International Meal Company Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Meal Company Bundle

International Meal Company faces a dynamic competitive landscape, with moderate bargaining power from suppliers and buyers influencing pricing and product offerings. The threat of new entrants is a significant consideration, as is the constant pressure from substitute products and services within the food and beverage sector.

This snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore International Meal Company’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for International Meal Company (IMC) leans towards moderate to high, especially when the market for essential ingredients or licensed international brands is concentrated. If IMC relies on a small number of specialized providers for critical components, like unique coffee beans or proprietary food items, these suppliers can exert significant influence. This situation is amplified for licensed brands where strict product specifications can restrict the pool of available suppliers.

For International Meal Company (IMC), high switching costs with suppliers, such as those stemming from long-term contracts or specialized equipment needs for particular ingredients, would significantly bolster supplier bargaining power. Conversely, if IMC can readily shift between providers for common items like fresh produce or standard dairy products without incurring substantial expenses, the suppliers' leverage is considerably weakened.

The bargaining power of suppliers for International Meal Company (IMC) is significantly influenced by the uniqueness of their inputs. When suppliers offer exclusive regional produce or specialized food processing services, their leverage naturally increases. This is particularly true if these inputs are crucial for IMC's unique menu items or contribute to its brand image.

For instance, if IMC relies on a specific supplier for a rare spice blend that differentiates its signature dishes, that supplier holds considerable power. Conversely, for common, readily available food items like basic grains or standard meats, the bargaining power of suppliers is considerably lower, as IMC can easily switch to alternative sources.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into the food service industry, essentially starting their own restaurants or food outlets, would significantly boost their bargaining power. This scenario is generally less prevalent for suppliers of common food items but becomes a more tangible concern for providers of highly specialized ingredients who also possess strong brand recognition.

For International Meal Company (IMC), this means that if a key supplier of a unique sauce or a proprietary spice blend were to launch its own chain of restaurants, it could divert supply or leverage its own brand to compete directly. Such a move would dramatically alter the power dynamic, potentially forcing IMC to pay higher prices for essential inputs or face direct competition from its own ingredient providers.

- Forward Integration Threat: Suppliers could start their own restaurants, increasing their leverage over IMC.

- Specialized Ingredients: This threat is more significant for suppliers of unique or branded ingredients.

- Potential Impact: Could lead to higher ingredient costs or direct competition for IMC.

Importance of IMC to Supplier's Business

The bargaining power of suppliers for International Meal Company (IMC) is significantly influenced by how crucial IMC is to their overall business. If IMC constitutes a substantial portion of a supplier's revenue, that supplier might have less leverage, as they'd be more reliant on maintaining the relationship with IMC. This dependence can temper their ability to dictate terms or raise prices aggressively.

Conversely, for major, broadly diversified food and beverage suppliers, IMC might represent a relatively small segment of their client base. In such scenarios, IMC's individual importance diminishes, and these larger suppliers, with their own scale and market presence, would likely wield greater bargaining power. Their ability to serve numerous other clients means they are less susceptible to pressure from any single customer like IMC.

For instance, in 2024, the global food and beverage supplier market is characterized by consolidation and significant players. Companies like Nestlé or Unilever, major suppliers to many food service businesses, often have the upper hand due to their vast production capacities and extensive distribution networks. IMC's purchasing volume, while important, might not be a deciding factor for such giants.

- Supplier Dependence: If IMC is a primary customer, a supplier's bargaining power is reduced.

- Supplier Diversification: For large, diversified suppliers, IMC's business is less critical, increasing supplier leverage.

- Market Concentration: The food supply chain in 2024 shows significant power held by large, consolidated suppliers.

- Negotiating Leverage: A supplier's ability to negotiate favorable terms often correlates with their market share and the importance of IMC as a client.

The bargaining power of suppliers for International Meal Company (IMC) is influenced by the concentration of the supplier market and the availability of substitutes. When few suppliers dominate the market for essential ingredients, like specialized coffee beans or proprietary sauces, their ability to dictate terms increases. For example, in 2024, the global coffee bean market, particularly for specific origin beans, can see suppliers with significant leverage due to limited production and high demand.

IMC's reliance on these specialized suppliers, coupled with potential high switching costs due to contract terms or unique processing needs, further amplifies supplier power. Conversely, for common ingredients like standard produce or meats, where numerous suppliers exist and switching costs are low, IMC's bargaining position is stronger.

The threat of suppliers engaging in forward integration, such as opening their own restaurant chains, also bolsters their bargaining power, especially for those providing unique or branded ingredients.

| Factor | Impact on IMC's Supplier Bargaining Power | 2024 Market Context Example |

| Supplier Market Concentration | High | Limited suppliers for specialty coffee beans |

| Availability of Substitutes | Low for specialized inputs | Few alternatives for proprietary sauces |

| Switching Costs | High for specialized inputs | Long-term contracts, unique processing needs |

| Forward Integration Threat | Moderate to High for branded suppliers | Suppliers launching own food service ventures |

What is included in the product

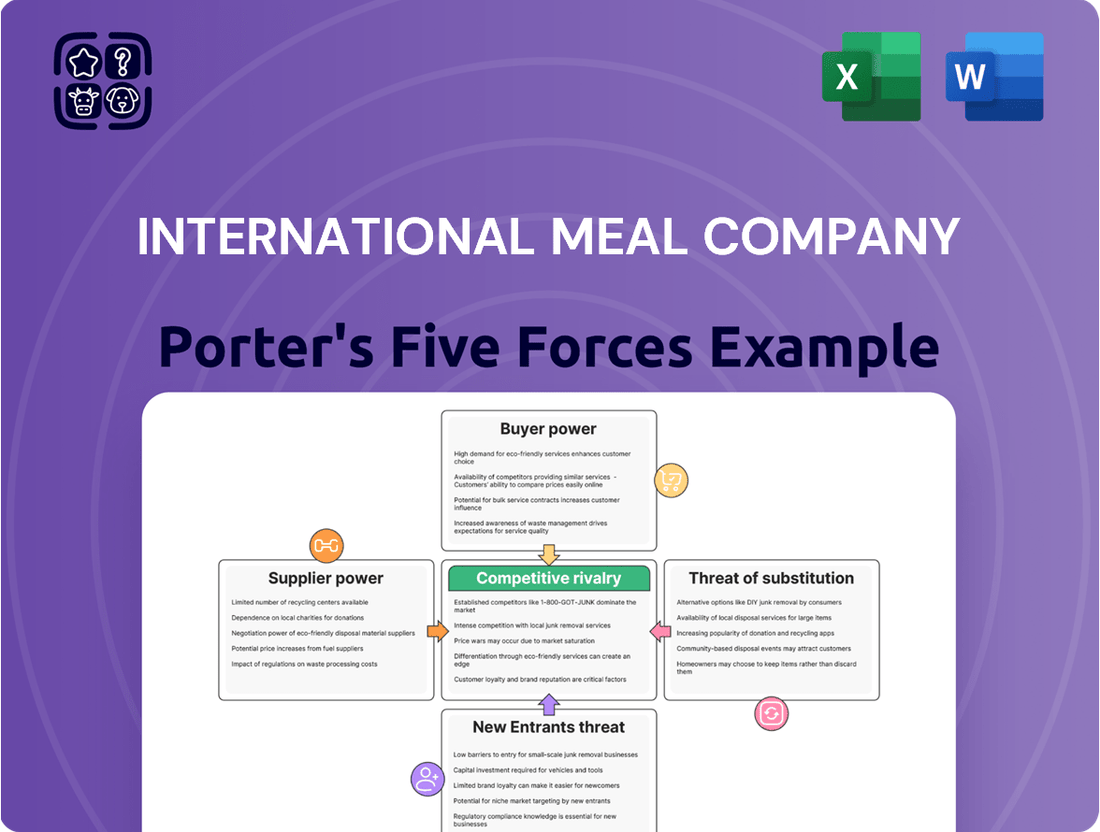

Tailored exclusively for International Meal Company, this analysis dissects the intensity of rivalry, buyer and supplier power, the threat of new entrants and substitutes, providing strategic insights into its competitive environment.

Instantly identify and mitigate competitive threats with a visual breakdown of supplier power, buyer bargaining, and new entrant risks.

Customers Bargaining Power

Customers in high-traffic areas such as airports and malls often face many dining choices. This means they can easily switch to a competitor if prices seem too high or the perceived value is low, significantly boosting their bargaining power. For quick-service restaurants like those operated by International Meal Company (IMC), this price sensitivity is a key factor.

In 2024, the increasing urbanization in Brazil, coupled with a growing preference for dining out, intensifies the competitive landscape. IMC operates within this environment, where customers actively seek good value for their money, further amplifying their ability to negotiate or choose alternatives based on price.

The sheer variety of dining choices in busy locations, including other restaurants, cafes, and even convenience stores, gives customers considerable leverage. If International Meal Company (IMC) doesn't offer something unique, patrons can easily switch to alternatives, boosting their bargaining power.

Brazil's food service sector is particularly varied, featuring everything from authentic Brazilian flavors to a wide range of international cuisines. This broad availability means customers have many options if IMC's pricing or product quality doesn't meet their expectations.

Customers of International Meal Company (IMC) experience very low switching costs. This means they can easily opt for a competitor's offering without incurring significant expenses or effort. For instance, a diner can readily choose a different fast-food chain or casual dining restaurant in the same mall or street.

This low barrier to switching directly empowers customers, enabling them to exert considerable pressure on IMC. They can leverage this ease of movement to demand better pricing, improved service quality, or more appealing menu options. In 2024, the competitive landscape in the food service industry, particularly in markets where IMC operates, continued to feature numerous players, reinforcing this customer leverage.

Customer Information and Transparency

Customers today have unprecedented access to information, significantly boosting their bargaining power. Online reviews, social media platforms, and price comparison apps empower diners to readily research pricing, quality, and service standards across a multitude of dining options. This heightened transparency allows them to make more discerning choices and effectively negotiate for better value.

For International Meal Company (IMC), this means customers can easily compare their offerings against competitors. For instance, in 2024, a significant portion of consumers, estimated to be over 70% in many markets, actively consult online reviews before selecting a restaurant. This trend forces IMC to maintain competitive pricing and consistently high service standards to retain customers.

- Informed Decision-Making: Customers leverage digital tools to compare IMC's menus, pricing, and customer feedback against rivals, driving demand for better deals.

- Price Sensitivity: Increased transparency on pricing across the industry makes customers more sensitive to perceived value, pressuring IMC to remain competitive.

- Service Expectations: Online feedback on service quality sets a benchmark; negative reviews can quickly deter potential customers, compelling IMC to prioritize excellent customer experiences.

- Brand Loyalty: While transparency empowers customers, it also means IMC must work harder to build and maintain loyalty through consistent quality and value propositions.

Diversity of IMC's Offering and Brand Loyalty

International Meal Company's (IMC) diverse portfolio, encompassing full-service restaurants, cafes, and quick-service outlets, aims to cultivate brand loyalty. This multi-brand approach can reduce the bargaining power of individual customers by creating distinct preferences for specific concepts.

However, the effectiveness of this strategy hinges on perceived differentiation. If customers view IMC's brands as largely interchangeable, or if convenience in high-traffic areas is the primary purchasing driver, their bargaining power remains substantial. For instance, in 2024, the quick-service restaurant segment, where IMC operates significantly, continued to see intense competition, placing pressure on pricing and service offerings.

- Brand Diversification: IMC operates a range of brands across different dining segments.

- Loyalty Factors: Brand loyalty is influenced by perceived differentiation and convenience.

- Competitive Landscape: The quick-service sector in 2024 highlighted strong customer price sensitivity.

Customers possess significant bargaining power due to the vast array of dining choices available, especially in high-traffic locations. This allows them to easily switch to competitors if International Meal Company (IMC) prices are too high or perceived value is low. In 2024, Brazil's expanding food service market, driven by urbanization and a preference for dining out, further amplified this customer leverage.

| Factor | Impact on IMC | 2024 Data/Trend |

|---|---|---|

| Availability of Substitutes | High; customers can easily switch to numerous other dining options. | Intense competition in Brazil's food service sector, with a wide variety of cuisine types and price points. |

| Switching Costs | Low; minimal effort or expense to choose an alternative restaurant. | Diners can readily select a different fast-food or casual dining outlet without significant cost. |

| Information Availability | High; customers use online reviews and price comparisons to make informed choices. | Over 70% of consumers in many markets consult online reviews before dining out in 2024, pressuring IMC on pricing and service. |

Preview the Actual Deliverable

International Meal Company Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape for the International Meal Company through a detailed Porter's Five Forces analysis, covering threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

The Brazilian food service market is intensely competitive, featuring a vast array of players. This includes major international fast-food giants and a multitude of smaller, independent local restaurants and cafes.

While there are many competitors, the market exhibits moderate concentration. For instance, in 2024, the top five quick-service restaurant chains in Brazil collectively held a substantial market share, demonstrating the influence of established brands.

The Brazilian foodservice market is expected to see substantial growth, reaching an estimated USD 93.2 billion by 2033, with a compound annual growth rate (CAGR) of 5.90% between 2025 and 2033. This robust expansion can indeed temper rivalry by offering ample opportunities for all players to grow.

However, such rapid market expansion also acts as a magnet for new companies looking to enter the lucrative sector. Simultaneously, it can spur existing competitors to aggressively pursue market share, thereby increasing the intensity of competition rather than diminishing it.

The food service sector, including International Meal Company (IMC), is characterized by significant fixed costs such as rent for prime locations, kitchen equipment, and staffing. These ongoing expenses necessitate a consistent and high volume of sales to achieve profitability. For instance, in 2024, many quick-service restaurant chains reported needing to maintain a certain sales threshold per outlet to break even, especially in competitive urban markets.

Compounding this is the perishable nature of food products. IMC, like its competitors, faces the challenge of minimizing spoilage, which can lead to substantial financial losses. This inherent risk drives a need for efficient inventory management and rapid sales, often prompting aggressive pricing strategies and promotional campaigns to move inventory quickly and prevent waste, thereby intensifying competition among players.

Differentiation and Brand Loyalty

International Meal Company (IMC) manages a diverse brand portfolio, encompassing both its own creations and well-known international franchises. This multi-brand strategy can foster some level of differentiation, as customers might gravitate towards specific tastes or experiences offered by particular brands within IMC's stable. For instance, the presence of popular international fast-food chains under its umbrella can attract a built-in customer base.

However, the competitive landscape, especially in high-traffic areas like airports or busy urban centers, often sees a high degree of substitutability among quick-service restaurants. Customers frequently prioritize convenience and price, which can dilute brand loyalty. This means that even with strong brands, IMC faces intense competition where price and speed of service become primary decision factors for consumers, potentially limiting the long-term impact of brand differentiation.

In 2024, the fast-casual dining sector, where many of IMC's brands operate, continued to see robust activity. For example, reports indicated that customer spending in this segment saw an increase of approximately 7% year-over-year, driven by demand for accessible and varied dining options. Yet, this growth also attracted new entrants and intensified competition among existing players.

- Brand Portfolio: IMC operates a mix of proprietary and licensed brands, aiming for differentiation.

- Customer Behavior: In high-traffic locations, price sensitivity and convenience often outweigh strong brand loyalty.

- Market Dynamics: The ease of substitution in the fast-casual market intensifies direct competition.

- 2024 Data: The fast-casual sector experienced around 7% year-over-year spending growth in 2024, highlighting both opportunity and increased competitive pressure.

Exit Barriers

International Meal Company (IMC) likely faces significant competitive rivalry due to high exit barriers. These barriers can include substantial investments in specialized restaurant equipment and long-term leases for prime real estate, making it costly and difficult for companies to leave the market. This situation can lead to a prolonged presence of less profitable entities, thus maintaining a higher number of competitors and intensifying the rivalry for market share.

For instance, in the fast-casual dining sector, a segment IMC operates in, the cost of fitting out a new outlet can easily run into hundreds of thousands of dollars. Add to this non-cancellable lease agreements that might extend for several years, and the financial commitment to exit becomes substantial. This forces companies to continue operations, even if returns are minimal, to avoid incurring further losses from abandonment.

- High upfront investment in specialized kitchen equipment and restaurant design.

- Long-term lease agreements for prime locations that are difficult and expensive to break.

- Brand reputation and customer loyalty built over time, making a complete withdrawal challenging.

- Potential write-offs of unamortized assets and leasehold improvements upon exit.

Competitive rivalry for International Meal Company (IMC) is substantial, driven by a diverse market with numerous players ranging from global fast-food chains to local eateries. While the market is growing, with Brazil's foodservice sector projected to reach USD 93.2 billion by 2033, this expansion also attracts new entrants and encourages existing competitors to aggressively vie for market share. High fixed costs, including prime real estate leases and equipment, coupled with the perishability of food, necessitate high sales volumes and can lead to aggressive pricing and promotional activities, further intensifying competition.

IMC's multi-brand strategy offers some differentiation, but in high-traffic areas, convenience and price often supersede brand loyalty, increasing the substitutability between quick-service restaurants. For example, the fast-casual dining segment, where IMC has a strong presence, saw approximately 7% year-over-year spending growth in 2024, indicating both opportunity and heightened competitive pressure. High exit barriers, such as significant investments in equipment and long-term leases, also contribute to a sustained level of competition as companies are incentivized to remain operational.

| Factor | Description | Impact on IMC |

| Market Size & Growth | Brazil foodservice market projected to reach USD 93.2 billion by 2033 (5.90% CAGR 2025-2033). | Attracts new entrants and intensifies competition for market share. |

| Competitor Landscape | Mix of international giants and local players; moderate concentration. | Requires strong brand positioning and operational efficiency. |

| Cost Structure | High fixed costs (rent, equipment) and perishable inventory. | Drives aggressive pricing and promotions to ensure sales volume. |

| Brand & Customer Behavior | Brand portfolio diversification vs. customer preference for convenience/price. | Limits long-term brand loyalty impact; price and speed are key differentiators. |

| Exit Barriers | High investment in equipment and long-term leases. | Keeps less profitable entities in the market, sustaining rivalry. |

SSubstitutes Threaten

Informal food vendors and street food in Brazil present a potent threat of substitutes for International Meal Company (IMC). These vendors offer highly competitive pricing, often significantly lower than IMC's sit-down restaurants, making them an attractive option for budget-conscious consumers. For instance, a typical street food meal in Brazil can cost a fraction of a fast-casual meal from a chain like Frango Assado or Burger King, which IMC operates.

The sheer accessibility and convenience of street food, particularly in densely populated urban centers, further bolster its substitutability. Consumers can grab a quick bite without the need for reservations or extended dining times, fitting seamlessly into busy schedules. This is especially true during peak hours in business districts and public transport hubs where IMC also has a presence.

Furthermore, the variety and localized appeal of street food can capture consumer preferences that IMC's standardized offerings might miss. While IMC aims for consistent quality, street vendors often tap into regional tastes and culinary traditions, providing a diverse and often novel dining experience. This adaptability allows them to cater to a broad spectrum of customer desires, directly competing for meal occasions.

The option for consumers to prepare meals at home or bring packed lunches is a significant substitute for International Meal Company's (IMC) offerings, particularly for those working or commuting. This trend gained further traction in 2024 as many companies continued to embrace hybrid work models, reducing the daily need for convenient, purchased meals.

Economic factors, such as the persistent inflation impacting food costs throughout 2024, made home cooking an even more appealing alternative. For instance, grocery prices saw continued upward pressure, making it economically sensible for many households to prepare meals from scratch, directly impacting IMC's potential customer base and sales volume.

Supermarkets, hypermarkets, and convenience stores present a significant threat of substitution, especially for International Meal Company's quick-service and cafe segments. These retailers increasingly offer a wide array of ready-to-eat meals, snacks, and beverages, directly competing with IMC's core product offerings. For instance, by late 2023, many major grocery chains had expanded their prepared food sections, with some reporting double-digit growth in these categories, indicating a strong consumer shift towards these convenient alternatives.

Alternative Food Delivery Services (Non-Restaurant)

Beyond traditional restaurant delivery, the growing popularity of meal kits and pre-cooked meal services presents a significant substitute. These offerings cater to consumers seeking convenience and home-based dining experiences, directly competing with IMC's restaurant offerings.

Digital platforms and delivery apps are fundamentally reshaping consumer habits in Brazil, making it easier than ever for consumers to access a wide array of food options beyond traditional dine-in or restaurant delivery. This shift in behavior amplifies the threat of substitutes.

- Meal Kits: Services like HelloFresh and Blue Apron, while not as prevalent in Brazil as in North America or Europe, are gaining traction, offering a convenient way to cook at home.

- Pre-cooked Meals: Companies specializing in delivering ready-to-eat meals are also emerging, providing a direct alternative to ordering from restaurants.

- Grocery Delivery: Enhanced grocery delivery services that include pre-prepped ingredients or meal components further empower home cooking, acting as a substitute for restaurant meals.

Shift in Consumer Preferences towards Health and Sustainability

The increasing consumer demand for healthier, organic, and sustainably produced food presents a significant threat of substitutes for International Meal Company (IMC). As consumers become more conscious of their dietary choices and environmental impact, they are actively seeking out alternatives that align with these evolving values. This shift can divert demand from IMC's existing product portfolio if it is not perceived as meeting these new criteria.

For instance, a growing number of consumers are opting for plant-based meals, locally sourced produce, and products with transparent supply chains. This trend is particularly strong among younger demographics. In 2024, the global plant-based food market was valued at over $30 billion, demonstrating substantial growth and a clear alternative for consumers seeking healthier and more sustainable options.

This presents a challenge for IMC as consumers may turn to:

- Specialty health food stores offering organic and natural products.

- Local farmers' markets providing fresh, seasonal produce.

- Meal kit delivery services focusing on plant-based or sustainable ingredients.

- Restaurants specializing in healthy, farm-to-table cuisine.

The threat of substitutes for International Meal Company (IMC) is substantial, encompassing everything from informal street food vendors to home-cooked meals. In 2024, persistent inflation on grocery items made preparing meals at home a more economically attractive option for many Brazilian households, directly impacting IMC's potential customer base.

Supermarkets and convenience stores are increasingly offering ready-to-eat options, directly challenging IMC's quick-service and cafe formats. Furthermore, the growing consumer demand for healthier, plant-based, and sustainably sourced foods presents alternatives that IMC's standardized offerings may not fully satisfy, especially among younger demographics who drove significant growth in the global plant-based food market, valued at over $30 billion in 2024.

| Substitute Category | Key Characteristics | Impact on IMC |

|---|---|---|

| Informal Food Vendors | Low price, high accessibility, localized tastes | Direct competition for everyday meal occasions |

| Home Cooking | Cost savings (especially with 2024 inflation), control over ingredients | Reduced frequency of dining out, especially for commuters |

| Prepared Foods (Retail) | Convenience, variety, competitive pricing | Threat to quick-service and cafe segments |

| Meal Kits & Pre-cooked Meals | Convenience, home-based dining experience | Alternative to restaurant delivery and dine-in |

| Health/Sustainable Options | Dietary consciousness, environmental impact | Demand shift away from conventional offerings |

Entrants Threaten

Entering the competitive food service sector, particularly for a company like International Meal Company (IMC) that operates multiple brands in prime locations such as airports and shopping malls, demands significant upfront capital. These costs include setting up state-of-the-art kitchens, acquiring specialized equipment, securing prime real estate leases, and obtaining necessary licenses and permits. For instance, establishing a single airport outlet can easily cost upwards of $500,000 to $1 million, considering the premium on space and stringent operational requirements.

Gaining access to prime distribution channels, particularly in high-traffic areas like airports and major shopping centers, presents a significant hurdle for new competitors looking to enter the quick-service restaurant market. These desirable locations are often already occupied by established players like International Meal Company (IMC), with long-term leases and strong relationships with property owners.

Securing similar high-visibility spots can be prohibitively expensive due to limited availability and escalating rental costs, often necessitating participation in competitive bidding processes. For instance, in 2024, average rental rates in prime airport retail spaces globally continued to see upward pressure, reflecting the intense demand and scarcity of these premium sites.

International Meal Company (IMC) benefits from a strong portfolio of well-recognized proprietary and licensed international brands. This established brand equity is a significant barrier to entry for newcomers. For instance, IMC operates brands like Viena and Frango Assado in Brazil, which have built decades of customer loyalty.

Developing such brand recognition and fostering customer loyalty in the highly diverse Brazilian food service market requires substantial time, extensive marketing investment, and a deep understanding of local consumer preferences. New entrants face the challenge of competing against these deeply entrenched brands, which have already captured significant market share and consumer trust.

Regulatory Hurdles and Licensing

The food service sector in Brazil, where International Meal Company operates, presents significant regulatory challenges for new businesses. These include stringent health and safety standards, alongside various operational licensing requirements that can be intricate and lengthy to obtain. For instance, obtaining all necessary permits and approvals can take several months, adding substantial upfront cost and time delays for potential competitors.

Navigating this complex regulatory landscape acts as a considerable barrier to entry. Newcomers must invest in understanding and complying with a multitude of rules, which can be a daunting and resource-intensive undertaking. This complexity can deter smaller or less experienced players from entering the market, thereby protecting established companies like IMC.

- Complex Licensing Processes: Obtaining food service licenses in Brazil involves multiple government agencies and can be a lengthy procedure.

- Stringent Health and Safety Standards: Compliance with hygiene, food handling, and safety regulations is non-negotiable and requires continuous investment.

- Evolving Regulatory Environment: Changes in legislation or new regulations can further complicate market entry and ongoing operations.

Economies of Scale and Experience Curve

Established players like International Meal Company (IMC) leverage significant economies of scale. This means they can negotiate better prices for ingredients and supplies due to bulk purchasing, a feat difficult for newcomers to match. For instance, in 2024, IMC's extensive supply chain likely allowed for cost savings that new entrants would find challenging to replicate, impacting their ability to compete on price.

The experience curve also creates a formidable barrier. IMC has honed its operational processes over years, leading to greater efficiency and lower costs per unit. This accumulated knowledge, from kitchen management to customer service, gives them an edge that new entrants, starting from scratch, would take considerable time and investment to develop.

- Economies of Scale: IMC's large operational footprint in 2024 allows for superior negotiation power with suppliers, directly reducing input costs compared to smaller, emerging competitors.

- Experience Curve Benefits: Years of operational refinement have equipped IMC with optimized processes and management expertise, translating into higher efficiency and lower per-unit costs.

- Cost Disadvantage for New Entrants: Start-up companies face higher initial costs for procurement and operations, making it difficult to achieve the same price competitiveness as established brands.

- Marketing Efficiency: Established brands can spread marketing costs over a larger sales volume, achieving a lower cost per customer acquisition than new entrants.

The threat of new entrants for International Meal Company (IMC) is moderate, primarily due to high capital requirements and established brand loyalty. Securing prime locations, like airport concessions, involves substantial upfront investment, often exceeding $1 million per outlet, as seen in 2024 market trends. IMC's portfolio of strong brands, such as Viena and Frango Assado, cultivated over years, presents a significant hurdle for new players needing to build comparable recognition and trust. Furthermore, navigating Brazil's complex and time-consuming regulatory environment, including stringent health and safety standards, adds considerable cost and delay for potential entrants.

Porter's Five Forces Analysis Data Sources

Our International Meal Company Porter's Five Forces analysis is built upon a foundation of robust data, drawing from the company's annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from financial news outlets and competitor disclosures to provide a comprehensive view of the competitive landscape.