Dr Lal PathLabs Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr Lal PathLabs Bundle

Dr Lal PathLabs faces a dynamic competitive landscape, with moderate to high rivalry from established and emerging players in the diagnostic services sector.

The threat of new entrants is somewhat contained by high capital investment and regulatory hurdles, but innovation in technology could lower these barriers.

Buyer power, particularly from large corporate clients and insurance providers, can exert pressure on pricing and service offerings.

The threat of substitutes is relatively low, as essential diagnostic tests are difficult to replace with alternative solutions.

Supplier power, especially for specialized reagents and equipment, can influence costs and operational efficiency.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dr Lal PathLabs’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The diagnostic industry heavily depends on a limited number of global manufacturers for advanced high-tech equipment, giving these specialized suppliers substantial bargaining power. This concentration often translates into increased procurement expenses, with equipment costs rising by 5-7% in 2024 due to ongoing supply chain disruptions. Such supplier leverage can significantly impact operational margins for diagnostic chains. To mitigate this, Dr. Lal PathLabs proactively secures long-term contracts with key suppliers, ensuring supply stability and managing future cost escalations effectively.

The accuracy and volume of diagnostic tests at Dr. Lal PathLabs are directly dependent on the consistent availability of specific chemical reagents. This critical reliance makes the company susceptible to the bargaining power of its reagent suppliers, leading to potential price volatility. In their FY2024 results, the cost of materials consumed represented a significant portion of Dr. Lal PathLabs' operational expenses, underscoring this vulnerability. Any disruption or price hike from these key suppliers could directly impact profitability and service delivery.

The diagnostic business, exemplified by Dr Lal PathLabs, fundamentally relies on trust and accuracy, making the quality of supplied reagents and equipment paramount.

Any compromise in the precision of diagnostic inputs or the reliability of machinery directly impacts test results, operational efficiency, and, critically, brand reputation. For instance, maintaining high accuracy is essential, especially as Dr Lal PathLabs reported robust revenue growth of 13.9% year-on-year in Q4 FY24 (ending March 2024), underscoring the need for uncompromised quality.

This necessity for consistently high-quality inputs significantly strengthens the bargaining position of suppliers who reliably meet stringent industry standards, as poor quality could lead to substantial financial and reputational damage.

Long-term contracts as a mitigation strategy

To mitigate the bargaining power of suppliers, Dr. Lal PathLabs and other prominent industry players frequently enter into long-term contracts. These strategic agreements are vital for securing a consistent supply of essential reagents and equipment at stable, predictable prices. This approach is crucial for maintaining operational stability and profitability, directly contributing to the company’s effective cost management. In 2024, this strategy supported Dr. Lal PathLabs in achieving a strong gross profit margin of 59.8%.

- Dr. Lal PathLabs utilizes long-term contracts to counter supplier power.

- These agreements ensure a consistent supply of critical materials.

- Predictable pricing from contracts supports profitability.

- This contributed to a 59.8% gross profit margin in 2024.

Logistics providers' influence

The time-sensitive nature of diagnostic testing makes reliable logistics crucial for Dr. Lal PathLabs, as samples must reach centralized labs swiftly. This dependency on a few key logistics providers grants them considerable bargaining power. For instance, in FY 2023, logistics costs represented approximately 10-12% of total operational expenses for major diagnostic chains in India. This reliance can lead to increased costs and potential service disruptions, directly impacting profitability.

- Critical dependence on timely sample transport.

- Limited number of specialized logistics providers.

- Logistics costs significantly impact operational expenditure.

- Potential for increased service costs in 2024 due to fuel prices.

Dr. Lal PathLabs faces significant supplier bargaining power from a concentrated pool of high-tech equipment and specialized reagent manufacturers. Equipment costs rose 5-7% in 2024, impacting operational expenses, while material costs remained substantial in FY2024. The critical need for precise inputs further empowers these quality-focused suppliers. Long-term contracts help mitigate this, contributing to a 59.8% gross profit margin in 2024.

| Supplier Type | Bargaining Power Impact | 2024 Data Point | ||

|---|---|---|---|---|

| High-Tech Equipment | High due to limited global manufacturers | Equipment costs up 5-7% | ||

| Chemical Reagents | High due to critical quality and specific needs | Material costs significant in FY2024 | ||

| Logistics Providers | Moderate-High due to time-sensitive transport | Logistics costs 10-12% of opex (FY23) |

What is included in the product

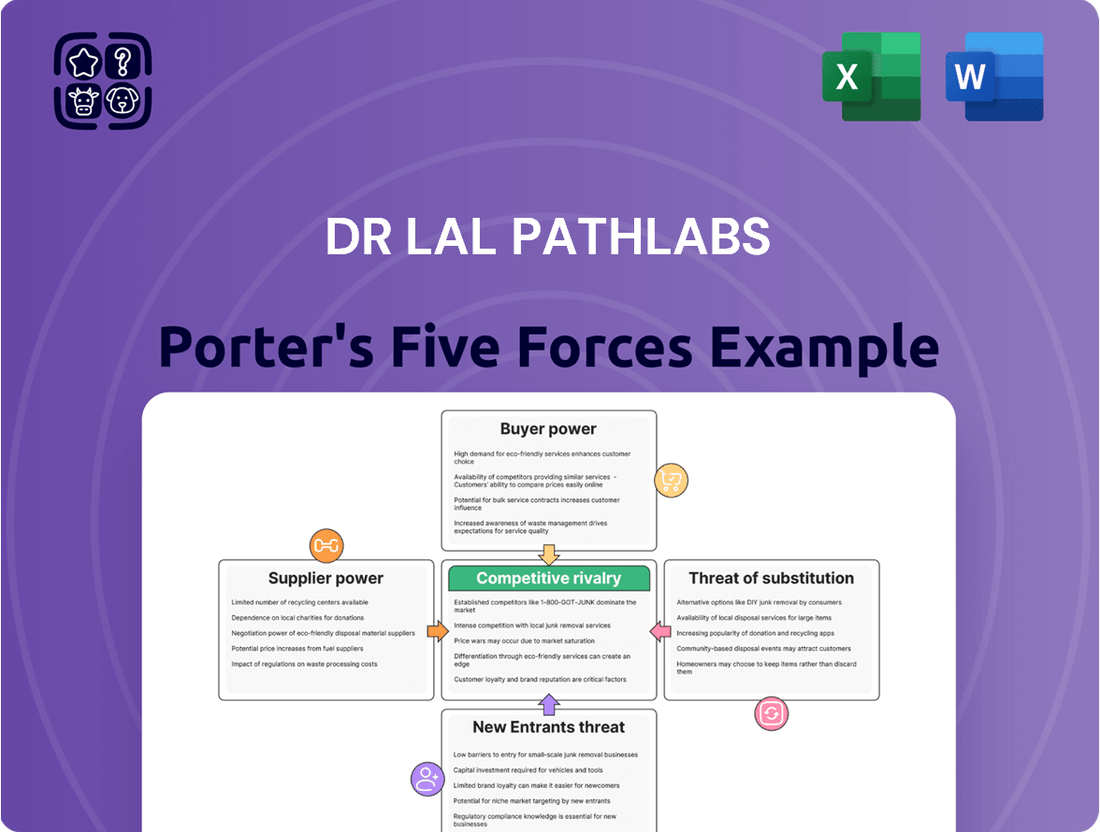

This analysis of Dr Lal PathLabs examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the risk of substitute services to understand the company's competitive environment.

Quickly assess competitive pressures with a visual representation of Porter's Five Forces, simplifying strategic analysis for Dr Lal PathLabs.

Empower informed decision-making by easily identifying and mitigating threats from rivals, new entrants, and substitute services.

Customers Bargaining Power

The Indian healthcare market is highly price-sensitive, driven by significant out-of-pocket expenditure which heavily influences patient choices for diagnostic services. This forces diagnostic companies like Dr Lal PathLabs to engage in competitive pricing, especially for routine tests where price transparency is higher. Test prices have remained relatively stable or increased only marginally over the last five years, with average revenue per test (ARPT) for Dr Lal PathLabs reported at around ₹680 in Q4 FY24. This constant pressure limits revenue growth per test, impacting the company's overall profitability.

The Indian diagnostic market is highly fragmented, featuring numerous unorganized local labs, hospital-based facilities, and growing organized chains like Metropolis Healthcare and Thyrocare Technologies. This extensive array of choices significantly empowers customers, enhancing their bargaining power to switch providers. Customers can easily compare options based on cost, convenience, or service quality. With the Indian diagnostic market projected to reach over $18 billion by 2024, the competitive landscape is intense, giving consumers ample alternatives.

Increasing health consciousness, particularly a shift towards preventive healthcare, significantly elevates customer power for diagnostic services like Dr Lal PathLabs. The rise of digital health platforms and at-home sample collection, which saw substantial adoption growth in 2024, enhances convenience and accessibility. This digital accessibility empowers customers to easily compare services and pricing, fostering greater choice. For instance, online platforms allow quick comparisons of test prices, putting pressure on providers. This trend, coupled with consumers' proactive health management, strengthens their bargaining position.

Brand reputation and trust

While pricing remains a factor, Dr. Lal PathLabs leverages its strong brand reputation for diagnostic accuracy and reliability, which significantly influences customer choice, especially for critical tests. This established trust builds customer loyalty, partially mitigating the high bargaining power of buyers. For instance, Dr. Lal PathLabs reported a network of over 271 clinical labs and 5,000 patient service centers as of fiscal year 2024, demonstrating its widespread reach and brand presence.

- Customer trust in diagnostic accuracy often outweighs minor price differences for complex tests.

- Dr. Lal PathLabs' strong brand equity helps retain patients, reducing their propensity to switch providers.

- Brand loyalty acts as a barrier, enabling the company to command premium pricing for its reputable services.

- In 2024, the company continued to invest in advanced technology and quality control, reinforcing its trusted image.

Low switching costs for consumers

For most routine diagnostic tests, patients face minimal cost or effort to switch providers, making customer loyalty challenging for Dr Lal PathLabs. This low switching cost compels diagnostic chains to continuously compete on price, service quality, and accessibility to retain their market share. While a doctor's recommendation can act as a barrier to switching, organized players like Dr Lal PathLabs leverage their extensive network and brand trust to influence these decisions. The Indian diagnostic market, valued at around $12 billion in 2024, sees intense competition among numerous players, necessitating constant innovation.

- Price sensitivity remains high for common tests.

- Ease of accessing multiple collection centers influences choice.

- Brand reputation built over years like Dr Lal's is crucial for retention.

- Digital platforms reduce friction for comparing services.

Customers wield significant bargaining power in India's fragmented diagnostic market, projected over $18 billion in 2024, due to high price sensitivity and low switching costs for routine tests. Digital platforms and increased health consciousness further empower choices, with substantial adoption growth in 2024. While Dr Lal PathLabs faces pressure on its average revenue per test (~₹680 in Q4 FY24), its strong brand reputation and extensive network of over 271 labs in FY24 build loyalty, partially mitigating this customer power.

| Metric | 2024 Data | Impact on Bargaining Power |

|---|---|---|

| Indian Diagnostic Market Value | >$18 Billion (projected) | High market fragmentation, more choices |

| Dr Lal PathLabs ARPT (Q4 FY24) | ~₹680 | Pressure on pricing due to customer sensitivity |

| Dr Lal PathLabs Labs (FY24) | 271+ clinical labs | Brand trust and widespread access partially mitigates |

Preview the Actual Deliverable

Dr Lal PathLabs Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Dr Lal PathLabs meticulously details the competitive landscape, including the intensity of rivalry among existing players, the bargaining power of buyers, and the threat of new entrants. It also thoroughly examines the bargaining power of suppliers and the threat of substitute services, providing a holistic view of the industry's attractiveness and the strategic positioning of Dr Lal PathLabs within it. This exact report will be available for download immediately upon purchase, ensuring you receive precisely the insights you need to inform your business strategy.

Rivalry Among Competitors

The Indian diagnostic industry is highly fragmented, leading to intense competitive rivalry for Dr Lal PathLabs.

Thousands of small, unorganized labs compete fiercely with large national chains, with over 100,000 diagnostic centers estimated across India in 2024.

This fragmentation results in aggressive pricing strategies and a constant battle for market share, particularly in major urban centers.

Dr Lal PathLabs faces continuous pressure to innovate and maintain service quality amidst this pervasive competition.

Dr. Lal PathLabs faces significant direct competition from other established pan-India players. Major diagnostics chains like Metropolis Healthcare, Thyrocare Technologies, and SRL Diagnostics intensely compete for market share. These rivals, as of early 2024, expand their network reach and diversify test menus, creating a dynamic environment. Competition is fierce on brand recognition and service quality, with all players investing in digital platforms. This constant rivalry significantly impacts pricing and operational strategies within the diagnostics sector.

The diagnostic market's attractive profit margins, notably Dr Lal PathLabs' reported EBITDA margin of around 26.5% for Q3 FY24, have fueled the entry of new competitors. This includes online health aggregators like PharmEasy and Tata 1mg, which expanded their diagnostic services significantly in 2024. Hospital chains such as Apollo Hospitals and Fortis Healthcare are also bolstering their in-house diagnostic capabilities. Furthermore, pharmacy chains like Reliance Retail's Netmeds are intensifying competition, particularly in the digital and direct-to-consumer spaces, making market share more contested.

Focus on network expansion and acquisitions

Competitive rivalry in the diagnostic sector is intense, driven by aggressive network expansion. Key players are rapidly adding new labs and collection centers, especially targeting volume growth in Tier II and Tier III cities. Consolidation through mergers and acquisitions is a common strategy for established chains like Dr Lal PathLabs to expand their geographic footprint and market share. For instance, diagnostic chains collectively added over 200 new collection centers in 2024 across India.

- Network expansion targets Tier II/III cities for volume.

- M&A is key for geographic footprint and market share.

- Over 200 new collection centers were added by major players in 2024.

Price wars and service differentiation

The diagnostic industry faces intense price wars, yet companies like Dr Lal PathLabs actively differentiate through superior service quality and faster turnaround times. There is a growing emphasis on advanced test offerings, including molecular and genetic diagnostics, which command higher value. For instance, the focus on preventive healthcare packages has seen growth, with Dr Lal PathLabs reporting a significant portion of its revenue from profiles and packages, aiming to increase volume per patient.

- Competitive pricing pressures remain high in 2024, driving laboratories to optimize costs.

- Service differentiation includes faster report delivery, often within 24 hours for routine tests.

- Investment in advanced diagnostics, like specialized oncology panels, enhances market position.

- Bundled preventive health check-ups are a key strategy to boost patient footfall and revenue per visit.

Competitive rivalry for Dr Lal PathLabs is intense within India's highly fragmented diagnostics market, estimated at over 100,000 centers in 2024. National chains, new online aggregators, and hospital groups aggressively expand, adding over 200 new collection centers in 2024. This fuels price competition, though Dr Lal PathLabs differentiates via service quality and advanced offerings.

| Rivalry Factor | Metric (2024) | Impact |

|---|---|---|

| Market Fragmentation | >100,000 Labs | High price pressure |

| New Entrants | Online/Hospitals | Increased competition |

| Network Expansion | >200 New Centers | Market share battle |

SSubstitutes Threaten

The growing availability and acceptance of self-use diagnostic kits, like those for blood sugar and blood pressure, pose a notable threat. These convenient and cost-effective solutions are driving market growth, with the global home healthcare market projected to reach 200 billion USD by 2024. Patients increasingly use these kits for routine monitoring, reducing their dependency on traditional diagnostic laboratories. This shift empowers individuals with immediate results and greater control over their health data.

Hospitals are increasingly developing their own advanced in-house laboratories, aiming for quicker test results and integrated patient care. This trend directly substitutes external diagnostic services, particularly for inpatients and emergency cases. Many major hospital chains in India, for example, have significantly ramped up their in-house diagnostic capabilities by 2024. This expansion reduces their reliance on third-party labs like Dr. Lal PathLabs for a substantial portion of their testing volume. Such in-house facilities offer convenience and faster turnaround times, posing a growing competitive threat.

The rise of telemedicine and digital health platforms presents a growing threat to traditional diagnostic chains like Dr Lal PathLabs by fundamentally altering patient pathways. These platforms, increasingly popular in 2024, often integrate with preferred diagnostic partners or emphasize at-home sample collection and monitoring solutions. This shift can significantly divert patients away from traditional walk-in labs, impacting footfall and altering the established referral patterns that labs have historically relied upon. As digital consultations rise, potentially reaching 70-80 million in India by 2025, the direct patient-to-lab connection diminishes, posing a challenge to revenue streams.

Government healthcare initiatives

Government healthcare initiatives pose a significant substitute threat, especially as programs like Ayushman Bharat expand access to free or heavily subsidized diagnostic services. These public healthcare offerings at government facilities directly compete with private players like Dr. Lal PathLabs, particularly impacting price-sensitive customers in rural and semi-urban areas. In 2024, the Ayushman Bharat PM-JAY scheme aims to cover over 50 crore beneficiaries, significantly increasing the availability of low-cost or free diagnostics. This expansion could divert a substantial volume of tests from private labs.

- Ayushman Bharat PM-JAY targeted over 50 crore beneficiaries in 2024 for subsidized healthcare.

- Government facilities offer diagnostics at zero or minimal cost, attracting price-sensitive populations.

- Increased public health spending reduces reliance on private diagnostic services.

- This particularly impacts Dr. Lal PathLabs' market share in non-metro regions.

Limited threat for specialized testing

While substitutes exist for routine diagnostic tests, the threat remains low for Dr. Lal PathLabs regarding complex, specialized, and high-precision diagnostics. These advanced pathology, radiology, and genetic testing services demand sophisticated equipment and highly specialized expertise, making them difficult to replicate by general practitioners or smaller labs. For instance, Dr. Lal PathLabs processed over 60 million samples in fiscal year 2024, with a significant portion being specialized tests, highlighting their deep market penetration in this segment. The capital expenditure required for advanced genetic sequencers or high-resolution imaging devices further limits new entrants or substitutes.

- Specialized tests require significant capital investment in equipment, such as advanced PCR machines and genetic sequencers.

- Expertise in interpreting complex results is a barrier, with Dr. Lal PathLabs employing over 300 pathologists and radiologists as of 2024.

- Accreditations like NABL (National Accreditation Board for Testing and Calibration Laboratories) are crucial for specialized labs, ensuring quality and trust.

- The company reported a revenue increase in specialized testing, indicating sustained demand and limited substitution in 2024.

The threat of substitutes for Dr. Lal PathLabs is mixed. Self-use kits and in-house hospital labs, significantly expanded by 2024, divert routine testing. Telemedicine and government schemes like Ayushman Bharat, targeting 50 crore beneficiaries in 2024, also reduce demand for traditional lab visits.

However, the threat remains low for Dr. Lal PathLabs' specialized diagnostics, which require significant capital and expert pathologists, like their 300+ specialists as of 2024. The company's 2024 revenue growth in specialized testing confirms this resilience.

| Substitute Type | Threat Level | 2024 Impact |

|---|---|---|

| Self-use Kits | Moderate | Home healthcare market 200B USD |

| Hospital In-house Labs | Moderate | Major chains ramped up |

| Specialized Tests | Low | Requires high capital/expertise |

Entrants Threaten

Setting up a basic diagnostic lab in India requires relatively low capital investment, making market entry accessible. This contributes significantly to the highly fragmented nature of the Indian diagnostics sector, which in 2024 continues to see a constant influx of small, local players. The ease of establishing such basic setups means the threat of new entrants at the lower end of the market remains persistently high, challenging established players like Dr. Lal PathLabs. This dynamic necessitates continuous innovation and service differentiation for market leaders.

Establishing a large-scale diagnostic chain like Dr. Lal PathLabs presents significant barriers for new entrants. This requires substantial capital investment, with setting up a comprehensive network of labs and collection centers often costing hundreds of crores of Indian Rupees. New players face complex regulatory hurdles, including the rigorous NABL accreditation, which ensures quality and compliance, a process that can take over a year. Building widespread patient trust and a robust doctor referral network, essential for volume, is also incredibly challenging against incumbents with decades of market presence. Dr. Lal PathLabs, for instance, reported over 250 clinical labs and 6,000 collection centers by early 2024, demonstrating the vast infrastructure required.

Established players like Dr. Lal PathLabs possess formidable brand equity, earning deep trust from doctors and patients alike due to their long-standing reputation for accuracy and reliability. As of financial year 2024, Dr. Lal PathLabs leverages its extensive network, making it a leading diagnostic chain. A new entrant would need to invest heavily, potentially billions, and operate for a considerable time to build a comparable level of brand recognition. This significant barrier to entry, coupled with the high cost of market penetration, makes it extremely challenging for new players to compete effectively. Their established brand acts as a major deterrent for potential competitors.

Economies of scale

Large diagnostic chains like Dr. Lal PathLabs leverage significant economies of scale, making it challenging for new entrants. This allows them to secure better pricing from suppliers for reagents and equipment, which is crucial given the high operational costs in the pathology sector. For instance, their vast network enables competitive pricing on high-volume routine tests, a key differentiator. New players entering the market in 2024 would face immense pressure to match this established cost efficiency, immediately putting them at a competitive disadvantage.

- Dr. Lal PathLabs operates over 270 clinical labs and 5,000 patient service centers, allowing for bulk procurement.

- Their scale supports efficient processing of millions of samples annually, reducing per-test costs.

- In FY24, their revenue from operations reflected the benefits of extensive testing volumes.

- New entrants typically lack the initial capital and volume to achieve comparable economies.

Complex regulatory landscape

New entrants into India's diagnostic sector face a complex and evolving regulatory landscape, posing a significant hurdle. Adherence to stringent quality standards, particularly those set by the National Accreditation Board for Testing and Calibration Laboratories (NABL), is crucial for credibility and market acceptance. This rigorous accreditation process acts as a substantial barrier for non-compliant new players. For instance, as of early 2024, only a fraction of India's diagnostic labs, approximately 1,700, had achieved NABL accreditation. This demanding compliance environment requires substantial investment and time, effectively deterring many potential new competitors.

- NABL accreditation: Essential for credibility, with only about 1,700 Indian medical labs NABL-accredited as of early 2024.

The threat of new entrants to Dr. Lal PathLabs is complex. While low capital allows many small, local labs to emerge, especially in 2024, establishing a large-scale chain with comprehensive services requires substantial investment and regulatory adherence. Building the brand trust and extensive network that Dr. Lal PathLabs possesses takes decades, posing a significant barrier for new players.

| Barrier Type | Dr. Lal PathLabs' Position (2024) | Impact on New Entrants |

|---|---|---|

| Capital Investment | Extensive network of 250+ labs, 6,000+ collection centers | New players need hundreds of crores for comparable scale. |

| Regulatory Compliance | NABL accredited; adheres to stringent standards | Only ~1,700 Indian labs NABL accredited; costly and time-consuming. |

| Brand Equity & Trust | Decades of established reputation and doctor referrals | Billions needed to build comparable trust and market penetration. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dr Lal PathLabs leverages data from publicly available financial reports, industry-specific market research, and competitor disclosures to meticulously assess competitive intensity and strategic positioning.