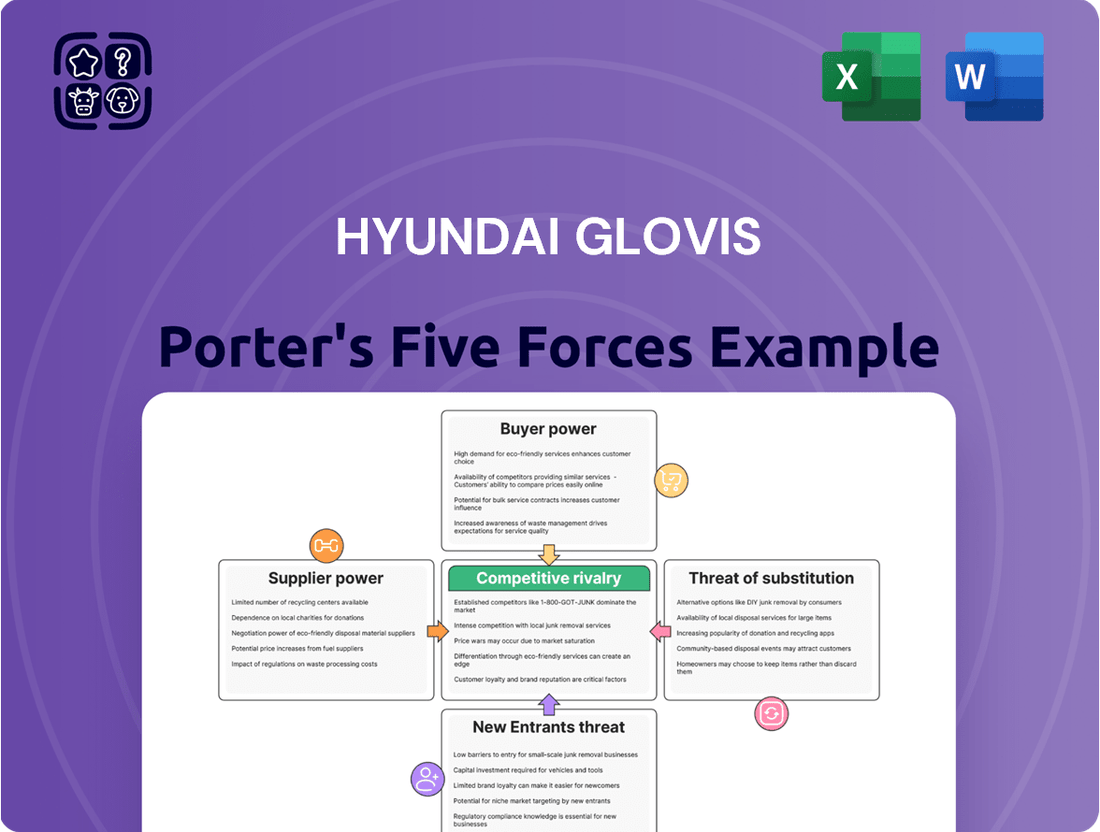

Hyundai Glovis Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Glovis Bundle

Hyundai Glovis navigates a complex logistics landscape, facing moderate bargaining power from buyers and suppliers due to the essential nature of their services. The threat of new entrants is present but tempered by high capital requirements and established relationships within the automotive supply chain.

The competitive rivalry among existing players is intense, driven by price sensitivity and the need for efficient, integrated solutions. Substitute products, such as in-house logistics or alternative transportation modes, pose a growing threat that requires continuous innovation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hyundai Glovis’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hyundai Glovis's dependence on specialized equipment, such as Pure Car and Truck Carriers (PCTCs) and advanced logistics technology, means suppliers in this niche can wield considerable bargaining power. The limited availability of providers for such highly specialized assets, coupled with the substantial costs associated with switching, strengthens their position.

The company's strategic investments underscore this reliance. By 2028, Hyundai Glovis plans to introduce new LNG dual-fuel vessels, and by mid-2026, it aims to deploy autonomous navigation systems for its PCTCs. These forward-looking initiatives highlight a clear dependence on suppliers capable of delivering cutting-edge technological advancements, further amplifying supplier bargaining power.

Hyundai Glovis, as a global logistics and shipping giant, relies heavily on fuel for its vast fleet of vessels and land vehicles. The price of oil, a key input, directly impacts operational costs. For instance, Brent crude oil prices averaged around $82.50 per barrel in early 2024, a significant factor for companies like Hyundai Glovis.

The bargaining power of fuel and energy suppliers is substantial due to the concentrated nature of major oil producers and the inelastic demand for fuel in the logistics sector. Limited alternatives for powering large-scale shipping and transport operations mean suppliers can exert considerable influence on pricing and terms.

Hyundai Glovis's strategic investments in emission reduction technologies and its exploration of alternative energy sources, such as hydrogen, could reshape its future supplier dynamics. By diversifying energy inputs and reducing reliance on traditional fossil fuels, the company aims to mitigate the bargaining power of existing suppliers and secure more favorable long-term energy contracts.

The logistics sector, including companies like Hyundai Glovis, grapples with persistent labor shortages, especially for skilled truck drivers and seasoned seafarers. This scarcity directly amplifies the bargaining power of these workers, potentially driving up wage expectations and operational expenses.

In 2024, the shortage of qualified truck drivers in the US alone was estimated to be around 78,000, a figure that highlights the critical nature of this issue globally. Similarly, the maritime industry faces challenges in attracting and retaining qualified seafarers due to demanding work conditions and global supply chain disruptions. These factors contribute to increased labor costs for logistics providers.

While Hyundai Glovis and others are investing in automation and advanced technologies to reduce reliance on human labor, skilled workers remain indispensable. The ability of these workers to demand better compensation and working conditions directly impacts the cost structure and operational efficiency of logistics giants.

Port and Terminal Operators

Hyundai Glovis relies on a global network of port and terminal operators for its extensive shipping and logistics operations. The bargaining power of these operators can be significant, particularly in locations with few competing facilities or where specific ports provide crucial strategic advantages for Hyundai Glovis's routes.

The concentration of port operators in certain regions, coupled with the specialized infrastructure required for large-scale vehicle and cargo handling, can create a situation where operators hold considerable leverage. For instance, in 2023, global port congestion, such as that seen around the Red Sea, directly impacted shipping schedules and costs, highlighting the influence operators can exert when capacity is strained.

- Limited Alternatives: In some key trading hubs, the number of suitable ports and terminals for specialized cargo like automobiles is limited, giving existing operators more pricing power.

- Strategic Importance: Certain ports offer unique geographical advantages or specialized handling equipment essential for Hyundai Glovis's efficient operations, increasing the operators' leverage.

- Operational Disruptions: Events like port congestion or labor disputes, which were prevalent in various global ports in 2023 and early 2024, can temporarily or permanently shift bargaining power towards operators by increasing demand for available capacity and causing delays.

Maintenance and Repair Service Providers

Hyundai Glovis relies heavily on maintenance and repair service providers for its extensive fleet of vehicles and vessels. The bargaining power of these suppliers can be significant if there's a scarcity of qualified providers for specialized or advanced equipment. For instance, the need for expert maintenance on newer, technologically advanced vessels or custom-built machinery can give these specialized service providers leverage in negotiating prices and contract terms.

The demand for specialized maintenance expertise is likely to grow as Hyundai Glovis continues to invest in new vessels and cutting-edge technologies. This increasing reliance on niche skills can shift the balance of power towards the service providers.

- Limited Specialized Expertise: The availability of providers capable of servicing complex or proprietary equipment is a key factor.

- Cost of Switching: High costs associated with finding and onboarding new, qualified maintenance providers can strengthen existing supplier relationships.

- Supplier Concentration: If only a few firms offer critical maintenance or parts, their bargaining power increases.

- Impact of New Technology: Investments in advanced fleets necessitate specialized maintenance, potentially increasing supplier leverage.

Suppliers of specialized logistics equipment, such as Pure Car and Truck Carriers (PCTCs), hold significant bargaining power due to limited availability and high switching costs for Hyundai Glovis. This is further amplified by Hyundai Glovis's planned investments in advanced technologies like LNG dual-fuel vessels and autonomous navigation systems by 2028 and mid-2026, respectively, which necessitate reliance on suppliers with cutting-edge capabilities.

Fuel and energy suppliers also exert considerable influence, driven by the concentrated nature of oil producers and the inelastic demand for fuel in shipping. Brent crude oil prices averaging around $82.50 per barrel in early 2024 illustrate this impact on operational costs. Hyundai Glovis's diversification into alternative energy sources aims to mitigate this power.

Labor shortages, particularly for skilled truck drivers and seafarers, empower workers in the logistics sector. The estimated shortage of 78,000 truck drivers in the US in 2024 highlights this global challenge, leading to increased wage expectations and operational expenses for companies like Hyundai Glovis, despite automation efforts.

Port and terminal operators can wield substantial bargaining power, especially in regions with limited competing facilities or where specific ports are strategically vital for Hyundai Glovis's routes. Global port congestion, observed in 2023 and early 2024, demonstrated operators' leverage when capacity is strained.

| Factor | Impact on Hyundai Glovis | Supporting Data/Trend (2023-2024) |

| Specialized Equipment Suppliers (e.g., PCTC manufacturers) | High Bargaining Power | Limited providers for advanced vessels and autonomous systems. High switching costs. |

| Fuel & Energy Suppliers | High Bargaining Power | Brent crude oil averaged ~$82.50/barrel in early 2024. Inelastic demand for shipping fuel. |

| Skilled Labor (Drivers, Seafarers) | High Bargaining Power | Estimated 78,000 truck driver shortage in the US (2024). Demanding work conditions in maritime. |

| Port & Terminal Operators | Moderate to High Bargaining Power | Concentration in key hubs. Impact of port congestion (e.g., Red Sea disruptions in 2023) on capacity and costs. |

What is included in the product

This analysis unpacks the competitive forces impacting Hyundai Glovis, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the logistics and automotive supply chain sectors.

Instantly visualize Hyundai Glovis's competitive landscape, identifying key threats and opportunities to strategically mitigate industry pressures.

Customers Bargaining Power

Hyundai Glovis's relationship with its parent company, Hyundai Motor Group, presents a clear case of strong customer bargaining power. As a primary client, Hyundai Motor Group's substantial volume of vehicle logistics needs gives it significant leverage over Hyundai Glovis. This internal dependency means Hyundai Glovis must often align its services and pricing to meet the demands of its largest customer.

In 2023, Hyundai Motor Group accounted for a significant portion of Hyundai Glovis's revenue, underscoring the parent company's influence. This concentration risk is a key factor in the bargaining power of customers. However, Hyundai Glovis is actively working to expand its client portfolio to include external automotive manufacturers. This diversification strategy, if successful, could dilute the bargaining power of any single customer, including Hyundai Motor Group.

Hyundai Glovis's large industrial and manufacturing clients, particularly in sectors like steel and energy, hold considerable bargaining power. These high-volume customers can leverage their scale to demand competitive pricing and tailored logistics services, putting pressure on Glovis's profit margins.

The ability of these clients to switch to alternative logistics providers with relatively low switching costs further amplifies their negotiating leverage. For instance, a major steel producer might negotiate bulk discounts, knowing that other transportation companies can readily accommodate their shipping needs.

Hyundai Glovis faces considerable bargaining power from major used car dealers and large distribution networks within its trading and distribution segment. These entities often command significant market share, allowing them to negotiate aggressively on pricing and terms. For instance, in 2024, the used car market saw continued consolidation, with larger players increasing their influence over wholesale pricing.

The ability of these key buyers to secure favorable deals directly impacts Hyundai Glovis's margins in the used car sector. Their collective demand can sway pricing, and their requirements for vehicle quality and delivery timelines can add operational complexities. This dynamic underscores the importance of strong relationships and competitive offerings for Hyundai Glovis to maintain profitability in this competitive landscape.

E-commerce Businesses and Retailers

The burgeoning e-commerce sector significantly impacts freight forwarding services, with online retailers increasingly demanding speed, reliability, and cost-efficiency. Many e-commerce businesses are seeking integrated logistics solutions that include advanced tracking and diverse delivery options to meet consumer expectations.

While individual e-commerce businesses might have limited individual bargaining power, the collective demand from the sector, especially from large online retailers, can exert considerable pressure on logistics providers like Hyundai Glovis. This can lead to negotiations for volume discounts and customized service agreements.

- E-commerce Growth: Global e-commerce sales are projected to reach $8.1 trillion by 2024, a substantial increase that fuels demand for logistics.

- Customer Demands: Consumers expect fast shipping, often within 1-2 days, and transparent tracking, pushing e-commerce businesses to demand similar service levels from their logistics partners.

- Provider Competition: The competitive landscape for freight forwarding services means that providers must offer attractive pricing and service packages to secure and retain e-commerce clients.

Customers with Low Switching Costs

Customers in the logistics sector, including those served by Hyundai Glovis, typically experience low switching costs. This means they can easily move to another provider if they find better pricing or service. For instance, many core logistics services are quite standardized, making it straightforward for a customer to change vendors without significant disruption or expense.

This low switching cost grants customers substantial bargaining power. They can leverage this by demanding more favorable terms or improved service from Hyundai Glovis, knowing that alternatives are readily available. In 2023, the global logistics market was valued at approximately $10.6 trillion, indicating a highly competitive landscape where customer retention is paramount.

- Low Switching Costs: Standardized logistics services allow customers to change providers with minimal effort or expense.

- Customer Bargaining Power: This ease of switching empowers customers to negotiate better prices and service levels.

- Competitive Landscape: The vast size of the global logistics market (over $10 trillion in 2023) intensifies competition, amplifying customer influence.

- Hyundai Glovis's Strategy: To combat this, Hyundai Glovis must differentiate through superior service quality, unwavering reliability, and unique value-added solutions to secure customer loyalty.

Hyundai Glovis faces significant customer bargaining power, particularly from its parent company, Hyundai Motor Group, which represents a substantial portion of its revenue. This internal reliance means Glovis often adapts to its largest client's demands. Furthermore, large industrial clients in sectors like steel and energy, along with major used car dealers and distribution networks, wield considerable influence due to their volume and ability to switch providers easily.

| Customer Segment | Bargaining Power Factors | Impact on Hyundai Glovis |

|---|---|---|

| Hyundai Motor Group | High volume, internal relationship | Pricing pressure, service alignment |

| Large Industrial Clients (Steel, Energy) | High volume, standardized needs | Price negotiation, demand for tailored services |

| Major Used Car Dealers/Distributors | Market share, volume purchasing | Aggressive pricing, quality/delivery demands |

| E-commerce Sector (Collective) | Growing demand, expectation for speed/reliability | Volume discounts, customized agreements |

Same Document Delivered

Hyundai Glovis Porter's Five Forces Analysis

This preview shows the exact Hyundai Glovis Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the automotive logistics sector. You'll gain a comprehensive understanding of the strategic forces shaping Hyundai Glovis's market position without any surprises or placeholders. This professionally formatted document is ready for your immediate use and strategic planning.

Rivalry Among Competitors

The logistics sector is incredibly crowded, featuring a vast array of global and regional companies, which naturally fuels fierce competition. This saturation means Hyundai Glovis faces constant pressure from established giants and agile regional specialists alike.

Major global players such as DHL Global Forwarding, Kuehne + Nagel, DSV Global Transports and Logistics, DB Schenker, and Bollore Logistics command substantial market shares. Their extensive networks and resources create a challenging landscape for Hyundai Glovis, demanding continuous innovation and efficiency to remain competitive.

This fragmented market often drives competition primarily through pricing strategies and the quality of services offered. Companies are constantly vying to offer the most cost-effective solutions and superior customer experiences to attract and retain business.

The core logistics services, like moving goods from point A to point B or storing them, are often seen as very similar across different providers. This lack of uniqueness means companies often compete primarily on price, which can squeeze profit margins. For instance, in 2023, the global freight forwarding market saw intense price competition, with many smaller players struggling to gain market share against larger, more established entities.

This commodity-like nature of basic logistics makes it tough for companies like Hyundai Glovis to truly differentiate themselves. Customers might not perceive significant differences in the fundamental service, leading them to choose the cheapest option. This was evident in the contract logistics sector, where many bids in 2024 were won by the lowest-cost provider, even for substantial contracts.

To overcome this, Hyundai Glovis needs to consistently develop and offer specialized services that go beyond standard transportation and warehousing. Think about advanced tracking systems, customized supply chain solutions, or integrated technology platforms. Companies that successfully introduce these value-added elements in 2024, such as those focusing on cold chain logistics or last-mile delivery optimization, have been able to command higher prices and build stronger customer loyalty.

The logistics sector, including companies like Hyundai Glovis, is characterized by substantial fixed costs tied to expensive assets such as ships, trucks, and warehousing facilities. These investments necessitate high utilization rates to achieve profitability and spread costs effectively.

This pressure to maximize asset usage often fuels intense competition for freight volume. Companies may engage in aggressive pricing strategies to secure contracts and keep their fleets and warehouses busy, particularly when the market experiences overcapacity or a slowdown in demand.

For instance, in 2024, the global shipping industry continued to grapple with the aftermath of pandemic-induced demand fluctuations and the subsequent delivery of new vessel orders, leading to periods of oversupply on key trade routes. This environment directly pressures logistics providers like Hyundai Glovis to compete fiercely on price and service to ensure their high fixed costs are covered, thereby intensifying competitive rivalry.

Technological Advancements and Digitalization

The logistics sector is experiencing a significant shake-up due to rapid technological advancements and increased digitalization. Companies embracing innovations like AI, automation, and real-time data analytics are carving out substantial competitive advantages. For instance, Hyundai Glovis's investment in an AI-driven self-sailing car carrier fleet and advanced emission reduction systems highlights this trend, positioning them to operate more efficiently and sustainably.

This technological race means competitors are compelled to continuously upgrade their own systems to remain competitive. The pressure to innovate is constant, as falling behind on technological adoption can quickly lead to a loss of market share. In 2024, the global logistics market's growth is heavily influenced by these digital transformations, with companies prioritizing investments in smart warehousing and predictive analytics to optimize supply chains.

- AI and Automation: Hyundai Glovis is deploying AI for route optimization and predictive maintenance, aiming to reduce operational costs by an estimated 15% by 2025.

- Digitalization of Services: The company has digitized over 90% of its customer interactions, streamlining processes and improving response times.

- Emission Reduction Technologies: Investments in technologies to cut emissions align with global sustainability goals and are becoming a key differentiator in the industry.

- Data Analytics: Real-time data analytics are crucial for managing complex global supply chains, allowing for quicker adjustments to disruptions.

Geopolitical Risks and Economic Volatility

Geopolitical risks and economic slowdowns directly affect trade volumes and supply chain stability, escalating competitive rivalry. Companies like Hyundai Glovis must navigate these uncertainties as they contend for market share in a more volatile environment.

Recent events, such as the ongoing impacts of the Israel-Gaza conflict and disruptions to Red Sea shipping routes, highlight how external geopolitical factors can create significant operational challenges. These disruptions force companies to compete more intensely for limited or delayed shipping capacity, driving up competition for available business.

- Trade Volume Impact: Global trade volumes saw a modest increase in 2023, but forecasts for 2024 suggest continued vulnerability to geopolitical shocks, potentially dampening growth and intensifying competition.

- Supply Chain Disruptions: The cost of shipping containers, a key indicator of supply chain efficiency, experienced significant spikes in late 2023 and early 2024 due to rerouting around conflict zones, increasing operational costs and competitive pressure.

- Market Uncertainty: Economic slowdowns in major markets can reduce demand for goods, leading to overcapacity in shipping and logistics, thereby heightening rivalry among service providers.

The logistics industry is intensely competitive, with numerous global and regional players vying for market share. Hyundai Glovis faces pressure from established giants like DHL and Kuehne + Nagel, as well as specialized regional providers, leading to a constant need for efficiency and innovation. This competition often centers on pricing and service quality, as basic logistics services are frequently perceived as commodities.

Companies must manage high fixed costs associated with assets like ships and warehouses, driving a need for high utilization rates. This can lead to aggressive pricing to secure freight volume, especially during market overcapacity. For example, the global shipping industry in 2024 saw periods of oversupply on key routes, intensifying price competition.

| Competitor Type | Example | Impact on Hyundai Glovis |

|---|---|---|

| Global Logistics Giants | DHL Global Forwarding, Kuehne + Nagel | Intense price and service competition, pressure on market share. |

| Regional Specialists | Various smaller, agile firms | Targeted competition in specific markets, innovation pressure. |

| Technology-Driven Competitors | Firms investing in AI, automation | Need for continuous technological investment to maintain efficiency and service levels. |

SSubstitutes Threaten

Large manufacturing companies, particularly automotive original equipment manufacturers (OEMs), are increasingly considering bringing their logistics operations in-house. This trend represents a significant substitute threat to third-party logistics (3PL) providers like Hyundai Glovis. For instance, in 2024, several major automotive players were reportedly evaluating or implementing internal logistics solutions to gain more direct oversight and potentially reduce costs.

This move towards vertical integration in logistics is driven by a desire for enhanced supply chain control and the pursuit of cost efficiencies. Companies are analyzing whether the capital investment in their own logistics infrastructure and personnel can yield greater long-term savings and operational flexibility compared to relying on external providers. This strategic shift can directly impact the market share and revenue streams of established 3PL companies.

A significant threat to Hyundai Glovis arises from potential modal shifts in transportation. If customers increasingly favor one mode over another due to cost, speed, or environmental considerations, it could disrupt existing business models. For instance, a major pivot towards air freight for time-sensitive cargo, or a surge in rail usage for long-distance domestic shipping, could directly impact Hyundai Glovis's market share in those specific segments.

In 2024, the global logistics market continued to see evolving preferences. While ocean freight remains dominant for bulk goods, the demand for faster delivery options is growing, potentially benefiting air cargo. Furthermore, sustainability initiatives are pushing for more efficient land-based solutions, like rail, for certain routes, presenting both challenges and opportunities for diversified logistics providers like Hyundai Glovis.

The emergence of digital freight marketplaces poses a significant threat of substitution to traditional freight forwarding services like those offered by Hyundai Glovis. These platforms, such as Freightos and Convoy, directly connect shippers with carriers, often bypassing intermediaries. For instance, by mid-2024, Freightos reported a substantial increase in booking volumes on its platform, indicating a growing preference for digital solutions.

These digital alternatives frequently provide enhanced transparency, real-time tracking, and competitive pricing, making them attractive substitutes. Companies can leverage these platforms for more efficient logistics management, potentially reducing reliance on traditional freight forwarders. This disintermediation trend directly challenges the established business models of companies like Hyundai Glovis.

Direct-to-Consumer (D2C) Shipping Models

The rise of direct-to-consumer (D2C) shipping models presents a significant threat of substitutes for traditional logistics providers like Hyundai Glovis. As more companies bypass intermediaries and manage their own last-mile deliveries, they reduce their dependence on large, integrated logistics networks for certain segments of their operations. This shift is particularly noticeable in sectors experiencing rapid e-commerce expansion.

For instance, the growth in online retail has fueled the development of specialized last-mile delivery solutions and localized delivery fleets by businesses themselves. This trend can fragment the market for logistics services, as companies may opt for niche providers or in-house capabilities over comprehensive logistics partners for specific shipping needs. In 2024, the global D2C e-commerce market was projected to reach over $700 billion, indicating a substantial volume of goods potentially handled outside traditional logistics channels.

This evolution impacts companies like Hyundai Glovis by potentially reducing the volume of certain types of shipments they handle. The ability of businesses to manage their own deliveries, especially for high-volume, geographically concentrated customer bases, offers a viable alternative to outsourcing. This necessitates that logistics providers adapt their service offerings to remain competitive in this evolving landscape.

Key implications of this trend include:

- Increased competition from specialized last-mile delivery providers.

- Potential for reduced market share in specific shipping segments.

- Need for logistics companies to offer more flexible and customized solutions.

- Growing importance of technology adoption for efficient last-mile operations.

Technological Advancements Enabling Self-Management

Technological advancements are increasingly enabling companies to take greater control of their own logistics. Sophisticated supply chain management software, coupled with AI-driven forecasting and real-time visibility tools, empowers businesses to optimize their operations internally. For instance, in 2024, the global supply chain management software market was valued at approximately $25 billion, with a projected compound annual growth rate (CAGR) of over 10% through 2030, indicating a strong trend towards self-management capabilities.

While Hyundai Glovis provides comprehensive third-party logistics (3PL) solutions, the growing accessibility and enhanced capabilities of these internal management tools present a potential substitute. As more firms develop in-house expertise and leverage advanced technology, the reliance on external providers for end-to-end logistics management may diminish for certain segments of their client base. This shift could lead some clients to insource aspects of their supply chain, thereby reducing the demand for Hyundai Glovis's integrated services.

- Technological Empowerment: Advances in AI, real-time tracking, and advanced analytics allow companies to manage logistics internally.

- Market Growth: The supply chain management software market is expanding rapidly, with significant investment in self-service technologies.

- Client Insourcing: Increased client capability to manage their own supply chains reduces the perceived necessity of comprehensive 3PL services.

- Competitive Pressure: The availability of sophisticated internal tools creates a substitute threat for traditional 3PL providers like Hyundai Glovis.

The threat of substitutes for Hyundai Glovis is significant, stemming from both technological advancements and evolving business strategies. Companies are increasingly bringing logistics in-house, driven by a desire for greater control and cost savings, as seen in the robust growth of the supply chain management software market, valued at approximately $25 billion in 2024. Digital freight marketplaces also offer a direct alternative, bypassing intermediaries and providing enhanced transparency, with platforms like Freightos experiencing substantial booking volume increases by mid-2024. Furthermore, the rise of direct-to-consumer (D2C) shipping models, supported by a global D2C e-commerce market projected to exceed $700 billion in 2024, allows businesses to manage their own deliveries, fragmenting the market for traditional 3PL providers.

| Substitute Type | Description | 2024 Market Indicator | Impact on Hyundai Glovis |

|---|---|---|---|

| In-house Logistics | OEMs bringing logistics operations in-house for control and cost reduction. | Several major automotive players evaluating/implementing internal logistics. | Potential reduction in outsourced logistics volume. |

| Digital Freight Marketplaces | Online platforms directly connecting shippers with carriers. | Freightos reported substantial booking volume increase by mid-2024. | Disintermediation of traditional freight forwarding services. |

| Direct-to-Consumer (D2C) Shipping | Companies managing their own last-mile deliveries. | Global D2C e-commerce market projected to exceed $700 billion in 2024. | Fragmentation of logistics market, reduced reliance on integrated 3PLs. |

| Advanced SCM Software | Empowering companies to manage logistics internally with technology. | SCM software market valued at ~$25 billion in 2024, with >10% CAGR. | Reduced perceived necessity of comprehensive 3PL services for some clients. |

Entrants Threaten

The general logistics and freight forwarding market often presents relatively low barriers to entry for fundamental services, especially in road freight and localized warehousing. This accessibility permits new, smaller companies to surface, frequently utilizing technology or specialized offerings to capture market share. For instance, in 2023, the global logistics market was valued at approximately $9.7 trillion, with a significant portion attributed to less capital-intensive segments.

New entrants are increasingly utilizing advanced technologies like AI and blockchain to build asset-light logistics models. These startups can bypass the capital-intensive nature of traditional players by focusing on digital platforms and optimization, offering agile and cost-effective solutions that challenge established players.

New entrants can carve out a competitive space by concentrating on specialized logistics niches, such as cold chain management for sensitive goods or focusing on specific, underserved regional transportation routes. This allows them to develop deep expertise and offer highly tailored solutions, directly appealing to clients who may find larger, more generalized providers less adaptable. For instance, in 2024, the global cold chain logistics market was valued at over $200 billion, with specialized segments showing robust growth, indicating opportunities for focused new players.

Investment in Logistics Infrastructure by Non-Logistics Companies

Large e-commerce players and major manufacturers are increasingly building their own logistics networks. For instance, Amazon's substantial investment in its own delivery fleet and fulfillment centers directly impacts the demand for third-party logistics services. This vertical integration by non-logistics companies can significantly reduce the market share available for traditional logistics providers like Hyundai Glovis.

These companies are motivated by a desire for greater control over their supply chains, aiming for enhanced efficiency and cost savings. By managing their own warehousing and transportation, they can optimize delivery times and customer experiences. This trend was evident in 2024, with continued significant capital expenditure by major retailers on logistics infrastructure.

- E-commerce Dominance: Companies like Amazon continue to expand their logistics capabilities, aiming to control the entire customer journey from purchase to doorstep.

- Manufacturing Vertical Integration: Large manufacturers are also investing in logistics to streamline their operations and reduce reliance on external providers.

- Efficiency and Cost Control: The primary drivers for this trend are the pursuit of greater operational efficiency and the reduction of logistics costs.

- Market Share Reduction: This vertical integration directly shrinks the addressable market for third-party logistics providers.

Regulatory Changes and Government Support

Favorable government policies, such as subsidies for electric vehicle adoption or investments in green logistics infrastructure, could significantly lower the barrier to entry for new competitors in the automotive logistics sector. For instance, South Korea's commitment to carbon neutrality by 2050, as outlined in its Green New Deal, incentivizes companies to develop sustainable logistics solutions. This can attract new players focused on eco-friendly transportation, potentially disrupting established players like Hyundai Glovis.

Changes in trade agreements or the implementation of new regulations, like stricter emissions standards, can also influence the threat of new entrants. While stringent rules can be a barrier, government support for innovative technologies, such as autonomous driving or advanced tracking systems, can empower new companies to enter the market with competitive advantages. For example, the EU's push for decarbonization in transport directly supports the entry of logistics firms specializing in low-emission fleets.

- Government support for green logistics technologies can lower entry barriers.

- Changes in environmental regulations may favor new, technologically advanced entrants.

- Trade policy shifts can impact the cost structure for new market participants.

The threat of new entrants for Hyundai Glovis remains moderate, primarily due to the capital-intensive nature of automotive logistics and the specialized expertise required. However, technological advancements and shifts towards asset-light models are lowering some traditional barriers. For example, the global automotive logistics market is projected to reach over $200 billion by 2027, indicating substantial growth potential that could attract new, agile players.

New entrants are leveraging digital platforms and specialized services to gain a foothold, bypassing the need for extensive physical assets. This is particularly evident in niche areas like electric vehicle logistics and the handling of advanced automotive components. In 2024, venture capital funding for logistics technology startups continued to be robust, signaling ongoing innovation and potential new competition.

Furthermore, large e-commerce companies and major manufacturers increasingly integrating their own logistics operations present a significant indirect threat. For instance, Amazon's expansion into broader logistics services in 2023 and 2024 directly impacts the available market for third-party providers. This vertical integration by non-logistics giants can reshape market dynamics and reduce opportunities for traditional players like Hyundai Glovis.

Government incentives for green logistics and new regulatory frameworks can also influence entry barriers, potentially favoring new entrants with innovative, sustainable solutions. South Korea's focus on carbon neutrality by 2050, for example, encourages the development of eco-friendly transportation, which could attract specialized new companies.

| Factor | Impact on New Entrants | Hyundai Glovis Relevance |

|---|---|---|

| Capital Intensity | High barrier for traditional asset-heavy models | Requires significant investment to compete directly |

| Technological Advancements | Lowering barriers through asset-light models | Potential for agile, tech-focused competitors |

| Specialized Niches | Opportunity in areas like EV logistics | Requires focus and tailored solutions |

| Vertical Integration by Clients | Shrinks addressable market for 3PL providers | Direct competition from large customers |

| Government Policies | Can lower or raise entry barriers (e.g., green tech) | May favor new entrants with sustainable solutions |

Porter's Five Forces Analysis Data Sources

Our Hyundai Glovis Porter's Five Forces analysis is built upon a foundation of reliable data, including Hyundai Glovis's annual reports, industry-specific market research from firms like IHS Markit, and publicly available financial data from sources such as Bloomberg and S&P Capital IQ.