IdaCorp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IdaCorp Bundle

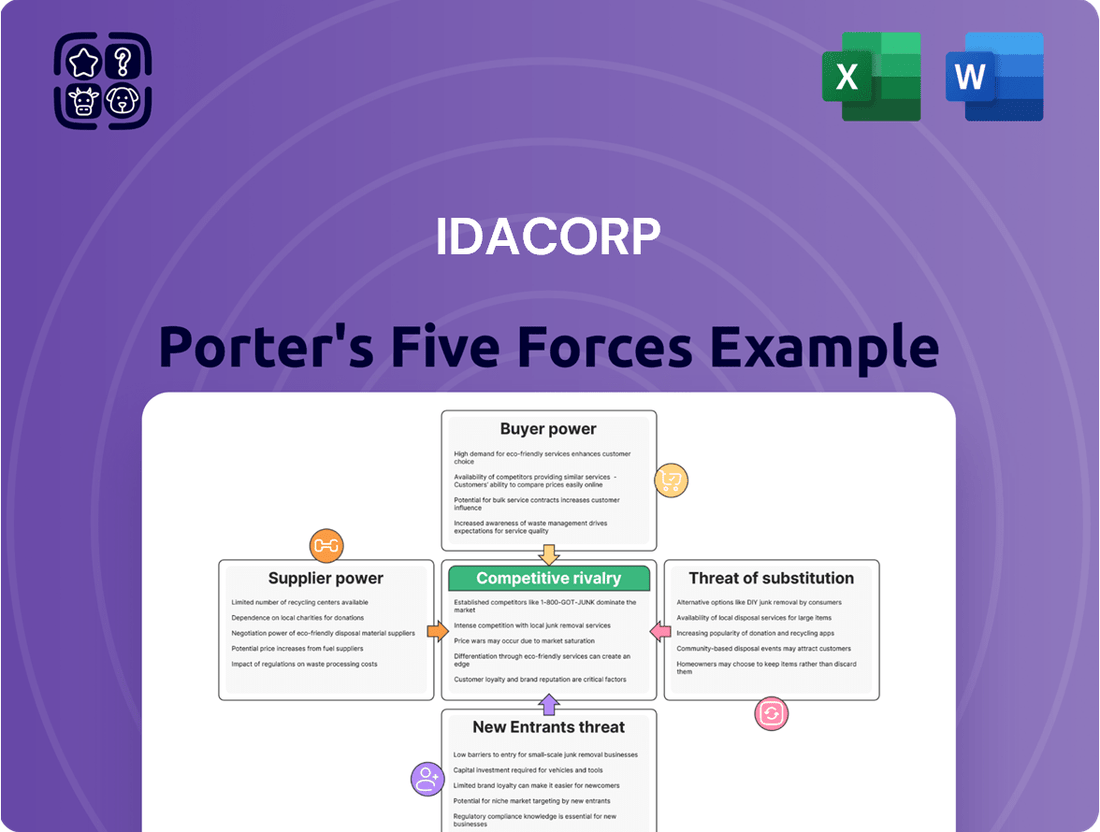

IdaCorp operates within a dynamic market, influenced by the bargaining power of buyers and the threat of new entrants. Understanding these forces is crucial for any strategic decision.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IdaCorp’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Idaho Power, operating as a regulated electric utility, faces a concentrated supplier market for essential inputs. This means it often deals with a limited number of specialized providers for crucial items like power generation equipment, transmission infrastructure parts, and fuel sources such as natural gas and coal.

The highly specialized nature of these goods and services, coupled with substantial switching costs, can significantly empower these suppliers. For instance, Idaho Power's transition from coal to natural gas units increases its reliance on natural gas suppliers, thereby concentrating bargaining power.

The bargaining power of suppliers for IdaCorp, specifically Idaho Power, is significantly influenced by high switching costs. For instance, changing major component suppliers or fuel types can incur substantial expenses for retooling facilities and requalifying new vendors, potentially delaying crucial infrastructure projects. This financial and operational disruption inherently strengthens suppliers' leverage.

Idaho Power's substantial capital expenditures, such as the reported $1.2 billion in planned capital investments for 2024, underscore long-term commitments to its current supply chains. These investments in grid modernization and new energy resources often involve specialized equipment and long-term fuel contracts, making it economically challenging and operationally complex to shift to alternative suppliers quickly.

The inputs from suppliers are critical for Idaho Power's electricity generation, transmission, and distribution. Their reliability directly impacts Idaho Power's service dependability and its capacity to satisfy increasing customer needs, thereby granting suppliers significant leverage.

Idaho Power's 2025 Integrated Resource Plan highlights the substantial requirement for energy resources, transmission infrastructure, and battery storage. This strategic focus underscores the dependency on suppliers for these vital components, amplifying their bargaining power.

Supplier Differentiation and Uniqueness

Supplier differentiation significantly impacts IdaCorp's bargaining power. When suppliers offer unique or highly specialized technologies, such as advanced smart grid components or proprietary renewable energy solutions, IdaCorp faces limited alternatives. This scarcity allows these suppliers to command higher prices and dictate terms, thereby increasing their leverage.

For instance, IdaCorp's strategic integration of solar and battery storage technologies highlights this dynamic. The specialized nature of these components means fewer suppliers can provide them, giving those suppliers a stronger negotiating position. In 2024, IdaCorp announced plans to add approximately 120 MW of solar and 240 MW of battery storage capacity, requiring specialized equipment and potentially increasing reliance on differentiated suppliers.

- Supplier Differentiation: The availability of specialized technologies, like advanced smart grid components or unique renewable energy solutions, reduces IdaCorp's ability to switch suppliers.

- Limited Alternatives: When few suppliers can provide essential, proprietary equipment, their bargaining power increases, allowing them to influence pricing and contract terms.

- Impact on IdaCorp: IdaCorp's investments in areas like solar and battery storage in 2024, totaling hundreds of megawatts, necessitate reliance on suppliers with unique capabilities, strengthening those suppliers' negotiating positions.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Idaho Power's business, becoming direct competitors, is a theoretical concern. While suppliers of essential components like turbines or fuel could potentially enter the electricity generation market, the utility sector's high capital requirements and complex regulatory framework present substantial barriers. For instance, the average cost to build a new natural gas power plant can exceed $1 billion, a significant hurdle for most suppliers.

Idaho Power operates in a heavily regulated environment, which inherently limits opportunities for new entrants, including suppliers seeking to integrate forward. Regulatory bodies like the Idaho Public Utilities Commission (IPUC) oversee pricing, service territories, and operational standards, making it difficult for any new competitor, regardless of its origin, to establish a foothold. This regulatory oversight effectively acts as a protective shield for incumbent utilities.

The inherent nature of the utility business, requiring massive infrastructure investment in generation, transmission, and distribution, makes forward integration by suppliers a low probability. For example, the capital expenditure for transmission and distribution infrastructure alone for a company like Idaho Power can run into hundreds of millions of dollars annually. Such extensive and specialized investments are not typically within the scope or financial capacity of typical equipment or fuel suppliers.

- High Capital Requirements: Building new power generation facilities or distribution networks requires billions of dollars, a prohibitive cost for most suppliers.

- Regulatory Hurdles: Strict oversight by bodies like the IPUC creates significant barriers to entry and competition.

- Specialized Infrastructure: The utility sector demands unique and extensive infrastructure that suppliers typically do not possess.

The bargaining power of suppliers for Idaho Power is considerable due to the specialized nature of inputs and high switching costs. For instance, Idaho Power's 2024 capital investments of $1.2 billion are tied to existing supply chains, making pivots costly. Suppliers of advanced grid components or unique renewable energy solutions, for which Idaho Power planned significant additions in 2024, hold substantial leverage.

| Factor | Description | Impact on Idaho Power | 2024 Data/Context |

|---|---|---|---|

| Supplier Concentration | Limited number of providers for essential inputs like specialized equipment and fuel. | Increases suppliers' ability to dictate terms. | Reliance on natural gas suppliers grew with shifts from coal. |

| Switching Costs | High expenses associated with changing suppliers, retooling, and requalifying vendors. | Makes it difficult and costly for Idaho Power to switch, strengthening supplier leverage. | Transitioning fuel sources or major component suppliers involves significant financial and operational disruption. |

| Input Importance | Criticality of supplier inputs for generation, transmission, and distribution reliability. | Suppliers with essential, reliable inputs gain significant power. | Meeting increasing customer needs depends on dependable supply chains. |

| Supplier Differentiation | Availability of unique or proprietary technologies and solutions. | Reduces Idaho Power's alternatives, allowing suppliers to command higher prices. | Integration of solar and battery storage requires specialized components from fewer suppliers. |

What is included in the product

IdaCorp's Porter's Five Forces analysis provides a comprehensive understanding of the competitive intensity and profitability potential within its industry, detailing the threats of new entrants, buyer and supplier power, and the threat of substitutes and existing rivals.

Easily identify and mitigate competitive threats with a visual representation of all five forces, simplifying complex strategic analysis.

Customers Bargaining Power

As a regulated electric utility, Idaho Power's rates are determined by state public utility commissions in Idaho and Oregon. This regulatory framework significantly curtails customers' ability to negotiate prices directly. For instance, in 2023, Idaho Power filed for a rate increase with the Idaho Public Utilities Commission, demonstrating the commission's role in approving any changes to customer costs.

Customers typically lack alternative electricity providers within their service territories, which inherently limits their power to switch and exert pressure on pricing. This lack of competition means customers cannot easily seek out lower rates from other companies. The regulatory oversight is designed to strike a balance, ensuring the utility can cover its costs and invest in infrastructure while keeping rates affordable for consumers.

Idaho Power's expanding customer base, which reached over 650,000 in 2024 with a 2.6% growth, signifies robust demand. This upward trend, projected to continue, means the utility is prioritizing overall system capacity over individual customer demands, thereby diminishing the bargaining power of any single customer.

For most residential and commercial customers, the bargaining power of customers is significantly limited because switching electricity providers is generally not an option. This is due to the monopolistic nature of regulated utilities, which dictates service areas and pricing. In 2024, the vast majority of households and businesses remained with their incumbent utility provider, reflecting this lack of choice.

Even for large industrial customers, who might theoretically explore alternatives, the infrastructure investment required to connect to a different energy source, if one is even available, would be prohibitively expensive. This creates extremely high switching costs, effectively neutralizing much of their potential bargaining power. For instance, a large manufacturing plant would face millions in costs for new transmission lines and grid connections, making it uneconomical to switch from their established provider.

Customer Segmentation and Influence

While individual residential customers typically have limited sway, IdaCorp's bargaining power of customers shifts significantly with larger entities. Major industrial and commercial clients, particularly those with high energy demands such as data centers and manufacturing plants, can indeed wield considerable influence over pricing and contract terms.

Idaho Power's 2025 Integrated Resource Plan highlights this dynamic, projecting considerable increases in peak electricity demand. This growth is partly attributed to significant new customer investments, indicating a growing reliance on these large consumers and potentially increasing their leverage.

- Customer Concentration: A small number of large industrial customers may represent a substantial portion of IdaCorp's revenue, giving them greater negotiation power.

- Switching Costs: For businesses heavily reliant on electricity, the cost and complexity of switching energy providers can be high, but if alternatives exist, it empowers them.

- Demand Growth: As IdaCorp anticipates substantial demand growth from large customers, these clients gain leverage by being essential to the company's expansion plans.

Public and Regulatory Scrutiny

Public and regulatory scrutiny significantly shapes the bargaining power of customers for utilities like Idaho Power. Customer groups, advocacy organizations, and public opinion can directly influence regulatory decisions concerning rates and service quality. This collective voice exerts pressure on utility commissions, indirectly impacting Idaho Power's pricing strategies and operational policies by ensuring customer interests are considered.

While not direct price negotiation, this external pressure can lead to outcomes that mirror customer bargaining. For instance, public comments and advocacy efforts regarding solar compensation mechanisms can influence how Idaho Power structures its net metering policies or distributed generation tariffs. In 2024, continued discussions around fair compensation for rooftop solar generation highlight this dynamic, where widespread public sentiment can sway regulatory bodies to implement policies more favorable to individual energy producers.

- Public Advocacy: Customer groups and environmental organizations actively engage with utility commissions on issues like rate design and renewable energy integration.

- Regulatory Influence: Public opinion and advocacy can lead to regulatory mandates that limit a utility's pricing flexibility or require specific service improvements.

- Solar Compensation Debates: Ongoing discussions in 2024 about net metering rates and solar buy-back programs demonstrate how public sentiment can influence policy decisions impacting customer economics.

For most residential and commercial customers, bargaining power is minimal due to the regulated, monopolistic nature of electricity supply, meaning switching providers isn't an option. Idaho Power's growing customer base, exceeding 650,000 in 2024 with a 2.6% increase, further dilutes individual customer influence as the utility focuses on overall capacity. While large industrial clients can exert more pressure, especially with increasing demand projections for 2025, the overall customer bargaining power remains low.

| Customer Segment | Bargaining Power Factor | Impact on IdaCorp |

|---|---|---|

| Residential | Very Low (No alternatives, high switching costs) | Minimal influence on pricing or terms. |

| Small Commercial | Low (Limited alternatives, moderate switching costs) | Slight influence through collective action or regulatory input. |

| Large Industrial | Moderate to High (Potential for alternatives, high demand) | Can negotiate pricing and contract terms, especially with projected 2025 demand growth. |

What You See Is What You Get

IdaCorp Porter's Five Forces Analysis

This preview showcases the exact, comprehensive IdaCorp Porter's Five Forces Analysis you will receive immediately after purchase, ensuring no surprises. You are looking at the actual, professionally formatted document, ready for your strategic planning needs. Once you complete your purchase, you’ll gain instant access to this complete file, enabling immediate utilization of its insights.

Rivalry Among Competitors

Idaho Power operates as a regulated monopoly within its primary service areas of southern Idaho and eastern Oregon. This structure means there's essentially no direct competition from other electric utilities vying for the same retail customers. This dramatically lowers competitive rivalry, a stark contrast to more open, unregulated markets.

The company's strategic focus, therefore, is less on outmaneuvering rivals and more on effectively managing regulatory frameworks. For instance, in 2023, Idaho Power reported total operating revenue of $1.55 billion, a figure largely insulated from direct competitive pressures due to its regulated status.

Idaho Power's competitive rivalry is significantly shaped by regulation, which effectively substitutes for direct market competition. Regulatory bodies like the Idaho Public Utilities Commission (IPUC) and the Oregon Public Utility Commission (OPUC) meticulously oversee the company's operations, from setting rates to ensuring service quality. This oversight prevents potential monopolistic abuses and ensures that consumers are treated fairly, mirroring the protective function of robust competition.

Idaho Power's competitive rivalry isn't primarily a price war with other utilities. Instead, the focus is on showcasing exceptional reliability and keeping costs manageable to meet the expectations of both regulators and its customer base. This strategic emphasis helps differentiate the company in a sector where consistent service is paramount.

The company consistently achieves high reliability ratings, a key performance indicator that directly impacts customer satisfaction and regulatory approval. For instance, in 2023, Idaho Power reported an average of 99.98% reliability for its customers, a testament to its operational efficiency and investment in infrastructure.

Maintaining affordable prices is equally crucial. Idaho Power actively works to manage costs, aiming for competitive rates that benefit consumers. This dual approach of reliability and affordability positions the company favorably against competitors who might solely focus on price reductions, potentially at the expense of service quality.

Inter-fuel Competition (Indirect)

While IdaCorp, as an electric utility, faces limited direct competition for its core electricity service, it experiences significant indirect competition from alternative energy sources. Customers can choose natural gas for heating or explore on-site generation like solar panels, especially with declining solar costs. For instance, residential solar adoption in Idaho has seen steady growth, with the state's solar capacity increasing, reflecting customer interest in diversifying energy sources.

These inter-fuel competitive pressures require IdaCorp to strategically plan its resource mix and pricing to remain attractive. The company must consider the total cost of ownership for customers opting for alternatives, including installation and maintenance of solar or natural gas infrastructure. This dynamic influences demand for IdaCorp's services and necessitates a focus on reliability and cost-effectiveness.

- Inter-fuel Competition: Indirect rivalry from natural gas for heating and on-site solar generation.

- Customer Adoption Trends: Growing interest in residential solar, influencing demand for traditional electricity.

- Strategic Implications: Need for IdaCorp to adapt resource mix and pricing to remain competitive.

Growth in Demand and Infrastructure Development

The expanding customer base and increasing energy demands within Idaho Power's service territory are primarily driving opportunities for growth rather than fostering intense competitive rivalry. This surge in demand necessitates significant infrastructure development to ensure reliable service delivery.

Idaho Power is actively addressing this by making substantial investments in new energy resources and crucial transmission projects. For instance, in 2023, the company reported capital expenditures of approximately $850 million, with a significant portion allocated to grid modernization and new generation capacity to meet projected load growth.

- Infrastructure Investment: Idaho Power's 2024 capital budget includes over $900 million for projects aimed at enhancing reliability and meeting growing demand.

- New Resources: The company is actively evaluating and investing in new energy sources, including renewables, to diversify its portfolio and meet future needs.

- Transmission Upgrades: Significant funds are earmarked for upgrading and expanding the transmission network to handle increased power flows and improve grid resilience.

Idaho Power's competitive rivalry is notably low due to its regulated monopoly status, meaning there are no direct utility competitors for its core electricity services. However, indirect competition arises from alternative energy sources like natural gas for heating and the increasing adoption of residential solar power, which has seen steady growth in Idaho. This inter-fuel competition necessitates that Idaho Power maintains reliability and cost-effectiveness to retain customers.

The company's strategic focus is on operational excellence and regulatory compliance rather than battling rivals. In 2023, Idaho Power reported $1.55 billion in operating revenue, demonstrating its insulated market position. Its commitment to reliability, evidenced by a 99.98% service uptime in 2023, and efforts to manage costs are key differentiators.

Growth in demand within its service territory is a more significant factor than direct competition, driving substantial infrastructure investments. Idaho Power's 2024 capital budget, exceeding $900 million, is largely dedicated to enhancing reliability and expanding capacity to meet this rising demand, including investments in new energy resources and transmission upgrades.

| Factor | Description | Impact on IdaCorp |

| Regulated Monopoly | No direct utility competitors for retail electricity. | Significantly reduces direct competitive rivalry. |

| Inter-fuel Competition | Natural gas for heating, residential solar adoption. | Requires focus on cost-effectiveness and reliability to retain customers. |

| Customer Demand Growth | Increasing energy needs in service territory. | Drives infrastructure investment rather than intense rivalry. |

SSubstitutes Threaten

The threat of substitutes for IdaCorp is significant, primarily driven by distributed generation, especially rooftop solar installations. Customers can increasingly generate their own electricity, diminishing their reliance on traditional utility providers like Idaho Power.

This trend is particularly impactful as it directly competes with IdaCorp's core service. For instance, in 2023, Idaho Power saw a notable increase in customer-sited generation applications, highlighting the growing adoption of rooftop solar among its service area population.

IdaCorp has been involved in regulatory proceedings concerning the compensation mechanisms for customers who feed excess solar power back into the grid, a key factor influencing the attractiveness of these substitute solutions.

Customers are increasingly adopting energy efficiency measures and conservation practices, which directly substitute for Idaho Power's electricity services. For instance, the U.S. Department of Energy reported that by 2024, the adoption of ENERGY STAR certified appliances alone could save American households billions of dollars annually on energy bills, thereby reducing their reliance on utility providers.

These behavioral shifts and technological adoptions, such as upgrading to LED lighting or improving home insulation, diminish the overall demand for electricity. This trend presents a significant threat of substitutes for Idaho Power as consumers actively seek ways to lower their energy consumption and associated costs.

Customers seeking heating and cooling solutions have several viable substitutes to electricity. These include readily available options like natural gas, propane, and even wood-burning systems, particularly in regions where these fuels are abundant and cost-effective.

The widespread availability and often lower per-unit cost of these alternatives present a significant threat. For instance, in 2024, a substantial portion of US households, approximately 48%, relied on natural gas for heating, demonstrating a clear preference and established infrastructure for this substitute.

This reliance on alternative energy sources directly impacts electricity demand for heating and cooling, especially within the residential and commercial sectors. A noticeable shift towards these substitutes can lead to reduced sales volumes and potentially lower revenue for electricity providers if they cannot effectively compete on price or offer compelling value propositions.

Battery Storage Technologies

The threat of substitutes for traditional electricity supply is growing as battery storage technologies mature and become more accessible. As prices fall, customers can increasingly store power generated from their own renewable sources or during cheaper off-peak times. This reduces their dependence on the grid for consistent energy. Idaho Power itself is actively investing in battery storage solutions, acknowledging this shift.

The increasing affordability and efficiency of battery storage present a significant substitute threat. For instance, residential solar installations paired with battery systems can provide a substantial portion of a household's energy needs, directly competing with grid-supplied electricity. This trend is expected to accelerate as battery costs continue their downward trajectory, with projections indicating further significant price reductions in the coming years.

- Advancing Technology: Battery energy density and lifespan are improving, making them more viable long-term energy storage solutions.

- Cost Reduction: The levelized cost of storage (LCOS) for battery systems has been steadily declining, making them more competitive with traditional grid power.

- Grid Independence: Consumers can achieve greater energy independence by storing self-generated or off-peak power, reducing reliance on utility providers.

- Utility Investment: Utilities like Idaho Power are investing in battery storage, signaling its growing importance and potential to displace traditional supply models.

Self-Generation for Large Industrial Users

Large industrial or commercial customers with substantial energy requirements might explore self-generation, like combined heat and power (CHP) plants, if the economics and regulatory landscape favor it over purchasing from Idaho Power. For instance, in 2024, the average industrial electricity price in Idaho was approximately $0.07 per kilowatt-hour, a figure that could incentivize significant energy users to investigate onsite generation if their capital expenditure and operational costs for CHP fall below this threshold.

While this remains a niche threat, its impact can be considerable for entities with very large, consistent energy loads. These users might find that the long-term savings and energy independence offered by self-generation outweigh the initial investment, especially considering the potential for volatile energy market prices. The decision often hinges on a detailed cost-benefit analysis comparing the upfront costs of a CHP system against projected electricity bills from Idaho Power over the system's lifespan.

- Niche Threat: Primarily affects large industrial or commercial users with significant and consistent energy demands.

- Economic Driver: Cost savings compared to purchasing electricity from Idaho Power, influenced by industrial electricity prices (e.g., around $0.07/kWh in Idaho for 2024).

- Technology: Combined Heat and Power (CHP) plants are a key self-generation option.

- Impact: Can be significant for very large loads, offering potential for long-term savings and energy independence.

The threat of substitutes for IdaCorp is multifaceted, encompassing distributed generation, energy efficiency, and alternative fuel sources. Rooftop solar installations, in particular, directly compete by allowing customers to generate their own electricity, a trend supported by increasing applications in 2023. Energy efficiency measures, such as ENERGY STAR appliances, further reduce demand, with potential savings for households projected to be substantial by 2024.

Alternative fuels like natural gas and propane also pose a significant threat, especially for heating and cooling needs. In 2024, a considerable percentage of U.S. households, around 48%, relied on natural gas for heating, highlighting its established presence and infrastructure as a substitute for electricity.

The increasing viability of battery storage, coupled with falling costs, allows customers to store self-generated or off-peak power, lessening grid dependence. Large industrial users may also explore self-generation options like CHP plants, especially if industrial electricity prices, such as Idaho's approximate $0.07/kWh in 2024, make it economically attractive.

| Substitute Type | Key Driver | 2023/2024 Data Point | Impact on IdaCorp |

| Distributed Generation (Solar) | Customer self-generation | Increased applications in 2023 | Direct competition with core service |

| Energy Efficiency | Cost savings | ENERGY STAR savings potential by 2024 | Reduced overall electricity demand |

| Alternative Fuels (Natural Gas) | Heating/Cooling preference | 48% of US households used gas for heating in 2024 | Lowered demand for electricity in specific sectors |

| Battery Storage | Grid independence, cost reduction | Declining LCOS, utility investment | Reduced reliance on grid supply |

| Industrial Self-Generation (CHP) | Cost savings, energy independence | Idaho industrial electricity price ~$0.07/kWh (2024) | Potential loss of large customer load |

Entrants Threaten

The electric utility sector, including companies like IdaCorp, presents a formidable barrier to entry due to exceptionally high capital requirements. Establishing power generation facilities, extensive transmission infrastructure, and robust distribution networks demands billions in upfront investment. This financial hurdle significantly limits the number of new players that can realistically enter the market.

For context, Idaho Power itself anticipates an average annual expenditure of $1.1 billion over the next five years specifically for grid enhancements. Such substantial ongoing capital needs underscore the financial commitment required to operate and compete within this industry, effectively deterring potential new entrants who may lack the necessary financial resources.

The electric utility sector faces significant barriers to entry due to extensive regulatory oversight. IdaCorp, operating in Idaho and Oregon, must contend with stringent federal and state regulations. New companies would need to secure numerous licenses and permits, a process that can take years and involve substantial capital investment, delaying market entry significantly.

Navigating the complex web of approvals from public utility commissions in both Idaho and Oregon presents a formidable challenge for potential new entrants. These commissions oversee everything from service territories to pricing structures. For instance, in 2024, the Idaho Public Utilities Commission (IPUC) continued its rigorous review of utility rate cases, underscoring the detailed scrutiny any new entrant would face, making initial market penetration exceptionally difficult and expensive.

Idaho Power possesses a significant advantage due to its deeply entrenched transmission and distribution infrastructure, a vital asset for any utility. This existing network, built over decades, represents a massive capital investment and operational complexity that new entrants would struggle to replicate. For instance, as of December 31, 2023, Idaho Power operated approximately 24,000 miles of transmission and distribution lines, a scale that inherently creates substantial barriers to entry.

Furthermore, network effects play a crucial role. The more customers connected to Idaho Power's grid, the more valuable that grid becomes for all users, including the utility itself. This established customer base and the associated economies of scale make it economically challenging for a new competitor to gain traction and offer services at a comparable price point. In 2023, Idaho Power served over 620,000 customers, a testament to its widespread reach and the strength of these network effects.

Economies of Scale and Experience

Idaho Power, with over a century of operation, has built substantial economies of scale across its generation, transmission, and distribution networks. This extensive operational history allows them to spread fixed costs over a vast customer base and a large asset base, leading to lower per-unit costs that are difficult for newcomers to match.

New entrants would face immense challenges in replicating Idaho Power's cost efficiencies. The capital investment required to build a comparable infrastructure, from power plants to transmission lines and local distribution grids, is astronomical. For instance, in 2023, Idaho Power reported total operating revenues of $1.7 billion, reflecting the scale of its operations.

- Significant Capital Requirements: Building new generation facilities and transmission infrastructure demands billions in upfront investment, a barrier new entrants can rarely overcome.

- Operational Experience Advantage: Idaho Power's long-standing operational expertise translates into optimized efficiency and lower operating costs, a learning curve new companies must ascend.

- Regulatory Hurdles: Navigating complex and lengthy regulatory approval processes for new utility operations adds substantial time and cost, further deterring new entrants.

- Established Customer Base: Idaho Power's existing customer relationships and brand recognition provide a stable revenue stream, making it harder for new competitors to gain market share.

Public Service Obligation and Reliability Expectations

The threat of new entrants for electric utilities like IdaCorp is significantly mitigated by their public service obligation and the inherent reliability expectations. New companies entering this space would immediately be burdened with the responsibility of ensuring consistent and affordable power delivery to all customers within a designated service territory. This isn't a simple task; it demands substantial operational expertise and considerable resources to maintain a stable and resilient grid. For instance, in 2024, the average cost of grid modernization projects for utilities across the US was estimated to be in the billions, highlighting the immense capital investment required.

These stringent reliability expectations translate into substantial barriers. New entrants must demonstrate an immediate capacity to meet and exceed these standards, which often involve significant upfront investment in infrastructure, advanced grid management technologies, and a highly skilled workforce. The regulatory environment also plays a crucial role, with utility commissions closely scrutinizing any new player's ability to fulfill these essential public service duties. Failing to meet these benchmarks can lead to severe penalties and loss of operational licenses, making the initial hurdle exceptionally high.

- High Capital Investment: The cost of building and maintaining a reliable power grid, including substations and transmission lines, can run into billions of dollars. For example, a single new major transmission line project can cost upwards of $100 million.

- Operational Expertise: Managing a complex and interconnected grid requires deep knowledge of power generation, distribution, and real-time load balancing, a skill set that takes years to develop.

- Regulatory Hurdles: New entrants must navigate a complex web of state and federal regulations, including obtaining numerous permits and demonstrating compliance with safety and reliability standards, which can delay market entry significantly.

- Public Trust and Reputation: Established utilities have built decades of trust. A new entrant would need to quickly establish a similar level of confidence, which is difficult given the critical nature of electricity supply.

The threat of new entrants for IdaCorp is considerably low, primarily due to the immense capital required to establish a competitive presence in the electric utility sector. Building new generation facilities and the necessary transmission and distribution infrastructure demands billions in upfront investment, a financial barrier that most potential competitors cannot surmount. For instance, the U.S. energy sector saw significant investments in 2023, with utility capital expenditures projected to exceed $150 billion, underscoring the scale of financial commitment involved.

Furthermore, the extensive regulatory landscape and the need for established operational expertise create additional hurdles. New companies must secure numerous licenses and permits, a process that can take years and involves substantial capital. IdaCorp's established infrastructure, spanning approximately 24,000 miles of transmission and distribution lines as of December 31, 2023, and its customer base of over 620,000 individuals in 2023, represent significant network effects and economies of scale that are exceptionally difficult to replicate.

| Barrier | Description | IdaCorp's Advantage | Impact on New Entrants |

|---|---|---|---|

| Capital Requirements | Building power plants and grid infrastructure costs billions. | IdaCorp has existing, massive infrastructure. | Extremely high barrier, deterring most new entrants. |

| Regulatory Hurdles | Obtaining licenses and permits is complex and time-consuming. | IdaCorp has established relationships and compliance processes. | Significant delays and costs for new entrants. |

| Economies of Scale | Larger operations lead to lower per-unit costs. | IdaCorp's century of operation provides cost efficiencies. | New entrants struggle to match cost competitiveness. |

| Infrastructure Access | Control over transmission and distribution lines is crucial. | IdaCorp operates a vast network of 24,000 miles. | Replicating this network is practically impossible for newcomers. |

Porter's Five Forces Analysis Data Sources

Our IdaCorp Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company annual reports, industry-specific market research reports, and publicly available financial statements.

We leverage insights from government regulatory filings, economic indicator databases, and leading industry publications to provide a comprehensive assessment of competitive intensity and strategic positioning.