Hyakugo Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyakugo Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hyakugo Bank's trajectory. Our expertly crafted PESTLE analysis provides the essential intelligence you need to anticipate market shifts and identify strategic opportunities. Gain a competitive advantage by understanding the external forces at play. Download the full PESTLE analysis now for actionable insights.

Political factors

The Bank of Japan's departure from its negative interest rate policy in March 2024, followed by further rate hikes in July 2024 and January 2025, marks a significant shift. This normalization, moving towards a 'world with interest rates,' presents both opportunities and challenges for financial institutions like Hyakugo Bank.

This policy change is anticipated to boost net interest margins for banks by allowing them to earn more on their lending activities. However, it simultaneously introduces increased credit risks for businesses that had become accustomed to and dependent on the prolonged period of ultra-low borrowing costs.

For Hyakugo Bank, a regional player, adapting to this evolving interest rate landscape is crucial. The bank must strategically manage its loan portfolio and deposit strategies to capitalize on higher rates while mitigating the potential for increased defaults among its corporate clients.

The Financial Services Agency (FSA) has outlined key priorities for the July 2024 to June 2025 period, focusing on enhancing corporate governance, driving digital innovation in financial services, and championing sustainable finance initiatives. Hyakugo Bank must actively integrate these directives into its strategic planning and operational framework, especially concerning governance improvements and digital advancements.

The Japanese government is actively encouraging the consolidation and revitalization of regional banks, a move that includes providing financial subsidies for mergers. This policy directly impacts institutions like Hyakugo Bank.

Broader government strategies focused on invigorating regional economies and bolstering local enterprises are set to shape Hyakugo Bank's operational landscape and growth prospects. For instance, the government's FY2024 budget allocated ¥1 trillion (approximately $7 billion USD) towards regional revitalization projects, which could indirectly benefit banks supporting these initiatives.

Corporate Governance Reforms

Japan's ongoing corporate governance reforms, particularly the revisions to the Financial Instruments and Exchange Act and the Corporate Governance Code, are significantly impacting financial institutions like Hyakugo Bank. These changes are designed to foster greater transparency and accountability throughout the corporate sector.

Key aspects of these reforms include enhanced disclosure requirements for material agreements and the unwinding of cross-shareholdings. For Hyakugo Bank, this translates to a need for more robust reporting mechanisms and potential adjustments to its internal governance frameworks to align with these new standards.

- Increased Transparency: Mandates for disclosing material agreements will provide stakeholders with clearer insights into Hyakugo Bank's business relationships and strategic partnerships.

- Accountability Measures: The reforms aim to strengthen board oversight and executive accountability, pushing for more independent director representation.

- Cross-Shareholding Reduction: The push to reduce cross-shareholdings encourages a focus on shareholder value and can lead to more active capital allocation decisions.

- Compliance Burden: Hyakugo Bank will need to invest in systems and processes to ensure compliance with the evolving disclosure and governance requirements, potentially impacting operational costs.

Anti-Money Laundering (AML/CFT) Measures

Japan's government is intensifying Anti-Money Laundering and Counter-Financing of Terrorism (AML/CFT) measures, aligning with global standards and recommendations from bodies like the Financial Action Task Force (FATF). This includes a push for enhanced management systems and proactive initiatives from domestic financial institutions.

Hyakugo Bank must therefore ensure its compliance frameworks are not only robust but also continuously updated to navigate these evolving regulatory landscapes. Failure to do so could result in significant penalties and reputational damage.

- Increased Regulatory Scrutiny: The Financial Services Agency (FSA) is expected to increase its oversight of banks' AML/CFT compliance programs.

- Investment in Technology: Banks will likely need to invest in advanced transaction monitoring and customer due diligence (CDD) technologies.

- FATF Recommendations: Japan's commitment to implementing FATF's 40 Recommendations underscores the seriousness of these measures.

- Potential Fines: Non-compliance can lead to substantial fines, with penalties for major financial institutions potentially reaching millions of dollars.

The Bank of Japan's pivot from negative interest rates in March 2024, with further hikes in July 2024 and January 2025, directly impacts Hyakugo Bank by potentially increasing net interest margins but also raising credit risks for businesses. Additionally, the Financial Services Agency's focus on corporate governance and digital innovation for the July 2024-June 2025 period necessitates strategic adaptation by Hyakugo Bank.

Government initiatives promoting regional bank consolidation, backed by subsidies, present a landscape where Hyakugo Bank might consider mergers or acquisitions to enhance its competitive position. Furthermore, national strategies aimed at regional economic revitalization, such as the FY2024 budget's ¥1 trillion allocation for such projects, offer indirect opportunities for banks supporting local development.

Japan's strengthened corporate governance reforms, including revised disclosure requirements and a push to unwind cross-shareholdings, demand greater transparency and accountability from Hyakugo Bank. The government's intensified AML/CFT measures, aligned with FATF recommendations, also require Hyakugo Bank to bolster its compliance systems to avoid penalties.

What is included in the product

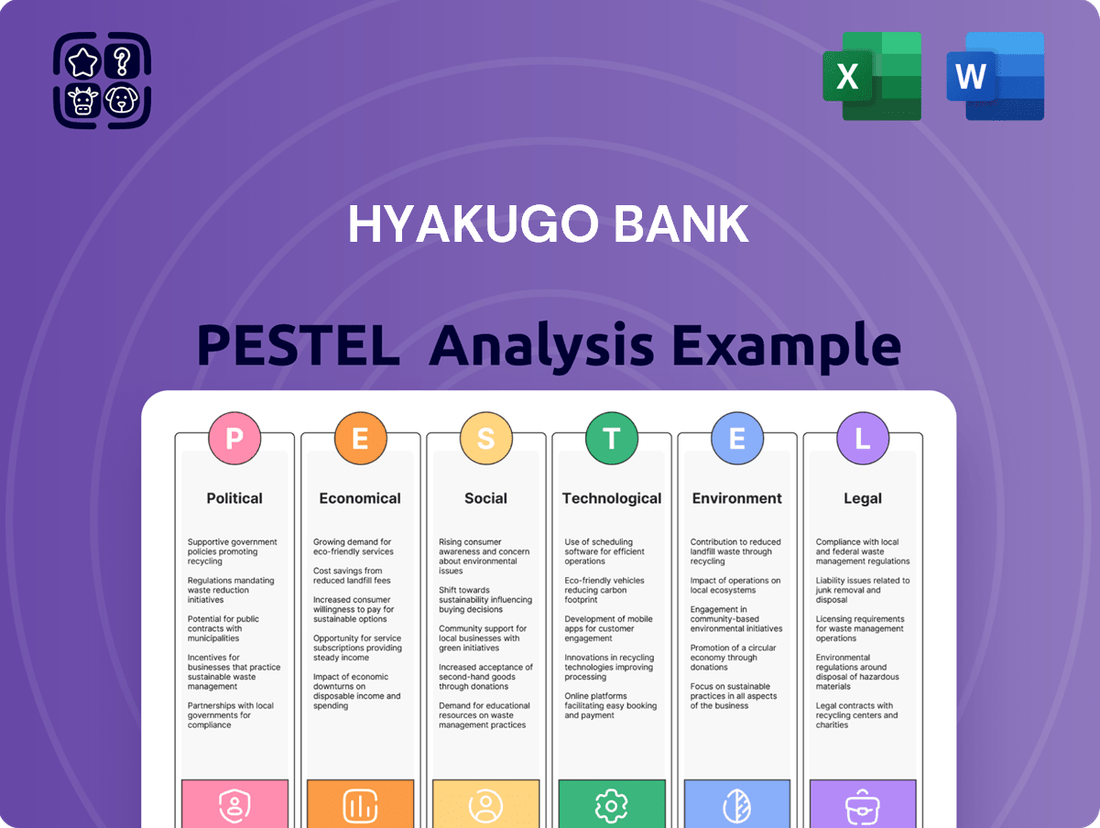

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Hyakugo Bank, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives, enabling strategic decision-making and proactive adaptation to market shifts.

The Hyakugo Bank PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during meetings or presentations.

This analysis is visually segmented by PESTEL categories, allowing for quick interpretation at a glance and relieving the pain of sifting through complex data.

Economic factors

The Bank of Japan's move away from negative interest rates, with rates reaching approximately 0.5% by January 2025 and further hikes anticipated, is a pivotal economic shift. This normalization directly impacts financial institutions like Hyakugo Bank by potentially boosting their net interest margins, the difference between interest income and interest expense.

However, this policy adjustment also introduces a heightened risk of corporate defaults. Companies heavily reliant on borrowed funds will face increased interest expenses, potentially straining their ability to service debt, especially if revenue growth doesn't keep pace with rising financing costs.

Japan is seeing a notable uptick in both wage growth and inflation. For fiscal year 2024, the Consumer Price Index (CPI) is projected to stay above the 2% mark, with forecasts suggesting it will hover around 2.5% for fiscal year 2025. This environment is a positive sign for private consumption.

This sustained increase in consumer spending, fueled by rising wages, can create a positive feedback loop for the economy. As people have more disposable income, they tend to spend more, leading to increased economic activity across various sectors.

For Hyakugo Bank, this economic scenario is largely beneficial. Higher economic activity translates to more demand for banking services, such as loans and financial products, ultimately supporting the bank's revenue and profitability.

Japan's economic growth is anticipated to be moderate, with real GDP growth forecast around 0.4% for fiscal year 2024 and a more robust 1.2% for fiscal year 2025. This upward trend, fueled by sustained private demand, particularly from increased consumer spending linked to wage improvements, and strong business investment in non-residential sectors, creates a favorable environment for Hyakugo Bank.

Impact of Global Economic Uncertainties

Global economic uncertainties continue to cast a shadow, with ongoing volatility in financial and capital markets a persistent concern. These external pressures can significantly influence even recovering economies.

While Japan's economy has shown signs of recovery, its export-driven nature makes it particularly vulnerable to external shocks. A notable example is the potential impact of a slowdown in the Chinese economy.

Such a slowdown could directly affect Japanese exports, subsequently impacting the nation's financial sector, including institutions like Hyakugo Bank. For instance, in early 2024, concerns about China's property market and its broader economic trajectory led to increased caution among global investors, affecting currency exchange rates and trade flows relevant to Japan.

- Export Dependence: Japan's reliance on exports means global economic downturns can directly curb demand for its goods and services.

- Financial Market Volatility: Fluctuations in international stock and bond markets can impact investment portfolios and the cost of capital for Japanese banks.

- Geopolitical Risks: Ongoing geopolitical tensions can disrupt supply chains and trade, adding another layer of uncertainty to the global economic outlook.

Regional Economic Vitality

The economic vitality of Mie Prefecture and its surrounding regions is a critical determinant for Hyakugo Bank, directly influencing its local client base and the demand for loans. Historically, regional banks in Japan have grappled with low profitability, a situation often linked to sluggish regional economic activity, underscoring the importance of robust regional development for Hyakugo Bank's financial health.

For instance, Mie Prefecture's Gross Prefectural Product (GPP) for fiscal year 2022 was ¥13.6 trillion, showing a 1.1% increase from the previous year, indicating a modest but positive trend in regional economic output. This growth is vital for Hyakugo Bank as it translates into greater business investment and consumer spending, both of which drive loan demand and deposit growth.

- Regional GDP Growth: Mie Prefecture's GPP grew by 1.1% in FY2022, signaling an expanding local economy.

- Industrial Output: Key industries in Mie, such as automotive manufacturing and food processing, are vital contributors to regional economic activity and thus to the bank's client base.

- Employment Trends: Stable or growing employment rates in the region directly correlate with increased consumer confidence and borrowing capacity, benefiting Hyakugo Bank.

- Local Investment: Increased capital expenditure by businesses within Mie Prefecture, driven by favorable economic conditions, directly supports Hyakugo Bank's lending opportunities.

Japan's economic landscape is shifting, with the Bank of Japan moving away from negative interest rates, aiming for rates around 0.5% by early 2025. This policy change is expected to improve bank profitability by widening net interest margins, though it also raises concerns about increased corporate borrowing costs and potential defaults for highly leveraged companies.

Inflation is on the rise, with the CPI projected to exceed 2% in fiscal year 2024 and remain near 2.5% in fiscal year 2025, supported by wage growth. This bodes well for consumer spending, which in turn fuels economic activity and creates a more favorable environment for Hyakugo Bank's lending and service offerings.

Real GDP growth is forecast to pick up, reaching 1.2% in fiscal year 2025, driven by sustained consumer demand and business investment. However, global economic uncertainties and export dependence, particularly on markets like China, present ongoing risks that could impact Japan's financial sector.

Mie Prefecture's economy, vital for Hyakugo Bank, showed a 1.1% GPP increase in fiscal year 2022, indicating a positive local growth trajectory that supports increased demand for banking services.

| Economic Indicator | FY2024 Projection | FY2025 Projection | Impact on Hyakugo Bank |

|---|---|---|---|

| Bank of Japan Policy Rate | Moving towards ~0.5% | Further hikes anticipated | Potential for improved Net Interest Margins, but increased default risk |

| Consumer Price Index (CPI) | ~2.5% | ~2.5% | Supports consumer spending and economic activity |

| Real GDP Growth | ~0.4% | ~1.2% | Favorable for loan demand and overall business activity |

| Mie Prefecture GPP Growth | (Data not available for FY2024/2025) | (Data not available for FY2024/2025) | Local economic health is crucial for regional loan demand |

Same Document Delivered

Hyakugo Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Hyakugo Bank's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Hyakugo Bank.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Japan's demographic challenge is stark: an aging and shrinking population creates significant headwinds for regional banks like Hyakugo Bank. This persistent trend directly impacts profitability by reducing the potential customer base and economic activity.

The shrinking population, with a projected decline in the working-age population, directly translates to smaller balance sheets for banks. This can lead to lower loan origination volumes and a reduced capacity to attract deposits, impacting Hyakugo Bank's ability to grow and maintain its financial health.

By 2025, Japan's population is expected to continue its downward trajectory, with projections indicating a further decrease in the number of individuals of working age. This demographic reality puts sustained downward pressure on loan-to-deposit ratios, a key indicator of a bank's lending capacity and long-term sustainability.

Japanese consumers are increasingly prioritizing asset growth over simple savings, a trend amplified by government initiatives aimed at making Japan a prominent asset management hub. The introduction of the new NISA (Nippon Individual Savings Account) system in 2024, designed to encourage investment by offering tax benefits, is a key driver of this shift. For instance, by the end of March 2024, over 10 million new NISA accounts had been opened, demonstrating strong public interest in wealth building.

Hyakugo Bank must therefore evolve its service offerings to cater to this growing demand for asset formation tools and investment guidance. This includes developing more sophisticated investment products and advisory services. Furthermore, enhancing customer financial literacy is crucial, as many individuals may lack the knowledge to effectively navigate these new investment opportunities. Providing educational resources and personalized financial planning can help bridge this knowledge gap.

Customers increasingly expect seamless, 24/7 access to financial services, driving a shift away from traditional passbooks towards smartphone banking. This digital transformation is evident in the growing adoption rates of mobile banking apps across Japan.

For Hyakugo Bank, this necessitates a robust expansion of its digital services to meet evolving customer expectations. For instance, in 2024, over 80% of Japanese consumers used mobile payment services, a trend that directly impacts banking preferences.

Community Engagement and Social Responsibility

Hyakugo Bank actively engages with its community, aiming to foster economic growth and address local financial needs. This commitment is evident in its problem-solving consulting services and its dedication to building a sustainable society through its core banking operations.

For instance, in fiscal year 2023, Hyakugo Bank reported lending growth of 3.5% to local businesses, underscoring its role in community development. The bank also initiated several financial literacy programs across Aichi Prefecture, reaching over 5,000 residents in the past year.

- Community Focus: Hyakugo Bank prioritizes supporting the economic vitality and financial well-being of its regional base.

- Social Responsibility: The bank integrates sustainable practices and social contribution into its primary business activities.

- Local Impact: Initiatives like financial literacy workshops and targeted lending demonstrate a tangible commitment to societal betterment.

- Economic Contribution: Lending growth of 3.5% in FY2023 highlights the bank's direct support for local enterprises.

Labor Shortages and Wage Increases

Japan is grappling with significant labor shortages, a trend that could impede economic recovery but also fuel wage growth. For Hyakugo Bank, this translates to potentially higher operating expenses as employee compensation rises. However, this economic shift could also foster a more financially secure customer base, as increased wages potentially boost consumer spending and savings.

The Ministry of Health, Labour and Welfare reported in May 2024 that the ratio of job openings to applicants in Japan stood at 1.30, indicating a persistent imbalance. This shortage is particularly acute in sectors like healthcare and logistics, impacting service delivery and operational efficiency across industries, including banking.

- Labor Shortage Impact: Persistent labor shortages in Japan, exemplified by a job openings to applicants ratio of 1.30 in May 2024, can constrain economic growth.

- Wage Growth Potential: These shortages are a catalyst for sustained wage increases as companies compete for talent.

- Hyakugo Bank's Costs: Hyakugo Bank may face increased operational costs due to rising employee salaries and benefits.

- Customer Base Stability: Conversely, higher wages can lead to a more financially stable and potentially larger customer base for the bank.

Societal shifts in Japan, particularly the aging and declining population, present a dual challenge for Hyakugo Bank: a shrinking customer base and increased demand for specialized financial services. The government's push to promote asset management, evidenced by the over 10 million new NISA accounts opened by March 2024, signals a move towards investment-focused financial behavior among consumers.

Furthermore, the increasing preference for digital banking, with over 80% of Japanese consumers using mobile payments in 2024, necessitates Hyakugo Bank's investment in robust online and mobile platforms. The bank's active community engagement, including a 3.5% lending growth to local businesses in FY2023 and financial literacy programs for over 5,000 residents, highlights its commitment to local economic development and social responsibility.

| Sociological Factor | Description | Impact on Hyakugo Bank |

|---|---|---|

| Demographics | Aging and shrinking population, declining working-age population. | Reduced customer base, potential for lower loan demand. |

| Consumer Behavior | Shift towards asset growth, increased demand for investment products and digital banking. | Opportunity to offer wealth management services, need for digital transformation. |

| Community Engagement | Focus on local economic support and financial literacy. | Strengthened community ties, potential for increased customer loyalty. |

Technological factors

Hyakugo Bank is making significant strides in digital transformation, evidenced by its restructuring of the IT Strategy Department into a dedicated 'DX Promotion Office'. This strategic move signals a strong commitment to accelerating digital initiatives throughout the entire group and its regional operations.

A key focus of this digital push is enhancing operational efficiency through advanced data utilization. Furthermore, the bank is expanding its smartphone banking services, aiming to provide customers with more convenient and accessible financial tools. For instance, in fiscal year 2023, Hyakugo Bank reported a 15% year-on-year increase in the number of active users for its mobile banking application.

Hyakugo Bank's digital transformation (DX) strategy is multifaceted, focusing on both internal operational enhancements and external community support. Internally, the bank is actively phasing out mailed documents, a move projected to significantly cut operational costs and boost efficiency. This aligns with a broader trend in the financial sector towards paperless operations, aiming for a leaner and more agile organizational structure.

Externally, Hyakugo Bank is committed to fostering regional digitalization by offering IT transformation consulting services to its customers and local communities. This initiative not only strengthens customer relationships but also addresses the critical need for digital literacy and infrastructure development in the regions it serves. Such support is vital for businesses and individuals to adapt to the evolving digital landscape.

The bank's commitment to DX is underscored by its investment in new technologies and digital platforms. For instance, in fiscal year 2023, Hyakugo Bank allocated a substantial portion of its capital expenditure towards IT system upgrades and digital service development, aiming to improve customer experience and streamline internal processes. This strategic investment is expected to yield a measurable increase in digital transaction volumes and a reduction in manual processing by the end of fiscal year 2024.

The accelerated growth in digital transactions is pushing banks like Hyakugo to strategically adopt AI and enhance data utilization. This trend is critical for staying competitive in an increasingly digital financial landscape.

Hyakugo Bank is actively planning to centralize its data and expand its utilization capabilities. This initiative aims to improve customer services and boost operational efficiency, mirroring a wider industry push towards data-driven strategies.

In 2023, the global AI in banking market was valued at approximately $10.7 billion and is projected to grow significantly. This highlights the immense opportunity for institutions like Hyakugo to leverage AI for enhanced customer experiences and streamlined operations.

Cybersecurity and System Resiliency

As financial services increasingly move online, Hyakugo Bank faces significant challenges in maintaining system resilience during peak transaction times and fending off cyber threats. The bank must invest in and maintain a robust, scalable IT infrastructure capable of handling the surge in digital activity while rigorously protecting sensitive customer data. This is crucial as digital transactions are expected to continue their upward trajectory, with global digital payment transaction volumes projected to reach over $12.4 trillion by 2027, underscoring the need for advanced cybersecurity measures.

Ensuring system resiliency means Hyakugo Bank's IT platforms must be able to withstand high volumes of simultaneous transactions without performance degradation or failure. This includes having contingency plans and backup systems in place. For example, many banks have adopted cloud-based solutions to enhance scalability and flexibility, allowing them to quickly adjust resources based on demand. The ongoing sophistication of cyberattacks means that continuous investment in threat detection, prevention, and rapid response capabilities is not just a best practice but a necessity for maintaining customer trust and operational continuity.

Key considerations for Hyakugo Bank include:

- Investing in advanced threat detection and prevention systems: This includes AI-powered security solutions that can identify and neutralize threats in real-time.

- Regularly updating and patching software: This is vital to address known vulnerabilities that cybercriminals exploit.

- Implementing multi-factor authentication for all user access: This adds an extra layer of security beyond just passwords.

- Conducting regular penetration testing and security audits: This helps identify weaknesses in the bank's defenses before they can be exploited by attackers.

Fintech Integration and Competition

The Japanese banking landscape is experiencing a significant shift with fintech integration, intensifying competition. Digital-native challengers are redefining customer expectations, forcing traditional players like Hyakugo Bank to adapt their value propositions. This trend underscores the necessity for Hyakugo Bank to explore strategic partnerships with fintech firms and utilize technologies such as Application Programming Interfaces (APIs) to broaden its service portfolio and remain competitive.

Fintech adoption in Japan is accelerating, with a notable increase in digital payment solutions and online lending platforms. By mid-2024, over 70% of Japanese consumers reported using at least one fintech service. Hyakugo Bank's strategic response should focus on:

- Ecosystem Partnerships: Collaborating with innovative fintech startups to offer specialized services like robo-advisory or peer-to-peer lending.

- API Strategy: Developing and leveraging APIs to enable seamless integration with third-party fintech applications, thereby expanding customer touchpoints and data utilization.

- Digital Service Enhancement: Investing in the modernization of its own digital platforms to offer user-friendly interfaces and personalized banking experiences that rival fintech offerings.

- Data Analytics: Utilizing advanced analytics, powered by fintech-driven data, to better understand customer needs and develop targeted financial products.

Hyakugo Bank's technological advancement is centered on a robust digital transformation strategy, aiming to enhance efficiency and customer experience. The bank is actively investing in AI and advanced data utilization, recognizing their critical role in staying competitive. By fiscal year 2023, Hyakugo Bank saw a 15% year-on-year increase in mobile banking users, demonstrating a growing adoption of digital services.

The bank's commitment to DX is evident in its capital expenditure for IT upgrades and digital service development, with a focus on improving customer experience and streamlining processes. This strategic investment is projected to boost digital transaction volumes and reduce manual processing by the end of fiscal year 2024.

Hyakugo Bank is also addressing the critical need for system resilience and cybersecurity in the face of escalating digital transactions, which are projected to exceed $12.4 trillion globally by 2027. This necessitates continuous investment in advanced threat detection, prevention, and rapid response capabilities to maintain customer trust and operational continuity.

The bank is also embracing fintech integration, exploring partnerships and API strategies to broaden its service portfolio and meet evolving customer expectations. This aligns with the accelerating fintech adoption in Japan, where over 70% of consumers used at least one fintech service by mid-2024.

Legal factors

The Banking Act is the cornerstone of local bank regulation in Japan, dictating everything from licensing and organizational structure to the permissible range of business activities and crucial customer protection measures. Hyakugo Bank must operate within these strict parameters, which clearly define its core banking functions and any related ancillary services it can offer.

Adherence to the Banking Act ensures Hyakugo Bank's operations are sound and fair, contributing to the stability of the financial system. For instance, in 2024, the Financial Services Agency (FSA) continued its oversight of regional banks, emphasizing robust risk management frameworks and compliance with evolving capital adequacy requirements.

Japanese local banks, including Hyakugo Bank, are subject to stringent capital adequacy requirements. These regulations mandate maintaining specific core capital ratios to ensure financial resilience, with international operations facing additional leverage ratio stipulations.

As of the latest available data, the Bank for International Settlements (BIS) standards, which Japan adheres to, require Common Equity Tier 1 (CET1) ratios to be at least 4.5% of risk-weighted assets. Hyakugo Bank must consistently meet and exceed these prudential norms to demonstrate its financial soundness and stability, a critical factor for depositor confidence and regulatory approval.

Japan is actively reinforcing its Anti-Money Laundering and Counter-Financing of Terrorism (AML/CFT) framework. Recent legislative updates, such as amendments to the Act on Prevention of Transfer of Criminal Proceeds, underscore a commitment to stricter oversight. The Financial Services Agency (FSA) is enhancing its monitoring capabilities, signaling a more rigorous enforcement environment for financial institutions.

Hyakugo Bank, like all Japanese banks, must proactively adapt its AML/CFT management systems. This involves continuous updates to policies, procedures, and technological infrastructure to align with these evolving regulatory demands. Non-compliance can lead to significant penalties, reputational damage, and operational disruptions, making robust AML/CFT compliance a critical risk mitigation strategy for the bank.

Corporate Governance Code and Disclosure Requirements

Amendments to Japan's Corporate Governance Code and related Cabinet Office Ordinances are set to increase disclosure demands. Specifically, fiscal years ending on or after March 31, 2025, will require more detailed reporting on ‘material agreements, etc.’ and cross-shareholdings. Hyakugo Bank needs to adapt its financial reporting to meet these heightened transparency expectations.

These regulatory shifts underscore a broader trend towards greater accountability and investor protection within the Japanese financial sector. For Hyakugo Bank, this means a proactive approach to data management and reporting to ensure full compliance and maintain stakeholder confidence.

- Enhanced Disclosure: Focus on ‘material agreements, etc.’ and cross-shareholdings for FY ending March 31, 2025, onwards.

- Regulatory Alignment: Ensure Hyakugo Bank's reporting practices meet new transparency standards.

- Investor Confidence: Improved disclosure can bolster trust and attract investment.

- Compliance Strategy: Develop robust internal processes to manage and report on these expanded requirements.

Changes in Security Interests Law

The enactment of the Act on the Promotion of Cash Flow-Based Lending in June 2024, introducing the 'Enterprise Value Charge,' signifies a significant shift in how security interests are structured. This new legal framework could alter Hyakugo Bank's approach to collateral assessment and loan origination, particularly for businesses that may not possess traditional tangible assets. The potential for increased lending based on future cash flows, rather than solely on physical assets, could unlock new market segments for the bank.

This legal evolution impacts Hyakugo Bank by potentially expanding its lending base to include more innovative or service-oriented businesses. The Enterprise Value Charge allows for security to be taken over a broader range of a company's assets, including intangible ones, which is crucial for sectors like technology and software development. For instance, a growing number of Japanese startups in 2024 are valued primarily on intellectual property and projected earnings, making this new security interest particularly relevant.

- New Security Interest: The Enterprise Value Charge, introduced by the June 2024 Act on the Promotion of Cash Flow-Based Lending, broadens the scope of collateral beyond traditional physical assets.

- Impact on Lending: This change could enable Hyakugo Bank to offer more flexible financing options to businesses, especially those with strong cash flow but limited tangible assets, potentially increasing loan volumes.

- Market Relevance: The new law is particularly pertinent for the growing number of technology and service-based companies in Japan, whose valuations are increasingly tied to intangible assets and future earnings potential.

- Risk Assessment Adaptation: Hyakugo Bank will need to adapt its risk assessment models to effectively evaluate the value of intangible assets and projected cash flows when utilizing the Enterprise Value Charge.

Japan's financial regulatory landscape remains dynamic, with continuous updates to banking laws and corporate governance codes. Hyakugo Bank must navigate these evolving legal requirements, including stringent capital adequacy ratios and enhanced disclosure mandates for fiscal years ending March 31, 2025, onwards. The recent introduction of the Act on the Promotion of Cash Flow-Based Lending in June 2024, with its Enterprise Value Charge, also presents both opportunities and challenges for lending practices.

These legal factors necessitate proactive adaptation from Hyakugo Bank. Staying abreast of amendments to the Banking Act, Anti-Money Laundering (AML) regulations, and corporate governance rules is crucial for maintaining compliance and operational integrity. The bank's ability to adapt its risk assessment and reporting frameworks will be key to leveraging new legal provisions effectively.

The emphasis on increased transparency, as seen in the updated disclosure requirements, aims to bolster investor confidence. For Hyakugo Bank, this means ensuring its financial reporting accurately reflects its business dealings and cross-shareholdings. Furthermore, the new cash flow-based lending framework could open avenues for supporting businesses previously underserved due to a lack of traditional collateral.

The Bank for International Settlements (BIS) standards, which Japan adheres to, mandate a Common Equity Tier 1 (CET1) ratio of at least 4.5% of risk-weighted assets. Hyakugo Bank's commitment to meeting and exceeding these prudential norms is vital for its financial stability and regulatory standing.

| Legal Area | Key Regulation/Act | Impact on Hyakugo Bank | Effective Date/Period | Example Data/Requirement |

|---|---|---|---|---|

| Banking Regulation | Banking Act | Defines permissible business activities, licensing, and customer protection. | Ongoing | Adherence to FSA oversight and capital adequacy requirements. |

| Capital Adequacy | BIS Standards (Japan Adherence) | Mandates minimum capital ratios for financial resilience. | Ongoing | CET1 ratio requirement of at least 4.5% of risk-weighted assets. |

| AML/CFT | Act on Prevention of Transfer of Criminal Proceeds | Reinforces framework for stricter oversight and compliance. | Ongoing updates | Enhanced FSA monitoring and enforcement. |

| Corporate Governance | Corporate Governance Code Amendments | Increases disclosure demands on material agreements and cross-shareholdings. | FY ending March 31, 2025, onwards | More detailed reporting required. |

| Lending Practices | Act on Promotion of Cash Flow-Based Lending | Introduces 'Enterprise Value Charge' for broader collateral assessment. | June 2024 | Potential to lend based on future cash flows and intangible assets. |

Environmental factors

Hyakugo Bank is actively pursuing a transformation into a 'Green & Consulting Bank Group' by 2028, with a clear objective to foster regional decarbonization. This commitment extends to supporting clients in their own decarbonization journeys and implementing internal measures, such as achieving net zero greenhouse gas emissions by fiscal year 2030.

Hyakugo Bank is actively broadening its sustainable finance options, offering customers guidance and support in developing decarbonization strategies. This initiative reflects Japan's strong dedication to Environmental, Social, and Governance (ESG) principles.

The bank's efforts are synchronized with the national push for Green Transformation (GX), exemplified by the issuance of GX bonds. These bonds are specifically earmarked to finance projects aimed at reducing carbon emissions, a critical component of Japan's climate action plan.

Japan is actively championing ESG investments, with the government prioritizing sustainable finance and the Financial Services Agency (FSA) encouraging its adoption. This national push creates a favorable environment for institutions like Hyakugo Bank to integrate ESG principles.

Hyakugo Bank's commitment to ESG is vital for attracting both domestic and international investors who increasingly favor sustainable portfolios. Aligning with Japan's national financial priorities will bolster the bank's reputation and market position.

As of early 2024, Japan's GPIF, the world's largest pension fund, has significantly increased its ESG investment allocations, demonstrating a clear market trend. This growing investor demand for ESG-compliant assets underscores the strategic importance for Hyakugo Bank to enhance its ESG offerings.

Transition to Renewable Energy

Hyakugo Bank is actively transitioning to renewable energy sources, starting with its head office buildings and planning to expand this initiative to its branches and affiliated companies. This proactive approach underscores the bank's commitment to environmental stewardship and sustainable operations.

This strategy aligns with broader Japanese government targets, such as the goal to increase the share of renewable energy in the country's electricity mix. For instance, Japan aims to achieve around 36-38% of its electricity from renewables by fiscal year 2030. Hyakugo Bank's internal efforts contribute to this national objective.

- Increased Renewable Energy Use: Hyakugo Bank is boosting its consumption of electricity generated from renewable sources at its main offices.

- Expansion Plans: The bank intends to roll out these green energy initiatives to its individual branches and group companies.

- Demonstrated Responsibility: This commitment showcases Hyakugo Bank's dedication to operating in an environmentally conscious manner.

- Contribution to National Goals: The bank's actions support Japan's broader aims for a higher proportion of renewable energy in its national power supply.

Climate-Related Risk Management

Financial institutions like Hyakugo Bank are facing increased pressure to manage climate-related financial risks, a trend amplified across the Japanese banking sector. This involves identifying, assessing, and mitigating potential impacts from both physical climate events and the transition to a low-carbon economy. For instance, the Bank of Japan has been actively promoting climate stress tests for financial institutions, with a pilot program in 2023 indicating the need for enhanced risk management frameworks.

The growing awareness of environmental, social, and governance (ESG) factors means that Hyakugo Bank, like its peers, must consider how climate change could affect its loan portfolio and overall financial stability. This includes evaluating exposure to industries heavily reliant on fossil fuels or those vulnerable to extreme weather events. By 2024, many Japanese banks were integrating climate risk into their corporate governance and strategic planning, aiming to align with global sustainability goals and investor expectations.

- Increased regulatory focus on climate risk in the Japanese financial sector, with the Financial Services Agency (FSA) encouraging robust disclosure and management practices.

- Potential for physical risks impacting Hyakugo Bank's assets and operations through extreme weather events, such as typhoons and heavy rainfall, which are becoming more frequent.

- Transition risks associated with shifts in government policy, technology, and market sentiment towards decarbonization, potentially affecting the creditworthiness of borrowers in carbon-intensive sectors.

- Growing investor demand for climate-related financial disclosures and sustainable investment strategies from financial institutions.

Hyakugo Bank is actively aligning with Japan's national climate goals, aiming to support regional decarbonization and achieve net zero emissions by fiscal year 2030. The bank's strategy includes expanding sustainable finance options and issuing GX bonds to fund carbon reduction projects, reflecting Japan's commitment to Green Transformation (GX).

The bank is also transitioning to renewable energy sources for its operations, starting with its head office, which supports Japan's target of achieving around 36-38% of its electricity from renewables by fiscal year 2030. This proactive stance on environmental stewardship is crucial for attracting investors who increasingly favor ESG-compliant portfolios, as evidenced by the GPIF's growing ESG allocations in early 2024.

Financial institutions, including Hyakugo Bank, are facing heightened scrutiny regarding climate-related financial risks, with the Bank of Japan conducting climate stress tests. This necessitates robust management of physical risks from extreme weather and transition risks from decarbonization policies, impacting loan portfolios and overall financial stability.

| Environmental Factor | Hyakugo Bank's Action/Alignment | Relevant Data/Target |

|---|---|---|

| Decarbonization | Pursuing 'Green & Consulting Bank Group' transformation, supporting regional decarbonization. | Net zero greenhouse gas emissions by fiscal year 2030. |

| Renewable Energy | Transitioning to renewable energy sources for operations. | Supports Japan's target of 36-38% renewable electricity by fiscal year 2030. |

| Sustainable Finance | Broadening sustainable finance options, issuing GX bonds. | Aligns with Japan's Green Transformation (GX) initiative. |

| Climate Risk Management | Addressing climate-related financial risks in loan portfolios. | Bank of Japan pilot climate stress tests in 2023. |

PESTLE Analysis Data Sources

Our Hyakugo Bank PESTLE Analysis is informed by a comprehensive review of official Japanese government publications, reports from reputable financial institutions, and current economic indicators. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscape impacting the bank.