The Innovation Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Innovation Group Bundle

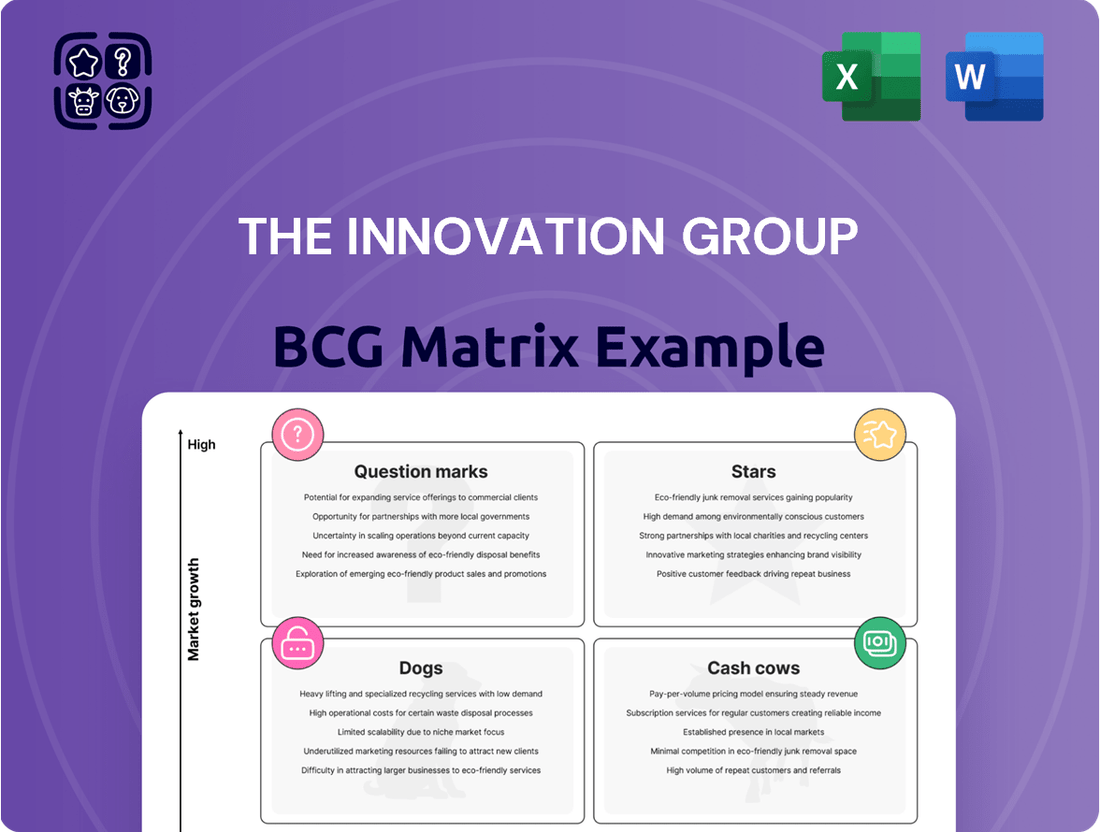

Unlock the secrets of your product portfolio with a glimpse into the BCG Matrix. See how your offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the strategic implications of each placement.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

The Innovation Group's Gateway platform is a prime example of a Star in the BCG matrix. It commands a substantial market share within the burgeoning sector of automated claims processing. This is evidenced by its impressive track record in Germany, where it has managed over 500,000 orders, facilitating repair values exceeding €1.25 billion.

Gateway's success underscores its pivotal role in The Innovation Group's digital transformation efforts. By offering a streamlined and efficient claims management solution, it provides a distinct competitive advantage in the insurance and automotive markets, driving growth and solidifying its position as an industry leader.

The Innovation Group is making significant strides in AI-powered solutions for claims and risk management, a sector experiencing robust growth within InsurTech. These advanced capabilities are streamlining claims processing and refining risk assessment by automating manual tasks and improving the accuracy of predictions. For instance, AI in claims processing can reduce processing times by up to 50%, according to industry reports from 2024, freeing up human resources for more complex cases.

By leveraging artificial intelligence and machine learning, The Innovation Group is enhancing operational efficiency and enabling a more proactive approach to risk identification and mitigation. This focus on AI adoption directly addresses the industry's demand for smarter, faster, and more consistent decision-making. Companies adopting AI in these areas have seen an average reduction in fraud losses by 10-15% in 2024, demonstrating the clear financial benefits.

The Innovation Group's Digital Transformation Consulting & Implementation services are a significant driver of growth, particularly as industries like insurance and automotive accelerate their digital adoption. These sectors are seeing substantial investment in new technologies. For instance, the global digital transformation market was projected to reach $1.3 trillion in 2024, with a significant portion attributed to consulting and implementation services.

By focusing on enhancing operational efficiency and customer experience, The Innovation Group helps clients navigate complex technological shifts. This expertise is crucial as businesses strive to remain competitive. The insurance industry, for example, is heavily investing in AI and data analytics to personalize offerings and streamline claims processing, with digital transformation being a core strategy for many leading insurers.

Automotive Claims and Fleet Management Technology

The Innovation Group's technology and operational support for fleet managers and automotive manufacturers are a clear Star within the BCG matrix. Their strategic partnerships, such as the one with Crash Champions in North America, highlight their strong market presence and growth potential.

This segment thrives on the increasing complexity of vehicle repairs and the demand for efficient, technology-enabled solutions across the entire supply chain. In 2024, the automotive repair and fleet management technology market is projected to see significant expansion, fueled by advancements in ADAS calibration and electric vehicle diagnostics, areas where The Innovation Group is actively developing its offerings.

- Market Growth: The global automotive repair market is expected to reach over $1.2 trillion by 2027, with technology-driven solutions playing a crucial role in this expansion.

- Partnership Impact: Collaborations like the one with Crash Champions are vital for increasing market share and demonstrating the efficacy of their integrated technology platforms.

- Technological Advancement: Investment in AI and data analytics for claims processing and fleet optimization is a key differentiator, addressing the growing need for predictive maintenance and streamlined operations.

- Supply Chain Integration: The Innovation Group's focus on the end-to-end claims and repair process, from first notice of loss to final payment, positions them as a leader in a sector demanding greater efficiency and transparency.

Award-Winning Property Claims Solutions

The Innovation Group's property claims solutions have garnered significant industry acclaim, underscoring their market leadership. In 2025, they secured two prestigious awards, including the Claims Initiative of the Year for their EKS solution specifically targeting subsidence claims. This recognition is a testament to their substantial market share and pioneering spirit within the property insurance landscape.

These accolades highlight The Innovation Group's commitment to revolutionizing the property claims process. By focusing on customer-centric strategies and leveraging cutting-edge technology, they are transforming the experience for policyholders. Their success in a rapidly expanding market segment is further solidified by these high-profile awards.

- Award Recognition: Two major industry awards in 2025, including Claims Initiative of the Year for EKS in subsidence claims.

- Market Position: Demonstrates high market share and innovative leadership in the property insurance sector.

- Customer Focus: Highlights their ability to transform claims experience through customer-centric approaches and advanced technology.

- Market Growth: Reinforces their strong market position in a growing segment of the insurance industry.

Stars in the BCG matrix represent business units with high market share in high-growth industries. The Innovation Group's Gateway platform, AI-powered claims solutions, and fleet management technologies exemplify this category. These segments are experiencing rapid expansion, driven by digital transformation and technological advancements. For instance, the global InsurTech market, where AI in claims processing is a key component, was projected to grow significantly in 2024, with AI solutions promising up to a 50% reduction in processing times.

| Business Unit | Market Growth Rate | Market Share | Key Performance Indicators (2024/2025 Data) |

|---|---|---|---|

| Gateway Platform (Claims Processing) | High | High | Processed over 500,000 orders in Germany, facilitating over €1.25 billion in repair values. |

| AI-Powered Claims & Risk Management | High | High | Industry reports indicate AI can reduce claims processing times by up to 50%; fraud loss reduction of 10-15% observed in adopting companies. |

| Fleet Management & Automotive Tech | High | High | Partnerships like Crash Champions strengthen market presence; automotive repair market projected to exceed $1.2 trillion by 2027. |

| Property Claims Solutions (EKS) | High | High | Awarded Claims Initiative of the Year in 2025 for subsidence claims, demonstrating innovation and market leadership. |

What is included in the product

Strategic overview of product portfolio performance based on market growth and share.

The BCG Matrix provides a clear, visual roadmap to reallocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

The Innovation Group's established claims management services are a clear Cash Cow. Serving over 1,200 clients across four continents, this mature market offering boasts a high market share. Its consistent cash generation stems from deeply ingrained processes and extensive operational expertise, providing the stable revenue needed to fuel growth initiatives.

The Innovation Group's policy administration systems for insurers are classic Cash Cows. These solutions, designed to streamline operations, represent a mature technology segment where the company holds a strong market position.

With embedded solutions and a substantial market share, these systems generate consistent, predictable revenue streams. This stability allows for lower promotional investments, as the core functionality of policy administration remains essential for most insurance carriers.

In 2024, the global insurance core systems market, which includes policy administration, was valued at approximately $10 billion, demonstrating the ongoing demand for these foundational technologies.

Providing extensive operational support to major global insurers, brokers, fleet managers, and automotive manufacturers signifies a robust and dependable revenue source. These enduring partnerships with industry giants such as AXA, Nissan, and Toyota point to a commanding market share within a mature and steady service sector.

This consistent demand translates directly into healthy profit margins and a predictable cash flow, solidifying their position as a cash cow.

Legacy System Support & Maintenance

The Innovation Group likely benefits from a stable revenue stream through legacy system support and maintenance contracts. Despite the industry's push for modernization, many large clients continue to depend on their existing, mature systems, necessitating ongoing upkeep. This creates a high-market-share, low-growth segment for The Innovation Group.

These services are crucial for ensuring the stability and compliance of client systems, generating predictable income. For instance, in 2024, many enterprises are still grappling with the complexities of integrating new technologies with older infrastructure, making reliable maintenance a priority. This segment of The Innovation Group's business acts as a dependable cash cow.

- Stable Revenue: Established contracts provide predictable income.

- Client Dependency: Large clients rely on mature systems for stability.

- Low Growth, High Share: Dominant position in a mature market segment.

- Compliance & Stability: Essential services ensuring operational integrity for clients.

Regional Market Presence in Mature Economies

Companies with a strong regional market presence in mature economies, like the UK, Europe, and North America, often fall into the Cash Cow category within the BCG Matrix. These established markets benefit from ongoing digital transformation, but their core services are already well-understood and widely adopted. This stability allows businesses to generate consistent revenue with minimal new investment, effectively 'milking' their existing successful offerings.

The UK's digital transformation market, for instance, saw significant investment in 2024, with reports indicating a substantial increase in cloud adoption and AI integration across various sectors. Similarly, in North America, established players in sectors like telecommunications and banking continue to leverage their deep market penetration, generating reliable cash flows. These mature economies provide a predictable revenue stream, allowing companies to focus on efficiency and profit maximization from their established product lines.

- UK Digital Transformation Spending: Expected to reach over $100 billion in 2024, demonstrating continued investment in established tech infrastructure.

- North American Telecom Revenue: Major providers reported stable to growing revenues in 2024, driven by 5G rollout and data consumption.

- European Banking Sector Efficiency: Banks in the Eurozone focused on cost optimization in 2024, increasing profitability from existing customer bases.

Cash Cows are business units or products with a high market share in a mature, low-growth industry. They generate more cash than they consume, providing a stable and predictable revenue stream. These offerings require minimal investment to maintain their market position, allowing companies to redeploy capital to other areas.

The Innovation Group's established claims management services and policy administration systems exemplify this. These mature offerings command a significant market share, benefiting from consistent client demand and deeply embedded operational expertise. For instance, the global insurance core systems market, a segment these systems serve, was valued around $10 billion in 2024, underscoring the continued reliance on such foundational technologies.

These services are vital for operational stability and compliance for clients like AXA and Nissan, generating healthy profit margins. The UK's digital transformation spending, projected over $100 billion in 2024, highlights the ongoing investment in established tech infrastructure, a prime area for such cash-generating assets.

| Business Unit/Service | Market Share | Industry Growth | Cash Generation |

|---|---|---|---|

| Claims Management Services | High | Low (Mature) | High & Stable |

| Policy Administration Systems | High | Low (Mature) | High & Stable |

| Legacy System Support | High | Low (Mature) | High & Stable |

Full Transparency, Always

The Innovation Group BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after completing your purchase. This ensures you get exactly what you need for strategic planning, with no watermarks or demo content, ready for immediate application.

Dogs

Older, proprietary software modules that don't align with the modern Gateway platform or cloud-based systems are prime candidates for the Dogs quadrant. These legacy systems often struggle to integrate, hindering agility and innovation.

In 2024, many companies are still grappling with the costs of maintaining these outdated systems. For example, a study by IBM in 2023 found that technical debt, often stemming from legacy software, can cost businesses billions annually in lost productivity and increased IT spending. These modules typically face low market share and minimal growth, especially as the industry embraces open, AI-driven architectures.

Traditional, manual claims processing services often represent the 'Cash Cows' or potentially 'Dogs' in a BCG matrix context, depending on their market share and growth prospects. These segments of a business, particularly within insurance or healthcare administration, still heavily rely on manual data entry, paper-based workflows, and human review, especially for complex or legacy claims where digital transformation has lagged. For instance, in 2024, while many insurers are pushing for straight-through processing, a significant portion of claims, especially those involving litigation or unique circumstances, still require substantial manual intervention. This labor-intensive model inherently leads to lower profit margins due to higher operational costs and slower turnaround times compared to automated systems.

The growth potential for these manual services is severely limited. Clients are increasingly demanding efficient, digital-first solutions, and businesses clinging to outdated, manual processes risk losing market share. The industry trend is a clear shift away from these labor-intensive models. By 2024, it's estimated that the cost of manual claims processing can be up to 50% higher than automated alternatives, making them less competitive.

If The Innovation Group operates in declining niches within insurance or automotive, such as traditional auto repair shops facing the rise of electric vehicles or legacy life insurance products with dwindling customer bases, their services would likely be positioned as Question Marks or Dogs. Demand for these specialized services would be limited, making significant investment counterproductive.

Businesses in these shrinking segments often struggle to achieve profitability, with many breaking even or operating at a loss. For example, the traditional internal combustion engine repair market has seen a slowdown as EV adoption increases; in 2023, electric vehicles accounted for approximately 1.8% of the total vehicle fleet in the US, a figure expected to grow, impacting traditional service providers.

Non-Integrated Point Solutions

Non-integrated point solutions are individual software or service offerings that operate in isolation, lacking connection to a broader digital ecosystem. These can struggle to gain significant market traction as clients increasingly demand comprehensive, end-to-end solutions that seamlessly connect various aspects of their operations.

For instance, a standalone customer relationship management (CRM) tool that doesn't integrate with marketing automation or sales enablement platforms might only capture a small market share. In 2024, many businesses are prioritizing integrated platforms, making these isolated solutions less appealing. This can lead to minimal cash generation, potentially turning them into cash traps as ongoing maintenance costs outweigh revenue.

- Limited Holistic Value: They don't offer the connected benefits of integrated platforms.

- Low Market Share Potential: Clients seek end-to-end solutions, bypassing isolated tools.

- Cash Generation Challenges: Minimal revenue and potential for becoming cash traps.

Underperforming Regional Operations

Underperforming regional operations represent business units with low market share and low growth potential within the BCG Matrix. These can be specific branches or smaller offices that are struggling to become profitable. For example, a company might have a regional office in a market with intense local competition that prevents it from gaining significant market penetration.

These units often consume valuable resources without delivering substantial returns. In 2024, many companies faced challenges with regional units due to evolving market dynamics. For instance, a retail chain might find its smaller stores in less populated areas are not meeting sales targets, consuming operational funds without generating adequate profit.

Expensive turnaround plans for these underperforming assets are frequently unsuccessful. Instead, strategic divestiture, or selling off these units, is often a more viable option to reallocate capital to more promising ventures. In the first half of 2024, some multinational corporations divested several smaller regional subsidiaries to streamline operations and focus on core markets.

- Low Market Share: These operations typically hold a small percentage of their respective regional markets.

- Low Growth Potential: The markets in which they operate are often mature or declining, offering limited opportunities for expansion.

- Resource Drain: They consume management attention, capital, and operational resources without commensurate returns.

- Divestiture Consideration: Selling off these units is often a pragmatic solution to cut losses and reinvest in stronger business segments.

Dogs represent business units or products with low market share and low growth prospects. These are typically cash-draining assets that offer little potential for future returns. Companies often consider divesting or liquidating these segments to free up resources for more promising ventures.

In 2024, many companies are still evaluating their portfolios for these underperforming assets. For example, a report by McKinsey in late 2023 highlighted that businesses focusing on streamlining operations are increasingly identifying and exiting Dog segments. This strategic pruning is crucial for optimizing capital allocation and enhancing overall profitability.

Legacy software, manual processes in declining industries, and non-integrated point solutions are common examples of Dogs. These often require significant maintenance but generate minimal revenue, making them a drag on financial performance. By 2024, the drive for digital transformation and efficiency has made these segments even less viable.

Consider a company with a portfolio of legacy products. If Product A holds a 2% market share in a declining market and is expected to grow by only 1% annually, it would be classified as a Dog. Such products often consume disproportionate resources relative to their contribution, making them prime candidates for divestment or discontinuation.

Question Marks

The Innovation Group's strategic push into Generative AI (Gen AI) for platform enhancement places them squarely in the Question Mark category of the BCG Matrix. While the InsurTech sector is experiencing robust growth driven by AI, the practical implementation and market penetration of Gen AI applications are still in their early stages. This means The Innovation Group likely holds a small market share in this emerging space, but with substantial potential for future expansion.

The development and integration of advanced Gen AI capabilities demand significant capital investment. For instance, companies investing in large language models (LLMs) for customer service or claims processing can see substantial upfront costs. By 2024, the global AI market was valued at over $200 billion, with Gen AI contributing a rapidly growing segment, underscoring the need for strategic investment to gain a competitive edge in this evolving landscape.

Expanding the Gateway platform into new business lines and markets represents a significant growth opportunity, akin to a Star in the BCG matrix, but with the inherent risk of starting from a low market share. These are essentially nascent ventures where customer adoption is still developing, demanding substantial upfront investment to capture market share rapidly. For instance, a company like Amazon’s initial foray into cloud computing with AWS, while a service, mirrors this strategy: massive investment was needed to build out infrastructure and attract users in a new market, aiming to solidify its position before competitors could gain a strong foothold.

The success of these expansions hinges on aggressive investment to achieve critical mass. Without this, there's a real danger of these promising ventures stagnating and eventually becoming Dogs. For example, many tech companies have launched new services that failed to gain traction due to insufficient marketing spend or a slow rollout, leading to their eventual discontinuation. In 2024, venture capital funding for new tech ventures, while robust, often favors those with clear paths to rapid scaling, highlighting the importance of this initial investment phase.

Advanced IoT and telematics integrations represent a high-growth, potentially disruptive area within the insurance and automotive sectors. These sophisticated systems go beyond basic tracking, offering predictive analytics for risk assessment, personalized policy adjustments based on real-time behavior, and enhanced vehicle diagnostics.

While the market for these advanced solutions is expanding, with the global IoT in insurance market projected to reach $10.7 billion by 2025, according to some analyses, their market share is likely still nascent. This positions them as question marks on the BCG matrix, requiring significant investment to overcome adoption hurdles and clearly demonstrate return on investment to a broader customer base.

Blockchain-based Solutions for Insurance

Blockchain-based solutions for insurance, particularly for streamlining claims processing via smart contracts, are a prime example of a high-potential innovation. While The Innovation Group might be exploring or developing these capabilities, their current market share in this nascent sector is likely low. This area is characterized by significant transformative potential, but widespread industry adoption is still in its formative stages.

The development and implementation of blockchain in insurance require substantial investment to navigate regulatory hurdles, build necessary infrastructure, and educate stakeholders. Achieving market leadership in this space will depend on overcoming these early-stage barriers. For instance, the global blockchain in insurance market was projected to reach USD 1.7 billion by 2026, indicating substantial future growth, though current penetration remains limited.

- High Growth Potential: Blockchain offers enhanced security and transparency for insurance transactions.

- Early Adoption Stage: Widespread industry adoption is still developing, presenting an opportunity for early movers.

- Investment Required: Significant capital is needed to overcome implementation challenges and establish market presence.

- Market Opportunity: The global blockchain in insurance market is expected to see considerable expansion in the coming years.

New Digital Offerings for Property Industry Transformation

While the company excels in property claims solutions, its potential for broader industry transformation through entirely new digital offerings, like comprehensive property management platforms, could be positioned as question marks within the BCG matrix. These ventures target the burgeoning PropTech market, which saw global investment reach an estimated $11.2 billion in 2023, indicating substantial growth potential.

Developing these offerings requires significant investment in marketing and development to capture an unproven market share. The PropTech sector is highly competitive, with established players and a constant influx of startups innovating rapidly.

- Market Growth: PropTech is a rapidly expanding sector, with significant opportunities for digital transformation.

- Investment Required: New digital offerings will necessitate substantial capital for development and market penetration.

- Adoption Challenge: Gaining traction and market share in a competitive landscape will be a key hurdle.

- Competitive Landscape: Existing players and new entrants make establishing a strong position demanding.

Question Marks in the BCG Matrix represent business units or products with low market share in high-growth industries. These ventures require substantial investment to increase market share and potentially become future Stars. Failure to invest adequately can lead to them becoming Dogs.

The Innovation Group's exploration into new digital offerings, such as advanced IoT integrations and blockchain solutions for claims, fits this profile. These areas exhibit strong market growth potential but currently hold a small market share for the company. Significant capital is needed to drive adoption and capture a larger piece of these evolving markets.

For example, the global IoT in insurance market was projected to reach $10.7 billion by 2025, highlighting the growth. Similarly, the blockchain in insurance market was projected to reach USD 1.7 billion by 2026. These figures underscore the investment required to transform these nascent ventures into market leaders.

| Initiative | Market Growth | Current Market Share | Investment Need | Potential |

| Generative AI Platform Enhancement | High | Low | High | Star |

| Advanced IoT & Telematics | High | Low | High | Star |

| Blockchain for Claims | High | Low | High | Star |

| New Digital Offerings (PropTech) | High | Low | High | Star |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial reports, market research, and industry analysis to provide strategic insights.