Indian Railway Finance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indian Railway Finance Bundle

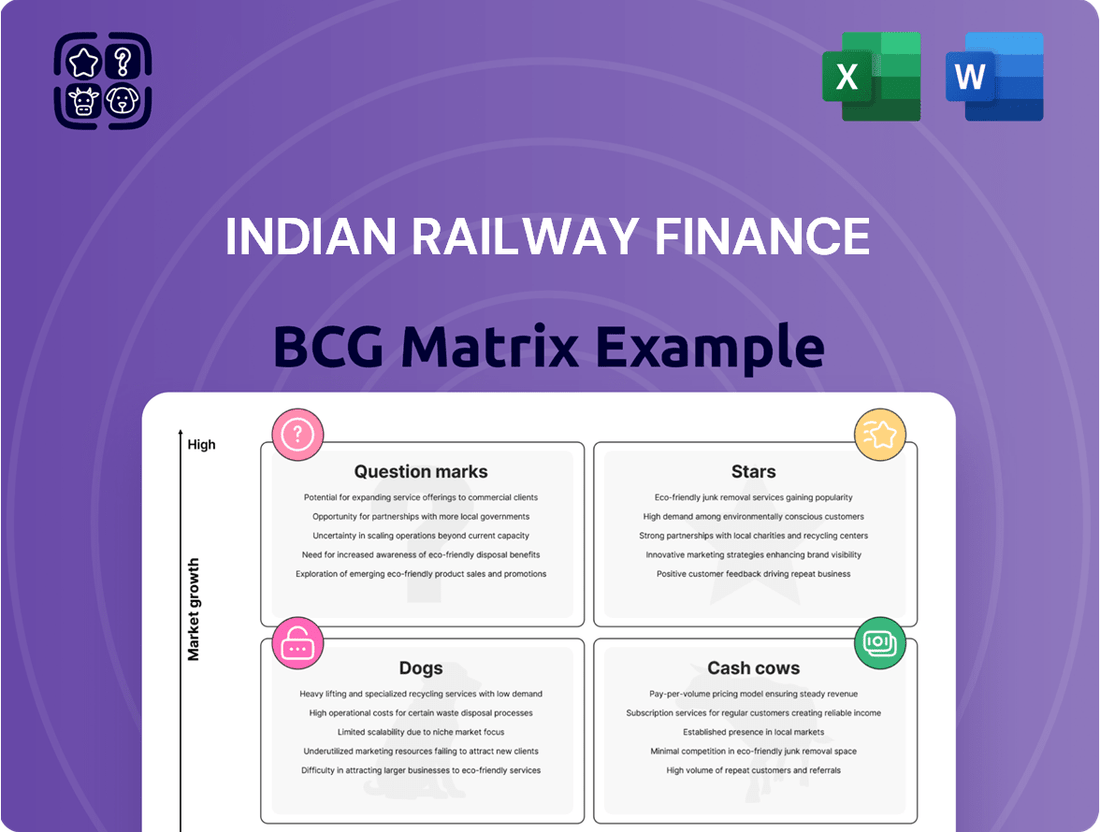

The Indian Railway Finance Corporation (IRFC) operates in a vast and complex market, financing crucial infrastructure projects. This preliminary look at IRFC's BCG Matrix reveals some intriguing dynamics. Identifying the "Stars" and "Cash Cows" is key to understanding its financial strength and future growth. But where do its newer initiatives and existing assets truly sit within the competitive landscape? This snapshot only scratches the surface. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

IRFC's core business, financing rolling stock, is a Star. This area is high-growth, fueled by Indian Railways' modernization, including new trains like Vande Bharat. IRFC funds a significant portion of Indian Railways' rolling stock. In FY24, IRFC's loan assets grew by 23.75% to ₹5.23 lakh crore. Indian Railways plans to spend ₹2.55 lakh crore on capital expenditure in FY25.

IRFC's role as a financier for railway infrastructure projects, including dedicated freight corridors and station redevelopment, positions it as a "Star" within the BCG Matrix. The Indian government's infrastructure plans, backed by substantial funding, create high growth opportunities for IRFC. In fiscal year 2024, IRFC sanctioned ₹74,587 crore for railway projects. This illustrates the substantial financial backing and high growth potential.

IRFC's shift to metro, rapid rail, and renewable energy projects marks it as a Star. In 2024, Indian Railways' capital expenditure is about ₹2.55 lakh crore. IRFC's diversification aligns with high-growth areas. This strategic move aims at increasing its market share.

Access to Competitive Funding

Indian Railway Finance Corporation (IRFC) excels in securing competitive funding, a cornerstone of its financial strategy. As a Public Sector Undertaking (PSU) under the Ministry of Railways, IRFC leverages its strong credit ratings to access funds from both domestic and international markets. This advantage allows IRFC to secure borrowings at favorable rates, which is crucial for financing extensive railway projects.

- In FY2023-24, IRFC raised approximately ₹50,000 crore through bonds and other instruments.

- IRFC's bonds are rated AAA by various credit rating agencies.

- IRFC has a diversified funding mix, including loans from banks and financial institutions.

- IRFC's borrowing costs are typically lower than those of other entities in the infrastructure sector.

Strategic Importance to Indian Railways

IRFC's strategic importance to Indian Railways is significant, given its role as the primary financing arm. This relationship ensures consistent demand for IRFC's financial products and services. The Indian government's focus on railway infrastructure development further boosts IRFC's growth prospects. IRFC's performance is closely tied to the expansion and modernization of the Indian railway network.

- IRFC's loan portfolio grew by 25.7% to ₹5.03 trillion in FY24.

- IRFC's net profit increased by 16.7% to ₹6,418 crore in FY24.

- The Indian government allocated ₹2.55 lakh crore for railway capex in FY25.

IRFC's core financing of rolling stock and railway infrastructure are clear Stars, driven by Indian Railways' ₹2.55 lakh crore FY25 capital expenditure and modernization. Its diversification into metro and green energy further strengthens this position. IRFC's strong credit ratings and strategic importance ensure consistent demand, with loan portfolio growth of 25.7% in FY24.

| Metric | FY24 Data | FY25 Projection |

|---|---|---|

| Loan Portfolio Growth | 25.7% (₹5.03 trillion) | N/A |

| Net Profit Increase | 16.7% (₹6,418 crore) | N/A |

| Railway Capex Allocation | N/A | ₹2.55 lakh crore |

What is included in the product

Analysis of Indian Railway Finance's portfolio using BCG Matrix, identifying investment strategies for each quadrant.

Printable summary optimized for A4 and mobile PDFs. Easily share the IRFC's portfolio analysis!

Cash Cows

Leasing rolling stock and infrastructure is a major Cash Cow for Indian Railway Finance Corporation (IRFC). These long-term leases provide steady revenue. IRFC's cash flow is very stable, backed by the Indian government. In FY2024, IRFC's revenue from leasing was substantial. It ensures predictable income with minimal risk.

IRFC's low-risk model, mainly serving Indian Railways, guarantees significant profits and robust cash flow. The cost-plus approach provides stable margins. In FY24, IRFC's net profit reached ₹6,338 crore, and the GNPA was at 0% due to sovereign backing.

IRFC's consistent profitability and dividend payouts classify it as a Cash Cow. In FY24, IRFC reported a profit after tax (PAT) of ₹6,431 crore. This demonstrates its ability to generate stable income. IRFC's financial performance supports its dividend distribution, making it a reliable investment. The company's dividend yield was approximately 3.6% in 2024.

Strong Asset Under Management (AUM) Growth

IRFC's expanding Asset Under Management (AUM) demonstrates strong financial health. This growth, fueled by railway project financing, shows its solid business and cash-generating abilities. A larger AUM base directly boosts interest and leasing income. In fiscal year 2024, IRFC's AUM grew significantly, reflecting its robust financial performance.

- IRFC's AUM growth is a key indicator of its financial strength.

- The increase in AUM leads to higher income from interest and leasing.

- IRFC's performance in fiscal year 2024 highlights its strong financial position.

Exemption from Certain RBI Norms

Indian Railway Finance Corporation (IRFC) benefits from exemptions from some Reserve Bank of India (RBI) regulations, boosting its financial health and Cash Cow status. These exemptions relate to asset classification, provisioning, and exposure limits concerning the Ministry of Railways. This regulatory backing supports IRFC's stable financial environment and operational efficiency.

- Exemption from specific RBI rules.

- Enhances financial stability.

- Supports Cash Cow status.

- Favorable operating conditions.

IRFC’s core business of financing Indian Railways' expansion and asset acquisition makes it a robust Cash Cow. Its stable leasing income and sovereign guarantee ensure consistent high profitability and zero NPAs. In FY2024, IRFC reported a net profit of ₹6,431 crore, coupled with significant AUM growth. This consistent performance and strong financial health solidify its position as a key cash generator.

| Metric | FY2023 | FY2024 | ||

|---|---|---|---|---|

| Net Profit (₹ crore) | 6,337 | 6,431 | ||

| GNPA (%) | 0 | 0 | ||

| Dividend Yield (Approx. %) | 3.8 | 3.6 |

What You See Is What You Get

Indian Railway Finance BCG Matrix

The preview displays the complete Indian Railway Finance BCG Matrix you'll receive. It’s the full, unlocked document ready for your strategic analysis and business planning needs. Get the same professional quality report instantly upon purchase, no extra steps. This version is ideal for immediate application, offering detailed insights and data.

Dogs

A potential Dog in the Indian Railway Finance Corporation (IRFC) BCG Matrix could be stagnation in traditional lending. This stems from increased government budgetary support, reducing the need for extra-budgetary resources. IRFC's core lending business may slow down if diversification efforts don't compensate. In fiscal year 2024, Indian Railways' capital expenditure was about ₹2.52 lakh crore.

IRFC's heavy reliance on Indian Railways (IR) presents a "Dog" risk. In 2024, almost all revenue came from IR. Policy changes or funding cuts could severely impact IRFC's financials. Diversification is key to mitigate this single-client risk, considering 2024's ₹25,167 crore revenue.

IRFC's traditional business with Indian Railways, based on a fixed lending spread, sees lower profit margins. In 2024, IRFC's net interest margin (NIM) was around 3.5%, which is relatively modest. If IRFC can’t find higher-margin opportunities, it could become a Dog in the BCG matrix.

Potential for Increased Competition in New Areas

IRFC's expansion into sectors like renewable energy and infrastructure financing could intensify competition. Established firms might make these areas less profitable, especially if IRFC struggles to gain market share. This situation is akin to the "Dogs" quadrant in the BCG matrix. Competing in markets with many players often reduces profitability.

- In 2024, the infrastructure sector saw increased competition.

- Renewable energy projects also faced pressure.

- IRFC's profitability might be affected by this.

- Market share is key to success.

Slowdown in Asset Under Management Growth from Traditional Sources

If funding from Indian Railways decreases, IRFC's traditional Assets Under Management (AUM) growth might slow, possibly classifying this part as a "Dog." This could happen if the demand for rolling stock and infrastructure financing drops. IRFC's reliance on this area makes diversification crucial. For instance, in FY24, IRFC's loan portfolio grew by 16.5%, but future growth could be lower.

- Reduced funding from Indian Railways could impact IRFC's growth.

- Diversification is essential to maintain strong performance.

- AUM growth slowdown might categorize this segment as a "Dog."

- FY24 loan portfolio grew by 16.5%.

IRFC's traditional, low-margin lending to Indian Railways, with a 2024 Net Interest Margin around 3.5%, acts as a Dog due to limited growth potential. Its reliance on Indian Railways for nearly all 2024 revenue, totaling ₹25,167 crore, presents a significant single-client risk. Additionally, new ventures into competitive sectors like renewable energy, which saw increased competition in 2024, may yield lower returns. Future AUM growth, despite a 16.5% increase in FY24, could slow if IR funding decreases.

| Metric | 2024 Data | Implication |

|---|---|---|

| Net Interest Margin (NIM) | ~3.5% | Modest profitability |

| Revenue from Indian Railways | ₹25,167 crore | High client dependency |

| FY24 Loan Portfolio Growth | 16.5% | Potential for future slowdown |

Question Marks

IRFC's move into metro and rapid rail financing is a "Question Mark." These sectors boast high growth prospects. IRFC's market share and profitability in these new areas are still developing. As of 2024, investments are substantial. Success hinges on effective execution and strategic planning.

Financing renewable energy projects for Indian Railways falls under the Question Mark category for IRFC. This sector is growing, driven by sustainability goals, but IRFC's specific expertise here is nascent. In 2024, Indian Railways aims to source 100% of its energy needs from renewable sources. IRFC's financial involvement in such projects is still scaling up.

Funding port rail connectivity and PPP projects present growth prospects for IRFC, spurred by infrastructure development. However, IRFC's precise role and the profitability of these ventures remain unclear. In 2024, Indian Railways allocated ₹2.5 trillion for infrastructure projects. The success depends on project execution and market conditions, potentially impacting returns.

Expansion into Non-Railway Linked Sectors

IRFC's move into sectors linked to railways, like power and logistics, is expanding its financing scope. This strategy aims for growth by tapping into areas connected to railway operations. However, it also introduces new market risks and challenges for IRFC to manage effectively. In 2024, IRFC's diversification strategy included financing projects in port development and warehousing, as part of its larger infrastructure funding plans.

- IRFC's expansion considers sectors with strong ties to railway operations.

- This diversification seeks growth opportunities beyond core railway financing.

- New markets bring different risks that IRFC must navigate.

- In 2024, IRFC financed projects in port development.

Securing Higher-Margin Business

Indian Railway Finance's push into new, higher-margin areas places it firmly in the Question Mark quadrant of the BCG matrix. The strategic aim is to boost profitability by diversifying beyond standard lending, but this is a risky endeavor. Success hinges on navigating competitive new markets and maintaining those higher margins. As of 2024, IRFC's net interest margin was approximately 2.5%, with future profitability hinging on these new ventures.

- Targeting new disbursement areas with higher margins.

- Success depends on competitive market navigation.

- IRFC's 2024 net interest margin was around 2.5%.

- Future profitability depends on these ventures.

IRFC's Question Mark ventures, like metro rail, renewable energy, and port connectivity, demand substantial 2024 investments. These areas offer high growth potential, yet IRFC's market share and specific profitability remain nascent. Success hinges on navigating new markets effectively to secure future returns.

| Sector | 2024 Growth Potential | IRFC's Current Status |

|---|---|---|

| Metro/Rapid Rail | High, Urban Expansion | Developing Market Share |

| Renewable Energy | Significant, Sustainability Driven | Nascant Expertise, Scaling Up |

| Port/Logistics | Strong, Infrastructure Push | Unclear Profitability, Expanding Scope |

BCG Matrix Data Sources

This BCG Matrix employs railway financials, market growth, infrastructure reports, and expert evaluations for strategic accuracy.