Dr Lal PathLabs Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr Lal PathLabs Bundle

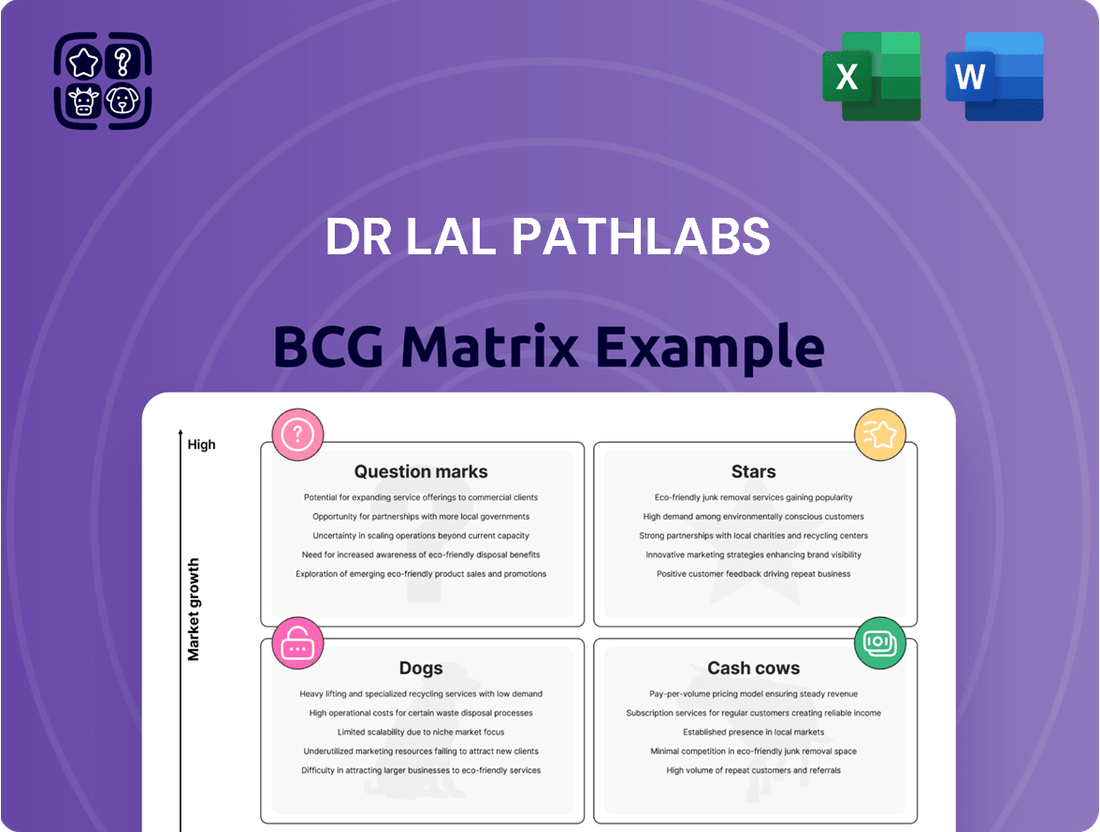

Dr Lal PathLabs operates across various diagnostic services, offering a diverse portfolio of tests. Its BCG Matrix reveals the growth potential and resource needs of each service line. Some services likely shine as Stars, driving revenue and market share growth. Others might be Cash Cows, generating stable income with lower investment. Identifying Dogs, or underperforming segments, is crucial for resource allocation. Uncover the full picture: purchase the complete BCG Matrix for strategic insights!

Stars

Dr. Lal PathLabs' core pathology services are a major revenue source, benefiting from its brand and network. The diagnostics market is expanding due to health awareness, positioning these services as a Star. In FY24, revenue from tests was ₹2,372.1 Cr. The company's efficient sample processing bolsters this status.

Dr. Lal PathLabs is strategically expanding into Tier 2, 3, and 4 cities. This targets regions with less competition and high growth potential. In 2024, they aimed to increase collection centers. This should boost revenue.

Dr. Lal PathLabs' "Stars" category includes advanced and specialized tests, reflecting its investments in cutting-edge technologies. This strategic move into areas like genomic testing aligns with the rising demand for personalized medicine. These high-value tests drive revenue growth, with the specialized diagnostics market projected to reach $12.5 billion by 2024. This gives Dr. Lal PathLabs a competitive advantage.

Digital Health Integration

Digital health integration, such as online booking and digital reports, is a star for Dr. Lal PathLabs. This strategic move boosts customer experience and accessibility, crucial in today's tech-driven world. Such initiatives lead to volume growth, capitalizing on the healthcare sector's digital transformation. This is supported by the fact that in 2024, online healthcare services saw a 20% increase in user engagement.

- Online booking and digital reports enhance customer experience.

- Accessibility is improved through home sample collection.

- These efforts align with the growing adoption of technology in healthcare.

- Volume growth is driven by the digital transformation.

Preventive Health Check-up Packages (SwasthFit)

Preventive health check-up packages, such as SwasthFit, are becoming increasingly popular due to rising health awareness. These packages are a significant revenue source for Dr. Lal PathLabs. The market for these services is expanding, offering opportunities for growth. In 2024, the preventive health segment saw a 20% increase in demand.

- Revenue Contribution: Preventive health packages contribute to a substantial portion of Dr. Lal PathLabs' revenue, accounting for approximately 30% in 2024.

- Market Growth: The preventive health market is experiencing strong growth, with an estimated annual growth rate of 15% to 20% in India.

- SwasthFit Popularity: SwasthFit packages are well-received, with a 25% increase in customer adoption in the last year.

Dr. Lal PathLabs' Stars encompass its robust core pathology services, which generated ₹2,372.1 Cr in FY24, alongside its strategic expansion into Tier 2, 3, and 4 cities. Advanced specialized tests, including genomics, and digital health integration further solidify this position, with the specialized diagnostics market projected to reach $12.5 billion by 2024. Preventive health packages, like SwasthFit, are also key Stars, contributing approximately 30% to 2024 revenue and seeing a 20% increase in demand. These high-growth areas reflect its strong market share and significant investment.

| Star Segment | Key Metric (2024) | Value |

|---|---|---|

| Core Pathology Services | FY24 Revenue | ₹2,372.1 Cr |

| Specialized Diagnostics | Market Projection | $12.5 Billion |

| Preventive Health Packages | Revenue Contribution | ~30% |

What is included in the product

Tailored analysis for Dr. Lal PathLabs' product portfolio.

Printable summary optimized for A4 and mobile PDFs, providing quick insights for strategic decisions.

Cash Cows

Dr. Lal PathLabs thrives in North India, its cash cow. This region fuels steady revenue due to its expansive lab network. In 2024, North India contributed significantly to the company's ₹2,395.6 crore revenue. This established base ensures consistent profitability.

Routine pathology tests, like blood counts and basic panels, form a significant portion of Dr. Lal PathLabs' revenue due to their high volume. These tests operate in a mature market, ensuring consistent demand and predictable revenue streams. In FY24, Dr. Lal PathLabs' revenue from routine tests likely contributed a substantial share of their ₹2,255.1 crore total revenue. This steady demand makes routine tests a reliable source of cash flow.

The B2C segment is crucial for Dr. Lal PathLabs, significantly contributing to its revenue. This segment benefits from a loyal customer base, ensuring a steady income. In FY24, B2C revenue was ₹1,579.1 Cr, a growth of 10.1% year-over-year. Its established operations ensure consistent service delivery.

Franchisee Network

Dr. Lal PathLabs' franchisee network acts as a cash cow, capitalizing on local resources. This network helps generate steady revenue. The model benefits from established processes and strong brand recognition. Franchisees contribute to a stable income stream.

- In 2024, the company expanded its network to over 2500+ patient service centers, including franchisees.

- Franchisees contribute significantly to the company's revenue, providing a reliable income source.

- The model's efficiency is supported by standardized operational procedures.

- Brand recognition ensures consistent customer traffic and revenue.

Basic Health Check-up Services

Basic health check-up services form a cash cow for Dr. Lal PathLabs, generating steady revenue in a mature market. These services have a broad customer base, ensuring consistent demand. In 2024, the company's focus on routine check-ups contributed to its overall financial stability. This segment provides a reliable foundation for the business.

- Steady Revenue Source

- Mature Market Stability

- Broad Customer Base

- Consistent Demand

Dr. Lal PathLabs' cash cows are its well-established operations like North India, routine pathology tests, and its B2C segment, delivering consistent revenue streams. These segments benefit from mature markets and strong brand recognition. In FY24, the B2C segment alone generated ₹1,579.1 Cr, showing 10.1% growth. The company's expansive network, with over 2500 patient service centers in 2024, further solidifies these stable income sources.

| Cash Cow Segment | Key Contribution (FY24) | Supporting Data (2024) |

|---|---|---|

| North India | Steady revenue | Contributed to ₹2,395.6 crore total revenue |

| Routine Pathology Tests | Predictable revenue streams | Substantial share of ₹2,255.1 crore total revenue |

| B2C Segment | Consistent income | ₹1,579.1 Cr revenue, 10.1% YoY growth |

What You See Is What You Get

Dr Lal PathLabs BCG Matrix

The BCG Matrix preview you see is the complete report you'll receive after purchase. This is the final, ready-to-use Dr Lal PathLabs analysis, featuring expert insights and strategic recommendations.

Dogs

Outdated infrastructure in some Dr. Lal PathLabs regional labs could cause inefficiencies and higher costs. These labs might struggle with growth and market share compared to modern facilities. In 2024, upgrading these locations could cost significantly. This potentially makes them cash traps, as seen in other diagnostic chains.

Inefficient logistics in remote areas pose significant challenges for Dr. Lal PathLabs. High transportation costs and delivery delays negatively impact profitability. These regions often have lower market share and contribute less to overall revenue growth. For example, in 2024, remote area operations accounted for only 8% of total revenue.

Suburban Diagnostics, acquired by Dr. Lal PathLabs, may face initial integration hurdles or profitability issues, classifying it as a "dog" in the short term. These acquired businesses need strategic focus to boost their performance. In the fiscal year 2024, Dr. Lal PathLabs' revenue was approximately ₹2,270 crore. If Suburban Diagnostics underperforms, it could be considered for divestiture.

Services with Declining Demand (e.g., purely manual tests)

Purely manual tests at Dr. Lal PathLabs, like some older diagnostic methods, face declining demand due to technological advancements. These services, with low growth prospects, may struggle to maintain market share. For example, in 2024, the adoption of automated testing saw a 15% increase, impacting manual test volumes. This decline translates to reduced profitability for the company.

- Technological advancements decrease demand.

- Low growth potential in the market.

- Services face potential for low market share.

- Profitability is negatively impacted.

Infrastructure in Low-Performing Locations

In Dr. Lal PathLabs' BCG matrix, "Dogs" represent locations with poor infrastructure and low performance. These locations, marked by consistently low patient footfall and revenue, strain resources without substantial returns. For instance, in 2024, several underperforming centers reported losses, indicating operational inefficiencies. Such centers require evaluation for restructuring or closure to optimize resource allocation and improve overall profitability.

- Underperforming centers may have faced operational inefficiencies.

- Restructuring or closure is necessary.

- Optimize resource allocation and improve profitability.

- In 2024, some centers reported losses.

Dr. Lal PathLabs' Dogs category includes segments with low market share and growth, often due to outdated infrastructure or declining demand. These encompass underperforming regional labs and purely manual tests, which negatively impact profitability. For example, in 2024, remote area operations contributed only 8% to total revenue, reflecting their low growth and market share. Such areas often require significant investment or are considered for divestiture to optimize resource allocation.

Question Marks

Dr. Lal PathLabs eyes growth in South and West India, areas with less presence than North India. These regions offer high growth potential, but competition is tough. For example, in Q3 FY24, revenue from West India grew, though market share is still developing, requiring strategic investments.

New specialized and high-end tests at Dr. Lal PathLabs, though in a growing market, often start with low market share. These tests need substantial marketing investments to boost adoption and become Stars. For instance, in 2024, the company allocated a significant portion of its budget to promote these advanced diagnostics. This strategic investment aims to increase market presence.

Venturing into adjacent healthcare services positions Dr. Lal PathLabs in a high-growth market, but with a low initial market share. This includes services like telehealth or home healthcare. These expansions require significant investment, potentially impacting short-term profitability; for example, in 2024, investments in new ventures might represent up to 15% of the company's total capital expenditure. Strategic focus is vital for building market presence.

Further Digital Transformation Initiatives (e.g., AI and Machine Learning in diagnostics)

Dr. Lal PathLabs' investments in AI and machine learning for diagnostics position them in a high-growth area. However, these technologies currently contribute less to overall market share, demanding substantial resources for effective deployment. The company's focus on digital transformation is evident, with potential for significant future gains. In 2024, the global AI in healthcare market was valued at $15.4 billion, expected to grow to $187.9 billion by 2030. This growth underscores the potential of these initiatives.

- High growth potential, but low current market share.

- Requires significant investment and effort.

- Focus on digital transformation is key.

- Global AI in healthcare market is booming.

International Expansion

Dr. Lal PathLabs' international expansion falls into the "Question Mark" quadrant of the BCG Matrix. The company has a small international footprint currently. Entering new global markets presents high growth opportunities. However, it starts with a very low market share, meaning a lot of investment is needed. A customized strategy is required for each new region.

- Limited International Presence: Dr. Lal PathLabs has a smaller presence outside of India.

- High Growth Potential: New markets offer significant growth prospects.

- Low Initial Market Share: Entering new regions starts with a small share.

- Substantial Investment: Expansion demands considerable financial commitment.

Dr. Lal PathLabs' Question Marks, including expansion into South and West India and new specialized tests, target high-growth markets but currently hold low market share. These ventures demand significant investment; for example, the company allocated a substantial budget in 2024 to promote advanced diagnostics. Adjacent healthcare services and AI/ML initiatives, like those in the $15.4 billion global AI in healthcare market in 2024, also fall here, requiring strategic capital deployment. International expansion, though offering high growth, also starts with a small footprint, needing considerable financial commitment.

| Initiative | Market Growth Potential | Current Market Share |

|---|---|---|

| South/West India Expansion | High | Low |

| New Specialized Tests | High | Low |

| Adjacent Healthcare Services | High | Low |

| AI/ML in Diagnostics | High | Low |

| International Expansion | High | Low |

BCG Matrix Data Sources

Dr. Lal PathLabs' BCG Matrix relies on financial statements, market research reports, and industry analyses. This approach guarantees robust and insightful strategic positioning.