International Flavors & Fragrances Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Flavors & Fragrances Bundle

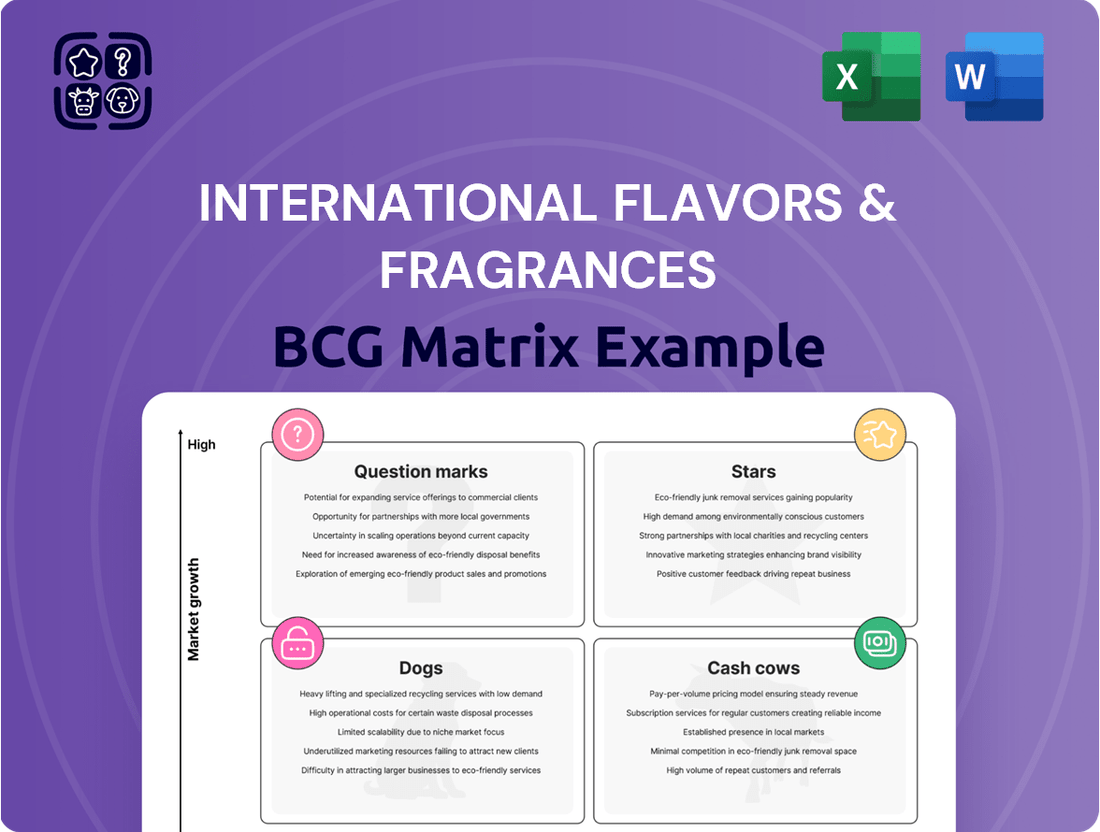

International Flavors & Fragrances (IFF) operates in a dynamic market, and understanding its product portfolio through the BCG Matrix is crucial for strategic growth. This analysis helps identify which segments are generating significant cash and which require further investment.

Discover the Stars, Cash Cows, Dogs, and Question Marks within IFF's diverse offerings. Gain a clear picture of their market share and growth potential to make informed decisions.

Purchase the full BCG Matrix report for a comprehensive breakdown of IFF's strategic positioning, complete with actionable insights and data-backed recommendations to optimize your investment and product strategies.

Stars

The Scent segment, encompassing Fine Fragrance and Consumer Fragrance, is a standout performer for IFF. In 2024, it achieved impressive double-digit comparable currency-neutral sales growth, a trend that continued into Q1 2025. This robust performance is directly linked to consumers actively seeking out fragrance options that are both innovative and environmentally conscious.

IFF's commitment to this high-growth area is evident in its strategic product development. The recent introduction of ENVIROCAP™, a novel and sustainable scent delivery system designed for fabric care products, exemplifies this focus. This innovation underscores IFF's strategy to invest in product lines that capture significant market share and cater to evolving consumer preferences for sustainability.

The Taste segment, recently reconstituted from the former Nourish segment, demonstrated exceptional performance in Q1 2025. It achieved substantial comparable currency-neutral sales growth, with a notable uptick across all global regions. This growth is fueled by shifting consumer demands for more engaging sensory experiences in food and beverages.

The Flavors sub-segment within Nourish experienced robust double-digit growth throughout 2024. This strong showing highlights its established market leadership and significant potential for continued expansion, solidifying its position as a Star in the BCG matrix.

IFF's Health & Biosciences segment is a shining example of a Star in the BCG matrix, showcasing robust growth. In 2023, this segment saw significant comparable currency-neutral sales increases, with notable double-digit jumps in areas like Cultures & Food Enzymes and Home & Personal Care.

This segment's success is fueled by strategic investments in biotechnology and a strong market position in high-growth markets for specialized ingredients. The emphasis on sustainable and functional ingredients further solidifies its status as a Star, promising continued strong performance.

Biotechnology-driven Solutions

Biotechnology-driven solutions represent a significant growth area for IFF, particularly within its Health & Biosciences and Taste segments. This focus translates into substantial investment, aiming to develop sustainable and innovative flavors and fragrances. For instance, in 2024, IFF continued to expand its portfolio of bio-based ingredients, reflecting a strategic push toward environmentally conscious product development.

These biotechnological advancements are crucial for IFF's competitive edge. By leveraging cutting-edge science, the company can offer unique and high-performance ingredients that meet evolving market demands. This includes a strong emphasis on plant-based and alternative products, tapping into consumer preferences for healthier and more sustainable options.

- Innovation Engine: Biotechnology fuels IFF's development of novel ingredients for flavors, fragrances, and health applications.

- Sustainability Focus: Investments in bio-based solutions align with growing consumer and regulatory demand for eco-friendly products.

- Market Responsiveness: The rise of plant-based and alternative products, driven by biotech, positions IFF to capture growth in key consumer markets.

Strategic R&D and Capacity Expansion

International Flavors & Fragrances (IFF) is strategically increasing its investment in research and development (R&D), commercial capabilities, and capacity expansion, particularly within its high-growth segments such as Health & Biosciences, Scent, and Taste. This commitment is aimed at fostering the growth of existing product lines and developing entirely new ones, ensuring IFF remains a market leader through consistent innovation.

These significant investments are designed to fuel future revenue streams and solidify IFF's competitive position. For example, in 2024, IFF continued to emphasize its innovation pipeline, which is crucial for maintaining leadership in dynamic markets. This proactive strategy ensures that key business units stay at the cutting edge of their respective industries.

- R&D Investment: IFF's ongoing commitment to R&D is central to its growth strategy.

- Capacity Expansion: Investments in expanding production capacity support increased demand in key segments.

- High-Growth Areas: Focus on Health & Biosciences, Scent, and Taste segments targets areas with strong market potential.

- Market Leadership: Continuous innovation through these investments aims to maintain and enhance IFF's market leadership.

IFF's Health & Biosciences segment is a prime example of a Star in the BCG matrix, demonstrating robust growth and a strong market position. In 2023, this segment experienced significant comparable currency-neutral sales increases, with notable double-digit growth in areas like Cultures & Food Enzymes and Home & Personal Care. This success is driven by strategic investments in biotechnology and a leading market presence in high-growth sectors for specialized ingredients.

The Scent segment also performs exceptionally well, achieving impressive double-digit comparable currency-neutral sales growth in 2024, a trend that continued into Q1 2025. This strong performance is attributed to consumers actively seeking innovative and environmentally conscious fragrance options. IFF's investment in sustainable scent delivery systems, like ENVIROCAP™, further solidifies its Star status in this category.

The Taste segment, recently reorganized, also showed exceptional performance in Q1 2025, with substantial comparable currency-neutral sales growth across all global regions. This growth is fueled by consumer demand for more engaging sensory experiences in food and beverages, with the Flavors sub-segment, in particular, experiencing robust double-digit growth throughout 2024, highlighting its market leadership and expansion potential.

| Segment | 2024 Performance | Key Drivers | BCG Status |

|---|---|---|---|

| Health & Biosciences | Significant comparable currency-neutral sales increases (2023) | Biotechnology investments, strong market position in specialized ingredients | Star |

| Scent | Double-digit comparable currency-neutral sales growth (2024-Q1 2025) | Consumer demand for innovative and sustainable fragrances | Star |

| Taste | Substantial comparable currency-neutral sales growth (Q1 2025) | Consumer demand for engaging sensory experiences in food/beverages | Star |

What is included in the product

This BCG Matrix analysis categorizes IFF's business units by market share and growth, guiding strategic resource allocation.

A clear BCG Matrix visual for IFF's portfolio clarifies strategic focus, easing the pain of resource allocation decisions.

Cash Cows

The mature and well-established components of International Flavors & Fragrances' (IFF) flavor portfolio, particularly within its Taste segment, are significant cash generators. These foundational products benefit from strong market presence and established customer loyalty, reducing the need for extensive promotional investment.

While specific growth rates across all flavor sub-categories can fluctuate, the Taste segment as a whole consistently demonstrates high profit margins and reliable cash flow generation within a mature market. This stability points to its role as a Cash Cow for IFF.

Core fragrance ingredients, the foundational elements in many beloved scents, are International Flavors & Fragrances' (IFF) cash cows. These are the reliable workhorses, present in countless consumer and personal care items, and they command a significant share of their respective, mature markets. Their consistent demand translates into robust and predictable cash flows for IFF, requiring minimal new investment to maintain their position.

Functional Ingredients, a key component of the former Nourish segment, demonstrated resilience in Q1 2025. Despite a sales dip, adjusted operating EBITDA saw an increase. This indicates strong profitability and cash generation capabilities, characteristic of a cash cow.

The efficiency of these functional ingredients, likely due to their substantial market share and mature position, allows them to be leveraged for consistent cash flow. International Flavors & Fragrances is effectively milking these established products for profit rather than pursuing aggressive expansion.

Mature Food & Beverage Applications

Mature Food & Beverage Applications within International Flavors & Fragrances (IFF) likely represent its Cash Cows. These segments, focused on established, stable demand in areas like certain savory products and dairy, generate consistent, profitable revenue. IFF's deep-seated relationships and extensive expertise in these mature markets contribute to their reliable cash flow generation. In 2024, IFF continued to emphasize efficiency in its mature segments, leveraging its existing infrastructure to maintain strong margins even with modest growth.

- Stable Demand: These applications benefit from consistent, predictable consumer purchasing patterns, ensuring a steady revenue base.

- High Profitability: Mature segments typically offer higher profit margins due to economies of scale and optimized operational costs.

- Efficient Operations: IFF's established infrastructure and long-standing expertise allow for cost-effective production and distribution in these areas.

- Reliable Cash Flow: The combination of stable demand and high profitability makes these segments dependable sources of cash for the company.

Home & Personal Care Fragrance Bases

Home & Personal Care Fragrance Bases are IFF's Cash Cows. These are the foundational scents found in countless everyday items, from laundry detergents to shampoos. While the market for these staples isn't growing at a breakneck pace, IFF commands a substantial share, translating into consistent and significant cash generation.

This segment provides the financial bedrock for IFF. The steady demand for these essential fragrance components in mass-market consumer goods ensures a reliable stream of earnings, bolstering the company's overall financial health and stability.

- Market Share: IFF holds a leading position in the home and personal care fragrance market, a testament to its broad portfolio and established customer relationships.

- Revenue Contribution: While specific figures for this segment are not publicly broken out, the overall Fragrance division contributed approximately $2.5 billion to IFF's net sales in 2023.

- Profitability: The mature nature of this market, combined with IFF's scale, typically leads to healthy profit margins, making these bases a significant cash generator.

The core fragrance ingredients and mature food & beverage applications within International Flavors & Fragrances (IFF) are prime examples of its cash cows. These established product lines benefit from strong market positions and consistent demand, generating reliable profits with minimal reinvestment.

In 2024, IFF continued to focus on optimizing its mature segments, such as certain savory and dairy flavor applications, to ensure sustained profitability. The company’s robust market share in home and personal care fragrance bases, which contributed significantly to the Fragrance division's approximately $2.5 billion in net sales in 2023, underscores their cash cow status.

Functional Ingredients, despite a sales dip in Q1 2025, showed increased adjusted operating EBITDA, highlighting their strong cash generation capabilities due to efficient operations and substantial market share.

| IFF Business Segment | BCG Matrix Category | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Core Fragrance Ingredients (Home & Personal Care) | Cash Cow | Stable demand, high market share, consistent cash flow | Fragrance Division Net Sales: ~$2.5 billion (2023) |

| Mature Food & Beverage Applications (e.g., Savory, Dairy) | Cash Cow | Established markets, loyal customer base, efficient operations | Emphasis on efficiency in mature segments (2024) |

| Functional Ingredients | Cash Cow | Resilient profitability, strong EBITDA generation | Increased adjusted operating EBITDA (Q1 2025) |

Delivered as Shown

International Flavors & Fragrances BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive upon purchase, offering a comprehensive strategic analysis of International Flavors & Fragrances' product portfolio. This preview showcases the exact data and insights that will be delivered, ensuring transparency and immediate utility for your business planning. You can confidently expect a professional-grade report, free from watermarks or demo elements, ready for immediate application in your strategic decision-making processes. This is not a mockup; it's the actual, analysis-ready BCG Matrix report, designed for clarity and actionable insights into IFF's market position.

Dogs

International Flavors & Fragrances (IFF) completed the divestiture of its Pharma Solutions segment on May 1, 2025. This move strongly suggests the segment was categorized as a Dog in IFF's BCG Matrix, signifying low market share and limited growth potential within the company's broader operations. The sale, which occurred just over a year ago, allows IFF to concentrate resources on its more promising and higher-growth business units, streamlining its overall portfolio.

Within International Flavors & Fragrances' (IFF) diverse offerings, certain legacy product lines may be characterized as Dogs in a BCG Matrix analysis. These are typically older formulations or niche ingredients with limited market appeal and low growth potential, contributing minimally to overall revenue. For instance, a flavor component popular in the early 2000s but now supplanted by newer, more cost-effective or sensorially advanced alternatives would likely fall into this category.

These underperforming product lines often possess a small market share within mature or shrinking market segments. While not explicitly detailed in IFF's public reporting, a hypothetical example could be a specific fragrance compound used in a declining personal care product category. Such products require careful operational scrutiny to determine if they are sustainable or if their resources could be better allocated elsewhere.

International Flavors & Fragrances (IFF) has strategically divested assets as part of its ongoing portfolio optimization, a move that impacts its position within a BCG Matrix analysis. These divestitures, occurring in 2023 and continuing into 2024, targeted business units or product lines identified as having lower growth potential and market share within IFF's broader portfolio.

By shedding these underperforming segments, IFF aims to strengthen its financial standing and sharpen its focus on core, high-growth areas. For instance, the company completed the sale of its minority stake in its Health & Biosciences business in 2023, a move that generated significant proceeds and signaled a strategic shift.

Specific Niche Ingredients Facing Declining Demand

Certain highly specialized ingredients within International Flavors & Fragrances' portfolio, once catering to niche markets, are now experiencing a decline in demand. This downturn is attributed to evolving consumer preferences and the obsolescence brought about by technological advancements. These products typically hold a low market share within a shrinking market, yielding minimal returns on invested capital for their production and distribution.

For instance, consider the market for certain synthetic musk compounds that were popular in the early 2000s but have seen reduced usage due to environmental concerns and the development of more sustainable alternatives. In 2024, the global market for these specific musk compounds is estimated to be significantly smaller than its peak, with IFF's share reflecting this contraction.

- Declining Demand: Specialized ingredients are losing traction as consumer tastes shift towards natural or novel compounds.

- Low Market Share: These products represent a small fraction of IFF's overall sales in their respective categories.

- Shrinking Market: The overall market size for these ingredients is contracting, limiting growth potential.

- Capital Reallocation: IFF is likely to minimize further investment, focusing resources on higher-growth areas of its business.

Inefficiently Produced or High-Cost Products

Inefficiently produced or high-cost products within International Flavors & Fragrances (IFF) would be classified as Dogs. These are product lines that, while perhaps having some market share, consistently struggle with profitability due to excessive production expenses or operational inefficiencies. Such products can drain valuable capital and resources that could be more effectively deployed in more promising areas of the business. For instance, a specialty chemical ingredient with a complex, multi-step synthesis and volatile raw material costs might fall into this category if its selling price cannot consistently cover these elevated expenses.

IFF's strategic emphasis on productivity enhancements is designed to address and mitigate these very inefficiencies across its diverse product portfolio. By streamlining manufacturing processes, optimizing supply chains, and investing in advanced technologies, the company aims to reduce the cost base for all its offerings, thereby minimizing the number of products that languish in the Dog quadrant.

Consider the impact on a company’s overall financial health. Products that are dogs can:

- Consume capital without generating commensurate returns, potentially leading to a drag on earnings per share.

- Tie up management attention and operational resources that could be better focused on high-growth or high-margin segments.

- Distort inventory levels and warehousing costs if they are slow-moving due to uncompetitive pricing stemming from high production costs.

- Require significant investment in R&D or process improvement to become competitive, which may not yield a sufficient return on investment.

Dogs within IFF's portfolio represent product lines with low market share in low-growth markets. These are often older, less competitive offerings that contribute minimally to revenue and profitability. For instance, a specific fragrance compound popular in the early 2000s, now facing declining demand due to evolving consumer preferences and the emergence of superior alternatives, would likely be categorized as a Dog.

The divestiture of IFF's Pharma Solutions segment in May 2025 is a strong indicator of its classification as a Dog, given its limited growth potential and market share within the company's overall structure. This strategic move allows IFF to reallocate resources towards more promising business units, thereby optimizing its portfolio and enhancing overall financial performance.

Inefficiently produced or high-cost specialty ingredients also fall into the Dog category. These products, despite potentially having some market presence, consistently struggle with profitability due to elevated production expenses or operational inefficiencies. For example, a complex synthetic musk compound, facing reduced usage in 2024 due to environmental concerns and the availability of sustainable alternatives, exemplifies such a product.

Question Marks

ENVIROCAP™ Sustainable Scent Delivery System, launched by International Flavors & Fragrances (IFF) in July 2025, is positioned as a potential Star in the BCG Matrix. This innovative fabric care technology leverages a proprietary biopolymer for scent delivery, tapping into the burgeoning demand for eco-friendly consumer products. The global market for sustainable home care products was projected to reach over $200 billion by 2024, highlighting the significant growth opportunity for ENVIROCAP™.

The Xelestia Concept Formulation Collection, launched by International Flavors & Fragrances (IFF) in March 2025, represents a bold foray into the 'phygital escapism' trend, blending physical products like skin and haircare with an interactive mobile game. This innovative strategy aims to capture a segment of consumers seeking immersive experiences, a market that has shown significant growth in recent years, with the global market for augmented reality in gaming alone projected to reach $13 billion by 2026.

As a new offering, Xelestia likely holds a low current market share within the broader beauty and gaming industries. This places it in the Question Mark category of the BCG Matrix, necessitating substantial investment in marketing and user acquisition. For instance, IFF's commitment to innovation is evident in their 2024 R&D spending, which represented a significant portion of their revenue, supporting the development of such novel concepts.

The China Scent Exploration Program, launched in January 2025 by International Flavors & Fragrances (IFF), represents a strategic move into a high-growth market. This initiative focuses on developing fragrances tailored for the specific preferences of the Chinese consumer base. While China's fragrance market is projected to reach over $10 billion by 2027, IFF's share within this niche segment is currently nascent.

This program clearly fits the Question Mark category within the BCG Matrix. Significant investment is being channeled into research and development to decipher local olfactory tastes and build brand presence. The substantial market opportunity in China contrasts with the program's current low market share, necessitating careful management and future investment to capitalize on its potential.

New Biotechnology-Derived Ingredients

New biotechnology-derived ingredients at IFF often begin as question marks in the BCG matrix. These innovative products, fueled by significant R&D investment, target growing consumer preferences for plant-based and clean-label options. For instance, IFF's 2024 focus on sustainable sourcing and bio-fermentation for novel flavor compounds exemplifies this category.

- High Growth Potential: Driven by innovation and alignment with future consumer trends.

- Low Market Share: Initial adoption and market penetration are typically limited.

- High Investment Needs: Require substantial capital to scale production and establish market presence.

- Strategic Importance: Position IFF for future market leadership in emerging ingredient categories.

Emerging Market Specific Innovations

International Flavors & Fragrances (IFF) is strategically investing in growth projects within emerging markets such as India and Mexico. This focus includes the potential introduction of new products specifically designed to resonate with consumer preferences in these regions. This approach positions these emerging market ventures as potential Stars within the BCG matrix, given their high growth potential.

While these markets offer significant upside, IFF's initial market share for these new, tailored offerings may be relatively low. Consequently, substantial investment in commercialization efforts and local infrastructure will be crucial for IFF to effectively capture and grow its market share in these dynamic economies.

- India and Mexico Growth Projects: IFF's commitment to these key emerging markets signifies a strategic push to tap into rapidly expanding consumer bases.

- Tailored Product Innovation: Developing products specifically for regional tastes and demands is a key strategy to gain traction in these new territories.

- Potential Star Status: The high growth potential of these markets, coupled with IFF's targeted investments, suggests these ventures could evolve into Stars in IFF's portfolio.

- Market Share Challenges: Initial low market share necessitates significant investment in sales, marketing, and distribution to realize the full potential of these emerging market initiatives.

Question Marks in IFF's portfolio represent new ventures with high growth potential but currently low market share. These are products or initiatives that require significant investment to determine their future success. Examples include the Xelestia Concept Formulation Collection and the China Scent Exploration Program.

These ventures are characterized by substantial investment needs, often in research and development, to capture emerging market trends and consumer preferences. The success of these Question Marks is crucial for IFF's future growth, as they have the potential to become Stars if market penetration can be successfully achieved.

IFF's 2024 R&D spending, which was a notable portion of their revenue, directly supports the development and nurturing of these Question Mark products. The strategic importance lies in their potential to lead future market segments, aligning with IFF's commitment to innovation and sustainability.

| BCG Category | IFF Initiative Example | Market Growth | Current Market Share | Investment Need |

|---|---|---|---|---|

| Question Mark | Xelestia Concept Formulation Collection | High (Augmented Reality in Gaming projected $13B by 2026) | Low | High |

| Question Mark | China Scent Exploration Program | High (China Fragrance Market projected >$10B by 2027) | Low | High |

| Question Mark | New Biotechnology-Derived Ingredients | Growing (Plant-based & Clean-label demand) | Low | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.