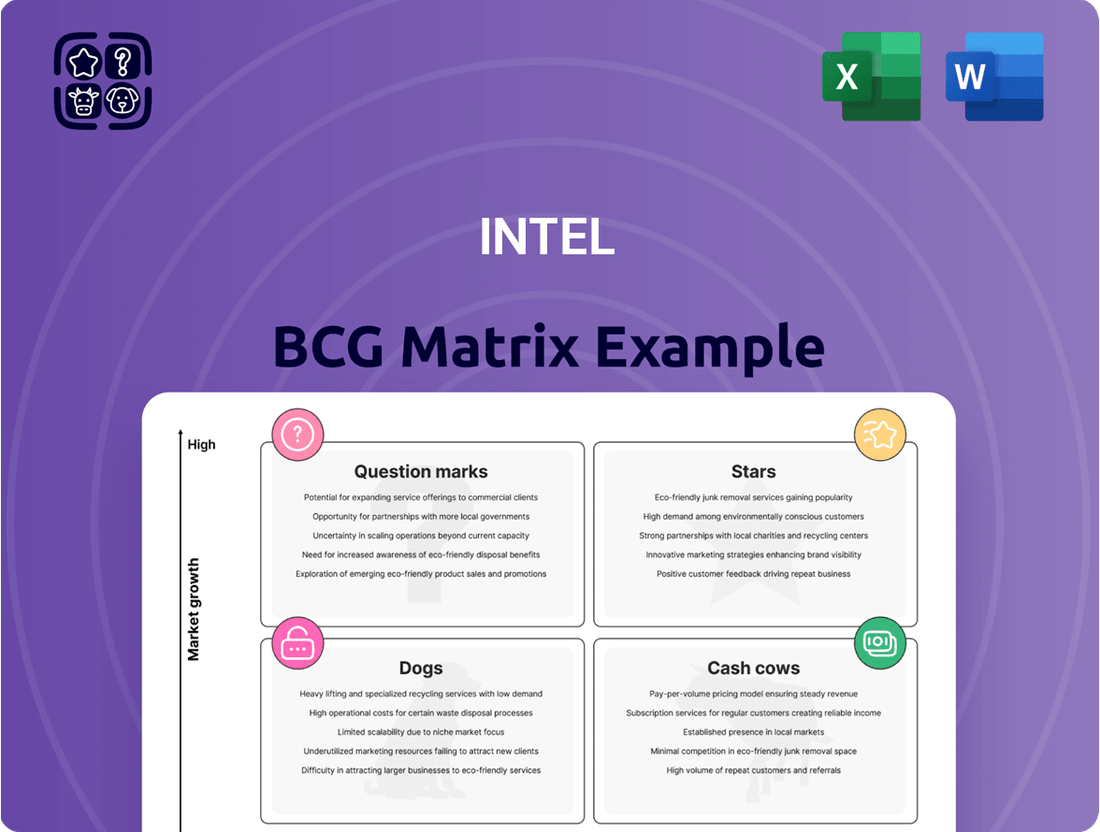

Intel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intel Bundle

Uncover the strategic positioning of Intel's product portfolio with our comprehensive BCG Matrix analysis. See which innovations are poised for explosive growth and which are generating consistent returns, all within a clear, actionable framework.

This preview highlights the power of the BCG Matrix in understanding market dynamics. Purchase the full report to gain a detailed quadrant-by-quadrant breakdown, complete with data-driven insights and strategic recommendations tailored for Intel's future success.

Don't miss out on the complete picture of Intel's competitive landscape. The full BCG Matrix provides the clarity you need to make informed decisions about resource allocation and future investments, transforming raw data into strategic advantage.

Stars

Intel's Data Center and AI (DCAI) segment, especially its server-focused Xeon processors, is positioned in a rapidly expanding market, even with heightened competition. The company noted robust performance in this area during Q1 2025, with a subsequent 4% growth observed in Q2 2025.

Intel is actively working to reclaim market share in hyperscale computing. Its new Xeon 6 processors, codenamed 'Sierra Forest' and 'Granite Rapids,' have entered full production, indicating a strategic push to meet the demands of modern data centers and AI workloads.

The Network and Edge Group (NEX) Solutions, a segment Intel is preparing to spin off, brought in $5.8 billion in revenue during 2024. This division is strategically positioned within the expanding markets of private networks and edge computing, areas Intel identifies as crucial for future enterprise growth and efficiency.

Intel believes these private networks are fundamental to enterprise success in the coming years. The planned spin-off aims to grant the new, independent entity the agility needed to accelerate innovation and capitalize on the dynamic nature of these high-growth sectors.

Intel is heavily investing in AI integration for its client computing devices, evidenced by upcoming processors like Arrow Lake and Lunar Lake designed for notebooks. This strategic move capitalizes on the recovering PC market, positioning AI-enabled PCs as a key future growth driver.

Despite intense competition, the client computing segment continues to be Intel's bedrock, contributing a substantial portion of its revenue. For instance, in 2023, Intel's Client Computing Group (CCG) generated $32.5 billion in revenue, underscoring its foundational importance to the company's financial performance.

Future Advanced Process Nodes (e.g., Intel 18A)

Intel's aggressive push into advanced process nodes, exemplified by its Intel 18A technology, signals a strong bid for leadership in the burgeoning semiconductor foundry market. This commitment is poised to generate substantial wafer volumes for Intel's own products, extending well into the 2030s.

The success of Intel 18A hinges not only on internal adoption but also on its ability to attract external foundry customers. If Intel can secure significant third-party business for this cutting-edge technology, it could fundamentally reshape its foundry operations into a primary engine for growth.

- Intel 18A: Targeting production readiness by late 2024 or early 2025, this node represents a significant leap in transistor density and performance.

- Foundry Market Growth: The global semiconductor foundry market is projected to experience robust growth, with some forecasts indicating a compound annual growth rate (CAGR) exceeding 10% through 2030.

- Customer Acquisition: Intel has publicly stated its ambition to become the second-largest foundry by 2030, requiring substantial gains in external customer wins for its advanced nodes.

Strategic Partnerships in Emerging Tech

Intel's strategic partnerships are pivotal for its growth, especially in emerging technologies. Collaborations like the one with IBM to integrate Gaudi 3 chips into IBM's cloud data centers by 2025 are designed to tap into rapidly expanding markets.

These alliances are key to broadening the adoption of Intel's cutting-edge technologies and capturing new revenue streams. By working with industry leaders, Intel strengthens its position in competitive, high-growth sectors.

- IBM Partnership: Intel's deal with IBM to deploy Gaudi 3 AI accelerators in IBM Cloud data centers starting in 2025 highlights a focus on the booming AI infrastructure market.

- Market Expansion: These collaborations are crucial for Intel to gain a significant foothold in emerging technology segments where early adoption and widespread integration are vital for long-term success.

- Competitive Edge: Strategic alliances help Intel counter competitors by leveraging shared resources and expertise, accelerating the development and deployment of advanced solutions.

Stars in the BCG matrix represent high-growth markets where Intel holds a strong competitive position. These are areas where the company has invested significantly and expects substantial future returns. Intel's focus on AI and advanced process technology positions it well within these high-growth segments.

The company's advancements in foundry services, particularly with Intel 18A, are aimed at capturing a larger share of a rapidly expanding market. This strategic direction, coupled with strong partnerships, is designed to solidify Intel's status as a leader in key technology areas.

Intel's investment in AI-enabled client computing and its efforts to reclaim market share in data centers with new Xeon processors also fall under the Star category. These initiatives are crucial for driving future revenue and maintaining a competitive edge.

Intel's Data Center and AI (DCAI) segment is a prime example of a Star, given the immense growth in AI and cloud computing. The company's continued innovation in Xeon processors and its focus on AI accelerators are key drivers in this high-growth market.

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

A clear, visual representation of Intel's business units, simplifying strategic decisions.

Quickly identify underperforming units, enabling focused resource allocation and problem-solving.

Cash Cows

Intel's Client Computing Group (CCG), responsible for desktop and notebook CPUs, continues to be a major revenue source. Despite facing increased competition, CCG maintained a strong position in the PC processor market, capturing 75.4% of the consumer PC processor unit market share in Q4 2024. This segment consistently generates significant cash flow for Intel.

Intel's mature server CPU lines, particularly its Xeon processors, remain significant cash cows. Despite facing intensified competition, Intel held a substantial 72.8% share of the x86 server market as of the first quarter of 2025. This dominant position ensures consistent and substantial revenue generation.

The robust revenue from these established server CPU lines provides Intel with the financial flexibility to invest in and develop emerging technologies and product categories. This steady income stream is crucial for funding research and development in areas like AI accelerators and next-generation computing architectures.

Integrated Graphics (iGPUs) represent a significant cash cow for Intel. Intel held a commanding 67% share of the PC GPU market in Q4 2023, largely driven by its iGPU offerings bundled with its processors. This dominant position in a mature market generates consistent and substantial revenue from the widespread PC user base.

Existing Chipset Products

Intel's existing chipset products, crucial for its client and server CPU platforms, are firmly established in a mature market. These chipsets hold a significant market share, acting as foundational components that drive consistent revenue for the company. For instance, in 2024, Intel continued to focus on its 700-series chipsets for its latest client processors, ensuring compatibility and performance for a vast installed base.

The strategy for these mature products involves minimal investment, primarily aimed at maintaining compatibility with newer CPU generations and optimizing existing efficiency. This approach ensures they remain relevant and profitable without requiring substantial R&D expenditure. Intel's financial reports consistently show these established product lines contributing a stable, albeit not rapidly growing, portion of their overall revenue stream.

- High Market Share: Intel's chipsets dominate a substantial portion of the PC and server motherboard market.

- Consistent Revenue Driver: These products provide a reliable income stream due to their integration into existing and new systems.

- Low Investment Focus: Capital allocation is directed towards maintaining compatibility and incremental efficiency improvements.

- Mature Product Lifecycle: The emphasis is on maximizing profitability from established technology rather than groundbreaking innovation.

IoT Group (IOTG) Solutions

Intel's Internet of Things Group (IOTG) is positioned as a Cash Cow within the BCG matrix. This segment focuses on embedded and edge computing solutions, a market that, while not experiencing explosive growth, offers predictable and steady revenue streams for Intel. The stability of this market allows IOTG to generate consistent cash flow.

The performance of related segments provides insight into Intel's broader strategy. For instance, in Q1 2025, Intel's 'All Other' segment, which encompasses businesses like Mobileye and Altera, demonstrated robust financial results. This segment reported revenue of $943 million and an operating income of $103 million, indicating positive momentum and strong profitability in these areas.

- Stable Revenue Generation: IOTG consistently contributes to Intel's earnings through its established presence in embedded and edge markets.

- Mature Market Position: Intel holds a strong, established position in these segments, allowing for reliable cash flow.

- Synergistic Potential: The success in related segments like Mobileye and Altera, as seen in Q1 2025 with $943 million in revenue and $103 million in operating income, highlights Intel's ability to manage and grow diverse technology portfolios.

- Cash Flow Driver: IOTG's steady performance is crucial for funding Intel's investments in high-growth areas.

Intel's established server CPU lines, particularly its Xeon processors, remain significant cash cows. Despite facing intensified competition, Intel held a substantial 72.8% share of the x86 server market as of the first quarter of 2025, ensuring consistent and substantial revenue generation.

The robust revenue from these established server CPU lines provides Intel with the financial flexibility to invest in and develop emerging technologies. This steady income stream is crucial for funding research and development in areas like AI accelerators.

Intel's integrated graphics (iGPUs) are also a strong cash cow. The company held a commanding 67% share of the PC GPU market in Q4 2023, largely driven by its iGPU offerings bundled with processors, generating consistent revenue from the widespread PC user base.

| Product Segment | Market Share (Approx. Q1 2025) | Revenue Contribution | Investment Focus |

| Server CPUs (Xeon) | 72.8% (x86 Server Market) | High, Stable | Maintenance, Efficiency |

| Integrated Graphics (iGPUs) | 67% (PC GPU Market) | High, Stable | Bundling, Optimization |

| Client CPUs (Desktop/Notebook) | 75.4% (Consumer PC Processor Unit Market Share Q4 2024) | High, Stable | Compatibility, Efficiency |

Delivered as Shown

Intel BCG Matrix

The Intel BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive, professionally formatted analysis ready for your strategic decision-making. You can be confident that what you see is precisely what you will download, enabling you to instantly leverage its insights for your business planning and competitive strategy. This ensures a seamless transition from preview to actionable intelligence, empowering you to understand Intel's product portfolio within the strategic framework of the Boston Consulting Group Matrix.

Dogs

Intel's foray into discrete graphics cards, branded as Intel Arc, is currently positioned as a Dog in the BCG matrix. The company's market share in this competitive segment plummeted to a concerning 0% in the second quarter of 2024, highlighting substantial challenges in gaining traction against established players like Nvidia and AMD.

Despite significant investment in the Arc A-Series, sales have reportedly collapsed, indicating a failure to capture consumer or enterprise interest. This segment appears to be a cash trap for Intel, draining resources without generating meaningful returns or establishing a discernible market presence.

Intel's strategic shift includes discontinuing or divesting underperforming product lines, a move underscored by significant workforce reductions announced in early 2024. This action directly addresses the burden of legacy products that consume valuable capital and resources without generating sufficient returns or contributing to the company's growth trajectory.

By phasing out these less competitive offerings, Intel aims to streamline operations and reallocate investments towards more promising and profitable ventures. This is a critical step in optimizing its portfolio and enhancing overall financial health, ensuring resources are focused on areas with higher growth potential.

Intel's strategic adjustments include halting planned manufacturing projects in Germany and Poland, a move reflecting a critical assessment of capital allocation. These decisions underscore a broader trend of re-evaluating underutilized assets and fragmented operational footprints that have historically demanded significant investment without commensurate demand, impacting profitability.

The company is consolidating assembly and test operations in Costa Rica, signaling a focus on optimizing existing capabilities. This consolidation is a direct response to investments that are not currently generating the anticipated returns, a common challenge for large-scale manufacturing enterprises navigating fluctuating market demands and technological shifts.

Altera (Programmable Solutions Group)

Intel's sale of a 51% stake in its Altera Programmable Solutions Group to a private equity firm in 2024 marked a significant strategic shift. This divestiture signals Altera's classification as a non-core asset within Intel's broader portfolio.

While Altera generated revenue, its sale suggests it did not align with Intel's primary strategic objectives and may have been a drain on resources. This action reflects a common corporate strategy of shedding divisions that are less profitable or not central to the company's future direction.

- Divestiture of Non-Core Asset: Intel sold a 51% stake in Altera in 2024.

- Strategic Realignment: The move indicates Altera was not considered a core strategic focus for Intel.

- Resource Allocation: The sale suggests Altera may have been a drain on Intel's resources.

- Shedding Underperforming Divisions: This mirrors a strategy to divest less profitable or non-strategic business units.

Rialto Bridge and Falcon Shores GPU Accelerators

Intel's strategic pivot in the high-performance GPU accelerator market saw the cancellation of its Rialto Bridge GPU accelerator. This move, coupled with the confirmation that Falcon Shores will not see a commercial release and will remain an internal testing product, underscores significant challenges in establishing a competitive foothold. These decisions reflect substantial Research and Development investments that did not translate into market viability, a key consideration within the BCG Matrix framework.

The discontinuation of these projects signifies Intel's struggles to effectively challenge established players in the lucrative GPU accelerator sector. This situation places these initiatives in the 'Dog' category of the BCG Matrix, characterized by low market share and low market growth potential, despite prior investment.

- Rialto Bridge Cancellation: Intel officially canceled the Rialto Bridge GPU accelerator, a product intended to compete in the data center GPU market.

- Falcon Shores Reclassification: Falcon Shores, Intel's Xe-HPC GPU architecture, will not be released commercially and is designated for internal testing and development purposes only.

- Market Competitiveness: These cancellations highlight Intel's difficulties in achieving significant market share and competitive differentiation against established high-performance GPU providers.

- R&D Investment Impact: The company's substantial R&D expenditures on these projects did not yield commercially successful products, impacting their position in the GPU market.

Intel's discrete graphics efforts, particularly the Arc A-Series, are firmly in the Dog quadrant of the BCG matrix. The company's market share in this segment was a stark 0% in Q2 2024, demonstrating a failure to gain traction against dominant players like Nvidia and AMD. Despite substantial investments, sales have reportedly collapsed, indicating these products are cash drains with no significant market presence.

Intel's strategic response includes divesting non-core assets and discontinuing underperforming product lines. The sale of a 51% stake in its Altera Programmable Solutions Group in 2024 exemplifies this, signaling Altera's status as a non-core asset. This move aims to streamline operations and reallocate capital to more promising ventures, a critical step in optimizing its portfolio and improving financial health.

The cancellation of the Rialto Bridge GPU accelerator and the reclassification of Falcon Shores for internal testing only further solidify these initiatives' Dog status. These decisions reflect significant R&D spending that did not translate into commercially viable products, highlighting Intel's ongoing struggles to compete effectively in the high-performance GPU sector.

| Product/Segment | BCG Quadrant | Market Share (Q2 2024) | Strategic Action |

|---|---|---|---|

| Intel Arc Graphics (Discrete) | Dog | 0% | Discontinuation/Divestiture |

| Altera Programmable Solutions Group | Dog (Non-Core) | N/A (Divested 51%) | Divestiture of Majority Stake |

| Rialto Bridge GPU Accelerator | Dog | N/A (Canceled) | Project Cancellation |

| Falcon Shores GPU Accelerator | Dog | N/A (Internal Use Only) | Commercial Release Canceled |

Question Marks

Intel Foundry Services (IFS) currently finds itself in the Question Mark quadrant of the BCG Matrix. The chip manufacturing market is expanding rapidly, presenting a significant opportunity. However, IFS is currently a cash drain, posting a substantial $2.3 billion operating loss in the first quarter of 2025.

The challenge for IFS is attracting external clients for its cutting-edge 18A manufacturing process. Intel has signaled that it may prioritize using this advanced technology for its own internal chip production first. This strategy creates uncertainty regarding the immediate revenue generation from external foundry services.

Significant capital expenditure is necessary for IFS to compete in this capital-intensive industry. The long-term profitability and market adoption of its foundry services remain uncertain, characteristic of a Question Mark, where substantial investment is needed to determine future success.

Intel's Gaudi AI accelerators are positioned within the rapidly expanding AI chip market, a segment experiencing significant growth. However, Intel currently holds a comparatively small slice of this market, trailing behind established leaders like Nvidia and AMD. This competitive landscape presents a considerable challenge for Gaudi's market penetration.

The financial performance of Gaudi in 2024 fell short of expectations, with Intel missing its revenue target of $500 million for these accelerators. This underperformance suggests that despite the perceived competitive performance of Gaudi and various strategic collaborations, customer adoption has not met the anticipated pace. This situation places Gaudi in a precarious position within the BCG matrix, potentially requiring substantial investment to climb the market share ladder or risking a decline into the 'dog' category if momentum isn't gained.

Intel is strategically investing in new mobile and edge AI solutions, targeting high-growth markets where its current footprint is relatively small compared to its established CPU business. These ventures represent early-stage opportunities requiring significant capital to establish a strong market position.

Success hinges on rapid market adoption and the ability to differentiate Intel's offerings from competitors, a critical factor for moving these initiatives out of the question mark phase. For example, the edge AI market is projected to grow significantly, with some estimates placing its value at over $60 billion by 2028, underscoring the potential but also the competitive intensity.

Next-Generation Server Architectures for Hyperscale Workloads

Intel recognizes that while its Xeon processors remain strong performers for many tasks, the hyperscale market demands greater efficiency. This means focusing on architectures that deliver superior performance per watt, a critical factor for large-scale data centers. For instance, the growing adoption of specialized accelerators and custom silicon by hyperscalers highlights this shift, with companies like Microsoft and Google investing heavily in their own silicon designs by 2024.

The company's strategic imperative is to develop next-generation server architectures that can effectively compete in these dynamic environments. This is essential for Intel to counter the advancements made by competitors, particularly AMD's EPYC processors, which have gained significant market share, and the increasing influence of ARM-based solutions in the server space. By 2024, the server CPU market saw AMD capturing a notable percentage of new server designs, underscoring the competitive pressure.

These new architectures are not just about catching up; they represent a significant growth avenue for Intel. The demand for cloud computing and AI workloads continues to surge, creating a substantial market opportunity for processors that excel in these areas. Intel's investment in advanced packaging technologies and heterogeneous computing aims to address these evolving needs, with a focus on delivering integrated solutions that combine CPU, GPU, and other accelerators.

- Hyperscale Workload Demands: Focus on performance-per-watt for efficiency in large data centers.

- Competitive Landscape: Addressing market share gains by AMD and the rise of ARM in servers.

- Growth Opportunity: Tapping into the expanding cloud computing and AI market segments.

- Strategic Investments: Advancing technologies like advanced packaging and heterogeneous computing.

Strategic Acquisitions for New Market Entry

Intel's strategic exploration of new market opportunities via potential acquisitions is a classic question mark scenario. These moves would likely involve substantial investment in rapidly expanding, potentially disruptive industries where Intel's current market share is minimal. The ultimate classification of these ventures within the BCG matrix hinges entirely on their future performance and successful integration.

For instance, Intel's reported R&D spending in 2023 reached approximately $31.4 billion, indicating a strong commitment to innovation and exploring new technological frontiers. This financial muscle could be leveraged for acquisitions. Consider the burgeoning AI hardware market, projected to grow significantly in the coming years; an acquisition here could position Intel for future dominance.

- Potential Acquisition Targets: High-growth sectors like AI accelerators, advanced semiconductor materials, or specialized cloud infrastructure.

- Capital Outlay: Significant, potentially in the billions of dollars, depending on the target company's valuation.

- Risk Factor: High, due to market uncertainty and integration challenges, but with the potential for substantial rewards.

- Future Classification: Success would move them towards Stars or Cash Cows; failure could result in Dogs.

Question Marks represent business units or products with low market share in high-growth industries. Intel Foundry Services (IFS) embodies this, facing a booming chip manufacturing market but currently operating at a loss, with a $2.3 billion operating loss in Q1 2025. The success of IFS hinges on attracting external clients to its advanced 18A process, a move that is not guaranteed as Intel may prioritize internal use.

Intel's Gaudi AI accelerators are also in this category. While the AI chip market is expanding rapidly, Gaudi holds a small market share and missed its 2024 revenue target of $500 million. This indicates a need for significant investment to gain traction against established players.

Emerging ventures, such as new mobile and edge AI solutions, also fall under Question Marks. These require substantial capital to establish a market presence in competitive, high-growth sectors. Success depends on rapid customer adoption and differentiation, aiming to transform these into Stars or Cash Cows.

Intel's potential acquisitions in high-growth sectors like AI hardware also represent Question Marks. These ventures require significant capital outlay with high risk due to market uncertainty and integration challenges, but offer the potential for substantial rewards if successful.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.