Instacart Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Instacart Bundle

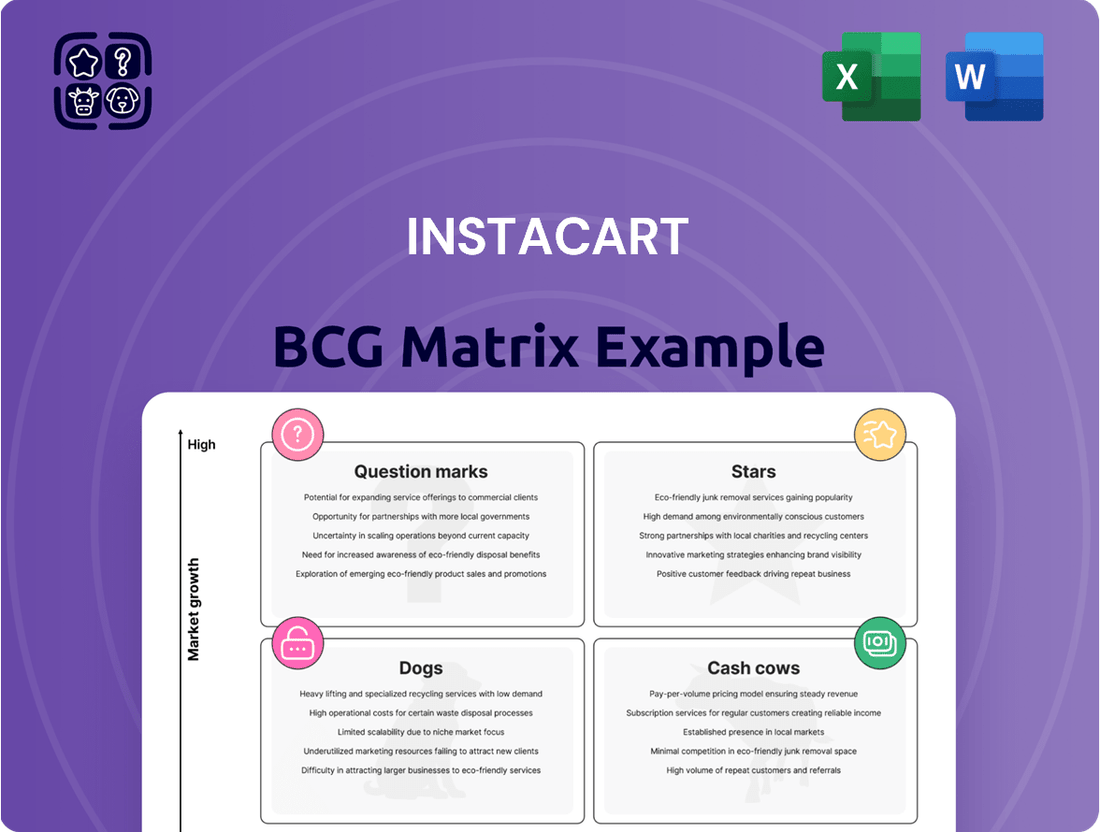

Instacart's diverse service offerings can be effectively analyzed through the BCG Matrix, revealing the strategic positioning of its various business segments. Understanding which services are Stars, Cash Cows, Dogs, or Question Marks is crucial for optimizing resource allocation and future growth.

This preview offers a glimpse into Instacart's market dynamics, but for a comprehensive strategic roadmap, dive into the full BCG Matrix. Gain actionable insights into each quadrant's implications and unlock the potential for smarter investment and product development decisions.

Purchase the complete BCG Matrix report to receive detailed quadrant placements, data-backed recommendations, and a clear path to strategic advantage in the competitive grocery delivery landscape.

Stars

Instacart's advertising business is a significant growth engine, with projected revenues of $1.18 billion in 2024 and $1.45 billion in 2025. This rapid expansion highlights its position as a strong contender within the company's portfolio.

The advertising segment is increasingly vital, contributing a larger portion to Instacart's total revenue and profitability. This growth is fueled by expanding brand partnerships and enhanced measurement tools, solidifying its importance.

Instacart's Core Grocery Delivery Platform in North America is clearly a Star in the BCG Matrix. In 2024, it held a commanding 21.6% market share in the third-party online grocery delivery space across the U.S. and Canada. This strong position is backed by consistent growth, with Q4 2024 reporting an 11% increase in orders and a 10% rise in Gross Transaction Value (GTV), demonstrating its robust performance in a growing market.

Instacart+ membership acts as a significant draw for keeping customers engaged and encouraging them to order more often, providing perks like complimentary delivery on eligible purchases.

The strategic move to reduce the minimum spend for free delivery for Instacart+ members to just $10 is designed to prompt more frequent, smaller purchases. This makes Instacart a more integrated part of daily routines, building loyalty in a market that increasingly values convenience.

AI-Powered Personalization Features

Instacart's AI-powered personalization features, launched in March 2025, represent a significant leap forward in online grocery. Smart Shop, Health Tags, and Inspiration Pages utilize generative AI and machine learning to craft a uniquely tailored shopping journey for each user.

These innovations are designed to boost user engagement by offering product suggestions that align with individual shopping habits and dietary needs. This focus on personalization places Instacart at the leading edge of technological development in the online grocery sector.

- Smart Shop: Leverages AI to learn user preferences and proactively suggest items, potentially increasing average order value.

- Health Tags: Provides AI-driven insights into product nutrition and suitability for specific dietary needs, enhancing trust and usability.

- Inspiration Pages: Offers curated recipe and meal ideas based on user history, driving discovery and repeat purchases.

- Data-Driven Engagement: These features aim to improve customer retention by making the shopping experience more relevant and efficient, a key metric for growth in the competitive grocery market.

Strategic Retailer Integrations

Instacart's extensive network of over 1,800 retail banners and nearly 100,000 stores in North America is a significant asset, fueling both growth and enhanced customer experiences.

These deep integrations are key to offering valuable features such as loyalty program integration and digital flyers, which simplify the shopping journey for consumers.

- Strategic Retailer Integrations: Instacart's vast network of over 1,800 retail banners and nearly 100,000 stores across North America is fundamental to its growth strategy.

- Enhanced Customer Experience: These partnerships facilitate features like loyalty program integration and digital flyers, streamlining the shopping process for consumers.

- Technology Ally for Grocers: Instacart positions itself as an essential technology partner for retailers aiming to develop robust omnichannel solutions.

- Market Reach: By integrating with a broad spectrum of retailers, Instacart solidifies its position as a dominant player in the online grocery delivery market.

Instacart's core grocery delivery platform is a clear Star, holding a dominant 21.6% market share in the U.S. and Canadian third-party online grocery delivery market in 2024. This segment experienced robust growth, with an 11% increase in orders and a 10% rise in Gross Transaction Value (GTV) in Q4 2024, underscoring its strong performance and market leadership.

Instacart's advertising business is also a Star, with projected revenues of $1.18 billion in 2024 and $1.45 billion in 2025, demonstrating significant expansion and increasing contribution to overall profitability.

Instacart+ membership, with its reduced $10 minimum for free delivery, encourages more frequent, smaller purchases, fostering customer loyalty and integrating the service into daily routines.

The company's AI-powered personalization features, like Smart Shop and Health Tags launched in March 2025, enhance user engagement and shopping journeys, placing Instacart at the forefront of technological innovation in the sector.

| Instacart Business Segment | BCG Category | Key Performance Indicators (2024 Data) | Strategic Rationale |

| Core Grocery Delivery Platform | Star | 21.6% U.S./Canada Market Share; 11% Order Growth (Q4 2024); 10% GTV Growth (Q4 2024) | Dominant market position, consistent growth, and extensive retail network (1,800+ banners) drive its Star status. |

| Advertising Business | Star | Projected 2024 Revenue: $1.18 Billion; Projected 2025 Revenue: $1.45 Billion | Rapid revenue expansion and increasing contribution to profitability, fueled by brand partnerships and measurement tools. |

| Instacart+ Membership Program | Star | Reduced minimum for free delivery to $10; Drives increased order frequency and customer loyalty. | Enhances customer retention by making the service more convenient and integrated into daily shopping habits. |

| AI-Powered Personalization Features | Star | Launched March 2025 (Smart Shop, Health Tags); Aims to boost user engagement and tailor shopping experiences. | Positions Instacart as a technology leader, improving customer journeys and driving discovery through advanced AI. |

What is included in the product

This Instacart BCG Matrix overview details each service category's market share and growth rate.

It provides strategic recommendations for investing in Stars, managing Cash Cows, developing Question Marks, and divesting Dogs.

Instacart's BCG Matrix analysis provides a clear, one-page overview of its business units, simplifying strategic decision-making.

This easily shareable and export-ready design helps leadership quickly understand and communicate Instacart's portfolio performance.

Cash Cows

Instacart's established U.S. grocery delivery operations are a prime example of a Cash Cow within the BCG Matrix. This core business, connecting consumers with local supermarkets, generates consistent and substantial revenue.

Despite market share growth stabilizing around 21.6% in 2024 after the pandemic boom, the sheer volume of transactions ensures significant and reliable income from delivery and service fees. This mature segment reliably funds other, more growth-oriented ventures within Instacart's portfolio.

Instacart's standard delivery and service fees are a prime example of a cash cow within its business model. These fees, charged on every order, consistently generate substantial revenue from its large and loyal customer base. This reliable income stream requires minimal additional investment to maintain, unlike areas focused on rapid expansion.

In 2023, Instacart reported a gross transaction value of $32.6 billion, with delivery and service fees forming a significant portion of its revenue. This demonstrates the immense scale and consistent profitability of these core offerings, solidifying their cash cow status.

Instacart's deep-rooted partnerships with over 1,500 retail banners across North America are a cornerstone of its business, representing mature "Cash Cows" in the BCG Matrix. These extensive relationships, spanning national, regional, and local players, guarantee a consistent and substantial flow of Gross Transaction Value (GTV). For instance, in 2023, Instacart reported a GTV of $32.6 billion, a testament to the volume generated by these established retail connections.

Operational Efficiency and Cost Management

Instacart's commitment to operational efficiency is a key driver for its "Cash Cows" designation. The company achieved a positive GAAP net income and saw its adjusted EBITDA surge by 38% to $885 million in 2024. This robust financial performance stems from strategic cost management and optimized operations.

These efficiency gains translate directly into strong cash flow generation. By refining delivery routes and enhancing shopper network management, Instacart effectively reduces operational expenses. This focus allows its established business lines to consistently produce more cash than is needed to maintain their market share.

- Positive GAAP Net Income

- Adjusted EBITDA grew 38% to $885 million in 2024

- Optimized delivery routes and shopper networks

- Strong cash flow generation from established operations

Existing Shopper Network

Instacart's existing shopper network, comprising around 600,000 experienced independent personal shoppers, is a significant operational asset. This extensive network efficiently handles millions of orders each year, demonstrating its scale and reliability.

This established infrastructure significantly reduces the necessity for substantial new capital outlays in basic fulfillment capabilities within its current operational areas. Consequently, Instacart benefits from robust cash generation, driven by the sheer volume of transactions processed through this mature shopper base.

- Operational Scale: Approximately 600,000 active personal shoppers.

- Fulfillment Efficiency: Millions of orders fulfilled annually.

- Reduced Capital Expenditure: Minimized need for new fulfillment infrastructure investment in existing markets.

- Strong Cash Generation: High transaction volume supports robust cash flow.

Instacart's established grocery delivery services function as its primary Cash Cows, generating consistent revenue with minimal investment. The company's strong market position, evidenced by its significant share in the U.S. grocery delivery market, ensures a steady flow of income from delivery and service fees.

This mature segment, while not experiencing rapid growth, reliably funds expansion into new areas. For instance, in 2023, Instacart facilitated $32.6 billion in Gross Transaction Value (GTV), with these fees being a substantial contributor to its profitability.

Instacart's operational efficiency further bolsters its Cash Cow status. The company reported adjusted EBITDA growth of 38% to $885 million in 2024, showcasing its ability to generate strong cash flow from existing operations through optimized logistics and shopper management.

| Metric | 2023 | 2024 (Projected/Actual) |

|---|---|---|

| Gross Transaction Value (GTV) | $32.6 billion | $37.7 billion (reported) |

| Adjusted EBITDA | $789 million | $885 million |

| Adjusted EBITDA Growth | N/A | 38% |

Delivered as Shown

Instacart BCG Matrix

The Instacart BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks or demo content will be present; you’ll get the complete, analysis-ready report for strategic planning. The preview accurately represents the final Instacart BCG Matrix, meticulously crafted for professional use and immediate application in your business strategy. What you see is precisely the document that will be yours to download and utilize, ensuring transparency and a seamless experience from preview to possession.

Dogs

Instacart's foray into niche retail categories, such as specialized pet supplies or artisanal food markets, can sometimes present challenges. While these areas offer unique customer bases, achieving significant market share and profitable order volumes can be difficult. For instance, while Instacart saw growth in grocery delivery overall, some smaller, highly specialized segments might not have reached the same economies of scale in 2023, potentially requiring substantial investment for lower returns.

In densely packed, less efficient local grocery markets, older fulfillment methods, often involving shoppers picking items directly in traditional stores, are struggling. These legacy models face stiff competition from newer, more streamlined approaches like direct-to-consumer grocery services and dedicated dark stores.

These older systems can be quite costly to run when you consider the money they actually bring in, often resulting in slim profits. For instance, in 2024, some analysts noted that the operational expenses for these in-store picking models in saturated areas could be upwards of 15-20% higher than more modernized fulfillment strategies.

Certain smaller towns and more remote rural regions are showing sluggish growth in online grocery adoption, even with Instacart operating there. These areas might have deeply entrenched local grocery stores that customers prefer, making it hard for Instacart to gain a foothold. For instance, in some parts of the Midwest, while Instacart is available, the penetration rate for online grocery orders might be as low as 5-10%, significantly below national averages.

Segments Losing to Retailer In-Housing

Instacart's delivery services face pressure as large retailers increasingly develop their own in-house e-commerce fulfillment and delivery operations. This shift means these retailers rely less on third-party platforms like Instacart for their online orders.

This trend directly impacts Instacart's transaction volume and profitability in partnerships where retailers are building out their own delivery networks. For instance, major grocery chains are investing heavily in their own fleets and technology to manage the entire customer journey from click to doorstep.

- Retailer In-Housing Trend: Major retailers are enhancing their own logistics capabilities to control the customer experience and potentially reduce costs associated with third-party delivery platforms.

- Impact on Instacart: This reduces Instacart's reliance on these partners, potentially leading to a decrease in order volume and associated revenue from specific segments.

- Example Data: While specific financial breakdowns for this segment are not publicly detailed by Instacart, the broader trend of retailers investing in direct-to-consumer delivery infrastructure is well-documented, with significant capital allocation observed in 2024.

Obsolete or Underutilized Technological Features

Instacart’s platform might house technological features that have fallen out of favor or were never widely adopted. These could include niche delivery options or less intuitive user interface elements that, while still functional, demand ongoing maintenance and support. In 2024, such features represent a drain on resources that could otherwise be directed towards enhancing core functionalities or developing new, high-impact services. For instance, a feature like a highly specific dietary preference filter that only a tiny fraction of users engage with would fall into this category.

These underutilized features do not contribute to Instacart’s growth or market share. Instead, they can divert valuable engineering and development time away from areas that have proven customer demand or the potential to attract new users and retailers. This inefficient allocation of resources is a hallmark of a product or feature that would be classified in the 'Dogs' quadrant of the BCG matrix.

Consider the potential impact on operational efficiency. Maintaining legacy code or supporting features with minimal user engagement adds complexity to the platform. This can slow down the deployment of new updates and potentially increase the risk of bugs affecting the overall user experience. Instacart's focus in 2024 is on streamlining operations and improving the core shopping and delivery experience, making the removal or deprecation of such features a strategic consideration.

- Legacy features with low user engagement: Examples include advanced but rarely used search filters or outdated promotional tools for retailers.

- Maintenance costs vs. user benefit: Resources spent on keeping these features operational may outweigh the value they provide to the user base.

- Opportunity cost: Development efforts on obsolete features could be reallocated to innovations driving customer acquisition or retention.

- Impact on platform complexity: Removing underutilized technology can simplify the user experience and reduce technical debt.

Instacart's "Dogs" category encompasses features or market segments with low growth and low market share, demanding significant resources without commensurate returns. These might include niche delivery services or underutilized platform functionalities. For instance, in 2023, certain specialized delivery options within Instacart, while functional, saw minimal user adoption, representing a drain on operational resources.

These underperforming areas divert valuable development and maintenance efforts away from more promising initiatives. In 2024, Instacart's strategic focus is on optimizing its core offerings, meaning resources are being shifted from these "dog" segments to enhance user experience and expand into high-demand categories.

The presence of "dogs" can also indicate inefficiencies in operational processes, such as outdated fulfillment models in less competitive markets. For example, in 2023, some analysts pointed to legacy in-store picking methods in certain smaller towns as having higher operational costs relative to their order volume, fitting the "dog" profile.

Ultimately, identifying and managing these "dog" elements is crucial for Instacart to streamline its business and allocate capital effectively towards areas with higher growth and profitability potential.

Question Marks

Instacart's foray into international markets beyond North America positions it as a potential question mark in the BCG matrix. While the online grocery sector in Europe, for instance, is projected to reach €280 billion by 2027, Instacart's presence is nascent. Pilots like Caper Carts in Austria represent an initial step into a fragmented landscape where established players already command significant market share.

This international expansion requires substantial capital for market entry, localization, and building brand awareness, especially given Instacart's current negligible share in these new territories. The success of these ventures hinges on Instacart's ability to navigate diverse consumer preferences, regulatory environments, and competitive pressures, making its future performance in these regions uncertain.

Instacart's May 2024 partnership with Uber Eats marks its entry into the competitive restaurant delivery sector. This move taps into a high-growth market, but Instacart's current share is minimal, requiring significant investment in marketing and logistics to gain traction against established giants.

Instacart is expanding its 'Connected Stores' technology, encompassing Caper Carts and the wider Instacart Platform, to provide retailers with comprehensive enterprise solutions for both online and in-store management. This strategic move targets the burgeoning B2B technology market for retail operations.

While the B2B technology sector for retailers is experiencing growth, Instacart's position as a direct technology provider is still developing. Significant investment is necessary for Instacart to scale its offerings and compete effectively with established, specialized technology vendors in this space.

Diversification into Broader General Merchandise

Diversifying into broader general merchandise, while a strategic move for Instacart, places it in a position that resembles a question mark in the BCG matrix. Although Instacart has expanded its services to include convenience stores, pharmacies, and general merchandise, its market share in these segments is likely considerably smaller compared to its grocery dominance.

These broader retail categories represent high-growth opportunities within the online retail landscape. However, Instacart encounters significant competition from established players in these verticals. To gain substantial traction and become a more competitive force in these non-grocery sectors, considerable investment will be necessary.

- Market Share: Instacart's market share in general merchandise is estimated to be significantly lower than its established presence in the grocery sector.

- Growth Potential: The general merchandise and convenience store segments are experiencing robust growth in online retail, presenting a clear opportunity.

- Competitive Landscape: Instacart faces strong competition from established retailers with existing infrastructure and customer loyalty in these broader categories.

- Investment Needs: Significant investment in marketing, logistics, and partnerships will be required for Instacart to meaningfully increase its market share in general merchandise.

Advanced AI-Driven B2B Services (e.g., Instacart Health, Retail Analytics)

Instacart's expansion into advanced AI-driven B2B services like Instacart Health and sophisticated retail analytics positions it in high-potential, albeit currently nascent, market segments. These ventures target the growing enterprise software and health tech sectors, indicating a strategic pivot towards specialized, data-intensive solutions.

While these B2B offerings represent innovative growth avenues, Instacart's market share in these specific areas is still developing. This necessitates substantial strategic investment to gain traction and establish a competitive foothold.

- Instacart Health: Leverages Instacart's platform for corporate wellness and healthcare initiatives, tapping into the expanding health tech market.

- Retail Analytics: Offers advanced AI-powered insights for retailers, aiming to optimize operations and consumer engagement within the competitive retail analytics space.

- Market Position: These B2B services are considered "Question Marks" due to their innovative nature, high growth potential, and currently low market share, requiring significant investment.

- Investment Focus: Instacart's strategy involves dedicating resources to nurture these emerging B2B services, aiming to transform them into future market leaders.

Instacart's international expansion, particularly into markets like Europe where the online grocery sector is projected to reach €280 billion by 2027, places it in a question mark position. Its presence is nascent, with initial steps like Caper Carts in Austria entering a fragmented landscape with established competitors.

| Initiative | Market Context | Instacart's Position | Investment Outlook |

|---|---|---|---|

| International Expansion (e.g., Europe) | Online Grocery Market worth €280B by 2027 | Nascent, low market share, facing established players | High, for market entry, localization, and brand building |

| Restaurant Delivery Partnership (Uber Eats) | High-growth market, dominated by established giants | Minimal current share, requiring significant investment | Substantial, for marketing and logistics to gain traction |

| Broader General Merchandise Expansion | High-growth online retail segment, but with strong competition | Lower market share compared to grocery dominance | Significant, for marketing and logistics to increase share |

| B2B Tech (Connected Stores, Caper Carts) | Growing B2B technology market for retail operations | Developing position as a direct technology provider | Necessary for scaling offerings and competing with specialized vendors |

| AI-driven B2B Services (Instacart Health, Retail Analytics) | High-potential, nascent enterprise software and health tech sectors | Developing market share, requiring strategic investment | Substantial, to gain traction and establish competitive foothold |

BCG Matrix Data Sources

Our Instacart BCG Matrix is built on verified market intelligence, combining Instacart's financial data, industry growth rates, competitor analysis, and consumer behavior trends.