Jazz Pharmaceuticals PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jazz Pharmaceuticals Bundle

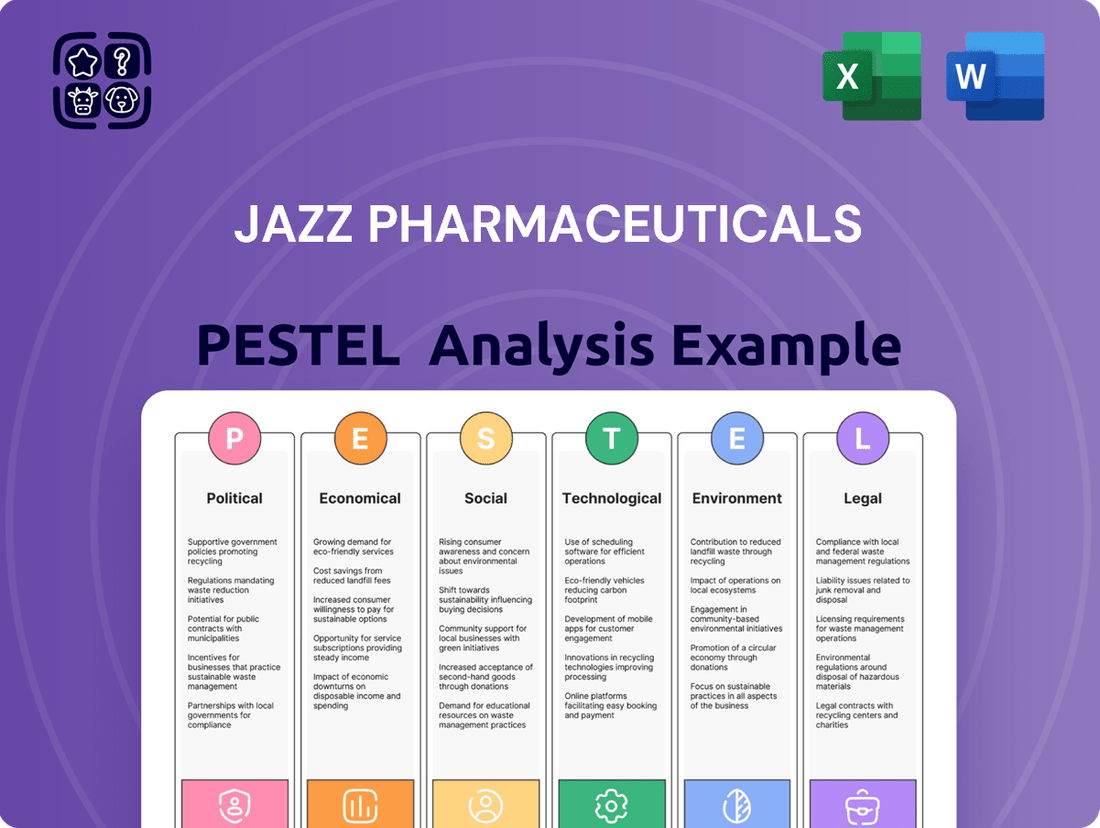

Uncover the intricate web of external factors shaping Jazz Pharmaceuticals's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces that present both challenges and opportunities for the company's growth and innovation. Gain a competitive edge by understanding these crucial dynamics.

This comprehensive report is your key to navigating the complex landscape impacting Jazz Pharmaceuticals. From evolving healthcare policies to shifting economic climates and emerging technologies, this analysis provides the actionable intelligence you need to make informed strategic decisions and anticipate future market trends. Don't get left behind.

Equip yourself with the insights that drive success in the pharmaceutical industry. Our PESTLE analysis of Jazz Pharmaceuticals is meticulously researched and presented, offering a clear and concise overview of the external environment. Ready to make smarter, data-driven choices?

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Jazz Pharmaceuticals. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Healthcare policies in the U.S. and Europe directly shape Jazz Pharmaceuticals' market access and revenue streams. The U.S. Inflation Reduction Act (IRA) of 2022, for instance, introduces Medicare drug price negotiation, with initial negotiated prices effective in 2026, impacting future profitability of key Jazz products. Changes in government healthcare spending and evolving reimbursement models also significantly influence product viability. The ongoing political climate surrounding drug costs, particularly in the lead-up to the 2024 U.S. elections, could prompt further legislative changes for the pharmaceutical industry. This regulatory uncertainty necessitates strategic adaptation for Jazz Pharmaceuticals to maintain market position.

Government-led drug price negotiations, especially those enabled by the U.S. Inflation Reduction Act, pose a significant political risk for Jazz Pharmaceuticals. These negotiations, with the first Medicare-negotiated prices effective January 2026, could lead to lower net prices for key products, directly impacting revenue and profit margins. The company must also navigate diverse reimbursement landscapes across countries, which are frequently subject to political shifts and budgetary constraints. For instance, European markets often implement stricter pricing controls, influencing product accessibility and profitability. Managing these evolving regulatory and reimbursement frameworks is critical for sustained financial performance.

The stringency and efficiency of regulatory bodies like the FDA and EMA are critical political factors for Jazz Pharmaceuticals. Political pressure can influence drug approval timelines, with the FDA's average review time for novel drugs often exceeding 10 months as of early 2025, creating uncertainty for pipeline products. Shifts in administration, such as potential changes following the 2024 US election cycle, could alter regulatory priorities and enforcement, impacting Jazz's compliance costs and market entry strategies for new therapies.

Geopolitical Instability and Trade Policies

Jazz Pharmaceuticals faces significant exposure to geopolitical instability, including ongoing global trade disputes and international conflicts that can severely disrupt its complex supply chains. These events elevate operational costs, particularly for raw materials and finished pharmaceutical products, as seen with rising shipping expenses in early 2024. Tariffs on imports or exports of essential components, such as those impacting global pharmaceutical trade, directly reduce profit margins and hinder market access in key developing regions.

- Global supply chain disruptions, like those seen in the Red Sea in late 2024, directly impact Jazz's logistics.

- Increased trade barriers could affect Jazz’s projected 2025 international revenue growth.

- Rising geopolitical tensions may necessitate re-evaluating manufacturing footprints for resilience.

Government Relations and Lobbying

Jazz Pharmaceuticals actively engages in substantial lobbying efforts to influence policies critical to its portfolio, particularly regarding orphan drugs, market access, and clinical trial regulations. The company's lobbying expenditures reflect this focus, with reported outlays such as approximately $1.6 million in 2023, indicating ongoing significant investment into 2024 and 2025. The effectiveness of these efforts directly shapes the legislative and regulatory landscape, potentially favoring drug approvals and pricing. However, constant political scrutiny of pharmaceutical lobbying activities and industry influence remains a crucial factor requiring careful management to maintain public trust and avoid adverse policy reactions.

- 2023 Lobbying Spend: Approximately $1.6 million, influencing 2024/2025 policy.

- Focus Areas: Orphan drug legislation, market access, and clinical trial frameworks.

- Regulatory Impact: Direct influence on drug approval pathways and pricing policies.

- Political Scrutiny: Ongoing examination of industry influence and lobbying transparency.

Political factors, including the U.S. Inflation Reduction Act impacting 2026 drug prices and potential 2024 election shifts, shape Jazz Pharmaceuticals' market access and regulatory landscape. Geopolitical tensions, like late 2024 Red Sea disruptions, elevate supply chain costs. The company's significant lobbying, approximately $1.6 million in 2023, influences 2024/2025 policy on orphan drugs and market access, navigating FDA/EMA approval timelines.

| Factor | Impact Area | 2024/2025 Data Point |

|---|---|---|

| IRA 2022 | Drug Pricing | Medicare negotiation affects 2026 prices. |

| Geopolitics | Supply Chain | Red Sea disruptions in late 2024 impacting logistics. |

| Lobbying | Policy Influence | Approx. $1.6M in 2023 influencing 2024/2025. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Jazz Pharmaceuticals, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities stemming from these dynamic forces.

This PESTLE analysis for Jazz Pharmaceuticals acts as a pain point reliver by providing a concise, easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the external landscape impacting their strategy.

Economic factors

Global economic conditions directly impact healthcare spending and patient access to Jazz Pharmaceuticals' specialized medicines. Economic downturns, although not the primary outlook for 2024 with global GDP growth projected around 3.2%, can still reduce healthcare budgets and lower demand for pharmaceutical products. Conversely, periods of economic growth, expected to continue into 2025, support increased investment in healthcare infrastructure and improved market conditions for Jazz's portfolio, potentially boosting demand for treatments like those for sleep disorders or oncology. This stable growth generally fosters a more favorable environment for the pharmaceutical sector.

National healthcare spending levels are a primary driver of demand for Jazz Pharmaceuticals' products. In 2024, U.S. healthcare expenditure reached approximately $4.8 trillion, directly impacting market potential. However, disparities in patient access persist, affecting the reach of their specialized therapies. Changes in reimbursement policies by payers like CMS can significantly alter sales and revenue streams for their neuroscience and oncology drugs.

Jazz Pharmaceuticals confronts intense competition from generics and branded products, applying considerable pricing pressure. The entry of generics for key products like Xyrem has directly impacted revenue, with Xyrem sales declining to $55.1 million in Q1 2024, down from $94.6 million in Q1 2023. The company must strategically price innovative therapies such as Rylaze and Zepzelca to balance market share with profitability. This competitive environment necessitates continuous innovation and robust market access strategies.

Inflation and Operational Costs

Inflationary pressures significantly impact Jazz Pharmaceuticals, elevating costs across research and development, manufacturing, and commercial operations. The rising prices for crucial raw materials, energy, and labor directly pressure profit margins if not actively managed. For instance, the US Consumer Price Index saw a 3.4% increase year-over-year in December 2023, reflecting persistent inflationary trends. Jazz Pharma must continuously pursue operational efficiencies and supply chain optimization to mitigate these financial impacts, ensuring sustained profitability in a challenging economic climate.

- Global supply chain disruptions continue to influence raw material costs, impacting pharmaceutical production.

- Labor costs, particularly for skilled scientific and manufacturing personnel, are projected to rise by approximately 4-5% in 2024-2025 due to competitive markets.

- Energy expenses, volatile since 2022, remain a significant operational cost, necessitating energy efficiency investments.

- Jazz Pharmaceuticals aims for a 1-2% annual improvement in operational efficiency to offset inflationary pressures.

Access to Capital and Investor Confidence

Jazz Pharmaceuticals' capacity to fund research and development, alongside strategic acquisitions, hinges critically on its access to capital and robust investor confidence. Fluctuations in the broader stock market, like the S&P 500's performance in early 2024, and shifts in interest rates directly impact the cost of financing and the company's market valuation. Investor sentiment towards the biopharmaceutical sector, often influenced by impending patent expirations for key drugs such as Xyrem or regulatory updates from the FDA, significantly shapes Jazz Pharmaceuticals' financial agility. The company’s Q1 2024 revenue of $911.9 million and a strong cash position are crucial for maintaining investor trust and funding future growth initiatives.

- Interest rate hikes by the Federal Reserve through late 2023 and early 2024 influenced borrowing costs across the biopharma sector.

- Investor sentiment remains sensitive to clinical trial outcomes and potential patent cliffs, impacting valuations.

- Jazz Pharmaceuticals' strong cash flow from operations, reported at $127.3 million for Q1 2024, supports internal funding.

- The company's ability to issue new debt or equity depends on favorable market conditions and perceived growth prospects.

Jazz Pharmaceuticals navigates economic conditions where global GDP growth, projected at 3.2% for 2024, generally supports healthcare spending, yet national healthcare expenditure, approximately $4.8 trillion in the U.S. for 2024, directly influences market potential and is sensitive to reimbursement shifts. Inflationary pressures, including a 3.4% US CPI increase in late 2023 and projected 4-5% labor cost rises in 2024-2025, impact operational costs. Access to capital and investor confidence, bolstered by Q1 2024 revenue of $911.9 million and $127.3 million in cash flow from operations, are crucial for funding growth initiatives amidst fluctuating interest rates.

| Metric | 2024 Projection | Impact |

|---|---|---|

| Global GDP Growth | ~3.2% | Supports healthcare spending |

| US Healthcare Spend | ~$4.8 Trillion | Drives market potential |

| Labor Cost Increase | 4-5% | Increases operational expenses |

| Q1 2024 Revenue | $911.9 Million | Funds operations, growth |

| Q1 2024 Cash Flow | $127.3 Million | Enhances financial agility |

What You See Is What You Get

Jazz Pharmaceuticals PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This in-depth PESTLE analysis of Jazz Pharmaceuticals covers Political, Economic, Social, Technological, Legal, and Environmental factors influencing its operations. It provides a comprehensive understanding of the external forces shaping the pharmaceutical industry and Jazz Pharmaceuticals' strategic landscape. You'll gain insights into market trends, regulatory challenges, and opportunities for growth.

Sociological factors

The increasing prevalence of target diseases significantly expands Jazz Pharmaceuticals potential patient pool. Global data for 2024-2025 indicates a continued rise in sleep disorders, with estimates suggesting over 1 billion people worldwide suffer from chronic insomnia or sleep apnea. Concurrently, cancer incidence is projected to grow, driven by an aging global population where individuals aged 65 and over are expected to constitute a larger demographic segment, thereby increasing demand for Jazz's oncology and neuroscience therapies.

Patient advocacy groups significantly raise awareness for conditions like narcolepsy and specific cancers, which are core therapeutic areas for Jazz Pharmaceuticals. Their efforts influence public perception, contributing to a more informed patient base and potentially increasing the diagnosis rates for these complex diseases. These groups can also advocate for research funding and improved patient access to innovative treatments, creating a favorable environment for the adoption of Jazz's therapies like Xywav for narcolepsy or Zepzelca for small cell lung cancer. For instance, increased advocacy around sleep disorders helps drive a market projected to reach over $11 billion by 2025, directly benefiting companies like Jazz.

Patients are increasingly engaged in their healthcare decisions, expecting more personalized and convenient treatment options; for instance, a 2024 survey indicated over 70% of patients desire digital tools for health management. The rise of digital health and telemedicine platforms is significantly changing how patients interact with healthcare providers and receive medications, with telehealth utilization remaining substantially elevated compared to pre-pandemic levels in 2024. Jazz Pharmaceuticals must adapt its commercial and patient support models to meet these evolving expectations. This includes enhancing digital engagement strategies and offering more flexible support programs, as the global digital health market is projected to reach $660 billion by 2025.

Public Perception of the Pharmaceutical Industry

The pharmaceutical industry faces intense public scrutiny concerning drug pricing, marketing practices, and transparency, directly impacting Jazz Pharmaceuticals. This ongoing public perception significantly influences potential regulatory policies, with calls for greater affordability intensifying into 2025. Maintaining a positive public image and clearly demonstrating the value of specialized treatments are crucial for Jazz Pharmaceuticals' long-term success and market acceptance.

- Public trust in the pharmaceutical sector remains a challenge, with consumer surveys in early 2024 indicating persistent concerns over drug costs.

- Legislative efforts, such as the US Inflation Reduction Act's drug price negotiation provisions, reflect public and political pressure for affordability.

- Jazz Pharmaceuticals' reputation is tied to broader industry perceptions, necessitating proactive communication on patient access and innovation.

Integrative and Holistic Health Approaches

A significant sociological shift sees a growing embrace of integrative medicine, blending conventional treatments with complementary therapies, especially for complex conditions like cancer. This holistic approach prioritizes overall patient well-being, focusing on managing treatment side effects and improving quality of life, such as addressing sleep disturbances in cancer patients. This trend aligns well with Jazz Pharmaceuticals' strategic focus on addressing critical unmet patient needs.

- The global integrative health market is projected to reach approximately $350 billion by 2025.

- Surveys indicate over 70% of cancer patients experience sleep disturbances, highlighting a significant unmet need.

- Patient-reported outcomes increasingly drive treatment protocols, emphasizing holistic care.

Sociological trends significantly shape Jazz Pharmaceuticals' market landscape, driven by rising chronic disease prevalence, particularly sleep disorders and cancer, increasing demand for therapies. Patient empowerment and advocacy groups actively influence healthcare decisions and access, pushing for greater transparency and affordability in drug pricing. The growing acceptance of integrative medicine further emphasizes holistic patient care, aligning with Jazz's focus on unmet needs.

| Sociological Factor | Trend (2024-2025) | Impact on Jazz Pharmaceuticals |

|---|---|---|

| Disease Prevalence | Sleep disorders: >1 billion sufferers; Cancer incidence rising | Expands target patient pool for neuroscience and oncology |

| Patient Engagement | 70%+ desire digital health tools; telehealth elevated | Requires enhanced digital strategies and patient support |

| Public Scrutiny | Persistent concerns over drug costs; IRA drug price negotiation | Necessitates proactive communication on value and access |

Technological factors

Artificial intelligence is rapidly transforming drug discovery by accelerating the identification of potential drug candidates and optimizing clinical trial design. By 2025, AI is estimated to be instrumental in the discovery of 30% of new drugs, significantly reducing timelines and costs across the pharmaceutical sector. This technological advancement allows companies like Jazz Pharmaceuticals to enhance the efficiency and success rate of their R&D pipeline. Leveraging AI tools can lead to more targeted therapies and a quicker path to market for innovative treatments.

Continuous innovation in biotechnology, including genomics, biologics, and CRISPR gene-editing, is creating new possibilities for treating complex diseases. These advancements are vital for developing novel therapies, particularly in oncology and neuroscience, which are core therapeutic areas for Jazz Pharmaceuticals. For instance, Jazz's 2024 R&D investments continue to prioritize pipeline assets like suvecaltostat for essential tremor and their expanding oncology portfolio, aligning with these cutting-edge trends. Maintaining a competitive edge hinges on Jazz's strategic investment in these rapidly evolving biotechnologies and their application to unmet medical needs.

The integration of digital health technologies, including wearable devices and telemedicine platforms, is reshaping healthcare delivery. These tools enhance patient monitoring, improve medication adherence, and broaden access to specialized care, which can significantly boost the effectiveness of Jazz's therapeutic solutions. The global digital health market is projected to reach approximately $660 billion by 2025, indicating robust growth and creating new opportunities for Jazz to integrate digital solutions for patient support and optimized treatment outcomes.

Manufacturing Process Innovation

Technological advancements in pharmaceutical manufacturing, including automation and digital quality management systems, significantly improve efficiency, quality control, and scalability for Jazz Pharmaceuticals. Smart manufacturing and the use of digital twins can optimize factory operations, potentially reducing production costs by 10-15% by 2025. Adopting these innovations is essential for maintaining a reliable and cost-effective supply chain, especially as the global pharmaceutical manufacturing market approaches 1.1 trillion USD in 2025.

- Automation can reduce human error by up to 80% in key processes.

- Digital quality management systems can lower quality-related deviations by 20%.

- Digital twin adoption is projected to cut operational costs by 10-15% by 2025.

Data Analytics and Real-World Evidence

The increasing reliance on big data analytics and real-world evidence (RWE) significantly impacts Jazz Pharmaceuticals. Analyzing vast datasets provides critical insights into treatment effectiveness and patient outcomes, especially for demonstrating product value to payers. This data-driven approach supports regulatory submissions globally, with the RWE market projected to reach over $2.5 billion by 2025, underscoring its importance for market access negotiations and post-market surveillance. Such capabilities enhance Jazz’s ability to optimize clinical development and secure favorable reimbursement.

- RWE adoption surged, with 80% of pharmaceutical companies integrating it into their strategies by early 2024.

- FDA guidance in 2024 emphasizes RWE for regulatory decisions, streamlining approvals for new indications.

- AI-driven analytics platforms are reducing clinical trial timelines by 15% for early-stage development in 2024.

- Payers increasingly demand RWE, with over 70% of health technology assessments in 2025 requiring such data.

Artificial intelligence and advanced biotechnology are transforming drug discovery, with AI projected to aid 30% of new drug discoveries by 2025, enhancing Jazz’s R&D efficiency in oncology and neuroscience. Digital health technologies and sophisticated manufacturing processes are optimizing patient engagement and operational costs, as the global digital health market nears $660 billion by 2025. Furthermore, the increasing reliance on big data and real-world evidence, a market valued over $2.5 billion by 2025, is critical for market access and demonstrating product effectiveness.

| Technological Factor | Key Impact | 2024/2025 Data |

|---|---|---|

| AI in Drug Discovery | Accelerated R&D | 30% of new drugs by 2025 |

| Digital Health Market | Patient engagement, access | ~$660 billion by 2025 |

| RWE Market Value | Market access, product value | >$2.5 billion by 2025 |

Legal factors

Protecting intellectual property through robust patents is fundamental to Jazz Pharmaceuticals business model, ensuring market exclusivity for its specialized therapies like Xywav. The company faces ongoing legal challenges, including litigation with generic competitors aiming to invalidate key patents, influencing 2024 revenue projections. The evolving legal landscape for pharmaceutical patents, especially for complex biologics and orphan drugs, requires constant navigation to defend its product portfolio. For instance, ongoing disputes regarding Xywav patents continue to be a significant legal and financial focus for Jazz into 2025.

Navigating the intricate drug approval processes of agencies like the FDA and EMA is a critical legal factor for Jazz Pharmaceuticals. Changes in regulatory requirements or delays, such as the typical 10-12 month FDA review period post-NDA submission, significantly impact product launch timelines and development costs. For instance, a single Phase 3 clinical trial can exceed $200 million, making adherence to stringent guidelines for clinical trials and data submission paramount to gaining marketing authorization by 2025. This ensures their pipeline, including potential oncology or sleep disorder therapies, progresses efficiently.

As a pharmaceutical manufacturer, Jazz Pharmaceuticals faces significant exposure to product liability lawsuits, a critical legal factor. The company is actively involved in litigation, including antitrust lawsuits concerning its drug Xyrem, which continued to impact operations into 2024. These ongoing legal proceedings can lead to substantial financial settlements, potentially in the tens of millions of dollars, and cause considerable damage to the company's market reputation and investor confidence, influencing stock performance in 2024 and beyond.

Marketing and Promotion Regulations

The marketing and promotion of pharmaceutical products like those from Jazz Pharmaceuticals are under intense scrutiny, requiring strict adherence to regulatory guidelines to ensure truthful and non-misleading information. Legal and compliance teams must meticulously vet all promotional materials and activities to meet mandates from bodies such as the FDA and FTC. Violations can lead to substantial financial penalties and reputational damage, with industry fines for non-compliance often reaching hundreds of millions or even billions of dollars in past cases. This regulatory environment significantly impacts Jazz Pharmaceuticals' commercial strategies, demanding substantial investment in compliance infrastructure.

- In 2023, the pharmaceutical industry saw increased scrutiny on digital marketing, anticipating stricter 2024-2025 enforcement.

- Companies face potential False Claims Act penalties, which can exceed $100 million for significant marketing misconduct.

- Compliance costs for pharmaceutical marketing are projected to rise, reflecting heightened regulatory expectations.

Data Privacy and Security Laws

Jazz Pharmaceuticals must rigorously comply with evolving data privacy and security laws, including GDPR and HIPAA, given the extensive use of digital health technologies and sensitive patient data. Secure handling of patient information from clinical trials and commercial activities is paramount to avoid significant legal liabilities and maintain public trust. Breaches, like the 2023 average cost of a healthcare data breach reaching $10.93 million, pose substantial financial and reputational risks.

- GDPR fines can reach €20 million or 4% of global annual revenue, whichever is higher, impacting companies by July 2025.

- HIPAA non-compliance penalties range from $100 to $50,000 per violation, with annual caps up to $1.5 million.

- The average cost of a data breach in the pharmaceutical industry was $5.34 million in 2024.

Jazz Pharmaceuticals faces complex legal challenges including patent litigation defense for therapies like Xywav, critical for 2024-2025 revenue. Strict adherence to evolving FDA and EMA drug approval processes and marketing regulations is essential, with non-compliance fines potentially reaching hundreds of millions of dollars. Product liability and data privacy laws, like HIPAA, also pose significant financial risks, with breaches averaging $5.34 million in 2024 for the pharmaceutical sector.

| Legal Area | Key Risk | Potential Impact (2024-2025) |

|---|---|---|

| Intellectual Property | Patent invalidation lawsuits | Loss of market exclusivity; revenue decline |

| Regulatory Compliance | FDA/EMA approval delays | Delayed product launches; increased R&D costs |

| Product Liability | Antitrust/Product lawsuits | Substantial financial settlements; reputational damage |

| Data Privacy | GDPR/HIPAA non-compliance | Fines up to €20M or 4% revenue; data breach costs |

Environmental factors

Jazz Pharmaceuticals, like all pharmaceutical manufacturers, faces increasingly stringent environmental regulations aimed at reducing pollution and waste. Compliance with standards for waste disposal, emissions, and water usage is a significant operational challenge, with the global environmental, social, and governance (ESG) reporting landscape evolving rapidly for 2024 and 2025. For instance, the EU's Corporate Sustainability Reporting Directive (CSRD) impacts companies with EU operations or significant revenue, requiring detailed disclosures. Non-compliance can lead to substantial fines, such as the EPA’s 2024 enforcement actions, and severe reputational damage, impacting investor confidence and market access. This pressure necessitates continuous investment in sustainable manufacturing practices and waste reduction technologies.

The pharmaceutical industry, including Jazz Pharmaceuticals, is increasingly prioritizing sustainable manufacturing, a trend expected to intensify through 2025. This involves adopting greener solvents and optimizing energy consumption, with some firms targeting over 50% renewable energy use in new facilities. Such initiatives, like reducing Scope 1 and 2 emissions, not only enhance brand reputation but also offer significant operational cost savings, potentially decreasing energy expenditures by 15-20% through efficiency upgrades by late 2024. Minimizing the carbon footprint aligns with global environmental regulations and investor expectations for ESG performance.

Companies like Jazz Pharmaceuticals face increasing pressure to ensure their entire supply chain is sustainable, from the ethical sourcing of raw materials to the environmental impact of distribution. This involves rigorously auditing suppliers for their environmental practices and promoting transparency across operations. Regulatory directives, such as the EU Corporate Sustainability Due Diligence Directive (CSDDD) effective from 2024 for larger companies, are formalizing these expectations, requiring due diligence on human rights and environmental impacts. Jazz Pharmaceuticals must proactively manage these risks, as an estimated 70% of a pharmaceutical company's environmental footprint often lies within its supply chain.

Waste Management and Product Disposal

The proper disposal of pharmaceutical waste and end-of-life products poses a significant environmental challenge for companies like Jazz Pharmaceuticals. Regulatory pressures are increasing globally, pushing for more sustainable practices. For instance, the European Union's updated waste directives are influencing packaging choices and disposal programs, aiming to reduce the environmental footprint of medical products. This includes developing environmentally friendly packaging solutions and implementing robust programs for the safe disposal of unused medicines. Industry initiatives saw a 5% increase in pharmaceutical companies adopting take-back programs for unused medications by early 2025.

- Global pharmaceutical waste volume is projected to reach approximately 4 million tons annually by 2025, emphasizing disposal challenges.

- The market for sustainable pharmaceutical packaging is expected to grow by 8% in 2024, driven by regulatory demands and consumer preference.

- By Q1 2025, over 60% of major pharmaceutical companies had publicly committed to reducing their packaging waste by at least 15% from 2020 levels.

Climate Change and Operational Resilience

Climate change poses significant operational risks for Jazz Pharmaceuticals, including potential supply chain disruptions from extreme weather events, which could impact drug manufacturing and distribution. Building resilience into global networks is crucial; for instance, the pharmaceutical industry aims to reduce Scope 1 and 2 emissions by 25% by 2025 from a 2019 baseline. The health sector's substantial contribution to carbon emissions, estimated at over 4% of global emissions, drives a strong need for more sustainable operations across the entire value chain. This necessitates Jazz Pharmaceuticals to invest in robust climate adaptation strategies and greener practices.

- Global warming increases the frequency of severe weather, threatening pharmaceutical logistics.

- The industry is pressured to reduce its carbon footprint, impacting operational strategies.

- Ensuring resilient supply chains is a key strategic priority for 2024-2025.

Jazz Pharmaceuticals faces escalating environmental regulations for waste, emissions, and water use, with global ESG reporting intensifying for 2024-2025. This drives investments in sustainable manufacturing, targeting reduced Scope 1 and 2 emissions and greener supply chains, as 70% of its footprint is often supply-chain related. Climate change also poses significant operational risks, requiring resilient logistics. By early 2025, over 60% of major pharma firms committed to 15% packaging waste reduction.

| Environmental Focus | 2024/2025 Trend | Impact |

|---|---|---|

| Regulatory Compliance | CSRD/CSDDD enforcement | Increased disclosure, operational costs |

| Sustainable Practices | Renewable energy, green solvents | Cost savings, enhanced reputation |

| Supply Chain Sustainability | Supplier audits, due diligence | Risk mitigation, ethical sourcing |

| Waste Management | Reduced packaging, take-back programs | Lower environmental footprint |

| Climate Resilience | Supply chain adaptation | Mitigated disruption risks |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Jazz Pharmaceuticals draws upon a robust dataset including regulatory filings from health authorities like the FDA and EMA, market intelligence reports from leading pharmaceutical industry analysts, and economic data from organizations such as the IMF and World Bank. This comprehensive approach ensures all political, economic, social, technological, legal, and environmental factors are assessed with accuracy and current relevance.