Jazz Pharmaceuticals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jazz Pharmaceuticals Bundle

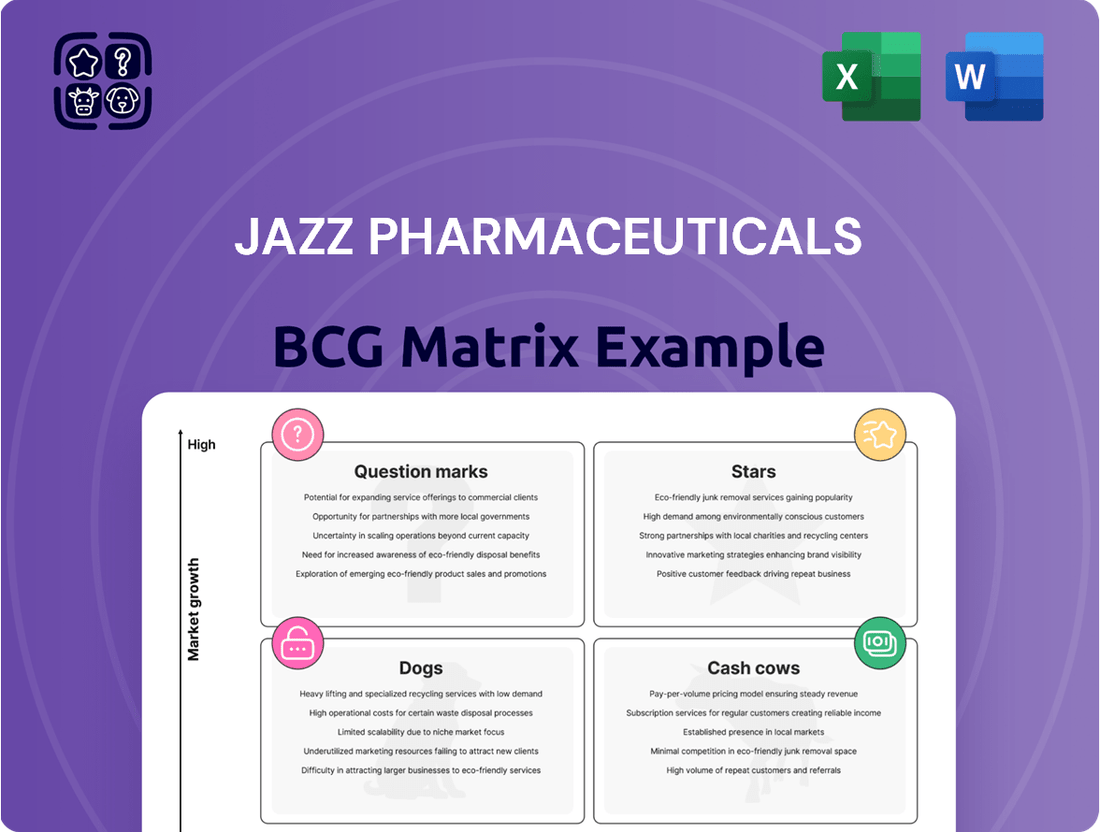

Jazz Pharmaceuticals operates in a competitive pharmaceutical landscape, offering a portfolio of products that vary in market share and growth potential. Understanding where each product falls within the BCG Matrix—Stars, Cash Cows, Question Marks, or Dogs—is crucial for strategic decision-making. For instance, sleep disorder treatment Xywav is a Star, growing rapidly. Its Narcolepsy drug Xyrem appears to be a Cash Cow. The company has a few Dogs that do not generate substantial profits.

This preview provides a glimpse, but the full BCG Matrix delivers deep, data-rich analysis, strategic recommendations, and ready-to-present formats—all crafted for business impact.

Stars

Xywav is a star in Jazz Pharmaceuticals' BCG matrix, fueled by strong 2024 sales growth. It's a key driver, with continued patient additions. Xywav, a low-sodium oxybate, uniquely treats narcolepsy and idiopathic hypersomnia, boosting neuroscience revenue. In 2024, Xywav's net product sales reached $887.1 million, a 33% increase.

Epidiolex/Epidyolex, a cannabis-derived epilepsy drug, is a Star in Jazz Pharmaceuticals' BCG Matrix.

It exhibited strong sales growth, with 2024 revenue at $735.4 million.

The drug is anticipated to achieve blockbuster status by 2025.

Its approval in various countries outside the U.S. indicates a growing market.

This expansion fuels further growth.

Ziihera, a new oncology product, is a Star in Jazz Pharmaceuticals' BCG Matrix. It recently received FDA approval for HER2-positive biliary tract cancer. This chemotherapy-free option addresses an unmet medical need, indicating strong growth potential. Jazz Pharmaceuticals' revenue in 2024 was approximately $3.8 billion, showing its market presence.

Zepzelca (lurbinectedin)

Zepzelca, a key oncology product for Jazz Pharmaceuticals, is experiencing growth. Sales of Zepzelca are on the rise in 2024, indicating its increasing importance. Jazz aims to broaden Zepzelca's use in first-line treatment for extensive-stage SCLC. This expansion could greatly boost its market share and earnings.

- 2024 sales growth expected.

- Label expansion planned.

- Focus on SCLC treatment.

- Potential for increased revenue.

Pipeline Assets with High Potential

Jazz Pharmaceuticals' "Stars" category includes promising late-stage assets. These assets, especially in oncology, have the potential to drive future growth. Ongoing research focuses on expanding the uses of zanidatamab and Zepzelca. Other candidates like dordaviprone also show promise.

- Zanidatamab is being investigated for HER2-positive biliary tract cancer.

- Zepzelca is being studied for small cell lung cancer.

- Dordaviprone is in development for hepatic encephalopathy.

Jazz Pharmaceuticals' Stars, like Xywav and Epidiolex/Epidyolex, show strong 2024 sales growth and market expansion. New oncology products such as Ziihera and Zepzelca also drive significant revenue. These key assets, alongside promising late-stage candidates, underpin future company growth.

| Product | Category | 2024 Sales (MM USD) |

|---|---|---|

| Xywav | Neuroscience | 887.1 |

| Epidiolex/Epidyolex | Neuroscience | 735.4 |

| Ziihera | Oncology | New launch |

What is included in the product

Jazz Pharma's BCG Matrix reveals investment, hold, and divestment strategies across its portfolio. It highlights strategic insights for each quadrant.

Printable summary optimized for A4 and mobile PDFs, offering a concise overview of Jazz Pharmaceuticals' diverse portfolio.

Cash Cows

Xyrem, despite facing generic competition, remains a cash cow for Jazz Pharmaceuticals. In 2024, Xyrem generated substantial revenue, though sales are declining. Jazz benefits from royalty revenue on authorized generics, supporting its neuroscience segment. This steady income stream helps fund other ventures. The cash flow makes it a stable asset.

Defitelio (defibrotide) is a cash cow for Jazz Pharmaceuticals. This oncology product has shown consistent sales growth, contributing to Jazz's oncology revenue. In 2024, Defitelio's sales were a steady contributor, although not the primary revenue source. It provides a reliable cash flow in its niche market segment.

Vyxeos, an oncology product, significantly boosts Jazz Pharmaceuticals' revenue. In 2024, Vyxeos generated approximately $280 million in revenue. Jazz is actively pursuing expanded indications through clinical trials to broaden Vyxeos's market reach and revenue potential. These efforts aim to solidify Vyxeos's position as a key revenue driver.

High-sodium oxybate authorized generic royalties

High-sodium oxybate authorized generic royalties remain a steady revenue source for Jazz Pharmaceuticals, even as Xyrem sales decline. This royalty stream helps to cushion the impact of reduced branded Xyrem sales, contributing to financial stability. In Q1 2024, Jazz reported $106.3 million in net product sales for Xywav, which includes royalties from high-sodium oxybate generics. The company's strategy involves maximizing this revenue stream.

- Royalty income provides a financial buffer.

- Offsetting the decline in Xyrem sales.

- Jazz is focused on maximizing this revenue.

- Q1 2024 Xywav sales were $106.3 million.

Established Neuroscience Portfolio (excluding Xywav and Epidiolex)

Jazz Pharmaceuticals' established neuroscience portfolio, excluding Xywav and Epidiolex, serves as a steady source of revenue. This segment includes products like Sunosi and Vyxeos, which generate reliable income. In 2024, these products collectively contributed significantly to the company's financial stability. This financial base supports investments in newer, high-growth areas.

- Provides a base of consistent income.

- Includes products like Sunosi and Vyxeos.

- Supports investments in newer, high-growth areas.

- Contributed significantly to the company's financial stability in 2024.

Epidiolex (cannabidiol) serves as a key cash cow for Jazz Pharmaceuticals, consistently delivering substantial revenue. In Q1 2024, its net product sales reached $205.1 million, anchoring the company's neuroscience segment. This robust performance generates significant cash flow, funding strategic investments in new product development. Its established market position ensures a stable financial contribution.

| Product | Category | Q1 2024 Sales (MM) |

|---|---|---|

| Epidiolex | Neuroscience | $205.1 |

| Xywav | Neuroscience | $106.3 |

| Vyxeos | Oncology | ~$70.0 (est. Q1 of $280M annual) |

What You See Is What You Get

Jazz Pharmaceuticals BCG Matrix

The BCG Matrix you're viewing is the complete document you'll receive. It's a fully-featured, ready-to-use analysis of Jazz Pharmaceuticals, perfect for strategic planning.

Dogs

Xyrem, a branded product from Jazz Pharmaceuticals, faces a shrinking market share. Sales have declined due to authorized generics entering the market. In 2024, Xyrem's revenue was impacted by generic competition. This shift reflects a changing competitive landscape. The BCG Matrix suggests a "Star" to "Question Mark" transition.

Products like Xyrem, facing generic competition, fit the "dog" category. Sales decline significantly as generics enter the market. For example, Xyrem's sales dropped substantially post-generic launch. These products generate low revenue and little future growth, as seen in Jazz's financial reports from 2024. They require strategic decisions, potentially including divestiture.

Underperforming legacy products within Jazz Pharmaceuticals' portfolio, such as some older medicines, fit the "Dogs" category of the BCG Matrix. These drugs hold a low market share in slow-growing markets and lack strategic importance for new drug development. For example, in 2024, some of these products may have contributed minimally to Jazz's overall revenue, potentially making them prime candidates for divestiture or discontinuation. This strategic move could free up resources for more promising ventures.

Products with limited market potential

In Jazz Pharmaceuticals' BCG Matrix, "Dogs" represent products with limited market potential and low sales. Even with a high market share, these products might not generate significant revenue if the overall market is small or stagnant. Maintaining these products can be costly, potentially exceeding the returns generated. For example, in 2024, a drug with $50 million in sales within a niche market with a 20% market share might be a Dog if the market isn't growing.

- Low Growth

- Limited Market Size

- High Maintenance Costs

- Low Revenue Generation

Divested or discontinued products

Products that Jazz Pharmaceuticals has divested or discontinued are categorized as "Dogs" within the BCG matrix. These products no longer generate revenue or contribute to the company's growth. Jazz Pharmaceuticals' strategic decisions to divest or discontinue products often stem from factors like declining sales or lack of strategic alignment. In 2024, Jazz completed the sale of its rights to Sunosi in the US and Canada to Axsome Therapeutics for $53 million. These moves help the company reallocate resources to more promising areas.

- Divested products no longer contribute to revenue.

- Discontinuation often results from low sales.

- Sale of Sunosi to Axsome in 2024 for $53M.

- These actions help reallocate resources.

Jazz Pharmaceuticals' Dogs are products like Xyrem, experiencing significant revenue decline in 2024 due to generic competition and low market growth. This category also includes underperforming legacy drugs contributing minimally to 2024 revenue. Divested assets, such as Sunosi sold for $53 million in 2024, also fit this low-potential category. These products demand strategic decisions, often leading to divestiture to free up resources.

| Product Type | 2024 Impact | Strategic Action | ||

|---|---|---|---|---|

| Xyrem | Revenue decline due to generics | Considered for divestiture | ||

| Legacy Drugs | Minimal 2024 revenue | Potential discontinuation | ||

| Divested Assets | Sunosi sale for $53M (2024) | Resource reallocation |

Question Marks

Zanidatamab, while approved for 2L BTC, is explored in various HER2+ cancers. It has high growth potential, but low market share currently. Success in these broader areas is uncertain. Jazz Pharmaceuticals' R&D spending in 2024 was approximately $290.5 million, supporting such ventures.

Dordaviprone, acquired by Jazz Pharmaceuticals via Chimerix, is a potential late-stage asset targeting brain tumors. The market for brain tumor treatments is expanding, indicating a growing need for new therapies. As of late 2024, dordaviprone has no market share as it awaits regulatory approval. The drug's future will depend on successful clinical trials and market acceptance, potentially positioning it as a "Star" or "Question Mark" within Jazz's BCG matrix.

JZP441, an oral orexin-2 receptor agonist, is in early trials for sleep disorders. The sleep disorder market is large; in 2024, the global sleep aids market was valued at approximately $75 billion. Its market share is uncertain. Jazz Pharmaceuticals' success with other sleep disorder drugs doesn't guarantee JZP441's success.

Other early-stage pipeline assets

Jazz Pharmaceuticals' early-stage pipeline assets represent "Question Marks" in its BCG matrix. These assets are in high-growth potential areas, yet have low market share and face high uncertainty regarding their future success. Significant investment is needed to advance these preclinical and Phase 1 programs and determine their viability. For example, in 2024, Jazz allocated a substantial portion of its R&D budget to these early-stage projects, totaling approximately $400 million, indicating a commitment to their development.

- High growth potential but low market share.

- Significant investment required.

- Uncertainty of success.

- Preclinical and Phase 1 programs.

Products in new geographic markets

When Jazz Pharmaceuticals introduces its existing products into new geographic markets, these offerings often begin as "question marks" in the BCG matrix. This is because they typically have a low market share in these new regions. The potential for these products to grow depends heavily on their success in gaining market share. If successful, they can evolve into "stars," representing high-growth, high-share opportunities.

- Market share growth is crucial for products entering new regions.

- Success can lead to "star" status, indicating strong growth.

- Failure to gain traction keeps them as "question marks."

- Jazz's strategic approach to these launches is vital.

Jazz Pharmaceuticals' Question Marks, like early-stage assets and new market entries, feature high growth potential but low market share. These products, including Zanidatamab and JZP441, face significant uncertainty regarding their future success and require substantial investment. In 2024, Jazz allocated approximately $400 million of its R&D budget to these preclinical and Phase 1 programs, reflecting their unproven status.

| Asset/Strategy | Growth Potential | Market Share (2024) |

|---|---|---|

| Zanidatamab | High | Low |

| JZP441 | High | Uncertain |

| Early-Stage Pipeline | High | Low |

BCG Matrix Data Sources

Our Jazz Pharmaceuticals BCG Matrix is based on SEC filings, market analyses, and analyst evaluations for accurate strategic positioning.