Intercontinental Hotels Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intercontinental Hotels Group Bundle

Intercontinental Hotels Group (IHG) navigates a complex landscape where buyer power from loyalty programs and online travel agencies significantly impacts pricing. The threat of new entrants is moderate, with franchising models allowing for expansion, but high capital investment remains a barrier. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Intercontinental Hotels Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

InterContinental Hotels Group (IHG) relies on technology providers for critical systems like global booking and property management. While some tech solutions are specialized, IHG's immense global scale, encompassing over 6,000 hotels across more than 100 countries as of early 2024, grants it substantial bargaining power. This leverage allows IHG to negotiate favorable terms, thereby diminishing the individual power of these technology suppliers.

Furthermore, IHG actively manages its supplier relationships by diversifying its technology partnerships. This strategy reduces its dependence on any single vendor, further strengthening its negotiating position and mitigating the risk of undue supplier influence on its operations.

The bargaining power of suppliers in construction and renovation services for InterContinental Hotels Group (IHG) is generally moderate. As a franchisor, IHG sets brand standards that influence the materials and services needed for its hotels. This standardization, coupled with the sheer volume of projects across IHG's global portfolio, allows them to negotiate favorable terms. For instance, IHG's significant capital expenditure on renovations and new builds, which amounted to billions globally in recent years, gives them considerable leverage with construction firms and material suppliers.

Intercontinental Hotels Group (IHG) procures a vast amount of food and beverage (F&B) supplies for its managed hotels worldwide. This substantial purchasing volume gives IHG significant leverage when negotiating with its F&B suppliers. For instance, in 2023, IHG reported a global revenue of $4.2 billion, indicating the scale of its operations and, by extension, its purchasing power.

This considerable scale allows IHG to secure advantageous terms, including bulk discounts and favorable payment schedules, which effectively reduce the bargaining power of individual F&B suppliers. Furthermore, IHG's strategy of local sourcing for many of its hotels fosters a more competitive supplier landscape, further diminishing the influence any single supplier can exert.

Labor Market

The bargaining power of suppliers in the labor market for Intercontinental Hotels Group (IHG) is influenced by the availability and cost of skilled staff, from frontline hotel employees to specialized management. In 2024, many regions experienced persistent labor shortages in the hospitality sector, potentially increasing wage demands. However, IHG's robust global recruitment efforts and emphasis on competitive compensation and benefits help to attract and retain talent, thereby moderating supplier power.

IHG's investment in comprehensive training and development programs also plays a crucial role in mitigating the bargaining power of labor suppliers. By cultivating internal talent and offering clear career progression paths, the company reduces its reliance on external hires for specialized roles. This strategy is particularly effective in markets where the supply of highly skilled hospitality professionals might be constrained.

While localized labor market conditions can present challenges, IHG's strong brand reputation and its status as a major employer generally provide an advantage in attracting a large pool of candidates. This appeal, combined with strategic human resource management, limits the ability of individual or collective labor groups to exert significant upward pressure on wages and working conditions across the group's diverse operations.

- Labor Shortages: In 2024, the global hospitality industry continued to face challenges with labor availability, leading to increased competition for skilled workers.

- IHG's Mitigation Strategies: IHG employs global recruitment, competitive compensation, and extensive training programs to secure and retain staff.

- Brand Appeal: IHG's strong brand recognition and career development opportunities attract a wide talent pool, reducing dependence on specific labor markets.

Online Travel Agencies (OTAs)

Online Travel Agencies (OTAs) exert considerable bargaining power over InterContinental Hotels Group (IHG) by acting as essential conduits for customer acquisition. These platforms, while not providing physical goods, supply a vital service: access to a broad customer base. Their leverage is often demonstrated through substantial commission rates, which can represent a significant portion of a hotel's revenue. For instance, in 2024, average OTA commissions for major hotel chains remained a key concern, with some estimates placing them between 15% and 30%.

IHG actively seeks to mitigate this supplier power by fostering direct bookings. A core strategy involves strengthening its own loyalty program, IHG One Rewards, and enhancing its direct booking website. This approach aims to reduce dependence on OTAs, thereby diminishing their influence. In 2023, IHG reported that direct channels accounted for a significant percentage of bookings, though specific figures for OTA reliance are often proprietary.

- OTA Commission Rates: Commissions paid to OTAs can range from 15% to 30%, impacting profitability.

- Customer Acquisition Cost: OTAs represent a significant, albeit necessary, cost for acquiring new customers.

- IHG's Mitigation Strategy: Focus on driving direct bookings through IHG One Rewards and the official website.

- Direct Booking Growth: Efforts to increase direct bookings aim to lower reliance and bargaining power of OTAs.

The bargaining power of suppliers for InterContinental Hotels Group (IHG) is generally considered moderate across most categories. IHG's vast global scale, encompassing over 6,000 hotels as of early 2024, provides significant leverage in negotiations with many suppliers, particularly for food and beverage and construction services. This scale allows IHG to secure bulk discounts and favorable payment terms, effectively limiting the power of individual suppliers.

However, certain specialized suppliers, like critical technology providers and, to some extent, labor in tight markets, can wield more influence. IHG actively manages supplier power through diversification of partnerships and strategies to boost direct bookings, thereby mitigating dependence on any single entity.

| Supplier Category | Bargaining Power | Key Factors Influencing Power |

| Technology Providers | Moderate to High | Specialized systems, reliance on innovation, but IHG's scale offers some leverage. |

| Food & Beverage Suppliers | Low to Moderate | IHG's massive purchasing volume, standardization, and local sourcing efforts. |

| Construction & Renovation Services | Moderate | Brand standards, project volume, and IHG's capital expenditure influence negotiations. |

| Labor Market | Moderate | Labor availability in 2024, IHG's brand appeal, and HR strategies balance power. |

| Online Travel Agencies (OTAs) | High | Essential customer acquisition channels, high commission rates (15-30% in 2024), but IHG actively reduces reliance. |

What is included in the product

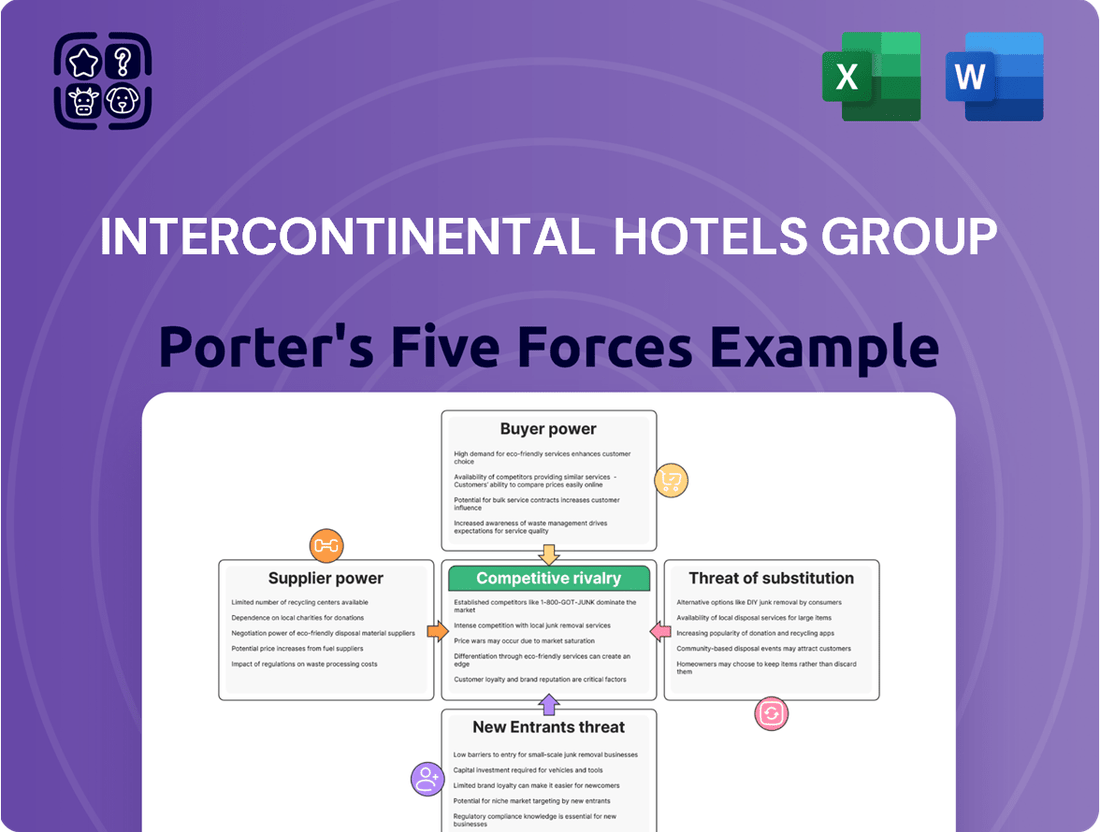

This Porter's Five Forces analysis for InterContinental Hotels Group (IHG) meticulously examines the competitive intensity within the global hotel industry, detailing the bargaining power of both customers and suppliers, the threat of new entrants and substitute services, and the overall competitive rivalry.

Instantly understand competitive pressures for IHG with a clear, actionable analysis of each Porter's Five Forces component.

Easily identify and address key strategic challenges within the hotel industry, empowering IHG to proactively manage threats and capitalize on opportunities.

Customers Bargaining Power

Individual leisure travelers wield substantial bargaining power. The widespread availability of online travel agencies and comparison websites, such as Booking.com and Expedia, means prices are highly transparent. This allows travelers to easily compare rates across numerous hotel brands, including IHG properties, and find the best deals. For instance, in 2024, a significant portion of leisure bookings were made through these third-party platforms, highlighting traveler reliance on comparative pricing.

Switching costs for these travelers are minimal. They can effortlessly shift their bookings from one hotel chain to another without incurring penalties or significant effort. This ease of switching further amplifies their leverage, as they are not tied to any particular brand. This is evident in the high volume of last-minute bookings and flexible cancellation policies commonly offered and utilized by this segment.

IHG actively works to counter this by strengthening its loyalty program, IHG One Rewards. By offering exclusive member rates, points, and perks for direct bookings, IHG aims to incentivize travelers to bypass third-party sites and book directly. In 2023, IHG reported that its loyalty members accounted for a substantial percentage of its room nights, demonstrating the program's effectiveness in capturing direct bookings and reducing customer reliance on comparison tools.

Large corporate clients and groups booking multiple rooms or extensive event space wield substantial bargaining power with InterContinental Hotels Group (IHG). These clients can negotiate preferential rates, customized service packages, and flexible cancellation policies due to the significant volume of business they provide. For instance, in 2023, IHG reported that corporate and wholesale segments represented a substantial portion of its revenue, underscoring the importance of these relationships.

Members of IHG's loyalty programs, such as IHG One Rewards, wield influence through their accumulated points and elite status. These members anticipate tangible value, including exclusive deals and room upgrades, which directly impacts IHG's pricing and service standards. For instance, in 2023, IHG One Rewards saw significant engagement, with members redeeming millions of reward nights, demonstrating the program's value proposition and the leverage these loyal customers possess.

Online Booking Platforms (Direct vs. Indirect)

Customers wield significant bargaining power when booking through online platforms, as they can easily compare rates and packages across Intercontinental Hotels Group's (IHG) direct channels and numerous Online Travel Agencies (OTAs) like Booking.com and Expedia. This accessibility to a wide array of options, including metasearch engines, allows consumers to readily identify and secure the most favorable pricing, thereby amplifying their influence.

IHG's strategy to maintain pricing parity across its direct booking channels and third-party platforms is crucial in managing this customer power. However, the sheer volume of available booking options means customers are constantly empowered to seek out the best deals.

- Customer Choice: Customers can book directly via IHG's website/app or through OTAs such as Expedia, Booking.com, and Skyscanner.

- Rate Comparison: Easy access to compare prices across multiple platforms empowers customers to find the best deals.

- Pricing Parity: IHG's efforts to align pricing across channels aim to mitigate direct price competition from OTAs, but customer awareness of options remains high.

Travel Agencies and Tour Operators

The bargaining power of customers, specifically travel agencies and tour operators, presents a notable force for InterContinental Hotels Group (IHG). These intermediaries aggregate demand, allowing them to negotiate favorable commissions and wholesale rates, effectively leveraging their client base to secure better terms from IHG properties. While the digital age has reshaped their role, they remain crucial for specific market segments.

These traditional channels continue to be significant for international travel and group bookings. For instance, in 2024, global tourism saw a substantial rebound, with international arrivals reaching an estimated 95% of pre-pandemic levels by the end of the year, according to UNWTO data. This sustained demand from international travelers channeled through agencies grants them continued leverage in negotiations with hotel chains like IHG.

Furthermore, the ability of agencies to bundle services, offering packages that include flights, accommodation, and activities, adds to their negotiating strength. This comprehensive offering appeals to a broad customer base, reinforcing their position as a vital distribution channel. Consequently, IHG must carefully manage these relationships to maintain competitive pricing and service levels.

- Aggregated Demand: Travel agencies and tour operators consolidate bookings from numerous travelers, providing IHG with a consistent volume of business.

- Negotiating Leverage: Their ability to negotiate commissions and wholesale rates is enhanced by the volume of business they can direct to IHG.

- Channel Significance: Despite online alternatives, agencies remain important for international and group travel segments, maintaining their influence.

- Value-Added Services: Offering bundled packages provides a competitive edge, strengthening their position in negotiations with hotel providers.

Individual leisure travelers hold considerable bargaining power due to transparent pricing on online platforms, making it easy to compare rates across brands like IHG. Switching costs are minimal, allowing travelers to easily move between hotels, which IHG counters with its IHG One Rewards program to encourage direct bookings.

Large corporate clients and group bookings represent another segment with significant leverage, able to negotiate preferential rates and customized packages based on the volume of business they provide. IHG's loyalty members also exert influence through their accumulated points and elite status, expecting tangible benefits that shape IHG's service standards.

Travel agencies and tour operators, by aggregating demand, negotiate favorable commissions and wholesale rates, remaining crucial for international and group travel. Their ability to bundle services further strengthens their negotiating position with IHG.

| Customer Segment | Bargaining Power Factors | IHG's Response/Mitigation |

|---|---|---|

| Individual Leisure Travelers | Price transparency via OTAs, low switching costs | IHG One Rewards loyalty program, direct booking incentives |

| Corporate Clients & Groups | High volume of business, potential for large contracts | Negotiation of preferential rates, customized packages |

| Loyalty Program Members | Accumulated points, elite status, expectation of benefits | Exclusive member rates, perks, and rewards |

| Travel Agencies & Tour Operators | Aggregated demand, bundling services, importance for international/group travel | Negotiation of commissions and wholesale rates |

Preview the Actual Deliverable

Intercontinental Hotels Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the InterContinental Hotels Group, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into industry rivalry, buyer and supplier power, and the threat of new entrants and substitutes.

Rivalry Among Competitors

The hospitality sector is intensely competitive, with major global brands like Marriott, Hilton, Accor, and Wyndham vying for dominance alongside IHG. This concentration means fierce competition for prime locations and customer loyalty.

In 2024, these major hotel groups continue to invest heavily in brand development and loyalty programs to stand out. For instance, Marriott's Bonvoy program boasts over 197 million members, showcasing the scale of customer engagement efforts.

This intense rivalry forces companies like IHG to constantly innovate in guest experiences and operational efficiency to maintain and grow their market share across diverse global markets.

Competitors in the hotel industry are constantly introducing new brands or acquiring established ones to cater to distinct market segments, ranging from ultra-luxury to budget-friendly and extended-stay options. This dynamic brand proliferation significantly escalates competition within each niche and across the entire market, as companies battle to capture diverse customer tastes and build loyalty.

IHG's own extensive brand portfolio, which includes names like InterContinental, Holiday Inn, and Kimpton, directly encounters rivals offering comparable brand categories. For instance, Marriott International's vast array of brands, such as The Ritz-Carlton, Sheraton, and Courtyard, mirrors IHG's strategy to cover various price points and guest experiences.

In 2024, the global hotel market continued to see aggressive brand expansion. Major players like Hilton Worldwide and AccorHotels also actively pursued brand growth and market penetration, reflecting a strategic imperative to diversify offerings and appeal to a wider customer base. This intense competition means that each brand within a company's portfolio must continuously innovate and differentiate to maintain its market share and profitability.

InterContinental Hotels Group (IHG) faces intense rivalry, with major hotel chains like Marriott and Hilton pouring significant resources into aggressive marketing and loyalty programs. These campaigns, often digital-first, aim to capture market share, with loyalty programs like IHG One Rewards constantly enhanced to incentivize repeat stays. For instance, in 2024, the industry saw a continued surge in digital ad spend, with major players allocating billions to reach potential guests.

The competition for customer loyalty is particularly fierce, driving innovation in rewards and exclusive benefits. IHG One Rewards, like its competitors, offers tiered benefits, bonus points, and experiential rewards to encourage guests to choose their brands consistently. This arms race in loyalty programs means companies must continually invest to maintain their customer base and attract new ones, directly impacting profitability and market positioning.

Geographic Expansion and Market Penetration

Intercontinental Hotels Group (IHG) faces intense rivalry fueled by aggressive geographic expansion. Hotel groups are constantly entering new and emerging markets, seeking to capture growth. This global push means direct competition in numerous cities and regions as companies battle for prime locations and market share.

The hotel industry’s global footprint ensures that competition is seldom localized. IHG's rivals, such as Marriott International and Hilton Worldwide, are also actively pursuing international growth strategies. For instance, in 2024, Marriott continued its expansion in Asia-Pacific, a key growth region for IHG as well, opening numerous new properties. This constant influx of new competitors into various markets intensifies the struggle for customer acquisition and brand visibility.

- IHG's continued expansion into high-growth markets like Southeast Asia and the Middle East directly pits it against competitors also prioritizing these regions.

- The pursuit of prime real estate in major global cities often results in bidding wars and increased development costs for all players.

- In 2024, the global hotel pipeline remained robust, with significant new supply additions expected in key markets, increasing competitive pressure.

Innovation in Guest Experience and Technology

Competitive rivalry is intensifying as companies like IHG battle for guest loyalty through innovation in experience and technology. This means hotels are pouring resources into making stays smoother and more personalized. For instance, many are rolling out mobile check-in and check-out options, alongside apps that allow guests to control room features like lighting and temperature. In 2024, the focus remains on leveraging AI for hyper-personalized recommendations and services, a trend expected to grow significantly.

The race is on to offer cutting-edge digital services and boost operational efficiency. IHG, along with its rivals, is investing heavily in upgrading booking platforms and implementing smart room technologies. This technological arms race is crucial; failing to keep pace means risking a less attractive offering. For example, Marriott's Bonvoy app continues to be a benchmark for digital integration, pushing others to enhance their own mobile capabilities and loyalty program features.

- Guest experience innovation: Hotels are competing on personalized services, seamless digital journeys, and advanced in-room technology.

- Technology investments: Significant capital is being allocated to mobile applications, AI-driven personalization, and smart hotel room features.

- Competitive pressure: Companies like IHG must continually innovate to maintain market share and guest satisfaction in a rapidly evolving digital landscape.

- 2024 trends: AI for personalized recommendations and enhanced booking platforms are key areas of focus for competitive differentiation.

Competitive rivalry within the hotel sector is exceptionally high, with giants like Marriott, Hilton, and Accor actively competing with IHG for market share and guest loyalty. This intense competition is evident in their substantial investments in brand development and loyalty programs. For instance, Marriott's Bonvoy program, boasting over 197 million members as of recent reports, highlights the scale of these efforts.

The industry sees a continuous influx of new brands and acquisitions, targeting diverse market segments from luxury to budget. IHG's portfolio, including brands like Holiday Inn, directly competes with similar offerings from rivals such as Hilton's Hampton by Hilton. In 2024, this brand proliferation continues to intensify competition across all niches.

Companies are aggressively expanding geographically, leading to direct competition in key growth markets. For example, IHG's focus on Asia-Pacific mirrors Marriott's significant expansion in the same region during 2024. This global push means constant battles for prime locations and customer acquisition.

Innovation in guest experience and technology is a critical battleground. IHG, alongside its competitors, is investing heavily in digital services, AI-driven personalization, and smart room features. The race to enhance mobile apps and loyalty platforms, like Marriott's Bonvoy app, is crucial for maintaining competitiveness.

| Rivalry Factor | Key Competitors | 2024 Focus Areas | Example Data Point |

| Brand Portfolio Breadth | Marriott, Hilton, Accor | New brand launches, acquisitions | Marriott's ~30 brands |

| Loyalty Programs | IHG One Rewards, Bonvoy, Hilton Honors | Enhanced benefits, digital integration | Bonvoy: 197M+ members |

| Geographic Expansion | All major players | High-growth markets (Asia, Middle East) | Marriott's 2024 Asia-Pacific expansion |

| Digital Innovation | IHG, Marriott, Hilton | AI personalization, mobile apps, smart rooms | Industry-wide billions in digital ad spend |

SSubstitutes Threaten

Short-term rental platforms like Airbnb and Vrbo present a substantial threat to Intercontinental Hotels Group. These platforms offer a wide array of lodging options, from spare rooms to entire homes, often at competitive prices. They cater to travelers seeking unique experiences and amenities such as kitchens and more space, directly competing with traditional hotel stays. For instance, Airbnb reported over 1.5 billion guest arrivals globally by the end of 2023, showcasing the scale of this alternative accommodation market.

Serviced apartments and dedicated extended-stay hotels present a significant threat, particularly for business travelers or those needing accommodation for longer periods. These alternatives often include features like full kitchens, laundry facilities, and more spacious living areas, which can be more economical and comfortable than traditional hotel rooms for extended stays. For instance, the extended-stay segment of the lodging market has seen robust growth, with many travelers prioritizing value and home-like amenities.

For many leisure travelers, especially those visiting friends or family, staying with loved ones is a significant substitute for commercial lodging. This free alternative bypasses the hotel market entirely, impacting demand, particularly during holidays and family gatherings. In 2024, an estimated 30% of leisure travelers reported staying with friends or family at least once, a trend driven by cost savings and personal connections.

Caravans, RVs, and Camping

For budget-conscious travelers and adventure seekers, alternatives like caravans, RVs, and camping offer distinct lodging options. These substitutes are particularly appealing for road trips and outdoor excursions, providing a way to bypass traditional hotel stays. They cater to a niche market that values flexibility and a connection with nature.

The appeal of these substitutes is growing. In 2023, the RV Industry Association reported a significant increase in RV shipments, indicating a strong consumer preference for this type of travel. This trend suggests that a portion of potential hotel guests are opting for self-contained, mobile accommodations, especially for leisure travel.

- Mobile Accommodation: Caravans and RVs provide flexibility and the ability to travel and stay in various locations without booking multiple hotel rooms.

- Cost-Effectiveness: For longer trips or group travel, RVing and camping can be more economical than hotel stays, especially when factoring in food costs with onboard kitchens.

- Outdoor Experience: Camping directly appeals to those seeking an immersive outdoor experience, a segment that traditional hotels do not serve.

- Market Penetration: While a smaller segment, the growing popularity of van life and adventure travel indicates an increasing threat from these alternatives for certain travel occasions.

Virtual Meetings and Remote Work

The rise of virtual meeting technologies and widespread remote work presents a significant threat of substitutes for Intercontinental Hotels Group (IHG). This trend, amplified by global events, directly reduces the need for traditional business travel, a core revenue driver for many hotel chains. For instance, in 2024, many corporations continued to prioritize cost savings and employee flexibility, leading to a notable decrease in business travel expenditure compared to pre-pandemic levels.

These virtual alternatives, while not offering accommodation, effectively substitute the need for hotel stays associated with in-person meetings and conferences. Companies are increasingly questioning the ROI of business trips, opting for digital solutions that can connect teams and clients without the associated travel and lodging costs. This shift impacts IHG’s corporate segment, particularly affecting demand for meeting spaces and individual business traveler bookings.

- Reduced Business Travel Spend: Many companies reported that their 2024 travel budgets remained constrained, with a portion of funds reallocated to technology enabling remote collaboration.

- Shift in Corporate Demand: The emphasis on virtual interactions means fewer corporate groups requiring hotel blocks for conferences and events.

- Impact on Ancillary Revenue: Beyond room nights, virtual meetings reduce spending on hotel-provided food and beverage, meeting room rentals, and other services.

- Long-Term Trend: The normalization of remote and hybrid work models suggests this threat is not temporary, requiring IHG to adapt its strategies to cater to evolving business needs.

The threat of substitutes for Intercontinental Hotels Group (IHG) is multifaceted, encompassing short-term rentals, serviced apartments, staying with friends/family, alternative accommodation like RVs, and even virtual meeting technologies. These alternatives directly compete by offering different value propositions, such as cost savings, unique experiences, or enhanced amenities, thereby impacting IHG's market share and revenue potential.

Short-term rental platforms like Airbnb continue to be a significant substitute, offering diverse lodging options that appeal to travelers seeking unique experiences and amenities, often at competitive price points. By the end of 2023, Airbnb had facilitated over 1.5 billion guest arrivals globally, underscoring the substantial scale of this alternative accommodation market.

Serviced apartments and extended-stay hotels cater to longer-term travelers, providing home-like amenities and potentially greater cost-effectiveness than traditional hotel rooms. This segment has experienced robust growth, reflecting a traveler preference for value and comfort during extended stays.

For many, particularly leisure travelers, staying with friends or family presents a zero-cost alternative to hotels, especially during holidays. In 2024, an estimated 30% of leisure travelers utilized this option, driven by both financial savings and personal connections.

The growing popularity of mobile accommodations like RVs and camping offers flexibility and a connection with nature, appealing to specific traveler segments. The RV Industry Association noted a significant increase in RV shipments in 2023, indicating a rising consumer preference for these self-contained travel solutions.

Virtual meeting technologies and the normalization of remote work have significantly reduced the need for business travel, a key revenue source for hotels. Many corporations maintained constrained travel budgets in 2024, reallocating funds to remote collaboration tools, which consequently lowered demand for business-related hotel stays and conference services.

| Substitute Type | Key Appeal | Market Indicator (2023/2024 Data) | Impact on IHG |

|---|---|---|---|

| Short-Term Rentals (e.g., Airbnb) | Unique experiences, local immersion, varied amenities | 1.5 billion+ global guest arrivals (end of 2023) | Direct competition for leisure and some business travel |

| Serviced Apartments/Extended Stay Hotels | Home-like amenities, cost-effectiveness for longer stays | Robust growth in the segment | Competition for longer-duration business and leisure bookings |

| Staying with Friends/Family | Zero cost, personal connection | ~30% of leisure travelers in 2024 | Reduced demand during peak leisure periods |

| Mobile Accommodation (RVs, Camping) | Flexibility, outdoor experience, cost savings | Significant increase in RV shipments (2023) | Niche competition for adventure and road trip travel |

| Virtual Meetings/Remote Work | Cost savings, convenience, reduced travel need | Constrained corporate travel budgets (2024) | Reduced demand for business travel and corporate events |

Entrants Threaten

The hotel industry, especially for a global giant like Intercontinental Hotels Group (IHG), demands substantial upfront capital. Newcomers face the daunting task of acquiring prime real estate, constructing or renovating properties to brand standards, and establishing robust marketing and reservation systems. For example, the average cost to build a new mid-scale hotel in the US can range from $15 million to $25 million, a figure that escalates dramatically for luxury properties or international expansion, presenting a formidable barrier to entry.

Established hotel groups like InterContinental Hotels Group (IHG) leverage decades of brand building, resulting in strong global recognition and deeply entrenched customer loyalty. For instance, IHG Rewards Club boasts millions of active members, creating a significant barrier for newcomers seeking to capture market share. New entrants find it incredibly difficult to quickly build the trust and reputation that established players like IHG have cultivated over many years.

The challenge for new entrants is immense when trying to persuade travelers to switch from familiar brands that offer established loyalty benefits. This requires substantial marketing investment and a considerable amount of time to even begin to erode existing customer relationships. In 2024, the hotel industry continued to see strong demand for loyalty programs, with many travelers prioritizing points and perks, making it even harder for unproven brands to gain traction.

Newcomers face significant hurdles in securing access to established distribution channels and lucrative partnerships. Gaining entry into global distribution systems, securing favorable terms with Online Travel Agencies (OTAs), and building relationships with corporate travel accounts are essential for driving occupancy, yet these networks are often dominated by incumbents.

InterContinental Hotels Group, for instance, benefits from its extensive existing agreements with major OTAs and corporate clients, which are difficult for new entrants to replicate. In 2024, the global travel market continues to see strong reliance on these established channels, with OTAs accounting for a substantial portion of bookings. New entrants must invest heavily in building their own distribution networks and forging new partnerships, a process that is both time-consuming and capital-intensive, often leading to less favorable initial terms.

Regulatory Hurdles and Permitting Processes

The hotel industry faces significant regulatory complexities, with new entrants needing to navigate diverse zoning laws, building codes, and health and safety standards that vary greatly by location. For instance, obtaining the necessary permits and licenses in major markets can take months, if not years, and involve substantial legal and administrative costs, acting as a strong deterrent. These compliance requirements represent a considerable operational burden that can significantly slow down or even prevent new players from entering the market, especially smaller or less capitalized ones.

Intercontinental Hotels Group (IHG), like its peers, must manage these varied regulations across its global portfolio. In 2023, IHG reported a robust pipeline of new hotels, indicating their ability to successfully navigate these entry barriers. The ongoing need for compliance with evolving environmental regulations, such as those related to energy efficiency and waste management, further adds to the complexity and cost of establishing new hotel operations.

- Zoning Laws: Varying local regulations dictate where hotels can be built, impacting site selection and development costs.

- Health & Safety Standards: Strict adherence to hygiene and safety protocols is mandatory, requiring significant investment in infrastructure and training.

- Licensing & Permits: Obtaining operational licenses and permits can be a lengthy and complex process, often requiring multiple approvals from different governmental bodies.

- Building Codes: Compliance with construction and fire safety codes adds to initial capital expenditure and ongoing maintenance.

Economies of Scale and Experience Curve Effects

Established hotel giants like Intercontinental Hotels Group (IHG) leverage substantial economies of scale. This translates into cost efficiencies across procurement, technology, marketing, and operations. For instance, IHG's global purchasing power allows for better negotiation on supplies, reducing per-unit costs compared to a new entrant. By 2024, major hotel chains were reporting significant operational leverage, with larger groups often having lower overheads per room.

The experience curve effect further solidifies IHG's competitive position. Years of operation refine processes, leading to greater efficiency and lower costs per guest. Newcomers face a steep learning curve and must invest heavily to reach comparable operational performance, making it challenging to compete on price or service quality from the outset.

- Economies of Scale: IHG's vast network allows for bulk purchasing of goods and services, reducing overall costs.

- Experience Curve: Decades of operational refinement lead to improved efficiency and lower per-unit costs for established players.

- New Entrant Disadvantage: Start-ups lack the scale and experience, requiring substantial investment to achieve parity.

The threat of new entrants for Intercontinental Hotels Group (IHG) remains moderate, primarily due to high capital requirements and established brand loyalty. While the allure of the hospitality sector is strong, the sheer cost of acquiring prime locations and developing properties to brand standards, often running into tens of millions of dollars per hotel, presents a significant barrier. For instance, in 2024, the cost of constructing a new mid-scale hotel in a major metropolitan area can easily exceed $20 million, a substantial hurdle for any new player.

Furthermore, IHG, along with other major players, benefits from deeply entrenched customer loyalty programs, such as IHG Rewards Club, which boasts millions of active members. New entrants struggle to replicate this level of trust and recognition, requiring extensive marketing investment and time to build a comparable customer base. The reliance on established distribution channels and partnerships, often dominated by incumbents, also poses a challenge for newcomers seeking to gain visibility and secure bookings in 2024.

Regulatory hurdles, including zoning laws, health and safety standards, and licensing, add another layer of complexity and cost for potential entrants. These factors, combined with the economies of scale and experience curve advantages enjoyed by giants like IHG, collectively keep the threat of new entrants at a manageable level for the foreseeable future.

Porter's Five Forces Analysis Data Sources

Our Intercontinental Hotels Group Porter's Five Forces analysis is built upon a foundation of reliable data, drawing from IHG's annual reports, investor presentations, and financial statements. We supplement this with insights from reputable industry research firms, hospitality trade publications, and macroeconomic data to capture the full competitive landscape.