Hyundai Glovis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Glovis Bundle

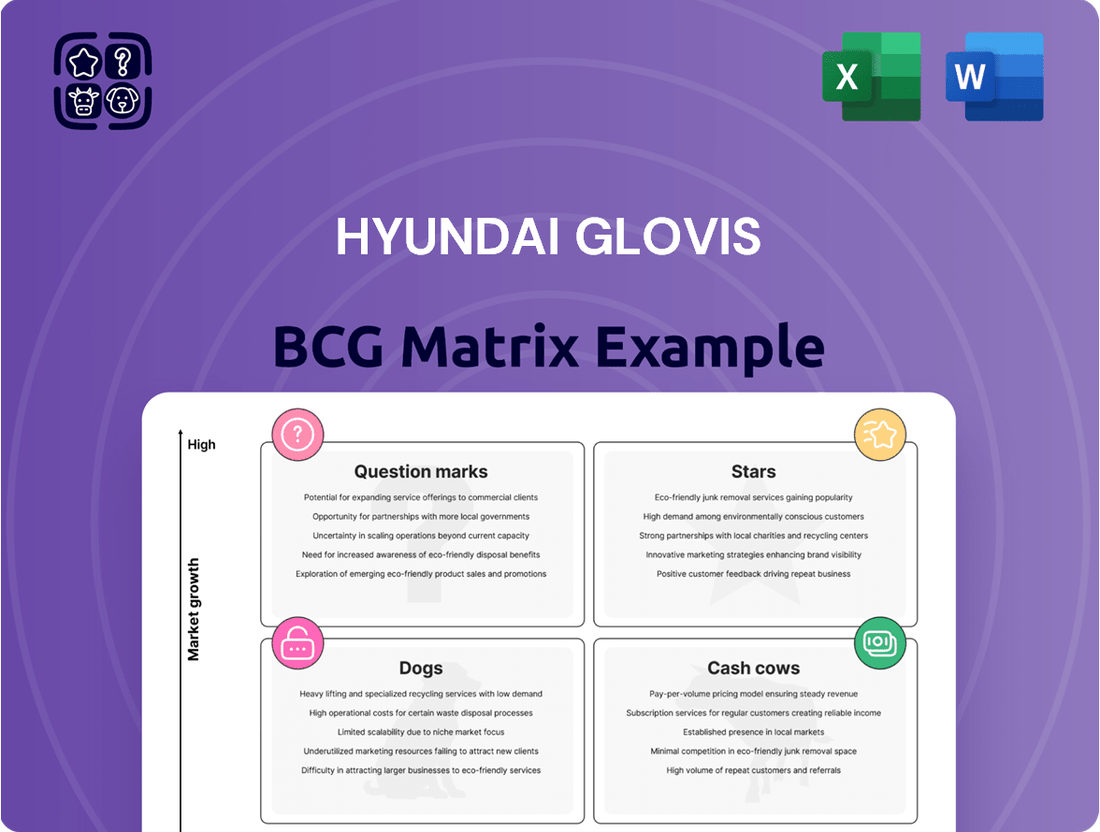

Hyundai Glovis's BCG Matrix offers a crucial snapshot of its product portfolio's market share and growth potential. Understand which segments are driving revenue and which require strategic re-evaluation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Hyundai Glovis.

Stars

Hyundai Glovis's Finished Vehicle Ocean Transportation segment, utilizing Pure Car and Truck Carriers (PCTCs), is a clear star in its business portfolio. This segment is experiencing robust growth, fueled by strong demand and strategic fleet expansion. In 2024, the company continued to benefit from renewed contracts and elevated freight rates, which significantly boosted its revenue from this sector.

The company's commitment to expanding its PCTC fleet underscores its leadership position. Hyundai Glovis has been making substantial investments in new vessels, aiming to capture a larger share of the global finished vehicle shipping market. This aggressive expansion strategy is a testament to the high market demand and the segment's strong performance, contributing significantly to overall company revenue.

The overseas finished vehicle and CKD logistics segment for Hyundai Glovis is a star performer. This division, which handles the shipping of completed cars and the movement of parts for vehicles assembled abroad, is experiencing significant expansion.

This robust growth is directly linked to higher production output from Hyundai's international manufacturing facilities and a surge in business from companies outside of the Hyundai group. For instance, in 2023, Hyundai Glovis reported a substantial increase in its finished vehicle logistics volume, driven by these factors.

Looking ahead, Hyundai Glovis anticipates this trend to continue, projecting further growth in export volumes for this segment. This positions the overseas finished vehicle and CKD logistics as a key business unit characterized by both high market share and strong growth potential.

Hyundai Glovis is making substantial investments in smart logistics solutions, aiming to lead in this high-growth sector. Their development includes autonomous drones for inventory management and broader digital transformation efforts. This focus on automation and advanced data analytics signals a strong commitment to future-oriented logistics.

Hydrogen Logistics (HTWO Logistics)

Hydrogen Logistics (HTWO Logistics) represents a significant growth opportunity for Hyundai Glovis within the expanding clean transportation sector. This joint venture is actively developing hydrogen fuel cell truck solutions, targeting a market poised for substantial expansion. Hyundai Glovis's deployment of these trucks for inbound logistics at new electric vehicle (EV) plants underscores a deliberate strategy to integrate hydrogen into its core operations and the broader automotive supply chain.

The company's commitment to the hydrogen economy is evident in its efforts to build a comprehensive hydrogen value chain. This forward-thinking approach positions HTWO Logistics as a key player in an innovative and rapidly evolving industry. For instance, by 2024, the global hydrogen fuel cell market was projected to reach $13.4 billion, with commercial vehicles being a major driver of this growth. HTWO Logistics's focus aligns directly with this trend.

- Market Growth: The hydrogen fuel cell vehicle market, particularly for commercial transport, is experiencing accelerated growth driven by environmental regulations and corporate sustainability goals.

- Strategic Integration: Hyundai Glovis's use of HTWO Logistics trucks for EV plant logistics demonstrates a practical application and a commitment to a holistic hydrogen ecosystem.

- Innovation Focus: This venture places Hyundai Glovis at the forefront of sustainable logistics, leveraging cutting-edge technology to reduce carbon emissions in transportation.

- Future Potential: As the hydrogen infrastructure develops and fuel cell technology matures, HTWO Logistics is well-positioned to capture significant market share in clean freight solutions.

Air Cargo Logistics Expansion

Hyundai Glovis is strategically expanding its air cargo logistics capabilities, a move that positions it as a star in the BCG matrix. This expansion is driven by significant investments, including its acquisition of a stake in Asiana Airlines' cargo division. This move directly targets the high-growth air logistics sector, aiming to bolster Glovis's overall competitive edge in transportation and diversify its infrastructure.

The company's commitment to this sector is further underscored by the establishment of a Global Distribution Center at Incheon International Airport. This facility is designed to support its ambitious push into the air cargo market, a segment demonstrating substantial potential for future growth. For instance, global air cargo volumes saw a notable increase in 2023, with many regions experiencing renewed demand, painting a positive outlook for players like Hyundai Glovis.

- Strategic Investment: Acquisition of a stake in Asiana Airlines' cargo division.

- Market Focus: Targeting the high-growth air logistics sector.

- Infrastructure Development: Establishment of a Global Distribution Center at Incheon International Airport.

- Competitive Enhancement: Aiming to diversify transportation and boost overall logistics competitiveness.

Hyundai Glovis's Finished Vehicle Ocean Transportation, overseas finished vehicle and CKD logistics, and air cargo logistics all represent strong Star segments. These areas are characterized by high growth and significant market share, driven by increasing global vehicle production and demand for efficient supply chain solutions. The company's strategic investments in fleet expansion, smart logistics, and air cargo infrastructure solidify their positions as leaders.

Hydrogen Logistics (HTWO Logistics) is also a burgeoning Star, tapping into the rapidly expanding clean transportation market. The company's proactive development of hydrogen fuel cell truck solutions and integration into its core operations, particularly for EV plant logistics, positions it for substantial future growth. The global hydrogen fuel cell market's projected expansion further validates this segment's Star status.

| Segment | Market Growth | Market Share | Key Drivers | 2024 Outlook |

|---|---|---|---|---|

| Finished Vehicle Ocean Transportation | High | High | Global vehicle demand, fleet expansion | Continued strong freight rates, contract renewals |

| Overseas Finished Vehicle & CKD Logistics | High | High | International production, increased third-party business | Projected further export volume growth |

| Air Cargo Logistics | High | Growing | Strategic investments, airport infrastructure | Increased global air cargo volumes |

| Hydrogen Logistics (HTWO Logistics) | Very High | Emerging | Clean transportation demand, government incentives | Significant expansion in hydrogen value chain |

What is included in the product

This BCG Matrix overview highlights Hyundai Glovis' strategic positioning, identifying units for investment, divestment, or maintenance.

The Hyundai Glovis BCG Matrix offers a clear, one-page overview to identify and address underperforming business units, alleviating the pain of strategic uncertainty.

Cash Cows

Complete Knock Down (CKD) Parts Supply is a cornerstone of Hyundai Glovis's operations, acting as a reliable cash cow. This segment, a mature but vital part of their distribution network, consistently generates substantial revenue, underpinning the company's financial stability. Its strength lies in its established infrastructure and deep integration with the Hyundai Motor Group, ensuring a steady demand for its services.

In 2024, the CKD parts supply business continued to be a significant revenue driver for Hyundai Glovis. While not experiencing explosive growth, its consistent performance reflects its mature market position. This segment’s efficiency in supporting overseas assembly operations translates directly into predictable and robust cash flow, solidifying its status as a cash cow within the company’s portfolio.

Hyundai Glovis's domestic logistics services, covering transportation, storage, and unloading within Korea, are a cornerstone of its operations. This segment operates in a mature market, where Hyundai Glovis has solidified a robust and enduring presence.

These services consistently generate substantial revenue and operating profit, functioning as a reliable source of cash for the company. For instance, in 2023, Hyundai Glovis reported a significant portion of its revenue derived from its domestic logistics operations, underscoring its stability.

Ongoing investments in domestic infrastructure are strategically designed to enhance operational efficiency. This focus on improvement is crucial for sustaining and potentially increasing the strong cash flow generated by these mature business lines.

Hyundai Glovis’s used car auction market in Korea is a prime example of a Cash Cow within its business portfolio. This segment holds the largest share in a mature domestic market, demonstrating a stable and predictable revenue stream.

The company’s extensive infrastructure and deep network of dealers are key to its consistent profitability. Despite low growth potential, this established operation reliably generates strong cash flow, supporting other ventures.

In 2023, Hyundai Glovis's used car auction volume reached approximately 1.2 million units, with the company consistently handling over 50% of the total domestic auction market, underscoring its dominant and cash-generating position.

General Cargo Transportation and Distribution

Hyundai Glovis's general cargo transportation and distribution services form a cornerstone of its business, catering to vital sectors like steel and energy. This segment operates within a mature market, meaning it's not experiencing rapid expansion but offers consistent revenue streams. It’s a dependable contributor to the company's financial health.

This stable performance is crucial for Hyundai Glovis, as it underpins their broader integrated supply chain solutions. While growth might be modest, the sheer volume and essential nature of these services ensure their ongoing profitability and market relevance. For example, in 2023, Hyundai Glovis reported total revenue of approximately 21.6 trillion KRW, with logistics services, including general cargo, forming a significant portion of this figure.

- Core Business: The provision of general cargo transportation and distribution is a foundational service for Hyundai Glovis.

- Market Position: Operates in a mature market, ensuring stable demand and consistent revenue generation.

- Financial Contribution: This segment reliably contributes to the company's overall profitability and revenue.

- Strategic Importance: Acts as a critical component of Hyundai Glovis's integrated supply chain management offerings.

Traditional Warehousing and Storage Solutions

Hyundai Glovis's traditional warehousing and storage solutions are a cornerstone of its integrated supply chain offerings, serving as a reliable cash cow. These services are fundamental to numerous industries, ensuring the secure and efficient handling of goods. In 2023, the global third-party logistics (3PL) market, which heavily relies on warehousing, was valued at approximately $1.3 trillion, with warehousing being a significant component.

This segment benefits from consistent demand, acting as a stable income generator for Hyundai Glovis. Given its established nature and essential function within logistics, it typically operates in a mature market. This maturity translates to predictable revenue streams, making it a vital contributor to the company's financial stability.

- Established Market Presence: Hyundai Glovis has a long-standing reputation and infrastructure in traditional warehousing.

- Consistent Revenue: The essential nature of storage and warehousing ensures a steady demand and predictable income.

- Mature Market Dynamics: Operating in a developed sector provides a stable, albeit potentially slower, growth environment.

- Foundation for Integrated Services: Warehousing acts as a critical node supporting Hyundai Glovis's broader logistics solutions.

Hyundai Glovis's domestic logistics services, including transportation and storage, consistently generate substantial revenue and operating profit, acting as a reliable source of cash. This segment's efficiency in supporting domestic operations translates into predictable and robust cash flow, solidifying its status as a cash cow.

The used car auction market in Korea is another prime example of a cash cow, holding the largest share in a mature domestic market with a stable and predictable revenue stream. Its extensive infrastructure and dealer network ensure consistent profitability, reliably generating strong cash flow despite low growth potential.

General cargo transportation and distribution, serving vital sectors like steel and energy, also contributes as a cash cow. While operating in a mature market with modest growth, the sheer volume and essential nature of these services ensure ongoing profitability and market relevance.

Traditional warehousing and storage solutions are fundamental to Hyundai Glovis's integrated supply chain, acting as a reliable cash cow due to consistent demand and established market presence. This segment benefits from predictable revenue streams, making it a vital contributor to the company's financial stability.

| Business Segment | BCG Category | 2023 Revenue Contribution (Approx.) | Market Maturity | Cash Flow Generation |

|---|---|---|---|---|

| CKD Parts Supply | Cash Cow | Significant | Mature | High & Stable |

| Domestic Logistics (Transport & Storage) | Cash Cow | Significant | Mature | High & Stable |

| Used Car Auction (Korea) | Cash Cow | Significant | Mature | High & Stable |

| General Cargo Transportation | Cash Cow | Significant | Mature | High & Stable |

| Warehousing & Storage | Cash Cow | Significant | Mature | High & Stable |

What You See Is What You Get

Hyundai Glovis BCG Matrix

The Hyundai Glovis BCG Matrix preview you are currently viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations – just the complete, analysis-ready document designed for strategic decision-making.

Rest assured, the Hyundai Glovis BCG Matrix you see here is the exact file that will be delivered to you upon completing your purchase. It's a professionally crafted report, ready for immediate integration into your business strategy or presentations, ensuring you get precisely what you expect.

What you are previewing is the actual Hyundai Glovis BCG Matrix document that will be yours after purchase. Upon buying, you gain access to the complete, unedited version, allowing you to instantly utilize its insights for your strategic planning and competitive analysis.

The Hyundai Glovis BCG Matrix report you are reviewing is the genuine article you will receive once your purchase is confirmed. This isn't a mockup; it's a professionally designed, data-rich file ready for download and immediate application in your business initiatives.

Dogs

As global markets stabilize, Hyundai Glovis is observing a dip in sales for less specialized air and sea freight forwarding. This suggests these non-core services face slower growth and tougher competition, potentially becoming less profitable for the company.

These commoditized services, if they aren't directly linked to high-growth industries or providing distinct advantages, could turn into financial burdens. Hyundai Glovis is likely re-evaluating its commitment to these areas, possibly reducing investment or divesting from them to concentrate on more promising ventures.

Hyundai Glovis's logistics operations, particularly those involving critical shipping lanes like the Red Sea, have been significantly disrupted by ongoing geopolitical tensions. These disruptions have led to increased transit times and higher operating costs, impacting profitability. For instance, the rerouting of vessels around the Cape of Good Hope instead of the Suez Canal adds considerable time and expense to voyages, directly affecting the efficiency of their global supply chain network.

Hyundai Glovis' domestic used car trading volumes have experienced a downturn. This segment saw a profit decline in Q1 2024, driven by reduced sales. If this trend continues without strong offsetting growth from other business units, it positions the Korean used car market within the BCG Matrix as a potential 'Dog' due to its low growth and potential for declining returns.

Outdated or Inefficient Legacy IT Systems

Outdated or inefficient legacy IT systems at Hyundai Glovis, those not yet integrated into their smart logistics initiatives, would likely fall into the Dogs category of the BCG Matrix. These systems, while perhaps functional, represent a drain on resources due to ongoing maintenance costs and can impede overall operational efficiency.

For instance, if a significant portion of Hyundai Glovis's fleet management or warehouse operations still relies on older, non-integrated software, it hinders the real-time data flow crucial for their smart logistics. This lack of modernization means these systems are not contributing to growth or offering a competitive edge.

- Legacy Systems as Dogs: IT infrastructure not updated within smart logistics initiatives.

- Resource Drain: High maintenance costs and operational inefficiencies.

- Hindered Growth: Lack of modern capabilities preventing competitive advantage.

- Digital Transformation Focus: Hyundai Glovis's ongoing investment to phase out these inefficiencies.

Over-reliance on Affiliated Business in Stagnant Areas

Segments within Hyundai Glovis that are heavily reliant on affiliated business within stagnant or declining sub-markets, without significant diversification, could be classified as Dogs in a BCG matrix. This over-dependence limits growth potential and exposes the company to the risks of those specific, underperforming sectors.

For instance, if a particular logistics segment primarily serves the automotive sector, and that sector is experiencing a downturn, the segment's performance will directly suffer. Hyundai Glovis's reported strategy to increase non-affiliated client revenue, aiming for a more balanced business portfolio, directly addresses this potential weakness.

- Over-reliance on Affiliated Business: Segments solely dependent on Hyundai Motor Group's internal demand in declining automotive sub-markets.

- Stagnant Market Exposure: Lack of diversification into growing or stable non-automotive logistics sectors.

- Strategic Shift: Hyundai Glovis's stated goal to boost non-affiliated client business to mitigate Dog characteristics.

Hyundai Glovis's domestic used car trading segment, which saw a profit decline in Q1 2024 due to reduced sales, exemplifies a 'Dog' in the BCG matrix. This indicates low market growth and potentially declining returns.

Similarly, legacy IT systems not integrated into their smart logistics initiatives represent Dogs, as they incur high maintenance costs and hinder efficiency without offering a competitive edge. Hyundai Glovis's investment in digital transformation aims to phase out these inefficiencies.

Business segments overly dependent on stagnant or declining sub-markets, like those solely serving the automotive sector during a downturn, also fall into the Dog category. Hyundai Glovis's strategy to increase non-affiliated client revenue is a direct response to this risk.

Question Marks

Autobell Global, Hyundai Glovis's burgeoning B2C used car platform, is positioned as a Question Mark in the BCG matrix. The company is aggressively pursuing international expansion, targeting markets with a strong appetite for Korean used vehicles, a segment experiencing significant growth.

While the market potential is substantial, Autobell Global faces the challenge of carving out market share against established competitors and building a reputation for reliability in the online used car space. This necessitates considerable investment to gain traction and achieve scalability.

Hyundai Glovis' battery recycling business is positioned as a Question Mark in the BCG Matrix, representing a new and promising growth avenue fueled by the electric vehicle (EV) surge. The company is dedicating strategic capital to this emerging sector.

As a relatively new entrant, the business likely commands a small market share. Significant investment is necessary to build the necessary infrastructure and secure a competitive position in this rapidly expanding market. For instance, the global battery recycling market was valued at approximately USD 1.5 billion in 2023 and is projected to reach over USD 10 billion by 2030, indicating substantial growth potential.

Hyundai Glovis's entry into the LNG transport business with its first LNG carrier in 2023 marks a strategic move into the burgeoning eco-friendly energy sector. This expansion aligns with the global shift towards cleaner energy, a trend expected to drive significant growth in LNG demand. For instance, the International Energy Agency projected global LNG demand to reach 700 billion cubic meters by 2024, highlighting the market's potential.

As a relatively new entrant, Hyundai Glovis faces the challenge of establishing a strong market presence in a competitive landscape. Significant capital investment will be crucial for securing long-term contracts and expanding its fleet to effectively compete with established players. This positions the LNG transport business as a potential 'Question Mark' in the BCG matrix, requiring careful strategic investment to capture market share.

New Non-Affiliate Shipping Contracts (e.g., Chinese Automakers)

Hyundai Glovis is actively pursuing new shipping contracts with non-affiliated automakers, especially those from China. This strategy aims to broaden its customer portfolio and reduce exposure to potential U.S. import tariffs. The company sees significant growth opportunities in this area, even though its current market share is relatively small.

Securing long-term agreements with Chinese automakers presents both opportunities and hurdles. While Chinese car exports are experiencing robust growth, establishing a strong market presence against established shipping providers is a key challenge. This segment is characterized by high growth potential but currently holds a lower market share for Hyundai Glovis.

- Diversification Strategy: Hyundai Glovis is targeting non-affiliated clients, particularly emerging Chinese automotive manufacturers, to reduce reliance on its parent company and mitigate geopolitical risks like tariffs.

- Market Potential: The global automotive shipping market, especially for burgeoning Chinese brands, offers substantial growth prospects, aligning with the high-growth potential quadrant of the BCG Matrix.

- Challenges: Gaining significant market share against established international shipping lines and securing stable, long-term contracts with new partners are key obstacles for this segment.

- 2024 Outlook: As of mid-2024, Chinese automakers are projecting a significant increase in export volumes, with some estimates pointing to over 5 million vehicles exported globally, presenting a prime opportunity for logistics providers like Hyundai Glovis to capture new business.

Strategic Mergers and Acquisitions (M&As) in Emerging Sectors

Hyundai Glovis is strategically focusing on mergers and acquisitions (M&As) within emerging sectors, earmarking a substantial portion of its investment capital for these ventures. The company's objective is to target high-growth areas where its current market presence is minimal or non-existent, aiming to capture significant market share.

These M&A activities are inherently high-risk, high-reward propositions. Their ultimate success hinges on effective integration of acquired entities and successful penetration into new markets. For instance, in 2024, Hyundai Glovis announced a plan to invest approximately 2 trillion KRW (around $1.5 billion USD) in new growth engines, with M&A being a key component.

- Targeting nascent industries: Hyundai Glovis is actively scouting for M&A opportunities in sectors like electric vehicle (EV) battery logistics and hydrogen supply chain management, areas poised for substantial expansion.

- Low existing market share: The strategic intent is to enter markets where Hyundai Glovis has limited to no established footprint, allowing for aggressive market share acquisition.

- Integration challenges: The success of these M&As is heavily dependent on the company's ability to seamlessly integrate new technologies, talent, and operational processes, a critical factor for growth in these dynamic sectors.

- Capital allocation: A significant portion of the 2024 investment budget, estimated at 30-40%, is earmarked for potential M&A targets in these emerging fields.

Hyundai Glovis's strategic investments in emerging sectors like battery recycling and LNG transport, alongside its aggressive pursuit of new automotive shipping contracts, position these ventures as Question Marks. These areas exhibit high growth potential, driven by global trends such as electrification and cleaner energy, but currently represent smaller market shares for the company.

Significant capital is being channeled into these segments to build infrastructure, secure market presence, and overcome competition from established players. For instance, the company allocated a considerable portion of its 2024 investment budget, estimated at 30-40%, towards potential mergers and acquisitions in these nascent industries.

The success of these Question Marks hinges on effective market penetration and the ability to secure long-term contracts, especially as global demand for services like LNG transport is projected to rise significantly, with IEA forecasts indicating a substantial increase in demand by 2024.

Hyundai Glovis's expansion into non-affiliated automaker shipping, particularly from China, exemplifies this strategy, aiming to capitalize on robust export growth while navigating the challenges of competing with established logistics providers.

BCG Matrix Data Sources

Our Hyundai Glovis BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.