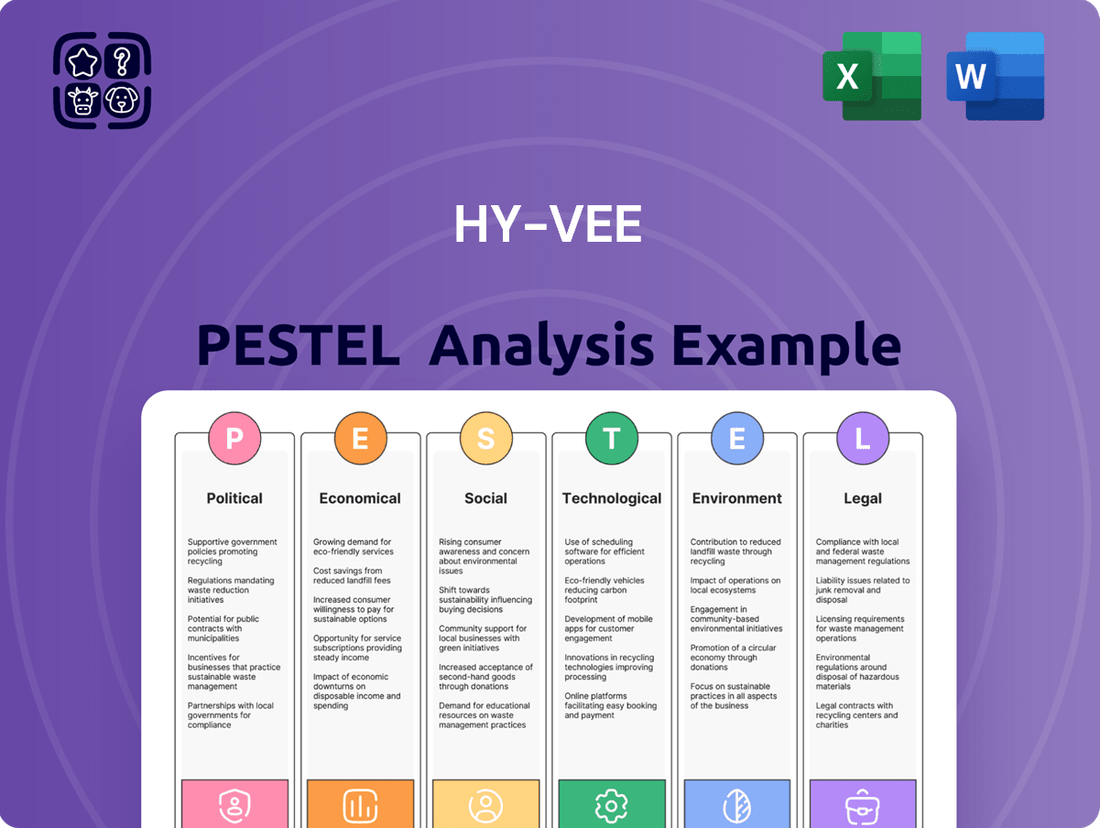

Hy-Vee PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hy-Vee Bundle

Unlock the critical external factors shaping Hy-Vee's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting its operations. Gain a competitive edge by leveraging these insights for strategic planning. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Hy-Vee navigates a complex web of government regulations impacting food safety, labeling, and general retail practices. These rules, often varying by state, directly influence operational expenses and compliance efforts for the company, particularly across its Midwestern footprint.

For instance, in 2024, ongoing discussions around updated FDA food labeling requirements, such as enhanced allergen declarations, could necessitate significant packaging and system adjustments for Hy-Vee. Furthermore, state-specific health department mandates on temperature control and sanitation, enforced through regular inspections, remain a critical operational focus.

Recent legislation, like California's Protect Grocery Workers Jobs Act (AB 647), mandates preferential hiring for existing employees during grocery store ownership changes. This directly impacts Hy-Vee's human resources planning and any potential mergers or acquisitions, influencing how employee transitions and benefits are managed.

The trend towards more stringent labor laws, including minimum wage increases and expanded sick leave policies, is a significant political factor. For instance, states are increasingly mandating higher minimum wages; by mid-2024, over 20 states had minimum wages exceeding the federal $7.25 per hour, with some reaching $15 or more. These regulations directly increase Hy-Vee's labor costs and necessitate careful workforce management strategies to maintain profitability.

Hy-Vee's ambitious expansion plans, including new store developments and remodels, are directly influenced by local government zoning ordinances and permitting procedures. These can introduce significant variability in project timelines and construction costs, potentially impacting capital expenditure budgets. For instance, navigating complex local regulations for a new store in a suburban area could add months to the development cycle, as observed in past projects where regulatory hurdles caused delays.

Conversely, local governments might offer targeted incentives, such as tax abatements or grants, to encourage business development, particularly in underserved or rural communities. These incentives could be a boon for Hy-Vee's smaller format stores or its strategic push into less populated regions, potentially offsetting some of the operational challenges associated with these markets. For example, a state or county looking to bolster food access in a rural area might provide financial assistance to a grocery chain like Hy-Vee to establish a presence.

Political Contributions and Lobbying Efforts

As a significant regional employer, Hy-Vee actively participates in the political landscape through contributions and lobbying. These efforts are strategically focused on shaping policies that impact the grocery sector, covering areas like labor regulations, tax structures, and supply chain management. While Hy-Vee Inc. itself has not disclosed federal lobbying activities for the 2024 election cycle, its Political Action Committee (PAC) has been a notable contributor to federal candidates.

The Hy-Vee PAC's financial engagement underscores its commitment to influencing policy decisions. For instance, in the 2023-2024 election cycle, the PAC reported significant contributions to various federal campaigns, demonstrating a proactive approach to safeguarding its business interests. These contributions are vital for maintaining a dialogue with policymakers and ensuring that the company's perspective is considered in legislative processes.

- Federal Contributions: Hy-Vee's PAC has made substantial donations to federal candidates, indicating a strategic investment in political engagement.

- Policy Influence: Lobbying efforts are directed towards shaping legislation concerning labor, taxation, and supply chain logistics, crucial for the grocery industry.

- 2024 Cycle Focus: While direct corporate lobbying by Hy-Vee Inc. has not been reported for the current election cycle, PAC contributions remain active.

- Industry Advocacy: These political activities are essential for advocating for the company's operational needs and the broader grocery retail environment.

Public Health Policies and Partnerships

Government-led public health initiatives, often bolstered by public-private partnerships, directly shape Hy-Vee's strategic approach to its service portfolio. The company's proactive integration of in-store health clinics and complimentary health screenings reflects a growing societal emphasis on preventative care and overall wellness, a trend that public health policies are designed to foster.

Hy-Vee's commitment to community health is evident in its consistent participation in programs offering vital health checks. For example, the company has provided free A1C and biometric screenings, directly addressing public health priorities by making essential health assessments more accessible to the communities it serves. These efforts align with national health objectives aimed at early detection and management of chronic conditions.

- Government Support: Public health policies can offer grants or tax incentives for businesses investing in community wellness programs, potentially reducing operational costs for Hy-Vee's health services.

- Partnership Opportunities: Collaborations with public health agencies can expand Hy-Vee's reach and impact, allowing for joint campaigns on issues like vaccination drives or nutritional education.

- Regulatory Alignment: Changes in healthcare regulations, such as those pertaining to telehealth or data privacy for health services, necessitate ongoing adaptation of Hy-Vee's clinic operations and offerings.

Political factors significantly shape Hy-Vee's operational landscape, from stringent food safety regulations to evolving labor laws. For instance, by mid-2024, over 20 states had minimum wages exceeding the federal $7.25 per hour, directly impacting Hy-Vee's labor costs and requiring careful workforce management.

Government incentives, such as tax abatements for rural store development, can offer financial advantages, while local zoning ordinances can introduce project delays and cost variability for new store constructions. Hy-Vee's political engagement through its PAC, which made substantial contributions in the 2023-2024 election cycle, aims to influence policies on labor, taxation, and supply chain logistics.

Public health initiatives and partnerships can also influence Hy-Vee's service portfolio, encouraging investments in in-store health clinics and wellness programs. Regulatory alignment with evolving healthcare laws, such as those concerning telehealth and data privacy, remains a key consideration for Hy-Vee's health service operations.

What is included in the product

The Hy-Vee PESTLE Analysis dissects the grocery retailer's strategic landscape by examining Political, Economic, Social, Technological, Environmental, and Legal forces, offering actionable insights for informed decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining discussions about Hy-Vee's external environment and strategic adjustments.

Economic factors

Inflation significantly impacts the grocery sector, directly affecting the cost of goods and, consequently, consumer purchasing power. For Hy-Vee, this means navigating the challenge of rising prices, which necessitates strategic adjustments in how they analyze spending and work to reduce operational costs. The goal is to absorb as much of these increased costs as possible to avoid passing them directly onto shoppers.

In 2024, persistent inflation, particularly in food categories, has been a dominant economic factor. For instance, the Consumer Price Index (CPI) for food at home saw an increase of 2.6% in the year ending April 2024, according to the U.S. Bureau of Labor Statistics. This trend forces consumers to become more price-sensitive, actively seeking out deals and discounts. This shift in consumer behavior directly influences shopping habits and can even impact preferences for different store formats as shoppers prioritize value.

Hy-Vee faces escalating labor expenses due to mandated minimum wage hikes and intense competition for retail talent. For instance, in 2024, several states saw significant minimum wage increases, impacting the broader retail sector. This economic factor directly pressures Hy-Vee's profitability, requiring careful cost management strategies.

To mitigate these rising labor costs, Hy-Vee has strategically realigned its workforce, reassigning corporate employees to frontline retail positions. This move aims to optimize staffing and reduce reliance on external hiring at higher wage rates. Such operational shifts are crucial for maintaining financial stability amidst economic pressures.

The persistent upward trend in wages compels Hy-Vee to prioritize workforce efficiency and invest in technology. Automation and improved operational processes can help offset increased labor expenditures. For example, investments in self-checkout systems and inventory management software can enhance productivity, thereby mitigating the impact of higher wage demands.

Global and regional supply chain snags, alongside volatile fuel prices, directly influence Hy-Vee's expenses for moving products and keeping shelves stocked. These external pressures can drive up operational costs and impact product availability, necessitating strong supply chain management. Hy-Vee itself has identified these disruptions as a significant hurdle, alongside inflationary pressures.

Competitive Landscape and Market Share

The grocery sector is intensely competitive, with Hy-Vee navigating a crowded field. Major national chains, aggressive discount retailers, and the ever-expanding online grocery segment all present significant challenges to maintaining and growing market share. For instance, in 2024, the U.S. grocery market saw continued strong performance from discounters like Aldi and Lidl, while online sales, driven by platforms like Instacart and Amazon Fresh, continued to capture a larger portion of consumer spending.

To combat this, Hy-Vee must consistently innovate across its offerings. This includes refining pricing strategies to remain competitive, enhancing the in-store and online customer experience, and adapting to evolving consumer preferences. The increasing demand for value, particularly evident in 2024 and projected for 2025, means that private-label brands are becoming crucial differentiators for retailers seeking to attract budget-conscious shoppers.

Key competitive factors influencing Hy-Vee's market share include:

- Price Competitiveness: Hy-Vee's ability to match or beat prices offered by discount grocers and online retailers.

- Product Assortment and Quality: Offering a diverse range of high-quality products, including fresh produce and private-label options.

- Customer Loyalty Programs and Experience: Implementing effective loyalty programs and providing superior customer service to foster repeat business.

- Digital Presence and Convenience: Expanding and improving online ordering, delivery, and pickup services to meet consumer demand for convenience.

Economic Downturns and Expansion Decisions

Anticipating economic downturns significantly shapes Hy-Vee's strategic planning, particularly concerning investments and expansion. The company has a history of implementing cost-saving measures in response to economic shifts, such as optimizing corporate staffing levels.

For instance, during periods of economic uncertainty, Hy-Vee might review its capital expenditure plans. The decision to postpone new store construction in specific markets can be directly linked to broader economic conditions, including the impact of rising building costs.

- Hy-Vee's proactive cost-saving measures can include adjustments to operational expenses and potentially corporate headcount to weather economic slowdowns.

- The grocery sector, while often considered defensive, is not immune to economic contractions, which can affect consumer spending on non-essential items.

- In 2023, inflation remained a key economic factor, impacting building material costs and potentially influencing Hy-Vee's decisions on new store development timelines.

- The company's financial resilience is tested during economic downturns, requiring careful management of debt and cash flow to maintain operational stability.

Inflation continues to be a primary economic driver, impacting Hy-Vee through increased costs for goods and services, which in turn affects consumer purchasing power. The U.S. Bureau of Labor Statistics reported a 2.6% increase in food at home prices for the year ending April 2024, highlighting the pressure on shoppers to find value. This economic climate necessitates Hy-Vee's focus on cost management and competitive pricing strategies to retain customers.

Labor costs are a significant concern, with rising minimum wages and competition for talent driving up expenses for retailers like Hy-Vee. In 2024, several states implemented minimum wage increases, adding to the operational cost burden. To address this, Hy-Vee has explored internal workforce realignments to optimize staffing and mitigate the impact of higher wage demands.

Supply chain disruptions and volatile fuel prices remain critical economic factors, directly influencing Hy-Vee's operational costs and product availability. These external pressures, coupled with inflation, create a challenging environment for maintaining consistent inventory and managing logistics efficiently.

The competitive landscape in the grocery sector is intensifying, with discounters and online platforms gaining market share. For instance, Aldi and Lidl demonstrated strong performance in 2024, while e-commerce grocery sales continued to grow. Hy-Vee must therefore focus on price competitiveness, product assortment, customer loyalty, and digital convenience to maintain its market position.

| Economic Factor | Impact on Hy-Vee | 2024/2025 Data/Trend |

| Inflation | Increased cost of goods, reduced consumer spending power | Food at home CPI up 2.6% (year ending April 2024) |

| Labor Costs | Higher wages, increased operational expenses | Minimum wage hikes in multiple states in 2024 |

| Supply Chain & Fuel Prices | Elevated logistics costs, potential product shortages | Ongoing global supply chain volatility |

| Competition | Pressure on pricing and market share | Growth of discounters (Aldi, Lidl) and online grocery platforms |

Preview Before You Purchase

Hy-Vee PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hy-Vee PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping Hy-Vee's strategic landscape.

Sociological factors

Consumers today place a high premium on convenience, a trend that significantly impacts grocery retailers. This demand is evident in the booming online grocery sector and the growing popularity of meal kits and prepared foods. For instance, a 2024 report indicated that over 70% of consumers now regularly use online grocery shopping, a substantial increase from previous years.

Hy-Vee has strategically adapted to these evolving preferences by investing in its digital infrastructure and physical store formats. The company's Aisles Online platform allows for easy ordering and pickup, while the development of micro-fulfillment centers aims to speed up online order processing. Furthermore, Hy-Vee's expansion of its Fast & Fresh convenience store concept directly addresses the need for quick meal solutions and grab-and-go options.

The integration of services like curbside pickup and the exploration of automated ordering systems further underscore Hy-Vee's commitment to meeting consumer demand for seamless and time-saving shopping experiences. These initiatives are crucial for maintaining competitiveness in a market where convenience is a key differentiator.

Societal shifts are increasingly prioritizing health and wellness, driving demand for organic, gluten-free, and specialized health products. Hy-Vee is actively responding to this trend by introducing dedicated health markets and providing in-store dietitian services, directly addressing consumer interest in well-being and preventative care.

Hy-Vee's identity as an employee-owned company deeply rooted in Midwestern communities fuels its commitment to community engagement and social responsibility. This is evident in its proactive disaster response, such as its significant contributions during the 2023 Midwest flooding, and ongoing partnerships with food banks, which distributed over 50 million pounds of food in 2024 to combat hunger.

These initiatives, including local promotional events and sponsorships, not only address societal needs but also cultivate strong brand loyalty and a positive public image. For instance, Hy-Vee's "Aisles of Thanks" program in November 2024 provided Thanksgiving meals to over 10,000 families across its operating states, reinforcing its community-centric values.

Demand for Sustainable and Ethically Sourced Products

Consumers increasingly prioritize products with a positive environmental and ethical footprint, driving demand for sustainable and transparently produced food. This shift means companies like Hy-Vee must demonstrate their commitment to responsible sourcing and production practices to resonate with their customer base.

Hy-Vee is actively responding to these evolving consumer expectations. For instance, their initiative to source 100% of their fresh and frozen seafood responsibly highlights a dedication to ethical supply chains. Furthermore, their efforts to reduce single-use plastics directly address growing concerns about environmental impact.

- Consumer Awareness: A 2024 Nielsen report indicated that 73% of global consumers are willing to change their consumption habits to reduce their environmental impact.

- Hy-Vee's Seafood Sourcing: By 2024, Hy-Vee aimed to have 100% of its fresh and frozen seafood sourced responsibly, aligning with international sustainability standards.

- Plastic Reduction: Hy-Vee's commitment to reducing single-use plastics by 2025 is a direct response to consumer pressure and regulatory trends favoring eco-friendly packaging.

Impact of Store Closures on Local Neighborhoods

The closure of Hy-Vee stores, especially in areas with a higher concentration of working-class residents, can create significant sociological disruptions. These closures directly impact food access, potentially creating food deserts where healthy and affordable options become scarce. Furthermore, the loss of local employment opportunities can destabilize household incomes and community well-being.

Hy-Vee has implemented strategies to lessen the blow of these closures. They've offered employment opportunities at their other locations to affected employees, aiming to retain their workforce. Additionally, the company has provided free grocery delivery services to nearby communities and increased support for local food banks, recognizing the heightened need in affected neighborhoods.

For instance, in 2024, Hy-Vee announced the closure of several stores, with reports indicating a focus on underperforming locations. While specific neighborhood impacts are often localized, data from similar retail closures in the past suggests that communities reliant on these stores can experience a decline in foot traffic for other small businesses as well. This ripple effect can further strain the social fabric of these areas.

The sociological ramifications extend beyond immediate access and employment:

- Reduced Community Cohesion: Local grocery stores often serve as informal community hubs, and their absence can diminish social interaction.

- Health Disparities: Limited access to fresh produce and healthy food options following a closure can exacerbate existing health disparities.

- Economic Strain on Vulnerable Populations: Working-class neighborhoods are often disproportionately affected by job losses and increased costs associated with accessing necessities.

Societal shifts toward health and wellness are a significant driver for Hy-Vee, influencing product selection and store offerings. Consumers are increasingly seeking organic, gluten-free, and specialized health products, prompting Hy-Vee to expand its health market sections and offer in-store dietitian services. This focus on well-being directly aligns with consumer demand for preventative care and healthier lifestyles, a trend strongly supported by market data showing a consistent rise in spending on health-focused foods year-over-year.

Hy-Vee's identity as an employee-owned company deeply integrated into Midwestern communities fosters strong community engagement and social responsibility. This is demonstrated through substantial contributions to disaster relief efforts, such as aid provided during the 2023 Midwest flooding, and ongoing partnerships with food banks. In 2024 alone, these partnerships facilitated the distribution of over 50 million pounds of food to combat hunger, underscoring the company's commitment to local well-being and social support networks.

Consumer demand for ethically sourced and environmentally conscious products is reshaping the retail landscape, pushing companies like Hy-Vee to prioritize sustainability. A 2024 Nielsen report highlighted that 73% of global consumers are willing to alter their buying habits to minimize environmental impact. Hy-Vee's commitment to responsible seafood sourcing, aiming for 100% by 2024, and its initiatives to reduce single-use plastics by 2025 directly address these growing consumer expectations for transparency and eco-friendly practices.

| Sociological Factor | Consumer Trend | Hy-Vee's Response/Initiative | Supporting Data/Example |

| Health & Wellness | Demand for organic, gluten-free, specialized health products | Expansion of health markets, in-store dietitian services | Consistent year-over-year growth in health food sales. |

| Community & Social Responsibility | Support for local initiatives, ethical business practices | Disaster relief contributions, food bank partnerships | Distributed over 50 million pounds of food in 2024. |

| Environmental Consciousness | Preference for sustainable and ethically sourced products | Responsible seafood sourcing, single-use plastic reduction | 73% of consumers willing to change habits for environmental impact (Nielsen 2024). |

Technological factors

Hy-Vee's investment in its RedMedia retail network is a key technological factor. By deploying over 10,000 digital screens across its stores, the company facilitates personalized advertising and real-time promotions, directly connecting brands with shoppers in a dynamic way.

This expansion into retail media networks offers significant advantages, creating new revenue streams for Hy-Vee through advertising sales. Furthermore, it enhances customer engagement by providing relevant offers and information at the point of purchase.

Hy-Vee's embrace of Digital Transformation, particularly through Electronic Shelf Labels (ESLs), is revolutionizing store operations. By deploying ESLs across hundreds of its locations, the company gains the ability to update pricing instantly, a significant leap from traditional manual methods. This not only boosts efficiency but also directly impacts labor costs associated with price changes.

Beyond operational streamlining, Hy-Vee's adoption of ESLs underscores a commitment to sustainability. The reduction in paper usage, a direct consequence of eliminating paper price tags, contributes to the company's environmental goals. Furthermore, the integrated flashing LED feature on these labels plays a crucial role in optimizing in-store order fulfillment for online purchases, ensuring faster and more accurate picking by staff.

Hy-Vee is significantly investing in its e-commerce infrastructure, aiming to streamline online grocery shopping. The company is developing micro-fulfillment centers (MFCs) to boost the efficiency of preparing online orders placed through its Aisles Online service, which is crucial for managing increased digital demand.

These MFCs are projected to handle a higher volume of orders and improve product availability for customers. For instance, Hy-Vee opened its first MFC in April 2023, with plans for more, indicating a strategic push to meet growing online grocery needs.

Further enhancing its digital reach, Hy-Vee has integrated Instacart's Fulfillment-as-a-Service. This partnership bolsters Hy-Vee's online delivery capabilities, allowing for faster and more reliable fulfillment of customer orders across its service areas.

Adoption of Autonomous Robotics for Operations

Hy-Vee is actively integrating autonomous robotics to streamline store operations. For instance, the company has deployed 'Tally' robots in select locations to perform crucial inventory checks, identifying out-of-stock items and pricing inaccuracies. This automation directly contributes to enhanced operational efficiency and a reduction in inventory errors.

The implementation of these robots allows Hy-Vee employees to shift their focus from manual stock-taking to direct customer engagement, thereby improving the overall in-store experience. This strategic adoption of technology underscores Hy-Vee's dedication to leveraging automation within its physical retail spaces to drive productivity and customer satisfaction.

- Robotic Shelf Scanning: Hy-Vee utilizes Tally robots for autonomous shelf monitoring, detecting stockouts and pricing errors.

- Operational Efficiency Gains: Automation reduces manual labor for inventory checks, improving overall store performance.

- Enhanced Customer Service Focus: By offloading inventory tasks, employees can dedicate more time to direct customer interaction.

- Reduced Inventory Discrepancies: Real-time data from robots helps minimize stock inaccuracies and associated losses.

Seamless Payment Technologies and Online Accessibility

Hy-Vee's integration of seamless payment technologies significantly boosts its online accessibility. Collaborations with providers like PayPal and Venmo offer customers secure and flexible transaction choices, directly improving the digital shopping journey. This focus on user-friendly payments is crucial in a market where convenience drives customer loyalty.

Further expanding reach, Hy-Vee now accepts SNAP/EBT for online grocery deliveries. This move not only broadens the customer base by serving a wider demographic but also aligns with the growing trend of digital inclusion in the grocery sector. By 2024, online grocery sales in the U.S. were projected to reach over $200 billion, highlighting the importance of accessible payment options in this expanding market.

- Expanded Payment Options: Partnerships with PayPal and Venmo enhance security and flexibility for online shoppers.

- Increased Accessibility: Acceptance of SNAP/EBT for online orders opens Hy-Vee to a broader customer segment.

- Market Alignment: These initiatives reflect the broader industry trend towards digital accessibility in retail.

- Digital Growth: Over 10% of U.S. grocery sales occurred online in 2024, underscoring the need for robust digital payment infrastructure.

Hy-Vee's technological advancements are reshaping the grocery landscape, from in-store operations to online fulfillment. The company's investment in its RedMedia retail network, featuring over 10,000 digital screens, transforms advertising and promotions at the point of sale. This strategy not only generates new advertising revenue but also enhances customer engagement through personalized offers.

Hy-Vee's adoption of Electronic Shelf Labels (ESLs) across hundreds of stores streamlines pricing updates, reducing labor costs and paper waste. These smart labels also feature flashing LEDs that aid staff in fulfilling online orders more efficiently. Furthermore, the company is bolstering its e-commerce capabilities by developing micro-fulfillment centers (MFCs), with the first opened in April 2023, to expedite online grocery order preparation and improve product availability for its Aisles Online service.

The integration of Instacart's Fulfillment-as-a-Service enhances Hy-Vee's online delivery network, ensuring faster and more reliable order fulfillment. In-store, Hy-Vee is deploying 'Tally' robots for autonomous inventory checks, identifying stockouts and pricing errors, which frees up employees for direct customer interaction and minimizes inventory discrepancies. The company also enhances digital accessibility by offering flexible payment options like PayPal and Venmo, and by accepting SNAP/EBT for online deliveries, aligning with the growing trend of digital inclusion in the grocery sector.

Legal factors

Legislation such as California's AB 647, enacted January 1, 2024, directly affects grocery retailers like Hy-Vee by establishing requirements during ownership changes or store closures. These laws mandate that a new owner must retain existing grocery workers for a minimum period, prioritizing those on preferential hiring lists. This aims to protect employees during industry shifts, impacting Hy-Vee's operational flexibility and potential acquisition costs.

Hy-Vee must navigate evolving state and local minimum wage laws, which have seen increases in recent years. For instance, as of January 1, 2024, several states and cities raised their minimum wages, impacting retail employers like Hy-Vee. These adjustments directly influence labor costs and necessitate ongoing review of HR policies.

Beyond wages, Hy-Vee is bound by comprehensive labor regulations covering areas like paid sick leave and workplace safety standards. Compliance with these mandates, which can vary significantly by jurisdiction, adds to operational expenses and shapes human resource strategies. The increasing focus on employee well-being and fair labor practices means these legal factors are critical for maintaining smooth operations.

The ongoing trend of raising minimum wages, particularly in urban centers where Hy-Vee operates, places direct pressure on the labor costs within its business model. For example, states like Iowa, where Hy-Vee is headquartered, have a state minimum wage, but local ordinances can sometimes impose higher requirements, creating a complex compliance landscape.

Hy-Vee's RedMedia platform, which leverages customer data for personalized marketing, faces increasing scrutiny under evolving data privacy and consumer protection laws. Regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which went into full effect in 2023, set stringent standards for data collection, usage, and consumer rights, impacting how Hy-Vee manages its customer information.

Compliance with these increasingly complex and stringent laws is paramount to maintaining consumer trust and avoiding significant legal penalties. For instance, violations of CCPA can result in fines of $2,500 per unintentional violation and $7,500 per intentional violation, as reported by the California Attorney General's office.

Antitrust and Competition Regulations

Antitrust and competition regulations are a significant legal consideration for Hy-Vee. The Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively monitor the grocery sector for potential monopolistic practices. Recent actions, such as the FTC's challenge to Kroger's proposed acquisition of Albertsons in late 2023, highlight the government's commitment to preventing large-scale consolidation that could harm consumers through higher prices or reduced choice. While Hy-Vee's acquisition of Strack & Van Til in early 2024 was permitted, indicating a focus on specific market impacts, any future substantial mergers or acquisitions by Hy-Vee would undoubtedly face intense scrutiny under these antitrust laws to ensure continued fair competition.

The regulatory environment demands careful navigation for companies like Hy-Vee aiming for growth through acquisition.

- Increased Scrutiny: Mergers in the grocery sector are under heightened antitrust review, with regulators prioritizing consumer welfare and market competition.

- Precedent Setting: Blocked or challenged large mergers serve as a clear signal of the regulatory stance on industry consolidation.

- Market Share Thresholds: While not explicitly defined, significant increases in market share within specific geographic areas are likely to trigger deeper investigations.

Workplace Violence Prevention Legislation

New legislation, including expanded temporary restraining orders for workplace violence, is scheduled for implementation in various states starting in 2025. This legal shift mandates that companies like Hy-Vee create and enact comprehensive workplace violence prevention plans.

Compliance with these new regulations will involve robust training programs for staff and meticulous recordkeeping. For instance, states like California have seen increased focus on employer responsibility for preventing harassment and violence, with potential penalties for non-compliance.

Hy-Vee's proactive approach to these legal changes is crucial for safeguarding its workforce and ensuring a secure operational environment. Failure to adhere to these evolving legal standards could result in significant fines and reputational damage.

- 2025: Implementation of new workplace violence prevention laws in several states.

- Mandatory development and execution of violence prevention plans by employers.

- Requirement for comprehensive employee training and diligent recordkeeping.

- Potential legal and financial repercussions for non-compliance.

Hy-Vee must navigate a complex web of labor laws, including minimum wage increases that directly impact operational costs. For example, states and cities continue to raise minimum wages, with many adjustments taking effect in early 2024 and projected for 2025, requiring constant HR policy review.

Data privacy regulations, such as California's CPRA, which became fully effective in 2023, impose strict rules on how Hy-Vee collects and uses customer data for its RedMedia platform, with potential fines of up to $7,500 per intentional violation.

Antitrust laws are a significant legal hurdle, as demonstrated by the FTC's challenge to the Kroger-Albertsons merger in late 2023, signaling increased scrutiny on large grocery sector consolidations and impacting Hy-Vee's potential future acquisitions.

New legislation starting in 2025 mandates comprehensive workplace violence prevention plans and employee training, adding to compliance burdens and operational expenses for retailers like Hy-Vee.

Environmental factors

Hy-Vee is making significant strides in waste reduction, particularly targeting food waste and plastics. In 2023, the company reported diverting over 10 million pounds of food waste from landfills across its retail operations. This commitment extends to its distribution centers, with several achieving TRUE Zero Waste certification, a testament to their comprehensive waste management strategies.

The company is actively working to phase out single-use plastics, prioritizing the adoption of recyclable containers and exploring innovative, sustainable packaging alternatives. These efforts are crucial in addressing environmental concerns and aligning with growing consumer demand for eco-friendly practices in the grocery sector.

Hy-Vee is actively investing in energy conservation and efficiency across its operations. The company has implemented significant upgrades, such as transitioning to LED lighting, which can reduce energy consumption for lighting by up to 80% compared to traditional incandescent bulbs. These initiatives are crucial for minimizing operational costs and aligning with growing consumer and regulatory demands for environmental responsibility.

Further enhancing efficiency, Hy-Vee's store designs increasingly incorporate features to maximize natural light, reducing reliance on artificial lighting during daylight hours. The integration of automated lighting controls and advanced refrigeration systems also plays a vital role in curbing energy usage. These comprehensive efforts are designed to substantially lower Hy-Vee's carbon footprint, demonstrating a commitment to sustainability that resonates with environmentally conscious stakeholders.

Hy-Vee's commitment to sustainable product sourcing is a key environmental consideration. Notably, they were the first Midwest retailer to source 100% of their fresh and frozen seafood from responsible sources, a significant achievement reflecting their dedication to environmental stewardship.

This focus on responsible sourcing isn't limited to seafood; Hy-Vee is expanding these practices across various product categories. This proactive approach directly addresses the increasing consumer demand for products that are both ethically produced and environmentally friendly, a trend that gained significant momentum in 2024 and is projected to continue growing.

Efforts to Reduce Plastic Usage and Sustainable Packaging

Hy-Vee is making strides in reducing its environmental footprint by tackling plastic usage. They are actively replacing single-use plastic to-go containers with more sustainable, recyclable options, responding directly to growing consumer demand for eco-friendly practices. This shift is crucial as consumers increasingly prioritize businesses that demonstrate environmental responsibility.

The company is also committed to ongoing research and adoption of innovative sustainable packaging solutions. The goal is to find materials that are not only practical for everyday use but also minimize harm to the planet. For instance, by 2024, many grocery retailers are aiming to increase their use of compostable or recycled content in packaging by 20% compared to 2020 levels.

- Reduced Single-Use Plastics: Transitioning away from traditional plastic to-go containers.

- Sustainable Packaging Research: Investing in and adopting new, environmentally friendly packaging materials.

- Consumer Demand Alignment: Addressing a key concern for environmentally conscious shoppers.

- Environmental Benefit Focus: Prioritizing packaging that is functional and ecologically sound.

Corporate Sustainability Goals and Reporting

Hy-Vee's commitment to sustainability is a core part of its mission to create a more responsible retailing model. This includes significant efforts to reduce environmental impact across its operations.

The company actively employs technology to combat food waste. For instance, Hy-Vee utilizes electronic shelf labels to dynamically adjust prices on perishable items, a strategy that directly addresses waste reduction and has shown promising results in pilot programs, contributing to their broader environmental objectives.

Key sustainability initiatives and their impact include:

- Food Waste Reduction: Implementing dynamic pricing on perishables through electronic shelf labels aims to divert a significant portion of food from landfills.

- Energy Efficiency: Investments in energy-efficient store designs and operations are ongoing, targeting a reduction in overall energy consumption.

- Sustainable Sourcing: Hy-Vee continues to explore and expand its partnerships with local and sustainable food producers, enhancing its supply chain's environmental credentials.

Hy-Vee is actively addressing environmental concerns through several key initiatives. The company is making significant progress in reducing its plastic footprint, with a notable focus on phasing out single-use plastics and adopting more sustainable packaging solutions, a trend that gained significant traction in 2024.

Waste reduction remains a priority, evidenced by their efforts in diverting food waste from landfills. For example, Hy-Vee reported diverting over 10 million pounds of food waste in 2023 alone, showcasing a tangible commitment to environmental stewardship.

Furthermore, Hy-Vee is investing in energy efficiency across its operations, including the widespread adoption of LED lighting, which can reduce lighting energy consumption by up to 80%. These measures are critical for minimizing operational costs and aligning with growing consumer and regulatory demands for environmental responsibility.

The company's commitment to sustainable product sourcing is also a key environmental consideration, with Hy-Vee being the first Midwest retailer to source 100% of its fresh and frozen seafood from responsible sources.

| Environmental Initiative | 2023 Data/Progress | 2024 Focus/Goals |

|---|---|---|

| Food Waste Diversion | Over 10 million pounds diverted from landfills | Continued expansion of waste reduction programs |

| Plastic Reduction | Phasing out single-use plastics, exploring recyclable containers | Increased adoption of sustainable packaging alternatives |

| Energy Efficiency | Transition to LED lighting (up to 80% reduction potential) | Further integration of energy-saving store designs and technologies |

| Sustainable Sourcing | 100% responsible sourcing for fresh/frozen seafood | Expanding responsible sourcing across additional product categories |

PESTLE Analysis Data Sources

Our Hy-Vee PESTLE analysis is informed by a robust blend of data, including government reports on agricultural policy and food safety regulations, economic indicators from the USDA and Bureau of Labor Statistics, and consumer spending trends from market research firms like Nielsen. We also incorporate environmental impact assessments and industry-specific technological advancements.