IdaCorp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IdaCorp Bundle

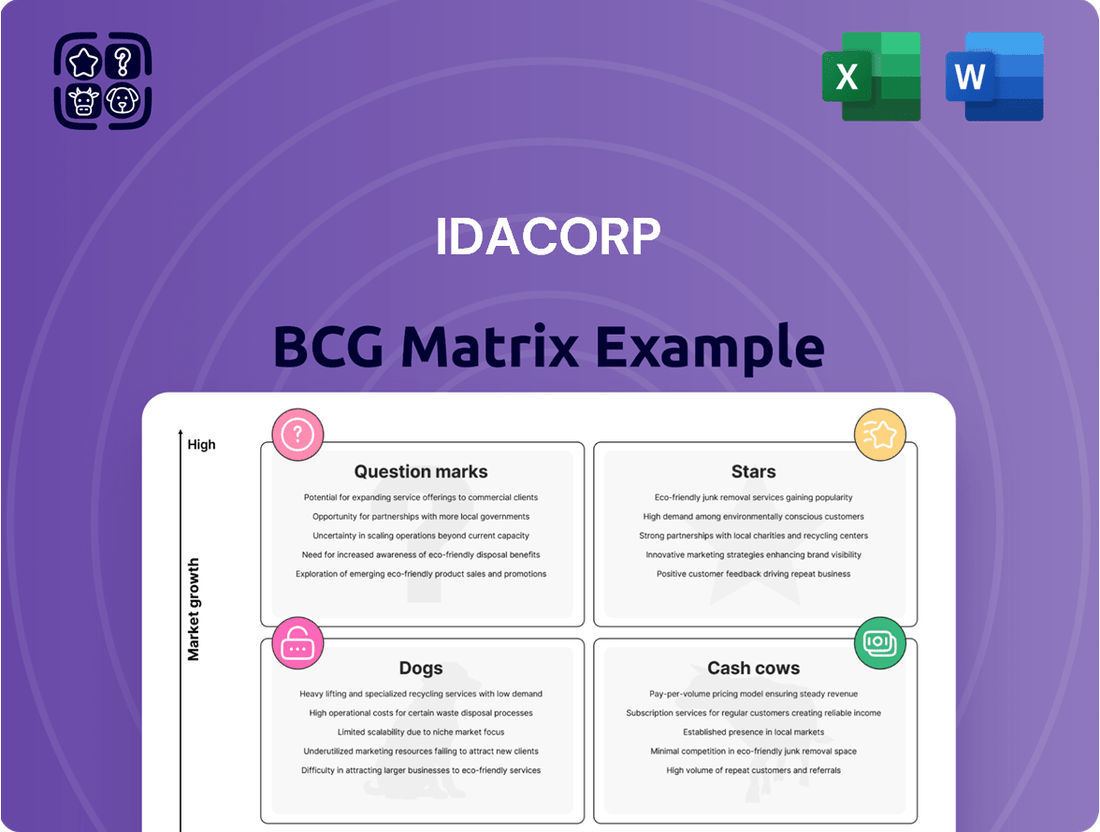

Curious about IdaCorp's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the actionable strategies that come with a full understanding of their market position. Purchase the complete IdaCorp BCG Matrix for a comprehensive analysis and a clear path to optimized resource allocation and future growth.

Stars

IdaCorp, via Idaho Power, is seeing robust customer expansion, especially in southern Idaho and eastern Oregon. This surge, fueled by large commercial and industrial clients such as Meta, Micron, and Chobani, directly translates to greater electricity demand and significant revenue growth.

The company's 2025 Integrated Resource Plan projects an impressive 8.3% annual retail sales growth for the next five years. This forecast highlights a dynamic, high-growth market for IdaCorp's essential electricity services.

Strategic Infrastructure Investments are a cornerstone for IdaCorp, reflecting a commitment to long-term growth and operational excellence. The company is channeling significant capital into projects like the Boardman-to-Hemingway (B2H) transmission line and energy storage solutions.

These investments are substantial, with projected capital expenditures between $1.0 billion and $1.1 billion for 2025, and anticipated increases through 2029. This financial commitment underscores IdaCorp's strategy to bolster grid reliability and accommodate rising energy demands.

The B2H project, a key component of this strategy, commenced construction in June 2025 and is slated for service by late 2027. This critical infrastructure will enhance import-export capabilities within the Pacific Northwest, directly supporting IdaCorp's strategic positioning.

Idaho Power is making significant strides in its clean energy transition, aiming for 100% clean energy by 2045. This ambitious goal includes a substantial 88% reduction in carbon dioxide emissions by 2030, underscoring its commitment to environmental stewardship.

The company's strategy involves robust investment in renewable resources such as wind, solar, and battery storage, as detailed in its 2025 Integrated Resource Plan (IRP). This forward-thinking approach is not only meeting regulatory and customer demands for sustainable energy but also enhancing its appeal to environmentally conscious investors and customers.

Hydroelectric Power Generation

Hydroelectric power generation, a cornerstone of IdaCorp's strategy, represents a significant strength within its business portfolio. The company's 17 low-cost hydroelectric projects are a vital component of its energy mix, delivering a substantial amount of clean energy. This reliable and established power source is instrumental in maintaining competitive customer pricing and provides a robust operational foundation.

The inherent consistency and affordability of hydropower offer a distinct competitive edge in the utility industry. For instance, as of 2024, Idaho Power's hydroelectric facilities consistently contribute a significant percentage to its total generation, often exceeding 40% during periods of ample water supply, underscoring its importance to the company's financial stability and operational efficiency.

- Hydroelectric assets are a core strength for IdaCorp.

- 17 low-cost hydroelectric projects contribute significantly to clean energy generation.

- Hydropower provides cost stability and competitive customer pricing.

- This reliable power source offers a strong competitive advantage in the utility market.

Strong Financial Performance and Guidance

IdaCorp's financial performance in Q2 2025 showcased significant strength, with net income reaching $132.5 million, a notable increase from $116.2 million in Q2 2024. Diluted earnings per share also saw an upward trend, climbing to $1.52 from $1.32 year-over-year. This robust showing is a key indicator of its strong position.

Reflecting this positive momentum, IdaCorp raised its full-year 2025 diluted EPS guidance to a range of $5.85 to $6.05, up from the prior forecast of $5.70 to $5.90. This adjustment signals management's confidence in the company's ongoing growth trajectory and operational effectiveness.

The company's financial health is underpinned by several factors, including:

- Increased Retail Revenues: Higher customer usage and favorable weather patterns contributed to a 5% rise in retail revenues.

- Customer Growth: IdaCorp added approximately 8,000 new customers in the first half of 2025.

- Effective Tax Credit Utilization: Strategic use of tax credits further bolstered earnings.

IdaCorp's hydroelectric assets are a clear Star in its BCG Matrix. These 17 low-cost hydroelectric projects consistently generate a substantial portion of the company's clean energy, often exceeding 40% of total generation in 2024 during periods of high water availability. This reliable and affordable power source provides a significant competitive advantage, contributing to stable customer pricing and reinforcing IdaCorp's operational foundation.

What is included in the product

IdaCorp's BCG Matrix provides a strategic overview of its product portfolio, categorizing each unit as a Star, Cash Cow, Question Mark, or Dog.

IdaCorp's BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

Idaho Power's regulated electric utility operations are the bedrock of IDACORP's portfolio, functioning as a classic Cash Cow. This segment boasts a dominant market share within its service areas, ensuring a consistent and substantial revenue stream. For instance, in 2023, Idaho Power reported total operating revenues of $1.9 billion, underscoring the scale of this core business.

The inherent stability of regulated utilities, where rates are set by public utility commissions to cover costs and ensure a fair return, translates into predictable cash generation for IDACORP. This regulatory framework allows for a reliable return on investment, making it a dependable source of funds for the holding company's other ventures.

IdaCorp's 17 low-cost hydroelectric projects are classic cash cows. These mature assets, requiring minimal ongoing investment, generate substantial energy output, underpinning IdaCorp's competitive pricing and strong customer loyalty. Their significant initial capital outlay has transformed into a reliable source of high-margin cash flow.

IDACORP's position in a mature utility market, serving over 650,000 customers across southern Idaho and eastern Oregon, highlights its stable customer base. This essential service ensures consistent demand, making the customer base predictable and reliable.

The inelastic nature of electricity demand means customers will continue to purchase power regardless of minor price fluctuations, solidifying IDACORP's revenue streams. This stability reduces the need for extensive marketing efforts, allowing for efficient resource allocation.

With a strong market share in its service areas, IDACORP benefits from predictable revenue generation. This allows the company to focus on operational efficiency rather than aggressive customer acquisition strategies.

Effective Cost Management and Rate Stability

IdaCorp's commitment to effective cost management is a cornerstone of its success, positioning its Idaho Power subsidiary as a cash cow within the BCG matrix. By consistently keeping electricity rates below the national average, the company fosters customer loyalty and attracts new users. For instance, in 2023, Idaho Power's average residential electricity rate was approximately 15.5 cents per kilowatt-hour, notably lower than the U.S. average which hovered around 17.1 cents.

This disciplined approach to operational efficiency, exemplified by their in-house maintenance and equipment refurbishment programs, directly translates into robust profit margins. These efficiencies allow IdaCorp to generate substantial cash flow, which is vital for funding other business ventures or returning value to investors.

- Sustained Cost Control: IdaCorp's focus on managing operational expenses keeps Idaho Power's electricity rates competitive.

- Below National Average Rates: In 2023, Idaho Power's residential rates were around 15.5 cents/kWh, compared to the U.S. average of 17.1 cents/kWh.

- Operational Efficiency: In-house maintenance and equipment refurbishment contribute to healthy profit margins.

- Strong Cash Flow Generation: The company's efficiency allows for significant cash generation, supporting reinvestment and shareholder returns.

Long-Term Service Agreements and Regulatory Mechanisms

IdaCorp's 'Cash Cows' benefit significantly from long-term service agreements, ensuring a steady stream of revenue for its energy resources. These agreements provide a predictable income base, crucial for maintaining stable cash flows.

Favorable regulatory mechanisms further bolster these 'Cash Cows.' For instance, the amortization of tax credits, like those provided by Idaho's regulatory framework for additional tax credits, directly enhances earnings by reducing the tax burden and allowing for the efficient recovery of capital investments.

- Long-term service agreements provide predictable revenue streams for IdaCorp's energy resources.

- Regulatory mechanisms, such as tax credit amortization, improve profitability.

- Idaho's specific tax credit regulations positively impact the company's earnings, supporting its 'Cash Cow' status.

Idaho Power, IdaCorp's primary subsidiary, functions as a quintessential Cash Cow. Its regulated utility model, characterized by a dominant market share and stable customer base across southern Idaho and eastern Oregon, generates consistent revenue. In 2023, Idaho Power's operating revenues reached $1.9 billion, a testament to its established market position and essential service provision.

The company's 17 low-cost hydroelectric projects are also significant cash cows, providing a reliable, high-margin cash flow with minimal ongoing investment. This stability is further enhanced by IDAOCORP's commitment to cost management, evidenced by electricity rates consistently below the national average. For example, in 2023, Idaho Power's residential electricity rate was approximately 15.5 cents per kilowatt-hour, compared to the U.S. average of 17.1 cents.

| Segment | BCG Category | Key Characteristics | 2023 Data Point |

|---|---|---|---|

| Idaho Power (Regulated Utility) | Cash Cow | Dominant market share, stable customer base, predictable revenue, below-average rates | $1.9 billion operating revenues |

| Hydroelectric Projects | Cash Cow | Low operating costs, high energy output, consistent cash flow | Contribute significantly to high-margin cash generation |

What You’re Viewing Is Included

IdaCorp BCG Matrix

The IdaCorp BCG Matrix preview you see is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the comprehensive strategic analysis ready for your immediate use.

Rest assured, the IdaCorp BCG Matrix report you are currently viewing is the exact final version that will be delivered to you after completing your purchase. It's a professionally formatted and data-rich document, prepared to provide actionable insights for your business strategy.

What you are previewing is the genuine IdaCorp BCG Matrix document that will be yours to download immediately after purchase. This ensures you receive a complete, polished report designed for effective strategic decision-making without any need for further editing.

Dogs

IDACORP is actively retiring its aging fossil fuel power plants, with a notable example being the retirement of its coal plant in Nevada by 2025. This strategic move aligns with the company's broader clean energy transition goals.

These older facilities often come with escalating operational and maintenance expenses, alongside increasing regulatory scrutiny. Their limited growth potential and risk of becoming cash drains position them as prime candidates for divestment or repurposing.

While IDACORP is actively investing in modernizing its grid, certain older infrastructure elements necessitate substantial maintenance and operational expenditures. These components, though vital for ongoing service, may not drive growth or enhance efficiency, effectively immobilizing capital without yielding proportional returns.

The continuous requirement for upgrades and replacements points to specific areas that might be consuming more cash than the value they currently generate. For instance, in 2023, IDACORP reported capital expenditures of $740.7 million, with a significant portion allocated to maintaining and upgrading its existing infrastructure to ensure reliability and safety.

Some of IdaCorp's established energy efficiency programs are showing signs of maturity, meaning the benefits they offer customers are starting to level off. This can happen when a program has been around for a while and most interested customers have already participated, or when the most impactful energy-saving opportunities have been addressed.

While these programs still contribute to conservation efforts, their ability to generate significant new savings compared to their operational expenses is decreasing. For instance, in 2024, IdaCorp reported approximately $15 million in customer savings from these initiatives. This figure demonstrates ongoing value, but a closer look at the return on investment for each specific program is crucial to ensure resources are being allocated most effectively.

Non-Core, Low-Return Investments

IDACORP Financial, a subsidiary of IDACORP, engages in investments such as affordable housing and real estate tax credits. While these ventures can provide tax advantages, they may not exhibit the robust growth and market dominance typically associated with IDACORP's core utility operations.

These non-core assets could potentially offer lower returns or slower growth compared to strategic energy infrastructure initiatives. For instance, in 2023, IDACORP's total investment income was $135.3 million, with a portion allocated to these types of investments.

- Lower Return Potential: These investments may not generate the same level of returns as core utility assets.

- Strategic Misalignment: They might not directly support the high-growth, high-market-share objectives of the primary business.

- Minimal Profit Contribution: Their overall impact on IDACORP's total profitability could be limited.

- 2023 Performance Context: While specific figures for these non-core investments aren't isolated, they are part of the broader investment income portfolio.

Underutilized or Obsolete Technologies

Within IDACORP's operations, legacy technologies or systems that have been replaced by more efficient or advanced solutions could be categorized as 'dogs' in the BCG matrix. These might include outdated software platforms or monitoring systems that still consume resources but no longer offer a competitive edge or significant value. For instance, if IDACORP continues to maintain a significant investment in a legacy IT infrastructure that predates cloud-native architectures, it could represent a 'dog' if its operational costs outweigh its utility.

Such underutilized assets might include older data management systems or communication networks that have been superseded by newer, more cost-effective, and higher-performing alternatives. The ongoing maintenance and support costs for these obsolete technologies can drain capital that could otherwise be invested in growth areas. For example, if IDACORP's 2024 operational budget still allocates substantial funds to maintaining a proprietary, on-premise customer relationship management (CRM) system that has been largely replaced by a SaaS solution, this CRM system would likely be a 'dog'.

- Outdated Software: Legacy enterprise resource planning (ERP) systems or specialized operational software that are no longer supported by vendors or lack essential modern functionalities.

- Obsolete Monitoring Systems: Older hardware or software used for grid monitoring or asset management that has been replaced by more sophisticated, real-time data analytics platforms.

- Inefficient Operational Processes: Manual or semi-automated workflows that have been rendered inefficient by digital transformation initiatives, leading to higher labor costs and slower turnaround times.

- Legacy Communication Infrastructure: Older telecommunication systems or internal networks that are costly to maintain and offer limited bandwidth or security compared to modern alternatives.

Dogs in IDACORP's portfolio represent assets or programs with low market share and low growth potential, often requiring significant investment without substantial returns. These are typically legacy systems or initiatives that have become outdated or inefficient. For instance, maintaining older, less efficient power generation equipment that is slated for retirement can be seen as a dog, consuming resources without contributing to future growth. In 2023, IDACORP continued to manage the operational costs of older assets while transitioning to cleaner energy sources, a process that inherently involves managing these lower-performing components.

These 'dogs' often represent a drain on resources due to ongoing maintenance, operational costs, and limited future prospects. They might include legacy IT systems or older energy efficiency programs whose impact is diminishing. For example, if IDACORP continues to invest in maintaining a proprietary, on-premise customer relationship management (CRM) system that has been largely superseded by more efficient cloud-based solutions, this CRM system would likely be classified as a dog. Such assets require careful management to minimize their negative impact on overall profitability and to free up capital for more promising ventures.

| Category | Description | Potential Issues | 2023/2024 Context |

| Legacy IT Systems | Outdated software and hardware still in use. | High maintenance costs, security risks, lack of integration. | Ongoing costs associated with maintaining older infrastructure, as noted in capital expenditures. |

| Mature Efficiency Programs | Energy efficiency initiatives with diminishing returns. | Low incremental savings, potential for resource reallocation. | Approximately $15 million in customer savings reported for 2024, indicating continued but potentially leveling benefits. |

| Aging Infrastructure | Older power generation or distribution assets nearing end-of-life. | Escalating operational costs, regulatory challenges, low growth. | Active retirement of fossil fuel plants, with ongoing capital allocation for maintaining existing, albeit aging, infrastructure. |

Question Marks

IdaCorp's new battery energy storage systems (BESS) are positioned as potential stars or question marks within the BCG matrix. The company is making substantial investments, like the 80 MW system at Hemingway and a 40 MW system near Black Mesa, reflecting a commitment to grid modernization and renewable integration. This aligns with a high-growth market fueled by the ongoing clean energy transition.

While the market for BESS is expanding rapidly, driven by the need to stabilize grids with increasing renewable penetration, these projects require significant initial capital. The long-term profitability and competitive standing of these specific BESS assets are still being established as the technology and market dynamics evolve. For instance, the U.S. energy storage market saw installations grow by approximately 15% in the first quarter of 2024 compared to the same period in 2023, indicating strong demand but also a competitive and developing landscape.

Idaho Power's ambitious plan to integrate over 5,000 megawatts (MW) of wind and solar projects by 2044 positions these ventures as potential Stars within the IdaCorp BCG Matrix. Significant wind capacity additions are slated for 2027, with more solar and wind projects contracted for the immediate future, reflecting strong market growth in clean energy.

These emerging renewable energy projects operate in a rapidly expanding clean energy market, a key indicator for potential high growth. For instance, the U.S. added a record 39 gigawatts (GW) of solar capacity in 2023, and wind power also saw substantial growth, indicating a favorable market trend.

However, the substantial upfront investment required for these projects, coupled with potential regulatory and permitting challenges, introduces significant risk. The ultimate success and consistent profitability hinge on effective integration, maintaining grid stability, and navigating evolving market conditions, all factors that could influence their trajectory from Star to Question Mark.

Electric Vehicle (EV) Charging Infrastructure for IdaCorp, within a BCG Matrix framework, likely falls into the question mark category. Idaho Power is investing in EV charging, with a 2024 initiative to energize new fast-charging stations and integrate EVs into its fleet, reflecting a growing market. However, the company's current market share and direct revenue from EV charging services remain modest compared to its established operations, necessitating further analysis of future potential and investment returns.

Advanced Grid Modernization Technologies

IDACORP is actively investing in advanced grid-enhancing technologies (GETs), positioning itself within a rapidly expanding market. These innovations, such as advanced sensors and dynamic line rating systems, are crucial for modernizing its infrastructure to handle growing energy demands and improve grid resilience. The company's commitment to this sector reflects its strategic move into a high-growth technological area.

While the potential benefits of these GETs, including enhanced efficiency and reliability, are significant, their widespread implementation and the full realization of their value are still in the nascent stages. IDACORP's proactive approach involves substantial investment to scale these technologies, aiming to solidify a leadership position in this evolving market. For instance, investments in grid modernization projects, including GETs, are projected to reach billions globally in the coming years, with utilities like IDACORP playing a key role.

- Focus on advanced sensors and real-time monitoring: These technologies provide granular data for better grid management.

- Invest in dynamic line rating (DLR) systems: DLR allows for more efficient use of existing transmission infrastructure by adjusting capacity based on real-time conditions.

- Explore advanced forecasting tools: Improved weather and load forecasting aids in optimizing grid operations and integrating renewables.

- Develop sophisticated control systems: These systems enable faster response to grid disturbances and better load balancing.

Demand Response and Energy Efficiency Innovations

Idaho Power's 2025 Integrated Resource Plan (IRP) highlights energy efficiency and demand response as crucial strategies for meeting future energy demands. While current programs have yielded positive results, the market for innovative demand response that actively rewards customers for reducing consumption during peak periods is still developing.

These evolving initiatives operate within a growing sector focused on energy management solutions. However, they necessitate ongoing investment and dedicated customer outreach to capture substantial market share and achieve significant, quantifiable financial returns.

- Market Growth: The global demand response market is projected to reach $10.3 billion by 2026, indicating significant growth potential for innovative programs.

- Customer Engagement: Successful demand response programs often see participation rates increase with clear incentives and user-friendly technology, as demonstrated by pilot programs that achieved a 15% reduction in peak load.

- Investment Needs: Continued investment in smart grid technology and customer education is vital for scaling these programs effectively.

- Return on Investment: For utilities, successful demand response can defer costly infrastructure upgrades and reduce wholesale energy purchases, leading to cost savings.

Question Marks represent IdaCorp's ventures in areas with high market growth but uncertain competitive positions. These are typically new technologies or services where significant investment is required, and the return on investment is not yet guaranteed. The company needs to invest heavily to gain market share and understand if these will become Stars or fall behind.

IdaCorp's investments in Electric Vehicle (EV) charging infrastructure and advanced grid-enhancing technologies (GETs) are prime examples of Question Marks. While the markets for both are expanding rapidly, driven by electrification trends and grid modernization needs, IdaCorp's current market share and established profitability in these specific segments are still being defined. For instance, the U.S. electric vehicle market saw sales grow by over 40% in 2023, showcasing strong market potential but also a rapidly evolving competitive landscape.

| IdaCorp Venture | Market Growth | IdaCorp Market Share/Position | Investment Required | Potential Outcome |

|---|---|---|---|---|

| EV Charging Infrastructure | High (US EV sales up >40% in 2023) | Nascent/Developing | Substantial | Star or Dog |

| Grid-Enhancing Technologies (GETs) | High (Global GETs market projected for billions in investment) | Emerging/Investing | Significant | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.