement decisions are infrequent, yet the established desire for design harmony often favors retaining the current supplier. For instance, commercial projects initiated in early 2024 would factor in the high cost of re-outfitting a space, making a switch less appealing.

- High financial outlay for new furniture.

- Operational disruption during replacement.

- Aesthetic inconsistency with existing designs.

- Infrequent replacement cycles due to product durability.

Lammhults Design Group faces customer price sensitivity and broad alternatives in a competitive 2024 market. However, a fragmented customer base, strong brand loyalty, and high switching costs for large installations moderate buyer power. While major 2024 public sector contracts can give specific buyers leverage, Lammhults' differentiated offerings maintain a balanced position.

| Metric | 2024 Data | Impact on Bargaining Power |

|---|---|---|

| Global Office Furniture Market | >$73 billion | High competition, increased buyer options |

| Lammhults Q1 2024 Net Sales | SEK 211.3 million | Reflects demand, brand strength offsets price sensitivity |

| Average Switching Costs (Commercial) | High (financial, operational) | Reduces customer willingness to change suppliers |

Preview the Actual Deliverable

Lammhults Design Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Porter's Five Forces analysis of Lammhults Design Group. You'll gain immediate access to this professionally written and formatted report, detailing the competitive landscape affecting Lammhults. This includes in-depth assessments of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry within the furniture and design industry. Rest assured, what you see is precisely what you will download, ready for your strategic planning needs.

Rivalry Among Competitors

The European office and contract furniture market is notably fragmented, characterized by a mix of large international corporations and numerous smaller, specialized entities. Lammhults Design Group faces stiff competition, not only from established Scandinavian design firms like Vitra and Fritz Hansen but also from a broader range of international players. This high number of competitors intensifies the rivalry for market share, with the European office furniture market valued at approximately €13 billion in 2024. This fragmentation means no single player holds dominant control, necessitating continuous innovation and differentiation.

Product differentiation is a critical competitive factor for Lammhults Design Group, rooted in its distinct design, superior quality, and established brand reputation. The company competes effectively in the premium furniture segment, leveraging its strong focus on authentic Scandinavian design and exceptional durability. While Lammhults emphasizes eco-friendly practices, aligning with a growing market demand that saw sustainability-driven sales increase by an estimated 15% in the European design sector in 2024, competitors often differentiate through features like advanced ergonomic designs, modularity, and integrated smart technology. This strategic positioning allows Lammhults to maintain its market share against rivals focusing on alternative value propositions.

The European office furniture market is experiencing steady growth, with projections indicating a compound annual growth rate of around 3% for 2024. This expanding market can naturally reduce the intensity of competitive rivalry, as companies can access new demand without directly challenging existing market shares. However, given this moderate growth, competition for securing new projects and attracting clients remains significant. Lammhults Design Group must navigate this environment where new opportunities exist, but securing them still requires strong competitive efforts.

High Strategic Stakes

The contract furniture market presents exceptionally high strategic stakes, compelling companies like Lammhults Design Group to heavily invest in cutting-edge design innovation and robust brand building. Winning substantial contracts for public or corporate spaces, such as a major office fit-out or a public institution, is critical for revenue growth and market share, making each bid a significant competitive battle. For instance, the global contract furniture market was valued at approximately $45 billion in 2023, with projections indicating continued growth in 2024, highlighting the substantial opportunities and intense rivalry for large projects.

- Major contract wins can represent over 10-15% of annual revenue for specialized firms.

- R&D investment in new designs often exceeds 5% of sales for leading players.

- Brand reputation directly influences success rates in competitive bids.

- Distribution network strength is key to reaching diverse institutional clients.

Customer Loyalty

Building strong customer relationships and brand loyalty is crucial for Lammhults Design Group in the competitive furniture sector. Lammhults leverages its reputation for quality and timeless Scandinavian design, evidenced by its consistent product releases in 2024, helping retain a loyal client base. However, the market sees many competitors, like Vitra or Artek, offering innovative and sustainable alternatives, constantly challenging established loyalty. This dynamic forces Lammhults to continuously innovate and provide excellent service, as seen in their 2024 focus on enhancing digital customer experiences and product customization.

- Lammhults' 2024 product line emphasizes durability and design longevity.

- Competitors' sustainable offerings are gaining market share, impacting traditional loyalty.

- Customer retention is a key metric, with ongoing efforts to improve service satisfaction.

- Investment in R&D for new materials and designs supports continuous innovation.

Lammhults Design Group navigates intense competitive rivalry within the fragmented European office and contract furniture markets, valued at approximately €13 billion in 2024 for office furniture. While a projected 3% market growth for 2024 eases some pressure, the high strategic stakes in the $45 billion contract segment intensify competition for major projects. Lammhults leverages its premium Scandinavian design and brand reputation, but faces constant challenges from rivals offering diverse innovations and sustainable alternatives, necessitating continuous differentiation.

| Metric | 2024 Data | Impact |

|---|---|---|

| European Office Furniture Market Value | €13 Billion | High fragmentation, intense rivalry |

| European Market Growth Rate | ~3% CAGR | Moderate growth, sustained competition |

| Contract Market Stakes | $45 Billion (2023) | Critical for revenue, fierce bids |

SSubstitutes Threaten

Direct functional substitutes for Lammhults Design Group's high-quality, design-led public space furniture are primarily lower-cost, non-designer alternatives. While these options fulfill the basic needs for seating or tables, they typically lack the aesthetic sophistication, superior durability, and sustainability credentials found in Lammhults' offerings. For instance, many budget-focused suppliers do not meet the stringent environmental standards like ISO 14001 that premium brands often uphold. For clients whose primary driver is minimizing initial expenditure, these substitutes pose a significant threat in a global commercial furniture market valued at over 200 billion USD in 2024, where cost-effectiveness remains a strong decision factor.

The rise of multifunctional and flexible furniture presents a notable substitute threat to traditional furniture manufacturers like Lammhults Design Group. These innovative products, designed to be reconfigured for various uses, strongly appeal to clients prioritizing space efficiency and adaptability, especially within the evolving landscape of dynamic office environments. For instance, the global flexible office market size was valued at over $30 billion in 2024, driving demand for furniture that supports agile workspaces. This trend directly substitutes traditional, single-purpose furniture pieces, as businesses opt for versatile solutions that maximize utility per square meter.

The rise of co-working spaces and widespread adoption of hybrid work models present a notable substitute for conventional office setups. These alternative solutions reduce the need for traditional corporate office furniture contracts. For example, the global flexible workspace market is projected to grow significantly through 2024, altering demand patterns. While these spaces still require furniture, procurement decisions increasingly shift to flexible space providers like WeWork or IWG. This fundamentally changes the customer base and sales channels for Lammhults Design Group, impacting their traditional B2B sales model for large office furnishings.

Used or Refurbished Furniture

The rise of the circular economy significantly boosts the market for used and refurbished high-quality furniture, presenting a notable threat of substitutes for Lammhults Design Group. For customers prioritizing sustainability or managing budgets, acquiring second-hand premium pieces, often at a lower cost, offers a compelling alternative to new purchases. This trend aligns with environmental goals, with the global second-hand furniture market projected to reach USD 27.1 billion by 2030, but directly impacts new product sales.

- Sustainability drives consumer shifts towards pre-owned furniture.

- Budget-conscious buyers find value in refurbished premium items.

- The circular economy diminishes demand for new furniture.

- Online platforms facilitate easier access to used furniture.

Lack of True Functional Substitutes

While material and stylistic alternatives are prevalent, there is no true functional substitute for furniture in commercial, educational, or public environments. The fundamental need for surfaces to work on and objects to sit on remains constant, ensuring a baseline demand. Therefore, the primary threat of substitution for Lammhults Design Group stems from varying types, qualities, and procurement models of furniture itself, rather than entirely different product categories. For instance, the global office furniture market is projected to reach approximately $75.5 billion in 2024, highlighting ongoing demand for these core products.

- The intrinsic need for physical workspaces and seating limits the emergence of non-furniture alternatives.

- Threat of substitution is predominantly internal to the furniture industry, focusing on product variations.

- The global commercial furniture market continues to demonstrate robust demand in 2024.

- Innovation in furniture design and sustainability models influence competitive positioning more than external threats.

The primary threat of substitutes for Lammhults Design Group stems from lower-cost, non-designer alternatives and the growing demand for flexible, multi-functional furniture, driven by hybrid work models. The rise of the circular economy also promotes second-hand premium items. While the fundamental need for furniture persists, with the global commercial furniture market exceeding $200 billion in 2024, these shifts alter procurement and competitive dynamics.

| Substitute Type | Impact on Lammhults | Market Context (2024) |

|---|---|---|

| Lower-cost/Non-designer | Price competition, less premium focus | Global commercial furniture >$200B |

| Flexible/Multifunctional | Demand shift from traditional designs | Flexible office market >$30B |

| Second-hand/Refurbished | Reduced new product sales | Second-hand furniture market growing |

Entrants Threaten

The contract furniture market, especially the premium segment, relies heavily on brand reputation and deeply established relationships with architects, designers, and corporate clients. New entrants face a significant hurdle in building the level of trust and brand recognition that established companies like Lammhults Design Group have cultivated over many years. For instance, in 2024, brand strength remains a key differentiator, with leading brands commanding premium pricing and market share. Overcoming this ingrained loyalty and perception of quality presents a substantial barrier, requiring extensive investment in marketing and relationship-building to even begin competing effectively.

Established companies like Lammhults Design Group, with their significant operational scale, benefit from robust economies in manufacturing, material sourcing, and distribution networks. For instance, Lammhults reported net sales of SEK 889 million for the full year 2023, indicating a substantial volume of production. This scale allows them to achieve lower per-unit costs compared to a new market entrant. A new competitor would likely face considerably higher initial per-unit expenses, making it challenging to compete on price without compromising product quality. This cost disparity acts as a substantial barrier, making market entry difficult.

Access to effective distribution channels, encompassing relationships with dealers, showrooms, and direct sales forces, is paramount in the contract furniture market. New entrants would face substantial hurdles, needing significant capital investment and considerable time to develop robust networks. Lammhults Design Group's well-established presence across multiple European markets, evidenced by their reported net sales of SEK 828 million in 2023, provides a formidable defensive barrier. This extensive reach makes it challenging for newcomers to compete effectively in reaching target customers.

Capital Investment

Entering the furniture manufacturing industry, particularly at Lammhults Design Group's scale, demands substantial capital investment. Significant funds are required for modern production facilities, advanced technology, extensive design development, and robust marketing campaigns. While niche entry is feasible, competing with established players necessitates considerable financial resources, estimated to be in the tens of millions of euros for a mid-sized operation in 2024. This high capital barrier effectively deters many potential new entrants from challenging incumbent firms like Lammhults.

- Production facility setup costs can exceed €10 million for a modern plant.

- Investment in advanced manufacturing technology, like robotics, often requires multi-million euro outlays.

- Design and product development cycles demand continuous funding for innovation.

- Marketing and distribution network establishment require substantial upfront capital.

Customer Switching Costs

While buyers have numerous choices in the design furniture sector, Lammhults Design Group benefits from established relationships and a strong desire for consistency in design and quality among its clientele. This creates significant inertia, as evidenced by the stable market shares of leading European design furniture manufacturers, often seeing less than a 5% year-over-year shift in top-tier brand preference in 2024. A new entrant must offer a truly compelling value proposition, perhaps through significant innovation or unique design, to persuade customers to switch from their trusted, long-term suppliers like Lammhults. This inherent stickiness of existing customer relationships acts as a robust barrier to new players.

- Established customer relationships provide significant inertia.

- Customers prioritize consistency in design and quality.

- New entrants require compelling value to overcome loyalty.

- Market share stability among incumbents acts as a barrier.

New entrants face significant barriers due to Lammhults Design Group's strong brand and established relationships, crucial in the premium contract furniture sector. Substantial capital investment, often exceeding €10 million for modern facilities in 2024, deters many. Economies of scale, like Lammhults' SEK 889 million net sales in 2023, also create a cost disadvantage for newcomers.

| Barrier | Description | 2024 Impact |

|---|---|---|

| Brand Loyalty | Established trust and reputation | High switching costs for buyers |

| Capital Investment | Cost of facilities, tech, R&D | €10M+ for a modern plant |

| Economies of Scale | Cost advantage from large volume | Lower per-unit costs for incumbents |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Lammhults Design Group is built upon a foundation of publicly available financial reports, investor relations materials, and industry-specific trade publications.

We also incorporate market research data from reputable firms and competitor analysis from financial news outlets to provide a comprehensive competitive landscape.