International Game Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Game Technology Bundle

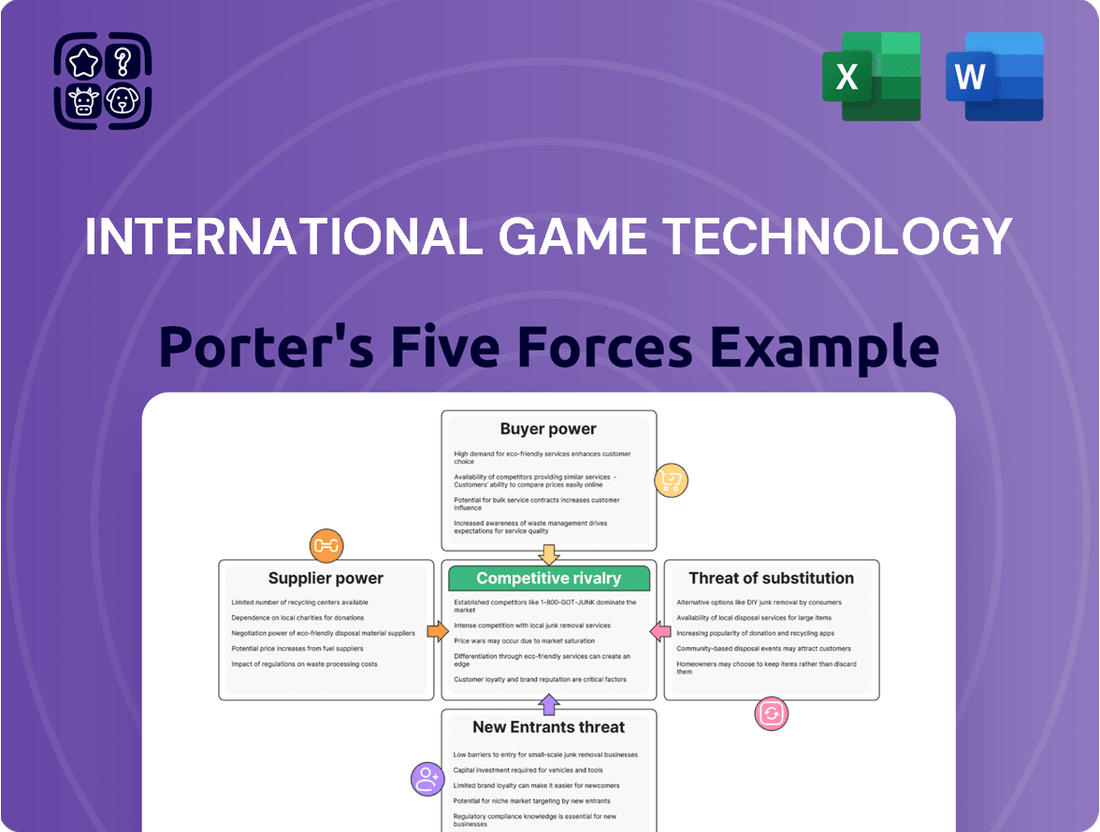

International Game Technology (IGT) operates in a dynamic industry shaped by intense competition, powerful buyers, and significant supplier leverage. Understanding these forces is crucial for navigating the gaming landscape.

The complete report reveals the real forces shaping International Game Technology’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

International Game Technology (IGT) depends on a limited number of suppliers for crucial components like advanced processors and specialized display screens, vital for its gaming and lottery systems. In 2024, the semiconductor industry, a key supplier for processors, continued to experience supply chain constraints, with lead times for certain advanced chips extending several months, directly impacting manufacturing costs.

When suppliers possess unique technology or intellectual property that is critical for International Game Technology's (IGT) operations, their bargaining power increases significantly. For instance, if a supplier holds patents for advanced gaming chipsets or proprietary software for secure lottery management, IGT's reliance on that supplier becomes more pronounced.

This exclusivity means IGT may face higher costs or performance trade-offs if it attempts to find an alternative supplier. The inability to easily substitute such specialized inputs restricts IGT's flexibility and strengthens the supplier's position in price negotiations and contract terms.

The costs IGT incurs when switching suppliers can be substantial. This includes expenses for re-tooling manufacturing lines, undergoing rigorous re-certification processes for new components, or integrating entirely new software systems. For instance, a transition to a new slot machine component supplier might necessitate significant engineering changes and extensive testing to ensure compliance with gaming regulations.

These high switching costs significantly bolster the bargaining power of IGT's current suppliers. When it becomes economically or operationally prohibitive for IGT to switch, suppliers can leverage this to their advantage, potentially increasing prices or dictating terms. This situation is common in specialized industries where components are highly integrated and require extensive customization.

Threat of Forward Integration by Suppliers

If a crucial supplier possesses the capability and motivation to enter the gaming or lottery system manufacturing sector themselves, they present a substantial threat. This potential for forward integration directly amplifies their bargaining leverage. IGT would not only face the loss of a vital supplier but also the emergence of a direct competitor, potentially impacting market share and pricing.

This threat is particularly relevant in specialized component manufacturing where a supplier might have proprietary technology or significant production expertise. For instance, if a key chip manufacturer for gaming machines were to develop their own integrated gaming solutions, IGT could face a dual challenge of sourcing components and competing on product offerings. In 2024, the semiconductor industry, a critical supplier for many tech-dependent sectors like gaming, saw continued consolidation and strategic investments in advanced manufacturing capabilities, underscoring the potential for suppliers to vertically integrate.

- Supplier Capability: Assessing if suppliers have the technical expertise and capital to manufacture gaming or lottery systems.

- Supplier Incentive: Evaluating if suppliers see greater profit potential in entering IGT's market than in continuing to supply.

- Competitive Landscape: Understanding how many suppliers could realistically forward integrate and the potential impact on IGT's market position.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails the bargaining power of suppliers for International Game Technology (IGT). If IGT can easily find alternative materials or components that fulfill the same function at a similar price point, suppliers lose considerable leverage. This is particularly true if these substitutes do not negatively impact the quality or performance of IGT's gaming products.

For instance, if a key component in a slot machine, like a specific type of display screen, has readily available alternatives from multiple manufacturers, IGT can switch suppliers if one attempts to impose unfavorable terms. This competitive landscape among input providers forces them to offer more attractive pricing and conditions to retain IGT as a customer. In 2024, the global semiconductor shortage, while impacting many industries, also highlighted the importance of supply chain diversification and the search for alternative component sources for companies like IGT.

- Reduced Supplier Leverage: The presence of viable substitutes directly diminishes a supplier's ability to dictate terms and prices to IGT.

- Cost Control: Access to alternatives allows IGT to negotiate better pricing, thereby managing its cost of goods sold more effectively.

- Supply Chain Resilience: Having multiple sourcing options for critical inputs enhances IGT's ability to maintain production even if one supplier faces disruptions.

The bargaining power of suppliers for International Game Technology (IGT) is moderated by the availability of substitutes for critical components. In 2024, while some specialized chips remained constrained, the broader market saw increased availability of certain display technologies, offering IGT more sourcing flexibility. This availability of alternatives directly limits suppliers' ability to unilaterally raise prices or dictate terms, as IGT can pivot to other providers if necessary.

IGT's ability to switch suppliers without incurring excessive costs or performance degradation is a key factor. For instance, if a new generation of processors becomes available from multiple vendors that meet IGT's performance and regulatory requirements, the leverage of incumbent suppliers diminishes. This dynamic encourages competitive pricing and service from the supplier side.

The threat of suppliers integrating forward into IGT's business also influences this power. If a key component manufacturer, such as a specialized semiconductor firm, possesses the capital and expertise to develop and market their own gaming systems, they gain significant leverage. In 2024, continued investment in advanced manufacturing by major semiconductor players indicated a potential for such strategic moves across the tech landscape.

| Factor | Impact on IGT | 2024 Context |

|---|---|---|

| Availability of Substitutes | Weakens Supplier Power | Increased availability of some display technologies, but specialized chips still constrained. |

| Switching Costs | Strengthens Supplier Power if High | High for proprietary software/hardware integration; moderate for more commoditized components. |

| Supplier Forward Integration Threat | Strengthens Supplier Power | Potential for semiconductor firms to enter gaming solutions market. |

What is included in the product

This analysis of International Game Technology's competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its market position.

Gain immediate clarity on competitive pressures within the gaming industry, enabling IGT to proactively address threats and capitalize on opportunities.

Customers Bargaining Power

International Game Technology (IGT) operates within a landscape where significant bargaining power can be exerted by its customers, particularly in sectors with high customer concentration. For instance, in the commercial casino market, a few major casino chains often account for a substantial portion of a supplier's revenue. These large entities can leverage their purchasing volume to negotiate more favorable terms, potentially impacting IGT's pricing and contract conditions.

Similarly, government-sponsored lotteries, which represent a core segment for IGT, often exhibit a high degree of customer concentration. A single state or national lottery commission can represent a very large contract. In 2024, the US lottery market alone generated over $115 billion in sales, highlighting the immense scale and purchasing power of these concentrated entities. Their ability to set specifications and demand specific service levels further amplifies their influence over suppliers like IGT.

International Game Technology (IGT) benefits from customer switching costs, which can influence their bargaining power. While IGT strives for lasting partnerships, clients face expenses when moving to different gaming machine or lottery system suppliers. These costs often encompass acquiring new hardware, integrating software, training personnel, and managing potential operational interruptions.

Commercial casinos and government lotteries are keenly aware of costs for gaming equipment and systems. In 2024, the global gaming market continued to see robust demand, but operators are still pressured to manage expenses. This makes them quite sensitive to the price IGT charges for its products.

This sensitivity directly translates into increased bargaining power for these customers. They are actively on the lookout for the most budget-friendly options that still satisfy their stringent operational needs and regulatory compliance, which can put pressure on IGT's pricing strategies.

Threat of Backward Integration by Customers

Large casino groups and lottery organizations, IGT's primary customers, possess significant bargaining power. They might explore developing their own proprietary gaming and lottery technologies or acquire smaller tech firms to reduce reliance on external suppliers like IGT. This potential for backward integration, while demanding substantial investment and technical expertise, grants these customers considerable leverage in pricing and contract negotiations with IGT.

For instance, in 2023, the global gaming market was valued at over $200 billion, with major operators consistently seeking cost efficiencies and greater control over their technological infrastructure. The increasing sophistication of in-house development capabilities within these large entities poses a direct threat, potentially forcing IGT to offer more competitive terms to retain its market share.

- Customer Leverage: The ability of major clients to develop or acquire technology in-house creates a significant bargaining chip.

- Cost & Complexity: While costly and complex, backward integration remains a viable threat for well-capitalized customers.

- Market Dynamics: The growing trend of vertical integration in the gaming sector amplifies this threat for technology providers like IGT.

Standardization of Products and Services

When gaming machines, lottery systems, and interactive platforms become highly standardized across the industry, customers gain more choices and can readily switch between providers. This widespread standardization diminishes International Game Technology's (IGT) capacity for differentiation, thereby amplifying customer bargaining power, particularly concerning price. For instance, in 2023, the global gaming machine market saw continued innovation, but the underlying technology for many core functions remained accessible, allowing for easier comparison and switching by operators.

The ease with which customers can compare features and pricing for standardized products directly translates to increased leverage. If IGT's offerings become indistinguishable from competitors' in key areas, buyers can more effectively negotiate terms or seek out lower-cost alternatives. This dynamic is particularly relevant in markets where regulatory bodies may also influence the types of games and machines permitted, inadvertently promoting a degree of standardization.

- Increased Switching Costs: Standardization generally lowers the costs associated with switching providers, as customers do not need to invest heavily in new infrastructure or training for unfamiliar systems.

- Price Sensitivity: When products are standardized, price becomes a more significant factor in purchasing decisions, giving customers greater power to demand lower prices.

- Market Comparison: A standardized market allows for easier direct comparison of features, performance, and pricing, empowering customers to identify the best value.

- Reduced Brand Loyalty: If IGT's products are seen as interchangeable with those of competitors, brand loyalty may weaken, further enhancing customer bargaining power.

The bargaining power of customers for International Game Technology (IGT) is significantly influenced by the concentration of its client base. In 2024, large casino operators and government lotteries, which form a substantial portion of IGT's revenue, wield considerable influence due to their purchasing volume. This concentration allows them to negotiate favorable pricing and contract terms, directly impacting IGT's profitability and market strategy.

The substantial revenue generated by these large clients, such as the over $115 billion US lottery market in 2024, underscores their economic leverage. Their ability to dictate specifications and demand high service levels further amplifies their power, forcing suppliers like IGT to adapt their offerings and pricing to meet these demands.

Customers' ability to develop proprietary technology or acquire competitors presents a potent threat, increasing their bargaining power. In 2023, the global gaming market, valued at over $200 billion, saw major operators increasingly seeking cost efficiencies and greater control over their technology, potentially reducing reliance on external providers like IGT.

Standardization in gaming and lottery systems also empowers customers by increasing product comparability and reducing switching costs. This allows them to more easily negotiate prices or switch to competitors, especially when regulatory environments inadvertently promote uniformity in offerings.

| Customer Segment | Concentration Level | Impact on IGT's Bargaining Power | 2024 Market Data Relevance |

|---|---|---|---|

| Commercial Casinos | High (few major chains) | High leverage on pricing and terms | Significant portion of global gaming revenue |

| Government Lotteries | High (single state/national bodies) | Strong influence on specifications and service | US market exceeded $115 billion in sales |

Same Document Delivered

International Game Technology Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for International Game Technology, offering a comprehensive examination of the competitive landscape that you will receive immediately upon purchase. You'll gain access to this exact, professionally formatted document, providing actionable insights into the industry's structure and IGT's strategic positioning. No placeholders or sample content are present; what you see is the full, ready-to-use analysis for your business needs.

Rivalry Among Competitors

International Game Technology (IGT) operates in a fiercely competitive landscape. Major global players such as Light & Wonder and Aristocrat Leisure are significant rivals, each possessing substantial resources and market presence. This intense competition is evident as these companies actively contend for dominance across various segments of the gaming market, including gaming machines, lottery systems, and sports betting solutions.

The gaming industry's growth rate presents a mixed picture, influencing competitive rivalry for International Game Technology. While segments like sports betting and iGaming are showing robust expansion, the more mature markets for traditional gaming machines can foster intense competition as companies vie for a limited pool of customers.

In 2023, the global online gambling market was valued at approximately $70.5 billion and is projected to reach $157.5 billion by 2030, demonstrating significant growth opportunities. However, this growth can also attract new entrants, further intensifying rivalry.

For IGT, this means that in areas with slower growth, the focus shifts to retaining existing players and aggressively pursuing market share from competitors. This dynamic can lead to price wars or increased marketing spend, impacting profitability.

Competitors in the gaming sector, including IGT, are constantly pouring resources into research and development to roll out novel products and features. This includes fresh game themes, sophisticated analytics, and more engaging player experiences. For instance, in 2023, the global gaming market saw significant investment in R&D, with companies striving to stand out.

The capacity to differentiate through innovation is paramount; without it, the industry often devolves into price wars. Companies that fail to innovate risk being perceived as commodities, forcing them to compete primarily on cost, which erodes profitability.

High Fixed Costs and Exit Barriers

The gaming technology sector, including companies like International Game Technology (IGT), is characterized by substantial fixed costs. These costs stem from continuous investment in research and development for new games and technologies, the manufacturing of specialized gaming equipment, and the rigorous process of obtaining and maintaining regulatory compliance across various jurisdictions. For instance, IGT's significant capital expenditures in 2023, reported at $536 million, underscore these ongoing investments.

High exit barriers further intensify competitive rivalry. Companies in this industry often possess highly specialized assets, such as proprietary software and unique hardware, which have limited alternative uses. Additionally, long-term contracts with casinos and gaming operators can lock companies into the market, making it difficult and costly to divest or withdraw. This can lead to persistent competition, even when market conditions are unfavorable, as firms are compelled to continue operating to recoup their investments.

- Significant R&D Investment: Gaming technology firms must consistently invest in innovation to stay competitive, a considerable fixed cost.

- Specialized Assets: The unique nature of gaming hardware and software creates high exit barriers due to limited resale value.

- Long-Term Contracts: Commitments with operators often prevent companies from easily exiting the market, fostering sustained rivalry.

- Regulatory Compliance Costs: Meeting diverse and evolving regulatory requirements across different gaming markets adds to fixed operational expenses.

Mergers and Acquisitions Activity

The gaming sector has experienced substantial merger and acquisition (M&A) activity. Companies are actively acquiring rivals to bolster market share, broaden their product offerings, and realize greater efficiencies through economies of scale. This trend towards consolidation, while potentially diminishing the number of direct competitors, can also result in the emergence of larger, more powerful industry players.

For instance, in 2023, the global gaming market saw significant M&A deals, with some reports indicating deal values in the tens of billions of dollars. These transactions often aim to integrate technologies, expand geographic reach, and streamline operations, thereby intensifying competition among the remaining, larger entities.

- Increased Consolidation: M&A activity in the gaming industry is consolidating the market, leading to fewer, but larger, competitors.

- Strategic Acquisitions: Companies acquire others to gain market share, expand product lines, and achieve operational efficiencies.

- Emergence of Formidable Rivals: Successful consolidations create larger, more resource-rich competitors that can exert greater market influence.

- Impact on IGT: Such M&A trends directly influence International Game Technology's competitive landscape by reshaping market dynamics and the power of its rivals.

Competitive rivalry for International Game Technology (IGT) is intense, driven by significant players like Light & Wonder and Aristocrat Leisure. These companies actively compete across gaming machines, lotteries, and sports betting, fueled by substantial resources and a drive for market dominance. The gaming industry's varied growth rates, with robust expansion in sports betting and iGaming contrasting with mature traditional gaming machine markets, further shape this rivalry.

Innovation is a critical battleground, with companies like IGT investing heavily in R&D to develop new game themes and technologies. For example, IGT reported capital expenditures of $536 million in 2023, a substantial portion of which likely supports this innovation. The high fixed costs associated with R&D, specialized assets, and regulatory compliance create significant barriers to exit, ensuring that competition remains fierce even in challenging market conditions.

Merger and acquisition activity is also reshaping the competitive landscape, with major deals consolidating the market and creating larger, more formidable rivals. This trend means IGT must navigate an environment where its competitors are constantly growing in scale and capability, intensifying the need for strategic agility and product differentiation.

| Competitor | 2023 Revenue (Approx.) | Key Business Segments | Recent Strategic Moves |

|---|---|---|---|

| Light & Wonder | $2.0 billion | Gaming, Lottery, Digital | Divested SciPlay in 2023, focusing on core gaming operations. |

| Aristocrat Leisure | $3.5 billion (AUD 5.3 billion) | Gaming Machines, Digital (Product Madness, Pixel United) | Acquired Roxor Gaming in 2023, expanding its UK presence. |

| IGT | $4.0 billion | Gaming, Lottery, Digital | Focus on digital transformation and expanding its global footprint. |

SSubstitutes Threaten

The threat of substitutes for International Game Technology (IGT) is substantial, stemming from a broad spectrum of entertainment choices vying for consumer attention and spending. These alternatives, ranging from video games and streaming services like Netflix and Disney+ to social media platforms and even traditional leisure activities, continually innovate and present fresh engagement opportunities.

In 2024, the global video game market was projected to reach over $200 billion, showcasing the immense competition for entertainment dollars. Similarly, the streaming industry continues its rapid expansion, with major players investing heavily in original content, directly diverting discretionary income that might otherwise be spent on gaming or gambling.

The proliferation of social and casual gaming, particularly on mobile devices, poses a significant threat of substitution for International Game Technology (IGT). These games, often free-to-play with monetization through in-app purchases, provide an easily accessible and low-cost entertainment alternative. For instance, the global mobile gaming market was valued at over $98 billion in 2023 and is projected to continue its upward trajectory. This accessibility can draw away potential players who might otherwise engage with IGT's slot machines and lottery products in traditional casino settings.

New technologies like virtual reality (VR) and augmented reality (AR) are emerging as potential substitutes for traditional gaming and lottery experiences. These immersive technologies, along with the growing metaverse, could offer alternative forms of entertainment that draw consumers away from IGT's core offerings. As VR and AR adoption increases, they may capture a significant portion of the entertainment budget previously allocated to gaming.

Changes in Consumer Preferences

Shifts in consumer preferences can significantly alter the landscape for companies like International Game Technology (IGT). For instance, a growing demand for more interactive, social, or personalized entertainment experiences might draw consumers away from IGT's traditional gaming products. This trend was evident in 2023, with the global entertainment market seeing a notable increase in spending on immersive experiences and user-generated content platforms.

If consumers increasingly favor engagement models that IGT's current offerings don't fully satisfy, they might turn to substitutes. These substitutes could range from advanced virtual reality gaming to sophisticated mobile entertainment apps that offer a higher degree of social interaction or customization. The gaming industry, in general, has seen substantial growth in mobile gaming revenue, which surpassed $90 billion globally in 2023, highlighting a clear consumer shift.

- Consumer preference for interactive and social gaming experiences is growing.

- IGT's traditional products may face competition from substitutes offering greater personalization.

- The global entertainment market saw increased spending on immersive experiences in 2023.

- Mobile gaming revenue exceeded $90 billion worldwide in 2023, indicating a significant shift in consumer engagement.

Regulatory Environment and Responsible Gaming Initiatives

The increasing focus on regulatory environments and responsible gaming initiatives presents a significant threat of substitutes for International Game Technology (IGT). As governments worldwide implement stricter rules and promote awareness around potential gambling harms, consumers might be nudged towards alternative entertainment options. This shift can indirectly bolster the appeal of substitutes that are perceived as less risky or more socially acceptable.

For instance, in 2024, many jurisdictions continued to strengthen their responsible gaming frameworks. This includes enhanced player protection measures and stricter advertising guidelines, which could temper the growth of traditional gaming. The push for these initiatives can lead consumers to explore other leisure activities, such as streaming services, video games, or even skill-based entertainment, which do not carry the same regulatory oversight.

- Regulatory Pressure: Stricter regulations on advertising and player engagement can limit IGT's reach and appeal, making other entertainment options more attractive.

- Responsible Gaming Impact: A heightened emphasis on responsible gaming may lead some consumers to reduce or cease gambling activities, seeking entertainment elsewhere.

- Consumer Behavior Shift: Growing awareness and societal attitudes towards gambling can encourage a migration towards non-gambling leisure activities.

- Substitute Attractiveness: The perceived safety and accessibility of substitutes, like digital entertainment platforms, can increase their competitive advantage against regulated gaming.

The threat of substitutes for International Game Technology (IGT) is significant, as consumers have a vast array of entertainment options available. These substitutes range from digital entertainment like video games and streaming services to alternative leisure activities, all competing for discretionary spending. For example, the global video game market was projected to exceed $200 billion in 2024, illustrating the intense competition for entertainment dollars.

Mobile gaming, in particular, presents a strong substitute, with its accessibility and often lower cost of entry. The global mobile gaming market was valued at over $98 billion in 2023, and this segment continues to grow. Furthermore, emerging technologies like virtual reality (VR) and augmented reality (AR) offer increasingly immersive experiences that could draw consumers away from traditional gaming formats.

| Substitute Category | 2023 Estimated Market Value | Key Trends |

|---|---|---|

| Video Games (Global) | $200+ billion (2024 Projection) | Continued innovation, esports growth |

| Mobile Gaming (Global) | $98+ billion (2023) | Freemium models, social integration |

| Streaming Services (Global) | Significant growth, heavy content investment | Original content, diverse platforms |

| VR/AR Entertainment | Emerging, increasing adoption | Immersive experiences, metaverse development |

Entrants Threaten

Entering the gaming technology and lottery systems market demands considerable upfront capital. Companies need to invest heavily in research and development to create innovative products, build robust manufacturing capabilities, and navigate complex regulatory landscapes. For instance, developing a new slot machine or lottery software can cost millions, making it a significant hurdle for smaller players.

Establishing a widespread distribution and service network is another capital-intensive aspect. New entrants must invest in sales teams, technical support infrastructure, and potentially even physical presence in various jurisdictions to compete effectively. This extensive financial commitment deters many potential competitors from entering the market.

The gaming industry is a minefield of regulations, demanding extensive licensing and adherence to compliance standards that differ significantly across global jurisdictions. For instance, obtaining a license in a major market like Nevada can involve multi-year processes and substantial upfront costs, acting as a significant deterrent to newcomers. This complex and time-consuming approval pathway presents a formidable barrier to entry for potential competitors looking to challenge established players like International Game Technology.

International Game Technology (IGT) benefits from a deeply entrenched brand reputation and robust, long-term relationships with its clientele, which includes commercial casinos and government lotteries across the globe. This established trust is a significant barrier for any potential new entrant aiming to disrupt the market.

New competitors would face the substantial hurdle of not only matching IGT's product offerings but also replicating its credibility and the trust it has cultivated over years of reliable service. Building these same kinds of relationships and brand loyalty requires considerable time, investment, and a proven track record, making it a difficult, though not impossible, challenge.

Proprietary Technology and Intellectual Property

International Game Technology (IGT) and other established players in the gaming industry benefit from significant barriers to entry stemming from proprietary technology and intellectual property. IGT, for instance, holds a vast portfolio of patents covering everything from the intricate mechanics of gaming machines to sophisticated lottery systems and cutting-edge interactive platforms. These technological moats are not easily replicated.

The sheer scale of investment and the considerable time required to develop comparable technology from the ground up act as a substantial deterrent for any potential new entrants. This complex technological landscape, deeply embedded with intellectual property rights, makes it exceptionally challenging for newcomers to compete effectively. For example, IGT's commitment to R&D, which represented a significant portion of its operational expenses in recent years, underscores the ongoing investment needed to maintain this technological edge.

- Proprietary Technology: IGT's extensive patent portfolio in gaming machine design and lottery systems creates a high barrier.

- Intellectual Property: Safeguarding innovations in interactive platforms requires significant legal and development resources.

- R&D Investment: The continuous need for substantial research and development spending by incumbents deters new entrants.

- Time and Cost: Replicating IGT's technological capabilities would demand massive capital outlay and years of development.

Economies of Scale and Experience Curve Effects

Incumbents like International Game Technology (IGT) possess significant economies of scale in areas such as manufacturing, bulk procurement of components, and extensive research and development investments. This allows them to achieve lower per-unit production costs compared to potential new entrants who lack this established infrastructure. For instance, IGT's global supply chain and large-scale production facilities, a result of decades of operation, provide a cost advantage that is challenging for newcomers to replicate quickly.

Furthermore, IGT benefits from an experience curve effect. Over years of operation, the company has continuously refined its gaming machine design, software development, and operational processes. This accumulated knowledge and efficiency translate into a competitive edge, making it difficult for new companies to match IGT’s cost structure and product quality from the outset. This learning curve means that IGT can often introduce new products or upgrades more efficiently and at a lower cost than a nascent competitor.

- Economies of Scale: IGT leverages its large production volumes to reduce manufacturing and procurement costs, a significant barrier for new entrants.

- Experience Curve: Decades of operational refinement have allowed IGT to optimize its processes, leading to cost efficiencies and improved product development that new competitors struggle to match.

- R&D Investment: IGT's substantial and ongoing investment in research and development creates a technological advantage and a pipeline of innovative products, further deterring new market entrants.

The threat of new entrants into the gaming technology and lottery systems market, where International Game Technology (IGT) operates, is significantly mitigated by several substantial barriers. High capital requirements for research, development, and establishing distribution networks are primary deterrents. For instance, the global gaming market is projected to reach approximately $714.1 billion by 2024, indicating the scale of investment needed to gain traction.

Regulatory complexity and the lengthy, costly licensing processes in key gaming jurisdictions present another formidable challenge. Obtaining approvals in markets like the US or Europe can take years and involve millions in fees, effectively limiting the pool of potential competitors. Furthermore, IGT's extensive patent portfolio and proprietary technology, coupled with significant ongoing R&D investments, create a technological moat that is difficult and expensive for newcomers to overcome.

IGT's established brand reputation and deep-rooted client relationships, built over decades, provide a strong competitive advantage. New entrants would struggle to replicate the trust and loyalty that IGT has cultivated with commercial casinos and government lotteries globally. This, combined with economies of scale in manufacturing and procurement, and the experience curve effect leading to cost efficiencies, makes it exceptionally challenging for new players to enter and compete effectively.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for R&D, manufacturing, and distribution networks. | Deters smaller players and requires significant funding. |

| Regulatory Hurdles | Complex and costly licensing and compliance across diverse jurisdictions. | Creates lengthy approval processes and substantial upfront costs. |

| Proprietary Technology & IP | Extensive patent portfolios and ongoing R&D investments. | Requires significant investment to replicate technological capabilities. |

| Brand Reputation & Relationships | Established trust and long-term client partnerships. | Difficult for new entrants to build credibility and market access. |

| Economies of Scale & Experience Curve | Lower per-unit costs due to large-scale operations and refined processes. | Provides a cost advantage that is hard for newcomers to match. |

Porter's Five Forces Analysis Data Sources

Our International Game Technology Porter's Five Forces analysis is built upon a robust foundation of data, including IGT's annual reports and SEC filings, alongside industry-specific market research from firms like Statista and IBISWorld.