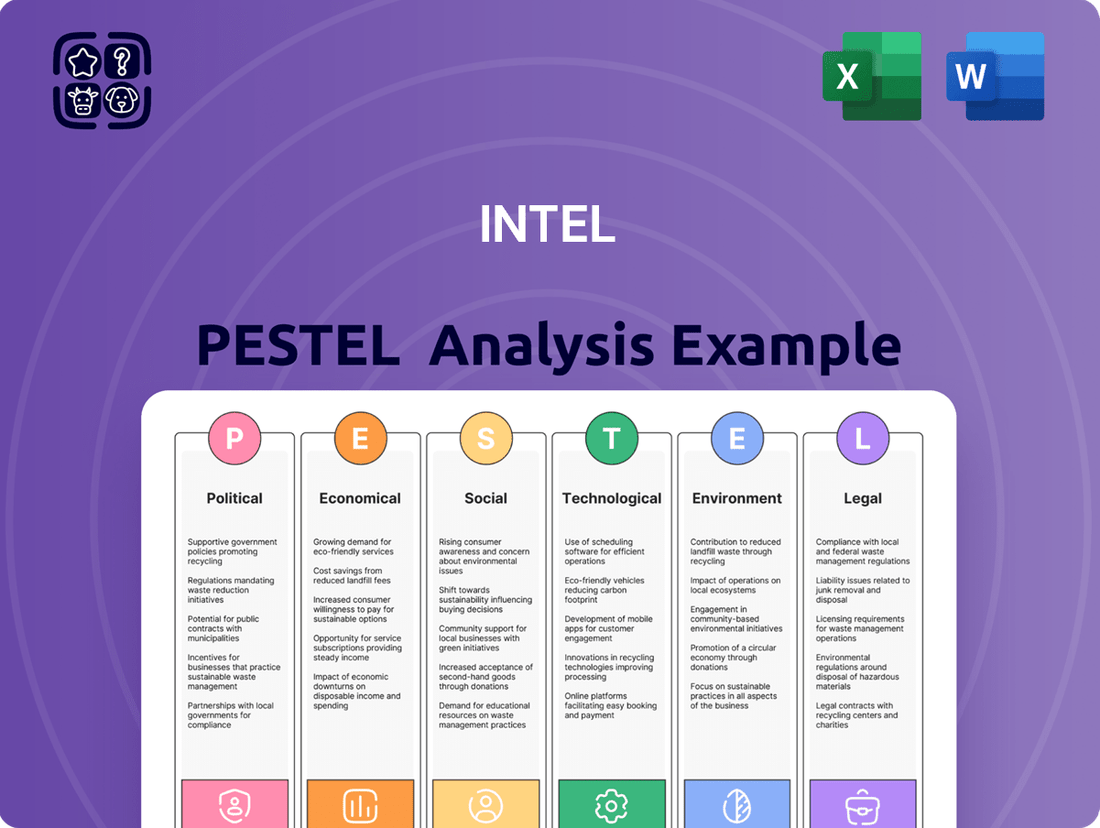

Intel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intel Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Intel's future. This comprehensive PESTLE analysis provides the deep insights you need to anticipate market shifts and strategize effectively. Empower your decisions with actionable intelligence – download the full report now.

Political factors

Global geopolitical tensions, especially between the US and China, create significant headwinds for Intel. These tensions directly affect Intel's intricate supply chain, its ability to access key markets, and the transfer of critical technologies. For instance, in 2023, the US government's continued export controls on advanced semiconductor technology to China meant Intel faced limitations in selling its latest processors to a major market.

Government-imposed export controls and tariffs can directly restrict Intel's revenue streams and operational efficiency. These policies can limit Intel's access to essential components or prevent the sale of its advanced chips to specific regions. In 2024, ongoing discussions and potential new tariffs on semiconductors could further complicate Intel's global sales strategy and component sourcing.

Government initiatives like the US CHIPS and Science Act are injecting significant capital into the semiconductor industry. In 2024, this act is expected to drive billions in investment for domestic chip manufacturing and research, directly benefiting Intel's expansion plans. These subsidies and tax incentives are critical for Intel to build new fabrication plants and develop cutting-edge technologies, bolstering US production capacity.

Intel, a cornerstone of the tech industry, is navigating heightened regulatory scrutiny worldwide, particularly concerning national security. Governments are increasingly focused on the integrity of semiconductor supply chains, recognizing their critical role in defense and infrastructure. This scrutiny translates into potential mandates for more stringent security audits and a push for greater domestic production of sensitive components.

The drive for supply chain resilience is a significant factor, with nations aiming to reduce reliance on single sources. For Intel, this could mean navigating new ownership restrictions or investment limitations in key markets. For instance, the US CHIPS and Science Act of 2022, with its significant funding, underscores this trend by incentivizing domestic semiconductor manufacturing and R&D, aiming to bolster national economic and security interests by 2025.

Antitrust and Competition Policy

Intel faces significant scrutiny under antitrust and competition policies worldwide due to its dominant position in the semiconductor market. Regulators in major economies like the United States, European Union, and China are actively monitoring its business practices to ensure a level playing field for competitors. For instance, the European Commission fined Intel approximately $1.2 billion in 2009 for anti-competitive practices, and ongoing investigations continue to shape market dynamics.

These regulatory pressures directly impact Intel's strategic decisions, particularly concerning product bundling, pricing, and exclusive agreements with customers. Any adverse findings or new regulations could result in substantial financial penalties, limitations on its business operations, and damage to its brand reputation, necessitating adaptive strategies to maintain market access and competitive advantage.

In 2024 and looking into 2025, the landscape remains dynamic. For example, ongoing reviews by the U.S. Federal Trade Commission (FTC) and similar bodies globally focus on potential monopolistic behavior in areas like chip manufacturing and software integration. Such oversight could lead to:

- Increased compliance costs for Intel.

- Potential divestiture of certain business units or product lines.

- Stricter guidelines on how Intel engages with its partners and customers.

- Heightened regulatory risk impacting future mergers and acquisitions.

Political Stability in Key Operating Regions

Political stability in regions where Intel operates is a critical factor. For instance, Taiwan, a major hub for semiconductor manufacturing, faces ongoing geopolitical tensions. Any escalation of these tensions could directly impact Intel's production capabilities and supply chains, as seen in the heightened cross-strait relations which have historically influenced global tech supply chain considerations.

Geopolitical risks, such as potential conflicts or civil unrest in key markets or manufacturing locations, can significantly disrupt Intel's operations. These disruptions can range from production halts to logistical nightmares and sudden drops in consumer demand. For example, the ongoing global focus on supply chain resilience, highlighted by events throughout 2023 and into early 2024, underscores the vulnerability of the semiconductor industry to political instability.

- Taiwan's Semiconductor Dominance: Taiwan is home to TSMC, the world's largest contract chip manufacturer, and Intel has significant partnerships and investments in the region, making its political stability paramount.

- Geopolitical Tensions: The People's Republic of China's claims over Taiwan create a persistent geopolitical risk that could, in a worst-case scenario, disrupt global semiconductor supply.

- US-China Relations: Broader trade tensions and technological competition between the US and China can also impact Intel's market access and operational strategies in both countries.

Government policies, like the US CHIPS and Science Act of 2022, are driving significant investment in domestic semiconductor manufacturing, directly benefiting Intel's expansion. These initiatives, with billions allocated through 2024 and beyond, aim to bolster US production capacity and technological development.

Global geopolitical tensions, particularly US-China relations, continue to impact Intel's supply chain and market access, with export controls limiting technology transfers. For instance, 2023 saw continued US restrictions on advanced semiconductor technology sales to China.

Regulatory scrutiny, especially concerning antitrust and national security, remains high for Intel. Ongoing investigations by bodies like the FTC in 2024 and 2025 could lead to increased compliance costs and potential business unit adjustments.

Political stability in key manufacturing regions like Taiwan is critical for Intel's operations, given the ongoing geopolitical risks that could disrupt global semiconductor supply chains.

| Policy/Factor | Impact on Intel | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| US CHIPS and Science Act | Incentivizes domestic manufacturing & R&D | Billions in funding expected to support Intel's new fabs through 2025. |

| US-China Trade Tensions | Supply chain disruption & market access limitations | Continued export controls affect Intel's ability to sell advanced chips in China. |

| Antitrust Regulations | Increased compliance & potential operational changes | Ongoing FTC reviews in 2024/2025 focus on market practices. |

| Geopolitical Stability (Taiwan) | Risk to production and supply chain continuity | Taiwan's critical role in chip manufacturing makes its political climate a constant concern. |

What is included in the product

This Intel PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors impact Intel's operations and strategy.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for immediate strategic application.

Economic factors

A global economic slowdown poses a significant risk to Intel's performance. For instance, during the first half of 2023, global GDP growth forecasts were revised downwards by institutions like the IMF, indicating a softening economic climate. This directly translates to reduced consumer and business spending on technology, impacting Intel's sales of PCs, servers, and other semiconductor-based products.

Persistent inflation further complicates Intel's operating environment. In 2023, many economies continued to grapple with elevated inflation rates, impacting the cost of essential inputs such as energy, raw materials, and skilled labor. This pressure on operational expenses can erode Intel's profit margins, especially if the company cannot fully pass these increased costs onto its customers in a competitive market.

Intel continues to grapple with ongoing global supply chain vulnerabilities. Shortages of critical materials like advanced semiconductor manufacturing equipment and experienced labor, coupled with persistent logistics bottlenecks, can significantly disrupt Intel's production schedules and inflate manufacturing costs. For instance, the lead times for specialized chipmaking machinery have extended, impacting expansion plans.

These persistent disruptions necessitate strategic adjustments for Intel. The company is actively pursuing enhanced inventory management strategies and accelerating efforts in supplier diversification to mitigate risks. Furthermore, Intel has signaled potential increases in capital expenditure aimed at building more resilient and geographically diverse supply chains, a move likely driven by the need to secure critical components and manufacturing capacity.

Currency fluctuations present a significant economic factor for Intel, a global semiconductor manufacturer. As a substantial portion of Intel's sales and manufacturing operations occur outside the United States, its financial performance is directly impacted by movements in foreign exchange rates.

A stronger U.S. dollar can make Intel's products, like its latest Core Ultra processors launched in late 2023, appear more expensive to international buyers, potentially dampening sales volume in key markets such as Europe and Asia. Conversely, a weaker dollar can boost the reported value of overseas profits when repatriated, though it also increases the cost of imported components.

For instance, in the first quarter of 2024, Intel reported net revenues of $12.7 billion, a 9% increase year-over-year, demonstrating how global economic conditions, including currency impacts, shape its top-line performance. Managing this exposure through hedging strategies is crucial for maintaining predictable earnings and competitive pricing globally.

Research and Development (R&D) Investment Cycles

The semiconductor industry, including Intel, demands substantial and ongoing investments in research and development to stay ahead and create cutting-edge technologies. These R&D cycles are long-term and require significant capital, making them highly sensitive to broader economic conditions.

Economic downturns can strain Intel's capacity to fund these crucial R&D efforts, potentially impacting its ability to innovate in areas like artificial intelligence (AI) and advanced packaging, which are vital for future market dominance. For instance, in 2023, Intel announced plans to invest billions in R&D for new chip architectures and manufacturing processes.

- Sustained R&D is critical: The semiconductor sector's rapid technological evolution necessitates continuous investment to develop next-generation products.

- Economic sensitivity: Fluctuations in the global economy directly affect Intel's financial capacity to support these capital-intensive R&D initiatives.

- AI and advanced packaging focus: Future competitiveness hinges on advancements in AI-driven chip design and sophisticated packaging techniques.

- 2024-2025 outlook: Analysts anticipate continued high R&D spending by Intel, projected to be in the tens of billions of dollars annually, to maintain its competitive edge.

Interest Rates and Access to Capital

Rising interest rates present a significant challenge for Intel, directly increasing the cost of borrowing. This makes it more expensive for the company to finance its substantial capital expenditures, such as building new semiconductor fabrication plants (fabs) and upgrading existing technology. For instance, as of mid-2024, the US Federal Reserve's benchmark interest rate has remained elevated, making debt financing more costly than in previous years.

Access to affordable capital is absolutely critical for Intel's strategic objectives. The company has outlined aggressive plans for expansion and R&D investment, aiming to reclaim its leadership in advanced chip manufacturing. The ability to secure capital at favorable rates directly impacts the feasibility and timeline of these ambitious projects, which are essential for its long-term competitiveness in the rapidly evolving semiconductor industry.

Intel's financial strategy in 2024 and 2025 will likely be shaped by the prevailing interest rate environment. The company may need to balance debt financing with other capital sources, potentially impacting its investment capacity. For example, in early 2024, Intel secured significant government funding through the CHIPS Act, a move that could partially offset the impact of higher borrowing costs on its capital projects.

- Increased Borrowing Costs: Higher interest rates directly translate to more expensive debt for Intel, impacting profitability and cash flow available for reinvestment.

- Impact on Capital Expenditures: Projects like the new Arizona fab, costing billions, become more financially burdensome with elevated interest rates, potentially delaying or scaling back expansion plans.

- Strategic Financing Decisions: Intel must carefully consider its debt-to-equity mix and explore diverse funding options, including government incentives and retained earnings, to manage capital access effectively.

Intel's financial health and strategic execution are significantly influenced by global economic trends. A projected slowdown in global GDP growth for 2024, estimated by various economic forecasters to be around 2.5-3%, directly impacts demand for Intel's products. This means reduced consumer spending on PCs and lower enterprise IT budgets, which are key revenue drivers for the company.

Persistent inflation continues to exert pressure on Intel's operational costs. In 2024, many regions are still experiencing inflation rates above central bank targets, leading to higher expenses for raw materials, energy, and labor. This can compress profit margins if Intel cannot fully pass these costs onto customers in a competitive market.

Supply chain disruptions remain a concern, with lead times for specialized manufacturing equipment still extended, impacting production ramp-ups. Intel's strategic investments in diversifying its supply base and building new fabrication facilities, such as its $20 billion investment in Ohio, aim to mitigate these risks and ensure a more stable supply of semiconductors through 2025.

Currency fluctuations also play a critical role. With a significant portion of Intel's revenue generated internationally, a strong U.S. dollar in 2024 can make its products more expensive for overseas buyers, potentially impacting sales volumes. Conversely, a weaker dollar can enhance the reported value of foreign earnings.

| Economic Factor | Impact on Intel | 2024/2025 Data/Outlook |

|---|---|---|

| Global GDP Growth | Reduced demand for tech products | Projected 2.5-3% global GDP growth in 2024 |

| Inflation | Increased operational costs, potential margin pressure | Inflation rates in many developed economies remain elevated above 2% targets |

| Supply Chain | Production delays, higher manufacturing costs | Extended lead times for semiconductor manufacturing equipment persist |

| Currency Exchange Rates | Impact on international sales and reported profits | U.S. Dollar strength is a key consideration for international revenue translation |

Preview the Actual Deliverable

Intel PESTLE Analysis

The preview shown here is the exact Intel PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Intel. You can confidently purchase knowing you'll get this complete, professionally structured report.

Sociological factors

The semiconductor industry faces a fierce global battle for top engineering and research talent. Intel's success hinges on its capacity to draw in, nurture, and keep skilled professionals, as these individuals drive innovation and ensure smooth operations. This necessitates offering competitive salaries and benefits, fostering an attractive work environment, and providing clear paths for career advancement.

Consumer preferences are increasingly leaning towards mobile-first experiences and the integration of artificial intelligence into everyday applications. This shift directly impacts Intel, as it necessitates the development of more power-efficient, high-performance processors for smartphones, laptops, and emerging wearable technologies. For instance, the global smartphone market saw shipments of approximately 289 million units in Q4 2023, highlighting the continued demand for mobile-centric solutions.

Enterprises are also driving significant changes, with a growing emphasis on cloud computing for scalability and data center efficiency. The demand for high-performance computing power to handle massive datasets and complex AI workloads is also on the rise. In 2024, the global cloud computing market is projected to reach over $1 trillion, underscoring the critical role Intel's server and data center chips play in this expanding ecosystem. Furthermore, the need for specialized AI accelerators is creating new market opportunities and challenges for Intel's product development.

Intel's commitment to Diversity, Equity, and Inclusion (DEI) is increasingly vital as society places a higher value on these principles. This focus directly influences Intel's workforce composition, the internal environment, and how the company is perceived by the public.

By actively pursuing DEI, Intel can attract a broader range of skilled individuals, which is essential for driving innovation. For example, in Q1 2024, Intel reported that women represented 28.7% of its global workforce, with efforts underway to increase this figure. This focus also bolsters Intel's reputation, appealing to customers and investors who prioritize socially responsible corporations.

Digital Divide and Accessibility

The persistent global digital divide underscores a critical need for accessible and affordable computing solutions. As of early 2024, estimates suggest around 2.6 billion people remain offline, representing a significant portion of the world's population. Intel, as a primary provider of processors for a vast array of devices, is positioned to play a key role in narrowing this gap.

This societal imperative places pressure on Intel to ensure its technological advancements are not only powerful but also broadly available and contribute positively to global development. Failure to address accessibility could limit Intel's market expansion and impact its social license to operate, especially as governments and NGOs increasingly focus on digital inclusion initiatives.

- Global Offline Population: Approximately 2.6 billion individuals lacked internet access as of early 2024, highlighting the scale of the digital divide.

- Affordability as a Barrier: Cost remains a primary obstacle for many in acquiring computing devices and internet services.

- Intel's Opportunity: Developing cost-effective processors and partnering on accessible device initiatives can expand Intel's market reach.

- Social License Impact: Demonstrating a commitment to digital inclusion enhances Intel's reputation and long-term sustainability.

Workforce Transformation and Automation

The increasing integration of automation and artificial intelligence in Intel's manufacturing and operational processes is reshaping workforce demands. This trend requires significant investment in reskilling and upskilling initiatives to equip employees with the necessary competencies for evolving roles. For instance, as of late 2024, Intel has been actively pursuing AI integration across its operations, with a focus on enhancing chip design and manufacturing efficiency, which directly impacts the skill sets needed within its workforce.

Managing the potential for job displacement due to automation is a critical sociological challenge. Intel must proactively address this by offering robust transition support and exploring new employment avenues within the company. Furthermore, adapting to novel work methodologies, such as increased collaboration with AI systems, is essential for maintaining operational efficiency and fostering positive employee morale amidst these transformations.

- Workforce Adaptation: Intel’s commitment to AI adoption means a growing need for employees skilled in AI development, data science, and advanced robotics.

- Reskilling Investment: The company is expected to continue substantial investments in training programs, aiming to upskill its existing workforce to meet the demands of an automated environment.

- Employee Morale: Proactive communication and support for employees navigating these changes are crucial for maintaining morale and a stable workforce.

- New Skill Demands: By 2025, roles focused on AI-driven process optimization and intelligent automation management are projected to become increasingly prominent within Intel's operational structure.

Intel's focus on Diversity, Equity, and Inclusion (DEI) is paramount, influencing its talent acquisition and public perception. As of Q1 2024, women constituted 28.7% of Intel's global workforce, with ongoing initiatives to boost this representation.

The digital divide remains a significant societal factor, with approximately 2.6 billion people offline globally in early 2024. Intel has an opportunity to expand its market by developing more affordable processors and supporting initiatives for accessible computing, thereby enhancing its social license.

Automation and AI integration are transforming Intel's operations, necessitating workforce reskilling. By 2025, roles in AI optimization and automation management are expected to grow, requiring proactive employee support and training investments to manage potential job displacement and maintain morale.

Technological factors

The relentless advancement of Artificial Intelligence, spanning sophisticated cloud-based large language models to localized edge AI, is directly fueling a significant demand for specialized processing units. This trend creates a critical need for hardware capable of handling complex AI workloads efficiently.

Intel's competitive edge hinges on its capacity to innovate and deliver high-performance solutions in AI hardware, encompassing traditional CPUs, graphics processing units (GPUs), and custom-designed AI accelerators. Success in this arena is crucial for maintaining relevance and driving future growth across all computing sectors.

By mid-2025, the AI chip market is projected to reach over $100 billion, with Intel aiming to capture a substantial share. Intel's recent investments in AI silicon development, including its Gaudi accelerators, highlight its strategic focus on this rapidly expanding technological frontier.

As Moore's Law slows, advanced packaging like 3D stacking and chiplets are becoming crucial for boosting performance and efficiency. Intel has been heavily investing in these areas, aiming to integrate multiple smaller dies, or chiplets, into a single package. This approach allows them to overcome the limitations of monolithic chip design.

Intel's strategy with technologies like Foveros and EMIB is a prime example of their commitment to advanced packaging. These innovations enable the vertical stacking of different types of silicon, creating more powerful and compact processors. For instance, their Ponte Vecchio GPU, released in late 2022, utilized Foveros 3D stacking technology, showcasing the practical application of these advancements.

Quantum computing, though still in its nascent stages, is a significant technological frontier that could fundamentally alter computational capabilities. Intel is actively investing in quantum computing research and development, focusing on both hardware and software advancements.

This strategic focus is vital for Intel to secure its future market position and sustain its leadership in core computing technologies. By engaging in this cutting-edge research, Intel aims to be at the forefront of the next wave of computational innovation.

Competitive Landscape in Foundry Services

The foundry services sector is intensely competitive, with Intel's own foundry business, Intel Foundry, aiming to challenge established players. Achieving technological parity and leadership, particularly with TSMC, is crucial for Intel's success. This requires substantial advancements in process technology and scaling manufacturing efficiently.

Intel Foundry is investing heavily to catch up and surpass competitors. For instance, Intel announced plans to spend tens of billions of dollars on new fabs and advanced packaging technologies. By 2025, Intel aims to regain process leadership in certain areas, a critical step in attracting external customers.

- Process Technology: Intel is targeting leadership in nodes like Intel 18A by 2025, aiming to be ahead of TSMC's comparable offerings.

- Advanced Packaging: Innovations like Foveros and EMIB are key differentiators, enabling chiplets and complex integrated designs.

- Manufacturing Capacity: Significant investments are being made in new facilities in Arizona, Ohio, and Europe to meet projected demand.

Cybersecurity Threats and Hardware Security

The escalating complexity of cyber threats demands that Intel integrate advanced hardware-level security into its processors. This is crucial for safeguarding sensitive user data and maintaining customer confidence in an era of heightened digital risk. For instance, the global cybersecurity market was projected to reach $345 billion in 2024, underscoring the immense value placed on security solutions.

Intel's commitment to chip integrity, from the initial design phase through to product deployment, is paramount. This focus directly addresses the growing need for secure computing environments, vital for compliance with stringent data protection regulations. Failure to do so can significantly hinder product adoption and damage brand reputation.

- Hardware-level security is a key differentiator in the competitive semiconductor market.

- Intel's R&D investment in security features directly combats evolving cyberattack vectors.

- Regulatory pressures, such as GDPR and CCPA, mandate robust data protection, influencing hardware design.

- The increasing prevalence of sophisticated attacks like ransomware and supply chain compromises necessitates proactive security measures at the silicon level.

The rapid evolution of AI hardware, including specialized accelerators and advanced CPUs, is a primary technological driver for Intel. The company's focus on high-performance computing is essential to meet the increasing demands of AI workloads, with the AI chip market projected to exceed $100 billion by mid-2025.

Intel's investment in advanced packaging techniques like Foveros and EMIB is critical for overcoming Moore's Law limitations, enabling more powerful and compact chip designs. These innovations are key to Intel's strategy for competitive differentiation in the semiconductor industry.

Quantum computing represents a significant long-term technological frontier, and Intel's ongoing research and development in this area position it for future computational advancements. This commitment to cutting-edge technology is vital for maintaining leadership in core computing.

The integration of robust hardware-level security features into Intel's processors is a direct response to escalating cyber threats. This focus on chip integrity is crucial for protecting data and ensuring compliance with stringent data protection regulations, with the global cybersecurity market valued in the hundreds of billions.

Legal factors

Antitrust and competition law remains a significant legal factor for Intel. The company has faced numerous investigations globally concerning its dominant market share, particularly in CPUs. For instance, in 2022, the European Commission fined Intel €1.1 billion for illegally stifling competition by using rebates to favor its x86 processors.

These regulatory actions can result in substantial financial penalties and force Intel to alter its business strategies, impacting its pricing, product bundling, and distribution agreements. Such scrutiny directly affects Intel's ability to maintain its competitive edge and pursue market expansion without facing legal challenges.

Intel's core business is built upon a massive collection of patents and intellectual property, which are essential for its technological leadership. The company actively engages in patent litigation, both initiating cases and defending against claims, a process that incurs significant costs and demands substantial time. In 2024, for instance, Intel continued to navigate numerous patent disputes, a common occurrence in the highly competitive semiconductor industry, impacting its operational expenses and strategic focus.

Global data privacy regulations, like the EU's GDPR and California's CCPA, directly influence Intel's operations. These laws dictate how Intel must manage customer, employee, and partner data, impacting everything from marketing to internal HR processes.

Compliance is critical; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. For Intel, this means investing heavily in robust data security measures and transparent data handling policies to avoid significant financial penalties and safeguard its reputation.

Export Controls and Trade Compliance

Intel operates under a stringent global framework of export controls, especially concerning its advanced semiconductor technologies and manufacturing equipment. These regulations are designed to prevent sensitive technologies from reaching nations or entities that could pose national security risks. For instance, in late 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continued to enforce restrictions on the export of advanced AI chips and related manufacturing equipment to China, impacting companies like Intel that supply these markets.

Compliance with these evolving trade regulations is not merely a legal necessity but a critical business imperative. Violations can result in substantial financial penalties, loss of export privileges, and significant reputational damage. Intel's commitment to trade compliance is therefore paramount to maintaining its access to global markets and its ability to conduct international business smoothly, ensuring its supply chains remain intact and its technological advancements are not compromised by unauthorized diffusion.

- Export Control Focus: Advanced semiconductor technology and manufacturing equipment are key areas of scrutiny.

- Geopolitical Impact: Restrictions often target specific countries, influencing market access and sales strategies.

- Compliance Costs: Adhering to complex regulations requires dedicated legal and operational resources.

- Risk Mitigation: Proactive compliance avoids severe penalties and preserves international business relationships.

Environmental Regulations and Compliance

Intel's semiconductor manufacturing is heavily regulated due to its intensive use of water, chemicals, and energy, alongside waste generation. For instance, in 2023, Intel reported investing $2.1 billion in environmental sustainability initiatives, including advanced water treatment and waste reduction technologies across its global facilities to meet stringent standards like the EPA's Clean Water Act and various state-level regulations.

Failure to comply with these environmental laws can result in significant financial penalties and operational disruptions. For example, a major semiconductor manufacturer faced a $500,000 fine in California in early 2024 for improper disposal of hazardous waste, underscoring the financial risks associated with non-compliance. Intel's ongoing commitment to obtaining and maintaining permits for emissions and water discharge is therefore critical for its operational continuity and reputation.

- Emissions Control: Adherence to air quality standards for volatile organic compounds (VOCs) and greenhouse gases.

- Water Management: Compliance with regulations on water withdrawal, wastewater discharge quality, and water recycling rates.

- Waste Disposal: Strict protocols for handling, treating, and disposing of hazardous and non-hazardous industrial waste.

- Chemical Management: Regulations governing the procurement, storage, use, and disposal of chemicals used in manufacturing processes.

Intel's legal landscape is shaped by ongoing antitrust scrutiny, intellectual property disputes, and evolving data privacy laws. The company's significant market share continues to attract regulatory attention globally, leading to potential fines and strategic adjustments. Navigating a complex web of patent litigation is also a constant, impacting operational costs and strategic direction.

Furthermore, stringent export controls and environmental regulations significantly influence Intel's operations and market access. Compliance is crucial to avoid penalties and maintain global business relationships, particularly concerning advanced technologies and manufacturing processes.

| Legal Factor | Description | Impact on Intel | Example/Data (2023-2025) |

|---|---|---|---|

| Antitrust & Competition | Addressing market dominance and anti-competitive practices. | Potential fines, forced business model changes, market access limitations. | Continued investigations in various regions; fines in past years highlight ongoing risk. |

| Intellectual Property | Protecting patents and defending against infringement claims. | Significant legal costs, potential licensing agreements, impact on R&D focus. | Active participation in numerous patent litigations globally throughout 2024. |

| Data Privacy | Compliance with regulations like GDPR and CCPA for data handling. | Investment in data security, potential fines for breaches (up to 4% of global revenue). | Ongoing need for robust data protection measures to avoid penalties. |

| Export Controls | Adherence to regulations on technology and equipment exports. | Market access restrictions, supply chain disruptions, compliance costs. | U.S. export restrictions impacting sales to certain countries continued through late 2023 and into 2024. |

| Environmental Regulations | Meeting standards for emissions, water usage, and waste management. | Operational costs for compliance, potential fines for violations, reputational risk. | Significant investments in sustainability ($2.1 billion in 2023) to meet EPA and state-level standards. |

Environmental factors

Semiconductor fabrication is incredibly energy-hungry, directly impacting Intel's environmental footprint. The company's operations, from wafer production to chip testing, require substantial electricity, making energy consumption a critical environmental factor. This intensity means Intel's carbon emissions are a significant concern.

There's a growing demand from various stakeholders for Intel to curb its energy use and reduce its carbon emissions. Regulators are implementing stricter environmental standards, investors are prioritizing Environmental, Social, and Governance (ESG) performance, and consumers are increasingly aware of a company's climate impact. For instance, Intel has committed to achieving net-zero greenhouse gas emissions by 2040, a substantial undertaking given the energy demands of its manufacturing processes.

To address these pressures, Intel is focusing on transitioning to renewable energy sources and setting aggressive decarbonization goals. The company is investing in on-site renewable energy generation and procuring renewable energy credits to power its facilities. In 2023, Intel reported that approximately 77% of its global electricity usage was from renewable sources, a significant step towards its net-zero target.

Chip manufacturing is incredibly water-intensive, demanding vast quantities of ultra-pure water. This makes water scarcity a significant environmental challenge for Intel, particularly in drought-prone areas where its fabrication plants, or fabs, are located.

Intel reported using approximately 11.7 billion gallons of water in 2023 across its global operations. This highlights the substantial reliance on this resource.

To address this, Intel is heavily invested in sustainable water management. Their initiatives focus on recycling water, aiming to reduce overall consumption and minimize their environmental footprint, which is vital for ensuring operational continuity.

Intel's manufacturing processes inherently create waste, encompassing hazardous substances and the growing challenge of electronic waste from discarded devices. The company is under increasing scrutiny to enhance its waste management strategies and actively embrace circular economy principles.

This involves designing products with recyclability in mind and actively working to reduce pollution stemming from both its operational footprint and the lifecycle of its products. For instance, in 2023, the electronics industry generated an estimated 62 million tonnes of e-waste globally, highlighting the scale of this environmental concern.

Supply Chain Environmental Impact

Intel's vast global supply chain presents a significant environmental challenge, as the practices of its numerous suppliers directly influence Intel's overall ecological footprint. Managing these supplier relationships to ensure adherence to environmental standards, covering emissions, waste reduction, and efficient resource utilization, is crucial for meeting sustainability targets and maintaining responsible sourcing practices.

For instance, in 2023, Intel reported a 10% reduction in water consumption across its operations compared to its 2019 baseline, a goal that extends to influencing supplier water management strategies. The company's commitment to reducing greenhouse gas emissions also necessitates close collaboration with suppliers to adopt cleaner energy sources and improve manufacturing efficiency. By 2024, Intel aims to have 100% of its key suppliers meet its environmental performance requirements.

- Supplier Emissions: Intel actively monitors and works with suppliers to reduce greenhouse gas (GHG) emissions, aiming for a 50% reduction in scope 3 GHG emissions by 2030.

- Water Stewardship: The company encourages suppliers to implement water conservation measures, aligning with Intel's 2030 goal of achieving net positive water use in water-stressed regions.

- Waste Management: Intel promotes circular economy principles among its suppliers, targeting a 90% reduction in manufacturing waste sent to landfills by 2030.

Climate Change Adaptation and Resilience

Intel faces tangible threats from climate change. The increasing frequency and intensity of extreme weather events, such as floods and heatwaves, pose a direct risk to its sophisticated manufacturing facilities, particularly those located in vulnerable regions. For instance, a significant flood event in 2023 impacted semiconductor production globally, highlighting the fragility of supply chains.

Building resilience is therefore paramount for Intel's operational continuity and asset protection. This involves investing in climate-resilient infrastructure and diversifying supply chain dependencies. By 2024, many leading tech companies, including those in the semiconductor sector, are earmarking substantial capital for climate adaptation measures, recognizing that proactive investment is more cost-effective than reactive disaster recovery.

Key adaptation strategies for Intel include:

- Enhancing water management systems at manufacturing sites to cope with potential droughts or increased rainfall.

- Strengthening supply chain diversification to reduce reliance on single geographic regions prone to climate-related disruptions.

- Investing in energy-efficient technologies and renewable energy sources to mitigate operational carbon footprints and reduce vulnerability to energy price volatility driven by climate impacts.

- Developing robust business continuity plans that specifically address climate-related scenarios, ensuring rapid recovery and minimal downtime.

Intel's environmental performance is increasingly under scrutiny, with a significant focus on energy consumption and carbon emissions. The company's commitment to net-zero greenhouse gas emissions by 2040 underscores the substantial efforts required to decarbonize its energy-intensive operations.

Water usage is another critical environmental factor, with Intel reporting a substantial 11.7 billion gallons of water consumed globally in 2023. The company's proactive approach to water management, including recycling initiatives, is vital for addressing water scarcity concerns.

Waste management, particularly electronic waste, presents a growing challenge for Intel and the broader semiconductor industry. The company's focus on circular economy principles and reducing manufacturing waste aligns with global efforts to minimize environmental impact.

Intel's supply chain also carries significant environmental implications. The company is working towards having 100% of its key suppliers meet its environmental performance requirements by 2024, aiming for a 50% reduction in scope 3 GHG emissions by 2030.

| Environmental Factor | 2023 Data/Goal | Key Initiatives |

| Energy Consumption & Emissions | Net-zero GHG by 2040; 77% renewable electricity in 2023 | Transition to renewables, energy efficiency |

| Water Usage | 11.7 billion gallons consumed in 2023 | Water recycling, net positive water use goal |

| Waste Management | Targeting 90% reduction in manufacturing waste to landfill by 2030 | Circular economy principles, e-waste reduction |

| Supply Chain Emissions | Targeting 50% reduction in scope 3 GHG emissions by 2030 | Supplier engagement, environmental performance requirements |

PESTLE Analysis Data Sources

Our Intel PESTLE Analysis draws from a comprehensive array of data, including official government reports, reputable market research firms, and leading technology publications. This ensures a robust understanding of political stability, economic trends, and technological advancements impacting the industry.