Ipsos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ipsos Bundle

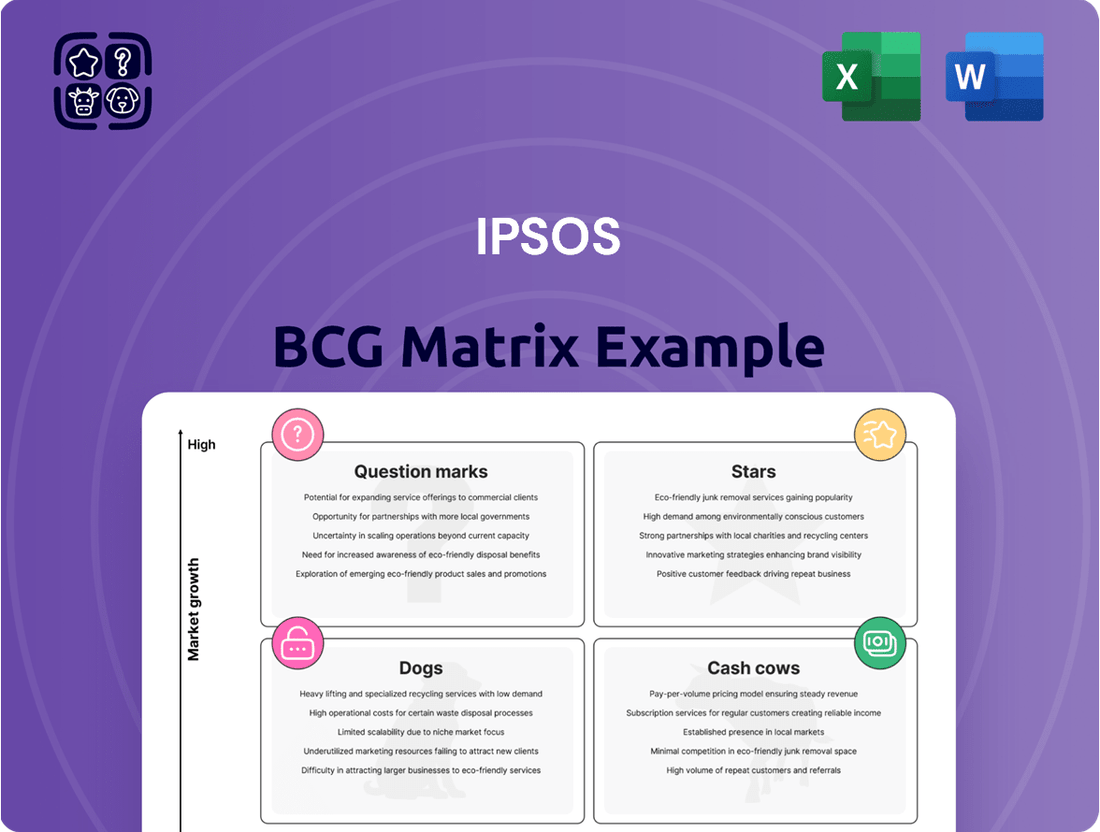

Curious about which products are driving growth and which might be holding your business back? The Ipsos BCG Matrix offers a powerful framework to categorize your portfolio into Stars, Cash Cows, Dogs, and Question Marks. This initial glimpse helps you understand the landscape, but imagine unlocking the full strategic potential.

To truly leverage this insight, you need to dive deeper. The full BCG Matrix report provides detailed quadrant placements, complete with data-backed recommendations tailored to your specific business. Don't just identify your portfolio's status; gain a clear roadmap for smart investment and decisive product management.

Gain a competitive edge by understanding precisely where your offerings stand in today's dynamic market. The complete BCG Matrix delivers quadrant-by-quadrant clarity and actionable strategic takeaways, fast-tracking your path to market dominance.

Purchase the full BCG Matrix now for instant access to a comprehensive strategic tool. Discover which products are leading the pack, which are consuming resources without return, and where your capital should be flowing next. Empower your decision-making with actionable intelligence.

Elevate your strategy with the full BCG Matrix, which includes both a detailed Word report for in-depth analysis and a high-level Excel summary for quick overviews and presentations. It's the complete package for evaluating, communicating, and strategizing with absolute confidence.

Stars

Ipsos is heavily investing in AI, generative AI, and advanced analytics, recognizing their potential for significant market growth. These technologies are key to accelerating research processes and uncovering deeper, more valuable insights for clients. This strategic focus directly addresses the increasing market demand for sophisticated data analysis in the market research sector.

The company's commitment to these areas is evident in platforms like Ipsos.Digital, their do-it-yourself research solution. This platform has demonstrated robust organic growth, highlighting the market's receptiveness to AI-enhanced research tools. For instance, in 2023, Ipsos reported that their digital solutions, which leverage AI, contributed substantially to their overall revenue growth, reflecting a strong market adoption trend.

Customer Experience (CX) research within digital channels is a rapidly growing area for Ipsos, driven by businesses' intense focus on understanding online customer behavior. This specialization taps into the ongoing digital transformation, where immediate and actionable insights are paramount. For instance, Ipsos reported a significant increase in digital CX projects in 2024, with mobile-first survey methods and in-app feedback mechanisms showing particularly strong adoption.

Synthetic Data Solutions, as a component of the Ipsos BCG Matrix, is positioned as a strong contender in the high-growth, high-potential quadrant. The increasing emphasis on data privacy and the inherent difficulties of traditional data gathering are fueling a significant demand for synthetic data.

Ipsos's strategic investment in developing synthetic data capabilities allows them to model elusive audiences and extract valuable insights without compromising privacy. This innovative approach offers substantial advantages in terms of both speed and cost-efficiency compared to conventional methods.

For instance, the global synthetic data market was valued at approximately $300 million in 2023 and is projected to experience a compound annual growth rate (CAGR) of over 35% through 2030, reaching billions of dollars. This rapid expansion underscores the market's receptiveness to these advanced solutions.

The ability to generate realistic, yet artificial, datasets makes synthetic data particularly effective for training AI models and conducting simulations, areas critical for future market research advancements.

Unified Marketing & Commercial Measurement (Ipsos MMA)

Ipsos MMA stands out as a premier provider of Marketing Mix Modeling (MMM) solutions. Their expertise helps businesses fine-tune their marketing and sales expenditures to achieve better results and a higher return on investment. In today's dynamic market, brands are increasingly focused on understanding the complete effect of their advertising and promotional activities, making Ipsos MMA's services highly sought after.

The demand for sophisticated measurement tools like those offered by Ipsos MMA has been growing. For instance, by 2024, the global marketing analytics market was projected to reach over $12 billion, with MMM being a significant component. Ipsos MMA's ability to deliver actionable insights into campaign effectiveness positions them strongly within this expanding sector.

- Leader in Marketing Mix Modeling: Ipsos MMA is recognized for its advanced capabilities in helping clients optimize marketing and commercial investments.

- Driving Measurable ROI: The service focuses on delivering tangible improvements in sales and return on investment for brands.

- High Market Demand: Companies are actively seeking holistic measurement solutions to understand the impact of their spending.

- Strong Market Position: Ipsos MMA is well-positioned to meet this growing demand due to its specialized expertise and established track record.

Innovation Testing and Development (Collective Innovation)

Ipsos's 'Collective Innovation' program, powered by AI, aims to boost the success of new product and service launches by ensuring they resonate with consumer needs and align with business strengths. This initiative is a direct answer to the growing market pressure for more relevant and impactful innovations.

By integrating big data analytics with traditional qualitative research methods, Collective Innovation tackles a key challenge: ensuring new offerings actually meet market demand. This approach is particularly valuable in 2024 as companies face increasing competition and a need to de-risk their innovation pipelines.

- AI-Driven Insights: Leverages artificial intelligence to analyze vast datasets, identifying unmet consumer needs and market opportunities.

- Consumer-Centric Approach: Focuses on deep consumer understanding to guide the development process, reducing the risk of market rejection.

- Business Capability Alignment: Ensures that innovative ideas are feasible and align with a company's existing resources and strategic goals.

- Enhanced Success Rates: Aims to significantly improve the probability of successful product and service launches in a crowded marketplace.

Stars represent high-growth, high-market-share offerings. For Ipsos, their AI and advanced analytics capabilities, including platforms like Ipsos.Digital, are prime examples of Stars. The significant investments in these areas and their demonstrated organic growth in 2023 and 2024 highlight their leading position in a rapidly expanding market.

What is included in the product

This matrix categorizes business units based on market share and growth, guiding investment and divestment strategies.

Simplify strategic decisions by visually identifying business unit performance and resource allocation needs.

Cash Cows

Traditional brand health tracking and advertising effectiveness studies are Ipsos's cash cows, providing a steady revenue stream. These services are vital for consumer goods companies, who regularly require insights into market trends and advertising impact.

While growth in these areas might be modest, their established nature and strong client ties ensure significant and consistent cash flow for Ipsos. For example, Ipsos reported in its 2023 annual report that its market understanding segment, which includes these traditional services, generated a substantial portion of its revenue, demonstrating their continued importance.

Public Opinion Polling and Citizen Studies represent a strong Cash Cow for Ipsos. The company boasts a significant market share and a long-standing reputation in this sector, consistently supplying vital data to governments and various organizations. This segment thrives on the perpetual need for understanding societal trends, public mood, and electoral behaviors.

The demand for these insights remains robust, ensuring a steady revenue stream for Ipsos, even with minor regional variations. Ipsos's extensive global network and deep-seated expertise are key drivers of this segment's consistent performance. For instance, in 2024, Ipsos continued to be a leading player in national election polling across numerous countries, demonstrating sustained client trust and market penetration.

Ipsos’s audience measurement and media development services are a cornerstone for media companies and advertisers, offering critical insights into media consumption habits and campaign effectiveness. This established market segment is a reliable source of income for Ipsos, driven by recurring revenue from syndicated data and long-term client agreements.

In 2024, the global media measurement market was valued at approximately $25 billion, with Ipsos holding a significant share due to its comprehensive data offerings and trusted methodologies. This segment operates as a cash cow, demanding minimal incremental investment while consistently contributing to Ipsos's financial stability through predictable revenue streams.

Customer Satisfaction and Employee Engagement Surveys

Customer satisfaction and employee engagement surveys are classic cash cows within the Ipsos portfolio, mirroring the stability of established, high-demand services. Businesses worldwide, from Fortune 500 companies to burgeoning startups, consistently allocate significant budgets to these initiatives, recognizing their direct impact on profitability and long-term sustainability. For instance, in 2024, the global market for employee engagement software alone was projected to reach over $2 billion, demonstrating a robust and ongoing demand for such insights. Ipsos’s long-standing expertise and trusted brand in this space ensure a consistent and reliable revenue stream from a diverse and broad client base operating within a mature market. These foundational services are critical for any organization aiming to optimize performance and reduce costly turnover.

The consistent demand for understanding customer sentiment and employee morale makes these survey offerings a bedrock of Ipsos’s financial stability. Companies understand that high customer satisfaction drives repeat business and positive word-of-mouth, while engaged employees are more productive and innovative. Data from 2024 indicates that companies with highly engaged employees exhibit 21% greater profitability. Ipsos’s ability to deliver actionable insights from these surveys solidifies their position as a valuable and recurring partner for businesses seeking to improve these key metrics.

- Stable Revenue Generation: Ipsos’s established customer satisfaction and employee engagement survey services provide a predictable and consistent income stream due to their fundamental importance to businesses.

- Broad Client Base: These services appeal to a wide range of organizations across various industries, ensuring a diversified and resilient revenue base.

- Mature Market Demand: The ongoing need for feedback and performance improvement in customer and employee relations means this market is consistently active.

- Industry Recognition: Ipsos’s reputation for reliable data collection and insightful analysis in these areas fosters strong client loyalty and repeat business.

Market Strategy & Understanding (MS&U) for Established Sectors

Ipsos's core market strategy and understanding services are a consistent revenue generator, particularly within established sectors. These offerings leverage Ipsos's deep historical data and extensive experience to deliver critical insights into market dynamics and competitive positioning, proving invaluable for strategic decision-making in stable economic environments.

These services are designed to equip businesses operating in mature industries with the intelligence needed to navigate predictable market shifts and maintain a competitive edge. For instance, in 2024, Ipsos reported a 6% year-over-year increase in demand for its market intelligence reports focused on consumer packaged goods and automotive sectors, both considered mature industries.

- Market Trend Analysis: Providing deep dives into evolving consumer preferences and economic factors affecting established product categories.

- Competitive Benchmarking: Offering detailed analysis of competitor performance, strategies, and market share within mature industries.

- Strategic Planning Support: Delivering data-driven recommendations to optimize marketing spend and product development in stable markets.

- Customer Segmentation: Identifying and profiling key customer groups within established markets to refine targeting efforts.

Ipsos's traditional brand health tracking and advertising effectiveness studies are prime examples of cash cows. These services, vital for consumer goods companies needing market insights, generate steady revenue with modest growth. Their established nature and strong client ties ensure consistent cash flow, as evidenced by Ipsos's 2023 report highlighting the market understanding segment's significant revenue contribution.

Full Transparency, Always

Ipsos BCG Matrix

The preview you are viewing is the identical, fully polished Ipsos BCG Matrix report you will receive upon purchase. This means the strategic insights, clear visual representations of market share and growth rates, and actionable recommendations are exactly as you see them now. You can confidently expect the same high-quality, analysis-ready document, free from any watermarks or demo limitations, ready for immediate integration into your business planning and decision-making processes.

Dogs

In developed markets, traditional face-to-face data collection methods, while once the norm, are now facing significant challenges. The sheer cost and time involved, especially for large-scale surveys, make them increasingly inefficient. Consider that in 2024, the average cost per interview for face-to-face surveys in Western Europe could easily exceed $50, a stark contrast to digitally-enabled methods.

These methods exhibit low growth prospects. As economies demand faster insights and businesses operate at a quicker pace, the inherent slowness of in-person interviews becomes a major bottleneck. The return on investment for these labor-intensive approaches is diminishing, especially when compared to the speed and scalability offered by online panels and digital data capture.

The resources consumed by traditional face-to-face methods are substantial. From interviewer training and management to travel expenses and data entry, each stage adds significant overhead. This makes them prime candidates for minimization or complete transformation into more cost-effective, digitally-integrated solutions to remain competitive.

Generic, non-specialized data tabulation services are increasingly finding themselves in the Dogs quadrant of the BCG matrix. As the market research landscape evolves, the demand for advanced analytics and deep insights has overshadowed the need for basic data processing. Clients are actively seeking partners who can offer more than just raw numbers; they want actionable intelligence derived from sophisticated analytical tools and technological integration.

This segment is characterized by low market share and minimal growth potential. In 2024, the global market research industry saw significant investment in AI-driven analytics, with companies spending an estimated $80 billion on advanced data solutions, pushing basic tabulation further into a commodity status. Services that merely tabulate data without offering added value are struggling to command premium pricing or attract substantial client investment.

While these services might achieve break-even financially, they often represent an inefficient use of resources. The time and personnel dedicated to simple tabulation could be better allocated to developing or offering more specialized, high-value services that align with current market demands. This strategic misallocation can hinder a company's ability to innovate and compete effectively in the evolving market research space.

Legacy IT infrastructure at Ipsos, particularly systems not integrated with modern platforms or AI, acts as a significant drag on efficiency and innovation. These outdated systems often require substantial maintenance, diverting valuable financial and human resources away from investments in cutting-edge market segments.

Such unintegrated systems can become cash traps, consuming resources without contributing to growth in high-potential areas. For instance, a company spending upwards of 70% of its IT budget on maintaining legacy systems, as seen in some industry benchmarks, struggles to allocate capital towards AI-driven market analysis or advanced data platforms that are crucial for future competitiveness.

This lack of integration hampers agility, making it difficult for Ipsos to adapt quickly to evolving market demands or to leverage new technologies for competitive advantage. The inability to seamlessly incorporate AI tools or connect with modern data ecosystems directly impacts Ipsos's ability to capture market share in rapidly advancing sectors.

Niche, Non-Scalable Qualitative Research Without Digital Tools

Niche, non-scalable qualitative research, relying purely on traditional methods without digital tools, often faces significant hurdles. The market demand for such bespoke, labor-intensive approaches can be limited, hindering substantial growth potential.

Without leveraging AI for analysis or integrating into broader insights platforms, these offerings struggle to meet the market's increasing need for speed and efficiency. For instance, a study by the Pew Research Center in 2024 indicated that over 70% of businesses prioritize data analysis speed when selecting research partners.

This segment, often characterized by high per-project costs and long turnaround times, may find it difficult to compete with digitally enhanced alternatives.

- Limited Scalability: Inability to efficiently expand services beyond a small client base.

- High Cost Structure: Reliance on manual processes drives up operational expenses.

- Slow Market Adaptation: Difficulty in responding quickly to evolving client needs or market shifts.

- Competitive Disadvantage: Lagging behind competitors who utilize digital tools for efficiency and data integration.

Underperforming Regional Public Affairs in Politically Unstable Markets

Ipsos's Public Affairs division, especially in the United States, experienced a downturn. This was largely attributed to unpredictable political landscapes and the natural conclusion of certain project-based contracts that do not repeat.

While the Public Affairs sector as a whole is performing as a Cash Cow for Ipsos, specific geographic segments within politically unstable markets are showing signs of weakness. These areas can be characterized as having low market growth and a low market share, demanding a strategic reassessment.

- United States Public Affairs Decline: In 2023, Ipsos reported a decline in its Public Affairs business, particularly in the US, citing the volatile political environment as a key factor.

- Impact of Non-Recurring Contracts: The cessation of significant non-recurring contracts in 2023 also contributed to the revenue shortfall in this segment, highlighting a reliance on specific, time-limited projects.

- BCG Matrix Classification: These underperforming regional segments within Public Affairs would likely be classified as Dogs in the Ipsos BCG Matrix, indicating low growth and low market share.

- Strategic Re-evaluation Needed: Such a classification necessitates a serious review of these market positions, potentially leading to divestment, restructuring, or a significant shift in strategy to improve performance.

Dogs represent business units or product lines with low market share and low growth prospects. These are typically cash traps, requiring resources but offering little return. For Ipsos, this could include outdated data collection methods or niche services that struggle to scale.

Consider traditional face-to-face surveys as an example; their high costs, as noted with potential 2024 expenses exceeding $50 per interview in Western Europe, combined with slow adaptation, place them firmly in the Dogs category. These offerings drain resources that could be better invested in high-growth areas.

Generic data tabulation services also fall into this quadrant, especially as the market increasingly demands advanced analytics. With the global market research industry investing heavily in AI, estimated at $80 billion in 2024 for advanced data solutions, basic tabulation without added value is becoming obsolete.

Legacy IT systems and non-scalable qualitative research also exemplify Dogs. These segments consume significant resources, often 70% or more of IT budgets in some industries, without contributing to future growth or competitive advantage.

Question Marks

Neuroscience and biometric research services from Ipsos, while promising deep insights into consumer reactions, are still relatively new players in the broader market research landscape. This means their widespread adoption is still developing.

Ipsos's commitment to these advanced techniques positions them for significant future growth. However, their current market share in this specific niche is modest, as many clients are still in the process of understanding and quantifying the return on investment for these cutting-edge methods.

For instance, the global neuromarketing market was projected to reach $11.5 billion by 2026, indicating substantial untapped potential. Ipsos's early investment in neuroscience and biometrics in 2024 positions them to capture a portion of this expanding market, even if initial adoption rates are cautious.

As the metaverse and Web3 technologies rapidly evolve, understanding consumer behavior and market dynamics within these emerging digital spaces is becoming critical. Ipsos's strategic entry into this innovative but still largely undefined sector places its research solutions firmly in the question mark quadrant of the BCG matrix.

This positioning indicates a need for substantial investment to build market share and establish leadership in a field where the rules are still being written. For instance, the global metaverse market was valued at an estimated $100 billion in 2023 and is projected to grow significantly, presenting a clear opportunity that requires upfront capital to capitalize on.

The rapid pace of technological change and the nascent nature of consumer adoption in the metaverse and Web3 necessitate ongoing research and development. This investment is crucial for Ipsos to refine its methodologies, develop specialized tools, and build expertise to effectively serve clients navigating these complex new frontiers.

The ESG advisory and measurement market is booming, driven by a global push for sustainability. In 2024, this sector is projected to reach hundreds of billions of dollars, with a significant compound annual growth rate. Ipsos, recognizing this trend, is actively enhancing its ESG services. While this presents a high-growth opportunity, Ipsos faces competition from established ESG specialists, necessitating strategic investment to capture a larger market share.

Advanced Predictive Analytics Consulting for Niche Industries

Advanced predictive analytics consulting for niche industries often falls into the question mark category of the BCG Matrix. While the overall predictive analytics market is booming, estimated to reach over $100 billion globally by 2025, specialized services for sectors like precision agriculture or rare disease drug development require deep, sector-specific knowledge.

This specialization demands substantial investment in building domain expertise and acquiring clients within these less-penetrated markets. Despite the high growth potential of predictive analytics itself, the initial journey to market share in these niche areas can be slow and capital-intensive, mirroring the characteristics of a question mark.

Key considerations for these services include:

- High upfront investment: Acquiring specialized talent and developing tailored analytical models for niche sectors demands significant financial resources.

- Longer client acquisition cycles: Educating and convincing clients in emerging or less-penetrated industries about the value of advanced analytics can be a protracted process.

- Significant growth potential: Once established, these services can capture substantial market share in industries ripe for digital transformation and data-driven decision-making.

- Need for deep domain expertise: Success hinges on understanding the unique data sets, regulatory environments, and operational nuances of each niche industry.

New AI-driven Solutions Requiring Client Education and Adoption

Ipsos is at the forefront of developing cutting-edge AI solutions, including those leveraging synthetic data and sophisticated automation. These innovations hold substantial promise for transforming client operations and decision-making. However, realizing this potential hinges on effectively educating clients about the tangible benefits and practical applications of these new technologies.

The path to widespread client adoption for these advanced AI tools is paved with the necessity for robust education and clear demonstrations of value. Without understanding how these solutions can directly improve their business outcomes, clients may be hesitant to integrate them. This is particularly true for innovations like synthetic data, which can be complex to grasp initially.

- High Growth Potential: AI in market research is projected for significant expansion, with reports indicating the market could reach tens of billions of dollars by 2030.

- Low Initial Penetration: Despite the potential, the adoption of highly specialized AI solutions like synthetic data generation for market research is still in its early stages, with penetration rates currently being relatively low.

- Investment in Client Success: To cultivate these offerings into market-leading ‘stars’ within the BCG matrix, Ipsos must allocate considerable resources towards marketing efforts and dedicated client success teams. These teams will be crucial in bridging the knowledge gap and ensuring clients derive maximum value.

- Demonstrating ROI: Success will be measured by Ipsos' ability to clearly articulate and prove the return on investment for these AI-driven solutions, showcasing efficiency gains or new insights previously unattainable.

Question marks, in the context of the BCG matrix, represent business units or product lines with low market share in high-growth industries. These ventures require careful evaluation and strategic decision-making regarding future investment.

They possess the potential to become market leaders but also carry a significant risk of failure if market conditions or competitive pressures do not shift favorably. For Ipsos, this means these areas need substantial funding to increase market share and transition into stars.

Examples include emerging technologies like AI in market research and specialized predictive analytics, where investment is crucial to navigate nascent markets and build necessary expertise.

Ipsos's ventures into metaverse and Web3 research, alongside advanced AI solutions like synthetic data, exemplify question marks. These areas represent high-growth potential but currently have low market penetration, demanding significant investment in R&D and client education to foster adoption and establish leadership.

| Ipsos Business Area | Industry Growth | Market Share | BCG Category | Strategic Consideration |

|---|---|---|---|---|

| Neuroscience & Biometrics | High | Low | Question Mark | Invest to build share, potential to become Star |

| Metaverse & Web3 Research | High | Low | Question Mark | Invest heavily for market penetration |

| Advanced AI Solutions (e.g., Synthetic Data) | High | Low | Question Mark | Focus on client education and ROI demonstration |

| Specialized Predictive Analytics | High | Low | Question Mark | Requires deep domain expertise and client acquisition |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial disclosures, competitor analysis, and market research reports to provide a clear view of product portfolio performance.