International Flavors & Fragrances PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Flavors & Fragrances Bundle

Navigate the complex external landscape impacting International Flavors & Fragrances with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the company's operations and future growth. Gain a strategic advantage by identifying opportunities and mitigating risks. Download the full PESTLE analysis now to unlock actionable intelligence and refine your market strategy.

Political factors

International Flavors & Fragrances (IFF) navigates a complex global landscape where trade policies and tariffs significantly shape its operations. As a company with a substantial international footprint, IFF is directly exposed to shifts in trade agreements and tariff structures across various markets. For instance, changes in import duties on key raw materials, such as essential oils or synthetic aroma chemicals, can directly inflate production costs. Conversely, preferential trade agreements can reduce these costs and improve market access for IFF's finished products, like flavors for food and beverages or fragrances for personal care items.

The impact of these policy fluctuations on IFF's bottom line is substantial. In 2024, for example, ongoing trade tensions between major economic blocs continued to create uncertainty, potentially leading to increased costs for sourcing ingredients or exporting finished goods. A 10% tariff on a key aromatic compound, sourced from a region with new trade restrictions, could directly reduce IFF's profit margins on products sold in that region or require a price adjustment that impacts competitiveness. Similarly, favorable trade terms negotiated in 2025 could unlock new growth opportunities by making IFF's offerings more attractive in previously cost-prohibitive markets.

Governments globally maintain rigorous oversight of products within IFF's core sectors, including food, beverages, personal care, and pharmaceuticals. These regulations dictate everything from the approval of specific ingredients to the clarity of product labeling and the assurance of safety standards. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, updated significantly in 2023 and continuing its impact into 2024, requires extensive data submission for chemical substances, directly affecting IFF's ingredient sourcing and development.

These stringent rules necessitate substantial and ongoing investment in research and development, as well as robust compliance infrastructure, for IFF to operate effectively. Failure to adhere can result in significant penalties, product recalls, and damage to brand reputation. IFF's 2023 annual report highlighted increased spending on regulatory compliance and product stewardship, reflecting the growing complexity of global chemical and product safety legislation.

Political stability in countries where International Flavors & Fragrances (IFF) sources ingredients, manufactures products, or sells its goods is a cornerstone for maintaining seamless operations. For instance, regions experiencing heightened geopolitical tensions, such as parts of Eastern Europe or the Middle East, can directly impact IFF's ability to procure raw materials reliably, potentially leading to increased costs or shortages. IFF's 2023 annual report highlighted that disruptions in key sourcing regions could affect ingredient availability, underscoring the direct link between political climate and operational continuity.

Geopolitical Tensions and Supply Chains

Escalating geopolitical tensions, like the ongoing conflicts and trade disputes impacting major economic blocs, pose significant risks to global supply chains. For International Flavors & Fragrances (IFF), this translates into potential disruptions in sourcing specialized ingredients and increased logistics costs. For instance, the ongoing trade friction between the US and China, which intensified in 2023 and continues into 2024, has already led to rerouting of some critical raw material shipments, impacting delivery times and overall expenses.

These global uncertainties can create substantial hurdles for IFF’s product distribution into international markets. The company’s reliance on a diverse network of suppliers, many of whom operate in regions susceptible to political instability, means that even localized conflicts can have ripple effects. The World Bank’s latest projections for 2024 indicate a continued slowdown in global trade growth, partly attributed to these geopolitical headwinds, which directly affects IFF’s ability to move its finished goods efficiently.

- Ingredient Sourcing: Geopolitical instability can restrict access to unique botanical extracts and specialty chemicals vital for IFF's product formulations.

- Logistics Costs: Trade wars and regional conflicts often lead to higher shipping rates and the need for more complex, costly transit routes.

- Market Access: Tariffs, sanctions, or outright trade barriers can impede IFF's ability to serve key international customer bases.

- Supply Chain Resilience: The need to diversify sourcing and build redundancy becomes paramount, adding to operational complexity and investment requirements.

Government Support for Innovation

Government initiatives aimed at fostering research and development are crucial for companies like International Flavors & Fragrances (IFF). Policies that encourage innovation through grants or tax breaks for sustainable practices can directly fuel IFF's progress in creating novel flavor, fragrance, and health solutions. This support is vital for maintaining a competitive advantage and driving expansion into new technological frontiers.

For instance, the United States government, through agencies like the National Science Foundation (NSF) and the Small Business Innovation Research (SBIR) program, has historically provided significant funding for scientific and technological advancements. In 2023, the NSF alone awarded billions in grants supporting a wide array of research areas, some of which directly align with IFF's innovation pipeline. Furthermore, tax incentives for green technologies, common in many developed nations, can lower the cost of developing sustainable ingredients and processes, making them more economically viable for large corporations.

Key areas where government support can be particularly impactful for IFF include:

- Accelerated R&D: Funding for early-stage research into biotechnology and sustainable ingredient sourcing.

- Tax Incentives: Reductions on taxes for investments in green chemistry and biodegradable product development.

- Regulatory Alignment: Government support in navigating and shaping regulations for novel food ingredients and sustainable packaging.

- Public-Private Partnerships: Collaborative projects with government-funded research institutions to explore cutting-edge flavor and fragrance technologies.

Government regulations significantly influence IFF's product development and market entry, particularly concerning ingredient safety and labeling. For instance, the EU's stringent chemical regulations, like REACH, require extensive testing and documentation, impacting IFF's operational costs and timelines through 2024 and beyond. Compliance with these evolving standards is critical for maintaining market access and consumer trust.

Trade policies and tariffs directly affect IFF's global supply chain and pricing strategies. Ongoing trade disputes, such as those between major economic powers in 2023-2024, can increase the cost of raw materials and finished goods, impacting profit margins. IFF must continuously adapt its sourcing and distribution networks to mitigate these risks and capitalize on favorable trade agreements.

Political stability in sourcing and manufacturing regions is paramount for IFF's operational continuity. Geopolitical tensions in key ingredient-producing areas, as observed in various global hotspots during 2023, can lead to supply disruptions and increased logistics expenses. Ensuring supply chain resilience requires strategic diversification and robust risk management.

Government support for research and development, including grants and tax incentives for sustainable innovation, plays a vital role in IFF's competitive edge. Initiatives promoting green chemistry and biotechnology, prevalent in many developed economies in 2024, can accelerate the development of novel, eco-friendly flavor and fragrance solutions.

What is included in the product

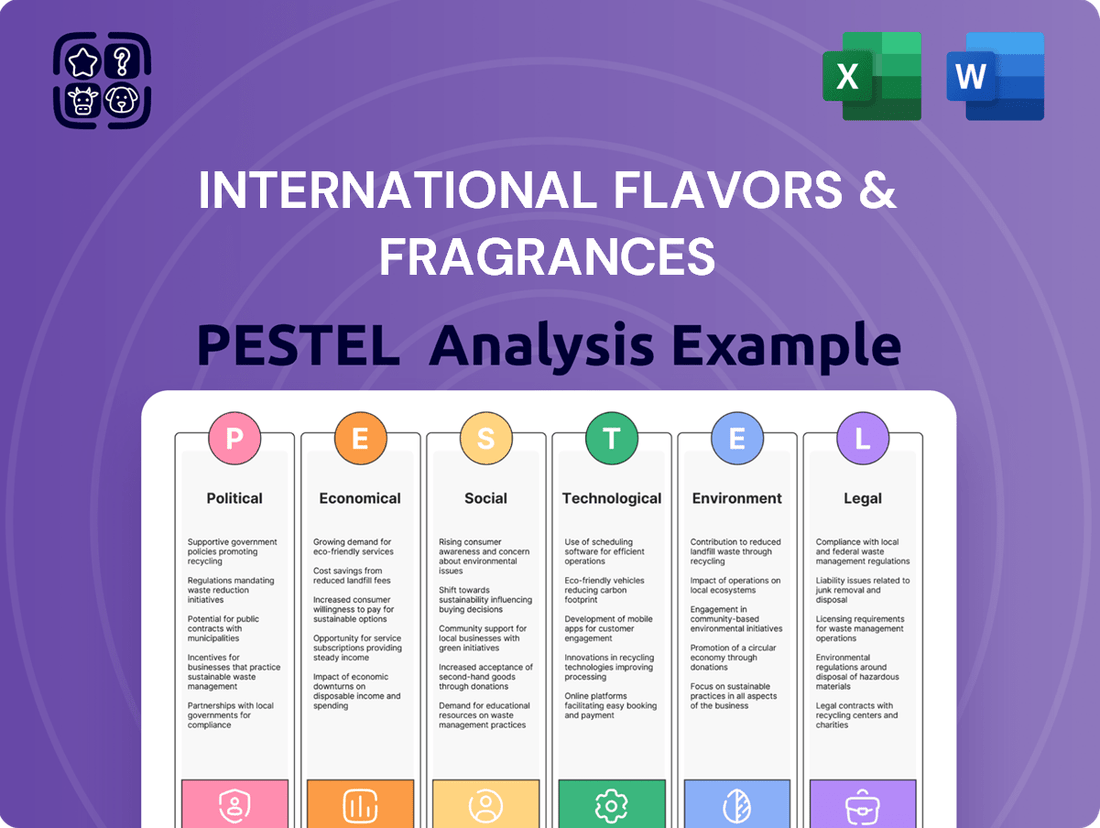

This PESTLE analysis examines how external macro-environmental factors, including political shifts, economic trends, social preferences, technological advancements, environmental concerns, and legal regulations, impact International Flavors & Fragrances' operations and strategic decisions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for International Flavors & Fragrances.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining political, economic, social, technological, environmental, and legal influences.

Economic factors

International Flavors & Fragrances (IFF) sees its fortunes closely linked to the pulse of the global economy and how much consumers are spending. As a key supplier for everyday items, IFF's success directly reflects broader economic health.

When economies are robust, people generally have more money to spend. This means higher demand for products that use IFF's ingredients, such as processed foods, higher-end personal care items, and health-focused products. For instance, in 2024, global GDP growth is projected to remain steady, supporting consumer spending, though inflation remains a consideration.

Rising inflation, a persistent economic challenge through 2024 and into 2025, directly impacts International Flavors & Fragrances (IFF) by escalating the costs of essential inputs. This includes everything from the agricultural commodities that form the basis of many flavors and fragrances to energy needed for production and the wages paid to its workforce. For instance, the Producer Price Index (PPI) for chemicals, a key input sector for IFF, saw significant year-over-year increases in late 2023 and early 2024, signaling broad cost pressures that are expected to continue.

This upward pressure on raw material and operational expenses poses a direct threat to IFF's profitability. If the company finds it difficult to translate these higher input costs into commensurate price increases for its products, its profit margins will inevitably shrink. In 2024, many consumer goods companies, including those in the food and beverage sectors that are major IFF customers, have been hesitant to implement substantial price hikes due to competitive pressures and consumer sensitivity, potentially limiting IFF's ability to fully recover its increased costs.

As a global player, International Flavors & Fragrances (IFF) faces significant exposure to currency exchange rate volatility. These fluctuations directly impact how IFF's overseas sales and expenses translate back into its U.S. dollar reporting currency.

For instance, a strengthening U.S. dollar in 2024 and early 2025 could make IFF's offerings pricier for customers in other countries. Conversely, it would diminish the reported value of profits earned in foreign currencies when those earnings are repatriated.

In 2023, the U.S. dollar saw periods of strength against major currencies like the Euro and Japanese Yen, a trend that continued into early 2024, presenting headwinds for U.S.-based multinationals like IFF.

Interest Rates and Access to Capital

Changes in global interest rates directly impact International Flavors & Fragrances' (IFF) cost of capital. For instance, if the US Federal Reserve maintains its benchmark interest rate around the 5.25%-5.50% range seen in early 2024, IFF's expenses for borrowing money for new facilities or acquisitions will be higher. Conversely, a reduction in rates, as some economists anticipate for late 2024 or 2025, could lower these financing costs, potentially freeing up capital for R&D or strategic investments.

Higher interest rates can dampen IFF's appetite for significant capital expenditures and acquisitions. For example, if a major expansion project requires a $500 million investment financed by debt, a 1% increase in interest rates could add millions annually to financing costs, potentially making the project less attractive. Conversely, a more favorable interest rate environment, perhaps with central banks lowering rates in response to moderating inflation, could encourage such investments, driving growth and innovation.

- Global Interest Rate Environment: As of mid-2024, major central banks like the Federal Reserve and the European Central Bank have kept rates elevated to combat inflation, influencing borrowing costs for companies like IFF.

- Impact on Capital Expenditures: Higher borrowing costs can make large-scale investments in new manufacturing plants or R&D initiatives more expensive, potentially leading to project delays or scaled-back plans.

- Acquisition Strategy: Increased interest expenses can affect the financial feasibility of mergers and acquisitions, a key growth driver for IFF, by increasing the cost of debt financing for such transactions.

- Working Capital Management: Fluctuations in interest rates also affect the cost of managing short-term debt and optimizing cash flow, impacting IFF's operational efficiency.

Disposable Income Trends

Disposable income trends are a critical factor for International Flavors & Fragrances (IFF), as they directly shape consumer spending on non-essential goods. When consumers have more money left after covering necessities, they are more likely to purchase premium food, beverages, and personal care items, which often incorporate IFF's specialized ingredients. For instance, in the United States, real disposable income saw a notable increase in early 2024, potentially boosting demand for IFF's higher-value offerings.

Conversely, a downturn in disposable income can significantly impact IFF's business. Consumers facing tighter budgets may shift towards more affordable, private-label brands or reduce their spending on products that rely on IFF's innovative flavor and fragrance solutions. This could particularly affect IFF's higher-margin segments, leading to reduced sales volume. For example, if economic conditions lead to a contraction in consumer discretionary spending, IFF might experience pressure on its revenue streams.

- Consumer Spending Power: Rising disposable income generally fuels demand for premium and specialty products where IFF ingredients are prevalent.

- Impact on Discretionary Segments: Declines in disposable income can lead consumers to trade down, impacting sales of higher-margin IFF products.

- Economic Sensitivity: IFF's performance is closely tied to the economic health of its key markets and the resulting consumer purchasing power.

- Global Variations: Trends in disposable income differ across regions, influencing the geographic focus and performance of IFF's ingredient sales.

Economic shifts significantly influence International Flavors & Fragrances (IFF). Global GDP growth, projected to remain steady in 2024, supports consumer spending, but persistent inflation in 2024-2025 increases input costs for raw materials and energy, potentially squeezing profit margins if price increases cannot be passed on. Currency fluctuations also pose a risk; a strong U.S. dollar in 2024 made IFF's products more expensive abroad and reduced the reported value of foreign earnings.

| Economic Factor | 2024/2025 Outlook | Impact on IFF | Key Data Point |

|---|---|---|---|

| Global GDP Growth | Steady projected growth | Supports consumer spending and demand for IFF products | IMF projects ~3.2% global GDP growth for 2024 |

| Inflation | Persistent challenge | Increases input costs (raw materials, energy, labor) | Producer Price Index (PPI) for chemicals saw significant year-over-year increases in late 2023/early 2024 |

| Interest Rates | Elevated, potential for cuts later | Affects cost of capital for investments and acquisitions | US Federal Reserve rate maintained around 5.25%-5.50% in early 2024 |

| Disposable Income | Mixed trends, but generally stable in key markets | Drives demand for premium products; downturns can shift consumers to value brands | Real disposable income saw notable increases in the US in early 2024 |

| Currency Exchange Rates | Volatility expected | Impacts reported value of foreign sales and profits | U.S. dollar showed strength against Euro and Yen in early 2024 |

Preview the Actual Deliverable

International Flavors & Fragrances PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of International Flavors & Fragrances delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain actionable insights into market dynamics and strategic considerations.

Sociological factors

Consumer preferences are increasingly leaning towards natural, organic, and clean-label ingredients, a trend that profoundly shapes International Flavors & Fragrances (IFF) product development and sourcing. This shift means IFF must constantly innovate to offer flavors, fragrances, and ingredients that resonate with consumers seeking transparency and perceived health advantages. For instance, the global natural ingredients market was valued at approximately $50 billion in 2023 and is projected to grow substantially, indicating a strong demand IFF needs to meet.

The growing emphasis on health and wellness globally is a significant driver for demand in functional foods, nutritional supplements, and healthier personal care items. This trend directly benefits International Flavors & Fragrances (IFF) through its Health & Biosciences segment, which is strategically positioned to develop ingredients that provide distinct health advantages or improve nutritional content.

In 2024, the global health and wellness market was valued at over $5.1 trillion, with projections indicating continued robust growth. IFF's investment in biosciences, including probiotics and enzymes, aligns perfectly with consumer preferences for products that support well-being, such as gut health and immunity.

Global demographic trends, like the aging populations in North America and Europe and the burgeoning youth in Asia, significantly shape consumer demand for IFF's products. For instance, by 2025, it's projected that over 20% of Europe's population will be 65 or older, increasing demand for products catering to mature consumers, such as those with sensitive skin or specific dietary needs. Conversely, rapid urbanization in emerging markets, with over 60% of the world's population expected to live in urban areas by 2030, drives demand for convenient, on-the-go food and beverage options, as well as personal care items reflecting modern lifestyles.

Ethical Consumerism and Sustainability

Consumers are increasingly prioritizing ethical sourcing and sustainable production, directly impacting their buying habits. This trend is a significant sociological factor for International Flavors & Fragrances (IFF).

IFF faces growing pressure to demonstrate responsibility across its entire supply chain. This includes ensuring ingredients are sustainably sourced and that its operations minimize environmental and social footprints to retain customer trust and loyalty. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for products from brands committed to sustainability.

- Consumer Demand for Sustainability: A significant portion of consumers, particularly younger demographics, actively seek out and favor brands with strong environmental and social governance (ESG) credentials.

- Supply Chain Transparency: IFF must provide clear visibility into its sourcing practices, addressing concerns about labor conditions, biodiversity impact, and fair trade for raw materials.

- Brand Reputation and Loyalty: A commitment to ethical consumerism directly influences brand perception. Companies like IFF that proactively address these concerns can build stronger customer relationships and differentiate themselves in a competitive market.

- Regulatory and Investor Scrutiny: Beyond consumer pressure, evolving regulations and investor expectations regarding sustainability reporting and practices are compelling companies to adopt more responsible operations.

Lifestyle Changes and Convenience

Evolving consumer lifestyles, marked by increasingly demanding schedules, are fueling a significant demand for convenience. This trend directly impacts the food and beverage, and personal care sectors, where consumers seek ready-to-eat meals, portable snacks, and efficient personal care products. IFF is instrumental in this shift by developing innovative flavors and fragrances that enhance the sensory appeal and functional benefits of these convenience-oriented goods, ensuring they remain desirable despite the fast pace of modern life.

The global convenience food market, for instance, was valued at approximately $1.3 trillion in 2023 and is projected to reach over $1.7 trillion by 2028, demonstrating a clear consumer preference for time-saving options. IFF's expertise in creating appealing taste and scent profiles is therefore critical for manufacturers looking to capture market share within this expanding segment. Their ingredient solutions help differentiate products, making them more attractive to busy consumers.

- Increased Demand for Ready-to-Eat: Busy lifestyles drive growth in the convenience food sector.

- Sensory Enhancement is Key: IFF's flavors and fragrances elevate the appeal of convenient products.

- On-the-Go Consumption: The market for portable snacks and beverages continues to expand.

- Personal Care Efficiency: Consumers seek quick and effective personal care solutions.

Societal shifts towards natural and organic products continue to influence IFF's product development, with consumers increasingly valuing transparency and perceived health benefits. The global market for natural ingredients reached approximately $50 billion in 2023, highlighting a significant opportunity for IFF to innovate in this space. Furthermore, a growing global emphasis on health and wellness, with the market valued at over $5.1 trillion in 2024, positions IFF's Health & Biosciences segment for continued growth through its offerings in functional ingredients and nutritional solutions.

| Sociological Factor | 2023/2024 Data Point | Impact on IFF |

|---|---|---|

| Natural & Organic Demand | Global natural ingredients market ~$50 billion (2023) | Drives innovation in clean-label flavors and fragrances. |

| Health & Wellness Focus | Global market >$5.1 trillion (2024) | Boosts demand for IFF's Health & Biosciences segment (probiotics, enzymes). |

| Ethical Sourcing Preference | ~60% consumers willing to pay more for sustainable brands (2024 survey) | Requires IFF to demonstrate supply chain responsibility and transparency. |

Technological factors

Breakthroughs in biotechnology, such as precision fermentation and synthetic biology, are significantly impacting how companies like International Flavors & Fragrances (IFF) operate. These advancements allow for the creation of new flavors, fragrances, and bio-based ingredients in more sustainable and cost-effective ways.

For instance, precision fermentation can yield complex flavor compounds previously difficult or expensive to extract from natural sources. This technology can reduce IFF's dependence on traditional agricultural supply chains, which are often subject to weather and geopolitical risks. By 2024, the global precision fermentation market was projected to reach over $5 billion, highlighting the growing importance of this sector.

Furthermore, synthetic biology opens doors to entirely novel sensory experiences, enabling IFF to develop unique ingredients that can differentiate their product offerings. This technological shift not only enhances product innovation but also supports the growing consumer demand for natural and sustainably sourced ingredients, a trend that continued to gain momentum through 2025.

Artificial intelligence and advanced data analytics are transforming how International Flavors & Fragrances (IFF) develops new products. These technologies allow IFF to quickly pinpoint how different ingredients work together and predict what consumers will like, speeding up innovation.

For example, AI can analyze vast datasets on consumer behavior and ingredient interactions to forecast successful flavor and fragrance combinations. This means IFF can create unique and targeted products more efficiently, potentially reducing development cycles and enhancing market responsiveness.

Innovations in extraction and encapsulation technologies are significantly boosting International Flavors & Fragrances' (IFF) capabilities. These advancements allow IFF to capture and preserve the essence of natural ingredients with greater efficiency and effectiveness. For instance, supercritical fluid extraction (SFE) methods, which gained traction in the early 2020s, offer a cleaner and more precise way to isolate volatile compounds compared to traditional solvent-based methods, potentially improving the quality and purity of their natural extracts.

These technological leaps directly translate into enhanced product performance for IFF's clients. By improving flavor and fragrance stability, these new extraction techniques can extend the shelf life of consumer goods, a critical factor in the competitive food and beverage and personal care markets. Furthermore, advancements in encapsulation, such as microencapsulation, enable better control over the release of sensory experiences, leading to more dynamic and impactful product formulations for consumers.

Automation in Manufacturing

Increased automation within International Flavors & Fragrances' (IFF) manufacturing operations is a significant technological driver. This trend directly enhances operational efficiency by streamlining complex production lines through robotics and advanced automated systems. For example, in 2024, IFF has been investing in smart factory initiatives, aiming to reduce manual labor dependency by an estimated 15% across key facilities by the end of 2025.

The implementation of these automated solutions leads to a tangible reduction in production costs. By minimizing errors and optimizing resource allocation, IFF can achieve lower per-unit manufacturing expenses. Furthermore, automation is crucial for elevating product consistency and quality. Automated processes ensure precise ingredient measurement and mixing, critical for the nuanced formulations IFF develops, thereby boosting output reliability and supply chain dependability.

- Enhanced Efficiency: Automation streamlines IFF's production, leading to faster cycle times and increased throughput.

- Cost Reduction: Reduced labor, minimized waste, and optimized energy consumption contribute to lower manufacturing costs.

- Product Quality: Precision in automated processes ensures greater consistency and adherence to strict quality standards for flavors and fragrances.

- Supply Chain Reliability: Higher output and fewer production disruptions bolster IFF's ability to meet market demand consistently.

Digitalization of Supply Chains

The digitalization of supply chains, leveraging technologies like the Internet of Things (IoT) and blockchain, is a significant technological factor for International Flavors & Fragrances (IFF). These advancements are crucial for enhancing transparency and traceability throughout IFF's extensive global network. This improved visibility allows for more effective management of everything from raw material acquisition to final product delivery, directly impacting operational efficiency and the ability to adapt to market dynamics.

Specifically, for a company like IFF, which deals with a vast array of natural and synthetic ingredients, these digital tools offer tangible benefits. For instance, IoT sensors can monitor conditions like temperature and humidity during transit for sensitive flavor and fragrance components, ensuring quality preservation. Blockchain technology can provide an immutable record of an ingredient's origin, batch number, and handling history, which is invaluable for regulatory compliance and consumer trust, especially with the growing demand for ethically sourced and sustainable products. In 2024, the global supply chain visibility market was valued at approximately $4.2 billion and is projected to grow substantially, indicating increasing adoption of these digital solutions across industries.

- Enhanced Traceability: Blockchain enables end-to-end tracking of ingredients, from farm to factory, ensuring authenticity and quality.

- Improved Inventory Management: IoT sensors provide real-time data on stock levels and product conditions, reducing waste and optimizing logistics.

- Increased Efficiency: Digitalization streamlines processes, cutting down on manual intervention and accelerating response times to market demands or disruptions.

- Greater Transparency: Stakeholders gain clear insight into the supply chain, fostering trust and supporting sustainability initiatives.

Technological advancements in biotechnology, particularly precision fermentation and synthetic biology, are revolutionizing ingredient creation for International Flavors & Fragrances (IFF). These innovations enable the development of novel flavors and fragrances more sustainably and cost-effectively, reducing reliance on traditional agriculture. The precision fermentation market alone was projected to exceed $5 billion by 2024, underscoring its growing significance.

AI and advanced data analytics are accelerating IFF's product development by quickly identifying successful ingredient combinations and predicting consumer preferences, leading to more efficient innovation cycles. Furthermore, sophisticated extraction and encapsulation technologies, such as supercritical fluid extraction, enhance the quality and stability of natural ingredients, improving product performance and shelf life for IFF's clients.

Increased automation in IFF's manufacturing, with smart factory initiatives targeting a 15% reduction in manual labor by late 2025, is boosting efficiency and consistency. Digitalization of supply chains through IoT and blockchain enhances transparency and traceability, critical for managing IFF's complex global ingredient network and meeting consumer demand for sustainable sourcing.

| Technology Area | Impact on IFF | Data Point/Trend (2024-2025) |

|---|---|---|

| Biotechnology (Precision Fermentation) | Sustainable & cost-effective ingredient creation | Global market projected over $5 billion in 2024 |

| Artificial Intelligence (AI) | Accelerated product innovation & consumer preference prediction | Enhancing development cycles for new flavor/fragrance profiles |

| Automation | Increased efficiency, reduced costs, improved consistency | Targeting 15% manual labor reduction by end of 2025 |

| Digitalization (IoT, Blockchain) | Enhanced supply chain transparency & traceability | Global supply chain visibility market valued at ~$4.2 billion in 2024 |

Legal factors

International Flavors & Fragrances (IFF) navigates a complex web of global food safety regulations, including those set by the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). These rules dictate everything from the acceptable levels of specific ingredients to the cleanliness of manufacturing facilities and the accuracy of product labels.

Adherence to these stringent standards is non-negotiable for IFF. Failure to comply can result in severe consequences, such as hefty fines, costly product recalls, and significant damage to the company's hard-earned reputation. For instance, in 2023, the FDA issued numerous warning letters to food manufacturers for labeling violations, highlighting the constant scrutiny within the industry.

Protecting International Flavors & Fragrances' (IFF) vast portfolio of proprietary flavors, fragrances, and ingredient technologies is paramount. This is achieved through a multi-layered approach involving patents, trademarks, and trade secrets, safeguarding their innovative edge.

Robust legal frameworks for intellectual property rights are essential to prevent unauthorized use and maintain IFF's competitive advantage in the highly innovative flavors and fragrances industry. In 2023, IFF continued to invest significantly in R&D, with a substantial portion dedicated to securing and defending its intellectual property.

Data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly impact International Flavors & Fragrances (IFF). As IFF collects customer data for market research, personalized product development, and digital engagement, strict adherence to these laws is paramount. Failure to comply, as seen with other large corporations facing substantial penalties, could lead to significant fines and damage consumer trust.

Labor Laws and Employment Regulations

International Flavors & Fragrances (IFF) navigates a complex web of labor laws across its global operations, impacting everything from minimum wage requirements to workplace safety standards. For instance, in 2024, many European countries continued to strengthen worker protections, with some nations exploring reduced workweeks or enhanced parental leave policies, directly affecting IFF's operational costs and HR strategies.

Compliance with these diverse regulations is not merely a legal obligation but a strategic imperative. Failure to adhere to labor laws, such as those concerning fair wages and anti-discrimination, can lead to significant financial penalties and reputational damage. In 2025, IFF will likely face increased scrutiny on fair labor practices, particularly in regions with robust union presence and stringent enforcement mechanisms.

- Wage and Hour Laws: IFF must comply with varying minimum wage laws and overtime regulations in each country of operation. For example, the US federal minimum wage remains $7.25 per hour, but many states and cities mandate higher rates, creating a complex compliance landscape.

- Workplace Safety and Health: Regulations like OSHA in the United States or similar bodies globally dictate safety protocols, impacting IFF's manufacturing and R&D facilities.

- Anti-Discrimination and Equal Opportunity: Laws prohibiting discrimination based on age, gender, race, religion, and other protected characteristics are universal and require robust HR policies.

- Unionization and Collective Bargaining: In many markets, IFF must engage with labor unions and adhere to collective bargaining agreements, influencing employee relations and operational flexibility.

Anti-trust and Competition Laws

International Flavors & Fragrances (IFF) operates in markets where its significant market share, especially following major acquisitions like the DuPont Nutrition & Biosciences merger, attracts attention from antitrust and competition authorities worldwide. For instance, in 2023, the European Commission continued its review of various industry practices, a common area of focus for large players like IFF.

Compliance with these complex regulations is not optional; it's crucial for maintaining operational freedom and avoiding severe penalties. Failure to adhere to fair competition principles can lead to substantial fines, mandatory divestitures of business units, or even restrictions on future mergers and acquisitions, impacting IFF's strategic growth plans.

- Regulatory Scrutiny: IFF's market dominance post-acquisitions places it under increased scrutiny from global competition regulators.

- Compliance Imperative: Adherence to antitrust laws is vital to prevent monopolistic behavior and ensure a level playing field.

- Risk of Penalties: Non-compliance can result in significant financial penalties and forced business restructuring.

- Strategic Impact: Antitrust regulations can influence IFF's ability to pursue future growth through mergers and acquisitions.

Legal factors significantly shape International Flavors & Fragrances' (IFF) operations, from ensuring product safety through compliance with FDA and EFSA regulations to protecting its intellectual property via patents and trademarks. The company must also navigate evolving data privacy laws like GDPR and CCPA, impacting how it handles customer information. Furthermore, IFF faces stringent labor laws globally, covering wages, safety, and unionization, with non-compliance risking substantial financial and reputational damage.

Environmental factors

Sustainability and ESG pressures are significantly influencing International Flavors & Fragrances (IFF). Investors, consumers, and regulators are increasingly demanding robust Environmental, Social, and Governance (ESG) performance, pushing IFF to integrate more sustainable practices throughout its operations. This focus is evident in IFF's commitment to reducing its carbon footprint and enhancing water conservation efforts.

IFF's dedication to ethical sourcing across its extensive value chain is a direct response to these mounting stakeholder expectations. For instance, in 2023, IFF reported a 19% reduction in absolute Scope 1 and 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating tangible progress in its sustainability journey.

International Flavors & Fragrances (IFF) depends heavily on agricultural products for its natural flavor and fragrance ingredients. This reliance makes the company susceptible to disruptions from resource scarcity, which can be triggered by factors like climate change impacting crop yields, increasing water shortages, or land degradation. For instance, the UN's Food and Agriculture Organization (FAO) reported in 2024 that climate change is already threatening agricultural production in many regions where IFF sources raw materials.

To mitigate these risks and ensure a steady supply, IFF is actively investing in sustainable sourcing practices and exploring alternative ingredients. The company also focuses on improving resource efficiency throughout its operations. By 2025, IFF aims to have 80% of its key agricultural raw materials sourced from certified sustainable programs, demonstrating a commitment to long-term supply chain resilience.

Climate change presents significant operational risks for International Flavors & Fragrances (IFF). Extreme weather events, becoming more frequent and intense, can disrupt the agricultural supply chains essential for sourcing raw materials, impacting availability and cost. For instance, droughts or floods in key growing regions for botanicals or key aroma chemicals can lead to supply shortages and price spikes. IFF’s 2024 sustainability report highlighted the need for enhanced resilience in sourcing strategies to mitigate these agricultural vulnerabilities.

Furthermore, climate change contributes to energy price volatility, directly affecting IFF's manufacturing and distribution costs. Increased demand for cooling during heatwaves or disruptions to energy infrastructure due to severe storms can lead to higher utility expenses. The company is investing in renewable energy sources and energy efficiency measures to combat these rising operational costs, aiming to reduce its carbon footprint while stabilizing expenditures through 2025.

IFF must also consider the potential physical damage to its facilities from climate-related events like rising sea levels or increased storm intensity. Proactive adaptation strategies, including site assessments and infrastructure upgrades, are crucial to ensure business continuity. The company's ongoing commitment to climate risk assessment, as detailed in its 2024 disclosures, underscores the importance of developing robust adaptation plans to safeguard its global operations.

Waste Management and Circular Economy

Growing environmental awareness is pushing companies like International Flavors & Fragrances (IFF) to prioritize robust waste management strategies. This involves actively reducing waste at its source, boosting recycling efforts, and increasingly embracing circular economy models. For instance, in 2023, IFF reported a 10% reduction in landfill waste compared to their 2020 baseline, demonstrating progress in their sustainability initiatives.

Adopting these practices offers tangible benefits beyond environmental responsibility. They can translate into significant cost savings through reduced disposal fees and more efficient resource utilization. Furthermore, a strong commitment to circularity can enhance IFF's brand reputation and appeal to environmentally conscious consumers and business partners.

- Waste Reduction Targets: IFF aims to further decrease waste generation by an additional 15% by 2027.

- Recycling Initiatives: The company is investing in advanced sorting technologies to improve recycling rates across its global facilities, targeting a 75% recycling rate by 2025.

- Circular Economy Pilots: IFF is exploring pilot programs for product packaging and ingredient sourcing that align with circular economy principles, aiming to reduce reliance on virgin materials.

Pollution Control and Emissions Regulations

International Flavors & Fragrances (IFF) faces stringent pollution control and emissions regulations impacting its manufacturing. These rules cover air quality, water discharge, and waste management, necessitating continuous investment in sophisticated abatement technologies. For instance, in 2023, IFF reported capital expenditures on environmental initiatives, underscoring this commitment to minimizing its ecological impact and ensuring compliance with environmental permits across its global facilities.

Adherence to these regulations is crucial for avoiding penalties and maintaining operational licenses. IFF's environmental strategy includes:

- Investing in advanced emission control systems to meet or exceed air quality standards.

- Implementing robust wastewater treatment processes to ensure discharged water quality meets regulatory requirements.

- Managing hazardous and non-hazardous waste through approved disposal and recycling methods to reduce landfill reliance.

- Monitoring and reporting environmental performance to regulatory bodies, demonstrating accountability and progress.

Environmental factors significantly shape International Flavors & Fragrances (IFF)'s operations and strategy. The company's heavy reliance on agricultural inputs makes it vulnerable to climate change impacts, such as extreme weather events and resource scarcity, which can disrupt supply chains and increase costs. For instance, the UN's FAO highlighted in 2024 that climate change is already impacting agricultural production in many of IFF's sourcing regions.

IFF is actively addressing these challenges by investing in sustainable sourcing, aiming for 80% of key agricultural raw materials to be sourced from certified sustainable programs by 2025. The company also focuses on reducing its environmental footprint, reporting a 19% decrease in absolute Scope 1 and 2 greenhouse gas emissions by 2023 against a 2020 baseline, and a 10% reduction in landfill waste in the same period.

Stringent environmental regulations worldwide necessitate continuous investment in pollution control technologies and compliance monitoring. IFF's environmental strategy includes adopting advanced emission control systems and robust wastewater treatment processes, underscoring its commitment to minimizing ecological impact and maintaining operational licenses.

| Environmental Factor | Impact on IFF | IFF's Response/Data (2023-2025) |

|---|---|---|

| Climate Change & Resource Scarcity | Disruptions to agricultural supply chains, increased costs | Aiming for 80% of key agricultural raw materials from certified sustainable programs by 2025. |

| Greenhouse Gas Emissions | Regulatory pressure, operational costs | Reduced absolute Scope 1 & 2 emissions by 19% (vs. 2020 baseline) by 2023. |

| Waste Management | Regulatory compliance, operational efficiency | Reduced landfill waste by 10% (vs. 2020 baseline) by 2023; targeting 75% recycling rate by 2025. |

| Pollution Control Regulations | Need for investment in abatement technologies, compliance costs | Ongoing capital expenditures on environmental initiatives. |

PESTLE Analysis Data Sources

Our PESTLE analysis for International Flavors & Fragrances is informed by a comprehensive review of economic indicators from bodies like the World Bank and IMF, and regulatory updates from governmental agencies worldwide. We also incorporate market research reports from leading industry analysts and technological trend forecasts to ensure a holistic understanding of the macro-environment.