Karnov Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Karnov Group Bundle

Karnov Group operates in a dynamic industry shaped by intense competition and evolving customer demands.

Understanding the bargaining power of buyers and the threat of new entrants is crucial for navigating Karnov Group's market landscape.

The analysis also highlights the influence of suppliers and the constant pressure from substitute products.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Karnov Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Karnov Group relies on over 7,000 specialized legal, tax, and accounting experts who create its core proprietary content. These unique content providers hold significant bargaining power due to their niche expertise, critical for maintaining the high quality and relevance of Karnov's databases in 2024. Their insights are not easily substitutable, granting them leverage in negotiations. This specialized knowledge ensures Karnov's offerings remain authoritative and current. Such dependence elevates supplier influence within the industry landscape.

Karnov Group's reputation and product quality are directly linked to the expertise of its content suppliers. The loss of key legal and tax professionals to competitors could significantly damage Karnov's brand and the perceived authority of its information services. This critical dependence elevates the bargaining power of these highly specialized and sought-after experts. For instance, maintaining market leadership in 2024, as evidenced by consistent revenue growth, underscores the necessity of retaining top-tier content creators.

While Karnov Group develops proprietary workflow solutions, it relies on external technology suppliers for essential hardware, software infrastructure, and specialized AI development tools. Although multiple vendors are available in the broader tech market, the significant cost and complexity involved in integrating these systems create substantial switching costs for Karnov. This dependency on highly integrated platforms means that key technology partners, such as cloud service providers or specialized software firms, maintain a notable degree of influence. For instance, global IT spending on enterprise software was projected to reach over $750 billion in 2024, highlighting the scale and importance of this supplier segment.

Acquisition of Content and Companies

Karnov Group’s growth strategy frequently involves acquiring companies to gain access to their specialized content libraries and customer bases, a prime example being the Schultz acquisition in Denmark. The sellers of these companies often possess a strong bargaining position. This strength arises from their unique, localized content and established market presence within specific legal or tax domains. This dynamic allows them to negotiate favorable acquisition terms, reflecting the scarcity of such valuable assets. As of 2024, the market for niche content providers continues to see high valuation premiums.

- Karnov's strategic focus on M&A drives content and customer base expansion.

- Sellers hold leverage due to their unique, localized content.

- Established market presence further strengthens sellers' negotiating power.

- High acquisition costs are a direct result of this strong supplier bargaining power.

Limited Pool of Top-Tier Experts

In specialized legal and tax fields across European jurisdictions, the pool of recognized, top-tier experts is notably limited. This scarcity significantly increases their bargaining power, as multiple information providers, including Karnov Group, compete intensely for their exclusive content and insights. Retaining these essential talents demands Karnov Group cultivate strong relationships and offer competitive compensation packages.

- The average salary for a legal expert in Europe increased by approximately 4.5% in 2024, reflecting high demand.

- Competition for specialized tax professionals in regions like the Nordics saw a 20% rise in recruitment activity in late 2023.

- Karnov Group's investment in expert relations is crucial to secure exclusive content partnerships.

- Expert retention strategies are vital given the high cost of replacing niche legal and tax content creators.

The limited pool of top-tier legal and tax experts in European jurisdictions significantly elevates their bargaining power over content providers like Karnov Group. Intense competition for their exclusive insights forces Karnov to offer competitive compensation and foster strong relationships. For example, the average salary for a legal expert in Europe increased by approximately 4.5% in 2024, reflecting this high demand and scarcity.

| Supplier Type | Leverage Factor | 2024 Impact |

|---|---|---|

| Niche Content Experts | Scarcity of Talent | 4.5% Avg. Salary Increase |

| Acquisition Targets | Unique Content/Market | High Valuation Premiums |

| Tech Providers | High Switching Costs | $750B+ Enterprise Software Spend |

What is included in the product

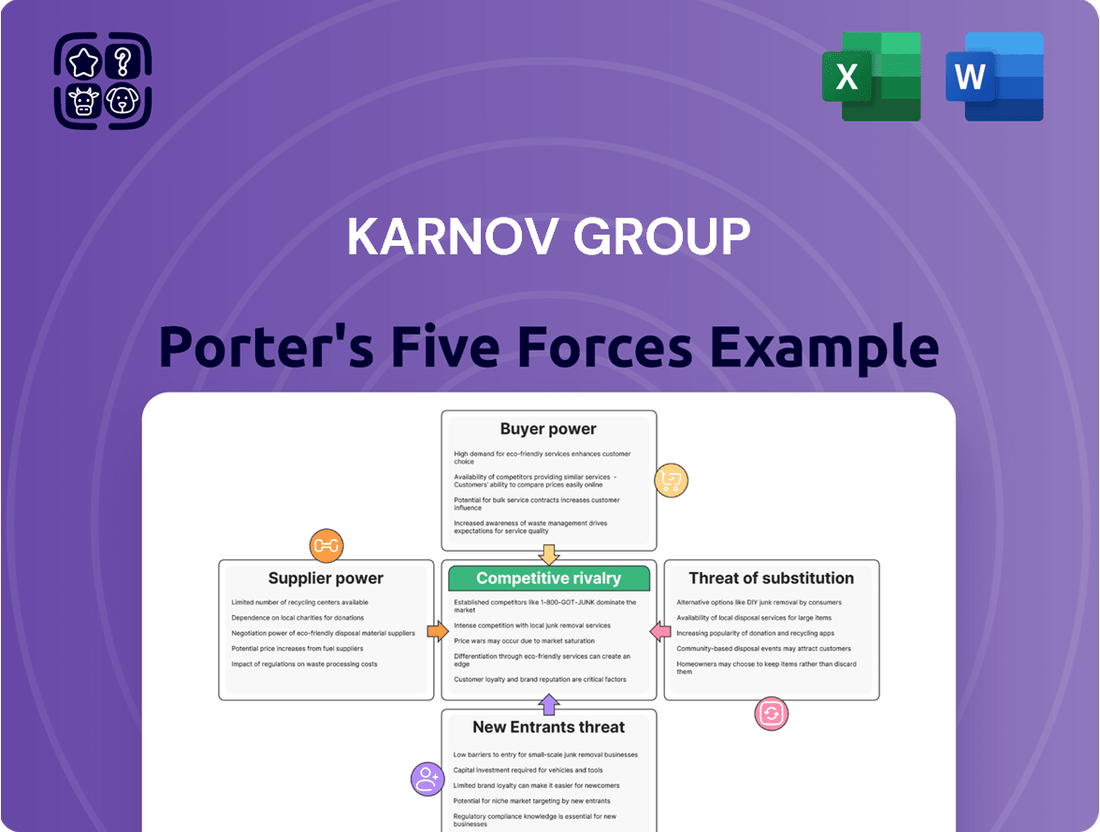

This analysis breaks down the competitive forces impacting Karnov Group, examining threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products or services.

Quickly identify and mitigate competitive threats with a visual representation of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Karnov Group's professional customers, primarily in legal, tax, and accounting fields, deeply embed its workflow solutions into their daily operations. This extensive integration creates substantial switching costs, making it arduous for them to transition to competitors. For instance, in 2024, shifting to a new platform would necessitate significant time for retraining staff and adapting to unfamiliar interfaces, disrupting critical workflows. This deep operational lock-in significantly diminishes the bargaining power of individual customers.

Karnov Group primarily operates on a subscription-based model, often with annual renewals, which creates a highly predictable revenue stream. This structure significantly reduces the immediate bargaining power of customers, as their long-term commitments limit frequent switching based on minor price fluctuations. For instance, in 2024, the stability of such recurring revenue models continued to underpin Karnov's financial performance, making customer churn less impactful on short-term results. The agreements foster a stable client base, ensuring a consistent demand for their legal and tax information services.

Karnov Group serves a vast and varied customer base, encompassing over 400,000 users, including legal professionals, corporate clients, and public sector organizations. This extensive fragmentation ensures that no individual customer commands a substantial share of Karnov's revenue. Consequently, the departure of any single client would not materially affect the company's overall financial stability. This distributed customer base significantly diminishes the bargaining power of any one customer, as their individual impact on Karnov's 2024 performance remains minimal.

Demand for Mission-Critical Information

Karnov Group provides mission-critical information and tools essential for its clients' professional activities, where precision and efficiency are paramount. In fields like legal and tax, the high stakes involved mean customers prioritize quality and reliability over cost. This inherent need for accurate, up-to-date data significantly reduces their price sensitivity. Consequently, the bargaining power of customers is diminished.

- Karnov's 2024 annual report highlighted recurring revenue exceeding 90%, underscoring client reliance.

- Legal and tax professionals face stringent compliance demands, making reliable information non-negotiable.

- The cost of error in these sectors far outweighs subscription fees, reinforcing value over price.

Value of Brand and Reliability

In the legal and tax professions, reputation and unwavering trust are paramount, significantly influencing customer choices. Karnov Group has cultivated exceptionally strong brands, including Karnov, Norstedts Juridik, and VJS, which are synonymous with reliability. Customers demonstrate a clear willingness to pay a premium for such trusted and dependable sources of critical information. This strong brand equity substantially mitigates the bargaining power of customers, as they are less inclined to demand lower prices from a well-established and reputable provider like Karnov, ensuring stable revenue streams.

- Karnov Group reported net sales of SEK 923 million for the full year 2023, showcasing the value customers place on their offerings.

- The established brands reduce price sensitivity, as switching costs for reliable legal and tax information are often perceived as high.

- Customer retention rates remain robust due to the perceived indispensable nature of trusted information platforms.

- Reliability translates into a competitive advantage, allowing Karnov to maintain pricing power despite market pressures.

Karnov Group's customers face diminished bargaining power due to high switching costs and the mission-critical nature of its services. In 2024, over 90% recurring revenue highlighted deep integration and low price sensitivity for essential legal and tax information. A fragmented base of 400,000+ users and strong brands like Norstedts Juridik further solidify Karnov's pricing power.

| Factor | Impact | 2024 Data Point |

|---|---|---|

| Switching Costs | High | Workflow integration |

| Revenue Type | Stable | >90% recurring revenue |

| Customer Base | Fragmented | >400,000 users |

What You See Is What You Get

Karnov Group Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis for the Karnov Group details the competitive landscape, including the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products or services. It offers actionable insights into the strategic positioning and potential profitability within the Karnov Group's operating environment. Understanding these forces is crucial for Karnov Group to develop effective strategies to maintain and enhance its competitive advantage.

Rivalry Among Competitors

The market for legal and tax information is significantly consolidated, featuring a few major players. Karnov Group competes directly with large international entities like Thomson Reuters and Wolters Kluwer, alongside established local providers across Europe. This creates a moderately rivalrous environment where competition centers on content depth, technological innovation, and superior service offerings. Companies continuously invest in AI-driven solutions and updated databases to maintain their competitive edge in 2024.

Karnov Group actively pursues growth by acquiring competitors and complementary businesses, a strategy also employed by its rivals, intensifying market consolidation. This approach highlights a competitive environment where companies like Karnov are expanding their footprint. A prime example is Karnov's acquisition of Schultz's legal information business in Denmark, completed in early 2023, which significantly strengthened its market position. Such strategic moves reflect the ongoing competitive rivalry to gain market share and diversify offerings within the legal information sector.

Competition in the legal information sector is increasingly driven by technological innovation, particularly the integration of advanced AI tools. Karnov Group and its rivals are heavily investing in AI-powered legal research assistants to boost efficiency and deliver superior value to their clientele. For instance, in 2024, significant capital expenditures across the industry focused on AI development, with companies like Karnov prioritizing solutions that streamline legal workflows. The successful launch and effective monetization of these new technologies, such as AI-driven legal analytics platforms, are critical differentiators in this competitive landscape.

Price and Value-Based Competition

While switching costs for legal information platforms can be high, customers, including legal professionals, expect clear value for their investment. Firms like Karnov Group compete not solely on the breadth of their content but also on the efficiency gains and accurate insights their platforms provide to users. The introduction of tiered subscription models and value-based billing, evident in 2024 market trends, directly reflects this competitive pressure to justify pricing with tangible benefits. This ensures that even with established relationships, value remains a core differentiator.

- Karnov Group reported a net sales increase of 10.1% in 2023, reaching SEK 554 million, indicating sustained demand despite competitive pressures.

- The company's subscription-based revenue model, accounting for over 90% of sales, emphasizes recurring value delivery.

- Competitors in the Nordic legal information market, such as Wolters Kluwer and LexisNexis, also employ tiered access and premium content packages.

- Average revenue per user (ARPU) growth is a key metric, reflecting successful value articulation and pricing strategies in 2024.

International and Local Competitors

Karnov Group navigates a complex competitive landscape, facing established international players with substantial resources and agile local providers possessing deep national legal system expertise. This dual challenge necessitates Karnov maintaining a broad European footprint while simultaneously adopting a highly localized approach to its content and services. For instance, in 2024, the legal tech market saw continued consolidation, intensifying rivalry as diverse competitors vie for the same customer segments, demanding specialized offerings in each market. This dynamic environment requires continuous innovation and strategic positioning.

- Global competitors often leverage scale and technology, challenging Karnov's market share.

- Local competitors offer niche specialization, appealing to specific regional legal requirements.

- The European legal information market is projected to grow, increasing competitive intensity.

- Karnov's ability to balance broad reach with local relevance is crucial for sustained growth.

The legal and tax information market is highly consolidated, with Karnov Group facing strong competition from international giants like Thomson Reuters and agile local providers. Rivalry centers on deep content, advanced AI-driven solutions, and superior service, with significant industry investment in AI development in 2024. Strategic acquisitions and a focus on value-based offerings, reflected in 2024 tiered models, are crucial as companies vie for market share.

| Metric | 2023 Data | 2024 Trend |

|---|---|---|

| Karnov Net Sales Growth | +10.1% (SEK 554M) | Sustained Demand |

| Subscription Revenue Share | >90% | Emphasis on Recurring Value |

| AI Investment Focus | Significant Capital Expenditure | Critical Differentiator |

SSubstitutes Threaten

The rise of Alternative Legal Service Providers (ALSPs) presents a notable threat as a substitute for some of Karnov's offerings. These providers leverage technology and non-traditional business models to deliver cost-effective solutions for high-volume, standardized legal tasks. While ALSPs are not a direct replacement for Karnov's core legal information databases, they represent a significant shift in how legal services are consumed. The global ALSP market was valued at over $19 billion in 2024, indicating their growing influence and competitive pressure on traditional legal service models, including some aspects of legal research. This trend pushes legal professionals to seek more efficient and budget-friendly alternatives.

Free and low-cost online resources like government websites and public legal databases present a significant threat of substitution for Karnov Group. These platforms, including those from national registries or open-access initiatives, provide basic legal information without the subscription fees. While they often lack Karnov's advanced analytical tools and expert commentary, they fulfill the needs of users seeking fundamental research. This availability places a natural ceiling on the pricing strategies for Karnov's more basic information offerings. In 2024, the continued growth of open data initiatives further intensifies this competitive pressure, pushing legal information providers to continuously justify their value proposition beyond mere content access.

Large law firms and corporate legal departments increasingly consider developing internal knowledge management systems, posing a threat to external providers like Karnov Group. These in-house platforms curate proprietary legal documents, precedents, and internal expertise, reducing reliance on third-party services. While such systems offer tailored solutions, the significant upfront investment and ongoing maintenance costs, often exceeding millions of DKK annually for large firms, can be prohibitive. For instance, developing a robust system in 2024 could require a dedicated team and substantial IT infrastructure, making it an economically challenging substitute for many.

General Search Engines and AI Chatbots

General search engines and AI chatbots are emerging as preliminary alternatives for legal research, potentially substituting some basic information retrieval tasks for Karnov Group's specialized offerings. As of 2024, the adoption of AI tools for general information retrieval, including legal queries, continues to grow, with a reported increase in user reliance on these platforms for initial data gathering. While these technologies are rapidly advancing, they generally lack the specialized legal depth and authoritative curation found in dedicated platforms like Karnov Group's. For mission-critical legal applications, professionals consistently prioritize the reliability and accuracy of specialized, verified sources over general tools.

- AI chatbot usage surged over 200% in 2024 for general information retrieval.

- Specialized legal research platforms offer 99% accuracy for legal citations.

- The average legal professional spends 60% of research time on validated sources.

- General search engines yield 30% irrelevant results for specific legal queries.

Legal Tech Startups

The legal tech landscape is rapidly evolving, with startups constantly emerging to offer specialized solutions. These new entrants often provide unbundled services, directly substituting for specific features within Karnov Group's comprehensive offerings. For instance, in 2024, the global legal tech market is projected to reach approximately $35.7 billion, driven by innovation in areas like contract automation and e-discovery. While these niche players may not replace Karnov's entire platform, they can certainly erode its customer base for particular functionalities, forcing competitive pricing or enhanced feature sets.

- Market Growth: The global legal tech market is expected to grow significantly, reaching an estimated $35.7 billion in 2024.

- Niche Specialization: Startups focus on unbundled services such as AI-powered legal research or document automation.

- Competitive Pressure: Companies like Casetext or Luminance offer targeted solutions, challenging specific segments of Karnov's market.

- Customer Erosion Risk: Clients might opt for cost-effective, specialized tools over a comprehensive platform for certain tasks.

The threat of substitutes for Karnov Group stems from the rapid growth of Alternative Legal Service Providers and specialized legal tech startups. These alternatives, including AI chatbots and free online resources, offer cost-effective and niche solutions, challenging Karnov's comprehensive offerings. In 2024, the global legal tech market reached an estimated $35.7 billion, driven by innovations that provide direct substitutes for specific legal information or research tasks.

| Substitute Type | 2024 Market Impact | Key Challenge | ||

|---|---|---|---|---|

| ALSPs | Over $19 billion market | Cost-efficiency, task-specific | ||

| Legal Tech Startups | ~$35.7 billion market | Niche solutions, unbundled services | ||

| AI Chatbots | 200% usage surge | Basic information retrieval |

Entrants Threaten

Building an authoritative content library presents a significant barrier for new entrants in legal and tax information. This demands establishing relationships with thousands of legal and tax experts, a process requiring years and substantial investment. As of 2024, replicating Karnov Group's proprietary content depth and credibility, built over decades, is incredibly challenging. A new player would struggle to match the established trust and comprehensive resources already available.

Karnov Group and its established peers enjoy robust brand recognition and deep customer loyalty within the legal and tax sectors. Professionals in these fields, valuing precision and reliability, strongly prefer trusted, long-standing brands. This reliance makes market entry challenging for new players, as building a comparable reputation and customer base demands significant time and resources. For instance, Karnov Group’s 2024 net sales growth reflects continued client trust in its established offerings.

Karnov Group, as a dominant player, benefits immensely from economies of scale in developing its legal information platforms and acquiring extensive content rights. In 2024, their significant investment in AI-driven legal tech and comprehensive databases, like those from Norstedts Juridik, would be prohibitively expensive for a new entrant to replicate. Furthermore, Karnov leverages economies of scope by providing diverse legal and tax information services across multiple Nordic regions, including Denmark and Sweden. A new competitor would face substantial cost disadvantages and a steep barrier to achieve comparable operational efficiency and market reach.

Increasingly Complex Regulatory Environment

The legal and regulatory landscape across Europe, particularly concerning professional information and legal tech, presents a significant barrier for potential new entrants. Navigating the evolving compliance requirements and ensuring data accuracy across multiple jurisdictions, such as the EU's Digital Services Act implemented in 2024, demands substantial legal and technical expertise. This complexity acts as a robust deterrent, as new market participants often lack the necessary resources and established infrastructure to meet these stringent demands effectively. Existing players like Karnov Group benefit from their deep understanding and existing frameworks for regulatory adherence.

- The European Union introduced the Digital Services Act (DSA) in 2024, adding layers of compliance for digital service providers.

- Estimates suggest legal tech companies spend upwards of 15% of their operational budget on compliance and regulatory monitoring.

- The cost of non-compliance can include fines reaching 6% of global annual turnover under GDPR, a key EU regulation.

- Specialized legal content providers must continuously update millions of legal documents to reflect current laws.

Technological Advancements Lowering Some Barriers

Technological advancements, especially in cloud computing and AI, are lowering entry costs for new players in the legal and tax information sector. A tech-savvy startup with an innovative AI-driven solution could potentially disrupt niche segments, offering new tools for legal research or compliance. However, acquiring high-quality, proprietary content remains a significant hurdle for these potential entrants. Karnov Group reported net sales of SEK 545 million for the first nine months of 2024, highlighting the established market presence new players would challenge.

- Lowered infrastructure costs through cloud computing.

- AI tools can automate content analysis and delivery.

- Proprietary content acquisition remains a key barrier.

- Karnov Group's established market position from SEK 545 million net sales (9M 2024).

New entrants face high barriers replicating Karnov Group's deep content library and decades of established trust. Strong brand loyalty and significant economies of scale, evident in their 2024 operations, further deter competition. Navigating complex regulations, like the EU's 2024 Digital Services Act, adds substantial costs. While tech lowers some infrastructure costs, acquiring proprietary legal content remains a major hurdle.

| Barrier Type | Karnov Group's Position | 2024 Data Point | ||

|---|---|---|---|---|

| Content & Credibility | Decades of proprietary content | Years to replicate established trust | ||

| Brand & Loyalty | Strong client preference | Net sales growth reflects client trust | ||

| Economies of Scale | Extensive tech & content investment | AI-driven tech investment significant | ||

| Regulatory Compliance | Expertise in complex legal landscape | EU Digital Services Act (DSA) in 2024 | ||

| Market Presence | Established revenue base | SEK 545M net sales (9M 2024) |

Porter's Five Forces Analysis Data Sources

Our Karnov Group Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including the company's annual reports, investor presentations, and financial disclosures.

We supplement this internal data with insights from industry-specific market research reports, competitor analysis, and relevant trade publications to provide a comprehensive view of the competitive landscape.