Intercontinental Hotels Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intercontinental Hotels Group Bundle

Curious about IHG's brand portfolio? Our BCG Matrix analysis offers a glimpse into which brands are driving growth and which might need a strategic rethink.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for IHG.

The complete BCG Matrix reveals exactly how IHG's brands are positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Voco Hotels is positioned as a Star within IHG's BCG Matrix. This premium brand experienced remarkable growth in 2024, reaching 100 open hotels across 25 countries and boasting an additional 95 in development.

Its adaptable design and operational model make it a prime candidate for hotel conversions, enabling swift integration with IHG's extensive platform. Voco is projected to hit 200 global properties, either open or in the pipeline, by 2028, with recent and upcoming launches in numerous international markets underscoring its strong upward trajectory.

The Vignette Collection, IHG's luxury and lifestyle offering, is a shining example of a brand with significant growth potential. Launched in 2021, it's already well on its way to achieving its ambitious target of 100 open and pipeline hotels within a decade, having surpassed the halfway mark. This rapid expansion highlights its appeal to independent luxury hotel owners seeking the backing of IHG's extensive global network while preserving their property's distinct identity.

Recent developments underscore Vignette Collection's upward trajectory. The brand has successfully expanded its footprint with new openings and strategic signings in important global markets. Notably, it made its debut in the United Kingdom and Hungary, demonstrating its ability to attract and integrate diverse luxury properties into its portfolio. This international growth is a key indicator of its strong performance and market acceptance.

Hotel Indigo is a significant player in IHG's Luxury & Lifestyle segment, ranking as the second-largest brand with 162 open hotels globally and a substantial pipeline of 128 properties. Its strategy centers on offering distinct, locally inspired experiences, positioning it firmly in the lifestyle segment.

The brand's commitment to unique neighborhood character and its ongoing global expansion, including new resort developments, underscore its growth potential. As of late 2024, Hotel Indigo continues to attract travelers seeking authentic local immersion, contributing to IHG's diversified portfolio.

Regent Hotels & Resorts

Regent Hotels & Resorts, an ultra-luxury segment within IHG's portfolio, is experiencing a significant revival. This strategic push is evidenced by new property openings, such as the highly anticipated Regent Santa Monica, marking its debut in the United States. This expansion aligns with IHG's broader objective to bolster its luxury offerings, which currently constitute a substantial 20% of its global development pipeline as of mid-2025.

The Regent brand is meticulously crafted to offer guests a unique blend of sophisticated design and serene environments. Its promise extends to delivering exceptionally refined service and deeply immersive cultural experiences, aiming to attract a discerning clientele seeking unparalleled luxury. By focusing on these core tenets, IHG positions Regent to capture a larger share of the high-end travel market.

Key developments for Regent Hotels & Resorts include:

- Brand Revival: Regent is a key focus for IHG's luxury growth strategy.

- U.S. Expansion: The opening of Regent Santa Monica signifies a major U.S. market entry.

- Portfolio Contribution: Luxury brands, including Regent, now represent 20% of IHG's global pipeline.

- Guest Experience: The brand emphasizes sophisticated style, tranquil escapes, refined service, and cultural immersion.

IHG One Rewards Loyalty Program

The IHG One Rewards loyalty program is a clear star within Intercontinental Hotels Group's portfolio. By the close of 2024, it’s projected to have around 145 million members worldwide, with enrollment numbers seeing a healthy increase of over 10% annually. This program is a key driver of valuable revenue, as loyalty members tend to spend more and favor direct bookings, which benefits hotel owners significantly.

The strategic enhancements to the IHG One Rewards program, including new partnerships and updated benefits, are poised to boost ancillary revenue streams and improve operating profits. These initiatives are designed to further solidify the program's position as a high-performing asset.

- Global Membership: Approximately 145 million members by year-end 2024.

- Growth Rate: Over 10% year-on-year enrollment increase.

- Revenue Impact: Loyalty members exhibit higher spending and direct booking tendencies.

- Profitability Drivers: Enhanced benefits and partnerships increase ancillary fees and operating profit.

The IHG One Rewards loyalty program is a clear star within Intercontinental Hotels Group's portfolio. By the close of 2024, it’s projected to have around 145 million members worldwide, with enrollment numbers seeing a healthy increase of over 10% annually. This program is a key driver of valuable revenue, as loyalty members tend to spend more and favor direct bookings, which benefits hotel owners significantly.

The strategic enhancements to the IHG One Rewards program, including new partnerships and updated benefits, are poised to boost ancillary revenue streams and improve operating profits. These initiatives are designed to further solidify the program's position as a high-performing asset.

Global membership is expected to reach approximately 145 million by year-end 2024, with a consistent year-on-year enrollment increase exceeding 10%. Loyalty members contribute significantly to revenue through higher spending and a preference for direct bookings, directly impacting profitability.

| Brand | Category | 2024 Status | Growth Potential |

|---|---|---|---|

| IHG One Rewards | Loyalty Program | 145M members (est. 2024) | High (drives revenue & direct bookings) |

| Voco Hotels | Star | 100 open hotels, 95 in development | High (adaptable, conversion-friendly) |

| Vignette Collection | Star | Over halfway to 100 hotels target | High (luxury lifestyle appeal) |

| Hotel Indigo | Star | 162 open hotels, 128 in development | High (lifestyle focus, global expansion) |

| Regent Hotels & Resorts | Star | Key luxury revival, U.S. expansion | High (20% of luxury pipeline) |

What is included in the product

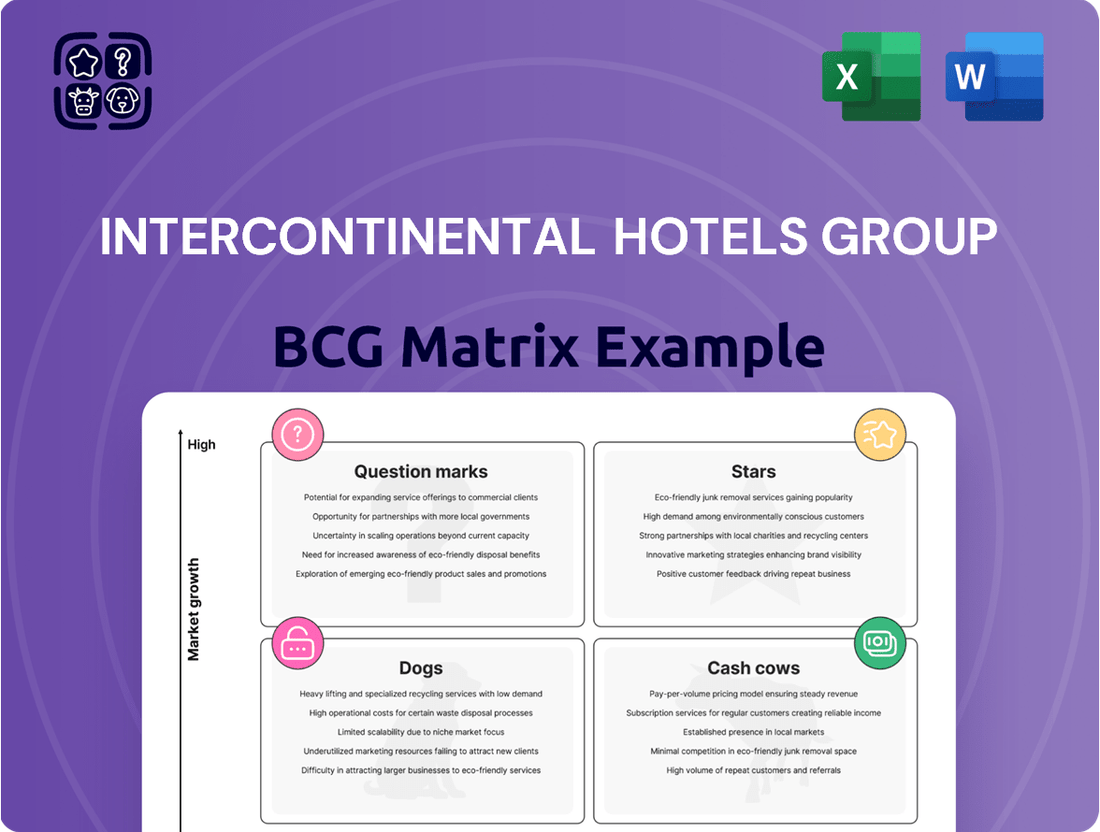

The InterContinental Hotels Group BCG Matrix analyzes its brand portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation across IHG's diverse hotel brands.

The InterContinental Hotels Group BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of complex portfolio analysis.

Cash Cows

Holiday Inn and Holiday Inn Express are IHG's cash cows, forming the core of their extensive hotel network. These brands represent a significant portion of IHG's total room inventory and revenue streams, underscoring their importance to the group's financial health.

Operating in the mature, essential segment of the travel market, these brands command a substantial market share. Their widespread recognition and consistent service delivery translate into predictable and robust cash flow for IHG, a hallmark of a successful cash cow.

While the overall hotel market might experience modest growth, the sheer volume and established presence of Holiday Inn and Holiday Inn Express ensure their continued profitability. In 2024, IHG reported a strong performance across its brands, with these legacy names consistently contributing to the company's bottom line through high occupancy rates and reliable revenue generation.

InterContinental Hotels & Resorts, IHG's premier luxury offering, stands as a significant cash cow. In 2024, it boasted over 225 hotels globally, a testament to its established presence in prime markets. This brand consistently delivers robust cash flow, driven by its appeal to a high-end clientele seeking refined experiences and cultural immersion.

The brand's enduring strength lies in its substantial brand equity and widespread recognition. This allows InterContinental to command high profit margins within the luxury segment, a market that generally exhibits stability and consistent demand. Its strategic expansion into key global locations further solidifies its position as a reliable generator of earnings for InterContinental Hotels Group.

Crowne Plaza, a key brand within IHG's extensive hotel network, is positioned as a Cash Cow in the BCG Matrix. It targets business travelers, offering a blend of amenities for both productivity and comfort. This segment, while not experiencing rapid expansion, benefits from a strong, established market presence and consistent demand, ensuring reliable cash flow for the parent company.

The brand's mature market position means it generates significant revenue with relatively lower investment needs compared to growth-oriented segments. For instance, in 2024, IHG reported that its premium and luxury segments, which include Crowne Plaza, continued to show resilience, contributing a substantial portion to the group's overall operating profit. This stability allows IHG to allocate capital from Crowne Plaza to support other brands or invest in new ventures.

Strategic investments focused on operational efficiency and enhancing the guest experience for business travelers can further bolster Crowne Plaza's cash-generating capabilities. By optimizing operational costs and maintaining its appeal to its core demographic, the brand solidifies its role as a dependable source of income for IHG, supporting the group's financial health and strategic flexibility.

Staybridge Suites

Staybridge Suites, a cornerstone of IHG's extended-stay offerings, marked its 25th anniversary in 2023, underscoring its deep roots and stable market presence.

With a significant global footprint exceeding 700 hotels, predominantly in the Americas, Staybridge Suites effectively taps into the growing demand for longer-term accommodations, generating consistent revenue streams.

The brand's strategic introduction of new prototype designs in 2024 is a forward-thinking move to enhance operational efficiency and boost owner returns, reinforcing its position as a reliable cash cow within IHG's portfolio.

- Established Market Presence: Celebrated 25th anniversary in 2023.

- Global Reach: Over 700 properties worldwide, with a strong concentration in the Americas.

- Demand Alignment: Caters to the rising need for extended-stay lodging.

- Future-Proofing: Launched new prototype options in 2024 to improve efficiency and owner value.

Candlewood Suites

Candlewood Suites, a well-established brand within IHG's extended-stay portfolio, operates as a cash cow. Its extensive network, boasting over 520 hotels either open or in development across the Americas, signifies a mature and stable market presence.

Since its inception in 1996, Candlewood Suites has consistently delivered reliable revenue by catering to guests who prioritize value and extended-stay amenities. This consistent demand underpins its cash-generating strength.

To further bolster its efficiency and profitability, Candlewood Suites is implementing new prototype designs. These innovations aim to optimize land utilization and drive operational efficiencies, thereby enhancing its capacity to generate cash.

- Brand Maturity: Candlewood Suites has been a consistent performer since 1996.

- Market Reach: Over 520 hotels are open or in the pipeline in the Americas.

- Revenue Stability: Attracts guests seeking value for longer stays, ensuring consistent income.

- Efficiency Improvements: New prototypes are being introduced to boost land usage and operational efficiencies.

IHG's established brands like Holiday Inn and Holiday Inn Express are prime examples of cash cows. They operate in mature markets, generating consistent and substantial revenue with relatively low investment needs. Their extensive global presence and strong brand recognition ensure predictable cash flows, which IHG can then leverage for growth initiatives.

InterContinental Hotels & Resorts, a leader in the luxury segment, also functions as a cash cow. Its global network of over 225 hotels in 2024, coupled with strong brand equity, allows for high profit margins and stable demand. This brand consistently contributes significant earnings to IHG's overall financial health.

Crowne Plaza, targeting business travelers, is another key cash cow. Its mature market position and consistent demand, as reflected in its contribution to IHG's premium and luxury segment profits in 2024, generate reliable income. Strategic focus on operational efficiency further solidifies its role as a dependable revenue generator.

Staybridge Suites and Candlewood Suites, both within IHG's extended-stay portfolio, are also cash cows. With significant global footprints and a focus on catering to the growing demand for longer accommodations, they provide stable revenue streams. Innovations in prototype designs in 2024 aim to enhance their efficiency and profitability even further.

| Brand | BCG Category | Key Characteristics | 2024 Data/Notes |

| Holiday Inn / Holiday Inn Express | Cash Cow | Mature market, high market share, predictable cash flow, extensive network | Significant portion of IHG's revenue and room inventory; high occupancy rates. |

| InterContinental Hotels & Resorts | Cash Cow | Luxury segment, strong brand equity, high profit margins, global presence | Over 225 hotels globally; appeals to high-end clientele. |

| Crowne Plaza | Cash Cow | Targets business travelers, mature market, reliable demand, operational efficiency focus | Contributes substantially to premium/luxury segment profits; stable revenue. |

| Staybridge Suites | Cash Cow | Extended-stay, strong global footprint, growing demand, efficiency improvements | Over 700 hotels; new prototypes launched in 2024. |

| Candlewood Suites | Cash Cow | Extended-stay, mature brand, consistent revenue, operational efficiency focus | Over 520 hotels open/in development; new prototypes to boost efficiency. |

Delivered as Shown

Intercontinental Hotels Group BCG Matrix

The InterContinental Hotels Group BCG Matrix preview you are viewing is the identical, comprehensive document you will receive immediately after purchase. This means you get the full strategic analysis, including detailed breakdowns of IHG's brands within the BCG framework, without any watermarks or demo content. The report is professionally formatted and ready for immediate application in your business planning or competitive analysis.

Dogs

Older, underperforming properties, often referred to as 'dogs' in a BCG matrix context, can exist across various IHG brands. These locations might not align with contemporary brand standards or current market expectations, potentially impacting guest satisfaction and revenue generation.

Such properties could be situated in markets that are already quite saturated, offering limited opportunities for future growth. Alternatively, they might necessitate substantial capital outlays for renovations, with the return on that investment being rather uncertain. For instance, as of late 2023, IHG's strategy has increasingly emphasized conversions and new developments, signaling a potential de-emphasis on revitalizing older, less profitable assets.

Within Intercontinental Hotels Group's (IHG) diverse brand family, certain offerings might be considered dogs, particularly those with limited global reach or catering to very specific niche markets. These brands often face challenges in achieving substantial market share beyond their core geographic areas or traveler demographics. For instance, a brand focused on a unique, localized experience might struggle to resonate with a broader international audience, limiting its growth potential.

These niche brands typically exhibit low market growth and require significant investment in marketing and operational adjustments to gain even modest traction. Their limited global footprint means they cannot leverage economies of scale as effectively as IHG's larger brands. In 2024, while IHG reported strong overall performance, brands with highly specialized appeal may have contributed minimally to the group's global revenue growth, potentially representing a smaller, less impactful segment of the portfolio.

Individual hotels or small clusters of properties in areas facing persistent economic hardship, political unrest, or severe travel limitations might be categorized as 'dogs' within IHG's portfolio. These challenging external conditions can result in persistently low occupancy and revenue per available room (RevPAR), effectively turning them into drains on resources.

For instance, IHG's Q1 2025 performance update highlighted a dip in RevPAR for Greater China. This could signal that certain hotels within that expansive market are indeed experiencing the 'dog' characteristics, struggling with subdued demand due to regional economic or political headwinds.

Properties with Outdated Infrastructure and High Operating Costs

Hotels within Intercontinental Hotels Group (IHG) that have not seen substantial upgrades often struggle with high operating and maintenance expenses. These properties, characterized by outdated infrastructure, typically exhibit a low Revenue Per Available Room (RevPAR), reflecting their diminished competitiveness against more modern establishments. This situation directly impacts profit margins, making them less attractive assets.

IHG's strategic direction, as evidenced by its focus on developing new hotel prototypes and pursuing conversion opportunities, indicates a deliberate effort to divest from or minimize investment in these costly legacy properties. This strategy aims to streamline operations and enhance overall portfolio efficiency.

- Low RevPAR: Properties with outdated infrastructure often report RevPAR figures significantly below the brand average, impacting overall profitability. For instance, older, unrenovated Holiday Inn Express properties might see RevPAR 15-20% lower than their modernized counterparts.

- High Operating Costs: Energy inefficiencies, increased maintenance needs, and higher staffing requirements for older buildings contribute to elevated operating expenses, eroding net operating income.

- Strategic Divestment: IHG's reported plans to accelerate conversions and new builds suggest a gradual phasing out of underperforming, legacy assets from its portfolio.

- Brand Dilution: Maintaining a significant number of outdated properties can negatively affect the overall brand perception and guest experience, further hindering RevPAR growth.

Brands with High Removal Rates

Within the Intercontinental Hotels Group (IHG) portfolio, brands or segments experiencing consistently high hotel removal rates can be considered analogous to the 'dogs' in a BCG matrix. This high attrition suggests these properties are struggling to maintain market share or profitability for their owners.

A significant removal rate signals that these hotels are underperforming or are not perceived as valuable, long-term investments by franchisees. For instance, IHG's 2024 reporting indicated a system-wide room removal rate of 1.9%, highlighting a degree of churn within the group's brands.

- High Removal Rate Indicator: Consistently high hotel departures from the IHG system suggest underperformance, akin to 'dogs' in the BCG matrix.

- Owner Disinvestment: A high removal rate implies owners view these properties as non-viable long-term investments due to poor performance or market position.

- 2024 Attrition Data: IHG reported a 1.9% room removal rate in 2024, indicating some level of brand or property attrition across the portfolio.

Properties that consistently underperform, exhibiting low occupancy and revenue, are classified as 'dogs' in IHG's portfolio. These often include older hotels requiring significant capital for modernization or those in declining markets. For example, in 2024, IHG's focus on new developments and conversions suggests a strategic move away from heavily investing in these legacy assets.

These 'dog' properties can also be niche brands with limited global appeal, struggling to achieve economies of scale. Their growth potential is often constrained by their specialized market focus, leading to lower contributions to overall group revenue. IHG's 2024 system-wide room removal rate of 1.9% indicates some properties are exiting the system, likely due to such underperformance.

The 'dogs' of IHG's portfolio are characterized by low Revenue Per Available Room (RevPAR) and high operating costs due to outdated infrastructure. IHG's strategy of accelerating conversions and new builds points to a plan to divest from or minimize investment in these less profitable, legacy properties to enhance portfolio efficiency.

Brands or specific hotels within IHG experiencing consistently high removal rates are also considered 'dogs'. This high attrition signifies that owners deem these properties non-viable due to poor performance or market positioning. IHG's 2024 reporting of a 1.9% room removal rate highlights this ongoing portfolio adjustment.

| BCG Category | IHG Portfolio Example | Key Characteristics | Financial Impact | Strategic Implication |

|---|---|---|---|---|

| Dogs | Older, unrenovated hotels in mature markets; Niche brands with limited global reach | Low RevPAR, high operating costs, low market share, high removal rates | Erodes profitability, drains resources, low ROI | Divestment, minimal investment, focus on conversions/new builds |

| Dogs | Properties in economically depressed regions | Persistent low occupancy, subdued demand, potential political instability | Negative contribution to overall revenue, requires significant support | Review for viability, potential closure or repositioning |

Question Marks

Ruby Hotels, acquired by IHG in February 2025 for roughly $116 million, represents a premium urban lifestyle brand poised for international growth. This acquisition brought over 30 hotels into IHG's fold, though its market share is still emerging due to its relatively new integration and its distinct 'urban micro' concept.

IHG expects Ruby to be available for franchising in the U.S. by late 2025. The company forecasts substantial additional fee revenue starting in 2028, underscoring Ruby's significant growth prospects despite its current low market share.

Garner Hotels, launched in 2024 by Intercontinental Hotels Group (IHG), is positioned as a new midscale conversion brand emphasizing quality and affordability. Despite rapidly establishing nearly 20 properties in Germany and extending its reach into other European markets, Garner's market share remains in its early stages.

IHG's significant investment in Garner, evidenced by its design for rapid owner adoption, signals a strategic push to capture substantial market share within the competitive midscale hotel segment. This rapid expansion suggests Garner is currently a "question mark" in IHG's BCG matrix, requiring continued investment to determine its future growth trajectory and market dominance.

Atwell Suites, with six open hotels by the close of 2024, represents a nascent but promising player in the upper-midscale extended-stay market. Its current limited market share, a natural consequence of its recent introduction, belies the significant growth potential within its operating segment. IHG's strategic decision to introduce new prototype designs in 2024, aimed at enhancing efficiency and capacity, underscores a clear commitment to expanding Atwell Suites' footprint and elevating its market standing.

New Market Entries for Established Brands (e.g., Candlewood Suites in Europe)

Candlewood Suites, a well-established extended-stay brand for InterContinental Hotels Group (IHG) in the Americas, is positioned as a question mark in the European market. Its planned expansion into Europe, with 14 hotels slated for Germany in 2025, signifies entry into a growing market but with a nascent presence.

IHG's strategic investment in this European launch aims to build market share and establish brand recognition. This move reflects the company's approach to leveraging its mature brands in new territories, a common strategy for growth.

- Brand: Candlewood Suites

- Market: Europe (specifically Germany)

- Status: Question Mark (new market entry for a mature brand)

- Key Strategy: Investment to gain market share and establish presence.

Strategic Investments in AI and Cloud Infrastructure

Intercontinental Hotels Group's (IHG) substantial investments in cloud infrastructure and its AI platform, highlighted during their Q4 2024 earnings, position these initiatives as question marks within the traditional BCG Matrix framework for individual hotel brands. While not directly tied to a specific brand's market share, these technological advancements are crucial for the company's long-term growth and operational agility.

These strategic technology outlays, though capital-intensive initially, are designed to unlock significant future returns. By enhancing operational efficiency and guest personalization through AI, IHG aims to bolster its competitive edge across its entire portfolio.

- AI and Cloud Investment: IHG's Q4 2024 earnings call confirmed increased capital allocation towards cloud and AI capabilities.

- Potential for High Returns: These investments are expected to drive efficiency, improve guest experiences, and support future portfolio growth.

- Question Mark Classification: While not directly impacting individual hotel brand market share, these are high-potential growth areas for the company's overall strategy.

- Competitive Advantage: The focus on technology aims to create a sustainable competitive advantage in the evolving hospitality landscape.

Ruby Hotels and Garner Hotels, despite recent launches and expansions, currently hold low market shares, necessitating further investment to determine their future growth potential within IHG's portfolio. Atwell Suites, while new, shows promise in the extended-stay segment, with IHG actively investing in its expansion and design enhancements.

Candlewood Suites' European debut in 2025, particularly with 14 hotels planned for Germany, positions it as a question mark due to its nascent presence in a new market. IHG's significant investments in AI and cloud infrastructure, highlighted in Q4 2024, are also classified as question marks, representing high-potential growth areas crucial for the company's long-term competitive advantage.

BCG Matrix Data Sources

Our Intercontinental Hotels Group BCG Matrix is built on verified market intelligence, combining financial data from IHG's annual reports, industry research on hotel market growth rates, and competitor analysis to ensure reliable insights.