The Innovation Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Innovation Group Bundle

Navigate the complex external landscape impacting The Innovation Group with our meticulously crafted PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping their operational environment. Unlock actionable intelligence to refine your own market strategies and gain a competitive advantage. Download the full analysis now for a comprehensive understanding.

Political factors

Governments globally are tightening data protection rules, mirroring the impact of GDPR and CCPA on how The Innovation Group manages client information. For instance, as of early 2024, regulatory bodies continue to refine enforcement of these laws, with fines for non-compliance potentially reaching millions. This necessitates robust data handling protocols and influences the design of their digital services.

Industry-specific policy changes significantly impact The Innovation Group. For instance, in 2024, several regions introduced stricter consumer protection laws for insurance policies, requiring enhanced transparency in claims processing. This necessitates updates to their policy administration software to ensure compliance and maintain client trust.

The automotive sector also saw evolving vehicle safety standards in 2024, which directly affect claims management. Companies like The Innovation Group must adapt their systems to accurately assess damages and manage claims related to new safety technologies, ensuring their solutions remain relevant and efficient in a changing market.

Furthermore, shifts in property industry regulations, such as new licensing requirements for property management services implemented in late 2024, can influence the demand for and features of claims management solutions. These policy adjustments, often aimed at market fairness, require The Innovation Group to be agile in its service offerings to remain competitive.

The Innovation Group's global operations are significantly impacted by international trade policies and geopolitical stability. For instance, the ongoing trade disputes between major economies, such as those involving the US and China, can lead to increased tariffs on technology components, directly affecting The Innovation Group's cost of goods. In 2024, the International Monetary Fund projected global trade growth to be around 3.0%, a figure susceptible to downward revision due to escalating geopolitical risks.

Geopolitical tensions, like the conflict in Eastern Europe, disrupt supply chains and create uncertainty in market access. This can hinder The Innovation Group's ability to source critical technologies and expand into new regions. The World Bank's 2025 outlook suggests that such instability could further dampen global investment flows, making cross-border expansion more challenging and costly for companies like The Innovation Group.

Government Investment in Digital Infrastructure

Government investment in digital infrastructure, such as broadband expansion and 5G deployment, directly benefits The Innovation Group by improving the efficiency and reach of its digital platforms. For instance, the US government's Broadband Equity, Access, and Deployment (BEAD) program, with its initial $42.45 billion allocation, aims to connect unserved and underserved areas, expanding the potential customer base for digitally-enabled services. This increased connectivity fosters a more robust environment for digital transformation, allowing for quicker data exchange and enhanced service delivery to clients.

These government initiatives create a more favorable landscape for digital adoption across various sectors. The acceleration of 5G rollout, with significant investments from both public and private entities in countries like South Korea and Japan, enables faster processing and transmission of data, which is crucial for advanced digital services The Innovation Group offers. This improved digital ecosystem supports the company's ability to innovate and scale its operations more effectively.

- Broadband Expansion: Government funding programs like the BEAD initiative directly increase the addressable market for digital services.

- 5G Rollout: Accelerated 5G deployment enhances data speeds and reliability, crucial for real-time digital solutions.

- Digital Transformation Support: Public investment in digital infrastructure encourages broader industry adoption of digital technologies.

- Improved Service Delivery: Enhanced connectivity allows for faster and more efficient data exchange, benefiting client services.

Taxation and Fiscal Policies

Changes in corporate tax rates directly affect The Innovation Group's bottom line and its capacity for reinvestment. For instance, if the United States, a key market, were to lower its corporate tax rate from the current 21% in the coming years, it could boost the company's net income, potentially freeing up capital for R&D or acquisitions. Conversely, an increase in taxation in a major operating region could force a review of operational costs and investment strategies.

Fiscal policies offering incentives for technology adoption or R&D tax credits are crucial for companies like The Innovation Group. In 2024, many governments continue to offer such credits, with some countries enhancing them to spur post-pandemic growth. For example, a 15% R&D tax credit on qualifying expenditures in the UK could significantly reduce the effective cost of innovation for The Innovation Group's UK-based operations. These incentives directly influence the group's decision-making regarding the pace and scale of its technological advancements.

Government spending priorities have a ripple effect on the economic environment in which The Innovation Group operates. Increased government investment in digital infrastructure or cybersecurity initiatives, for example, can create new market opportunities and demand for the group's services. Conversely, a shift in spending towards less technologically focused sectors might present challenges. The overall economic stability, influenced by these spending patterns, underpins the group's long-term strategic planning and market outlook.

- Corporate Tax Impact: A hypothetical 2% reduction in corporate tax rates in a major market could increase net profits by millions, influencing R&D budgets.

- R&D Incentives: Many nations, including Canada, offer R&D tax credits, with some programs providing refunds of up to 35% for eligible small businesses, directly supporting innovation investment.

- Government Spending: Increased public spending on AI research and development, projected to grow by over 20% annually through 2025 in several leading economies, can create significant demand for specialized services.

- Fiscal Stability: Government debt levels and fiscal deficits can influence interest rates and investor confidence, impacting the cost of capital for The Innovation Group's expansion plans.

Government regulations are a significant political factor for The Innovation Group, influencing everything from data handling to industry-specific operations. For instance, the ongoing refinement of data protection laws in 2024, building on GDPR and CCPA, means companies must maintain robust protocols, with potential fines for non-compliance reaching millions. Similarly, evolving consumer protection laws in sectors like insurance, requiring greater transparency in 2024, necessitate software updates to ensure client trust and regulatory adherence.

What is included in the product

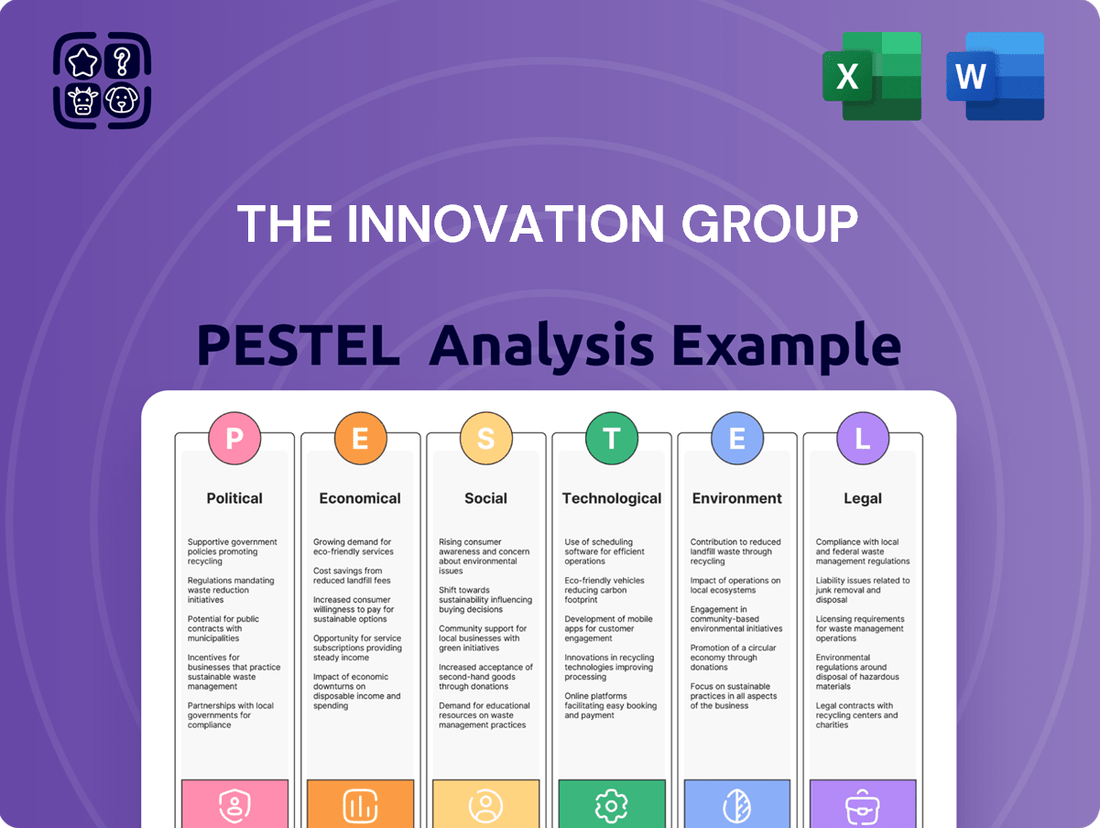

This PESTLE analysis for The Innovation Group meticulously examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions shape its strategic landscape.

It provides actionable insights for identifying opportunities and mitigating threats, empowering informed decision-making for business growth and resilience.

The Innovation Group's PESTLE Analysis provides a clear, summarized version of external factors, relieving the pain point of sifting through extensive data for quick referencing during meetings or presentations.

Economic factors

Global economic growth projections for 2024 and 2025 remain a key consideration. While the IMF's April 2024 World Economic Outlook projected global growth at 3.2% for 2024, a slight uptick from 2023, the risk of recession in major economies persists. This directly impacts The Innovation Group's client base, as robust growth typically spurs investment in digital transformation initiatives, boosting demand for their services.

Conversely, a downturn or recessionary pressures could lead clients to reduce discretionary spending, potentially impacting The Innovation Group's sales pipeline and project execution. For instance, sectors like automotive and property, which are sensitive to economic cycles, may see reduced demand for new services or upgrades. Strategic planning for The Innovation Group must therefore incorporate robust scenario analysis based on these economic forecasts.

Interest rate fluctuations directly affect The Innovation Group's cost of capital and its clients' willingness to invest in new technologies. For instance, if the Federal Reserve raises the federal funds rate, as it has done several times in 2023 and early 2024, borrowing becomes more expensive for businesses looking to adopt advanced digital platforms or claims management systems, potentially slowing innovation adoption.

Higher interest rates can also squeeze the profitability of insurance companies, a key client segment for The Innovation Group. With a higher cost of borrowing, insurers may reduce their capital expenditure on technology upgrades. Furthermore, the yields on their investment portfolios, which often include fixed-income securities, are impacted, influencing their overall financial health and capacity for new investments.

Insurance premium trends are a critical economic factor for The Innovation Group. If premiums are flat or falling, and claims costs are increasing, insurers might hold back on investing in new technologies. For instance, in early 2024, some segments of the property and casualty insurance market experienced premium rate increases, averaging around 8-10%, driven by higher inflation and reinsurance costs, which could potentially free up some budget for innovation.

Conversely, a robust market where premiums are rising and profitability is healthy encourages insurance companies to spend more on technology and services that can enhance efficiency and customer experience. The global insurance market was projected to see modest growth in gross written premiums in 2024, with some analysts predicting a 3-5% increase, suggesting a potentially more favorable environment for technology investments.

Automotive and Property Market Cycles

The Innovation Group's performance is closely linked to the automotive and property sectors, both of which experience distinct market cycles. A slowdown in vehicle sales or a dip in property transactions directly impacts the demand for The Innovation Group's claims management and administration services, potentially reducing revenue.

For instance, global new car registrations saw a modest increase in 2024 compared to 2023, but growth is uneven across regions, with some markets still showing signs of recovery. Similarly, the global property market in late 2024 and early 2025 is characterized by varying interest rate environments and inflation pressures, which can dampen transaction volumes and new construction starts. These fluctuations create a direct correlation between the health of these industries and The Innovation Group's operational performance.

- Automotive Market: Global vehicle sales are projected to grow by approximately 3-4% in 2024, but this masks significant regional variations.

- Property Market: Property transaction volumes in major economies like the US and UK have shown signs of stabilization in early 2025 after a period of decline, though affordability remains a challenge.

- Construction Activity: New housing starts in developed markets are expected to see moderate growth in 2025, contingent on interest rate stability and consumer confidence.

- Impact on Services: Reduced vehicle sales and property transactions can lead to a decline in the volume of insurance claims processed, directly affecting service providers like The Innovation Group.

Foreign Exchange Rate Volatility

Operating globally, The Innovation Group faces significant exposure to foreign exchange rate volatility. Fluctuations in currency values directly impact the translated value of international revenues and the cost of conducting operations across different countries. For instance, a strengthening of the Group's base currency against a key operating currency could reduce the reported value of foreign earnings.

Significant currency movements can materially affect profitability when earnings generated abroad are converted back to the company's reporting currency. This necessitates robust hedging strategies or meticulous financial planning to mitigate potential adverse impacts. The global service delivery model of The Innovation Group means that currency shifts can alter the cost competitiveness of its offerings in various markets.

- Impact on Revenue: A 10% depreciation of the Euro against the US Dollar in early 2024 could have reduced the reported USD value of The Innovation Group's European sales by a similar margin.

- Operational Costs: Conversely, if The Innovation Group sources a significant portion of its technology components from a country whose currency strengthens, its cost of goods sold could increase. For example, a 5% appreciation of the Japanese Yen in late 2024 might increase costs for components sourced from Japan.

- Profitability Margin: Exchange rate volatility can compress profit margins. If The Innovation Group's profit margin on a project in the UK is 15%, a sudden 3% adverse movement in the GBP/USD exchange rate could reduce that margin to 12% before hedging.

- Strategic Hedging: Companies like The Innovation Group often utilize forward contracts or options to lock in exchange rates for anticipated transactions, aiming to stabilize earnings and manage financial risk.

Economic factors such as global growth, interest rates, and currency fluctuations significantly shape The Innovation Group's operating environment. Projections indicate global growth around 3.2% for 2024, but recession risks remain, impacting client spending on digital transformation services.

Interest rate hikes, like those seen in 2023-2024, increase borrowing costs for clients and can reduce insurers' profitability, potentially curbing technology investments. Insurance premium trends, with some P&C segments seeing 8-10% increases in early 2024 due to inflation, could offer more budget for innovation.

The automotive and property markets, key sectors for The Innovation Group, are experiencing uneven recovery, with global new car registrations showing modest growth in 2024 and property markets stabilizing in early 2025. Foreign exchange volatility also poses a risk, impacting the translated value of international revenues and operational costs.

| Economic Factor | 2024/2025 Projection/Trend | Impact on The Innovation Group |

|---|---|---|

| Global GDP Growth | Projected at 3.2% for 2024 (IMF) | Influences client investment in digital transformation; recessionary risks can reduce demand. |

| Interest Rates (e.g., US Federal Funds Rate) | Increased in 2023-early 2024; future path uncertain. | Raises client borrowing costs, potentially slowing technology adoption; impacts insurer profitability. |

| Insurance Premiums (P&C) | Average 8-10% increase in early 2024 in some segments. | Potentially frees up budget for technology investments if profitability improves. |

| Automotive Sales | Modest global growth projected for 2024. | Affects demand for claims management and administration services. |

| Property Market Transactions | Stabilization in major economies in early 2025. | Impacts demand for services tied to property transactions. |

| Foreign Exchange Rates | Ongoing volatility. | Affects translated revenue values and operational costs for global operations. |

Same Document Delivered

The Innovation Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of The Innovation Group provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors influencing its operations and strategy.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering actionable insights for your business strategy.

Sociological factors

Consumers now demand effortless digital experiences across industries like insurance and automotive. For instance, a 2024 report indicated that 70% of consumers prefer digital self-service options for managing their accounts and making transactions.

This shift means businesses need robust digital platforms to meet expectations for speed and personalization. The Innovation Group's focus on enhanced customer experience solutions directly addresses this, as companies are prioritizing investments in technology that facilitates these seamless interactions.

Consequently, client priorities are moving towards digital capabilities, making The Innovation Group's offerings increasingly vital for businesses aiming to stay competitive in the current market landscape.

Aging populations in developed economies, like the US and Europe, mean a shrinking pool of younger workers to fill specialized roles. For instance, the median age in the US reached 38.9 years in 2023, a trend that will continue to shape the labor market.

The evolving workforce, with a greater emphasis on diversity and inclusion, necessitates adaptable service offerings. Companies like The Innovation Group must consider how to best serve a workforce with varied digital literacy levels and preferences.

The surge in remote and hybrid work models, accelerated by events in recent years, directly impacts talent acquisition and retention strategies. In 2024, it's estimated that over 30% of the global workforce will be working remotely at least part-time, making it crucial for The Innovation Group to offer flexible solutions and attract top tech talent who often prioritize these arrangements.

Public concern over data privacy is escalating, with a 2024 survey indicating 78% of consumers are worried about how their personal information is used by companies, directly influencing how The Innovation Group must approach its data collection and AI implementation. This heightened awareness necessitates a commitment to transparent data handling and ethical AI development to foster trust. A breach or perceived misuse of data could severely damage brand reputation, impacting market penetration and client acquisition efforts.

Impact of Social Media and Online Reviews

The Innovation Group's success is increasingly tied to how well its solutions enhance customer experience, as social media and online reviews make this aspect of business highly visible. By mid-2025, it's estimated that over 4.9 billion people will actively use social media, meaning customer sentiment is broadcast to a massive audience. Positive experiences fostered by The Innovation Group's platforms can significantly boost a client's brand image, whereas negative feedback can rapidly damage it, creating a strong market pull for reliable digital interaction management systems.

This heightened transparency places considerable pressure on businesses to excel in their online customer interactions. For instance, a study in late 2024 found that 85% of consumers trust online reviews as much as personal recommendations. Consequently, companies are actively seeking advanced solutions to monitor, manage, and improve their digital customer touchpoints, directly benefiting The Innovation Group's offerings in areas like customer relationship management and digital engagement.

- Customer Experience Transparency: Social media and review sites make customer satisfaction highly visible, impacting brand reputation.

- Digital Interaction Optimization: Businesses need robust systems to manage and improve their online customer interactions.

- Market Demand Driver: Negative feedback spreads quickly, increasing demand for solutions that ensure positive digital experiences.

- Consumer Trust in Reviews: A significant majority of consumers rely on online reviews, underscoring the importance of managing online reputation.

Work-Life Balance and Employee Well-being Trends

The growing focus on employee well-being and work-life balance is reshaping business operations and technology adoption. Companies are actively seeking solutions that streamline workflows and boost efficiency to foster a healthier work environment. For instance, a 2024 survey indicated that 70% of employees consider work-life balance a top priority when choosing an employer, directly impacting talent acquisition and retention strategies.

The Innovation Group's offerings, designed to automate routine tasks and enhance operational efficiency, directly address these evolving employee expectations. Businesses are increasingly investing in tools that enable flexible work arrangements, recognizing their impact on employee satisfaction and overall productivity. This trend is evident in the projected 15% growth in the flexible work solutions market by the end of 2025.

- Employee Well-being as a Priority: 70% of employees in a 2024 study cited work-life balance as a key factor in job selection.

- Market Growth for Efficiency Tools: The market for solutions that improve operational efficiency and support flexible work is expected to grow by 15% by year-end 2025.

- Impact on Business Strategy: Companies are prioritizing technology that enhances employee satisfaction and productivity to attract and retain talent.

Societal shifts towards digital-first interactions and heightened expectations for personalized customer experiences are paramount. A 2024 report found that 70% of consumers prefer digital self-service options, directly influencing business investment in robust digital platforms. The Innovation Group's focus on customer experience solutions aligns with this trend, as companies prioritize technology that facilitates seamless digital engagement.

The increasing emphasis on employee well-being and work-life balance is reshaping how businesses operate and adopt technology. With 70% of employees in a 2024 survey prioritizing work-life balance, companies are investing in tools that boost efficiency and support flexible work, a market projected to grow 15% by year-end 2025.

Public concern over data privacy is growing, with 78% of consumers in a 2024 survey expressing worry about personal information usage. This necessitates transparent data handling and ethical AI implementation from companies like The Innovation Group to maintain consumer trust.

The pervasive influence of social media and online reviews means customer satisfaction is highly visible, impacting brand reputation significantly. By mid-2025, with over 4.9 billion active social media users, positive digital experiences are crucial for brand image, making solutions that manage online interactions vital.

Technological factors

The Innovation Group's competitive edge hinges on the rapid evolution of Artificial Intelligence (AI) and Machine Learning (ML). These technologies are crucial for developing advanced claims management, sophisticated fraud detection, accurate predictive analytics, and highly personalized customer experiences. By effectively integrating AI and ML, the company significantly boosts the efficiency and precision of its offerings, solidifying its position in the market and fueling innovation across its core sectors.

Continued investment in AI research and development is not just beneficial but essential for The Innovation Group. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to reach over $1.8 trillion by 2030, demonstrating the immense growth potential and the strategic importance of staying at the forefront of these advancements. This commitment ensures they can continuously refine their solutions and maintain a strong competitive advantage.

The accelerating shift towards cloud computing and Software-as-a-Service (SaaS) models is a significant technological tailwind for The Innovation Group. Businesses are increasingly relying on these flexible, scalable, and cost-effective solutions to manage their operations and deploy new technologies. This trend directly supports The Innovation Group's digital platform strategy, making its offerings more attractive and accessible to a wider client base.

The global cloud computing market was projected to reach over $1.3 trillion by the end of 2024, with SaaS accounting for a substantial portion of this growth. This widespread adoption means clients are more comfortable with cloud-based deployments, reducing implementation hurdles for The Innovation Group's services. Furthermore, the inherent scalability of cloud infrastructure allows The Innovation Group to efficiently serve a growing number of users and handle increasing data volumes.

The ease of access and reduced upfront investment associated with SaaS models democratize technology adoption. This lowers the barrier to entry for businesses looking to leverage advanced solutions, a key market segment for The Innovation Group. As more companies embrace cloud-native architectures, the demand for integrated digital platforms that facilitate faster innovation cycles is expected to surge, positioning The Innovation Group favorably.

The Innovation Group's reliance on sensitive data across diverse sectors makes it a prime target for cyberattacks. The escalating sophistication of these threats, including ransomware and phishing, demands significant investment in advanced cybersecurity solutions. For instance, the global cybersecurity market was projected to reach $270 billion in 2024, highlighting the scale of this challenge and the necessary expenditure.

Implementing cutting-edge data protection, encryption, and real-time threat detection technologies is paramount to secure client information and uphold The Innovation Group's reputation for digital trust. Cyber resilience, demonstrated through effective incident response and recovery plans, is a critical competitive advantage. The increasing regulatory landscape, such as GDPR and CCPA, further underscores the need for robust compliance and data privacy measures.

Emergence of Blockchain and Distributed Ledger Technology

Blockchain and Distributed Ledger Technology (DLT) are emerging as significant technological factors, promising enhanced security and transparency. While some applications are still developing, the potential for DLT in areas like insurance claims processing through smart contracts and digital land registries is substantial.

The Innovation Group can leverage DLT to build greater client trust, mitigate fraud, and optimize operational efficiency, thereby creating novel value propositions. This integration signifies a forward-looking approach to innovation within the group.

- Blockchain in Insurance: Smart contracts can automate claims payouts, potentially reducing processing times and administrative costs.

- DLT in Property: Digital land registries using DLT can improve the security and transparency of property ownership records.

- Market Growth: The global blockchain market size was valued at approximately USD 12.76 billion in 2023 and is projected to grow significantly, indicating increasing adoption and investment in this technology.

- Efficiency Gains: Studies suggest that DLT can reduce operational costs in financial services by up to 30% by streamlining processes and eliminating intermediaries.

Development of IoT and Telematics Data

The explosion of Internet of Things (IoT) devices and telematics, particularly in automotive and property management, is a significant technological driver. This trend generates massive volumes of real-time data, offering unprecedented opportunities for enhanced risk assessment, predictive maintenance, and the development of usage-based insurance models. For instance, by 2025, it's projected that over 75 billion IoT devices will be connected globally, underscoring the sheer scale of data available.

The Innovation Group can strategically harness this influx of data. By integrating and analyzing information from connected vehicles and smart homes, the company can refine its claims processing to be more accurate and efficient. Furthermore, this data allows for the creation of highly personalized insurance policies and the delivery of proactive services, directly boosting the group's value proposition. Data-driven insights are becoming a cornerstone of competitive advantage in the insurance sector.

- IoT Device Growth: Global IoT connections are expected to reach 29.7 billion by 2030, a substantial increase from 14.3 billion in 2022, according to Statista.

- Telematics Adoption: In the automotive sector, telematics penetration in new vehicles is projected to exceed 90% in major markets by 2028, enabling rich data collection.

- Data Monetization: Companies leveraging IoT data effectively can see significant revenue growth; for example, businesses that have fully embraced data analytics are 5% more profitable on average.

- Predictive Maintenance Savings: Implementing predictive maintenance powered by IoT data can reduce maintenance costs by up to 30% and decrease downtime by 50%.

The rapid advancement and integration of AI and ML are foundational to The Innovation Group's operational efficiency and product development, particularly in claims management and fraud detection. Continued investment in these areas is critical, given the global AI market's projected growth from approximately $200 billion in 2023 to over $1.8 trillion by 2030. This technological focus ensures the company remains competitive and innovative.

Legal factors

The Innovation Group must navigate a complex web of data protection laws, including GDPR and CCPA, as they manage vast amounts of personal and business data. These regulations, which govern data collection, storage, processing, and sharing, directly impact the development of their digital products and services.

Failure to comply with these stringent rules can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. This underscores the critical need for robust data privacy frameworks within The Innovation Group to mitigate significant financial and reputational risks.

The Innovation Group's clients in the insurance sector face stringent solvency requirements, with global solvency ratios often exceeding 150% for major insurers as of early 2025, and adherence to fair claims practices is paramount. Similarly, automotive clients must comply with evolving vehicle safety standards, such as the upcoming Euro 7 emissions regulations impacting new vehicle sales from 2025, and robust recall management protocols. Property sector clients are bound by complex building codes and land use regulations that vary significantly by jurisdiction, influencing development timelines and costs.

The Innovation Group's success hinges on its ability to embed regulatory compliance into its solutions, acting as a critical value-add for clients grappling with these diverse mandates. For instance, their software might automate compliance checks for insurance claims processing or ensure automotive designs meet the latest safety certifications. Changes in these regulatory landscapes, such as the potential for stricter data privacy laws impacting all three sectors in 2025, directly shape The Innovation Group's product development priorities and investment in compliance expertise.

Consumer protection laws are critical for The Innovation Group, ensuring fair dealings with their clients. These regulations dictate how platforms manage interactions, process claims, and handle customer data, directly impacting operational procedures. For instance, in 2024, the EU continued to strengthen consumer rights through initiatives like the Digital Services Act, pushing for greater transparency in online platforms and advertising, which affects how The Innovation Group communicates value and manages client expectations.

Adhering to fair trading standards, including robust disclosure and transparent dispute resolution mechanisms, is paramount. Failure to comply can lead to significant legal penalties and damage to client trust. The UK's Competition and Markets Authority (CMA) actively enforces these standards, with fines for misleading consumers potentially reaching millions, underscoring the financial and reputational risks for non-compliance.

Prioritizing ethical customer engagement is not just a legal requirement but a strategic imperative. Building and maintaining client trust through honest practices, clear communication, and fair dispute resolution is essential for long-term success and customer loyalty in the competitive financial services landscape.

Intellectual Property Rights and Software Licensing

Protecting The Innovation Group's intellectual property (IP), such as software code and proprietary algorithms, is fundamental to their market position. This protection is achieved through patents, copyrights, and trademarks. For instance, in 2024, companies in the tech sector saw a significant rise in patent applications, reflecting the growing importance of IP as a competitive differentiator.

Simultaneously, The Innovation Group must diligently manage licenses for any third-party technologies or data integrated into their offerings. Failure to secure proper licensing can lead to costly infringement lawsuits, a risk that intensified in 2024 with increased regulatory scrutiny on data usage and software components. Proper IP management underpins their entire technology-centric business model.

- Patent protection is crucial for safeguarding unique algorithms and processes.

- Copyrights secure the company's software code and creative works.

- Trademarks protect brand identity and product names.

- Third-party licensing ensures compliance and avoids legal disputes, with a growing emphasis on open-source software compliance in 2024.

Cybersecurity Legislation and Reporting Requirements

Governments worldwide are enacting stricter cybersecurity laws, mandating specific security standards and requiring prompt reporting of data breaches. For The Innovation Group, this means ensuring all internal systems and client-facing services adhere to these evolving regulations. For instance, the EU's NIS2 Directive, which came into effect in early 2023, significantly expands the scope of cybersecurity obligations for many sectors, impacting companies operating within or serving the EU market.

Non-compliance with these legal frameworks can result in severe consequences. These include substantial financial penalties, such as the potential for fines up to 4% of a company's global annual turnover under GDPR, and significant legal liabilities. Beyond financial repercussions, a failure to adequately protect data or disclose breaches transparently can irrevocably damage The Innovation Group's reputation and erode client trust.

- Mandatory Standards: Adherence to regulations like GDPR, CCPA, and sector-specific cybersecurity frameworks is crucial.

- Breach Notification: Timely reporting of security incidents to regulatory bodies and affected individuals is legally required.

- Financial Penalties: Non-compliance can lead to fines, with some regulations imposing penalties based on a percentage of global revenue.

- Reputational Risk: Security failures and improper breach handling can cause severe damage to brand image and client relationships.

The Innovation Group must continuously adapt to evolving intellectual property (IP) laws to protect its core assets, like algorithms and software code. For example, global patent applications in technology saw a notable increase in 2024, highlighting IP's growing value as a competitive edge.

Navigating third-party licensing is also critical, with a heightened focus in 2024 on compliance for open-source software to avoid costly infringement claims. Proper IP management, including patents, copyrights, and trademarks, underpins the company's technology-driven business model and market position.

| Area of Legal Focus | Key Regulations/Practices | Impact on The Innovation Group | 2024/2025 Trend/Data |

|---|---|---|---|

| Intellectual Property | Patents, Copyrights, Trademarks | Safeguards proprietary algorithms, software, and brand identity. | Tech sector patent applications rose in 2024; increased scrutiny on software licensing. |

| Third-Party Licensing | Software Component Licenses, Data Usage Rights | Ensures compliance and prevents infringement lawsuits. | Growing emphasis on open-source software compliance in 2024. |

Environmental factors

Climate change is significantly escalating the frequency and intensity of extreme weather events. This directly translates to a surge in insurance claims, impacting property and casualty insurers, a key sector for The Innovation Group. For instance, global insured losses from natural catastrophes reached an estimated $110 billion in 2023, according to Swiss Re, highlighting the growing financial burden.

The Innovation Group's claims management solutions must therefore be exceptionally resilient to manage these increased claim volumes and associated costs. Integrating advanced data analytics is crucial for them to offer clients enhanced risk assessment and effective mitigation strategies in this evolving landscape. This growing challenge is a strong driver for the adoption of predictive analytics in the insurance industry.

Investor and regulatory demands for robust Environmental, Social, and Governance (ESG) reporting are intensifying. For instance, by the end of 2024, the SEC's climate disclosure rules, though facing legal challenges, signaled a significant shift towards mandatory environmental impact reporting for many US companies.

The Innovation Group's clients are increasingly seeking sophisticated tools and advisory services to accurately measure and communicate their environmental performance, driving demand for sustainability-focused solutions. This trend is underscored by a projected 20% annual growth rate in the ESG reporting software market through 2027.

The company must also proactively address its own operational sustainability, recognizing that its environmental footprint directly impacts its brand reputation and client trust. Failure to do so could lead to a competitive disadvantage as more businesses prioritize supply chain transparency and eco-friendly practices.

Stricter environmental regulations are increasingly shaping industries like automotive and property. For instance, the EU's Fit for 55 package aims to cut emissions by 55% by 2030, impacting vehicle design and building efficiency standards. The Innovation Group can leverage this by offering solutions that help clients navigate compliance, such as software for tracking vehicle emissions or managing sustainable building materials.

These evolving environmental mandates present significant opportunities for The Innovation Group to develop new service offerings. By providing tools that facilitate green initiatives, like carbon footprint management for corporate fleets or energy efficiency analytics for real estate portfolios, the company can tap into growing market segments focused on sustainability and corporate social responsibility.

Resource Scarcity and Supply Chain Resilience

The Innovation Group faces increasing pressure from resource scarcity, particularly concerning rare earth minerals crucial for its hardware components. Global demand for these minerals, essential for everything from smartphones to electric vehicle batteries, has surged. For instance, cobalt prices, a key component in many batteries, saw significant volatility, with prices reaching over $70,000 per ton in early 2024 before stabilizing. This trend highlights the potential for increased operational costs and supply chain instability.

Ensuring supply chain resilience is paramount for The Innovation Group to mitigate risks associated with environmental factors and resource availability. Disruptions, whether from geopolitical events impacting mining operations or extreme weather events affecting transportation, can directly hinder the group's ability to deliver its hardware and software services. For example, the semiconductor shortage experienced from 2020 through 2023, which saw lead times extend to over a year for some components, demonstrated the profound impact of supply chain fragility on technology companies. This necessitates robust contingency planning and strategic sourcing to maintain operational continuity and manage costs effectively.

- Resource Dependence: The Innovation Group relies on minerals like lithium and cobalt, with global demand for lithium-ion batteries projected to grow by over 15% annually through 2030.

- Supply Chain Vulnerability: Geopolitical tensions in key mining regions, such as the Democratic Republic of Congo (a major cobalt producer), can create significant price swings and supply disruptions.

- Cost Impact: Fluctuations in raw material prices directly affect the cost of goods sold for hardware manufacturers, potentially impacting The Innovation Group's profit margins.

- Operational Complexity: Diversifying suppliers and investing in more sustainable sourcing models adds layers of complexity to procurement and logistics management.

Client Demand for Eco-Friendly and Sustainable Solutions

Clients are increasingly prioritizing environmental responsibility, driving a surge in demand for sustainable products and services. This trend presents a significant opportunity for The Innovation Group to differentiate itself by showcasing its own eco-conscious practices and developing offerings that help clients minimize their environmental impact.

For instance, The Innovation Group could gain a competitive edge by offering solutions that streamline operations for claims adjusters, reducing travel-related emissions, or by championing digital, paperless workflows. This proactive approach aligns with the growing corporate emphasis on environmental, social, and governance (ESG) principles.

- Growing ESG Investment: Global sustainable investment assets reached $37.8 trillion in 2024, indicating strong client and investor preference for environmentally responsible businesses.

- Consumer Preference: A 2024 Nielsen study found that 73% of global consumers would change their consumption habits to reduce their environmental impact.

- Regulatory Push: Governments worldwide are implementing stricter environmental regulations, encouraging businesses to adopt greener operational models.

The increasing frequency of extreme weather events, driven by climate change, is significantly impacting the insurance sector. This translates to higher claims volumes and costs, necessitating resilient solutions for The Innovation Group's clients.

Investor and regulatory pressure for robust ESG reporting is growing, with mandatory climate disclosures on the horizon for many US companies by late 2024. This fuels demand for sustainability-focused tools and advisory services.

Resource scarcity, particularly for minerals vital to technology, poses a risk of increased operational costs and supply chain instability for The Innovation Group, as evidenced by cobalt price volatility in early 2024.

Stricter environmental regulations, such as the EU's Fit for 55 package, are transforming industries, creating opportunities for The Innovation Group to offer compliance-navigating solutions.

| Environmental Factor | Impact on The Innovation Group | Opportunity/Mitigation |

|---|---|---|

| Climate Change & Extreme Weather | Increased insurance claims, higher operational costs | Develop resilient claims management solutions, offer advanced risk assessment |

| ESG Reporting Demands | Need for accurate environmental performance measurement | Provide sustainability-focused tools and advisory services |

| Resource Scarcity | Supply chain vulnerability, potential cost increases | Enhance supply chain resilience, explore sustainable sourcing models |

| Environmental Regulations | Industry-wide compliance challenges | Offer solutions for emissions tracking, energy efficiency, and regulatory navigation |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from official government publications, international organizations like the World Bank and IMF, and leading market research firms. We meticulously gather information on economic indicators, regulatory changes, technological advancements, and societal trends to ensure comprehensive and accurate insights.