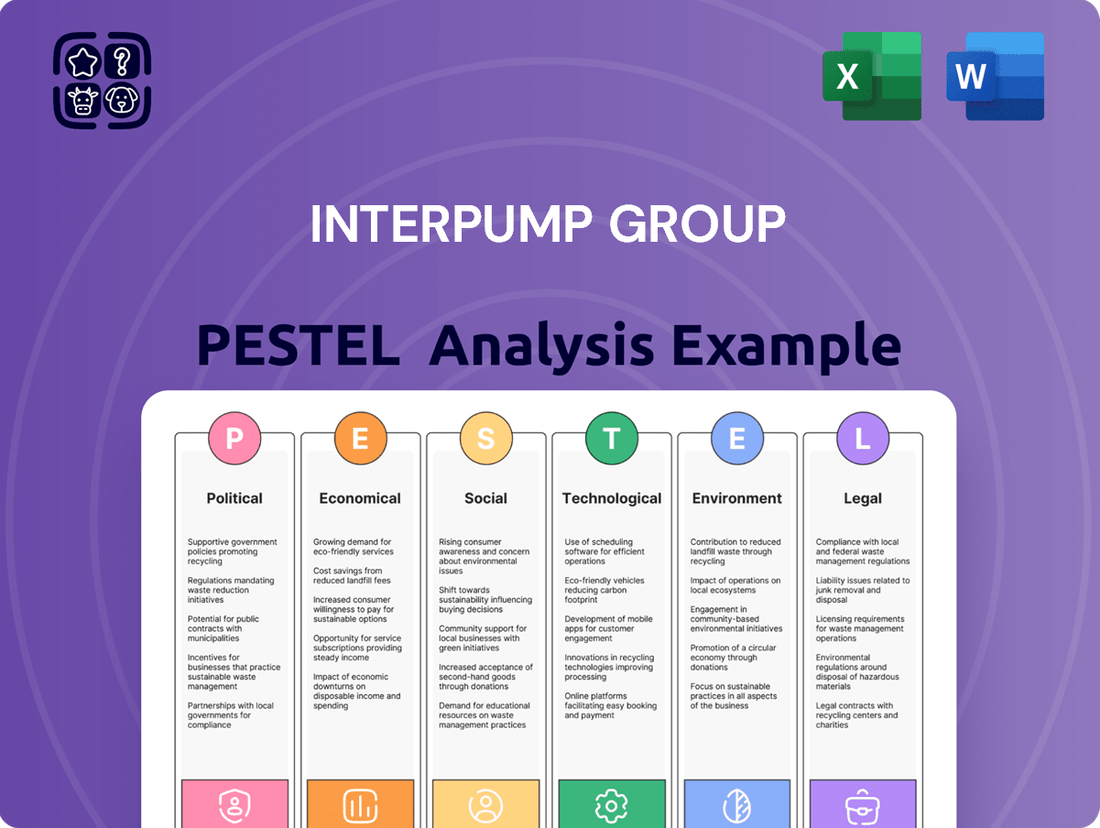

Interpump Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Interpump Group Bundle

Uncover the critical external factors shaping Interpump Group's trajectory. From evolving political landscapes to technological disruptions, our PESTLE analysis provides a clear roadmap of the opportunities and challenges ahead. Don't get left behind in a rapidly changing market; gain the strategic foresight you need to thrive.

Our expertly crafted PESTLE Analysis delves into the political, economic, social, technological, legal, and environmental forces impacting Interpump Group. Understand how global shifts, regulatory changes, and consumer trends directly influence their operations and future growth potential. Ready to make informed decisions and secure your advantage?

Gain an unparalleled understanding of the external environment affecting Interpump Group. This comprehensive PESTLE analysis reveals crucial insights into market dynamics, consumer behavior, and regulatory pressures that could impact your investments or competitive strategy. Download the full version now and unlock actionable intelligence.

Political factors

Government policies directly shape Interpump Group's operational landscape. For instance, shifts in industrial subsidies, like those seen in the European Union's push for green manufacturing in 2024, could incentivize Interpump's investment in sustainable production methods. Conversely, stricter export controls, perhaps implemented by a major trading partner in response to geopolitical tensions in late 2024, might necessitate a reevaluation of market strategies for specific product lines.

Trade barriers represent a significant variable. The potential for increased tariffs on imported components, a concern raised in early 2025 discussions surrounding global trade relations, could directly inflate Interpump's cost of goods sold. This would impact pricing strategies and potentially reduce margins unless offset by efficiencies or localized sourcing, a trend observed across many industrial manufacturers throughout 2024.

Political stability is paramount for Interpump's global operations. Regions experiencing heightened political uncertainty, as observed in certain emerging markets during 2024, pose risks to supply chain continuity and can dampen demand for industrial equipment. Maintaining a diversified operational footprint helps mitigate these risks, ensuring resilience against localized instability.

Interpump Group, operating globally, is significantly influenced by international trade agreements. For instance, the ongoing evolution of trade relationships, including those between major economic blocs like the EU and the United States, directly impacts tariffs and market access for Interpump's diverse product lines, from hydraulic components to fluid power systems. Favorable agreements can streamline cross-border operations, potentially lowering costs and expanding market reach, as seen in past trade pacts that facilitated European manufacturers' access to North American markets.

Conversely, the rise of protectionist policies or escalating trade disputes poses a challenge. These could introduce higher import duties or non-tariff barriers, affecting Interpump's ability to compete on price and hindering its expansion into key international territories. For example, in 2023, various countries implemented new tariffs on manufactured goods, a trend that requires constant vigilance and strategic adjustment to mitigate any negative effects on Interpump's global supply chain and sales volumes.

Interpump Group's operational landscape is significantly shaped by political stability in its key markets. Countries experiencing geopolitical tensions or civil unrest, such as certain regions in Eastern Europe or the Middle East, can pose direct threats to Interpump's production facilities and supply chains. For instance, the ongoing conflict impacting parts of Eastern Europe could disrupt component sourcing or affect demand in related industrial sectors.

Sudden policy shifts, like unexpected trade tariff changes or new regulatory impositions, can also create financial volatility. For example, if a major European market where Interpump has substantial sales were to implement protectionist measures, it could negatively impact export volumes and profitability. The company's financial performance in 2024 will likely reflect its ability to navigate these varied political landscapes.

Conversely, a stable political environment, like that found in many Western European nations and North America, offers predictable business conditions, allowing for more reliable forecasting and investment planning. Interpump's strong presence in the United States, a market generally characterized by political stability, contributes to its overall resilience.

Industry-Specific Regulations

Regulations specific to the industrial and agricultural machinery sectors, like safety standards for hydraulic components and environmental rules for high-pressure washers, directly influence Interpump Group's product design, manufacturing, and compliance expenses. For example, in 2024, the European Union's Machinery Regulation (EU) 2023/1230 continued to emphasize safety, potentially requiring design modifications for components used in complex machinery. Stricter environmental mandates, such as those concerning emissions or waste management, may necessitate substantial R&D investments and operational adjustments for Interpump.

These evolving regulatory landscapes can impact Interpump's market access and competitive positioning. For instance, compliance with varying national safety certifications adds complexity and cost to global operations. As of early 2025, discussions around updated energy efficiency standards for industrial equipment in key markets like North America could influence the development of new product lines, pushing for more sustainable and efficient hydraulic systems.

- Safety Standards: Adherence to EN ISO 13849 for machinery safety and similar international standards is critical for hydraulic components, impacting design and testing.

- Environmental Regulations: Compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe and similar chemical substance regulations globally affects material sourcing and product composition.

- Emissions Controls: Regulations on emissions for engines powering agricultural and industrial machinery, such as those mandated by EPA Tier 4 or EU Stage V, indirectly affect the demand for and design of integrated hydraulic systems.

- Product Lifecycle Management: Growing emphasis on extended producer responsibility and end-of-life management for industrial equipment could necessitate new approaches to product design and material selection.

Government Spending on Infrastructure and Agriculture

Government spending on infrastructure projects directly fuels demand for Interpump Group's specialized hydraulic components and high-pressure pumps. For instance, in 2024, the US government allocated an additional $30 billion towards upgrading roads and bridges, a significant portion of which will likely involve heavy machinery utilizing Interpump's technology. This increased public investment translates into higher sales volumes for the company's construction equipment segment.

Similarly, agricultural development initiatives represent a key market for Interpump. In 2025, the European Union plans to invest €15 billion in sustainable farming practices, which often require advanced irrigation and precision agriculture equipment, areas where Interpump's pumps play a crucial role. Fluctuations in these government funding cycles can therefore directly impact Interpump's revenue streams and future growth prospects.

- Infrastructure Spending Boost: Increased government investment in infrastructure, such as the projected $150 billion in transportation upgrades in Canada for 2024-2025, directly benefits demand for construction machinery powered by Interpump's hydraulic systems.

- Agricultural Support Programs: Government subsidies and grants for modernizing agricultural machinery, like those seen in Brazil's 2024 agricultural plan totaling R$364.2 billion, create opportunities for Interpump's pump solutions in farming equipment.

- Public Works Project Cycles: The cyclical nature of government-funded public works projects means Interpump's sales volumes can experience significant swings based on the timing and scale of these initiatives.

- Policy Impact on Equipment Demand: Government policies prioritizing renewable energy infrastructure or water management projects can steer demand towards specific Interpump product lines, influencing market share and revenue.

Governmental stability and trade policies are critical for Interpump Group's international operations. For instance, in 2024, the United States continued to navigate complex trade relations, impacting tariffs on manufactured goods, which directly affects Interpump's component sourcing and final product pricing. Similarly, the European Union's ongoing commitment to industrial decarbonization, with significant funding allocated in 2024 towards green technologies, could spur demand for Interpump's more energy-efficient hydraulic systems.

Trade agreements and protectionist measures present dynamic challenges. Fluctuations in import duties, a recurring concern in global trade discussions throughout 2024 and into early 2025, can alter Interpump's cost structure and competitive edge in key markets. Conversely, favorable trade pacts can streamline market access, potentially boosting sales volumes for hydraulic components and fluid power systems.

Political stability in regions where Interpump operates is crucial for supply chain integrity and market demand. Geopolitical tensions, as observed in certain Eastern European and Middle Eastern markets during 2024, can disrupt production and dampen demand for industrial equipment. A diversified global presence remains a key strategy for mitigating risks associated with localized political instability.

Government spending on infrastructure and agricultural development directly influences Interpump's revenue. For example, the projected $150 billion in Canadian transportation upgrades for 2024-2025, and Brazil's 2024 agricultural plan totaling R$364.2 billion, are significant drivers for the construction and farming equipment sectors, respectively, where Interpump's hydraulic solutions are vital.

| Factor | 2024/2025 Impact | Interpump Relevance |

| Infrastructure Spending | US allocated $30 billion for road/bridge upgrades in 2024; Canada plans $150 billion transport upgrades (2024-2025). | Increased demand for construction machinery powered by Interpump's hydraulics. |

| Agricultural Initiatives | EU investing €15 billion in sustainable farming (2025); Brazil's 2024 agricultural plan R$364.2 billion. | Boosts demand for Interpump's pumps in precision agriculture and farming equipment. |

| Trade Tariffs | Ongoing US trade policy discussions impacting manufactured goods (2024-2025). | Affects component costs, pricing, and competitive positioning. |

| Green Technology Subsidies | EU focus on green manufacturing (2024); potential for new energy efficiency standards (North America, early 2025). | Drives demand for energy-efficient hydraulic systems and sustainable production methods. |

What is included in the product

This Interpump Group PESTLE analysis meticulously examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic positioning.

It provides a comprehensive overview of external macro-environmental influences, highlighting potential threats and opportunities for Interpump Group within its global operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making Interpump Group's PESTLE analysis a valuable tool for strategic discussions.

Helps support discussions on external risk and market positioning during planning sessions, offering Interpump Group a clear understanding of the forces impacting its business.

Economic factors

Interpump Group's fortunes are significantly influenced by global economic expansion. A healthy global economy, particularly in its core industrial, cleaning, and agricultural markets, typically translates to higher demand for its products. For instance, the International Monetary Fund (IMF) projected global GDP growth to be around 3.2% in 2024, a slight acceleration from previous estimates, signaling a potentially supportive environment for Interpump.

Conversely, a global economic downturn or a slowdown in GDP growth can directly impact Interpump's top line. Reduced business investment and consumer spending during such periods often lead to decreased orders for new machinery and components, thereby affecting the company's revenue and profitability. The World Bank's forecasts for global growth in 2025, while still indicating expansion, are subject to various geopolitical and economic uncertainties that could temper demand.

Strong economic growth, on the other hand, fuels investment in infrastructure and industrial capacity, directly benefiting Interpump. When economies are expanding, businesses are more likely to upgrade or expand their operations, increasing the need for the pumps, hydraulic systems, and cleaning equipment that Interpump provides. This positive correlation means that periods of sustained global economic health are crucial for Interpump's sales growth and overall financial performance.

Interpump Group's international operations mean it's constantly navigating the choppy waters of currency exchange rate fluctuations. For example, a stronger Euro in 2024 could make Interpump's products more expensive for international buyers, potentially hurting export sales. Conversely, a weaker Euro could make imported components pricier, squeezing profit margins.

These swings directly impact the cost of raw materials sourced from abroad and the final price of goods sold in different countries. In 2023, Interpump reported that a significant portion of its revenue and costs were denominated in currencies other than the Euro, highlighting this exposure.

The value of profits earned by its overseas subsidiaries also gets a haircut or a boost when converted back to Euros. Effectively hedging against these currency movements is therefore a critical strategy for maintaining financial stability and predictable earnings for Interpump.

Changes in global interest rates directly impact Interpump Group's expenses for borrowing money needed for growth, acquisitions, and day-to-day operations. For instance, the European Central Bank's key interest rate, which influenced borrowing costs across the Eurozone, remained at 4.50% as of early 2024, a significant increase from previous years, potentially raising Interpump's financing costs.

Higher interest rates can also cool down demand for capital goods, as Interpump's customers face more expensive financing for their own investments. This could lead to a slowdown in orders for the company's specialized pumps and hydraulic systems.

Securing capital at reasonable rates is crucial for Interpump's ability to fund its investment projects and pursue strategic growth opportunities. The company's financial health and expansion plans are therefore closely tied to the prevailing cost of capital in its key markets.

Inflationary Pressures on Costs

Rising inflation, particularly in key input materials like steel and aluminum, along with energy costs, presents a significant challenge for Interpump Group by directly increasing its production expenses. For instance, global steel prices saw substantial volatility through 2023 and into early 2024, often driven by supply chain disruptions and energy costs, impacting manufacturers like Interpump.

While Interpump can attempt to offset these higher costs through price adjustments to its customers, the effectiveness of this strategy is contingent on its pricing power and the competitive landscape. Rapid or persistent inflation, if not fully passed on, can lead to a compression of profit margins, impacting overall profitability. In 2023, for example, many industrial companies reported challenges in fully absorbing input cost increases, leading to margin pressures.

- Input Cost Volatility: Steel and aluminum prices have experienced significant fluctuations, with some reports indicating increases of 10-15% in certain periods in 2023-2024 compared to previous years.

- Energy Price Impact: Higher energy bills directly affect manufacturing processes, potentially adding several percentage points to operational overheads.

- Pricing Power Assessment: Interpump's ability to maintain or increase prices without significantly impacting demand is crucial for margin protection.

- Margin Erosion Risk: If cost increases outpace price adjustments, profit margins could decline, impacting financial performance.

Industry-Specific Market Demand

Demand within Interpump Group's core sectors, including cleaning, industrial, and agricultural applications, is significantly shaped by broader economic trends. For example, economic slowdowns impacting construction can directly diminish the need for hydraulic components like cylinders. Conversely, robust agricultural markets often translate into increased sales for the company's pump technologies.

Interpump Group's strategic diversification across these distinct business areas is a key factor in managing the inherent risks associated with economic volatility in any single market. This approach allows the company to offset potential downturns in one segment with growth in another.

Recent performance data highlights this dynamic. In the first quarter of 2025, Interpump's hydraulic sector experienced a notable sales decrease, continuing a trend of revenue decline over six consecutive quarters.

- Hydraulic Sector Sales Decline: Interpump's hydraulic division saw a significant drop in sales during Q1 2025, marking the sixth consecutive quarter of revenue contraction.

- Water-Jetting Division Growth: In contrast, the company's water-jetting segment demonstrated healthy organic growth during the same period.

- Sectoral Interdependence: The performance illustrates how economic factors affecting specific industries, such as construction impacting hydraulics, directly influence demand for Interpump's products.

- Diversification as a Mitigant: The varied performance across divisions underscores the benefit of Interpump's diversified business model in buffering against sector-specific economic headwinds.

Interpump Group's financial performance is intricately linked to global economic health, with growth in industrial, cleaning, and agricultural sectors directly boosting demand for its products. The IMF's projection of 3.2% global GDP growth for 2024 suggests a supportive economic climate, although the World Bank's 2025 forecasts acknowledge potential uncertainties that could temper demand.

Currency exchange rate fluctuations pose a constant challenge, impacting the cost of raw materials and the final price of Interpump's goods sold internationally. A stronger Euro in 2024, for instance, could make its products less competitive abroad, while a weaker Euro increases the cost of imported components, potentially squeezing profit margins.

Rising interest rates directly affect Interpump's borrowing costs for growth and operations, with the ECB's key rate at 4.50% in early 2024 increasing financing expenses. Higher rates can also dampen customer demand for capital goods due to more expensive financing for their own investments, potentially slowing orders for Interpump's specialized equipment.

Inflation, particularly in raw materials like steel and energy, raises production costs for Interpump. While the company may pass these costs on, its pricing power and competitive landscape will determine the extent to which margins are protected from erosion. Steel prices saw significant volatility in 2023-2024, with some reports indicating increases of 10-15%.

Interpump's sales performance varies across its core sectors, with economic downturns impacting construction affecting demand for hydraulic components. For example, the company's hydraulic division experienced a sales decrease in Q1 2025, marking the sixth consecutive quarter of revenue contraction, while its water-jetting segment showed healthy organic growth.

| Economic Factor | Impact on Interpump Group | Data Point/Example |

|---|---|---|

| Global GDP Growth | Higher demand for products during expansionary periods. Slowdowns reduce orders. | IMF projected 3.2% global GDP growth for 2024. |

| Currency Exchange Rates | Affects export competitiveness and cost of imported materials. | A stronger Euro makes exports more expensive; a weaker Euro increases import costs. |

| Interest Rates | Influences borrowing costs and customer investment capacity. | ECB key interest rate at 4.50% in early 2024 impacted financing expenses. |

| Inflation (Input Costs) | Increases production expenses, potentially squeezing profit margins. | Steel prices saw 10-15% increases in certain periods of 2023-2024. |

| Sectoral Demand (e.g., Construction, Agriculture) | Directly influences demand for specific product lines (hydraulics vs. water-jetting). | Hydraulic sector sales declined in Q1 2025 (6th consecutive quarter of contraction). |

What You See Is What You Get

Interpump Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Interpump Group PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning. You will gain a thorough understanding of the external forces shaping the hydraulics and pumping systems market.

Sociological factors

Interpump Group's success hinges on access to a skilled manufacturing, engineering, and research and development workforce. The availability of these specialized skills directly influences operational efficiency and the capacity for product innovation.

Demographic trends, like the aging workforce in many developed economies, present a significant challenge, potentially increasing labor costs and creating a shortage of experienced personnel. For instance, in 2024, many European countries are grappling with declining birth rates and an increasing median age, impacting the pipeline of new engineers and technicians entering the manufacturing sector.

Addressing potential skill gaps requires proactive investment in training programs and robust talent acquisition strategies. Companies like Interpump Group must focus on reskilling existing employees and attracting new talent with the necessary technical expertise to maintain a competitive edge in the global market.

Customer preferences are steering Interpump Group towards more sophisticated machinery. There's a noticeable shift, with clients increasingly seeking products that are not only user-friendly but also boast enhanced energy efficiency and seamless digital integration. This is evident in the growing market share of smart, connected industrial equipment, a trend that Interpump must continue to address through innovation.

Broader lifestyle changes also play a role. For instance, a heightened societal emphasis on hygiene, particularly amplified post-2020, has indirectly boosted demand for advanced cleaning and sanitation solutions within sectors that Interpump serves. Similarly, a resurgence in DIY culture could influence the market for certain types of pumps and related equipment used in smaller-scale applications.

Societal demands for companies to act responsibly are on the rise, pushing Interpump Group to focus on ethical labor, community involvement, and clear governance. Meeting these expectations is crucial for building trust and attracting key stakeholders like employees, investors, and consumers. For instance, Interpump Group's 2024 sustainability report highlights their commitment, building on their 'ESG Journey 2023-2025' roadmap which sets specific goals across environmental, social, and governance areas.

Health and Safety Standards

Societal expectations increasingly demand stringent health and safety protocols within manufacturing environments, directly impacting companies like Interpump Group. This focus extends from safeguarding employees during production to ensuring the safety of end-users interacting with their hydraulic components. A commitment to robust safety features and adherence to occupational health and safety standards is not just a regulatory necessity but also a critical factor in mitigating risks, reducing potential liabilities, and bolstering corporate reputation.

Interpump Group actively works towards enhancing its safety performance, with a stated goal of improving its injury rate. For example, in 2023, the Group reported a Total Recordable Injury Rate (TRIR) of 0.98, a metric they continue to strive to reduce further in 2024 and beyond.

- Employee Well-being: Prioritizing worker safety through advanced training and protective equipment.

- Product Integrity: Ensuring hydraulic systems meet rigorous safety standards for end-user protection.

- Risk Mitigation: Implementing strict safety management systems to prevent accidents and associated costs.

- Reputational Capital: Building trust and loyalty by demonstrating a strong commitment to health and safety.

Urbanization and Agricultural Shifts

Global urbanization continues at a rapid pace, with the UN projecting that 68% of the world's population will live in urban areas by 2050, up from 56% in 2021. This trend directly impacts Interpump Group by shifting demand towards equipment suitable for compact urban construction sites, potentially boosting sales of smaller hydraulic components. Conversely, as rural populations decline in some regions, agricultural mechanization may see increased adoption of advanced, efficient pumping systems to optimize land use.

Shifts in agricultural practices, such as the growing adoption of precision farming, are also a key factor. This approach, which relies on data-driven insights to manage crop production more efficiently, can increase the demand for sophisticated hydraulic and pumping solutions that enable precise application of water and fertilizers. For instance, the global precision farming market was valued at approximately $8.5 billion in 2023 and is expected to grow significantly in the coming years, presenting opportunities for Interpump’s specialized equipment.

- Urban Population Growth: Expected to reach 68% by 2050, influencing construction equipment demand.

- Precision Farming Adoption: Growing market valued at $8.5 billion in 2023, driving demand for specialized pumping solutions.

- Sustainable Agriculture: Increasing focus can lead to demand for water-efficient hydraulic systems in irrigation.

- Rural-to-Urban Migration: May necessitate more automated and efficient agricultural machinery in remaining rural areas.

Societal expectations are pushing Interpump Group towards greater corporate responsibility, emphasizing ethical labor practices and community engagement. The Group's 2024 sustainability report, building on its 2023-2025 ESG roadmap, underscores a commitment to these principles, vital for stakeholder trust.

A heightened societal focus on health and safety directly impacts Interpump Group, necessitating stringent protocols for both employees and end-users of their hydraulic components. The company's 2023 Total Recordable Injury Rate (TRIR) of 0.98 reflects an ongoing effort to improve safety performance, a critical aspect of risk mitigation and reputation management.

Demographic shifts, particularly the aging workforce in developed nations, pose challenges for Interpump Group, potentially increasing labor costs and creating skill shortages. The declining birth rates and rising median age in Europe observed in 2024 highlight the need for proactive talent development and acquisition strategies.

Technological factors

Interpump Group's research and development (R&D) capabilities are crucial for staying ahead in its competitive markets. The company's focus on innovation, particularly in advanced hydraulics and smart sensor technology, directly fuels its ability to offer cutting-edge solutions. In 2023, Interpump Group reported significant investment in its R&D infrastructure, including the establishment of new research and study benches, demonstrating a commitment to enhancing its technological development.

Interpump Group's manufacturing operations stand to benefit significantly from the ongoing integration of automation and Industry 4.0 technologies. By adopting advanced robotics and smart manufacturing principles, the company can achieve greater operational efficiency, leading to reduced production costs and a notable uplift in product quality. This digital transformation is not merely an advantage but a necessity for maintaining competitiveness in the fast-paced industrial sector.

The financial implications are substantial; for instance, by 2024, investments in smart factory technologies globally were projected to reach hundreds of billions of dollars, indicating a clear industry trend toward increased automation for cost savings and output enhancement. Interpump's strategic embrace of these advancements positions it to capitalize on these efficiency gains, further solidifying its market standing.

Innovations in material science are significantly impacting the pump and hydraulics industry. For Interpump Group, advancements mean access to lighter, yet more robust materials, which directly translates to pumps with enhanced performance and greater durability. For example, the development of advanced composites and specialized alloys allows for components that can withstand harsher operating conditions and corrosive environments, extending product lifespans.

These material breakthroughs aren't just about performance; they also offer a pathway to cost reduction and improved sustainability. Lighter materials can lead to lower shipping costs and reduced energy consumption during operation, aligning with Interpump Group's environmental, social, and governance (ESG) goals. In 2024, the company’s focus on optimizing its supply chain included exploring new material sourcing to maintain competitiveness.

Digitalization of Products and Services

Interpump Group is increasingly embedding digital technologies into its core offerings. For instance, IoT capabilities are being integrated into pumps, allowing for remote monitoring and predictive maintenance, which not only boosts operational efficiency for clients but also opens up new avenues for recurring revenue. This strategic shift towards digital services alongside physical products is crucial for building stronger customer loyalty and establishing a distinct competitive edge in the market.

The company's focus on digitalization is a response to broader industry trends. In 2024, the global industrial IoT market was valued at approximately $113.3 billion and is projected to grow significantly, reflecting a strong demand for connected and intelligent industrial solutions. This presents a clear opportunity for Interpump to leverage its expertise in fluid dynamics and integrate advanced digital features, thereby enhancing product value and customer engagement.

- IoT Integration: Interpump is enhancing its product lines with Internet of Things (IoT) capabilities for remote diagnostics and proactive servicing.

- New Revenue Streams: Digital services, such as data analytics platforms for pump performance, are being developed to complement existing product sales.

- Customer Value: Predictive maintenance, enabled by digital integration, reduces downtime for customers and increases the overall lifespan of Interpump equipment.

- Market Differentiation: The provision of integrated digital solutions helps Interpump stand out from competitors relying solely on traditional product offerings.

Competitive Technological Landscape

The competitive technological landscape is a critical factor for Interpump Group. The industry sees constant innovation, meaning Interpump must stay ahead of rivals introducing new pump designs, advanced hydraulic systems, and more efficient manufacturing processes. For instance, competitors in the industrial hydraulics sector have been investing heavily in smart technologies and IoT integration for predictive maintenance, a trend Interpump needs to actively counter. Failure to adapt to these rapid changes could result in a significant loss of market share and a weakening of its competitive edge.

Staying current is paramount. Interpump's ability to integrate cutting-edge materials and digital solutions into its product lines directly impacts its market position. For example, advancements in electric powertrain technology for mobile machinery are rapidly gaining traction, and Interpump's response to this shift will be crucial. The company needs to monitor competitor R&D spending and patent filings closely. In 2024, the global industrial pump market was estimated to be worth over $50 billion, with technological differentiation being a key driver of growth.

- Rapid Innovation: Competitors are consistently rolling out new pump technologies and hydraulic system improvements.

- Market Share Risk: Not keeping pace with rivals' advancements can lead to a decline in Interpump's market share.

- Digital Integration: The trend towards smart pumps and IoT capabilities necessitates continuous investment by Interpump.

- Manufacturing Efficiency: Competitors adopting new manufacturing techniques could offer cost advantages that pressure Interpump.

Technological advancements are reshaping Interpump Group's operational landscape. The company's strategic investments in R&D, particularly in areas like smart sensor technology and advanced hydraulics, are key to maintaining its competitive edge. By embracing Industry 4.0 principles and automation, Interpump enhances manufacturing efficiency, reduces costs, and improves product quality, aligning with global trends where smart factory investments were projected to reach hundreds of billions of dollars by 2024.

Integrating IoT into its products allows Interpump to offer predictive maintenance and data analytics, creating new revenue streams and increasing customer value. This move is supported by the booming global industrial IoT market, valued at approximately $113.3 billion in 2024. Furthermore, innovations in material science, such as advanced composites, are leading to more durable and efficient pumps, positively impacting both performance and sustainability metrics. The company's vigilance regarding competitor R&D, especially in areas like electric powertrains, is crucial in the over $50 billion global industrial pump market of 2024, where technological differentiation is a primary growth driver.

Legal factors

Interpump Group operates under a complex web of product liability and safety regulations worldwide, necessitating strict adherence to prevent legal repercussions. Failure to meet these standards, such as a critical safety flaw in one of their hydraulic pumps, could trigger expensive litigation, mandatory product recalls, and significant damage to their brand image.

For instance, in 2023, the automotive industry faced billions in settlements related to product defects, highlighting the potential financial impact of safety lapses. Interpump's commitment to rigorous quality assurance, including ISO certifications and ongoing safety testing of its hydraulic systems, is crucial for navigating this legal landscape and protecting its financial stability.

Protecting its intellectual property, especially patents for its innovative pump designs and hydraulic technologies, is paramount for Interpump Group's competitive edge. These patents are vital for safeguarding its technological advancements and market position.

Navigating the diverse legal frameworks for intellectual property rights across its global operations is a key challenge. Effective enforcement of these rights is essential to prevent unauthorized use and maintain its technological leadership.

Interpump Group maintains a robust global compliance program, underscoring its commitment to adhering to intellectual property laws worldwide and actively defending its patented innovations.

Interpump Group must navigate a complex web of labor laws across its global footprint, covering everything from minimum wage requirements and workplace safety standards to union negotiations and employee benefits. For instance, in Germany, where Interpump has a significant presence, the Works Constitution Act influences employee participation in company decisions. Failure to comply with these diverse regulations, which are constantly evolving, can lead to substantial fines and reputational damage.

Shifts in employment regulations directly affect Interpump Group's operational costs and strategic flexibility. For example, an increase in the minimum wage in a key operating region, such as Italy, could necessitate adjustments to payroll budgets. Similarly, new rules around contract work or employee benefits, like those being discussed in some EU member states concerning remote work policies for 2024/2025, could impact hiring strategies and the overall cost of labor, influencing the group's ability to adapt its workforce efficiently.

Antitrust and Competition Laws

Interpump Group, operating as a global entity with a broad range of products, must meticulously adhere to antitrust and competition regulations worldwide. These laws are designed to ensure fair market practices and prevent the formation of monopolies, impacting Interpump's strategic moves, particularly its mergers and acquisitions (M&A) activities.

The company's growth often involves acquiring other businesses, and these transactions typically require approval from competition authorities in relevant jurisdictions. For instance, in 2023, the European Commission approved Interpump's acquisition of a significant portion of the hydraulics business of Danfoss, subject to certain divestitures to maintain competition in specific markets. This highlights the rigorous scrutiny these deals face.

Failure to comply with these regulations can lead to severe consequences. Penalties can include substantial financial fines, which, for major antitrust violations, can reach millions or even billions of Euros, as seen in past cases involving other industrial conglomerates. Beyond financial penalties, non-compliance can result in protracted legal battles, reputational damage, and restrictions on future business operations.

- Regulatory Scrutiny: Interpump's M&A activities are consistently reviewed by antitrust bodies globally.

- Market Impact: Regulators assess potential impacts on market concentration and consumer choice.

- Compliance Costs: Adherence to varying competition laws across different regions incurs significant legal and advisory expenses.

- Potential Fines: Violations can result in fines potentially reaching up to 10% of global annual turnover for severe breaches.

Data Protection and Privacy Regulations

Interpump Group operates within a landscape increasingly shaped by stringent data protection and privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. These laws mandate how the company collects, processes, and stores sensitive customer, employee, and operational data. Non-compliance can result in significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher. For instance, in 2023, regulatory bodies continued to enforce these rules, issuing substantial fines for data breaches and privacy violations across various industries, underscoring the critical need for robust data governance frameworks.

Maintaining robust data security measures and ensuring strict adherence to privacy laws are not merely legal obligations but are fundamental to preserving stakeholder trust and the company's reputation. A single data breach could lead to reputational damage and a loss of customer confidence, impacting future business opportunities. Interpump Group's commitment to these principles is therefore essential for its long-term operational integrity and market standing.

The evolving nature of these regulations requires continuous vigilance and adaptation. As digitalization accelerates, the volume and sensitivity of data handled by companies like Interpump Group will only increase. Staying abreast of legislative changes and implementing proactive measures to safeguard data is paramount.

Key considerations for Interpump Group include:

- Data Minimization: Collecting only the data that is strictly necessary for specific, stated purposes.

- Consent Management: Ensuring clear and informed consent is obtained before processing personal data.

- Data Breach Response: Establishing protocols for timely detection, reporting, and remediation of any data security incidents.

- Third-Party Risk: Vetting and managing data handling practices of suppliers and partners to ensure their compliance.

Interpump Group faces significant legal challenges related to product liability and safety, requiring strict adherence to global standards. For instance, in 2023, the automotive sector saw billions in settlements for product defects, underscoring the financial risks of safety failures. Interpump's proactive quality assurance, including ISO certifications, is vital for mitigating these risks and protecting its brand and financial health.

Navigating intellectual property laws globally is critical for Interpump's competitive edge, particularly in protecting its patented hydraulic technologies. The company maintains a strong compliance program to defend its innovations against unauthorized use, ensuring its technological leadership remains secure.

Labor laws across Interpump's operating regions, from minimum wage to workplace safety and union relations, present ongoing compliance demands. For example, evolving regulations in the EU concerning remote work for 2024/2025 could impact labor costs and hiring strategies, affecting operational flexibility.

Antitrust and competition regulations heavily influence Interpump's strategic growth, especially mergers and acquisitions. The company's 2023 acquisition of a portion of Danfoss's hydraulics business, approved by the European Commission with divestiture conditions, illustrates the intense regulatory oversight on market concentration.

Environmental factors

Global efforts to curb climate change are intensifying, with governments worldwide implementing stricter regulations like carbon pricing and emissions caps. These measures directly influence Interpump Group's manufacturing operations and the very design of its products, pushing for more sustainable solutions.

Interpump Group is proactively addressing these environmental shifts by developing its Group Carbon Neutrality Strategy. A key objective within this strategy is to achieve a significant 30% reduction in carbon intensity by the year 2025, demonstrating a commitment to operational efficiency and environmental responsibility.

Interpump Group's operations are directly impacted by the availability and fluctuating costs of essential raw materials, such as steel, aluminum, and specialized alloys, driven by global resource depletion trends. Environmental regulations increasingly mandate sustainable sourcing, pushing companies like Interpump to invest in more resilient and ethically managed supply chains. For instance, the global demand for critical metals, vital for pump components, saw significant price volatility in late 2024 and early 2025 due to geopolitical factors and increased mining scrutiny.

To mitigate these environmental pressures, Interpump is actively integrating eco-design principles into its product development lifecycle, aiming to reduce material usage and improve recyclability. This focus on sustainability not only addresses regulatory compliance but also enhances long-term operational efficiency and market appeal, aligning with the growing consumer and investor preference for environmentally conscious manufacturing.

Interpump Group, like many industrial manufacturers, faces stringent environmental regulations concerning waste disposal, wastewater treatment, and air emissions. Compliance requires substantial capital expenditure on pollution control technologies, impacting operational costs. For instance, the European Union's Industrial Emissions Directive sets strict limits for pollutants, pushing companies to invest in advanced abatement systems.

Effective waste management is not just a legal necessity but also crucial for Interpump's corporate reputation and brand image. Consumers and investors are increasingly scrutinizing companies' environmental footprints. A proactive approach to minimizing waste and pollution can enhance brand loyalty and attract environmentally conscious investors, potentially improving access to capital.

In 2023, Interpump Group reported investments in environmental protection measures as part of its sustainability efforts, though specific figures for waste management and pollution control were not itemized separately. However, general trends in the industrial sector indicate that companies are allocating significant portions of their capital budgets to meet evolving environmental standards, a trend expected to continue through 2024 and 2025.

Water Usage and Conservation

Interpump Group's core business, centered on high-pressure pumps and water-jetting equipment, makes water usage and conservation critical environmental factors. The company operates in an industry directly tied to water management, highlighting the importance of responsible practices. In 2024, global concerns over water scarcity intensified, with regions like the Western United States experiencing prolonged drought conditions, underscoring the need for efficient water use across all industries.

Stricter regulations concerning industrial water consumption and wastewater discharge are increasingly shaping operational mandates for companies like Interpump. Societal expectations for robust water stewardship also exert pressure, influencing both how Interpump conducts its business and the types of products it develops, with a growing demand for water-saving technologies.

Interpump Group is actively addressing these environmental considerations. A key initiative involves the implementation of a comprehensive water monitoring system. This system is designed to track water intake, usage patterns, and discharge quality across its operations, providing data for improved efficiency and compliance. For example, during 2024 reporting, many industrial sectors saw an average reduction in water intensity by 5-10% year-over-year due to such monitoring and efficiency drives.

The company's commitment to water conservation is reflected in its product innovation. There's a clear market trend towards developing pumps and systems that minimize water waste and maximize water recycling capabilities. This focus aligns with broader sustainability goals and addresses the growing environmental footprint concerns of end-users in sectors ranging from manufacturing to agriculture.

Circular Economy Principles and Product Lifecycles

The increasing focus on circular economy principles is pushing Interpump Group to develop products that are built to last, easy to fix, and can be recycled at the end of their useful life. This means looking at the whole journey of a product, starting with choosing eco-friendly materials and planning how to handle it when it's no longer needed, all to lessen its environmental footprint and possibly open up new ways of doing business.

Interpump Group has already put in place eco-design rules for its offerings, with a strong emphasis on using sustainable raw materials and embedding circular economy concepts. For instance, in 2023, the company reported that over 80% of its new product development projects incorporated specific eco-design criteria, aiming to improve resource efficiency and reduce waste throughout the value chain.

- Product Durability: Designing pumps and hydraulic systems for extended operational life, reducing the frequency of replacement.

- Repairability: Making components modular and accessible for easier maintenance and repair, extending product usability.

- Recyclability: Utilizing materials that can be effectively recovered and repurposed at the end of a product's lifecycle.

- Sustainable Sourcing: Prioritizing the use of recycled content and responsibly sourced raw materials in manufacturing processes.

Intensifying global climate change initiatives are driving stricter environmental regulations, pushing Interpump Group towards greater sustainability in its manufacturing and product design. The company's proactive Group Carbon Neutrality Strategy aims for a 30% reduction in carbon intensity by 2025, reflecting a commitment to operational efficiency and environmental responsibility.

The availability and cost of raw materials like steel and aluminum are impacted by resource depletion and environmental regulations mandating sustainable sourcing. For example, critical metal prices saw volatility in late 2024 and early 2025 due to geopolitical factors and increased mining scrutiny.

Interpump is integrating eco-design principles to reduce material usage and improve recyclability, enhancing long-term efficiency and market appeal. Strict regulations on waste, wastewater, and emissions necessitate capital investment in pollution control technologies, impacting operational costs, with the EU's Industrial Emissions Directive setting stringent pollutant limits.

Water scarcity concerns in 2024 are intensifying, making water usage and conservation critical for Interpump's business. This pressure, coupled with societal expectations for water stewardship, influences product development towards water-saving technologies, with industrial sectors reporting average water intensity reductions of 5-10% in 2024.

PESTLE Analysis Data Sources

Our Interpump Group PESTLE Analysis is grounded in data from official government publications, reputable financial news outlets, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.