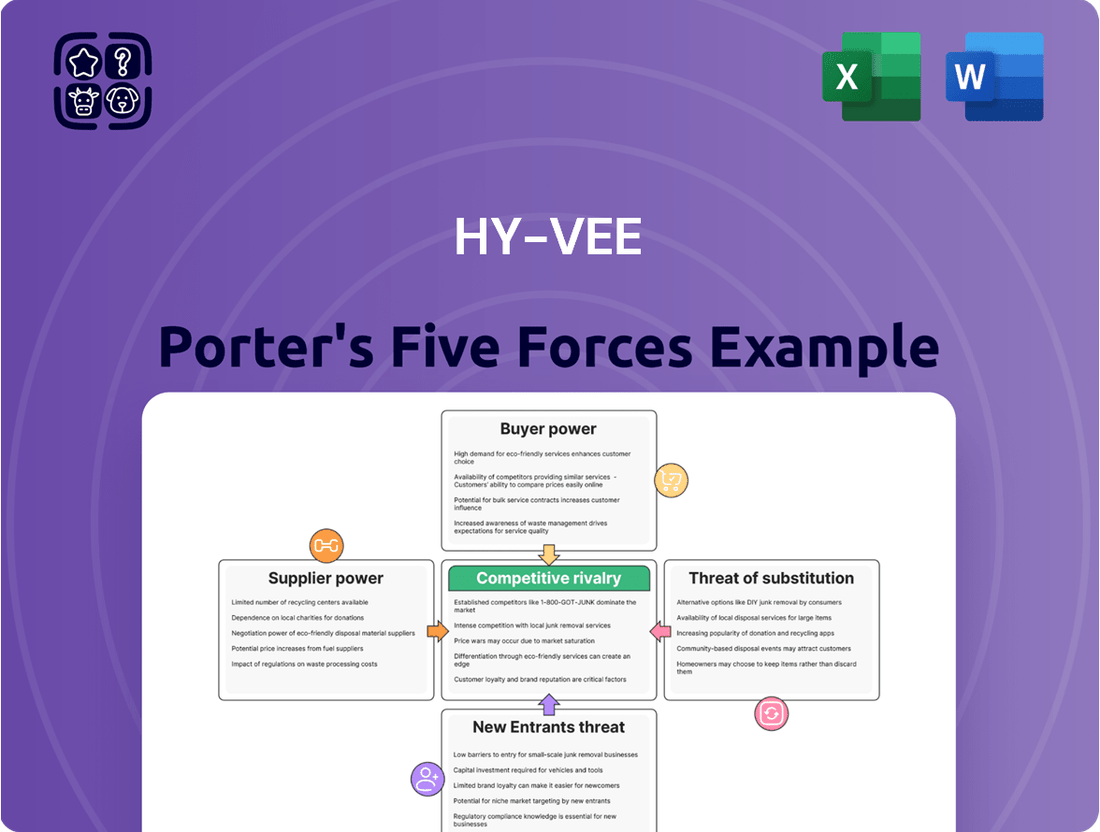

Hy-Vee Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hy-Vee Bundle

Hy-Vee navigates a dynamic grocery landscape, facing intense rivalry from established players and the ever-present threat of new entrants. Understanding the bargaining power of both its suppliers and its customers is crucial for its sustained success.

The complete report reveals the real forces shaping Hy-Vee’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hy-Vee's immense scale, boasting over 570 business units and generating annual sales exceeding $13 billion, grants it considerable sway with many suppliers. This large purchasing volume across a wide array of goods, from groceries to perishables, diminishes the leverage of individual suppliers.

The ability to place substantial orders for diverse product categories, including fresh produce, meat, and dairy, significantly reduces the bargaining power of many suppliers. This purchasing might enables Hy-Vee to secure advantageous terms, pricing, and delivery arrangements.

For many everyday grocery items, Hy-Vee faces minimal costs when switching between suppliers, as numerous vendors typically offer similar products. This generally limits the bargaining power of suppliers for these standard goods.

However, the situation changes for Hy-Vee's private-label brands or unique, specialty items. In these cases, the costs and complexities associated with finding and onboarding a new supplier can be substantial, thereby increasing the bargaining power of those specific suppliers.

To counter this, Hy-Vee actively cultivates a broad network of suppliers and consistently explores new relationships. For instance, in 2024, Hy-Vee continued its strategy of expanding its vendor base, aiming to reduce reliance on any single supplier for critical product lines.

The threat of suppliers integrating forward into the retail space, essentially becoming competitors, is generally low for Hy-Vee's primary product suppliers. Establishing and running a large supermarket chain like Hy-Vee demands substantial capital, sophisticated logistics, and extensive operational expertise, which are significant barriers for most suppliers.

While some smaller, perhaps local, food producers might explore direct-to-consumer sales models, their scale and reach typically do not present a material threat to Hy-Vee's established market presence and customer base. These efforts are often niche and lack the widespread appeal or operational efficiency to challenge a major retailer.

In fact, Hy-Vee's strategic emphasis on local sourcing often fosters collaborative, rather than competitive, relationships with its suppliers. This approach can lead to mutually beneficial partnerships, where suppliers gain a reliable sales channel and Hy-Vee secures unique, high-quality products, strengthening its brand and customer loyalty.

Uniqueness of Supplier Offerings

While some suppliers might offer unique products that consumers actively seek, Hy-Vee's strategy of being a comprehensive, one-stop shop for a wide array of goods dilutes the impact of any single unique offering. This broad product assortment means Hy-Vee isn't overly reliant on any one supplier's specialized items, providing a buffer against concentrated supplier power.

Hy-Vee proactively works to mitigate supplier uniqueness by actively seeking out new and innovative products through initiatives like its supplier summits. This continuous effort diversifies its product mix, lessening its dependence on any particular supplier's proprietary or highly differentiated items.

- Hy-Vee's extensive product catalog minimizes reliance on any single unique supplier offering.

- Supplier summits are a key strategy for diversifying product sourcing and reducing dependence on unique items.

- The company's commitment to being a 'one-stop shop' naturally spreads its purchasing power across a wider supplier base.

Hy-Vee's Strategy to Manage Suppliers

Hy-Vee actively mitigates supplier power through its innovative 'Opportunity Supplier Impact Summits.' These summits offer a direct channel for small businesses and entrepreneurs to connect with Hy-Vee's category managers, fostering a more competitive supplier landscape.

During these events, Hy-Vee can discover novel products, negotiate favorable terms, and even offer guaranteed shelf space. In 2024, Hy-Vee continued to emphasize sourcing from local and diverse suppliers, a trend that strengthens its bargaining position by increasing the pool of potential partners.

- Direct Access: Summits provide entrepreneurs direct engagement with Hy-Vee's buyers.

- New Product Discovery: Facilitates the introduction of unique and competitive products.

- Negotiation Opportunities: Enables on-the-spot deal-making and favorable pricing.

- Supplier Competition: Increases options for Hy-Vee, driving better terms and innovation.

Hy-Vee's substantial purchasing volume, exceeding $13 billion in annual sales across over 570 units, generally limits the bargaining power of its suppliers for common goods. The company's ability to switch between numerous vendors for standard products, like produce or dairy, keeps supplier leverage low. However, for Hy-Vee's exclusive private-label items or specialty products, the supplier's bargaining power increases due to higher switching costs and the need for specialized production.

Hy-Vee actively manages supplier power through its 'Opportunity Supplier Impact Summits.' These events, which continued to be a focus in 2024, allow Hy-Vee to discover new products and negotiate directly with a diverse range of suppliers, including local and minority-owned businesses. This strategy broadens Hy-Vee's supplier base, reducing reliance on any single entity and fostering a more competitive environment that benefits Hy-Vee's purchasing terms.

| Factor | Impact on Hy-Vee | Mitigation Strategy |

|---|---|---|

| Supplier Concentration | Low for commodity items, High for private label | Diversifying supplier base, exploring new partnerships |

| Switching Costs | Low for standard products, High for specialized items | Maintaining strong relationships with key private label suppliers |

| Supplier Differentiation | Diluted by Hy-Vee's 'one-stop shop' model | Supplier summits to discover unique products and foster competition |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Hy-Vee's grocery and retail landscape.

Instantly visualize Hy-Vee's competitive landscape with a dynamic Porter's Five Forces analysis, simplifying complex market pressures for strategic clarity.

Customers Bargaining Power

Customers in the Midwest grocery sector often show a strong sensitivity to price, especially given the wide array of choices available. With numerous competitors like Kroger, Aldi, and Walmart, consumers can easily shift their spending to find better deals or specific products, thereby amplifying their influence.

This ease of switching means Hy-Vee faces pressure to keep its prices competitive. For instance, in 2024, the average grocery inflation rate remained a concern for many households, making price a key decision factor. Hy-Vee's strategy must therefore balance competitive pricing with unique offerings to retain customer loyalty.

For grocery shoppers, the effort to switch to a different supermarket is generally quite low, mostly involving a change in driving route. Hy-Vee works to raise these costs, though, by using loyalty programs such as Hy-Vee PERKS and PERKS Plus. These programs offer special pricing, savings on fuel, and digital coupons, making it more appealing for customers to stick with Hy-Vee.

Customers today wield significant power due to readily available information. Online platforms, Hy-Vee's own app, and even social media allow shoppers to easily compare prices, quality, and promotions across different retailers. This transparency means Hy-Vee must constantly ensure its offerings are competitive and its pricing is clear to attract and retain customers. For instance, in 2024, grocery price comparison apps are widely used, giving consumers instant insights into where they can find the best deals.

Customer Concentration

Hy-Vee's customer base is highly fragmented, meaning no single customer or small group of customers represents a substantial portion of its revenue. This diffusion of customers inherently weakens the bargaining power of any individual buyer. For instance, in 2024, Hy-Vee's customer loyalty programs, which engage millions of shoppers across its operating regions, underscore this broad customer reach.

While individual customer influence is minimal, collective customer actions, driven by broader market trends or economic shifts, can still exert pressure. For example, widespread consumer demand for lower prices or specific product offerings can influence Hy-Vee's pricing and product assortment strategies. This is evident in the competitive grocery landscape where consumer sentiment, tracked through market research firms, often dictates strategic adjustments.

- Fragmented Customer Base: Hy-Vee serves a vast number of individual shoppers, preventing any single customer from wielding significant power.

- Limited Individual Bargaining Power: The lack of customer concentration means individual customers cannot easily dictate terms or prices.

- Collective Influence: While individual power is low, widespread consumer sentiment and demand can collectively impact Hy-Vee's strategies.

- 2024 Market Dynamics: Consumer preferences for value and convenience, widely observed in 2024 grocery trends, demonstrate the potential for collective customer influence.

Importance of Hy-Vee's Products to Customers

While groceries are undeniably essential, customers today have a wide array of choices for meeting their food and household needs. This means that no single product category is so crucial that customers cannot find alternatives if Hy-Vee's prices or offerings become unfavorable.

Hy-Vee actively works to mitigate this by positioning itself as more than just a grocery store. It aims to be a comprehensive lifestyle destination, offering a broad spectrum of products and valuable in-store services. These include:

- In-house delis and bakeries: Providing prepared foods and fresh baked goods, adding convenience and perceived value.

- Pharmacy services: Integrating health and wellness needs, making it a convenient stop for prescriptions and health essentials.

- Additional amenities: Such as floral departments, wine and spirits sections, and sometimes even cafes or restaurants, further solidifying its one-stop-shop appeal.

By bundling these diverse offerings and emphasizing strong customer service, Hy-Vee strives to cultivate customer loyalty and make itself the preferred choice for a larger basket of goods and services. This strategy aims to reduce the customers' ability to easily switch to competitors for any single item, thereby strengthening Hy-Vee's position.

Hy-Vee faces moderate bargaining power from its customers. The grocery market is highly competitive, with consumers easily switching between retailers like Walmart, Target, and regional chains. In 2024, grocery inflation continued to be a concern, amplifying price sensitivity among shoppers. This means Hy-Vee must maintain competitive pricing and offer compelling value propositions to retain its customer base.

While individual customers have little power due to Hy-Vee's large and fragmented customer base, collective consumer sentiment can influence strategies. For instance, widespread demand for organic or plant-based foods, observed in 2024 trends, has pushed retailers to expand these offerings. Hy-Vee's loyalty programs, like Hy-Vee PERKS, aim to increase switching costs by offering discounts and fuel rewards, thereby mitigating some customer power.

| Factor | Impact on Hy-Vee | Mitigation Strategy |

|---|---|---|

| Price Sensitivity | Moderate to High | Competitive pricing, loyalty programs (PERKS) |

| Availability of Substitutes | High | Differentiated offerings, in-store services, lifestyle destination |

| Switching Costs | Low (individual items) | Loyalty programs, bundled services, convenience |

| Information Availability | High | Transparent pricing, promotions, digital engagement |

What You See Is What You Get

Hy-Vee Porter's Five Forces Analysis

This preview showcases the complete Hy-Vee Porter's Five Forces Analysis, providing a thorough examination of competitive forces within the grocery industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning needs. You're looking at the actual, professionally formatted analysis, ready for instant download and use the moment you buy.

Rivalry Among Competitors

Hy-Vee operates in a fiercely competitive Midwestern grocery market. This intense rivalry stems from the presence of numerous national giants like Walmart, which boasts over 4,600 stores in the U.S. as of early 2024, and Kroger, operating over 2,700 stores. Regional players such as Meijer, alongside discount grocers like Aldi, further intensify the landscape.

The grocery retail sector generally sees moderate growth, which can make competition fierce as companies vie for a larger slice of the market. This environment demands strategic moves to stand out and capture more customers.

Hy-Vee is actively working to grow its presence. A key move in 2024 was the acquisition of the Strack & Van Til Food Market chain, adding several stores in Indiana to its portfolio. This expansion is a direct response to the need to increase market share in a competitive landscape.

Beyond acquisitions, Hy-Vee is also innovating with new store concepts like its Fast & Fresh format. These smaller, convenience-focused stores are designed to attract different customer segments and offer a quicker shopping experience, further fueling its growth strategy amidst industry maturity.

Hy-Vee actively works to stand out from competitors by offering a wide range of products, numerous in-store services like pharmacies, and a dedicated focus on customer service, famously promoting 'A Helpful Smile in Every Aisle'.

The company also embraces technology, implementing digital shelf labels and its RedMedia retail media network to improve the shopping journey and deliver distinctive value to both shoppers and suppliers.

Switching Costs for Customers

The grocery sector generally sees low customer switching costs, meaning shoppers can easily move between stores based on factors like price, promotions, or location. This ease of switching fuels intense competition among retailers. For instance, in 2024, the average US household spent an estimated $5,700 on groceries annually, a figure influenced by competitive pricing across numerous chains.

Hy-Vee addresses this by focusing on customer retention through its loyalty program. The Hy-Vee PERKS program provides tangible benefits such as fuel discounts and special pricing on select items. These incentives are designed to encourage repeat business and build a more committed customer base, thereby mitigating the impact of low switching costs.

The effectiveness of such loyalty programs can be seen in industry trends. By mid-2024, a significant portion of grocery shoppers actively engaged with loyalty programs, with many indicating that discounts and personalized offers were key drivers for their store choices. Hy-Vee's investment in these programs aims to capture a larger share of this engaged consumer segment.

- Low switching costs in grocery retail allow consumers to easily change where they shop based on price and convenience.

- Hy-Vee utilizes its PERKS loyalty program to incentivize repeat purchases and reduce customer churn.

- Loyalty programs offer benefits like fuel discounts and exclusive pricing to foster customer stickiness.

- Industry data from 2024 indicates a strong consumer reliance on loyalty programs for grocery shopping decisions.

Strategic Stakes and Exit Barriers

The grocery sector, including businesses like Hy-Vee, is characterized by substantial fixed costs. These include investments in brick-and-mortar stores, complex distribution systems, and prime real estate, all of which contribute to high exit barriers. For a company like Hy-Vee, these significant investments mean it's difficult and costly to leave the market.

Hy-Vee's deep roots, with a history dating back to 1930, and its employee-owned structure mean the company has considerable strategic stakes in its current market position. This ownership model fosters a long-term perspective and a strong incentive to protect its established presence, making it less likely to divest or withdraw.

These high strategic stakes and exit barriers naturally fuel intense competition. Established players are compelled to invest continuously and aggressively to defend their market share, leading to a dynamic environment where companies like Hy-Vee are constantly working to maintain their competitive edge.

- High Fixed Costs: Grocery retailers face significant upfront and ongoing expenses in physical infrastructure and logistics.

- Employee Ownership: Hy-Vee's employee ownership model creates a strong vested interest in long-term market stability.

- Market Defense: The combination of high exit barriers and strategic stakes encourages aggressive, sustained competition.

Hy-Vee faces intense competition from national players like Walmart and Kroger, as well as regional grocers and discount chains. This rivalry is amplified by moderate industry growth, pushing companies to innovate and expand to capture market share. Hy-Vee's acquisition of Strack & Van Til in 2024 and its development of new store formats like Fast & Fresh are strategic responses to this dynamic environment.

The grocery sector's low customer switching costs mean consumers readily move between stores, making customer retention crucial. Hy-Vee combats this with its PERKS loyalty program, offering benefits like fuel discounts and special pricing, which data from 2024 suggests is a key factor in consumer choices. This focus on loyalty aims to build a more committed customer base amidst fierce price and convenience competition.

High fixed costs, including investments in stores and distribution, create significant exit barriers in the grocery industry. Coupled with Hy-Vee's employee ownership structure, which fosters a long-term strategic commitment, these factors drive aggressive competition. Established players like Hy-Vee must continually invest to defend their market share, ensuring a perpetually competitive landscape.

| Competitor Type | Key Characteristics | Impact on Hy-Vee |

|---|---|---|

| National Giants (e.g., Walmart, Kroger) | Extensive store networks, economies of scale, aggressive pricing | Forces Hy-Vee to compete on price and operational efficiency |

| Regional Players (e.g., Meijer) | Strong local presence, tailored offerings | Requires Hy-Vee to differentiate through unique services and product selection |

| Discount Grocers (e.g., Aldi) | Low prices, limited selection, efficient operations | Puts pressure on Hy-Vee's pricing strategy and value proposition |

SSubstitutes Threaten

The threat of substitutes for Hy-Vee, particularly from prepared meals and meal kits, is significant as consumers increasingly prioritize convenience. Services offering ready-to-eat meals from restaurants, fast-casual establishments, and specialized meal kit delivery platforms directly compete with groceries intended for home preparation. Hy-Vee counters this by expanding its in-store prepared food offerings, including extensive delis, bakeries, and dedicated foodservice sections with options like 'Mealtime To Go'.

Hy-Vee's strategic response includes promoting initiatives like the 'Healthy Family Meal Kit Campaign', aiming to capture a share of the convenience-seeking market. This allows them to offer a middle ground between traditional grocery shopping and fully outsourced meal solutions. The prepared foods market itself is substantial; in 2024, the global ready-to-eat meal market was valued at over $150 billion and is projected to continue growing, underscoring the competitive pressure Hy-Vee faces from these substitutes.

The increasing prevalence of online-only grocery retailers and third-party delivery services presents a significant threat of substitutes for Hy-Vee's traditional brick-and-mortar model. These platforms offer unparalleled convenience, directly catering to consumers seeking to bypass physical store visits. For instance, by mid-2024, the online grocery market continued its robust expansion, with projections indicating further growth driven by evolving consumer habits and technological advancements in delivery logistics.

For fresh produce and unique or niche food items, consumers have alternatives to large supermarkets like Hy-Vee. Farmers' markets and specialty food stores, such as dedicated butcher shops, bakeries, or health food stores, cater to shoppers looking for local, organic, or artisanal products. These options can draw customers away by offering a more curated or specialized shopping experience.

Restaurants and Foodservice Industry

The broader foodservice industry, including dine-in restaurants, takeout, and catering, presents a significant substitute for consumers choosing to prepare meals at home using groceries. As of December 2024, the spending gap between dining out and grocery shopping exceeded $20 billion, highlighting the substantial appeal of prepared food options.

Hy-Vee effectively addresses this threat by integrating various in-store dining experiences and ready-to-eat solutions.

- The foodservice industry offers convenience alternatives to home cooking.

- In late 2024, the difference in consumer spending between eating out and buying groceries was over $20 billion.

- Hy-Vee counters this by providing in-store dining, such as Market Grille Express, and a wide array of prepared foods.

- These offerings directly compete with external restaurant substitutes, retaining customer spending within Hy-Vee's ecosystem.

Convenience Stores and Drugstores

Convenience stores and drugstores present a moderate threat of substitution for Hy-Vee, particularly for shoppers seeking immediate, fill-in purchases rather than a full grocery shop. These outlets, often found in highly accessible locations, cater to impulse buys and urgent needs, diverting some sales from Hy-Vee's larger format stores. For instance, a consumer needing a single item like milk or a prescription might opt for a nearby convenience store or drugstore, bypassing a trip to Hy-Vee.

Hy-Vee actively mitigates this threat by operating its own Fast & Fresh convenience stores. These are strategically positioned close to its main supermarket locations, aiming to capture those quick-trip customers. This integration allows Hy-Vee to benefit from the convenience shopper's need for speed and proximity, thereby retaining a portion of sales that might otherwise be lost to external competitors. In 2023, the convenience store sector in the US saw significant growth, with sales reaching over $270 billion, underscoring the market's demand for quick-stop options.

- Substitution Impact: Convenience stores and drugstores offer a viable alternative for consumers needing specific items quickly, posing a moderate threat to Hy-Vee's overall sales volume.

- Hy-Vee's Response: The company's Fast & Fresh convenience stores are a direct strategy to counter this threat by offering a complementary, convenient shopping experience.

- Market Context: The convenience store market's substantial revenue, exceeding $270 billion in the US in 2023, highlights the significant consumer reliance on these outlets for quick purchases.

The threat of substitutes for Hy-Vee is amplified by the growing popularity of meal kits and prepared meals, driven by consumer demand for convenience. These options directly compete with traditional grocery shopping for home preparation. Hy-Vee is actively addressing this by expanding its in-store prepared food selections and offering its own meal kit options, aiming to capture a share of this convenience-focused market.

The global ready-to-eat meal market, valued at over $150 billion in 2024, illustrates the significant competitive pressure from these convenient food substitutes. Hy-Vee's strategic investment in its foodservice and meal kit offerings, such as the 'Healthy Family Meal Kit Campaign', positions it to compete effectively by providing consumers with convenient, ready-to-prepare or ready-to-eat solutions.

| Substitute Type | Description | Hy-Vee's Counter-Strategy | Market Data (2024) |

| Prepared Meals & Meal Kits | Convenient, ready-to-eat or easy-to-prepare food options | Expanded in-store delis, bakeries, foodservice sections, Mealtime To Go, Healthy Family Meal Kit Campaign | Global ready-to-eat meal market > $150 billion |

| Online-Only Grocers & Delivery Services | Bypass physical stores, offering high convenience | Investing in online ordering and delivery infrastructure | Continued robust expansion of online grocery market |

| Farmers' Markets & Specialty Stores | Offer local, organic, or artisanal products | Curated selection of specialty items within stores | Niche market catering to specific consumer preferences |

| Foodservice Industry (Restaurants, Takeout) | Dine-in, takeout, and catering options | In-store dining (Market Grille Express), extensive prepared foods | Consumer spending gap between dining out and groceries > $20 billion |

Entrants Threaten

The grocery retail sector, particularly for a large supermarket chain like Hy-Vee, presents a formidable barrier to entry due to exceptionally high capital requirements. New players must secure significant funding for prime real estate, sophisticated store builds, extensive inventory stocking, and robust supply chain networks. For instance, the average cost to build a new supermarket can range from $10 million to over $50 million, depending on size and location.

These substantial upfront investments deter many potential entrants. Hy-Vee's own recent experiences, with reported delays in expansion projects attributed to rising interest rates and escalating construction expenses in 2023 and 2024, underscore the financial hurdles involved. These economic conditions make it even more challenging for new competitors to gather the necessary capital to establish a competitive foothold against established players.

Established grocery retailers like Hy-Vee leverage substantial economies of scale in purchasing, distribution, and marketing. This allows them to secure more favorable pricing from suppliers and operate with greater efficiency compared to newer market participants. For instance, in 2024, Hy-Vee's extensive network of stores and its multiple major warehouse facilities in regions like the Midwest enable significant logistical advantages, driving down per-unit costs.

New entrants would find it challenging to match these cost efficiencies, particularly in competing on price with established players. The capital investment required to build a comparable distribution and supply chain infrastructure is immense, creating a significant barrier to entry. This cost disadvantage makes it difficult for new companies to offer competitive pricing, a crucial factor in the grocery sector.

Hy-Vee's deep-rooted brand loyalty, built over decades and amplified by its employee-owned structure and commitment to customer service, presents a significant hurdle for new entrants. This loyalty is further solidified by programs like Hy-Vee PERKS, which make it challenging for newcomers to capture market share.

Access to Distribution Channels and Supplier Relationships

New entrants face significant hurdles in establishing efficient supply chains and securing favorable supplier relationships, a process that is both complex and time-consuming. Hy-Vee, with its decades of experience, has cultivated robust distribution networks and long-standing partnerships with a diverse range of suppliers. These established relationships are not easily replicated by newcomers, creating a substantial barrier to entry.

Hy-Vee's proactive approach to supplier engagement, exemplified by its supplier summits, ensures a continuous flow of innovative products. For instance, in 2023, Hy-Vee highlighted its commitment to supporting its supplier network, fostering an environment conducive to product development and market readiness. This strategic focus on supplier collaboration strengthens Hy-Vee's competitive advantage by ensuring access to a consistent and evolving product assortment.

- Established Distribution Networks: Hy-Vee's extensive logistics infrastructure, developed over many years, provides a significant advantage in reaching customers efficiently.

- Long-Standing Supplier Relationships: The company's deep ties with numerous suppliers foster trust and preferential treatment, securing consistent product availability and favorable terms.

- Supplier Summits: These events are crucial for Hy-Vee to identify emerging trends and secure partnerships with innovative suppliers, as seen in its ongoing product pipeline development.

- Barriers to Replication: The time, investment, and expertise required to build comparable distribution and supplier networks present a formidable challenge for potential new entrants in the grocery sector.

Regulatory Hurdles and Market Saturation

New entrants in the grocery sector, like Hy-Vee, must navigate a complex web of regulatory requirements. These include obtaining specific business licenses, adhering to stringent food safety and handling standards, and complying with local zoning laws that can dictate store location and size. For instance, in 2024, states continued to update their food safety regulations, often aligning with federal guidelines but with local nuances that can add complexity for new operators.

The Midwestern grocery market, Hy-Vee's primary operating region, is characterized by high saturation. Established players, including national chains and strong regional grocers, already command significant market share. This intense competition means new entrants would likely struggle to gain traction without substantial investment in aggressive pricing strategies or developing highly unique value propositions to differentiate themselves from existing, well-entrenched competitors.

- Regulatory Compliance: New entrants must satisfy a range of federal, state, and local regulations concerning food safety, licensing, and operational standards.

- Market Saturation: The Midwestern grocery landscape is densely populated with established competitors, limiting opportunities for new players to easily capture market share.

- Competitive Intensity: Overcoming the established presence of major grocers necessitates either significant price undercutting or highly innovative product and service offerings.

The threat of new entrants for Hy-Vee is generally low due to substantial barriers. High capital requirements for real estate, store build-outs, and inventory, estimated at $10 million to over $50 million per supermarket in 2024, deter many. Existing players like Hy-Vee benefit from economies of scale, with 2024 data showing their extensive distribution networks and purchasing power leading to lower per-unit costs, making it difficult for newcomers to compete on price.

Brand loyalty, cultivated through decades of service and loyalty programs like Hy-Vee PERKS, further solidifies market position. New entrants also face challenges in replicating Hy-Vee's established, efficient supply chains and long-standing supplier relationships, which are crucial for product availability and competitive pricing. Regulatory hurdles and a saturated Midwestern market also contribute to the low threat.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for real estate, construction, and inventory (e.g., $10M-$50M+ per store in 2024). | Significant financial hurdle, limiting the number of potential entrants. |

| Economies of Scale | Lower per-unit costs due to large-scale purchasing and distribution. | New entrants struggle to match price competitiveness. |

| Brand Loyalty | Established customer base and loyalty programs. | Difficult for new brands to attract and retain customers. |

| Supplier Relationships & Distribution | Extensive, long-standing networks providing efficiency and product access. | Time-consuming and costly for new players to build comparable infrastructure. |

| Regulatory Environment | Complex licensing, food safety, and zoning laws. | Adds operational complexity and cost for new entrants. |

| Market Saturation | High density of established grocery retailers in Hy-Vee's core markets. | Limited market share opportunities for newcomers. |

Porter's Five Forces Analysis Data Sources

Our Hy-Vee Porter's Five Forces analysis is built upon a foundation of publicly available information, including Hy-Vee's own annual reports, industry-specific trade publications, and consumer spending trend data from reputable market research firms.