Karnov Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Karnov Group Bundle

Navigate the complex external forces shaping Karnov Group's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks are impacting their operations and strategic direction. This in-depth analysis provides crucial intelligence for informed decision-making.

Gain a competitive edge by leveraging our expertly crafted PESTLE analysis of Karnov Group. Uncover the opportunities and threats presented by the dynamic global landscape. Equip yourself with actionable insights to refine your market strategy and anticipate future challenges.

Don't miss out on critical market intelligence. Our PESTLE analysis for Karnov Group is meticulously researched and presented, offering a clear view of the external environment. Purchase the full version now to unlock a deeper understanding and make more strategic investments.

Political factors

EU and national government stability across the Nordic region and other European operating countries directly impacts Karnov Group. Political stability, such as the consistent legal framework seen in Denmark or Sweden, fosters a predictable regulatory environment essential for a legal and tax information provider. Shifts in political ideologies or government changes, like potential legislative adjustments in specific EU member states in late 2024, can generate new demand for Karnov's services as clients seek clarity on evolving laws and regulations. However, these changes also pose a challenge in maintaining the immediacy and currency of their extensive information databases, requiring continuous updates to serve their professional clientele effectively.

Karnov Group, as a digital information provider, faces increasing regulatory scrutiny from EU initiatives. The Digital Services Act (DSA), fully applicable since February 2024, and the NIS2 Directive, effective from January 2023, impose obligations on intermediary service providers. These regulations mandate strict compliance with content moderation, transparency, and cybersecurity protocols. Non-compliance can lead to substantial financial penalties, potentially up to 6% of global annual turnover under the DSA, impacting market access and operational costs.

Karnov Group serves public sector entities, including courts, authorities, and municipalities across Scandinavia. Government budget allocations for these critical services directly influence Karnov's revenue streams in the 2024-2025 fiscal period. For instance, a 2024 Danish public sector budget allocation of DKK 1.5 billion for digitalization could boost demand for Karnov's legal information platforms. Conversely, economic downturns or shifts in government priorities, potentially leading to a 1-2% reduction in overall public sector spending, could impact sales and growth in this key customer segment. This dependency makes government fiscal policy a significant factor for Karnov's public sector performance.

Data Privacy and Protection Regulations

Data Privacy and Protection Regulations are critical for Karnov Group, especially the General Data Protection Regulation (GDPR) and similar laws. Handling extensive customer data for information services demands rigorous adherence to these frameworks. Non-compliance can lead to significant financial penalties, with GDPR fines reaching up to 4% of annual global turnover or €20 million, whichever is higher, impacting profitability directly.

Such failures also severely damage reputational standing and erode customer trust, posing substantial risks to business continuity and market position into 2025. Ensuring robust data protection measures is therefore paramount for operational stability.

- GDPR fines have totaled over €4.5 billion since 2018, with significant penalties issued throughout 2024.

- Regulatory bodies are increasing enforcement, with a 2024 focus on AI data usage and cross-border data transfers.

- Compliance costs for businesses are projected to rise, averaging 0.5-1% of revenue for large enterprises by mid-2025.

- Consumer trust in data handling directly correlates with market share, with 60% of consumers prioritizing privacy-conscious providers.

Political Stance on Artificial Intelligence

The political and regulatory landscape for Artificial Intelligence (AI) is rapidly evolving, with the EU AI Act being a pivotal piece of legislation effective from 2024, fully applicable by mid-2026. As Karnov Group increasingly integrates AI into its legal solutions, such as its AI legal research assistants, it must meticulously navigate these new rules. This includes ensuring compliance with transparency and risk management requirements for high-risk AI systems. The political approach to AI governance will significantly shape the development and deployment of these technologies, impacting Karnov's operational costs and market access across the EU.

- EU AI Act compliance costs for businesses could range from 0.5% to 5% of revenue depending on AI system complexity.

- Global AI regulatory frameworks are projected to expand to over 60 countries by late 2025.

Political stability in Nordic and EU regions shapes Karnov Group's predictable regulatory environment, yet shifts in legislation can drive new demand for their information services. Increasing regulatory scrutiny from the DSA and NIS2, effective 2024, mandates strict compliance, with potential fines up to 6% of global turnover. Government budget allocations, like Denmark's DKK 1.5 billion for digitalization in 2024, directly impact public sector revenue. Evolving AI regulations, such as the EU AI Act, further influence operational costs and market access.

| Regulatory Area | Key Legislation | Impact/Metric (2024/2025) |

|---|---|---|

| Digital Services | DSA | Penalties up to 6% of global annual turnover |

| Data Privacy | GDPR | Fines over €4.5 billion since 2018; 4% of turnover or €20M |

| Public Sector Spending | Danish Public Sector | DKK 1.5 billion digitalization budget (2024) |

| Artificial Intelligence | EU AI Act | Compliance costs 0.5%-5% of revenue (by 2026) |

What is included in the product

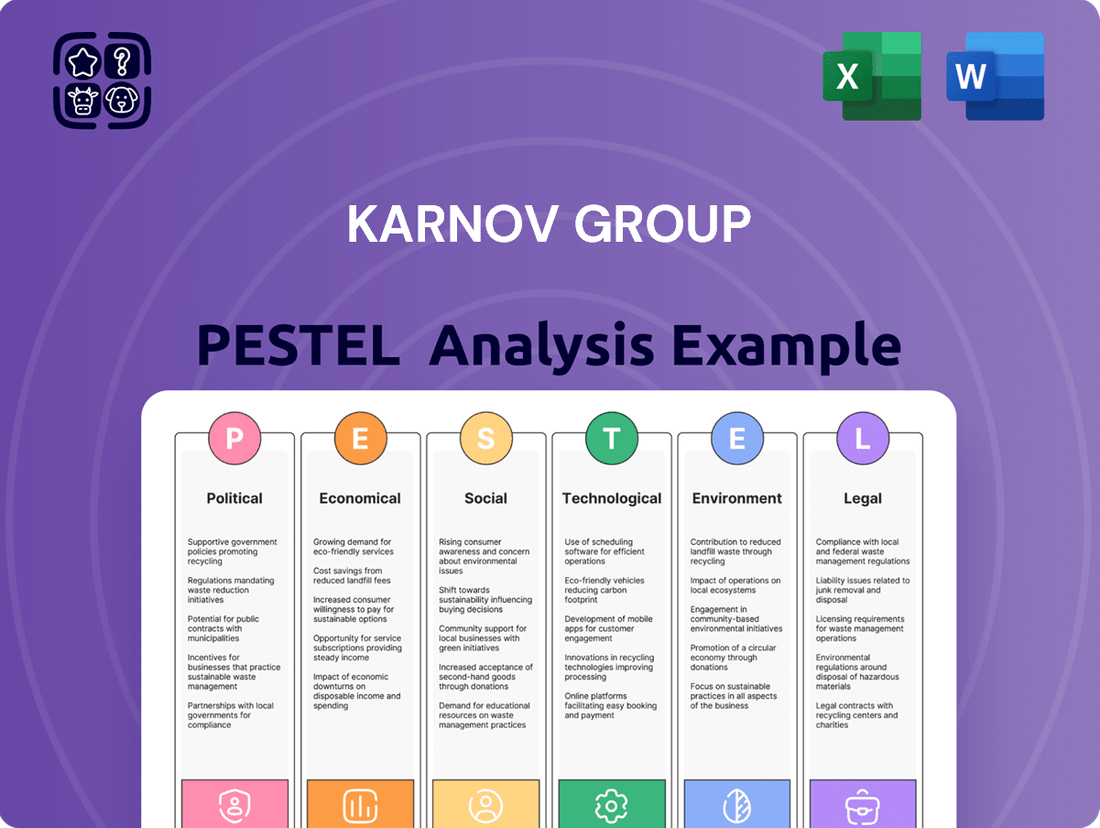

This Karnov Group PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces influencing its business landscape, offering a comprehensive understanding of its operating environment.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the Karnov Group's external environment to inform strategic decisions.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key Political, Economic, Social, Technological, Legal, and Environmental factors impacting Karnov Group.

Economic factors

Karnov Group's performance is closely tied to economic growth across its key Nordic and European markets. Projections for 2025 indicate varied but generally positive GDP growth, with Denmark's economy forecast to expand by 1.5% and Sweden's by 2.0%. This economic expansion drives increased demand for professional services and, consequently, for Karnov's specialized information solutions. Stronger economies typically translate to higher investment by law firms and public sector entities, bolstering Karnov's revenue opportunities.

Karnov Group operates primarily on a subscription-based model, which provides revenue stability, making it less susceptible to short-term economic shocks. This resilience is evident as subscription revenue consistently accounted for over 90% of total sales in fiscal year 2024, projected to remain similar for 2025. The high customer retention rate, exceeding 95% annually, further strengthens this dependable revenue stream, ensuring predictable cash flows regardless of broader economic fluctuations.

Inflationary pressures, though projected to soften to around 3.8% in 2024 globally, continue to influence Karnov's operational costs and client investment capacity. Persistent wage demands, with some European regions seeing over 5% growth in 2023, impact expenses. However, anticipated interest rate cuts by mid-2024 could ease credit conditions. This shift supports increased investment and growth among Karnov's customer base, potentially boosting demand for its services.

Foreign Exchange Rate Volatility

Karnov Group, operating across various European markets, faces significant exposure to foreign exchange rate fluctuations. The volatility of the Swedish Krona (SEK) against currencies like the Euro (EUR) directly impacts reported revenues and profits, as seen with the SEK's depreciation against the EUR in early 2024, trading around 11.50 EUR/SEK. This necessitates robust financial management and potential hedging strategies to mitigate currency risks and stabilize financial performance.

- SEK depreciation against EUR impacted cross-border revenue conversion.

- Hedging strategies are crucial to manage exposure to major currency pairs such as EUR/SEK and DKK/SEK.

- Financial reports for 2024-2025 will reflect the ongoing impact of these currency movements.

Investment in Legal and Professional Services

Investment in legal and professional services technology is a key economic factor for Karnov Group. Law and accounting firms, alongside corporations, are increasingly willing to invest in efficiency-enhancing tools to streamline operations. While economic uncertainty might typically reduce spending, it is currently driving investment in solutions that boost productivity and cut costs, with the global legal tech market projected to exceed $36 billion by 2025. Karnov's workflow solutions are well-positioned to benefit from this trend, as businesses prioritize optimizing their legal and compliance functions.

- Global legal tech market expected to reach over $36 billion by 2025.

- Firms prioritize efficiency gains to manage costs in uncertain economic climates.

- Karnov's digital workflow tools support this strategic investment shift.

Karnov Group leverages projected 2025 GDP growth in its Nordic markets, with Denmark at 1.5% and Sweden at 2.0%, boosting demand for its services. Its stable subscription model, over 90% of 2024 revenue, offers resilience against economic shifts. While inflation and SEK volatility present challenges, the anticipated mid-2024 interest rate cuts and a legal tech market projected to exceed $36 billion by 2025 underpin strong investment in Karnov's solutions.

| Economic Metric | 2024 Data | 2025 Projection |

|---|---|---|

| Denmark GDP Growth | N/A | 1.5% |

| Sweden GDP Growth | N/A | 2.0% |

| Global Legal Tech Market | N/A | >$36 Billion |

What You See Is What You Get

Karnov Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Karnov Group offers an in-depth examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction. It provides actionable insights to understand the external landscape and inform future decision-making.

Sociological factors

Modern society's escalating legal and regulatory complexity significantly boosts demand for Karnov Group's solutions. Professionals across legal, tax, and accounting sectors require immediate access to current, reliable information to navigate this intricate landscape effectively. This trend directly underpins Karnov Group's fundamental value proposition, as evidenced by their strong financial performance. For instance, Karnov Group reported net sales of SEK 545 million for the first nine months of 2024, reflecting sustained demand for their platforms in an increasingly regulated environment. This growth highlights the critical need for their specialized content and tools.

The growing emphasis on work-life balance and mental well-being globally, with reports indicating over 70% of professionals prioritize flexibility, drives demand for efficient digital tools. This societal shift encourages the adoption of technologies that streamline workflows and increase productivity. Karnov Group's legal and tax information solutions, designed for faster, more informed decision-making, directly address this need for efficiency. By enabling professionals to manage their workloads effectively and save time, Karnov's offerings align with the push for improved work-life integration in 2024 and 2025.

The digitalization of legal and professional services is a prominent sociological trend, with professionals increasingly integrating digital tools into their daily workflows. By early 2025, it is estimated that over 85% of legal professionals across Scandinavia and Europe will primarily utilize digital platforms for research, case management, and compliance. This widespread adoption reflects a significant comfort and reliance on digital resources, moving away from traditional, print-based materials. This societal shift directly underpins Karnov Group's digital-first strategy, validating its investment in online information solutions.

Focus on Diversity and Inclusion

The increasing societal and corporate emphasis on diversity, equality, and inclusion significantly impacts Karnov Group. By prioritizing these values within its workforce and through its commitment to providing access to justice, the company strengthens its brand reputation and enhances its appeal to prospective employees and business partners. For 2024, Karnov Group maintains a balanced gender distribution among its employees, reflecting its dedication to a diverse workplace. This focus is crucial for attracting top talent and fostering a progressive image.

- Societal focus on DEI boosts brand perception.

- Karnov's commitment enhances employer and partner attractiveness.

- Balanced gender distribution reported for 2024.

- Access to justice initiatives align with inclusion values.

Changing Demographics and Labor Market

Demographic shifts, including an aging population, significantly impact the Nordic labor market, potentially affecting the availability of skilled legal and business professionals for Karnov Group and its clientele. Sweden, for instance, projects its population aged 65 and over to increase from 20.6% in 2024 to 22.3% by 2030, intensifying competition for talent. The increasing privatization of public services in countries like Sweden also creates new market dynamics, as social work professionals increasingly require accessible legal information resources. This trend expands the user base for digital legal platforms, with social services and related fields seeking up-to-date regulatory guidance.

- By 2025, the Nordic region faces a projected shortage of professionals in specialized fields, impacting recruitment.

- Sweden's aging demographic means a growing demand for expertise in areas like elder law and social welfare.

- The privatization trend in Swedish public services (e.g., healthcare, social care) drives demand for legal tools among new private providers.

The growing societal emphasis on corporate social responsibility (CSR) and ethical business practices influences client and talent attraction. Businesses increasingly choose partners aligned with their values, with 60% of consumers globally favoring brands with strong CSR in 2024. Karnov Group's commitment to ethical content and responsible data usage aligns with this expectation. This focus enhances its market position and appeal to ethically conscious professionals by 2025.

| Sociological Trend | Impact on Karnov Group (2024-2025) | Relevant Data/Fact |

|---|---|---|

| Work-Life Balance Priority | Drives demand for efficiency tools. | Over 70% professionals prioritize flexibility. |

| Digitalization of Services | Validates digital-first strategy. | 85%+ legal professionals use digital platforms by 2025. |

| DEI & CSR Emphasis | Enhances brand and talent appeal. | 60% consumers favor brands with strong CSR in 2024. |

Technological factors

The rapid development of AI, particularly generative AI, stands as Karnov Group's most significant technological driver for 2024-2025. The company is actively investing in and launching advanced AI-powered legal research assistants, enhancing customer value through solutions like Karnov AI. This technology is set to transform legal workflows, potentially expanding the addressable market by 10-15% and creating substantial new revenue opportunities for the group.

The legal tech industry continues its significant growth, with market projections indicating a compound annual growth rate (CAGR) of over 15% through 2025, as law firms embrace digital transformation for efficiency and compliance. Karnov Group is a key enabler, providing essential technological tools that facilitate this shift for legal professionals. A notable trend for 2024/2025 involves deeper integration of legal tech platforms with broader business systems like ERP and CRM, streamlining operations across the entire enterprise. This connectivity enhances data flow and operational synergy, crucial for modern legal practices.

As a digital service provider, Karnov Group faces a constant and evolving threat from cybersecurity incidents. The EU’s NIS2 Directive, effective from October 2024, mandates robust security measures for critical entities like Karnov, significantly raising compliance requirements. Ensuring the integrity of its platforms and safeguarding customer data is paramount for maintaining trust and avoiding substantial regulatory penalties, which can reach up to €10 million or 2% of global annual turnover under NIS2. Proactive investment in advanced threat detection and prevention systems is crucial to mitigate risks in the 2024-2025 operational landscape.

Cloud Computing and SaaS Delivery

The tech industry widely adopts cloud-based, Software-as-a-Service (SaaS) models, enabling unparalleled scalability and continuous updates. This foundation allows for efficient delivery and supports subscription-based revenue streams, crucial for digital information providers. Karnov Group leverages this technological infrastructure, with its online legal and tax information solutions fully delivered via SaaS. This model facilitates widespread access for Nordic professionals, enhancing user experience and operational efficiency for the company. By 2024, global SaaS market revenue is projected to exceed $232 billion, highlighting the model's dominance and Karnov's alignment with industry best practices.

- Karnov's digital platforms are built on a robust SaaS framework.

- The SaaS model enables seamless content updates and service delivery.

- Subscription-based revenue from SaaS supports stable financial growth.

- Global SaaS market revenue is projected to reach over $232 billion in 2024.

Data Analytics for Enhanced Insights

The increasing importance of data analytics for legal professionals allows them to identify trends, predict outcomes, and make informed decisions. Karnov Group's platforms can leverage advanced analytics to provide more valuable insights to their users, enhancing legal research efficiency. This represents a significant area for future product development and differentiation in the competitive legal tech market.

- Global legal tech market revenue is projected to reach $36.7 billion by 2025, driven significantly by AI and data analytics tools.

- A 2024 survey indicates over 60% of legal firms are exploring AI-powered data analytics for case prediction and document review.

Karnov Group leverages advanced AI, like Karnov AI, to enhance legal research, with AI-powered data analytics driving the legal tech market projected at $36.7 billion by 2025. Their SaaS model underpins operations, aligning with the global SaaS market exceeding $232 billion in 2024. Cybersecurity, governed by the NIS2 Directive effective October 2024, poses a critical compliance challenge, with potential penalties up to €10 million.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| AI Adoption | Market expansion | 10-15% growth |

| Legal Tech Market | Industry growth | $36.7B by 2025 |

| SaaS Model | Operational foundation | >$232B in 2024 |

Legal factors

Karnov Group's operations are significantly shaped by the intricate and evolving legal landscape of the European Union. Key regulations like the Digital Services Act (DSA), fully applicable since February 2024 for most platforms, and the Digital Operational Resilience Act (DORA), effective January 2025, introduce substantial compliance obligations. Furthermore, the forthcoming EU AI Act and the Corporate Sustainability Reporting Directive (CSRD) mandate new reporting and operational adjustments. Proactively managing these legal shifts is vital for the company's sustained market position and operational efficiency, potentially increasing compliance costs by an estimated 5-10% of operational expenses in 2025 due to new frameworks.

Karnov Group's operations fundamentally rely on robust intellectual property rights protection, encompassing both safeguarding its own content and respecting others' IP. Its core business model, generating an estimated 85% of revenue from subscriptions, is built upon proprietary, authored legal and tax content from thousands of expert contributors. The company's Code of Conduct explicitly underlines the critical importance of protecting trademarks, copyrighted works, and other forms of intellectual property, minimizing legal risks and potential litigation costs that could impact its 2024/2025 financial performance. This strong IP framework supports its market leadership in Sweden and Denmark, where it held a significant market share in legal information services as of late 2024.

As a public entity on Nasdaq Stockholm, Karnov Group must fully comply with the Swedish Securities Market Act and associated financial reporting standards.

This mandates timely disclosure of price-sensitive information, including annual reports for fiscal year 2024 and interim reports for Q1 2025, ensuring market transparency.

The company also adheres to strict corporate governance rules, particularly concerning executive compensation and incentive programs, which are detailed in their latest remuneration reports.

Consumer Protection and Product Safety Laws

Karnov Group must navigate evolving consumer protection and product safety laws, especially with the EU's General Product Safety Regulation (GPSR) effective December 2024, impacting digital products and online marketplaces. The company ensures its legal and information services are safe, and that terms and conditions are transparent and fair for both consumers and business users. Upcoming legislation like the Digital Fairness Act, expected to be proposed in 2025, will further regulate online commercial practices, demanding adaptive compliance. This ensures robust consumer trust and avoids potential fines, which can reach 4% of annual turnover under new EU regulations.

- GPSR became effective in December 2024, directly impacting Karnov's digital offerings.

- Transparency and fairness in terms are crucial for consumer and business user trust.

- The Digital Fairness Act proposal in 2025 will introduce new regulatory demands.

- Non-compliance with EU regulations can lead to fines up to 4% of annual global turnover.

Labor and Employment Laws

Karnov Group, with approximately 1,200 employees across multiple European nations as of early 2024, must meticulously navigate diverse national labor and employment laws. These regulations encompass critical aspects like working conditions, health and safety standards, and comprehensive employee rights, which are particularly dynamic given recent EU directives on pay transparency and platform work. The company’s robust policies are designed to foster a safe, respectful, and inclusive work environment, ensuring full compliance with these intricate legal frameworks across its operational footprint.

- Compliance with varying national labor laws is crucial for Karnov Group's European operations.

- Regulations cover working conditions, health and safety protocols, and employee rights.

- Company policies prioritize a safe and inclusive environment, aligning with legal mandates.

- Ongoing legislative changes, like EU directives, necessitate continuous policy adaptation.

Karnov Group navigates complex EU legal frameworks, including the Digital Services Act (DSA) fully applicable since February 2024 and the Digital Operational Resilience Act (DORA) effective January 2025, projecting compliance cost increases of 5-10% in 2025. Robust intellectual property rights protect its core business model, generating an estimated 85% of revenue from subscriptions. As a Nasdaq Stockholm listed entity, it adheres to Swedish securities laws, ensuring transparency through 2024 annual and Q1 2025 interim reports. Compliance with consumer protection laws like the GPSR (December 2024) and diverse national labor laws is crucial to avoid potential fines, which can reach 4% of annual turnover under new EU regulations.

| Legal Area | Key Regulation/Impact | Effective Date/Period |

|---|---|---|

| EU Digital Legislation | DSA full applicability; DORA effectiveness | Feb 2024; Jan 2025 |

| Compliance Costs | Estimated increase in operational expenses | 5-10% in 2025 |

| Intellectual Property | Revenue from subscriptions | 85% of total revenue |

| Financial Reporting | Annual and interim reports | FY 2024; Q1 2025 |

| Consumer Protection | GPSR effective; Potential fines | Dec 2024; Up to 4% of annual turnover |

Environmental factors

Karnov Group actively champions a digital-first strategy, which significantly reduces its environmental footprint by minimizing the need for printed materials. This strategic pivot aligns perfectly with the broader global trend of digitalization, directly supporting customers in adopting more sustainable work practices through 2024 and 2025. The company's core services are delivered exclusively through digital, subscription-based agreements. This operational model inherently reduces waste and energy consumption associated with traditional physical publishing.

Although Karnov Group's direct environmental footprint is limited, it actively manages sustainability within its supply chain, particularly for its remaining print publications. The company prioritizes purchasing FSC-certified paper, ensuring raw materials originate from responsibly managed forests. This commitment significantly mitigates deforestation risks, aligning with global sustainability efforts as demand for certified products continues to rise through 2024 and 2025. Such practices bolster their environmental stewardship and stakeholder confidence.

The EU Corporate Sustainability Reporting Directive (CSRD) mandates more detailed and standardized environmental, social, and governance (ESG) disclosures for companies like Karnov Group. As of the 2024 fiscal year reporting, Karnov Group is subject to these expanded requirements, publishing a comprehensive Sustainability Report as part of its Annual Report. This significantly increases transparency and accountability regarding the company's environmental performance. For instance, their 2023 Annual Report, published in Q1 2024, already detailed their commitment to these evolving standards.

Focus on Minimizing Operational Footprint

Karnov Group's environmental strategy, critical for 2024-2025, emphasizes minimizing its operational footprint across key areas like purchasing and distribution. The company aims for continuous improvement in energy and water usage, alongside robust waste management practices. This commitment is central to their corporate responsibility and long-term value creation. For instance, their goal is to further reduce their Scope 1 and 2 emissions, building on efforts to enhance energy efficiency within their offices and data centers.

- Purchasing: Focus on sustainable sourcing, influencing suppliers.

- Distribution: Optimizing logistics to reduce fuel consumption and emissions.

- Energy Usage: Targeting further reductions in electricity consumption by 2025.

- Waste Management: Implementing advanced recycling programs for office waste.

Climate Change and ESG as a Business Driver

The increasing focus on Environmental, Social, and Governance (ESG) factors presents a significant opportunity for Karnov Group, especially as global ESG assets are projected to exceed $50 trillion by 2025. The company provides essential information solutions for environmental, health, and safety (EHS) professionals, a market directly driven by escalating sustainability regulations and corporate accountability demands. This direct correlation between environmental trends and the need for specialized EHS content positions Karnov for continued growth. New EU directives, such as the Corporate Sustainability Reporting Directive (CSRD) effective 2024, are expanding the scope of required ESG disclosures, further boosting demand for accurate and timely regulatory information.

- Global ESG assets are forecast to surpass $50 trillion by 2025.

- The EU's Corporate Sustainability Reporting Directive (CSRD) began impacting large companies from January 2024.

- Increased regulatory complexity drives demand for Karnov's EHS information solutions.

Karnov Group’s digital-first strategy inherently reduces its environmental footprint, aligning with global digitalization trends through 2024 and 2025. The company actively ensures supply chain sustainability, prioritizing FSC-certified paper for print and managing energy use. Compliance with the EU CSRD from the 2024 fiscal year enhances transparency on their environmental performance. This commitment, coupled with the projected $50 trillion ESG market by 2025, also boosts demand for their EHS information solutions.

| Environmental Aspect | Impact on Karnov Group | Data/Trend (2024-2025) | ||

|---|---|---|---|---|

| Digitalization & Footprint | Reduced waste, energy consumption | Aligns with global digital shifts | ||

| Regulatory Compliance (CSRD) | Increased reporting & transparency | Mandatory from 2024 fiscal year | ||

| ESG Market Growth | Opportunity for EHS solutions | Global ESG assets over $50 trillion by 2025 |

PESTLE Analysis Data Sources

Our Karnov Group PESTLE analysis draws from a robust blend of official government publications, economic indicators from leading international bodies, and comprehensive industry-specific reports. This ensures a well-rounded understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.