International Game Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Game Technology Bundle

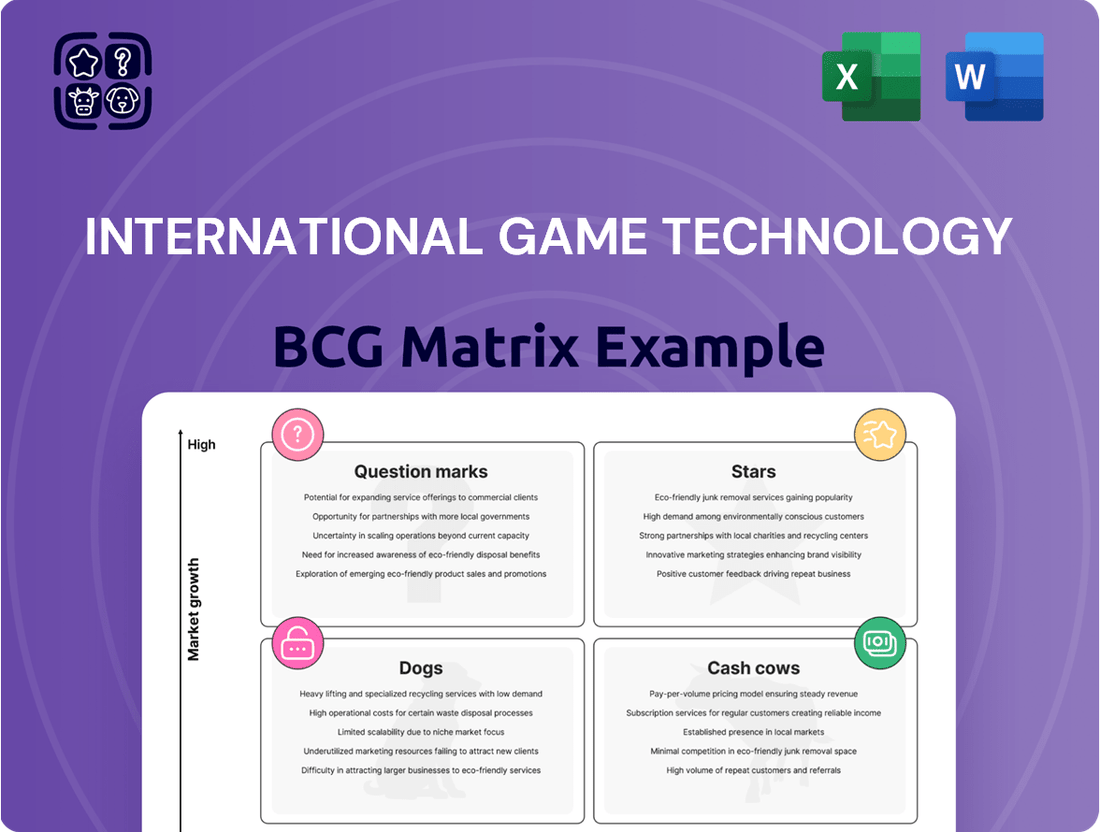

Curious about International Game Technology's product portfolio? This glimpse into their BCG Matrix highlights their position in the market, but the full report unveils the complete picture. Discover which segments are their Stars, Cash Cows, Dogs, and Question Marks, and gain the strategic clarity needed to make informed decisions.

Don't miss out on the actionable insights within the complete International Game Technology BCG Matrix. Unlock detailed quadrant analysis, understand the growth potential of each product, and receive data-driven recommendations to optimize your investment strategy and drive future success.

Ready to transform your understanding of IGT's market standing? Purchase the full BCG Matrix for a comprehensive breakdown, including strategic guidance tailored to their specific product placements. This is your key to navigating the competitive landscape and capitalizing on opportunities.

Stars

IGT's iLottery Solutions are a standout performer within the company's portfolio, fitting squarely into the "Star" category of the BCG Matrix. This segment is experiencing robust growth, with wagers surging by over 25% year-over-year in the first quarter of 2025. This impressive expansion is fueled by strong adoption and performance across diverse international markets, underscoring the global appeal and operational success of IGT's digital lottery offerings.

The significant digital expansion within the iLottery sector complements the steady overall growth of the broader lottery market. This dynamic positions IGT's iLottery business as a prime opportunity, especially as the company strategically prioritizes and invests further in its lottery segment. IGT's commitment is evident in its ongoing investments and expansion of its iLottery platforms, reinforcing its focus on this high-growth digital channel as a key driver of future success.

New Premium Gaming Machine Cabinets are a key part of International Game Technology's (IGT) product portfolio. The launch of innovative cabinets like the Wheel of Fortune DiamondRS Premium Wheel and the RISE55 cabinet in U.S. casinos in 2025 highlights IGT's ongoing commitment to advanced hardware. These cabinets are designed with ultra-HD displays and improved player comfort to create engaging experiences.

International Game Technology (IGT) has experienced robust growth in Latin America and other international markets, largely driven by its successful multi-level progressive (MLP) games like Mystery of the Lamp, Egyptian Link, and Magic Treasures. These titles are crafted to provide players with the allure of substantial jackpot wins and an immersive gaming experience, proving highly popular with a broad player base.

The strong market reception for these MLP games highlights their effectiveness in capturing player interest and generating significant revenue streams for IGT. In 2023, IGT reported a 10% increase in its Global Lottery segment revenue, partly fueled by the performance of its premium gaming content, which includes these popular progressive titles.

Sports Betting Solutions in Emerging Regulated Markets

The global sports betting market is booming, with forecasts suggesting a compound annual growth rate (CAGR) between 8.56% and 11% from 2025 onward. This surge is fueled by a wave of new regulations and a significant shift towards digital platforms. International Game Technology (IGT) is well-positioned to capitalize on this expansion.

IGT offers robust sports betting solutions, making it a key participant in this rapidly evolving landscape. As more regions embrace regulated sports betting, IGT's proven technology and industry experience enable swift market share gains in these nascent, high-potential markets. The company's comprehensive suite of offerings is a significant advantage.

- Market Growth: Projected CAGR of 8.56% to 11% from 2025 onwards.

- Key Drivers: Increasing legalization and digital adoption worldwide.

- IGT's Role: Provider of established sports betting technology and solutions.

- Strategic Advantage: Ability to quickly gain market share in newly regulated territories.

Interactive Gaming Content for Online Casinos

Interactive gaming content for online casinos represents a significant growth area for International Game Technology (IGT). The global iGaming market is anticipated to reach $97 billion in 2024 and is projected to expand to $125.6 billion by 2027, showcasing robust expansion. IGT's strategic focus on interactive content for online platforms aligns with this burgeoning market.

Despite ongoing divestitures in its broader Gaming & Digital segment, IGT's investment in its interactive gaming content library is crucial. The company's innovation in this space, particularly with popular titles and proprietary platforms, positions it to capitalize on the increasing demand for digital casino experiences. This segment is expected to see a compound annual growth rate (CAGR) of 6.47% between 2024 and 2029, underscoring its potential.

- Market Growth: Global iGaming market projected to hit $97 billion in 2024, reaching $125.6 billion by 2027.

- CAGR: Expected CAGR of 6.47% for iGaming from 2024 to 2029.

- IGT's Role: IGT provides interactive gaming platforms and content, a key area despite broader segment divestitures.

- Strategic Advantage: Strong content library and innovation in interactive gaming position IGT for success in this expanding digital landscape.

International Game Technology's (IGT) iLottery solutions are a prime example of a "Star" in the BCG matrix, demonstrating high growth and a strong market position. The company's commitment to this digital channel is evident through continuous investment and platform expansion. This focus is crucial as the iLottery segment, with wagers up over 25% year-over-year in Q1 2025, continues to be a significant driver for IGT.

IGT's premium gaming machines, such as the Wheel of Fortune DiamondRS Premium Wheel and the RISE55 cabinet launched in 2025, also represent "Stars." These innovative products, featuring enhanced player experiences and advanced technology, are designed to capture significant market share in the high-growth premium gaming segment.

The company's multi-level progressive (MLP) games, including Mystery of the Lamp and Egyptian Link, are also positioned as "Stars." These titles have driven a 10% increase in IGT's Global Lottery segment revenue in 2023, showcasing their strong performance and player appeal in international markets.

Furthermore, IGT's interactive gaming content for online casinos is a "Star" performer. With the global iGaming market projected to reach $97 billion in 2024 and a CAGR of 6.47% expected through 2029, IGT's investment in this area is strategically aligned with substantial market expansion.

| IGT Product Category | BCG Matrix Classification | Key Growth Drivers | IGT's Strategic Focus | Relevant 2024-2025 Data/Projections |

|---|---|---|---|---|

| iLottery Solutions | Star | Strong adoption, international market expansion | Continued investment and platform enhancement | Wagers up >25% YoY (Q1 2025) |

| Premium Gaming Machines | Star | Player engagement, advanced technology | Innovation in cabinet design and features | Launch of new cabinets in 2025 |

| Multi-Level Progressive (MLP) Games | Star | Jackpot appeal, immersive player experience | Content development for international markets | Contributed to 10% Global Lottery revenue growth (2023) |

| Interactive Gaming Content | Star | Digitalization of casino experience | Expansion of online content library | iGaming market to reach $97B (2024), 6.47% CAGR (2024-2029) |

What is included in the product

This BCG Matrix analysis provides a tailored look at IGT's portfolio, identifying which segments to invest in, hold, or divest.

The International Game Technology BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

IGT's traditional instant ticket and draw game sales represent a bedrock of their operations, showcasing enduring player interest and stable performance. This segment is a consistent powerhouse, delivering healthy profit margins and substantial cash flow that bolster IGT's financial stability.

While the overall lottery market experiences modest growth, IGT's dominant market position, built on years of expertise, allows them to maintain a significant market share. This translates into reliable and predictable revenue streams from these foundational lottery products.

International Game Technology's (IGT) draw-based lottery systems and games are a prime example of a cash cow within its business portfolio. This segment enjoys a substantial market share, especially in established markets like Italy and the U.S. & Canada, demonstrating its enduring appeal and IGT's strong presence.

The recurring revenue generated from managing these central lottery systems and providing game content, often secured through long-term contracts, ensures a consistent and predictable income stream. This stability is a hallmark of a mature, high-market-share business unit.

In 2023, IGT's Global Lottery segment, which heavily features these draw-based systems, reported revenues of $3.1 billion. This segment's consistent performance underscores its role as a reliable cash generator for the company, supporting investments in other areas of its business.

International Game Technology's (IGT) established land-based gaming machine installed base, especially within the U.S. commercial casino sector, functions as a classic cash cow. The company holds a dominant position, with roughly 70% of installed units in this key market.

This considerable market penetration translates into a reliable and predictable revenue stream. Income is generated through essential service agreements, ongoing maintenance contracts, and the continuous delivery of updated content to these machines.

Even as IGT evolves its strategic focus, this mature and widespread installed base remains a powerful engine for generating stable and consistent cash flow, underpinning the company's financial stability.

Long-term Lottery Management Agreements (LMAs)

International Game Technology (IGT) benefits significantly from its long-term Lottery Management Agreements (LMAs). These agreements are crucial for the company's financial stability, offering predictable and resilient revenue streams. For instance, in 2023, IGT's Global Lottery segment, heavily influenced by these LMAs, reported revenue of $3.2 billion, showcasing the substantial income generated from these mature markets.

These LMAs often encompass a broad range of services, from providing cutting-edge technology and innovative game design to offering comprehensive operational support. This integrated approach ensures a consistent income flow, as IGT partners with lotteries across various jurisdictions. The stability and inherently high margins associated with these comprehensive service contracts solidify their position as significant cash cows within IGT's portfolio.

- Predictable Revenue: LMAs provide a consistent and reliable income stream, reducing financial volatility.

- Comprehensive Services: IGT offers end-to-end solutions, from technology to operations, fostering strong client relationships.

- High Margins: The mature nature and established demand in these markets allow for healthy profit margins.

- Market Stability: These agreements are typically long-term, providing a stable foundation for the company's earnings.

Core Gaming Machine Product Sales (Recurring)

Beyond its existing installed base, International Game Technology (IGT) continues to generate consistent revenue from the ongoing sales of its core gaming machines. While these sales can see some ups and downs quarter-to-quarter, they form a reliable income source for the company.

These machine sales are bolstered by IGT's strong, long-standing partnerships with casinos. The industry's constant need to update hardware and introduce fresh game content fuels this demand. For instance, in the first quarter of 2025, IGT reported that its Gaming segment, which includes these machine sales, generated approximately $470 million in revenue, demonstrating the segment's continued importance despite facing some market challenges.

- Steady Revenue Stream: Core gaming machine sales provide a predictable income for IGT.

- Driver of Sales: Established casino relationships and the demand for hardware/content refreshes are key factors.

- Q1 2025 Performance: The Gaming segment, encompassing these sales, brought in around $470 million in revenue during Q1 2025.

- Mature Product Line: This segment represents a stable, cash-generating part of IGT's business.

IGT's established lottery systems and draw games are a significant cash cow, leveraging a dominant market share in key regions like Italy and North America. These operations generate consistent, predictable revenue through long-term management agreements and recurring game content sales, providing a stable financial foundation.

The company's extensive installed base of land-based gaming machines, particularly in the U.S. commercial casino market where IGT holds approximately 70% of units, also functions as a powerful cash cow. Revenue from service agreements, maintenance, and ongoing content delivery to this mature segment ensures a reliable income stream.

IGT's Global Lottery segment, heavily reliant on these cash cow activities, reported revenues of $3.2 billion in 2023, underscoring its role as a consistent profit generator. This stability allows IGT to reinvest in growth areas and maintain financial resilience.

| Business Segment | Role in BCG Matrix | Key Characteristics | 2023 Revenue (Approx.) |

| Lottery Systems & Draw Games | Cash Cow | High Market Share, Stable Demand, Long-Term Contracts | $3.2 Billion (Global Lottery Segment) |

| Land-Based Gaming Machines (Installed Base) | Cash Cow | Dominant Market Penetration (70% in U.S.), Recurring Service Revenue | Included in Gaming Segment Revenue |

Preview = Final Product

International Game Technology BCG Matrix

The International Game Technology (IGT) BCG Matrix preview you're seeing is the definitive, fully formatted document you'll receive immediately after purchase. This isn't a sample; it's the complete strategic analysis, ready for immediate application in your business planning.

Dogs

Certain older gaming machine titles within International Game Technology's (IGT) portfolio may be classified as "Dogs" in the BCG Matrix. These are games that have seen declining player interest and revenue generation, often due to being outpaced by more modern and engaging content. For example, titles that haven't been updated with new features or themes might struggle to attract a significant player base in 2024.

These underperforming legacy titles typically generate low revenue while still incurring maintenance costs. This situation ties up valuable resources and capital that IGT could potentially redeploy to higher-growth areas. The ongoing need for support, even with minimal returns, makes them a drain on operational efficiency.

IGT's strategic emphasis on developing and promoting new, high-performing "Master Limited Partnership" (MLP) titles indicates a clear direction away from these legacy assets. This strategic pivot aims to optimize resource allocation, focusing investment on content with greater potential for future revenue and market share growth, aligning with industry trends observed throughout 2024.

Specific geographic gaming markets with low penetration, where International Game Technology (IGT) holds a limited market share and the market itself is stagnant or declining, represent potential "dogs" in their BCG matrix analysis. These regions often demand significant resources for minimal return, making them candidates for divestiture as part of strategic portfolio reviews. For instance, while IGT's overall revenue for 2023 was $4.2 billion, a focus on high-growth markets is crucial for future performance.

Certain older gaming system technologies within International Game Technology's portfolio, while historically significant, now represent a challenge. These systems often come with high maintenance costs and struggle to keep pace with the demands of modern gaming, lacking the scalability and advanced features of newer platforms.

These legacy systems typically exhibit low market adoption rates and incur substantial operational expenses, rendering them inefficient. For instance, while specific financial figures for these older systems aren't publicly detailed, IGT's strategic direction clearly signals a divestment from such technologies.

IGT's proactive development and promotion of advanced solutions like the ADVANTAGE X system and cloud-based platforms such as IGT Evolve underscore this shift. This strategic pivot aims to phase out the reliance on older, less adaptable gaming technologies, focusing resources on innovation and future-proof solutions.

Revenue Streams Highly Dependent on Sporadic Jackpots

Some of International Game Technology's (IGT) revenue, especially from its U.S. multi-state jackpot wager-based games, is heavily reliant on the rare appearance of massive jackpots. This creates significant ups and downs in revenue from one period to the next, meaning revenue can drop in quarters where big jackpots don't hit. This reliance makes these particular income sources quite unpredictable and less attractive, similar to 'dogs' in the BCG matrix because their returns are low and inconsistent.

For instance, in the first quarter of 2024, IGT reported a slight increase in its Global Lottery segment revenue, reaching $739 million. However, the performance of specific jackpot-driven products within this segment can still exhibit volatility. The infrequent nature of large jackpot payouts directly influences the timing and magnitude of revenue recognition for these offerings.

- Revenue Volatility: Jackpot-dependent segments can experience sharp revenue fluctuations based on the occurrence of large prize payouts.

- Unpredictable Income: The sporadic nature of jackpots makes forecasting revenue from these streams challenging.

- Lower Attractiveness: Due to their inconsistency, these revenue sources are often viewed as less desirable within a diversified business portfolio.

Non-strategic, Low-Return Assets within Gaming & Digital

The announced sale of International Game Technology's (IGT) Gaming & Digital business for $4.05 billion signals a strategic pivot. This divestiture targets segments that may not fit IGT's future focus on a pure-play lottery business, or are characterized by lower growth and return potential.

These divested assets, or portions of them, can be viewed as Dogs within the context of IGT's evolving strategic landscape. The sale aims to streamline operations, reduce debt, and reallocate capital towards core, higher-priority areas.

- Divestiture Rationale: The $4.05 billion sale of the Gaming & Digital segment aims to sharpen IGT's focus on its lottery operations, shedding assets deemed less aligned with its long-term vision.

- Strategic Re-alignment: This move allows IGT to concentrate resources and investment on its core lottery business, potentially improving overall profitability and market position.

- Financial Impact: Proceeds from the sale are intended to deleverage the balance sheet and provide capital for strategic initiatives within the remaining business segments.

- Market Perception: Investors may view this divestiture positively, seeing it as a move towards a more focused and potentially higher-margin business model.

Certain older gaming machine titles within International Game Technology's (IGT) portfolio may be classified as "Dogs" in the BCG Matrix. These are games that have seen declining player interest and revenue generation, often due to being outpaced by more modern and engaging content. For example, titles that haven't been updated with new features or themes might struggle to attract a significant player base in 2024.

These underperforming legacy titles typically generate low revenue while still incurring maintenance costs. This situation ties up valuable resources and capital that IGT could potentially redeploy to higher-growth areas. The ongoing need for support, even with minimal returns, makes them a drain on operational efficiency.

IGT's strategic emphasis on developing and promoting new, high-performing titles indicates a clear direction away from these legacy assets. This strategic pivot aims to optimize resource allocation, focusing investment on content with greater potential for future revenue and market share growth, aligning with industry trends observed throughout 2024.

Some of International Game Technology's (IGT) revenue, especially from its U.S. multi-state jackpot wager-based games, is heavily reliant on the rare appearance of massive jackpots. This creates significant ups and downs in revenue from one period to the next, meaning revenue can drop in quarters where big jackpots don't hit. This reliance makes these particular income sources quite unpredictable and less attractive, similar to 'dogs' in the BCG matrix because their returns are low and inconsistent.

For instance, in the first quarter of 2024, IGT reported a slight increase in its Global Lottery segment revenue, reaching $739 million. However, the performance of specific jackpot-driven products within this segment can still exhibit volatility. The infrequent nature of large jackpot payouts directly influences the timing and magnitude of revenue recognition for these offerings.

| BCG Category | IGT Portfolio Example | Characteristics | Strategic Implication |

| Dogs | Underperforming legacy gaming titles | Low market share, low growth, declining revenue, high maintenance costs | Divestiture, harvest, or minimal investment |

| Dogs | Specific low-penetration geographic markets | Limited market share, stagnant or declining market growth, high resource demand for low return | Strategic review, potential divestment |

| Dogs | Older, less adaptable gaming system technologies | High operational expenses, low adoption rates, lack of modern features | Phased out, replaced by newer technologies |

| Dogs | Jackpot-dependent revenue streams | High revenue volatility, unpredictable income, inconsistent returns | Manage for cash flow, but de-emphasize reliance |

Question Marks

International Game Technology (IGT) is strategically eyeing expansion into nascent sports betting jurisdictions, a move that aligns with the global market's rapid growth. While the overall sports betting sector is booming, IGT's presence in these emerging markets might be relatively small, presenting a significant opportunity for future gains.

These new territories demand substantial capital for building infrastructure, launching targeted marketing campaigns, and tailoring products to local preferences. Success hinges on navigating evolving regulations, a competitive environment, and the pace of consumer acceptance, making these ventures inherently high-risk, high-reward.

New digital lottery initiatives beyond established iLottery, such as innovative mobile-first platforms or novel online game mechanics targeting younger demographics, would likely be classified as Question Marks within IGT's BCG Matrix. These ventures demand significant upfront investment in research, development, and marketing to cultivate market presence and user engagement, with their ultimate success remaining uncertain. For instance, IGT has been actively exploring new digital channels, and in 2024, the company continued to invest in expanding its digital offerings, aiming to tap into evolving player preferences and capture new market segments.

International Game Technology (IGT) is actively investing in and rolling out sophisticated casino management systems like ADVANTAGE X and its cloud-based counterpart, IGT Evolve. These advanced solutions are designed to boost operational efficiency and offer remote management capabilities for gaming floors.

These technologies promise substantial value to casino operators by optimizing gaming floor performance and providing deeper data insights. However, the market adoption for these cutting-edge solutions is still in its nascent stages within a highly competitive technology landscape.

IGT's continued investment in these systems is crucial to solidify their market position and demonstrate their full potential. The company is focusing on enhancing data analytics and remote accessibility, aiming to capture a larger share of the growing casino technology market.

Entry into Emerging iGaming Content Niches

International Game Technology's (IGT) entry into emerging iGaming content niches, such as new game genres or virtual reality gambling, positions these ventures as question marks within the BCG matrix. While the overall iGaming market is experiencing robust growth, IGT's current market share in these specific, nascent areas is likely limited, necessitating substantial investment to build a dominant presence.

These emerging niches demand significant upfront capital for content development and targeted marketing campaigns to attract and retain players. For instance, the global online gambling market was projected to reach over $114 billion in 2024, highlighting the immense potential, but carving out market share in specialized segments requires a dedicated strategy.

- High Investment: Significant R&D and marketing spend needed to establish a foothold in new game types or VR experiences.

- Uncertain Market Share: Current presence in these niche segments is likely small, making future market dominance uncertain.

- Growth Potential: Successful penetration could lead to substantial future returns if these niches gain widespread adoption.

- Strategic Partnerships: Collaborations with VR developers or niche content creators could accelerate market entry and player acquisition.

Self-service Lottery Vending Machines and In-Lane Purchasing

International Game Technology (IGT) is actively broadening its retail presence for lottery products. This includes the deployment of self-service vending machines and the integration of in-lane purchasing options at checkout counters. These strategies are designed to boost sales by making lottery games more accessible and convenient for players within established retail settings.

These innovations are positioned as growth drivers in an otherwise mature lottery market. While still in the early stages of scaling, these new touchpoints offer potential for increased market share and incremental revenue for IGT.

- Expanding Retail Footprint: IGT's focus on self-service kiosks and in-lane purchases aims to capture impulse buys and reach a wider consumer base.

- Driving Incremental Sales: By enhancing convenience, these initiatives are expected to generate additional sales beyond traditional lottery channels.

- Growth Potential in Mature Market: These innovations represent new avenues for growth, addressing the evolving preferences of lottery players.

- Scaling and Market Share: The long-term impact on market share is still being determined as these retail solutions continue to be rolled out and adopted.

IGT's ventures into new sports betting markets and emerging iGaming content niches, like VR gambling, are classic examples of Question Marks. These areas require substantial upfront investment for development and marketing, with their future success and market share remaining uncertain. For instance, the global online gambling market was projected to exceed $114 billion in 2024, underscoring the potential, but IGT's current position in these nascent segments is small.

The development of advanced casino management systems, such as ADVANTAGE X and IGT Evolve, also falls into the Question Mark category. While these technologies offer significant value by improving operational efficiency and providing data insights, their adoption is still in early stages within a competitive tech landscape. IGT's ongoing investment is key to proving their potential and securing market share.

IGT's expansion of retail lottery presence through self-service kiosks and in-lane purchasing represents another Question Mark. These initiatives aim to boost sales by increasing accessibility in mature markets, but their long-term impact on market share is still unfolding as rollout continues.

| IGT Venture | BCG Category | Key Characteristics | Investment Needs | Market Uncertainty |

|---|---|---|---|---|

| New Sports Betting Jurisdictions | Question Mark | High growth potential, low current market share, requires significant capital for infrastructure and marketing. | High | High |

| Emerging iGaming Content Niches (e.g., VR Gambling) | Question Mark | Nascent market segment, requires substantial R&D and marketing to build presence, uncertain player adoption. | High | High |

| Advanced Casino Management Systems (ADVANTAGE X, IGT Evolve) | Question Mark | Innovative technology offering operational efficiencies, early market adoption, competitive tech landscape. | High | Medium |

| Expanded Retail Lottery Touchpoints (Kiosks, In-lane) | Question Mark | Enhancing accessibility in mature markets, driving incremental sales, long-term market share impact still developing. | Medium | Medium |

BCG Matrix Data Sources

Our International Game Technology BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research on market share, and official growth forecasts to ensure reliable insights.