International Meal Company PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Meal Company Bundle

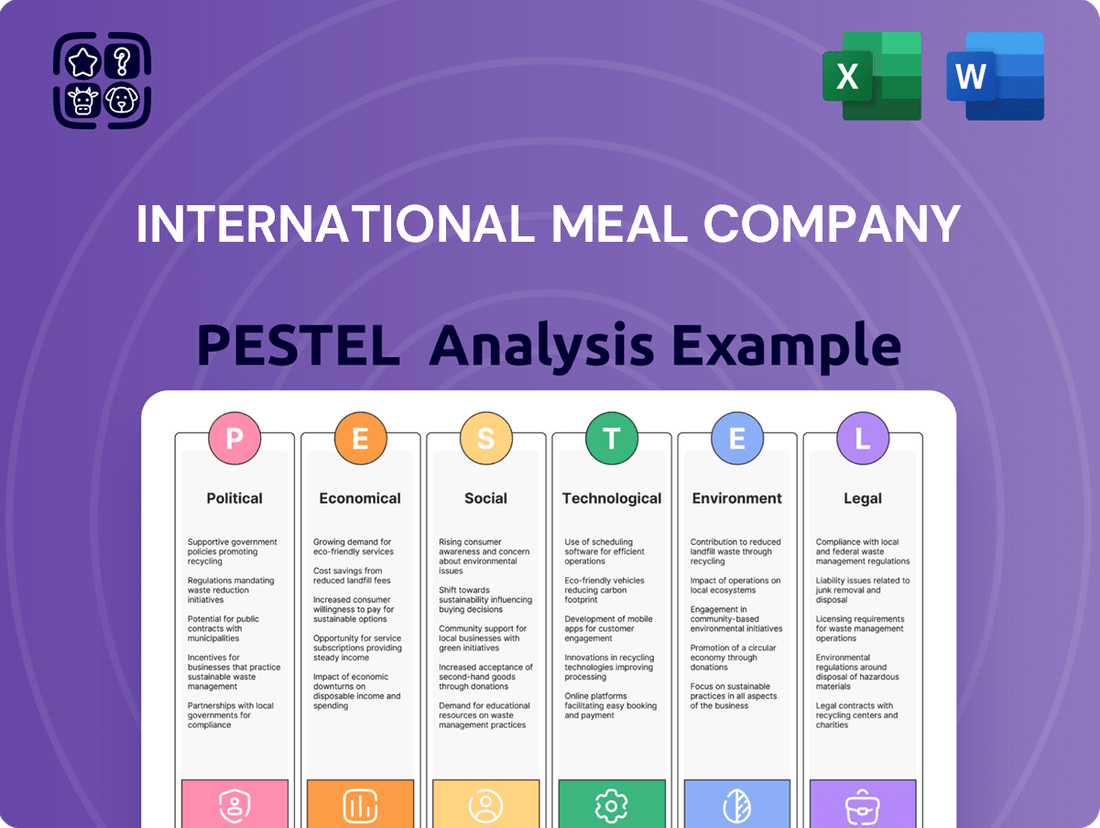

Navigate the complex external forces shaping International Meal Company's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends create both challenges and opportunities for the company. Gain actionable insights to inform your strategic decisions and competitive positioning. Download the full version now to unlock a deeper understanding and secure your market advantage.

Political factors

International Meal Company (IMC) navigates Brazil's evolving regulatory environment, particularly concerning food safety and public health, overseen by ANVISA. New resolutions in 2024-2025 are focusing on streamlining food product approvals and harmonizing with global standards, which could simplify compliance for IMC's varied brands.

Staying updated on these regulatory shifts, such as new guidelines for processed foods and packaging materials, is crucial for IMC to maintain operational adherence and prevent potential fines.

Brazilian labor laws are evolving, with significant implications for companies like International Meal Company (IMC). New regulations focus on equal pay and digital communication, directly affecting businesses with over 100 employees. For instance, companies must now produce transparency reports detailing gender-based wage gaps, a move aimed at promoting pay equity.

IMC, operating within this changing landscape, needs to adapt its human resource practices. The mandatory adoption of the Electronic Labour Domicile (eSocial) for official communications requires a streamlined digital approach to employee administration. These adjustments are crucial for maintaining compliance and mitigating potential legal challenges in 2024 and beyond.

Brazil's political stability and the government's policy support are crucial for International Meal Company (IMC). The country's G20 presidency in 2024 and its upcoming hosting of COP and BRICS summits in 2025 highlight a commitment to economic and regulatory practices, potentially leading to a more stable investment environment.

These global engagements suggest a focus on shaping commercial regulations, which could benefit IMC by creating a more predictable operational landscape. IMC's business, particularly its presence in high-traffic areas, is directly influenced by government decisions on infrastructure development and tourism promotion.

Taxation and Fiscal Policies

Changes in national and regional tax structures, such as shifts in corporate income tax rates or value-added tax (VAT) across IMC's operating countries, directly influence the company's net profitability and overall operational expenditures. For instance, Brazil, a key market for IMC, is known for its intricate tax system. In 2024, Brazil's federal government continued to discuss tax reforms aimed at simplifying the complex tax framework, which could potentially alter IMC's tax liabilities and compliance costs.

IMC must continually adapt its fiscal strategies to navigate these evolving tax landscapes. This includes optimizing its tax structure to mitigate risks associated with Brazil's historically high tax burden, estimated to be around 33% of GDP in recent years, and anticipating potential regulatory adjustments. Such optimizations are vital for managing the financial impact on raw material procurement and maintaining competitive pricing for consumers in the dynamic food service sector.

- Tax Burden Impact: Brazil's tax system can significantly increase the cost of doing business for companies like IMC.

- Regulatory Shifts: Potential reforms in Brazil could alter IMC's tax liabilities and necessitate strategic adjustments.

- Cost Management: Understanding tax implications is crucial for managing raw material costs and consumer pricing.

- Profitability: Effective fiscal strategy directly contributes to IMC's overall financial health and profitability.

Trade Policies and International Relations

International Meal Company (IMC), operating with licensed international brands, is significantly shaped by Brazil's trade policies and its international relationship dynamics. Changes in import tariffs on essential food ingredients or operational equipment directly impact IMC's supply chain costs and overall profitability. For instance, a shift in Brazil's tariff structure could alter the landed cost of imported goods, affecting margins for brands like Frango Assado or Viena.

Brazil's engagement in international trade agreements, such as Mercosur, also plays a crucial role. These agreements can either facilitate or hinder the movement of goods and services, influencing IMC's ability to source ingredients competitively or expand its brand presence across borders. The ongoing efforts by Brazil to harmonize its regulatory frameworks with international standards present both opportunities and challenges for IMC's global brand management and potential international expansion.

- Trade Agreements: Brazil's participation in trade blocs like Mercosur affects import duties on food products and operational supplies, directly impacting IMC's cost structure.

- Tariff Changes: Fluctuations in import tariffs on key ingredients (e.g., specific grains, spices) or restaurant equipment can alter IMC's cost of goods sold. For example, a 10% tariff increase on imported cooking oil could add millions to operational expenses annually.

- Regulatory Alignment: Brazil's progress in aligning with international food safety and labeling standards can streamline IMC's management of its diverse, licensed international brands, potentially reducing compliance complexities.

- Geopolitical Stability: Broader geopolitical shifts can influence investor confidence and capital flows into Brazil, indirectly affecting IMC's access to funding for expansion or modernization projects.

Brazil's political landscape directly influences International Meal Company (IMC) through government stability and policy direction. The nation's commitment to global forums like the G20 in 2024 and upcoming summits in 2025 signals a focus on economic and regulatory frameworks, potentially fostering a more predictable environment for businesses like IMC. These international engagements could lead to regulatory shifts that benefit IMC by creating clearer operational guidelines.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the International Meal Company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within the company's operating landscape.

A concise PESTLE analysis for International Meal Company offers a clear overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

This PESTLE analysis provides a structured framework to identify and address potential external challenges, thereby alleviating concerns about market volatility and competitive pressures for International Meal Company.

Economic factors

Rising disposable income in Brazil is a significant tailwind for the food service sector. In 2024, projections indicated continued growth in per capita disposable income, fueling greater consumer spending on dining out and a wider array of food choices. This trend directly supports International Meal Company's (IMC) diverse portfolio of quick-service, casual, and full-service restaurants.

The expansion of Brazil's middle class and ongoing urbanization are creating a stronger demand for convenience and novel culinary experiences. As more Brazilians have greater discretionary funds, they are increasingly opting for meals prepared outside the home, a behavior that aligns perfectly with IMC's business model and its ability to cater to evolving consumer preferences.

Inflationary pressures in Brazil, with a projected rate of 5.26% by March 2025, directly affect International Meal Company's (IMC) operational expenses. This includes the rising cost of key raw materials, such as coffee beans, a significant input for their QSR segment.

IMC must navigate these escalating costs while striving to keep menu prices competitive and preserve profit margins. This economic reality necessitates a proactive approach to cost management.

Strategies like optimizing supply chains, exploring alternative sourcing options, and renegotiating terms with suppliers are vital for IMC to effectively mitigate the impact of this economic factor and maintain financial resilience.

The Brazilian food service market is experiencing robust expansion, with projections indicating a value of USD 52.5 billion in 2024, expected to climb to USD 93.2 billion by 2033. This upward trajectory signals a fertile ground for investment, driving innovation and consolidation within the industry.

Significant capital is flowing into Brazil's food sector, with a noteworthy BRL 40 billion invested in 2024 alone, underscoring investor confidence in the market's growth potential. This trend fuels opportunities for companies like International Meal Company (IMC) to leverage market dynamics.

IMC's own financial achievements, such as a 14% adjusted EBITDA growth in Q4 2024, demonstrate its capacity to benefit from and contribute to this expanding market. Such performance suggests IMC is well-positioned to capitalize on the increasing consumer spending and evolving dining habits in Brazil.

Foreign Exchange Rate Fluctuations

Fluctuations in the Brazilian Real (BRL) significantly affect International Meal Company (IMC). As of early 2024, the BRL has experienced volatility against major currencies like the US Dollar and Euro. A weaker Real, for instance, directly escalates the cost of IMC's imported ingredients and franchise fees tied to international brands, potentially squeezing profit margins.

Conversely, a stronger Real can present strategic advantages. It could make it more financially appealing for IMC to pursue international expansion opportunities or acquire foreign businesses, as the cost of such ventures would be relatively lower in local currency terms.

- Brazilian Real Volatility: The BRL's exchange rate against the USD and EUR has shown notable fluctuations throughout 2024, impacting import costs for IMC.

- Import Cost Impact: A depreciating Real increases the BRL cost of essential imported ingredients and royalty payments for licensed international brands.

- Expansion Attractiveness: A strengthening Real can lower the BRL-denominated cost of international acquisitions or market entry for IMC.

- Profitability Squeeze: Unfavorable exchange rate movements can directly reduce IMC's net profit due to higher operational expenses for its international brand portfolio.

Access to Credit and Capital Markets

Access to credit and capital markets is crucial for International Meal Company's (IMC) growth, funding everything from new restaurant openings to essential renovations and day-to-day operations. IMC's financial health, demonstrated by a manageable leverage ratio of 2.4 times net debt as of Q4 2024, positions it favorably for securing the necessary capital.

The broader economic environment in Brazil significantly impacts IMC's ability to raise funds. A positive investment climate and strong investor confidence are key drivers that will enable IMC to attract the financing needed for its ambitious expansion strategies.

- Credit Availability: The ease and cost of borrowing directly affect IMC's capacity for expansion and operational funding.

- Leverage Ratio: IMC's Q4 2024 net debt to leverage ratio of 2.4 indicates prudent debt management, enhancing access to capital.

- Investment Climate in Brazil: Favorable economic conditions and investor sentiment in Brazil are critical for IMC's future financing.

- Capital Market Access: The company's ability to tap into capital markets influences its potential for significant growth initiatives.

Brazil's economic landscape presents both opportunities and challenges for International Meal Company (IMC). Rising disposable incomes and a growing middle class, particularly in urban centers, are driving increased consumer spending on dining out, directly benefiting IMC's diverse restaurant portfolio. However, persistent inflation, projected at 5.26% by March 2025, is escalating operational costs, especially for key ingredients like coffee beans, necessitating proactive cost management and supply chain optimization.

The Brazilian food service market is a significant growth area, valued at an estimated USD 52.5 billion in 2024 and projected to reach USD 93.2 billion by 2033, attracting substantial investment. IMC's own financial performance, including a 14% adjusted EBITDA growth in Q4 2024, reflects its ability to capitalize on these market dynamics, although currency volatility, particularly with the Brazilian Real, can impact import costs and international franchise fees.

| Economic Factor | Data Point | Impact on IMC |

|---|---|---|

| Disposable Income Growth | Continued growth projected for 2024 | Increased consumer spending on dining out |

| Inflation Rate (projected) | 5.26% by March 2025 | Higher operational costs for raw materials |

| Food Service Market Value (2024) | USD 52.5 billion | Significant growth opportunity |

| Brazilian Real Volatility | Notable fluctuations in 2024 | Impacts import costs and franchise fees |

| IMC Leverage Ratio (Q4 2024) | 2.4x net debt | Facilitates access to capital for expansion |

What You See Is What You Get

International Meal Company PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the International Meal Company delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understanding these elements is crucial for strategic planning and sustained growth in the dynamic food service industry.

Sociological factors

Urbanization in Brazil, with a growing percentage of the population now residing in cities, coupled with increasingly demanding work schedules, is fueling a powerful trend towards convenience. This societal shift means more consumers are opting for dining out and ready-to-eat meals rather than cooking at home. This directly plays into the hands of International Meal Company (IMC), as their strategy often involves locating restaurants in high-traffic urban areas, catering to this very need for accessible and quick meal solutions.

In 2024, it's estimated that over 87% of Brazil's population lives in urban centers, a figure that continues to climb. This demographic reality underscores the sustained demand for food service options. IMC's diverse portfolio, ranging from quick-service restaurants to full-service dining, is well-positioned to capture this market. The ongoing preference for convenience over home preparation is a key driver for the food service industry's continued expansion in the region.

Consumer demand for healthier, organic, and locally sourced food is on the rise in Brazil, fueled by heightened health and environmental awareness. This shift directly impacts International Meal Company (IMC) as it navigates evolving consumer tastes.

To stay competitive, IMC must adapt its menu to feature more nutritious and plant-based options, aligning with these growing preferences. For example, reports from 2024 indicated a significant increase in consumer spending on healthy food products, with projections suggesting continued growth through 2025.

This trend isn't just about menu changes; it also shapes IMC's innovation pipeline and marketing strategies, pushing the company to communicate its commitment to wellness and sustainability more effectively.

The surge in food delivery culture, particularly in Brazil, has been a seismic shift in consumer habits. Post-pandemic, people increasingly rely on apps like iFood and Rappi, valuing the convenience and safety of contactless delivery. This trend is not fleeting; in 2024, the Brazilian online food delivery market is projected to generate substantial revenue, with user penetration expected to climb significantly.

Consumers are actively seeking out deals and discounts, making promotional strategies crucial for restaurants. This preference for digital ordering and delivery means International Meal Company (IMC) must double down on its digital infrastructure and forge stronger alliances with these delivery platforms. Capturing this expanding segment of the market is essential for sustained growth.

Cultural Diversity and Culinary Preferences

Brazil's cultural tapestry significantly influences its food service landscape, with a strong demand for both authentic Brazilian flavors and global culinary trends. This rich heritage, shaped by indigenous, European, African, and Asian influences, means consumers appreciate a wide array of tastes. For instance, a 2024 report indicated that while feijoada remains a national favorite, interest in Japanese and Italian fusion dishes has grown by 15% in urban centers.

International Meal Company (IMC) leverages this diversity through its strategic multi-brand approach. By operating both its own popular brands and international licensed franchises, IMC effectively caters to the varied preferences of the Brazilian consumer base. This strategy allows them to tap into different dining segments, from fast-casual to more traditional eateries, ensuring broad market appeal.

- Diverse Culinary Demand: Brazil's consumers actively seek a mix of traditional Brazilian dishes and international cuisines, reflecting deep cultural influences.

- Market Responsiveness: IMC's portfolio, encompassing both proprietary and licensed international brands, is designed to meet these varied and evolving consumer tastes.

- Growth Opportunities: The increasing appreciation for international flavors, alongside enduring love for local cuisine, presents significant opportunities for IMC to expand its market reach.

Social Media Influence and Dining Experiences

Social media has become a powerful engine for restaurant promotion, with platforms like Instagram and TikTok driving significant interest in trending dishes and new dining concepts. For instance, a study in early 2024 indicated that over 60% of consumers discover new restaurants through social media recommendations. This trend directly impacts International Meal Company (IMC) by highlighting the need for robust online engagement to boost brand visibility and attract a wider customer base.

Beyond mere promotion, consumers are increasingly seeking unique and memorable dining experiences that offer value beyond just the price point. This includes factors like ambiance, service quality, and the overall story a restaurant tells. In 2024, consumer spending on experiential dining continued to rise, with many willing to pay a premium for novelty and quality. IMC can capitalize on this by curating distinctive experiences that resonate with diners.

- Social Media as a Discovery Tool: In 2024, platforms like TikTok and Instagram are crucial for restaurant discovery, with user-generated content significantly influencing dining choices.

- Experiential Dining Demand: Consumers are prioritizing unique experiences and value, not just food cost, driving a trend towards restaurants offering more than just a meal.

- Brand Visibility through Engagement: IMC's strategy must include leveraging social media marketing to showcase unique offerings and create engaging content that builds brand loyalty.

- Competitive Differentiation: Focusing on memorable customer experiences is key for IMC to stand out in a crowded market, attracting and retaining customers through exceptional service and atmosphere.

The increasing demand for convenience, driven by urbanization and demanding lifestyles, significantly benefits International Meal Company (IMC). With over 87% of Brazil's population urbanized in 2024, the need for quick, accessible meal solutions is paramount. IMC's strategic urban presence and diverse offerings directly address this trend, positioning them to capture a substantial share of the market.

Consumer preferences are shifting towards healthier, organic, and locally sourced options, reflecting growing health and environmental consciousness. Reports from 2024 show increased spending on healthy foods, with continued growth projected through 2025. IMC must adapt its menus and marketing to align with these evolving tastes to maintain competitiveness.

The rise of food delivery culture, amplified by platforms like iFood, is a major societal shift impacting dining habits. The Brazilian online food delivery market is expected to generate substantial revenue in 2024, with user penetration climbing. IMC's investment in digital infrastructure and partnerships with delivery services is crucial for capitalizing on this trend.

Cultural diversity in Brazil fuels a strong appetite for both traditional and international cuisines. IMC's multi-brand strategy, including international franchises, effectively caters to this varied demand. For example, while feijoada remains popular, interest in fusion dishes grew by 15% in urban areas in 2024.

Social media plays a vital role in restaurant discovery, with over 60% of consumers finding new eateries through online recommendations in early 2024. Furthermore, consumers increasingly value unique dining experiences. IMC needs to leverage social media for brand visibility and focus on creating memorable experiences to differentiate itself.

Technological factors

The Brazilian food service market is seeing a significant shift with the increasing popularity of digital ordering and delivery platforms. International Meal Company (IMC) needs to prioritize investment in its digital infrastructure to improve customer interaction and operational efficiency. In 2024, online food delivery in Brazil was projected to reach over BRL 30 billion, highlighting the immense potential of these channels.

IMC's strategy must include optimizing its own apps and partnering with third-party delivery services to broaden its customer base. The emergence of ghost kitchens and virtual restaurant concepts offers IMC opportunities to expand its offerings and potentially reduce overhead costs. For instance, by mid-2025, it's anticipated that virtual brands will account for a substantial portion of delivery-only sales in major Brazilian cities.

Data analytics is transforming how companies like International Meal Company (IMC) connect with customers. By leveraging vast amounts of data, IMC can gain deep insights into what consumers want, allowing for highly personalized menu options and targeted promotions. This is becoming essential in today's digital landscape where consumers expect tailored experiences.

For instance, in 2024, the global big data and business analytics market was projected to reach over $350 billion, highlighting the widespread adoption and perceived value of these technologies. IMC can utilize this trend to refine its offerings, perhaps by analyzing order history to predict demand for specific dishes or to identify popular ingredient combinations, thereby boosting customer satisfaction and loyalty.

Beyond personalization, data analytics significantly enhances operational efficiency, particularly in inventory management. By accurately forecasting demand based on historical data and external factors, IMC can minimize waste and ensure the availability of popular items. This data-driven approach to inventory control can lead to substantial cost savings, with some businesses reporting reductions in food waste by as much as 10-15% through advanced analytics.

The increasing integration of advanced kitchen technology, like AI-powered prep stations and automated cooking equipment, is a significant technological factor. For instance, in 2024, the global food service automation market was valued at approximately $3.5 billion and is projected to grow substantially. This adoption directly impacts operational efficiency and consistency in food preparation.

Digital ordering systems, including mobile apps and self-service kiosks, are also transforming the food service landscape. By 2025, it's estimated that over 70% of quick-service restaurant orders will be placed digitally. This trend allows for faster order processing and reduces errors, directly benefiting establishments prioritizing speed and accuracy.

Investments in kitchen automation are proving crucial for cost reduction and quality enhancement. Companies are seeing up to a 15% reduction in food waste and a 20% increase in throughput with automated solutions. This is particularly beneficial for quick-service restaurants where maintaining consistent quality at high volumes is paramount.

Customer Relationship Management (CRM) Systems

Customer Relationship Management (CRM) systems are pivotal for International Meal Company (IMC) to cultivate stronger customer connections and foster loyalty. By leveraging CRM, IMC can personalize interactions, track individual preferences, and implement targeted promotions, ultimately driving repeat business. For instance, a successful loyalty program, often managed through CRM, can significantly boost customer retention. In 2024, the global CRM market was valued at approximately $67.9 billion, with projections indicating continued growth, underscoring its importance for businesses like IMC aiming for customer engagement.

IMC can utilize CRM data to understand buying patterns and tailor marketing efforts. This data-driven approach allows for the creation of customized offers and communications, enhancing the customer experience. For example, identifying customers who frequently purchase specific menu items enables IMC to present them with relevant new product announcements or special discounts, thereby increasing their lifetime value and transforming them into brand advocates.

The strategic implementation of CRM systems contributes directly to IMC's competitive advantage by building robust brand commitment. A well-managed CRM platform helps in anticipating customer needs and proactively addressing them, which is crucial in the fast-paced food service industry. This focus on personalized service, supported by technology, can lead to higher customer satisfaction scores and a more resilient customer base, especially as digital engagement continues to rise.

- Personalized Engagement: CRM enables IMC to tailor communications and offers based on individual customer data, improving the dining experience.

- Loyalty Programs: Technology facilitates the management of loyalty programs, rewarding repeat customers and encouraging continued patronage.

- Data-Driven Insights: CRM systems provide valuable analytics on customer behavior, allowing IMC to refine marketing strategies and product development.

- Increased Retention: By fostering stronger relationships, CRM helps IMC reduce customer churn and build a base of long-term, loyal patrons.

Supply Chain Technology and Traceability

Technological advancements are revolutionizing supply chain management, with enhanced traceability systems at the forefront. For International Meal Company (IMC), this means a significant opportunity to bolster both sustainability and operational efficiency. By adopting these cutting-edge technologies, IMC can gain deeper insights into its ingredient sourcing, ensuring greater transparency and adherence to ethical production standards.

The increasing consumer demand for ethically sourced and traceable food products presents a compelling case for IMC to invest in advanced supply chain technologies. For instance, blockchain technology is emerging as a powerful tool for creating immutable records of a product's journey from farm to fork. This can help IMC verify claims about sustainable farming practices or fair labor conditions. In 2024, the global supply chain traceability market was valued at approximately USD 4.5 billion and is projected to grow significantly, indicating a strong market trend IMC can capitalize on.

Leveraging these technologies allows IMC to:

- Verify the origin and sustainability of ingredients, meeting growing consumer expectations for transparency.

- Improve inventory management and reduce waste through real-time tracking and data analytics.

- Enhance food safety and recall efficiency by pinpointing the exact source of any issues.

- Build stronger brand loyalty by communicating a clear commitment to ethical and sustainable practices.

Technological factors are fundamentally reshaping the food service industry, directly impacting how companies like International Meal Company (IMC) operate and engage with customers. The surge in digital ordering and delivery platforms, coupled with advancements in data analytics and kitchen automation, presents both opportunities and necessities for IMC to adapt and thrive in the evolving market landscape. By mid-2025, virtual brands are expected to capture a significant share of delivery-only sales in major Brazilian cities, underscoring the importance of digital presence.

Legal factors

Brazilian regulatory bodies, notably ANVISA, continuously revise food safety and health standards for processed foods, packaging, and ingredients. International Meal Company (IMC) must adhere rigorously to these dynamic regulations to preserve customer confidence and avert legal repercussions.

New directives for 2024-2025 are designed to simplify approval pathways by recognizing international regulatory approvals, a move that could positively impact IMC's global brands by potentially reducing time-to-market for new products or ingredients sourced internationally.

Brazil's labor landscape is shaped by robust legislation like the Federal Constitution and the Consolidation of Labor Laws (CLT), dictating terms for working hours, minimum wage, and employee termination. These laws are subject to ongoing evolution, with 2024-2025 seeing a heightened focus on achieving gender pay equity and mandating the use of the Electronic Labour Domicile for official communications.

International Meal Company (IMC) must diligently adhere to these evolving labor laws to prevent penalties and foster positive employee relationships, particularly as regulatory oversight is anticipated to intensify in the coming year.

International Meal Company (IMC) navigates a landscape shaped by stringent consumer protection laws in Brazil. These regulations, covering areas like transparent pricing, advertising integrity, and effective complaint resolution, are fundamental to IMC's operations. For instance, Brazil's Consumer Defense Code (CDC) mandates clear and accurate information about products and services, directly impacting how IMC markets its restaurant offerings.

Compliance with these consumer protection statutes is not merely a legal obligation but a strategic imperative for IMC. Failure to adhere can lead to significant penalties, damage to brand trust, and costly legal battles. In 2024, consumer advocacy groups continue to be highly active, ensuring that companies like IMC maintain high standards of ethical conduct and customer engagement.

Franchise and Licensing Agreements

International Meal Company (IMC) operates under intricate franchise and licensing agreements, which are fundamental to its business model of managing international food and beverage brands. These contracts meticulously outline brand standards, operational protocols, and the financial obligations, such as royalty payments, owed to the brand owners. For instance, a typical franchise agreement might stipulate specific sourcing requirements for ingredients, which directly impacts IMC's supply chain management and costs.

Adherence to these legal frameworks is paramount to IMC's success. Failure to comply can lead to significant repercussions, including termination of valuable brand partnerships and costly legal disputes. In 2024, the global food service industry saw an increase in litigation related to intellectual property and contract breaches, highlighting the critical need for rigorous compliance by companies like IMC.

- Brand Standards Compliance: Agreements often mandate strict adherence to brand presentation, menu offerings, and customer service levels, directly impacting operational consistency and brand reputation.

- Royalty and Fee Structures: Licensing contracts define royalty percentages and other fees, which are crucial for financial planning and profitability analysis. For example, a 5% royalty on gross sales is a common benchmark.

- Territorial Rights: Agreements specify the geographical areas where IMC is permitted to operate specific brands, influencing market expansion strategies and competitive positioning.

- Dispute Resolution Mechanisms: Contracts typically include clauses for arbitration or mediation, providing pathways to resolve disagreements with licensors outside of traditional court systems.

Data Privacy and Cybersecurity Regulations

International Meal Company (IMC) must navigate Brazil's General Law for the Protection of Personal Data (LGPD). This regulation mandates strict handling of customer data collected through digital platforms, a significant aspect of IMC's operations. Failure to comply can result in substantial fines, with penalties under LGPD potentially reaching up to 2% of a company's revenue in Brazil, capped at R$50 million per infringement, as reported by various legal analyses in 2023 and 2024.

Ensuring robust cybersecurity measures is paramount for IMC. Data breaches not only lead to legal penalties but also severe reputational damage, eroding customer trust. For instance, a 2024 report by a cybersecurity firm indicated a 40% increase in data breaches targeting the food service industry in Latin America, highlighting the heightened risk landscape.

- LGPD Compliance: Adherence to Brazil's data privacy law is non-negotiable for IMC's digital operations.

- Cybersecurity Investment: Proactive investment in cybersecurity is essential to prevent breaches and protect customer data.

- Reputational Risk: Data breaches can severely damage IMC's brand image and customer loyalty.

- Financial Penalties: Non-compliance with LGPD can incur significant financial penalties, impacting profitability.

International Meal Company (IMC) must remain vigilant regarding evolving Brazilian food safety regulations, with ANVISA's directives for 2024-2025 potentially easing international product approvals. Labor laws, including those focusing on gender pay equity and digital employee communication for 2024-2025, require strict adherence to avoid penalties and maintain positive employee relations.

Consumer protection laws, such as Brazil's Consumer Defense Code, necessitate transparent pricing and accurate advertising, with consumer advocacy groups actively monitoring compliance in 2024. Furthermore, IMC's franchise and licensing agreements are critical, with industry-wide litigation over contract breaches increasing in 2024, underscoring the need for meticulous compliance.

Brazil's LGPD mandates robust data protection, with potential fines up to 2% of revenue for non-compliance, a risk amplified by a reported 40% increase in data breaches in Latin America's food service sector in 2024.

Environmental factors

International Meal Company (IMC) faces increasing pressure from consumers and regulators to embrace sustainable practices. This includes a strong emphasis on reducing waste, enhancing recycling programs, and ensuring responsible disposal of all waste streams. For instance, in 2023, the food service industry globally saw a surge in initiatives aimed at cutting food waste, with many companies setting ambitious targets for reduction by 2025.

IMC's dedication to environmental sustainability and alignment with government adaptation strategies will significantly impact its public perception and operational effectiveness. A proactive approach to waste management not only mitigates environmental impact but also can lead to cost savings through resource efficiency, a trend highlighted by a 2024 report indicating that companies with robust sustainability programs often outperform their peers financially.

Consumers are increasingly seeking plant-based and locally sourced ingredients, a trend fueled by heightened awareness of environmental impact and personal health. This shift presents an opportunity for International Meal Company (IMC) to enhance its menu offerings with more sustainable and ethically procured items.

By actively engaging with suppliers to promote sustainable business practices, IMC can better align with evolving consumer preferences and anticipate future regulatory requirements. For instance, in 2024, the global plant-based food market was projected to reach over $74 billion, indicating a significant and growing demand for such ingredients.

International Meal Company (IMC), with its extensive network of restaurants and food service operations, particularly in busy urban centers, inherently requires substantial energy for daily functioning. This includes powering kitchens, maintaining refrigeration, and providing lighting and climate control for customer areas.

The increasing global emphasis on sustainability and the rising costs associated with traditional energy sources present a clear opportunity for IMC to explore and implement renewable energy solutions. For instance, integrating solar panels for water heating or electricity generation at its various outlets could significantly lower its carbon footprint and lead to considerable operational cost savings over time. This strategic shift is not only environmentally responsible but also aligns with growing consumer demand for eco-conscious businesses.

Globally, renewable energy sources are becoming more competitive. In 2024, solar energy costs have continued to decline, making it an increasingly viable option for large-scale commercial adoption. For example, the levelized cost of electricity for utility-scale solar photovoltaic projects in many regions is now competitive with, or even cheaper than, fossil fuel-based power generation, according to recent industry reports.

Packaging and Plastic Reduction

Environmental concerns are increasingly shaping how companies like International Meal Company (IMC) operate, particularly regarding packaging. Consumers are actively seeking out businesses that demonstrate a commitment to sustainability, pushing for reduced plastic waste. This trend is directly influencing product development and overall industry practices.

IMC has a significant opportunity to innovate by exploring and implementing eco-friendly packaging solutions. This not only addresses the growing demand for environmentally responsible products but also aligns with a broader shift towards minimizing plastic usage across the food service sector. For instance, by 2024, many European countries have implemented or are planning to implement stricter regulations on single-use plastics, impacting companies operating within these markets.

Key areas for IMC to focus on include:

- Material Innovation: Investigating and adopting biodegradable, compostable, or recycled materials for food packaging.

- Waste Reduction Strategies: Implementing programs to minimize packaging waste throughout the supply chain and in-store operations.

- Consumer Education: Communicating sustainability efforts to consumers to build brand loyalty and encourage participation in recycling or composting programs.

- Regulatory Compliance: Staying ahead of evolving environmental regulations related to packaging and waste management, particularly in markets like Sweden and Finland where IMC has a strong presence.

Climate Change and Resource Scarcity

Climate change poses significant risks to International Meal Company's (IMC) supply chain, impacting agricultural yields and the availability of key ingredients. For instance, extreme weather events, projected to intensify, could disrupt the sourcing of produce and proteins, potentially leading to increased ingredient costs. IMC's reliance on a stable agricultural output means that shifts in climate patterns directly affect its operational expenses and product pricing strategies.

Adapting to and mitigating these environmental shifts is crucial for IMC's long-term viability. Proactive strategies, such as investing in climate-resilient agriculture and diversifying sourcing locations, can build resilience against supply chain disruptions. Furthermore, a focus on water conservation and efficient resource management within IMC's own operations will be essential, especially in regions facing increasing water stress. For example, by 2025, many agricultural regions IMC operates in are expected to see a notable increase in water scarcity, according to recent environmental reports.

- Supply Chain Vulnerability: Climate change impacts agricultural productivity, affecting ingredient availability and cost volatility for IMC.

- Resource Management: Efficient water usage and conservation are critical for IMC's operational sustainability, particularly in water-scarce regions.

- Adaptation Strategies: Investing in climate-resilient sourcing and operational efficiencies will be key to IMC's long-term business resilience.

- Cost Implications: Fluctuations in crop yields and resource availability due to climate change can directly influence IMC's cost of goods sold.

Environmental factors significantly influence International Meal Company's (IMC) operations, from consumer demand for sustainable products to the impact of climate change on supply chains. IMC must navigate increasing pressure for waste reduction, with the global food service industry setting ambitious targets for cutting food waste by 2025.

The company's commitment to sustainability, including embracing renewable energy and eco-friendly packaging, is crucial for cost savings and positive consumer perception, especially as renewable energy sources like solar become more cost-competitive in 2024.

Climate change also presents risks, potentially disrupting ingredient sourcing and increasing costs, necessitating IMC's investment in climate-resilient agriculture and resource management by 2025.

| Environmental Factor | Impact on IMC | 2024/2025 Data/Trend |

|---|---|---|

| Waste Management | Consumer and regulatory pressure for reduction; cost savings from efficiency. | Global food service industry targeting significant food waste reduction by 2025. |

| Energy Consumption | High operational energy needs; opportunity for cost savings via renewables. | Solar energy costs continue to decline in 2024, making it competitive with fossil fuels. |

| Consumer Preferences | Growing demand for plant-based and locally sourced ingredients. | Global plant-based food market projected to exceed $74 billion by 2024. |

| Packaging | Need for eco-friendly solutions to reduce plastic waste. | Stricter regulations on single-use plastics in Europe impacting businesses. |

| Climate Change | Supply chain disruption, ingredient cost volatility, water scarcity risks. | Increased water stress in agricultural regions by 2025 expected. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for International Meal Company is built on a robust foundation of data from official government statistics, reputable market research firms, and international economic organizations. We meticulously gather insights on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive view.