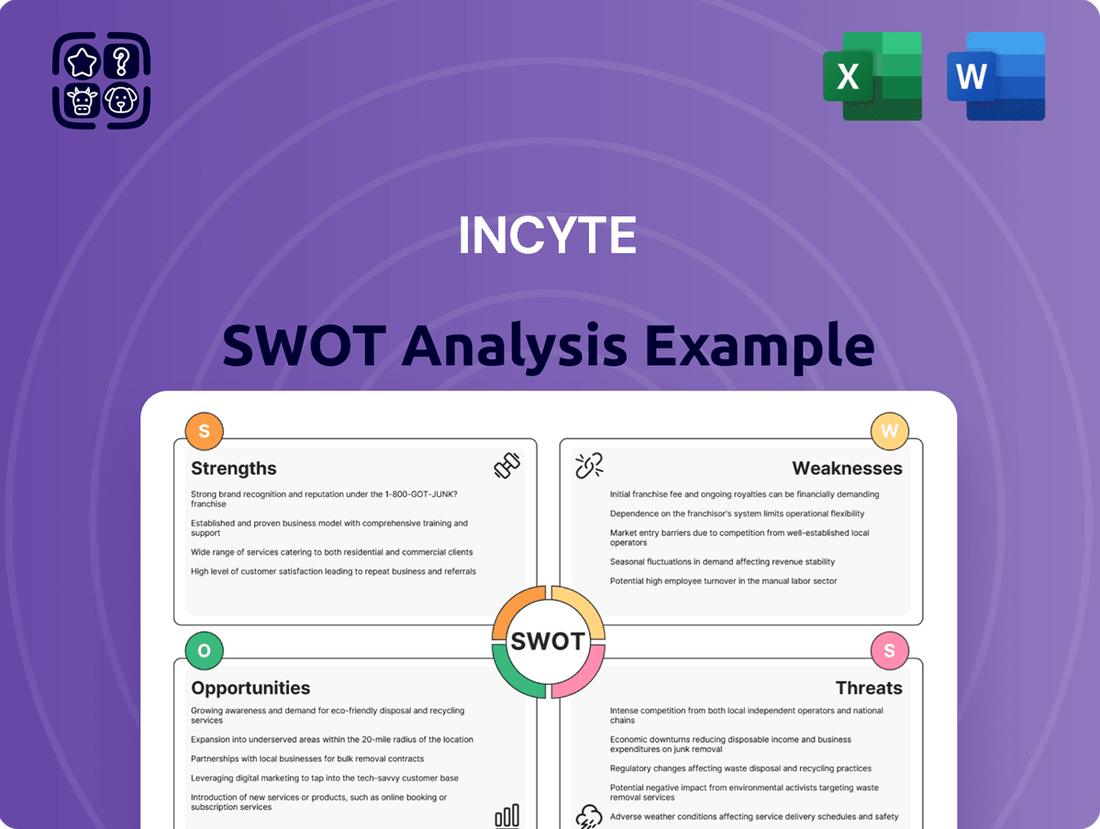

Incyte SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Incyte Bundle

Incyte's innovative pipeline, particularly in oncology, presents significant strengths, but the competitive biotech landscape and regulatory hurdles pose notable threats. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind Incyte's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Incyte has showcased impressive revenue growth, with total revenues reaching $3.5 billion in 2023, a notable increase from the previous year. This expansion is largely fueled by the continued success of its flagship products, Jakafi and Opzelura, which are seeing robust demand and expanding market reach.

The company's strategic diversification efforts are paying off, as it actively works to broaden its revenue base beyond its established oncology franchise. This proactive approach to developing and commercializing a wider range of therapies is crucial for long-term financial resilience and sustainable growth.

Incyte's research and development pipeline is a significant strength, boasting numerous anticipated milestones for 2025. These include multiple product launches, crucial trial readouts, and the initiation of new studies, underscoring the company's active pursuit of innovation.

This dedication to R&D, particularly in demanding fields like oncology and autoimmune diseases, positions Incyte for substantial future growth. The pipeline features potentially groundbreaking, first-in-class therapies alongside expanded uses for their existing successful drugs.

Incyte has cultivated deep scientific knowledge in critical fields like blood cancers, inflammatory conditions, and autoimmune diseases. This specialized focus allows them to tackle challenging health issues where patient needs are significant.

Their expertise is particularly evident in developing targeted therapies that leverage a sophisticated understanding of cellular processes and the immune system. This specialized knowledge is a key driver for their innovation pipeline.

The company's track record includes the successful development of groundbreaking, first-in-class treatments, underscoring their capability to translate scientific insight into impactful medicines for patients.

Strategic Partnerships and Collaborations

Incyte's strategic partnerships are a significant strength, enabling it to broaden its market presence and bolster its product pipeline. For instance, collaborations like the one for tafasitamab and axatilimab are instrumental in extending its global reach.

These alliances are crucial for Incyte, allowing it to tap into external expertise and gain valuable market access. A prime example is the agreement with Specialised Therapeutics, which facilitates distribution across Asia-Pacific markets, demonstrating the tangible benefits of these strategic moves.

- Expanded Pipeline: Collaborations enhance Incyte's drug development pipeline, bringing in new therapeutic candidates.

- Global Reach: Partnerships facilitate market entry and distribution in key international regions.

- Leveraged Expertise: Incyte benefits from the specialized knowledge and resources of its partners.

- Risk Mitigation: Sharing development and commercialization responsibilities can reduce financial and operational risks.

Strong Financial Position and Cash Flow

Incyte boasts a robust financial position, evidenced by its significant cash and cash equivalents. As of the first quarter of 2024, the company reported approximately $2.4 billion in cash and marketable securities, providing ample resources for ongoing research and development, potential strategic acquisitions, and funding future growth initiatives.

The company's financial strength is further bolstered by improving operating leverage and expanding margins, a direct result of its consistent revenue growth. This financial health allows Incyte to navigate market dynamics effectively and pursue its long-term strategic objectives.

- Strong Cash Reserves: Approximately $2.4 billion in cash and marketable securities as of Q1 2024.

- Revenue-Driven Margin Expansion: Increased operating leverage and margins due to consistent revenue growth.

- Strategic Flexibility: Financial capacity to invest in R&D, pursue acquisitions, and fund strategic initiatives.

Incyte's strong financial footing, with $2.4 billion in cash and marketable securities as of Q1 2024, provides significant capacity for innovation and strategic expansion. This financial health, coupled with expanding margins driven by consistent revenue growth, allows the company to effectively pursue its long-term objectives and invest in its promising R&D pipeline.

| Metric | Value (Q1 2024) | Significance |

|---|---|---|

| Cash & Marketable Securities | ~$2.4 billion | Funds R&D, acquisitions, and growth initiatives |

| Revenue Growth | 3.5 billion (2023) | Drives margin expansion and operating leverage |

| Pipeline Milestones | Multiple anticipated for 2025 | Indicates future growth potential and innovation |

What is included in the product

Delivers a strategic overview of Incyte’s internal and external business factors, highlighting its strengths in oncology, potential weaknesses in pipeline diversification, opportunities in new therapeutic areas, and threats from competition.

Offers a clear, actionable framework to identify and address Incyte's strategic challenges and opportunities.

Weaknesses

Incyte's financial health is heavily tied to its flagship products, Jakafi and Opzelura. In the first quarter of 2024, Jakafi generated $627 million in net product sales, while Opzelura contributed $70 million. This concentration means that any disruption to these specific drugs, whether from new competitors or regulatory shifts, could pose a significant risk to Incyte's revenue streams.

Incyte faces significant pipeline concentration and development risks, particularly within the competitive oncology and autoimmune disease sectors. These areas are notorious for high failure rates during clinical trials and protracted regulatory approval pathways, meaning a substantial portion of Incyte's future growth is tied to the success of a few key drug candidates.

For instance, as of early 2024, Incyte's pipeline includes several promising assets, but the inherent unpredictability of late-stage clinical trials means that setbacks or failures in these crucial stages could materially impact the company's revenue projections and stock valuation. The company's reliance on a limited number of pipeline products amplifies the impact of any adverse development, underscoring the critical need for successful navigation of these complex processes.

Incyte operates in intensely competitive arenas, particularly oncology and autoimmune diseases, where established pharmaceutical giants and nimble biotech firms vie for market dominance. This dynamic landscape presents a constant challenge, as new therapies and innovative approaches emerge regularly, threatening to disrupt existing market positions. For instance, the oncology market alone is projected to reach over $250 billion by 2025, underscoring the sheer scale of competition Incyte navigates.

The company faces the dual threat of existing, well-entrenched therapies and the continuous influx of new market entrants, each seeking to capture market share. Furthermore, the growing prevalence of biosimilars for established treatments poses a significant risk, potentially leading to downward pressure on pricing and a reduction in Incyte's market share for its key products.

Regulatory Hurdles and Market Access Challenges

Incyte faces significant regulatory hurdles in bringing its innovative therapies to market. The approval process for new drugs is inherently complex and lengthy, with no certainty of a successful outcome. This can delay or even prevent the commercialization of promising treatments.

Securing favorable reimbursement and market access presents another substantial challenge, especially across varied international healthcare systems. These negotiations are critical for determining a drug's commercial viability and patient accessibility. For instance, in 2024, navigating the evolving landscape of drug pricing and value-based assessments in key markets like the US and EU continues to be a primary focus for pharmaceutical companies, impacting revenue projections.

- Regulatory Approval Uncertainty: The path to FDA or EMA approval for new drug candidates is rigorous, with many compounds failing in late-stage trials.

- Reimbursement Negotiations: Gaining broad payer coverage and favorable pricing is essential but often involves protracted discussions and evidence of significant clinical benefit compared to existing treatments.

- Global Market Access Complexity: Each country has unique regulatory and reimbursement frameworks, requiring tailored strategies and significant investment to achieve market penetration.

Intellectual Property Protection and Patent Cliffs

The long-term success of Incyte hinges significantly on its ability to safeguard its intellectual property. The company confronts the looming challenge of patent expirations, a phenomenon often referred to as a patent cliff. A prime example is the approaching expiration of the patent for Jakafi, its flagship product. This eventuality could pave the way for generic competitors, potentially leading to a substantial decrease in revenue.

Mitigating the impact of these patent cliffs is crucial for Incyte’s sustained commercial viability. The company must strategically manage these expirations by ensuring a robust pipeline of new products and successful development of its existing pipeline. Without effective mitigation strategies, the revenue generated from key products could be significantly eroded once patent protection lapses.

- Jakafi Patent Expiration: The primary patent for Jakafi (ruxolitinib) is set to expire in the coming years, with key market exclusivity expected to end around 2027-2028 in major markets.

- Generic Competition Impact: Upon patent expiration, the entry of generic versions of Jakafi is anticipated, which typically leads to a significant price reduction and a corresponding drop in sales for the originator product.

- Pipeline Dependency: Incyte's ability to offset potential revenue losses from Jakafi relies heavily on the successful commercialization of its late-stage pipeline candidates, such as pemigatinib and povorcitinib, and the development of new indications for existing drugs.

Incyte's reliance on a limited number of key products, like Jakafi which generated $627 million in Q1 2024, presents a significant weakness. Any challenges to these drugs, such as increased competition or regulatory changes, could severely impact Incyte's financial performance.

The company also faces substantial risks due to pipeline concentration, with future growth heavily dependent on the success of a few drug candidates in highly competitive fields like oncology. Clinical trial failures or delays in regulatory approvals for these assets, as seen with several promising early 2024 pipeline entries, could materially affect revenue projections.

Furthermore, Incyte operates in intensely competitive markets, with the oncology sector alone projected to exceed $250 billion by 2025. This fierce competition, coupled with the threat of biosimilars, puts pressure on pricing and market share for its established products.

The impending expiration of Jakafi's patent, with market exclusivity expected to end around 2027-2028, poses a major threat. Generic competition following patent expiry could lead to a substantial decline in revenue, making the successful commercialization of its pipeline crucial for offsetting these losses.

Preview the Actual Deliverable

Incyte SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Incyte's internal strengths and weaknesses, alongside external opportunities and threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to see the complete breakdown of Incyte's strategic position.

Opportunities

Incyte has a substantial runway for growth by seeking new therapeutic indications for its established drugs like Jakafi and Opzelura. For instance, expanding Jakafi's use beyond myelofibrosis and polycythemia vera into other myeloproliferative neoplasms or graft-versus-host disease presents a significant opportunity. Similarly, Opzelura's potential in atopic dermatitis could be explored in other inflammatory skin conditions.

Geographic expansion is another key avenue. As of late 2024, Incyte continues to focus on increasing global access to its therapies. The company is actively pursuing regulatory approvals in new territories, particularly in emerging markets where there is a high unmet medical need for treatments like Jakafi. This global push aims to capture a larger share of the market and diversify revenue streams.

Incyte has a robust late-stage pipeline, notably povorcitinib for hidradenitis suppurativa and vitiligo, and a CDK2 inhibitor targeting ovarian cancer. These represent significant opportunities.

Successful development and commercialization of these advanced candidates could lead to substantial revenue generation and broaden Incyte's market presence. For instance, the global hidradenitis suppurativa market was valued at approximately $3.2 billion in 2023 and is projected to grow, offering a significant addressable market for povorcitinib.

The global autoimmune disease therapeutics market is projected to reach approximately $110 billion by 2025, a significant increase from previous years, fueled by rising autoimmune diagnoses and innovative treatment approaches. Incyte's strategic emphasis on inflammation and autoimmune disorders, particularly with its pipeline of novel immunomodulators, places it in a strong position to benefit from this expanding sector.

Leveraging AI and Advanced Technologies in Drug Discovery

Incyte has a significant opportunity to boost its drug discovery and development pipeline by embracing AI and other cutting-edge technologies. These tools can drastically speed up the identification of promising drug candidates and streamline the lengthy process of clinical trials. For instance, AI can analyze vast datasets to predict drug efficacy and potential side effects much faster than traditional methods.

The company is already making strides in this area, evidenced by its strategic partnerships. A key example is Incyte's collaboration with Genesis Therapeutics, a company focused on leveraging AI for drug discovery. This alliance is designed to tap into advanced computational approaches to accelerate the development of novel therapeutics.

The potential impact of AI in this sector is substantial. By 2024, the global AI in drug discovery market was projected to reach billions of dollars, with significant growth anticipated through 2025 and beyond. Companies that effectively integrate these technologies can achieve a competitive edge.

- Accelerated Discovery: AI algorithms can sift through millions of compounds, identifying potential drug candidates in a fraction of the time.

- Optimized Trials: Predictive analytics can improve patient selection for clinical trials, leading to higher success rates and reduced costs.

- Enhanced Efficiency: Automation of data analysis and research processes frees up scientists to focus on innovation.

- Strategic Partnerships: Collaborations with AI-focused firms like Genesis Therapeutics provide access to specialized expertise and technology.

Addressing Unmet Medical Needs in Oncology

Significant opportunities exist in addressing the persistent unmet medical needs within oncology. Many cancers and hematological malignancies still lack effective treatments, creating a fertile ground for innovation. Incyte's strategic emphasis on discovering and developing novel therapeutics, particularly for rare cancers, positions it well to fill these critical gaps and secure market leadership with groundbreaking solutions.

Incyte's pipeline, as of early 2024, includes several promising candidates targeting various hematological cancers and solid tumors with limited treatment options. For instance, their work in myelofibrosis and polycythemia vera continues to expand, addressing patient populations where existing therapies have limitations. The company's commitment to rare indications, such as certain types of leukemia and lymphoma, further underscores this opportunity, as these patient groups often have few or no approved treatment alternatives.

- Targeting Rare Cancers: Incyte's focus on rare oncological indications presents a significant opportunity, as these patient populations often have limited treatment choices and high unmet needs.

- Pipeline Expansion: The company's ongoing investment in R&D for novel therapeutics in areas like myelofibrosis and specific leukemias allows for the potential to capture market share with differentiated treatments.

- Addressing Treatment Gaps: By developing innovative solutions for cancers with poor prognoses or resistance to current therapies, Incyte can establish itself as a leader in critical therapeutic areas.

Incyte can significantly expand its therapeutic reach by exploring new indications for its established drugs like Jakafi and Opzelura. For example, broadening Jakafi's use beyond its current approvals into other myeloproliferative neoplasms or graft-versus-host disease offers substantial growth potential. Similarly, Opzelura's application in atopic dermatitis could be extended to other inflammatory skin conditions, tapping into larger patient populations.

Geographic expansion remains a key opportunity, with Incyte actively pursuing regulatory approvals in new territories, particularly in emerging markets with high unmet medical needs for its therapies as of late 2024. This global push aims to diversify revenue streams and capture a larger share of the international market.

The company's robust late-stage pipeline, including povorcitinib for hidradenitis suppurativa and vitiligo, and a CDK2 inhibitor for ovarian cancer, presents significant opportunities. Successful development of these candidates could generate substantial revenue, especially considering the global hidradenitis suppurativa market was valued at approximately $3.2 billion in 2023 and is projected to grow.

Incyte is well-positioned to benefit from the expanding global autoimmune disease therapeutics market, projected to reach approximately $110 billion by 2025. Their strategic focus on novel immunomodulators aligns with the rising diagnoses and innovative treatment approaches driving this growth.

Leveraging AI and advanced technologies presents a significant opportunity to accelerate drug discovery and development. Incyte's partnership with Genesis Therapeutics exemplifies this, aiming to speed up the identification of promising drug candidates and streamline clinical trials, a sector where the global AI in drug discovery market was projected to reach billions of dollars by 2024.

Addressing unmet medical needs in oncology, particularly for rare cancers and hematological malignancies, represents a critical opportunity. Incyte's pipeline, with candidates targeting myelofibrosis, polycythemia vera, and specific leukemias as of early 2024, is designed to fill these gaps and potentially capture market leadership.

Threats

The biopharmaceutical landscape is fiercely competitive, with numerous companies developing innovative treatments. Incyte faces this challenge as new therapies emerge, all seeking to capture market share.

A major threat arises from patent expirations, particularly for key drugs like Jakafi. Once patents lapse, the market opens to biosimilar and generic alternatives, which are typically priced much lower. This influx could significantly impact Incyte's revenue and market position for its established products.

Incyte faces the persistent threat of clinical trial failures, a common hurdle in drug development. For instance, a significant setback in a late-stage trial could derail a key product's path to market, impacting revenue projections.

Regulatory bodies like the FDA can impose delays or outright rejections, as seen with past challenges in the pharmaceutical industry. Such setbacks not only cost time but also incur substantial financial losses, potentially running into hundreds of millions of dollars for a single failed drug candidate.

These failures can also tarnish a company's reputation and erode investor confidence, making future funding more difficult. The financial implications of a major clinical trial failure are substantial, often leading to significant drops in stock price and a reassessment of the company's pipeline value.

Governments and payers are increasingly scrutinizing drug prices, a trend that intensified in 2024 with ongoing debates around drug affordability and legislative proposals aimed at price controls. This pressure directly impacts Incyte's ability to maintain current pricing for its key therapies, potentially squeezing profit margins.

Shifts in healthcare policy, such as changes to reimbursement structures or the introduction of new pricing regulations, represent a significant threat. For instance, the Inflation Reduction Act's provisions for Medicare drug price negotiation, which began impacting selected drugs in 2023 and will expand, could affect Incyte's revenue streams if its products become subject to these negotiations in the future.

Supply Chain Disruptions and Manufacturing Issues

Incyte, like many in the pharmaceutical sector, faces ongoing risks from supply chain vulnerabilities. Geopolitical tensions or natural disasters can easily interrupt the flow of raw materials and finished products. For instance, the semiconductor shortage that impacted various industries in 2022-2023 also had ripple effects on the specialized equipment used in drug manufacturing and logistics.

These disruptions directly threaten Incyte's production capacity and timely distribution of critical medicines. A significant interruption could lead to product shortages, affecting patient access and potentially resulting in lost revenue. The company's reliance on a global network of suppliers means that localized issues can quickly escalate into broader operational challenges.

- Supply Chain Vulnerability: Global pharmaceutical supply chains are susceptible to geopolitical events, natural disasters, and manufacturing process failures.

- Impact on Production: Disruptions can impede Incyte's ability to manufacture and distribute its medicines, leading to potential shortages.

- Financial Ramifications: Supply chain issues can translate into financial losses due to production delays, increased costs, and missed sales opportunities.

Loss of Key Personnel and Talent Competition

The biopharmaceutical sector thrives on specialized expertise, making Incyte’s reliance on skilled scientific and commercial talent a critical factor. The departure of key researchers or executives, or failing to attract and keep top-tier professionals in a fiercely competitive landscape, could significantly impede Incyte's progress in innovation, drug development, and bringing new therapies to market.

Talent competition in biotech is particularly intense, with companies vying for individuals possessing deep scientific knowledge and commercial acumen. Incyte, like its peers, faces the challenge of retaining its most valuable employees while simultaneously recruiting new talent to fuel its pipeline and growth strategies. For instance, in 2024, the demand for experienced biopharmaceutical professionals, especially in areas like oncology and gene therapy, remained exceptionally high, driving up compensation and retention efforts across the industry.

- High Demand for Specialized Skills: The biopharma industry requires highly specialized scientific, clinical, and commercial expertise, making talent acquisition and retention a constant challenge.

- Impact of Personnel Loss: The departure of key personnel can disrupt ongoing research projects, slow down development timelines, and negatively affect strategic decision-making.

- Competitive Talent Market: Incyte competes with numerous other pharmaceutical and biotechnology companies, as well as academic institutions, for a limited pool of highly skilled professionals, particularly in areas like oncology and immunology.

- Retention Strategies: Effective retention strategies, including competitive compensation, career development opportunities, and a positive work environment, are crucial for mitigating the threat of losing key talent.

Intense competition from other biopharmaceutical companies developing similar therapies poses a significant threat, as does the looming impact of patent expirations on key products like Jakafi, opening the door for lower-priced generics. Clinical trial failures are a constant risk, potentially derailing promising drug candidates and incurring substantial financial losses, with regulatory hurdles and pricing pressures from governments and payers further complicating market access and profitability.

The company also faces threats from supply chain disruptions, which can impact production and distribution, and the ongoing challenge of attracting and retaining highly specialized talent in a competitive market, which could slow innovation and development timelines.

In 2024, the biopharmaceutical industry continued to grapple with pricing scrutiny, with ongoing legislative discussions around drug affordability. For instance, the expansion of Medicare drug price negotiation under the Inflation Reduction Act could impact Incyte's future revenue streams if its products become subject to these negotiations.

The global talent market for biopharmaceutical professionals remained highly competitive in 2024, with demand for expertise in oncology and gene therapy driving up compensation and retention efforts across the sector.

SWOT Analysis Data Sources

This Incyte SWOT analysis is built upon a foundation of robust data, drawing from official financial filings, comprehensive market intelligence reports, and expert commentary from industry analysts. These sources provide a well-rounded view of the company's internal capabilities and external environment.